Frequently asked questions

KYC is an acronym for ‘Know Your Customer’. KYC is commonly used to describe the ‘Client Identification’ Process and it is a one-time requirement applicable for all Unit Holders, including Guardians and Power of Attorney holders but excludes Nominees, Minors

The Securities and Exchange Board of India (SEBI) has prescribed certain requirements under the Prevention of Money Laundering Act 2002 for Financial Institutions and Financial Intermediaries including Mutual Funds to ‘know’ their Customers. The KYC process helps prevent money laundering and other suspicious transactions.

CKYC refers to Centralized KYC (Know Your Customer) which came into effect from February 01, 2017. The main objective is to have a single platform which facilitates investors to complete their KYC only once before interacting with various entities across the financial services sector.

• All Financial Transactions and

• Non Financial Transactions

(For existing SIP / STP / DTP registrations, KYC norms are applicable on the date of acceptance of the request, unless specifically mentioned.

A PAN exempted KYC (PEKRN) would be needed to invest in Mutual Funds. An identity proof in lieu of PAN needs to be provided. (Refer form for the list of documents). Individuals, Minors, Sole Proprietor, Joint Holders can invest with a PAN exempt KYC.

The total investment (including fresh purchase, additional purchase, switches and SIP installments) in a rolling 12 months’ period or financial year i.e. April to March should not exceed Rs. 50,000 for a PAN exempted KYC.

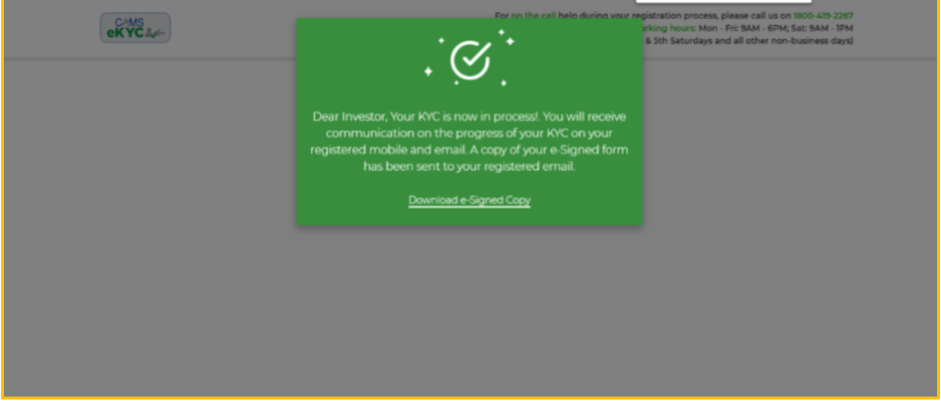

New Investors can complete the KYC process online through our website

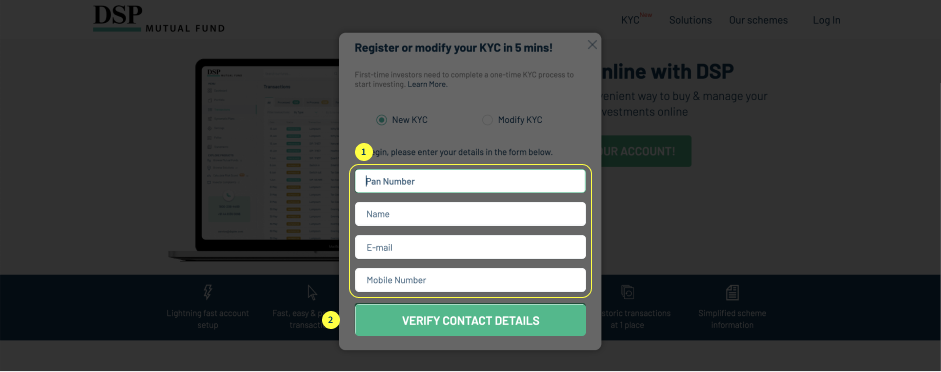

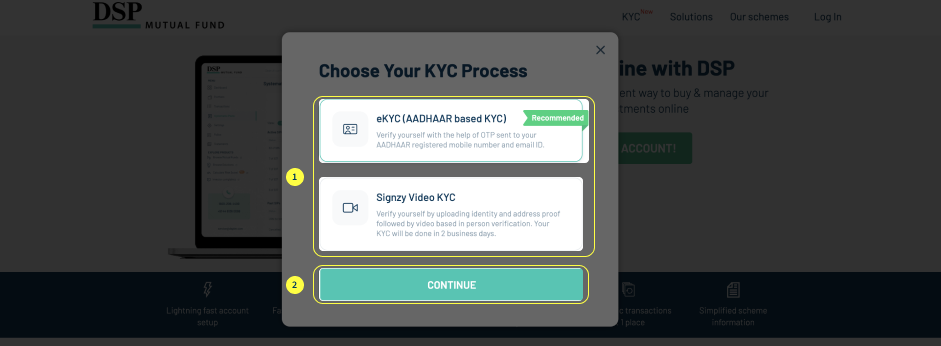

Please follow the below steps:

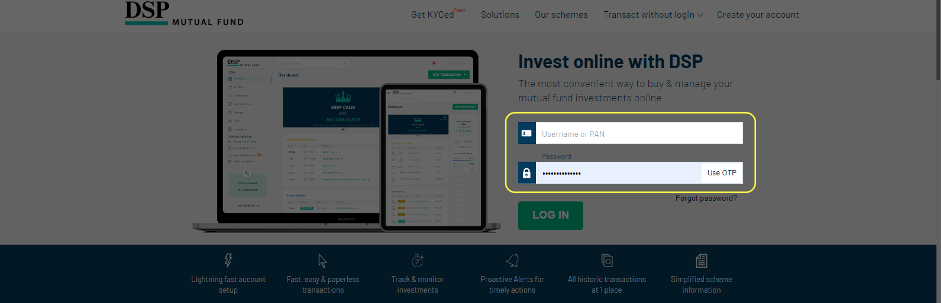

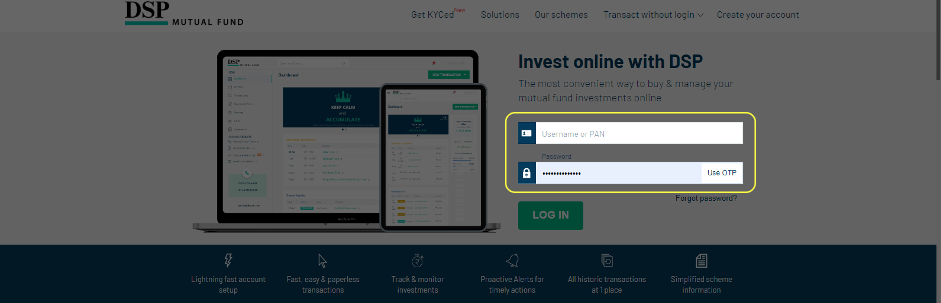

- Go to dspim.com/invest

- Click on ‘New KYC’

- Enter PAN Number, Name, Email, and mobile Number and click on “Verify Contact Details’

- Click on Signzy Video KYC

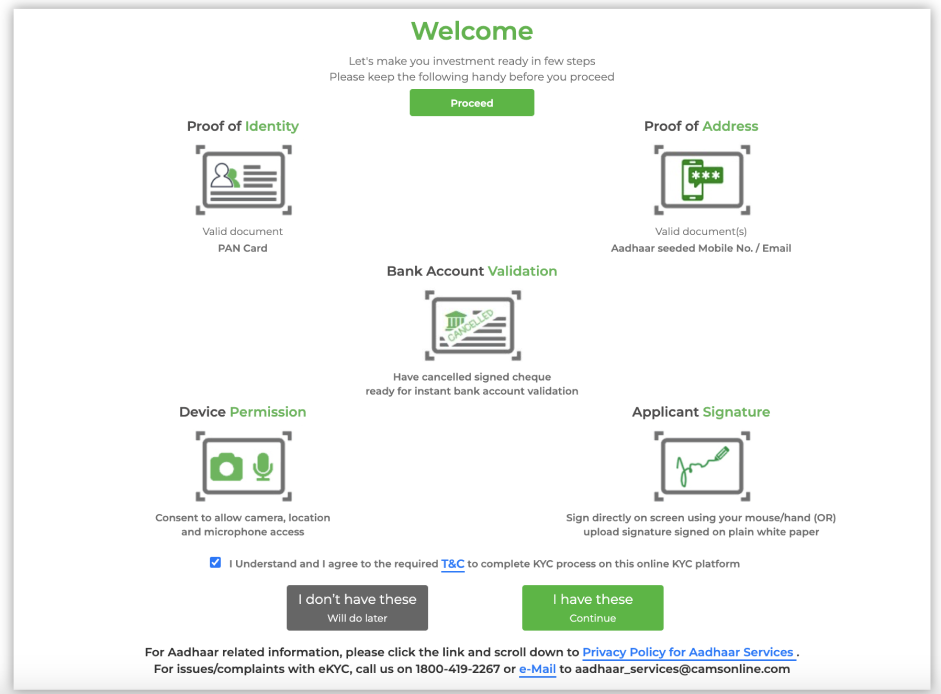

- Please ensure to use a video enabled device. Upload Proof of identity, Address, Cheque Leaf and Signature and complete your KYC

Alternatively, Individuals can submit the physical form to any of our branches or CAMS Investor Service Centres near you.

Non Individuals can submit the physical form to any of our branches or CAMS Investor Service Centres near you.

Existing investor can modify their KYC online through our website

Please follow the below steps:

- Go to dspim.com/invest

- Click on ‘Modify KYC’

- Enter contact details and verify with OTP

- Please ensure to use a video enabled device. Upload Proof of identity, Address, and Signature and complete your KYC

Alternatively, Individuals can submit the physical form to any of our branches or CAMS Investor Service Centres near you.

For completing the KYC process, investor has to submit any one of the following Officially valid document (OVD) defined as per Rule 2 (d) of Prevention of Money-Laundering (Maintenance of Records) Rules, 2005 (PML Rules) as Proof of Identity (POI) and Proof of Address (POA):

| S.No. | Document | Proof of Identity (POI)* | Proof of Address (POA)* |

|---|---|---|---|

| 1 | Passport | Yes | Yes |

| 2 | Driving licence | Yes | Yes |

| 3 | Aadhaar (Preferable) | Yes | Yes |

| 4 | Voter's Identity Card issued by Election Commission of India | Yes | Yes |

| 5 | Job card issued by NREGA duly signed by an officer of the State Government | Yes | Yes |

| 6 | Letter issued by the National Population Register containing details of name address | Yes | Yes |

| 7 | Any other document as notified by the Central Government in consultation with the Regulator | Yes | Yes |

KRA Validated Status: Wherever KYC Registered Agency (KRA) can independently validate;

- The POA/POI document with the source data [such as Income Tax Department (ITD) database on PAN, Aadhaar XML/DigiLocker/m-Aadhaar),

- PAN-Aadhaar linking was successful or Not Applicable,

- Email and/or Mobile is validated,

KYC status will be tagged as “KYC Validated”. In such instances, investor can transact seamlessly with any other SEBI registered intermediaries without production of KYC documents, provided there is no change in KYC information already available.

