DSP NETRA JANUARY 2024

A Case Study, Valuations & Opportunities

This Time It’s Different? Finally?

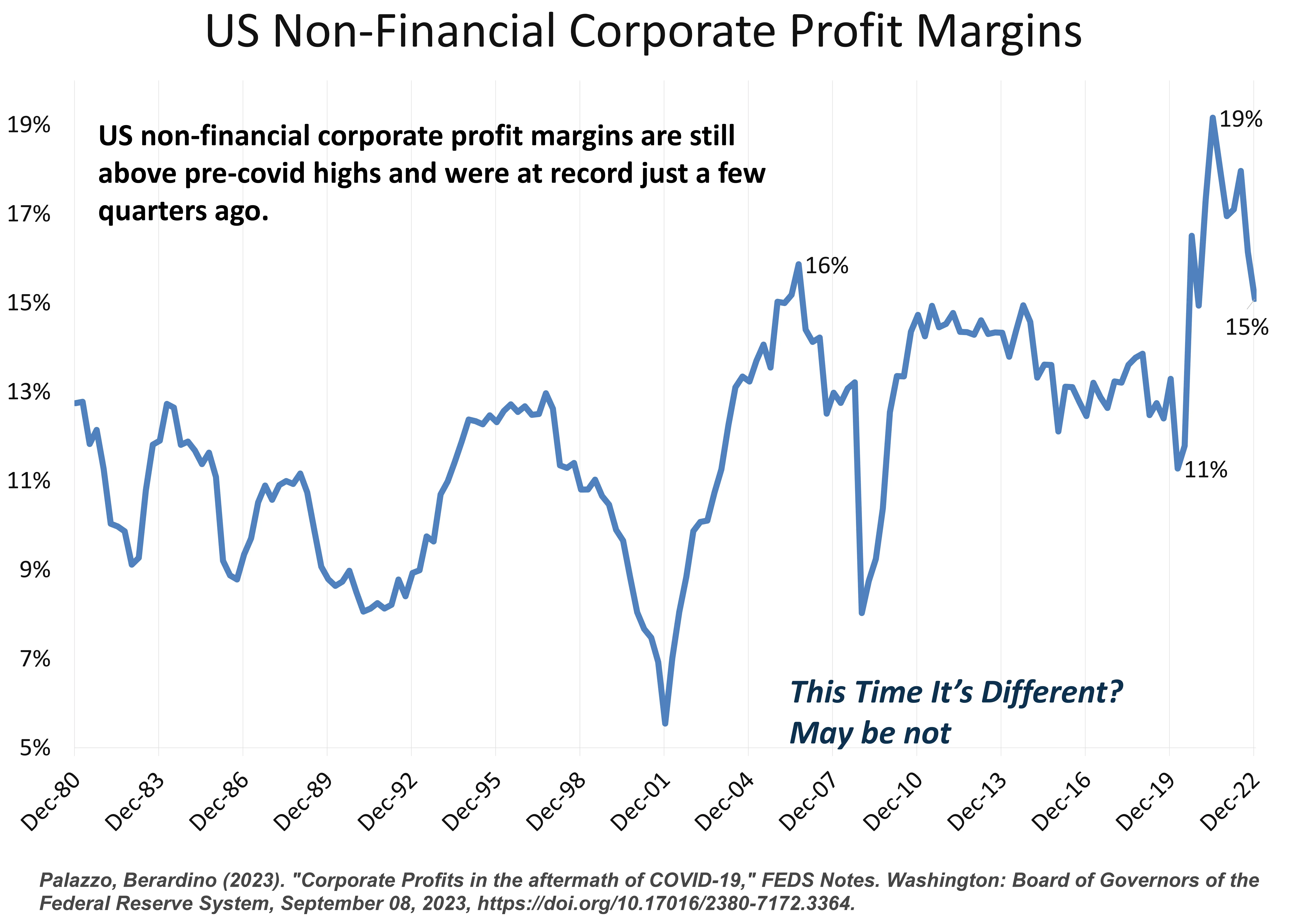

A commonly discussed narrative has unfolded as follows:

Post the COVID-19 pandemic and amidst heightened demand coupled with concurrent challenges in the supply chain, corporate entities raised the prices of their final goods and services beyond what was justified by changes in labor costs and input prices. The resultant effect was a significant expansion in profit margins, playing a contributing role in the broader context of inflation.

