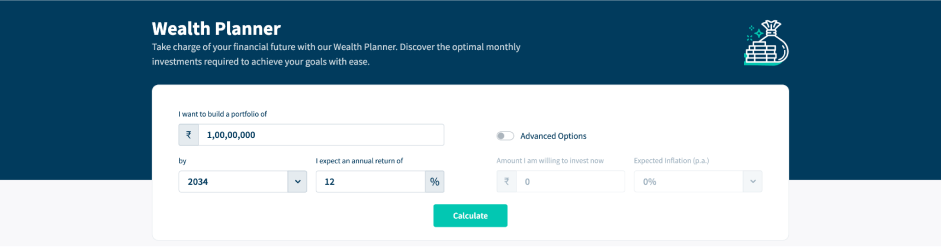

Wealth Planner

Take charge of your financial future with our Wealth Planner. Discover the optimal monthly investments required to achieve your goals with ease.

-

-

-

%

Related tools

House Purchase Planner

Planning to buy your dream house in few years? This tool helps you to analyse the future price expectation of your house and how much you should start investing from today.

Child Education Planner

Secure your child's future by taking control of their higher education expenses. Calculate the ideal monthly investments needed to build a sufficient corpus for their brighter tomorrow.

Vacation Savings Planner

Explore your desired destination with confidence by calculating the recommended monthly savings needed to fund your dream trip. Start investing now and embark on the adventure of a lifetime.

Returns Calculator

Understand the current value, absolute and annualized year-on-year (CAGR) returns on investments made in any of our products via the Lumpsum, SIP, SWP or STP mode.

SIP Top-up calculator

SIP brings consistency. SIP with a top-up feature accelerates your investment commitments to achieve financial goals faster.

Cost of Investment Delay

Calculate the difference in portfolio value over time between starting an SIP immediately and at a later date. Understand the consequences of delaying your investment strategy.

Understanding Financial Goal Planning

What is Financial Goal Planning?

Financial goal planning is a crucial aspect of personal finance management that involves setting specific financial objectives and developing strategies to achieve them. This process helps individuals and families create a roadmap for their financial future, ensuring you make informed decisions about saving, investing, and spending.

Financial goals can be categorised into three main timeframes:

1. Short-Term Financial Goals (1-3 years): These include objectives like creating an emergency fund, paying off credit card debt, or saving for a vacation.

2. Medium-Term Financial Goals (3-10 years): Examples include purchasing a car, saving for a down payment on a house, or funding a child’s education.

3. Long-Term Financial Goals (10+ years): These typically involve retirement planning, buying a home outright,

or building generational wealth.

The importance of financial goal planning cannot be overstated. It provides a clear direction for your financial decisions, helps prioritise spending, and enables you to make the most of your resources. By setting specific, measurable, achievable, relevant, and time-bound (SMART) goals, you can track your progress and adjust your strategies as needed.

What is a Wealth Planner?

A wealth planner is an investment planning tool designed to help individuals or families manage, grow, and protect their wealth over time. The primary goal of wealth planning is to have an actionable strategy that aligns with an individual's or family's financial objectives, whether they involve accumulating wealth, preserving it, or distributing it for specific purposes like retirement, education, or legacy planning.

What is a Financial Planning Calculator?

Wealth calculators are powerful tools that help individuals estimate the future value of their financial objectives. It also helps to determine how much you need to save or invest to reach those goals.

These calculators take into account various factors such as inflation, expected returns on investments, and the time horizon for each goal.

The primary function of a financial goal calculator is to:

• Project the future cost of a goal based on current prices and expected inflation rates.

• Calculate the required savings or investment amount needed to achieve the goal.

• Provide a breakdown of the monthly or annual contributions necessary to reach the target.

Why should you use a Wealth Planner?

Wealth creation involves three important aspects:-

• How much you should invest?

• Where you should invest? How much returns you will get?

• For how long you should invest?

All three aspects are equally important, if you understand the basic formula for wealth creation:-

Investment Value = Invested Amount X (1 + Return) Investment Tenure

If you are investing regularly through monthly SIP (or at any other interval e.g. weekly, fortnightly, quarterly etc) the same formula will apply for each SIP instalment. Let us now understand the individual components:-

1. Investment Value is the wealth your desire to create for your financial goals e.g. children’s higher education, children’s marriage, retirement planning, estate planning etc. Ideally should have wealth creation targets for each goal. The wealth that you create should fulfil all your aspirations for each of these goals in life. Inflation is an important factor in setting your wealth creation target because your inflation reduces the purchasing power of money. For example, if your wealth creation target is Rs 1 crore at today’s cost, your inflation adjusted target after 20 years should be Rs 2.7 crores (assuming 5% inflation).

2. Return is the capital appreciation or income, you expect from your investment. Return is the main difference between savings and investments. You should not just save; you should invest your savings to earn returns that will help you achieve your wealth creation target. Return on investment will depend on the asset class e.g. equity mutual funds, debt mutual funds etc or asset sub-category e.g. large cap funds, midcap funds, small cap funds etc. Different asset classes have different risk profiles. You should invest according to investment tenure and risk appetite. For long investment tenures equity is the preferred asset class.

3. Investment tenure is the timeframe by which you want to achieve your wealth creation target, if you started investing now. Investment tenure is a very important factor in wealth creation because it is directly related to the compounding effect. Compounding is interest earned on interest, or profit made on profits. The longer your investment tenure, higher in the power of compounding.

The wealth planner will tell you how much you need to save and invest every month to achieve your wealth creation goal. You can start saving and investing immediately in mutual funds through SIP to meet your wealth creation goal.

