1860

The DSP family began their involvement in the financial sector, laying the foundation for future contributions to the industry.

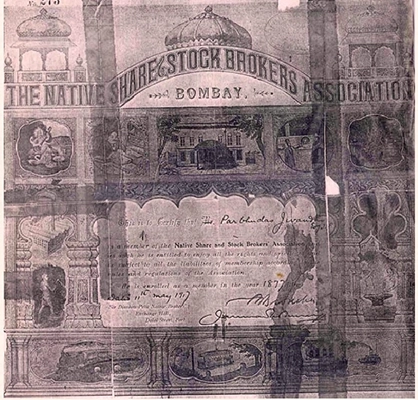

1875

An informal association of brokers was formed, including members of the DSP family.

1877

The first Indian stock exchange was established, with the DSP family among the founding members. Originally called 'The Native Share & Stock Brokers Association.'

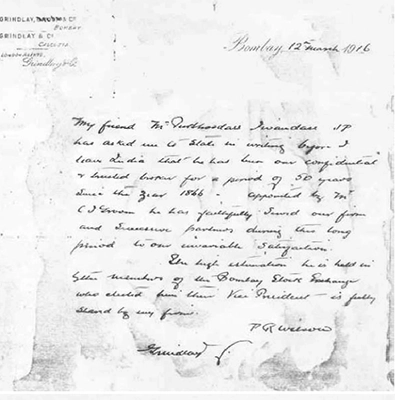

1916

The DSP family was recognized by Grindlays for their 50 years of esteemed brokerage services, dating back to 1866.

1953

The DSP family set up DS Purbhoodas Public Trust to support various public causes, continuing their legacy of community service.

1969

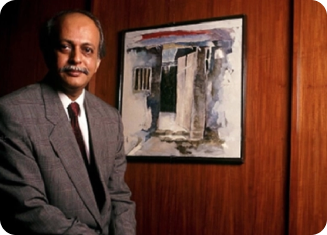

Hemendra Kothari joined his family's broking firm, DS Purbhoodas, representing the fourth generation of his family in the business.

1975

Hemendra Kothari founded DSP Financial Consultants Limited (DSPFC) in Mumbai on October 23rd, specializing in merchant banking, financial consultancy, investments, and finance.

1983

DSPFC entered into a significant business partnership with Dresdner Bank, AG, enhancing their financial services and global reach.

1984

DSPFC partnered with Merrill Lynch, the largest investment bank in the United States, marking a major milestone in their international expansion.

1985

DSPFC advised Merrill Lynch on launching 'The India Fund,' the first international mutual fund for investments into India. They also led India's first public bond issue in the German market for IDBI.

1987

DSPFC formed a business arrangement with Swiss Bank Corporation (SBC), further expanding their international collaborations.

1991

Hemendra Kothari was elected President of the Stock Exchange, Mumbai, after serving as Vice President for three years, highlighting his leadership in the financial sector.

1992

DSPFC and IDBI jointly promoted the IDBI Investment Management Company (IIMCO) to manage funds, marking a new venture in fund management.

1993

DSPFC, along with Merrill Lynch and SBC, led multiple new transactions, including the first Euro Convertible Bond issue for Essar Gujarat and project finance structuring.

1994

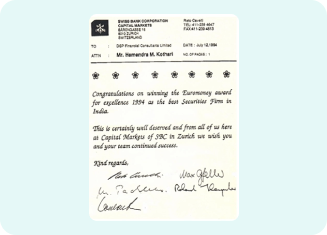

DSPFC co-managed GDR issues for East India Hotels Ltd. and JCT Ltd. They also received the 'Euromoney Award for the Best Securities Firm in India.'

1996

DSPFC formed DSP Merrill Lynch Ltd. (DSPML) with Merrill Lynch acquiring a 29.41% equity stake, later increasing to 40%. They also formed DSP Merrill Lynch Asset Management (India) Ltd.

1997

DSP Merrill Lynch Asset Management launched its first domestic equity and debt mutual fund schemes, expanding its investment offerings.

2005

DSP Merrill Lynch Fund Managers launched the Merrill Lynch Specialist Investment Funds (MLSIF) India Fund, a Luxembourg-domiciled UCITS fund for global investors.

2008

Following BlackRock's global asset management takeover, DSP Merrill Lynch Fund Managers became DSP BlackRock Investment Managers Ltd.

2018

DSP Group purchased BlackRock's 40% stake in DSP BlackRock Investment Managers, renaming it DSP Investment Managers. DSP BlackRock Mutual Fund became DSP Mutual Fund.

2023

DSP Investment Managers Private Limited (DSPIM) demerged its asset management business to form DSP Asset Managers Private Limited (DSPAM), effective April 1, 2023.

Today

DSP Asset Managers continues to help millions of Indians #InvestForGood, focusing on doing the right things with the right intent and always prioritizing investors' needs.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.