At present, where Aadhaar is used OVD for KYC processing, the same can be validated with the source data independently by KRA.

KYC Registered Status: Wherever KRA cannot independently validate the information at their end with the POA/POI document source data but Email and/or Mobile is validated and PAN-Aadhaar linking was successful or Not Applicable, KYC status will be tagged as “KYC Registered”.

In such instances, investor can transact with any other new SEBI registered intermediaries by producing the KYC documents again, even if there is no change in KYC information already available.

KYC On Hold Status: For instance, where Email and/or Mobile is not validated – KYC On-Hold

Investor will be required to resubmit valid Email and/or Mobile with the existing Intermediary or through any other Intermediary.

Please refer to the below table for more details:

| KYC Status | Existing with DSP AMC | New to DSP AMC |

|---|---|---|

| KYC Validated | No implications. Investor can transact seamlessly. | No implications. Investor can transact seamlessly. |

| KYC Registered | All financial transactions only in the AMC where investor already has investment | Investor needs to submit full set of KYC documents every time they invest with a new AMC. |

| KYC On hold | Investors will be able to transact only after remediating the reason for KYC on hold | Investors will be able to transact only after remediating the reason for KYC on hold |

NRI investors can invest in mutual funds with KYC Status as KYC Validated or KYC Registered

They should complete the KYC by submitting Aadhaar as OVD proof, giving valid email id and mobile so that they can invest with DSP MF or any other mutual fund.

You can check your KYC status online here : Mutual Funds Scheme: Invest in Mutual Funds Online in India | DSP (dspim.com)

You can send an email from your registered email ID to [email protected] or call us on 1800 208 4499 from your registered mobile number to update your KYC Status.

You should intimate your change of Name/Address/Contact Details/Status/Signature etc. to a point of service (POS) of the KRA or the AMC office.

Individuals can submit a Change in Details Form or CKYC Form along with the required documents

Non Individuals need to submit a fresh KYC form along with the required documents.

You need to complete the "Know Your Customer" (KYC) verification before you can begin investing in mutual funds.

Please click here to check if you are KYC complied. If you do not have a completed KYC, you can complete your KYC online, through our website click here.

Once you have completed your KYC verification, you may invest using the DSP app available on the Play Store as well as on the App Store or by visiting our webiste click here

If you are using the DSP App:

