SWP Calculator

SWP stands for Systematic Withdrawal Plan. If you invest lumpsum in a mutual fund, you can set an amount you'll withdraw regularly and the frequency at which you'll withdraw.

Calculation as per your inputs In table

| NAV Date | NAV | Units | Cash Flow | Net amount (₹) | Capital Gain/Loss | No of days invested | Portfolio Value |

|---|

FREQUENTLY ASKED QUESTIONS

What is SWP?

SWP stands for "Systematic Withdrawal Plan." It is a facility offered by mutual funds which allows investors to withdraw a fixed or variable amount from their mutual fund investments ona pre-decided day at regular intervals. SWP is the reverse of a Systematic Investment Plan (SIP), where you invest a fixed or variable amount at regular intervals.

What is the SWP calculator?

A SWP (Systematic Withdrawal Plan) calculator is a tool designed to help investors estimate the potential withdrawals they can make from their mutual fund investments over a specified period while maintaining a certain level of financial sustainability. It considers various factors such as the initial investment amount, the chosen withdrawal frequency, the expected rate of return, and the investment duration to provide users with projections of their future withdrawals and future value of their investments.

How does an SWP work?

In a Systematic Withdrawal Plan (SWP) you have to first invest in a mutual fund scheme; the investment can be made either in lumpsum or through a Systematic Investment Plan (SIP). The investor chooses a start date for SWP. Once the SWP in a certain scheme is initiated, it generates cash flows for investors by redeeming units fromthe invested mutual fund scheme at specified intervals. The number of units redeemed to generate cash flows in an SWP depends on the SWP amount and the scheme Net Asset Values (NAV) on the withdrawal dates.

Understanding SWP with an example

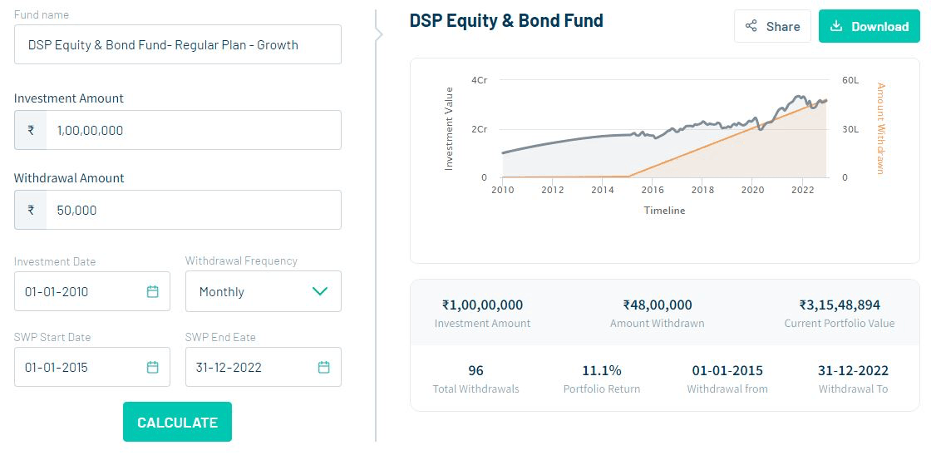

Suppose you invested Rs 1 crore in a DSP Equity and Bond Fund on 1st January 2010 at a NAV of Rs 100 per unit on 1st August 2022. You started a SWP of Rs 50,000 per month (SWP payment to be made on 1st day of the month) starting 1st January 2015. By this time the investment value had grown to Rs 17.5 lakhs. The chart below shows the cash-flows (cumulative withdrawals) and the change in value of your investment. Our SWP Calculator shows that you made 96 withdrawals over 8 years (till 31st December 2022) with total withdrawal of Rs 48 lakhs. Your current portfolio value will be Rs 3.15 crores, growth of Rs 2.15 crores despite withdrawal of Rs 50,000 every month.

Disclaimer: The table above is purely illustrative and meant for investor education purpose only. It is not indicative of the returns you will get from your investments. Mutual fund NAVs are subject to market movements. You should consult with your financial advisor or mutual fund distributor before planning your SWP investment.

Disclaimer: The table above is purely illustrative and meant for investor education purpose only. It is not indicative of the returns you will get from your investments. Mutual fund NAVs are subject to market movements. You should consult with your financial advisor or mutual fund distributor before planning your SWP investment.

How can a SWP calculator assist you?

An SWP calculator provides crucial assistance by allowing investors to meticulously plan their withdrawals from mutual fund investments.

It empowers users to determine the timing and amount of withdrawals, optimizing tax implications, and generating regular cash flows, making it particularly useful for retirees. Customizable options for withdrawal frequencies and amounts align with individual financial goals is possible. The calculator offers projections of future withdrawals, helping investors envision cash flow and ensuring sustainability throughout their investment journey.

Regular usage enables portfolio monitoring and helps users maintain financial stability while meeting their income needs and preserving their investments.

How to use SWP calculator?

Using a SWP calculator involves several steps to determine your withdrawal strategy:

1. Access a SWP Calculator: Find a reliable SWP calculator tool, which is often available on mutual fund company websites or financial planning platforms

2. Input Parameters:

a. Initial Investment: Enter the current value of your mutual fund investment.

b. Withdrawal Frequency: Specify how often you want to make withdrawals (example, monthly, quarterly, annually).

c. Expected Rate of Return: Provide an estimate of the annualized return you expect from your investments.

d. Withdrawal Amount:Decide if you want a fixed withdrawal amount or a percentage of your investment value.

e. WP Period: Determine the duration over which you plan to make withdrawals.

3. Calculate: Click the "Calculate" or "Generate Results" button to compute the projected withdrawal schedule and amounts.

4. Review Results: The SWP calculator will display a schedule showing the expected withdrawal amounts for each period and the remaining investment balance over time.