What are the advantages of wealth planners?

1. Goal Setting: Wealth planning involves setting specific financial goals. These goals can be short-term (buying a house, taking a vacation), medium-term (saving for education or a major purchase), or long-term (retirement, legacy planning). The planner helps you define your goals.

2. Retirement Planning: Wealth planners will help your plan for your retirement by estimating future expenses, determining the required savings, and preparing an entire life-stage journey of how to save and invest from a young age.

3. Estate Planning: For those interested in leaving a legacy for their children or grand-children estate planning is a critical component. Wealth planners can help you in estate planning.

4. Wealth creation: Wealth creation by itself, not linked to a particular life-stage goal, can be as aspiration for some investors. Wealth provides financial security which will enable you to pursue your dreams or aspirations. You may want to take an early retirement to pursue your interests or start a business. There can also be social aspirations which wealth creation can help you achieve, like philanthropic work.

Adapting financial strategies by using our DSP mutual fund calculator can significantly help in making informed decisions throughout one’s lifetime.

In summary, wealth planners can be useful for any investor who wants to achieve financial security and fulfil their or their family’s aspirations.

How to use a DSP wealth planner calculator?

The DSP wealth planner calculator (click here) is user-friendly and suitable for beginners and new investors seeking to achieve their financial goals using a wealth planner. DSP wealth planner calculator is a tool that helps you estimate your future financial goals and plan for them. To use the calculator effectively, please follow these steps after opening the calculator:

- I want to build a portfolio of: Enter the goal amount, the amount you need to acquire to consider being wealthy

- By: This shows the year in which the target should be achieved. One should choose a realistic timeframe.

- I expect the annual return of: Enter the expected returns from an asset class. This is among the most crucial steps, as an unrealistic input will lead the exercise to be impractical to implement.

Then Click on Calculate.

The result will consist of two components:

- It will show the monthly investment required to achieve the expected goal.

- The second will be a graph that will showcase the invested amount and the growth in the portfolio value.

There is also the option of switching to an advanced option; this will open two additional input criteria:

- Amount I am willing to invest now: Mention the amount you have today to invest towards becoming wealthy.

- Expected inflation (p.a.): Enter the expected inflation during the years when you are investing.

Click on ‘Calculate’.

What should one keep in mind while using the Wealth Planner?

• Wealth creation target: You should always factor inflation in setting wealth creation target. You should also factor in lifestyle changes. As your income grows your lifestyle improves and your costs go up. It is difficult to make changes in lifestyle once you get used to it. Therefore, you should try to be as ambitious as possible in setting your wealth creation target.

• Reasonable rate of return: Risk and return are interrelated. If you are a conservative investor you should moderate your returns expectations. Aggressive investors i.e. investors with higher risk appetite can expect a higher rate of return. However, you should input a reasonable rate to return for the wealth planner to be useful in your investment planning. If you input a very high returns percentage, then you will be saving less and may fall short of your wealth creation goal. You should be slightly conservative in returns expectations. It is better to sacrifice some expenses now to create more wealth in the future than saving less and creating less wealth in the future. You can refer to long term returns of mutual funds from different asset classes / categories to form your return expectations. Different asset classes and categories of mutual funds have different risk profiles; select the appropriate category according to your risk appetite. It is important to refer to long term returns because short term returns can be misleading.

• When to start investing: It is important for you to understand the wealth planner assumes that you will start saving and investing immediately. If you delay your investments then you will not be able to achieve your wealth creation target with the said monthly savings. The earlier you start investing, longer is your investment tenure and significantly higher compounding benefits.

Disclaimer

This tool has been designed for information purposes only. Investor should not consider above as a recommendation for any schemes of DSP Mutual Fund / third party mutual fund schemes. Data captured here is publicly available including information developed in-house. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. Investors are requested to note that there is no assurance of any returns/capital protection/capital guarantee to the investors in any schemes of DSP Mutual Fund. Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments. The Performance may vary from scheme to scheme and depends upon several factors including load structure, investment framework, AUM, Investment objective, sector diversion, asset allocation & internal risk management parameter. Investor before investing into any kind of mutual fund scheme should read and be aware of scheme specific risk factors including Risk-o-meter of scheme / benchmark, Investment strategy & objective, asset allocation, Load structure, Plan/options available etc. defined in offer documents (Scheme Information Document and Key Information Memorandum) which are available on website. While utmost care has been exercised while preparing this tool, the DSP Asset Managers Private Limited/ DSP mutual Fund nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information.

"All the returns shown are as per the category prescribed in latest AMFI Best practice Guidelines (AMFI BPG) and any such guidelines issued by AMFI from time to time. Category wise calculators used above is to provide conceptual clarity to investors or for educational purposes. Numerical illustrations are being used for SIP / SWP / STP calculators only for the categories to explain the power of compounding. “Past performance may or may not be sustained in future and is not a guarantee of any future returns”. These figures pertain to performance of the categories/situations as prescribed by AMFI by using the compounded annualized growth rate % (CAGR) prescribed against each category/situation and do not in any manner indicate the returns/performance of any of the schemes of the DSP Mutual Fund. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to any of the units of the schemes of the DSP Mutual Fund. Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Note: Returns calculated by taking mean of 10-year rolling returns between 01/06/13 and 30/05/23 for various benchmarks. Mean returns are as follows: INR Gold 9.34%; Sensex: 12.64%; Nifty 50: 12.93% and 10-year G-Sec: 7.20%. (This note is as per AMFI BP)"

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.