- Please log-in to your account

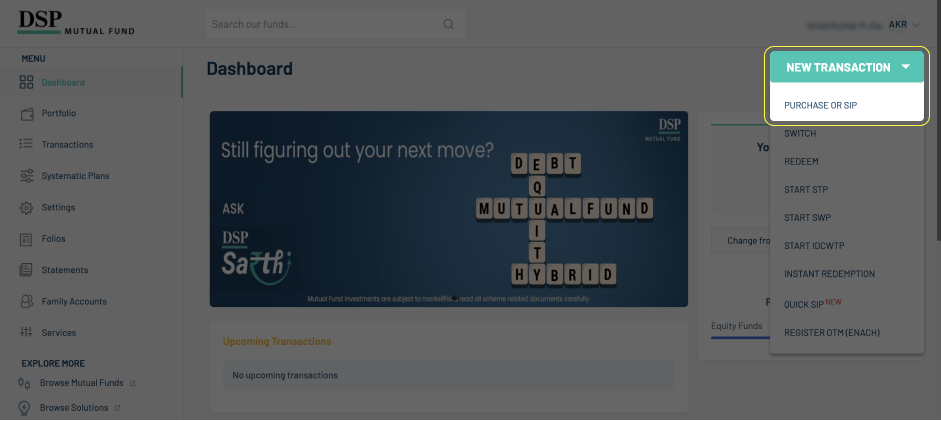

- Click on New Transaction

- Choose Invest or SIP

- Select folio number

- Choose the scheme you wish to invest in

- Enter the amount

- Choose the mode of payment

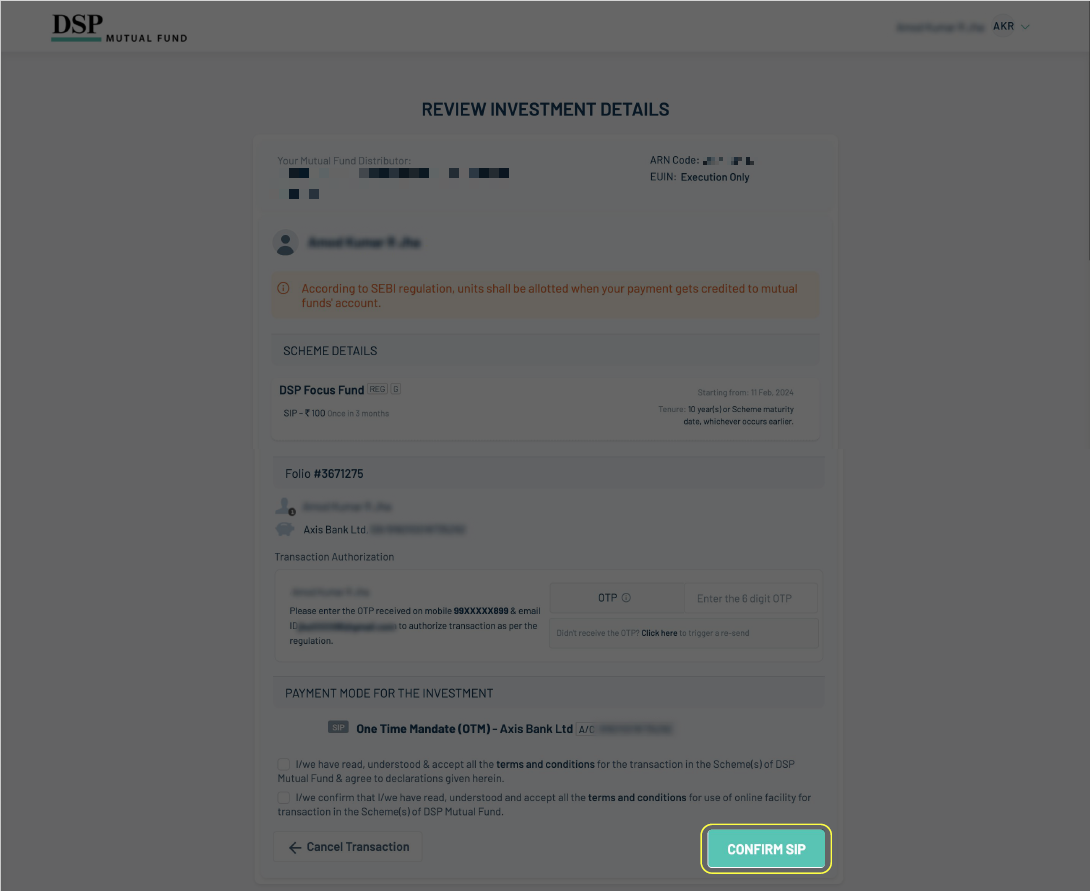

- Review & enter OTP

- Proceed for payment

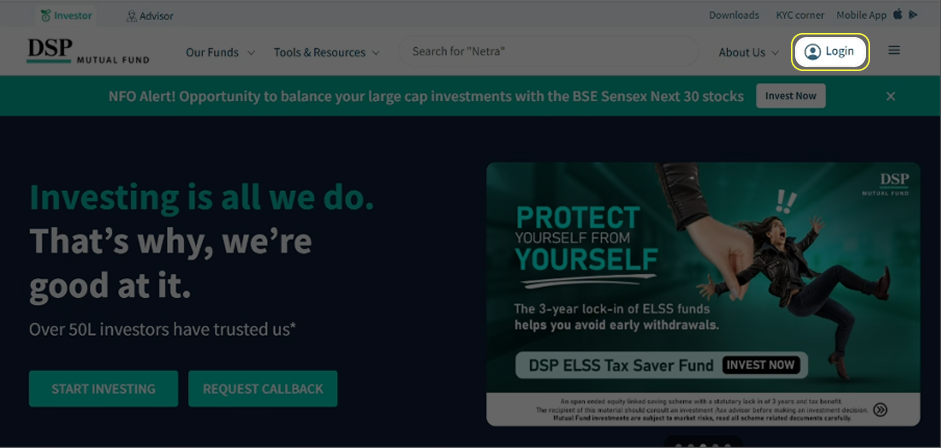

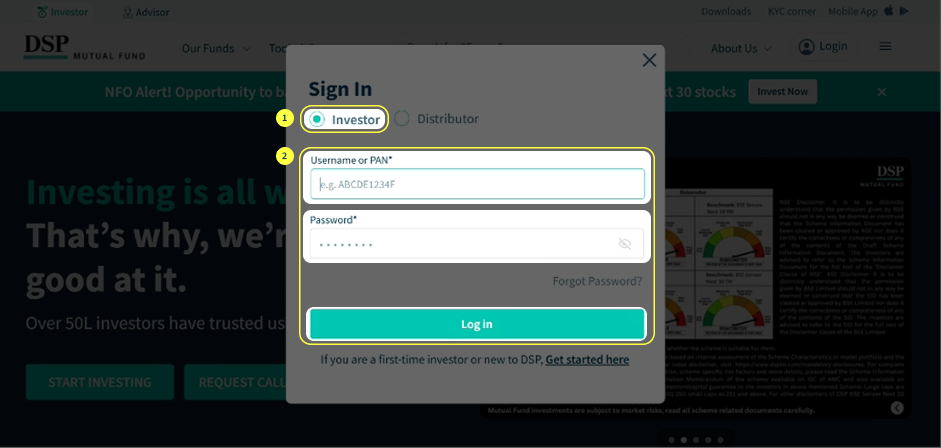

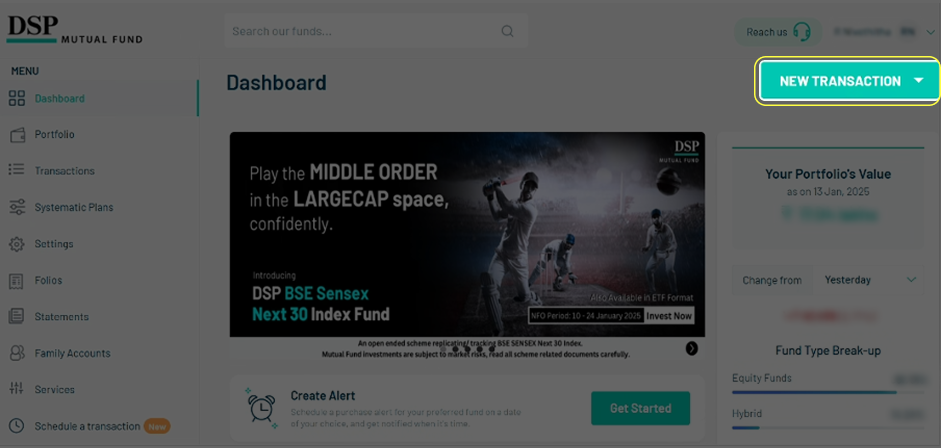

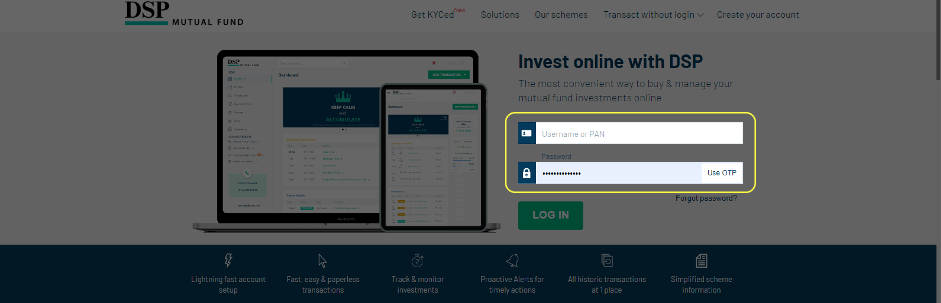

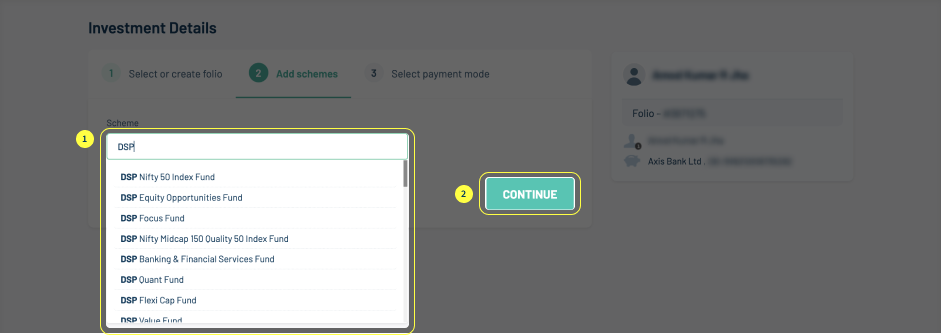

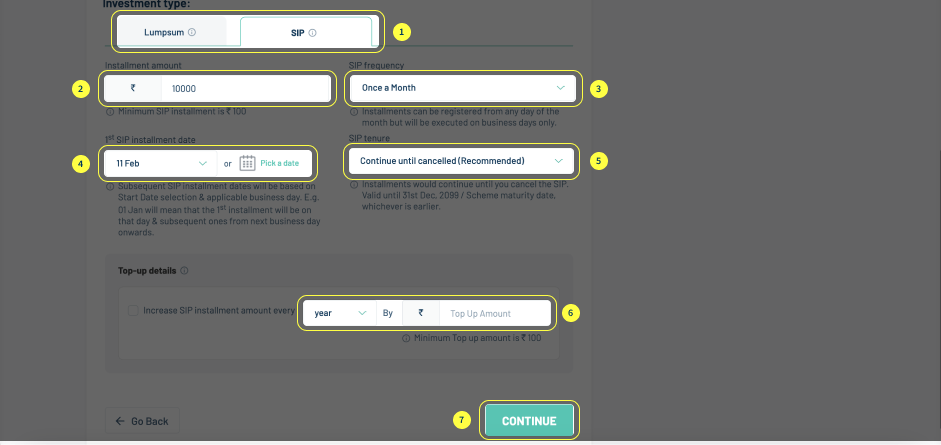

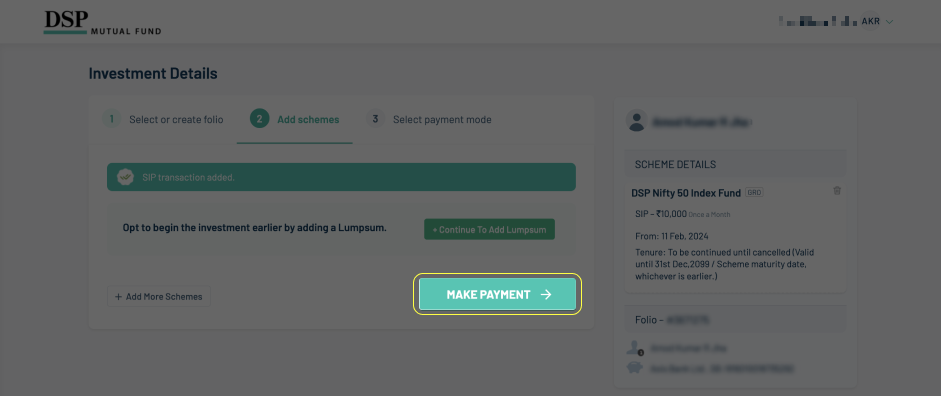

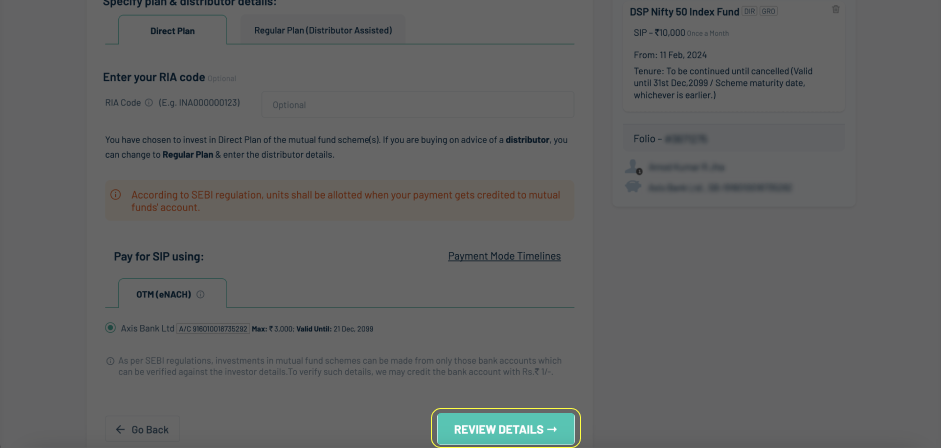

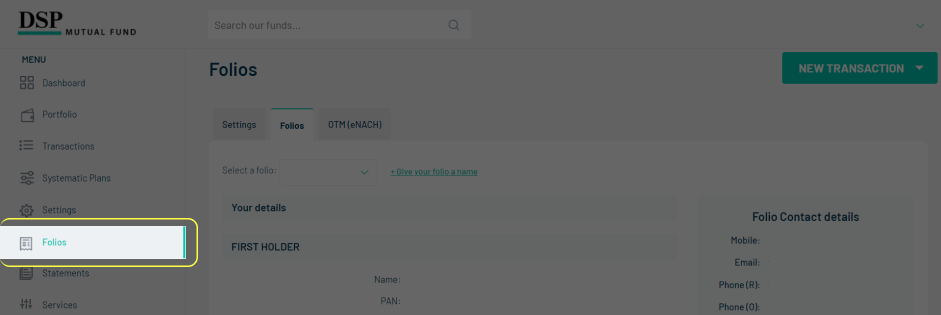

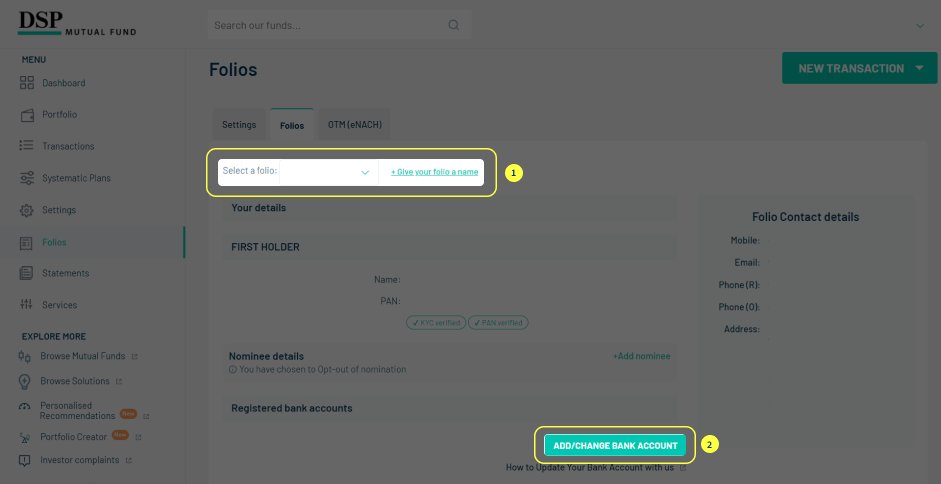

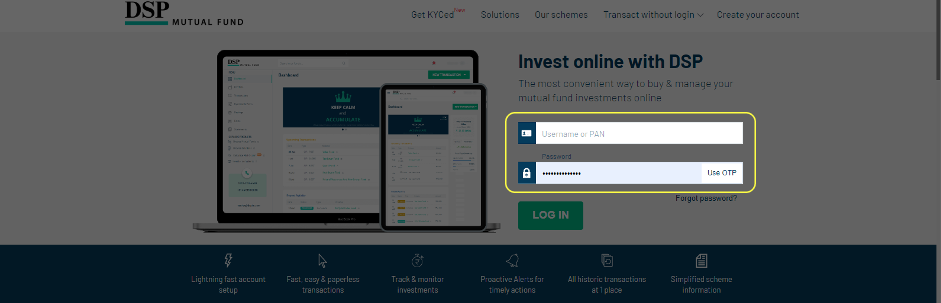

If you are using the DSP Website:

- Please log-in to your account

- Click on New Transaction

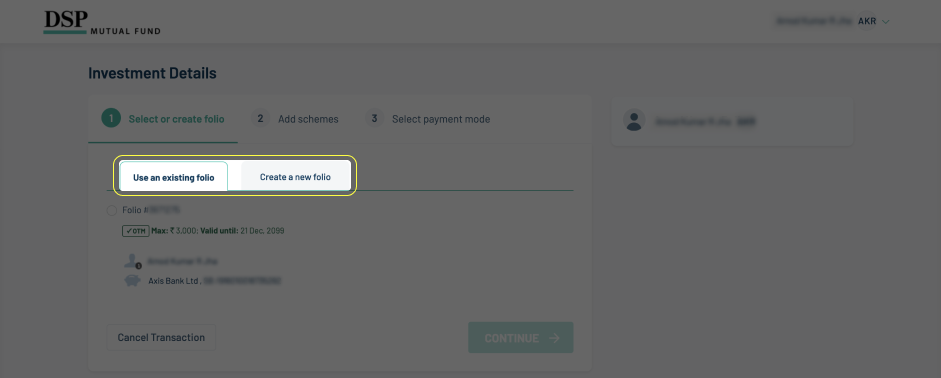

- Choose Lumpsum or SIP

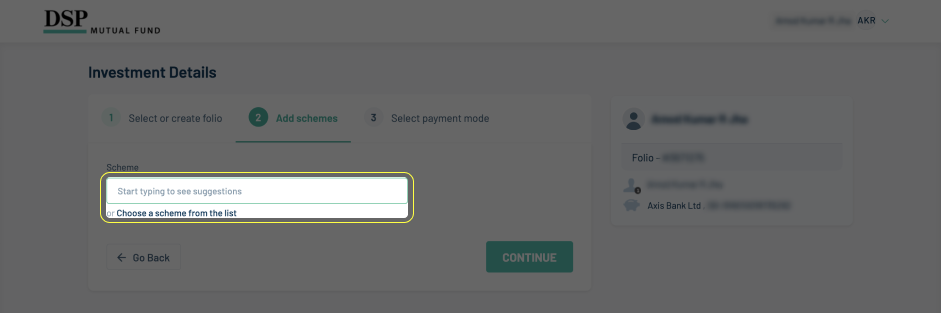

- Select folio number

- Select scheme and enter amount

- Select the payment mode through which you wish to purchase

- Review your purchase

- Enter OTP

- Proceed to pay

Alternatively, you may submit the physical form to any of our branches or CAMS Investor Service Centres near you.