Many have called this the new normal or the new era of heightened corporate profitability. Narratives like Big Becoming Bigger and the Magnificent 7 have contributed to these narratives.

In next few charts, we will take a look at what contributed to this corporate margin surge and how far could this continue?

Source: BEA, FRED, DSP; Data as on Dec 2023

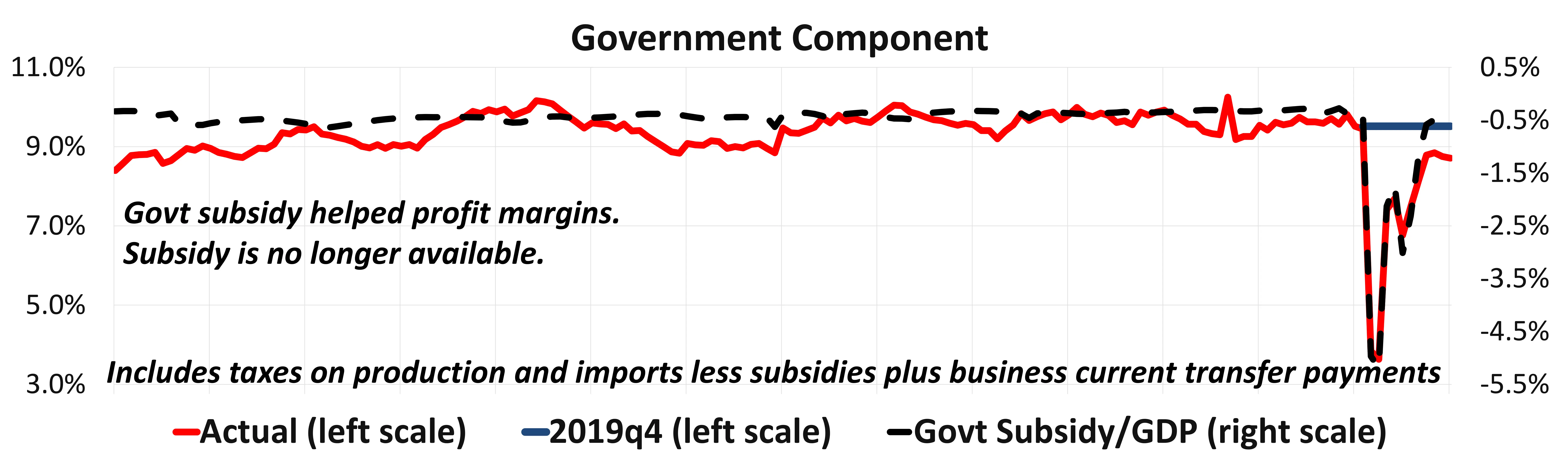

Cost Component Savings Contribute To Profit Margin Expansion?

