7.88 lakh people have invested in this fund

7.88 lakh people have invested

in this fund as of

Total AUM

₹16,135.31 crores

as of Jan 31, 2026

Age of Fund

13 years 1 month since Jan 01, 2013

Expense Ratio

0.8%

as of Feb 17, 2026

Exit Load

1%

upto 12 Months

Ideal holding period

10 Years+

| Mid Cap | 4.2% |

| Small Cap | 90.0% |

| Holdings | Weight % |

|---|---|

| Lumax Auto Technologies Limited | 5.2 % |

| Thangamayil Jewellery Limited | 3.5 % |

| eClerx Services Limited | 3.2 % |

| Kirloskar Oil Engines Limited | 2.9 % |

| Jubilant Ingrevia Limited | 2.8 % |

| Dodla Dairy Limited | 2.8 % |

| Welspun Corp Limited | 2.5 % |

| LT Foods Limited | 2.3 % |

| Triveni Engineering & Industries Limited | 2.1 % |

| Cyient Limited | 2.1 % |

| View All Holdings | 29.3 % |

| Credit rating profile | Weight % |

|---|---|

| Cash & Equivalent | 5.8 % |

| Instrument break-up | Weight % |

|---|---|

| TREPS | 5.8 % |

| Holdings | Weight % |

|---|---|

| TREPS / Reverse Repo Investments | 5.8 % |

| Cash & cash equivalents | -0.1 % |

| 5.8 % |

Portfolio turnover ratio

0.12 last 12 months

Performance highlights over last

for

investment

Cumulative returns on

Annual returns

Current value

Historical Returns (As per SEBI format)as of with investment of₹10,000

| This fund | BSE 250 Small Cap TRI ^ | NIFTY 50 TRI # | ||||

|---|---|---|---|---|---|---|

| CAGR | Current Value | CAGR | Current Value | CAGR | Current Value | |

Income distribution Cum Capital Withdrawal (IDCW) Distributed

| Record Date | Face Value | IDCW per unit | NAV Before | NAV After |

|---|

| Funds | Annual returns | Current Value | Absolute Growth |

|---|

Click here to view the information ratio of the scheme.

Date of allotment: Jan 01, 2013.

Period for which fund's performance has been provided is computed based on last day of the month-end preceding the date of advertisement

Different plans shall have a different expense structure. The performance details provided herein are of Direct Plan.

Since inception returns have been calculated from the date of allotment till June 30, 2021

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments

Rolling returns have been calculated based on returns from regular plan growth option.

Pursuant to payments of Income Distribution cum Capital Withdrawal, the NAV of the IDCW option(s) of Schemes would fall to the extent of payout, and statutory levy, if any.

^ Fund Benchmark # Additional Benchmark

Vinit Sambre

The primary investment objective is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities of small cap companies. From time to time, the fund manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction.

There is no assurance that the investment objective of the Scheme will be realized

An open ended equity scheme predominantly investing in small cap stocks

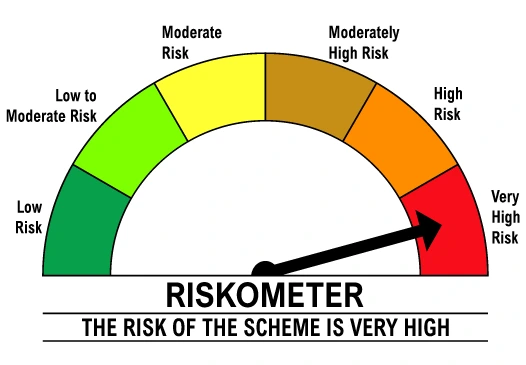

Level of Risk in the fund

| Holding period | Capital gain type | Applicable tax rate |

|---|---|---|

| More than 12 months | Long term | 12.5 % |

| 12 months or less | Short term | 20 % |

Mutual fund taxation is based on the fund's taxation category, sub-category, and holding period. The applicable tax rates are subject to prevailing tax laws, including surcharges, cess, and exemptions. Please consult a tax advisor for personalized guidance. View detailed tax guide

Transaction timelines

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if money is received before cut-off) | 3:00 PM (business days) | Units added to your folio on T+1 days (if money is received before cut-off). |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Redemption processed on T+1 business days. Money credited to your bank account by T+2 business days. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| Same-day NAV (if request is placed before cut-off) | 3:00 PM (business days) | Switch-out processed on T+2 business days |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NAV of this scheme | 3:00 PM (business days) | Units added on T+1 business days after the switch-out from the source scheme. |

| NAV You Get | Cut-off Time | Processing Timeline |

|---|---|---|

| NA | NA | Money credited instantly. |

A small cap fund is a mutual fund that invests in stocks of companies that are ranked 251 and onwards by market capitalisation in India. A small-cap fund can potentially drive relatively higher returns for your portfolio if invested long-term, provided you have the appetite to tide over the possible short-term volatility. It can help to diversify your portfolio by complementing other equity and debt mutual fund investments.