If you are a MF Distributor and looking to initiate a purchase on behalf of your investor, you may do so using our IFAXpress App or the IFAXpress website www.dspim.com/ifaxpress.

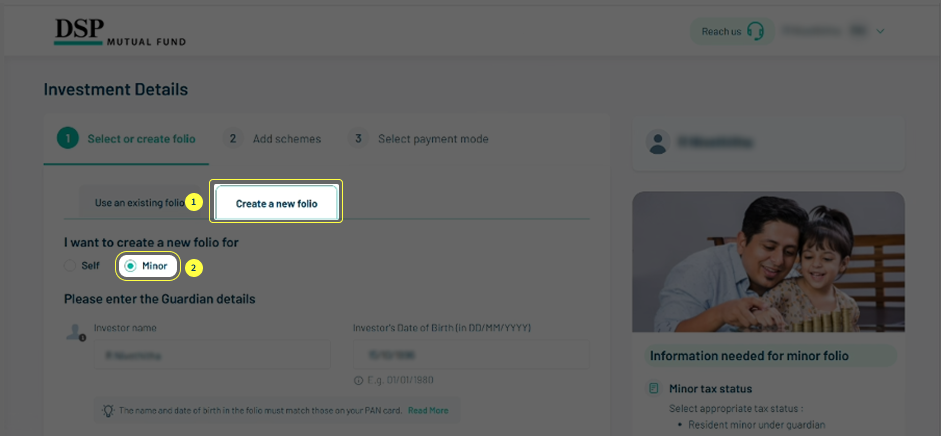

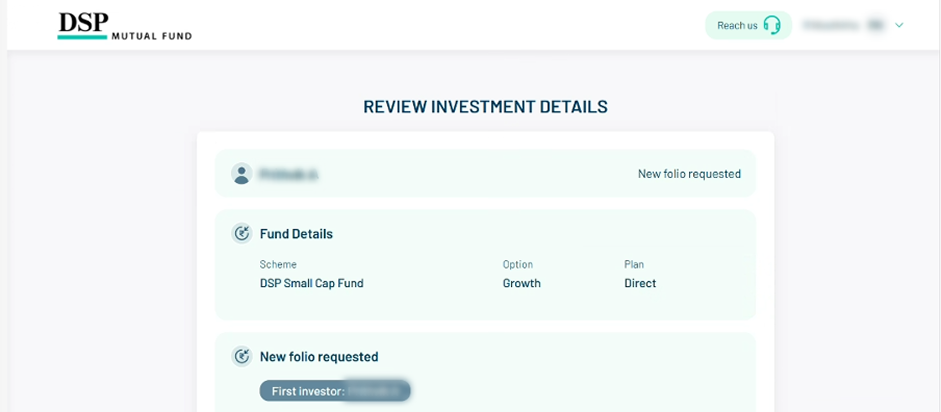

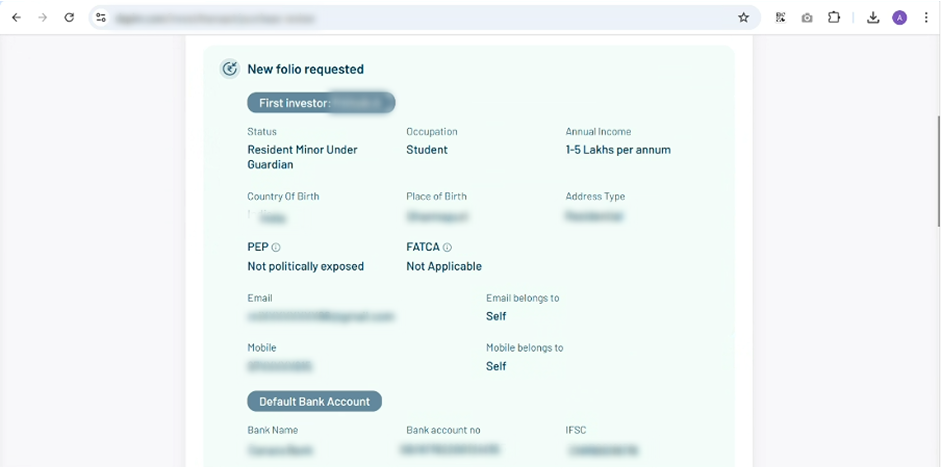

Any child under the age of 18 can invest in a DSP Mutual Fund under their name; however, they are not allowed to operate the account independently. The guardian—either a parent or a court-appointed legal guardian—can open the folio online on behalf of the minor using their own PAN. It is important to note that the guardian must be KYC-compliant.

Alternatively, you can submit a physical form to any of our nearest branches or CAMS Investor Service Centres CAMS Investor Service Centres .

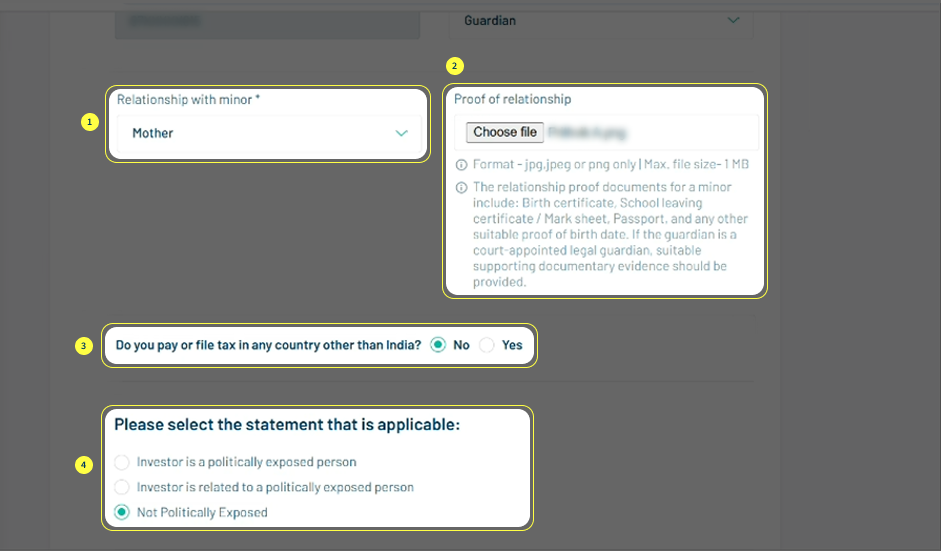

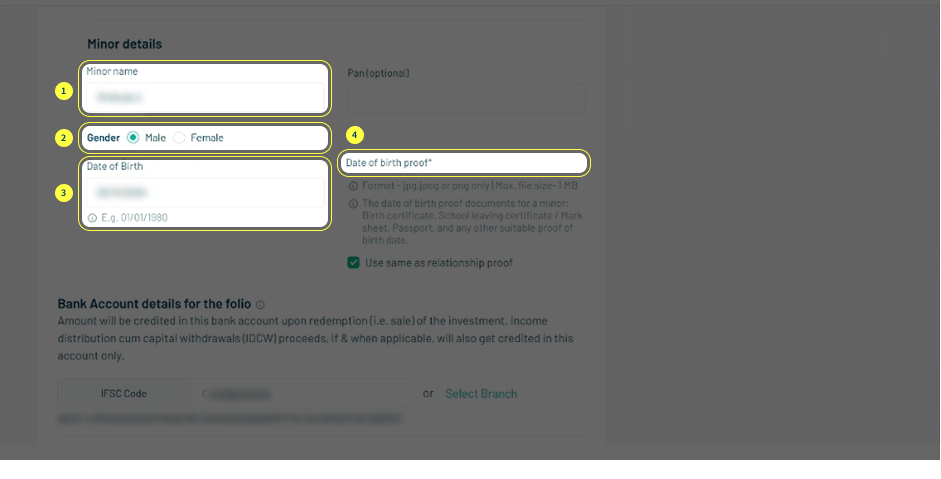

Documents required to open a folio in the name of a minor:

• Date of Birth (DOB) proof of the minor, which can be a Birth Certificate, Passport, School Leaving Certificate/Marksheet issued by the HSC Board of the respective state, or any other suitable document that verifies the minor’s DOB

• Proof of relationship with the minor

• Court order, if applicable, in the case of a court-appointed legal guardian

Important Notes:

• Payment for the investment can be made from the minor’s bank account, the parent’s or legal guardian’s bank account, or a joint bank account of the minor and the parent/legal guardian.

• Redemption bank mandates must be in the name of the minor or a joint bank account of the minor and the parent/legal guardian.

Please keep the birth and relationship proof ready before you start the process.

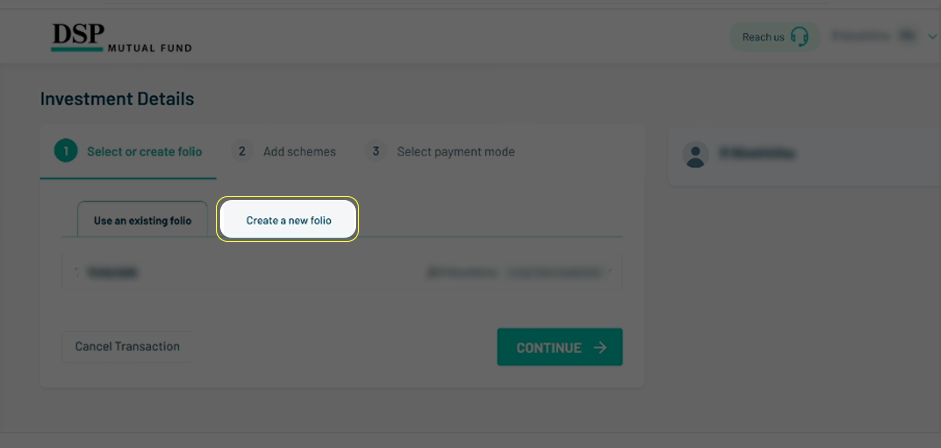

- Log in to your account

- Enter your User ID & Password

- Click on ‘New Transaction’

- Click on ‘Purchase / SIP’

- Click on ‘Create a New Folio’

- Select ‘Minor’