Using an SWP calculator helps you plan your withdrawals systematically, considering factors like investment returns, withdrawal frequency, and duration, ensuring that your investment can provide the desired income while maintaining financial sustainability.

How to use the DSP SWP report or DSP SWP Calculator?

You can click here to get to the DSP SWP Report / Calculator. This calculator is a historical scheme level calculator. Where you get to see how a SWP strategy would have worked using a scheme managed by the DSP Investment Managers.

Steps to use the DSP SWP calculator

1. Choose a scheme: You can choose any of the existing schemes, the options are pre-defined as Growth option and Regular plan.

2. Investment Amount: Then you need to enter the lumpsum amount that you may have invested.

3. Withdrawal Amount: Enter the amount you want to withdraw on regular intervals.

4. Investment date: This is the date when the investment is made. From this date the calculation is done. This date can be any date after the inception date of the scheme. The calculator ensures that you can only select a date after the inception of the fund.

5. Withdrawal Frequency: There are two options here – monthly or annual. So, the frequency of withdrawal amount is determined here.

6. SWP Start Date: The date from when the SWP had started.

7. SWP End Date: This can be the latest date or choose a date after which you may not have withdrawn.

8. Click on ‘Calculate’.

The result is shown in threeparts.

First, there is a graph which shows how the investment portfolio grew and how the gradual withdrawal amount. This visual presentation aims to give a sense of how the portfolio is getting impacted over the long term due to a combination of market movement and withdrawals that are taking place. It also shows how the withdrawal is taking place.

The second part is a box that shows the investment amount at the start, the amount withdrawn during the period, current portfolio value, the count of withdrawals that have taken place, the returns (calculated in XIRR), withdrawal from and withdrawal to – the dates you would have entered.

The third part is how the cash flow during the entire period. This shows the NAV as on the date and the value and also the capital gains and loss that would have been reported on the portfolio.

What are the benefits of SWP?

Systematic Withdrawal Plans (SWP) offer several benefits to investors.They provide a regular income stream, making them ideal for retirees or those needing consistent payouts.

• Monthly Withdrawals: SWP allows for systematic monthly withdrawals or withdrawals at any other interval, providing a dependable cash-flow stream. Unlike SWP, mutual fund dividends or IDCW payouts are not assured. Dividend payments are made from the accumulated profits of the scheme at the discretion of the fund manager. A fund may stop paying dividends for a certain period of time depending on market conditions. On the other hand, in SWP, you will continue to receive cash-flows as long as you have sufficient balance in the account.

• Tax Benefit on Long-Term Capital Gains: Investors may enjoy tax benefits, especially on long-term capital gains, when utilizing SWP strategically. Taxation of capital gains in certain categories of mutual funds is much more efficient than most traditional fixed income investments where interest income is taxed as per your income tax rate. We will discuss capital gains taxation later in this article.

• Variable Amount: SWP offers flexibility in choosing variable withdrawal amounts, adapting to changing financial needs.

• Customizable Withdrawal Plan:Investors can tailor their SWP to align with their goals and preferences.

SWP enhances financial planning, offering regular cash flows and tax advantages while accommodating individual preferences.

When should an investor opt for an SWP scheme?

Investors should consider opting for a Systematic Withdrawal Plan (SWP) when they need a regular income stream from their investments, such as during retirement or for meeting ongoing financial commitments. SWP is suitable when they want to systematically convert their accumulated savings into cash-flows while preserving or growing the principal amount to the extent possible. It's also beneficial for managing tax-efficient withdrawals, especially for long-term capital gains.

Retirees seeking regular tax efficient cash-flows from their investments for long periods (retired lives can be 25 – 30 years or longer) can opt for SWP. With SWP you can get cash-flows to meet your post retirement living expenses and also get potential capital appreciation that can help you cope up with inflation over long investment tenures. You can also use SWP for your children’s education planning especially if you children’s higher education spans several years (4 – 5 years or longer). If your child is seeking professional education (e.g. medical, engineering etc), or post graduate education (e.g. master’s degree, MBA, CA, doctorate etc), then SWP can be a useful mechanism for funding their education. Investors seeking financial stability, disciplined cash-flows, and flexibility in managing their mutual fund investments should explore SWP schemes.

Is SWP a good option?

SWP (Systematic Withdrawal Plan) can be a good option for investors looking to generate regular cash flows from their investments while maintaining or even growing their principal amount to the extent possible. For moderate rates of withdrawal, SWP can provide regular cash flows along with capital appreciation. It is especially suitable for retirees and those with ongoing financial needs. The choice of funds for SWP depends on individual financial goals, risk tolerance, and tax considerations. Investors should carefully assess their specific circumstances and consult a financial advisor to determine if SWP aligns with their needs.

Disclaimer

For Product labelling, scheme and benchmark riskometer and Performance of scheme in SEBI prescribed format Click here

The calculators are based on past returns and meant for illustration purposes only. The calculators are designed to assist you to get a better understanding on how returns would have panned out in various scenarios. This calculator alone is not sufficient and shouldn’t be used for the development or implementation of any investment strategy. The calculator uses information that is publicly available and information developed in-house. Information gathered and material used in this calculator is believed to be from reliable sources. DSP Mutual Fund however does not warrant the accuracy, reasonableness and/or completeness of any such information. It is neither an investment advice nor should it be construed as indicative of any returns of the schemes of DSP Mutual Fund. In view of the individual circumstances and risk profile, each investor is advised to consult their investment/tax advisor(s) before making a decision to invest. Investments made in mutual fund schemes carry high risk and there is no assurance or guarantee that the objective of the schemes will be achieved.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Online KYC Registration

Online KYC Registration  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  FAQs

FAQs Reach us

Reach us

.

.