A key characteristic of a small-cap mutual fund is its volatility or sensitivity to market conditions. Over short or medium terms, small-cap funds may carry this risk of fluctuation in returns. Having said that, in the long run, they might have the potential of helping you achieve your long-term life goals like retirement or your child's higher education.

If you have a high-risk appetite, it is only then recommended to invest a portion of your portfolio in small-cap funds Of course, you will need to be patient with the market's ups and downs and hold on to your investment for the long term.A small-cap fund can help you diversify the risk and returns of a portfolio. While they're more likely to be volatile in the short term than mid-caps or large caps, they may likely see potentially higher returns in certain market conditions when held for the long term.

A small cap fund lets you capture a company's growth journey from it being relatively lesser known in the market until it enters the top 250 stocks in the index basis market capitalisation.

Small cap funds can potentially enhance your portfolio returns compared to large cap funds, which are proven to provide moderate returns (subjected to market conditions). This is because large-cap funds are invested in companies that are meant to be more stable in nature as they are already established. With small-cap companies, on the other hand, the returns have more wriggle room given the higher growth potential.

Anyone can invest in a small-cap mutual fund provided they are looking for long-term capital growth and appreciation in their investment's value and has the risk appetite for it.

Over the short or medium term, small-cap funds may experience market volatility. The funds invested into small-cap funds should be treated as money required for a goal over 10 years.

Finally, investors who have low-risk appetites may not enjoy the experience of market volatility that accompanies a small-cap fund on its path to potential growth. Alternatively, investors like this can take a holistic look at their portfolio value and/or invest only a small part of it in small-cap mutual funds . We advise due diligence before making a decision to invest in small-cap funds.It is recommended to invest in DSP Small Cap Fund with a SIP or systematic investment plan and for a longer period of time. Small-cap funds can be sensitive to market conditions over short-term periods. However, they have the potential to give higher returns along with higher risk as well over the long term. The benefit of a SIP is that it helps in averaging your cost of purchase across the market's ups and downs over time, i.e. rupee cost averaging.

Having said that, if you have the expertise to be able to time the market, a lump sum investment can be considered as well. While you can invest in DSP Small Cap Fund with a lump sum, it is important to remember the long-term mindset required to harvest a small-cap fund's returns.The thumb rule, and not just for small-cap fund/DSP Small Cap Fund , is that your returns from your mutual fund are not taxed if you continue to hold on to them.

Short-Term Capital Gains (STCG) are gains made from selling your small-cap fund/DSP Small Cap Fund units before 12 months from the date of purchase.

Whereas, Long Term Capital Gains (LTCG) are gains made from selling your small-cap fund/DSP Small Cap Fund units after 12 months from the date of purchase.

Here's how they are taxed:| Applicable tax as per the Income Tax Act, 1961 | |

|---|---|

| Short-term gain (< 12 months) | Long-term gain (>12 months) |

| 15% | No tax till Rs 1,00,000.10% above 1,00,000 |

Historic small-cap fund investment returns are typically higher when evaluated over long-term periods. If you invest for the long term, typically around 7-10 years, the possibility of your small-cap fund/DSP Small Cap Fund giving you relatively higher returns compared to a large or mid-cap fund can be potentially higher. However, the long-term mindset is critical as stocks in this asset category are volatile and sensitive to market conditions over the short term.

A premature or medium-term withdrawal of funds can have an investor miss the period of potential growth that is possible in a small-cap fund . While past returns are not indicative of a small-cap fund's/DSP Small Cap Fund's future performance and returns, one can see that returns over longer terms may potentially hover above the anchor of 15% (however, it's not guaranteed and is subjected to fluctuation due to market conditions at any point of time). A SIP and a long-term mindset can be catalysts for an investment to give you such a return.Any small-cap fund is likely to fluctuate across market conditions. DSP Small Cap Fund, too, can be volatile when considered over a short period, like 5 years or less. However, if held for the long term, the fund may have the potential to outperform subjected to market conditions.

For a better understanding of a fund's performance across market conditions, you can look at the standard deviation of the fund, which is a measure of the volatility of a mutual fund scheme. Having said the above, as per the risk-o-meter, small-cap funds do fall under the " very high risk " category. Hence, we recommend that you take into account your risk appetite before investing.

For Scheme type, product labelling, Riskometer and other details and disclaimers of DSP Small Cap Fund , kindly scroll above.

7.88 lakh peoplehave invested in this fund as of