- Enter the specified details

- Upload the relationship proof and date of birth proof

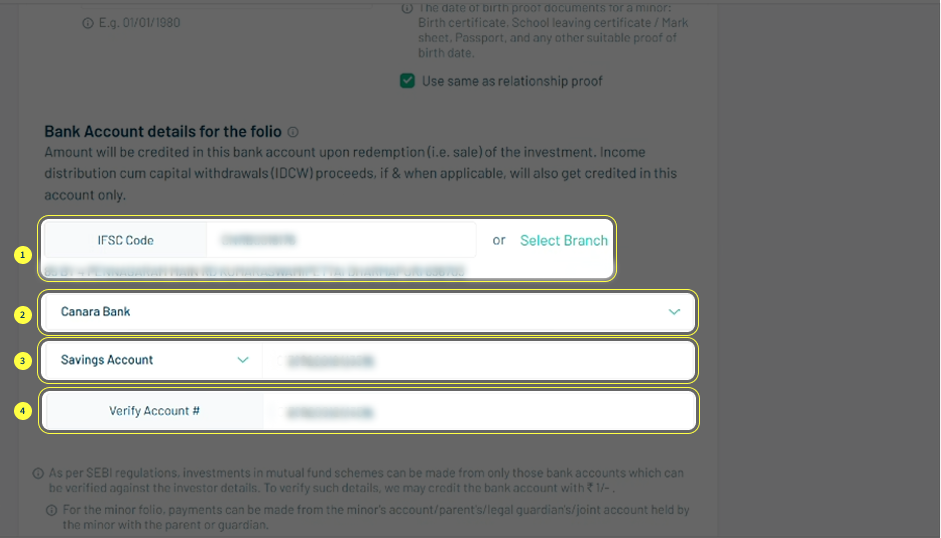

- Enter the bank details

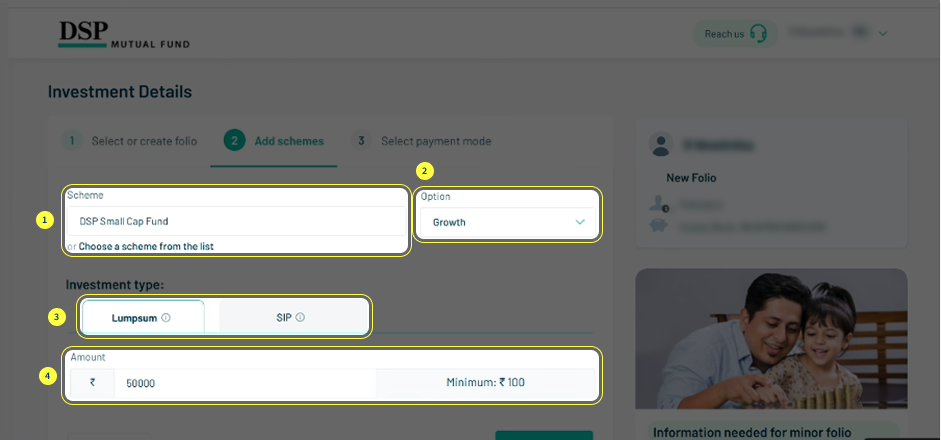

- Select Scheme for Investment and Amount

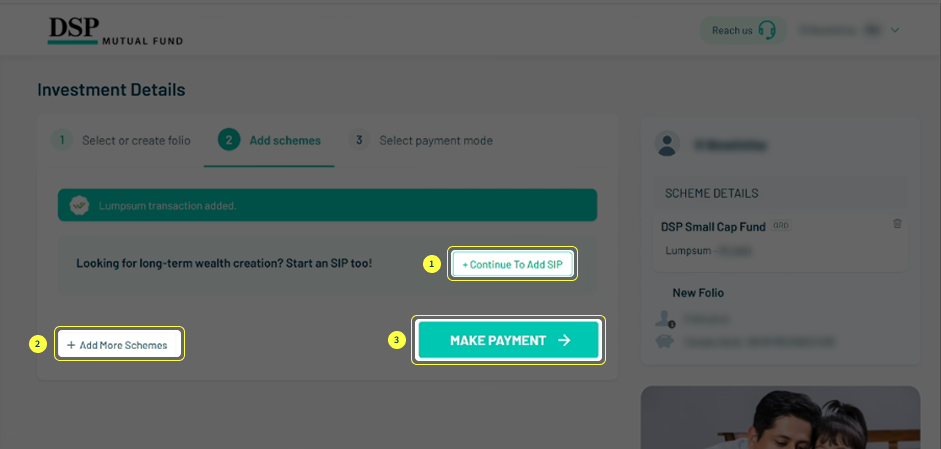

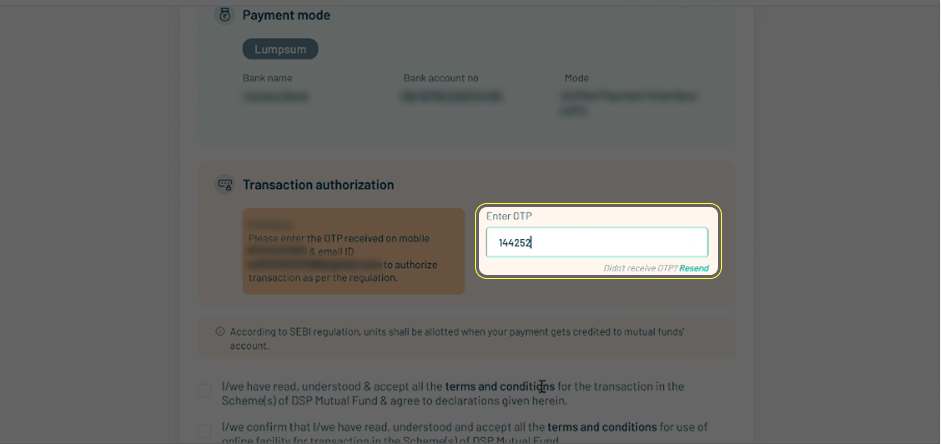

- Click on ‘Make Payment’

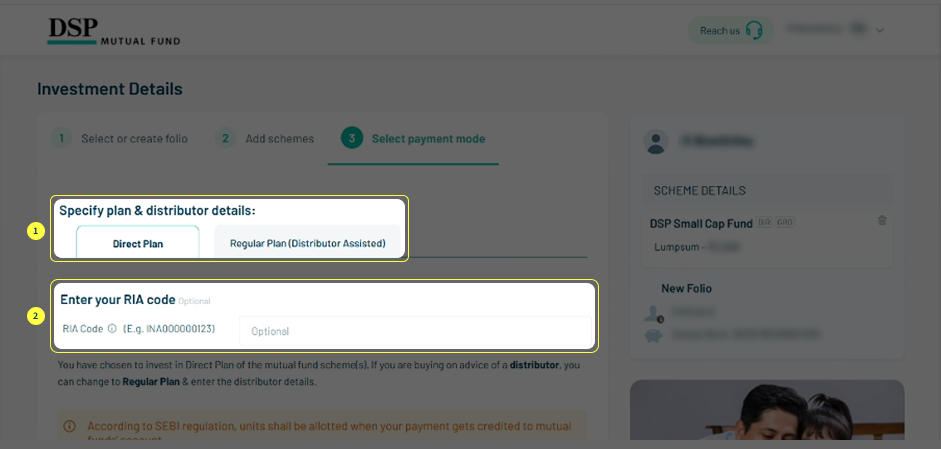

- Specify the Scheme Plan Details and select a mode of Payment

- Review the investment details

- Enter the OTP and ‘Confirm’

- Your transaction will be processed subject to Verification

a. eNACH (NACH = National Automated Clearing House)

b. Cheque: Cheque should made out to "DSP Mutual Fund Collection Account"

c. Funds Transfer or RTGS/NEFT: Our bank details will be shared on request

d. UPI (UPI = Unified Payments Interface)

e. One Time Mandate

-

What is a UPI ID in the context of mutual fund investments?

A UPI ID (Unified Payments Interface ID) is a virtual payment address that allows investors to make seamless payments directly from their bank accounts while investing in mutual funds. It is used for transactions such as lump sum purchases, subscribing to new fund offers (NFOs), and registering for Systematic Investment Plans (SIPs), enabling quick and secure payments without the need to enter bank details each time. -

Why does a UPI ID need to be “valid” for mutual fund transactions?

Only UPI IDs that are registered with and approved by SEBI are considered valid for mutual fund investments. This validation ensures secure transactions, enables payment traceability, and complies with SEBI’s e-payment regulations.

SEBI circular dated June 11, 2025.

If a UPI ID is not approved by SEBI, your investment transaction may fail or remain pending due to rejection at the payment gateway or Registrar and Transfer Agent (RTA) level. Any amount debited from your bank account may not be credited to the Asset Management Company’s (AMC) account, and the AMC will not be responsible for recovering or resolving such payments. Therefore, investors should avoid transferring funds directly to these UPI IDs outside of authorized investment platforms.

-

How does SEBI ensure the safety of UPI payments for mutual funds?

SEBI approves only those UPI IDs that comply with RBI and NPCI security standards, ensuring strong encryption, user authentication, and protection against misuse. -

What is the latest SEBI-approved list of valid UPI IDs of DSP MF?

dsp.xxxx.mf@validicici

dsp.xxxx.mf@validhdfc

Note: Your DSP payment requests should only be initiated through these or other verified channels. Avoid manually entering or transferring funds to these UPI IDs outside the mutual fund’s official investment platforms.

-

Do I need to change my UPI ID as an investor?

No, investors do not need to create or modify their personal UPI IDs. The requirement for a “valid” UPI ID applies only to intermediaries such as mutual funds and their service providers (payment aggregators, platforms, etc.) that receive investor funds. You can continue using your existing UPI ID for your investments. -

Can I register multiple UPI IDs for mutual fund purchases?

Yes, you can register multiple valid UPI IDs, as long as all of them are linked to your own bank account under your name. -

Is there a transaction limit when using UPI for mutual fund purchases?

Yes. As per recent UPI regulations, the maximum limit per transaction is ₹5 lakh, with a daily cumulative limit of ₹10 lakh (subject to your bank’s specific limits). Please check with your bank for any additional restrictions. -

Are UPI-based transactions mandatory for mutual funds?

No. UPI is one of the available e-payment options. Investors can still use net banking, NEFT/RTGS, debit mandate, or cheque depending on the platform. -

What should I do if my UPI transaction fails but the amount is debited?

If funds are debited but units are not allotted, the amount will be automatically refunded to the investor’s bank account within 3–5 working days. Investors can also contact the Registrar and Transfer Agent (RTA) or DSP Mutual Fund at [[email protected]] for status updates. -

Are there any impacts on existing SIP investments registered under UPI mandates?

No, existing SIPs registered with valid UPI mandates will continue without any disruption. Investors do not need to take any action, and ongoing investments will remain unaffected. -

How to recognize a valid UPI ID when making a payment for DSPMF?

A validated UPI ID clearly shows the intermediary’s name, followed by a short category code such as “.mf” for Mutual Funds before the “@” symbol. After the “@” symbol, the exclusive handle “@valid” appears, followed by the bank name.