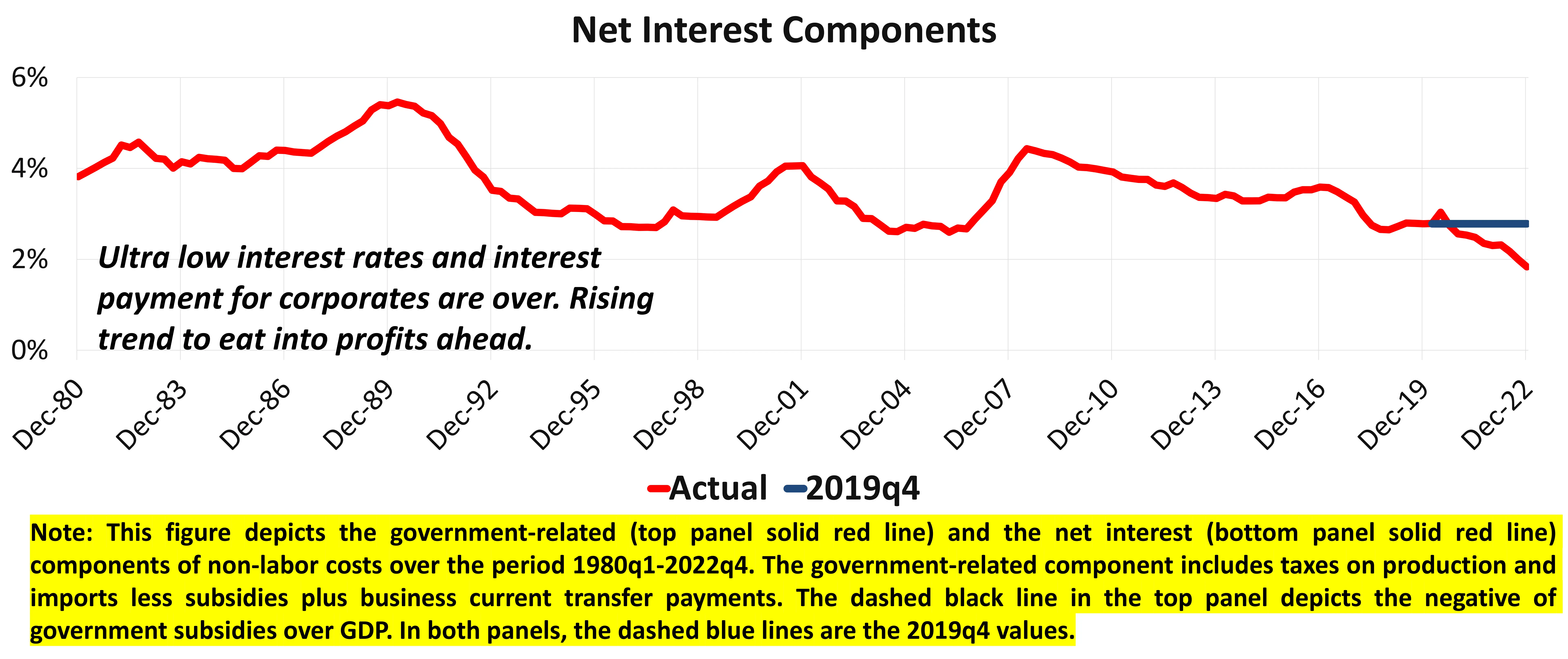

Due to the impact of the COVID-19 pandemic, unprecedented support was extended to U.S. businesses through legislative measures such as the Coronavirus Aid, CARES ACT of 2020, the Paycheck Protection Program and others. These initiatives significantly augmented the subsidy component of non-labor costs, leading to a substantial increase in corporate profits. The government-related portion of non-labor costs fluctuated between 8% and 10%, with an average of 9.4%. However, in 2020q2, this component dropped to 3.8 %, approximately 13 standard deviations below the 40-year average. The noteworthy shift in the government-related component after 2019 closely aligns with the government subsidy-to-GDP ratio (dashed black line, top panel), strongly indicating that heightened subsidies played a significant role in elevating profit margins.

At the same time, profit margins also received a boost over the 2020q1-2022q4 period by a rapid decline in interest expenses.