For example: dsp.xxxx.mf@validicici or dsp.xxxx.mf@validhdfc

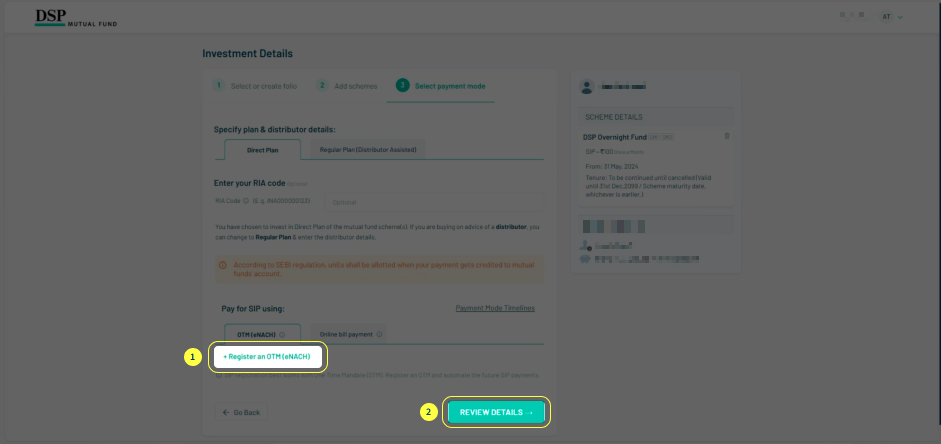

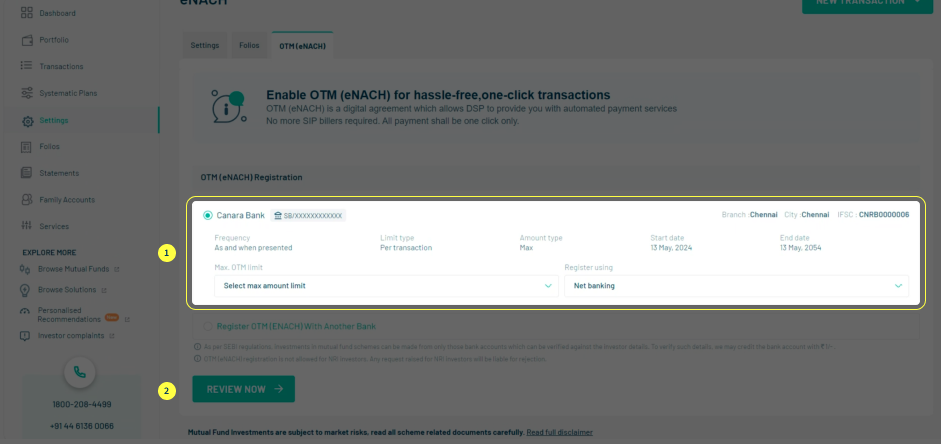

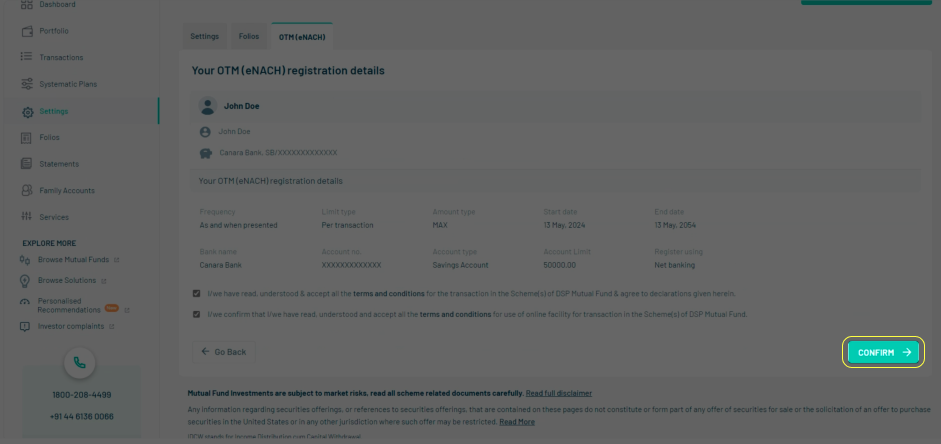

eNACH, also known as 'One Time Mandate' is a one-time online registration process that allows you to seamlessly initiate all future investments with DSP in a completely digital manner.

It is a completely paperless process that lets you authorize your bank to debit your account up to a certain limit that you set up yourself.

This debit will happen through National Automated Clearing House (NACH) created by National Payments Corporation of India (NPCI), which is set up under a mandate from the Reserve Bank of India in 2008.

Both are essentially the same. However, OTM is registered via a physical form and eNACH is registered online through our website dspim.com

Most investors prefer eNACH as it is paperless and therefore very convenient.

• Make a purchase or register a SIP without the hassle of writing cheques or bank transfers.

• Register a SIP just 5 days after eNACH is registered in your folio.

• It is available for investing in all open ended schemes of DSP Mutual Fund (except DSP Liquid ETF)

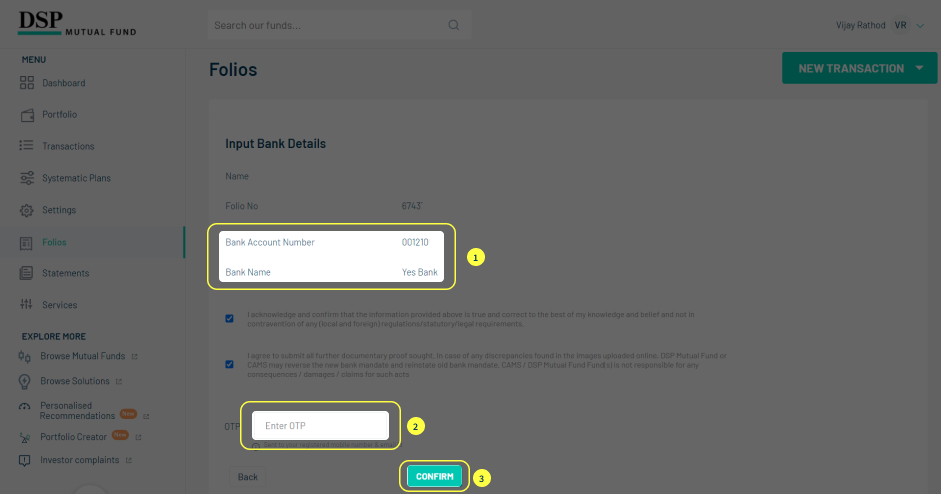

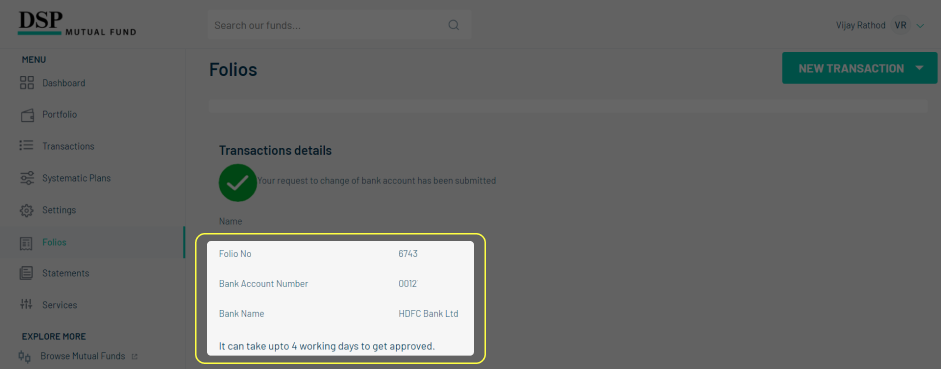

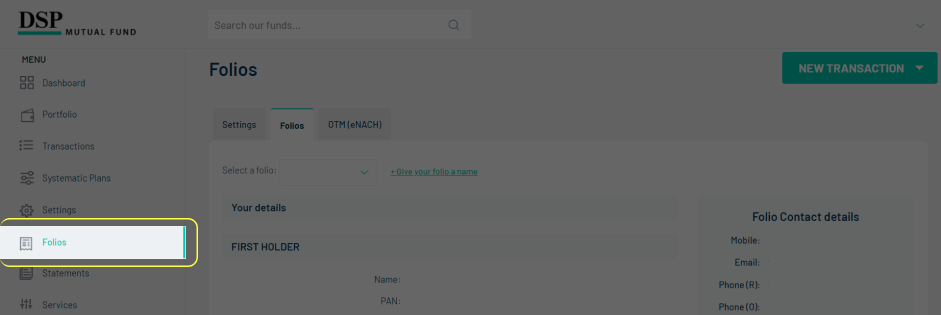

- Log-in to your account on invest.dspim.com

- Click on Register eNACH

- Enter your bank details

- Enter the OTP

- Done!

33 Banks (authorized by NPCI) currently support eNACH. Here is a list for your quick reference:

| S.No. | BANK NAME |

| 1. | Andhra Bank |

| 2. | AU Small Finance Bank |

| 3. | Axis Bank Ltd |

| 4. | Bank of Baroda |

| 5. | Bank of Maharashtra |

| 6. | Canara Bank |

| 7. | Central Bank of India |

| 8. | City Union Bank |

| 9. | Deutsche Bank AG |

| 10. | Development Credit Bank Ltd |

| 11. | Dhanlaxmi Bank Ltd |

| 12. | Equitas Small Finance Bank Ltd |

| 13. | Federal Bank Ltd |

| 14. | HDFC Bank Ltd |

| 15. | ICICI Bank Ltd |

| 16. | IDBI Bank Ltd |

| 17. | IDFC Bank Ltd |

| 18. | Indian Overseas Bank |

| 19. | IndusInd Bank |

| 20. | Karnataka Bank Ltd |

| 21. | Kotak Mahindra Bank Ltd |

| 22. | Oriental Bank of Commerce. |

| 23. | Paytm Payments Bank Ltd |

| 24. | Prime Cooperative Bank Ltd |

| 25. | Punjab National Bank |

| 26. | Ratnakar Bank Ltd |

| 27. | South Indian Bank Ltd |

| 28. | Standard Chartered Bank Ltd |

| 29. | State Bank of India |

| 30. | Tamilnad Mercantile Bank Ltd |

| 31. | The Cosmos Coop Bank Ltd |

| 32. | Union Bank of India |

| 33. | Yes Bank |

In most cases, eNACH is registered in two working days from the date of registration. Once the eNACH Bank is registered on your folio, an e-mail and SMS confirmation will be sent to you on your registered details.

No, there are no charges.

Yes. You can cancel the eNACH online however cancellation will be allowed only if there are no underlying active SIPs linked to that eNACH. Please click here to cancel the eNACH

First, don’t worry. This usually happens because of a payment failure at your bank’s end or at times even due to poor internet connectivity.

Rest assured, if your account has been debited, we will definitely allot you the units after receiving a confirmation from your bank.

If your units are not allotted within 2-3 days, please email us at [email protected] or call us on 18002084499 / 18002004499.

You may redeem your units using our App available on the Play Store as well as on the App Store or by visiting www.dspim.com/invest/

If you are using the DSP App:

- Log-in

- Click on redeem

- Choose the scheme you wish to redeem from

- Enter units or amount

- Enter OTP which is sent on your registered email id/mobile number

- Click on continue

Alternatively, if you still prefer to do things old school, you may submit a transaction form to any of our branches or at any CAMS Investor Service Centres near you.

If you are a MF Distributor and looking to initiate a redemption on behalf of your investor, you may do so using our IFAXpress App or the website www.dspim.com/ifaxpress

If you get stuck at any point, please call us at 1800 208 4499.

It usually takes between T+ 1-5 business days for the money to be transferred to your registered bank account depending on the scheme you have redeemed.

‘T’ here stands for transaction day. ‘Business Day’ is a day other than Saturday and Sunday or a day on which the Banks in Mumbai or BSE or NSE or RBI are closed.

T+1 - Liquid/Fixed Income schemes

T+2 - Equity & Hybrid Schemes

T+5 - International/ Fund of Fund schemes

The redemption proceeds are paid directly to your registered bank account through RTGS/NEFT, provided we have your complete core banking account details.

In the absence of core banking account details, a cheque will be sent to your registered address. Please ensure you have your correct/latest address updated with us.

Also, to get your redemption proceeds on time, we request you to verify your bank details by creating an account on our App, available on the Play Store as well as on the App Store or by visiting www.dspim.com/invest/.

If there are non-business days after you placed the redemption request, or if the redemption has been done post cut off, there may be a delay of 1-2 days in receiving your redemption proceeds.

The payout mechanism (RTGS/NEFT or cheque) is mentioned on your account statement. We always endeavour to transfer the redemption proceeds to your registered bank account or to send the cheque as per the above mentioned payout cycle.

If it’s been 3-4 business days since you placed your redemption request and you still haven’t received the funds, please call us on 18002084499 or write to us on [email protected].

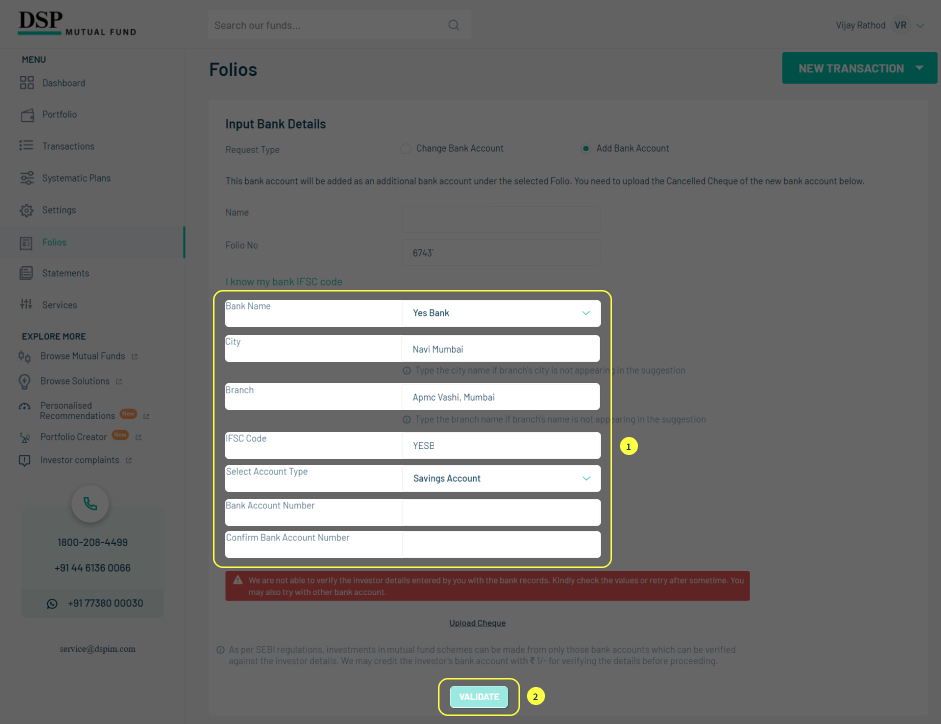

Unfortunately, this is not possible in one single step. As per regulations, a change of bank mandate request and a redemption request cannot be processed together. There has to be a gap of 10 days between these two specific requests. This regulatory gap is for your own protection, to reduce fraud and other related operational risks.

We have an ‘Instant Redemption’ facility where we endeavour to send the redemption proceeds to your registered bank account instantly at the time we receive your Instant Redemption request. We use the Immediate Payment Service (IMPS) provided by various banks to manage this and this service is available on all days, at all points of time.

This facility is available only in DSP Liquidity Fund (Growth) and DSP Overnight Fund (Growth).

You can withdraw a maximum of Rs. 50,000 or the redeemable balance from your investment in DSP Liquidity Fund or DSP Overnight fund, whichever is lower. The minimum redemption limit is Rs. 100.

This facility is available to all investors, except NRIs. Your complete bank account details along with core bank account details must be registered with your account in order to use this facility.

The Instant Redemption Facility is available on the DSP App as well as from our website www.dspim.com/invest/.

Yes, you may switch your investment using our DSP App available on the Play Store as well as on the App Store or by visiting www.dspim.com/invest/

- Log in

- Click on switch

- Choose the scheme you wish to switch from

- Click on continue

- Select the scheme you want to switch into

- Enter units or amount

- Enter OTP which is sent on your registered email id/mobile number

- Click on continue to confirm the transaction

Alternatively, if you still prefer to do things old school, you may submit a transaction form to any of our branches or at any CAMS Investor Service Centres near you. You may also call us on our toll free no. 1800 208 4499.

If you are a MF Distributor and are looking to initiate a switch on behalf of your investor, you may do so using our IFAXpress App or the website www.dspim.com/ifaxpress.

If you get stuck at any point, please call us at 1800 208 4499.

A switch from one scheme to the other is treated as a redemption from the switch-out scheme and a purchase into the switch-in scheme. Relevant exit loads will apply.

All scheme loads and relevant information is available on any scheme page on our App or our website.

You may subscribe for Units in dematerialized mode by providing details of your demat account in the purchase request submitted by you. Units shall be allotted in physical form by default unless you do not intimate your intention of holding Units in demat form.

All schemes except Daily Reinvestment of Income Distribution cum Capital Withdrawal / Weekly Reinvestment / Payout of Income Distribution cum Capital Withdrawal options under various schemes of the Fund are available to be held in Demat Mode.

In case, you wish to convert your existing units allotted in non-demat or physical mode at a later date in a Dematerialized form, you must fill a Dematerialization request form provided by your Depository Participant and submit the same along with copy of the Account Statement to your Depository Participants.

In case, you wish to Remat your units, the Rematerialisation request should be submitted to your Depository Participant.

Units in demat mode can only be redeemed only through the Stock Exchange Platform or through your Depository Participant. Approach either your stockbroker or your distributor or your Registered Investment Advisor (RIAs) to submit your redemption request. You will not be able to redeem by placing a request with the Fund House.

Yes. Switch is permissible. Units can be switched only through the Stock Exchange Platform. Approach your distributors or your Registered Investment Advisor (RIA) to submit your switch request. You will not be able to switch by placing a request with the Fund House.

For any changes in static information like address, bank details, nomination, contacts etc. you should approach your respective Depository Participant. You will not be able to change these details by placing a request directly with the Fund House.

You should approach your Depository Participant for issuance of an account statement. The AMC/Fund will not send any account statement in respect of Units bought in demat mode or accept any request for statement as the units will be credited in your demat account.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

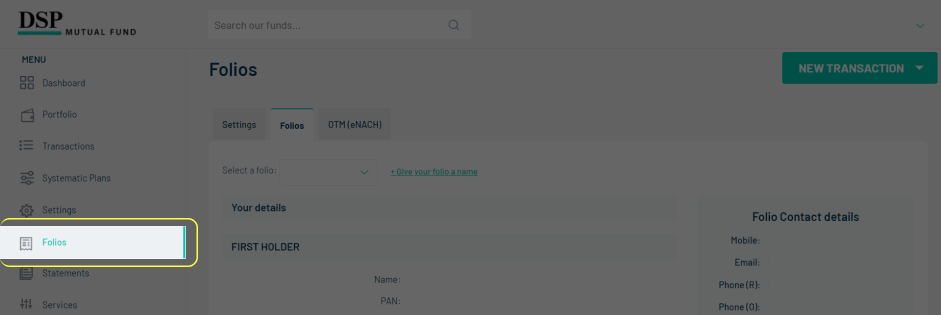

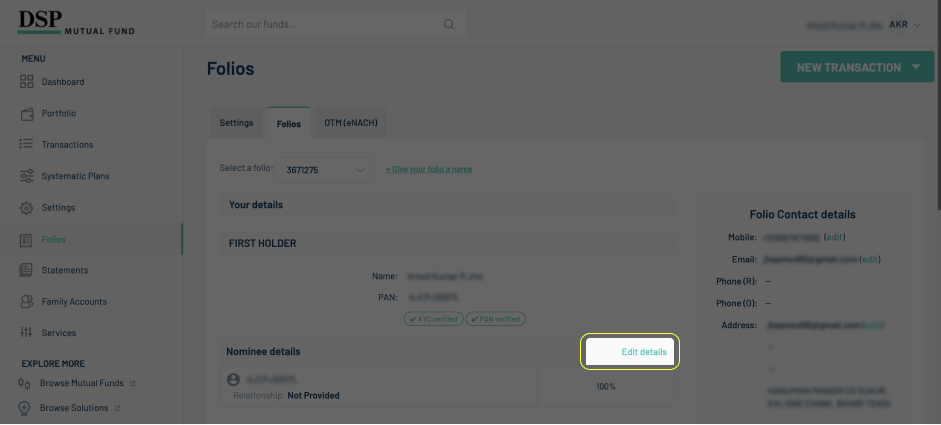

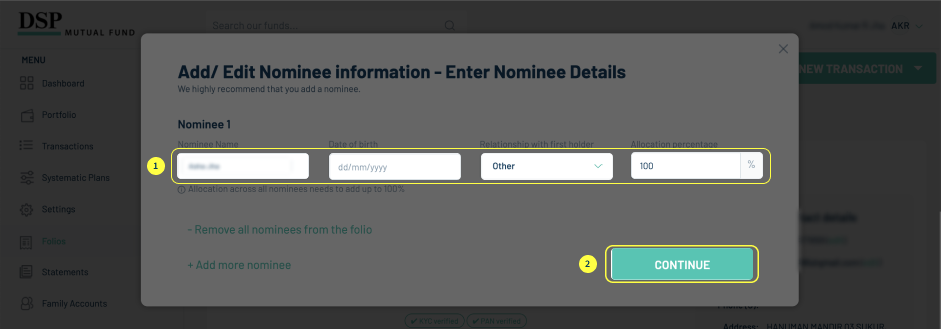

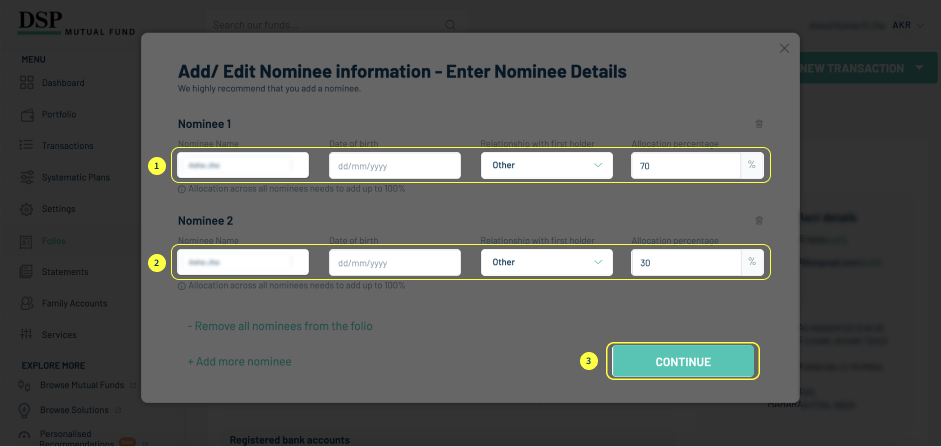

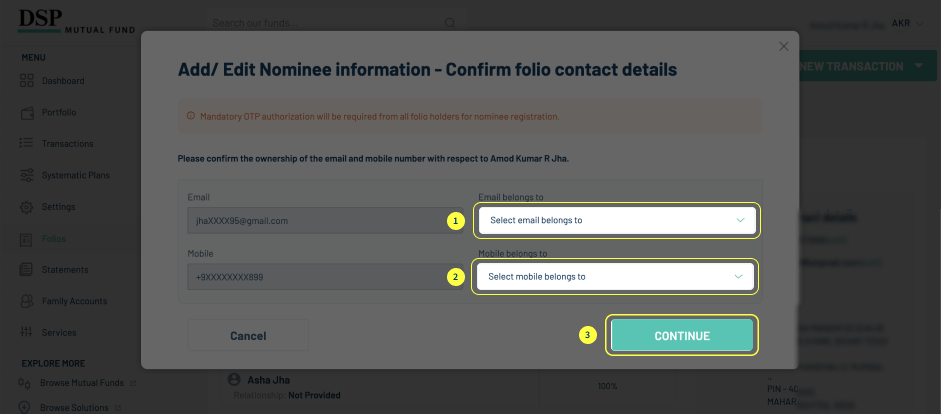

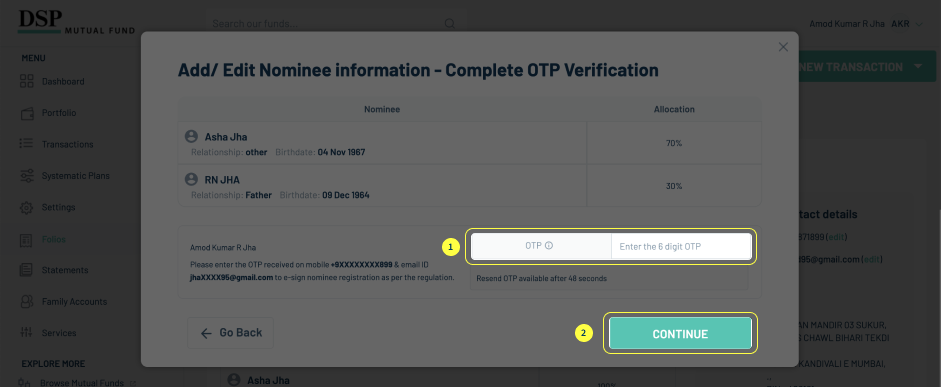

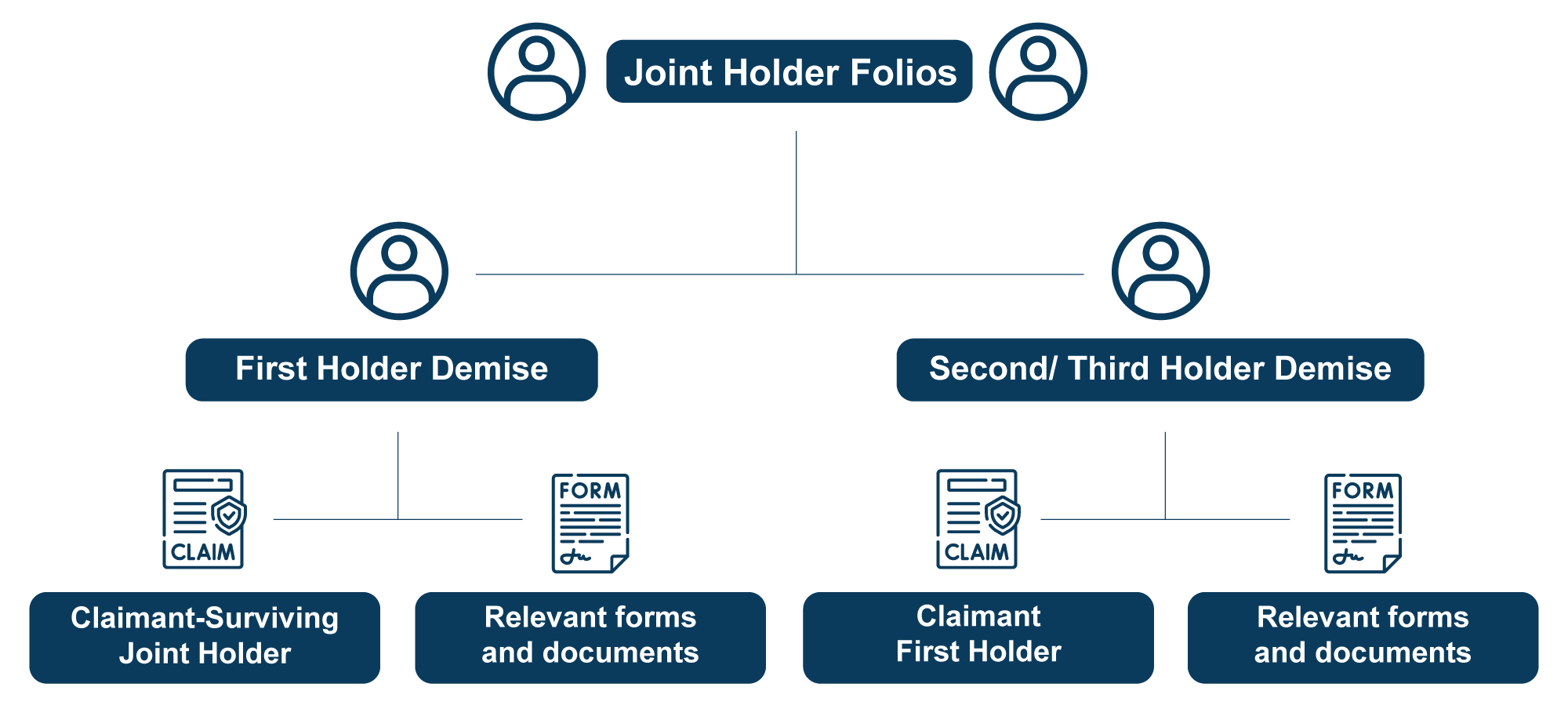

Register / Modify KYC Online  Nominee Registration

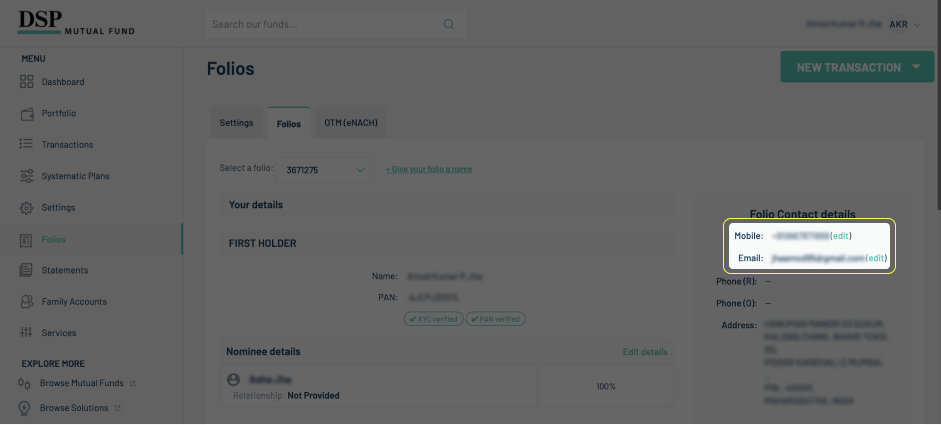

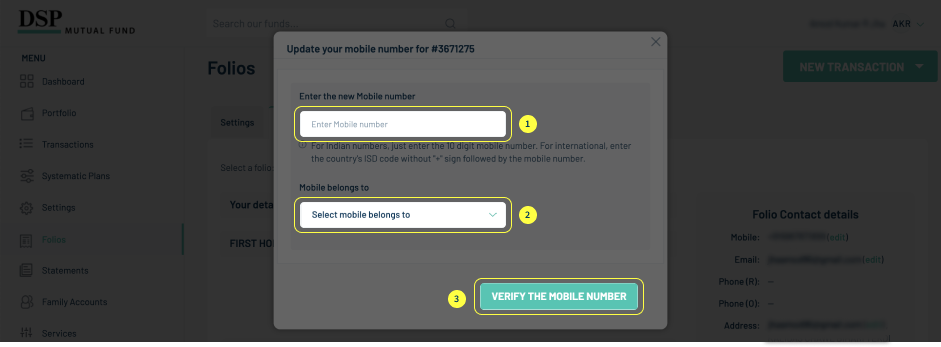

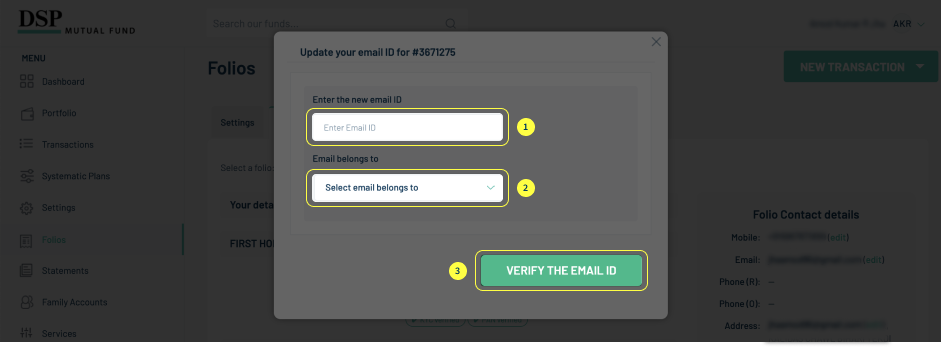

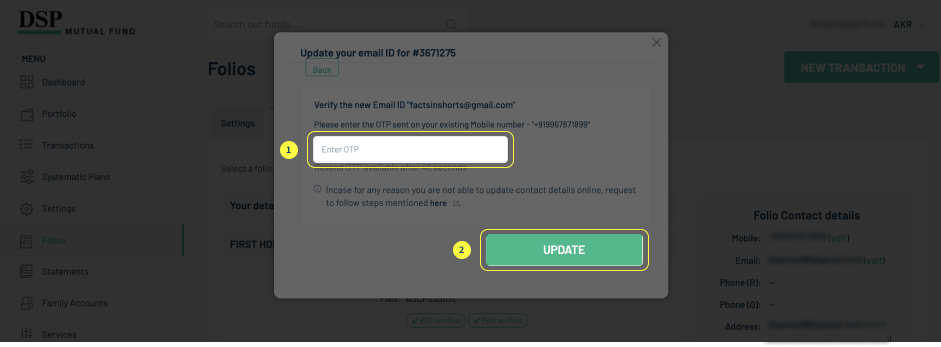

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.