Source: US BEA, DSP; Data as on Dec 2023

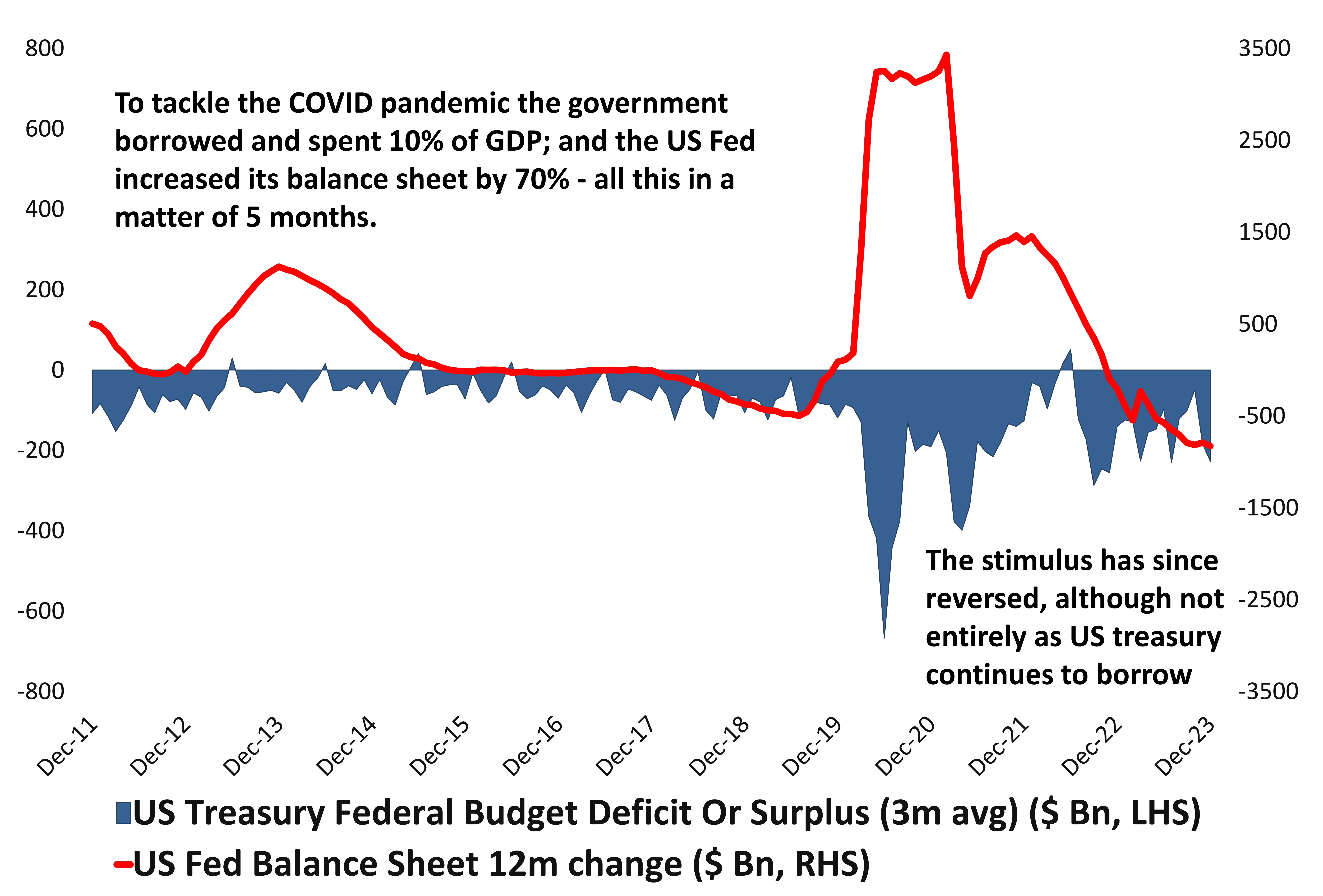

Post Pandemic Double Dose Stimulus – Fiscal Spending & Monetary Easing

The COVID-19 pandemic unleashed a historic economic crisis, prompting a bold joint response from the U.S. Treasury and Federal Reserve from 2020 to 2023. The Treasury deployed trillions through colossal stimulus packages like the CARES Act and American Rescue Plan, offering direct payments, expanded unemployment benefits, and support for businesses and vital sectors like healthcare. In totality the US treasury enacted programs exceeded $5 trillion to support recovery.

Simultaneously, the Fed slashed interest rates and launched an unprecedented quantitative easing program to inject liquidity and bolster financial markets. The Fed more than doubled its balance sheet via quantitative easing, printing more money than ever and slashing rates to near zero.

The Fed has since reversed its stimulus and the US Treasury is yet to reverse fully.

Source: FRED, BEA, DSP; Data as on Dec 2023

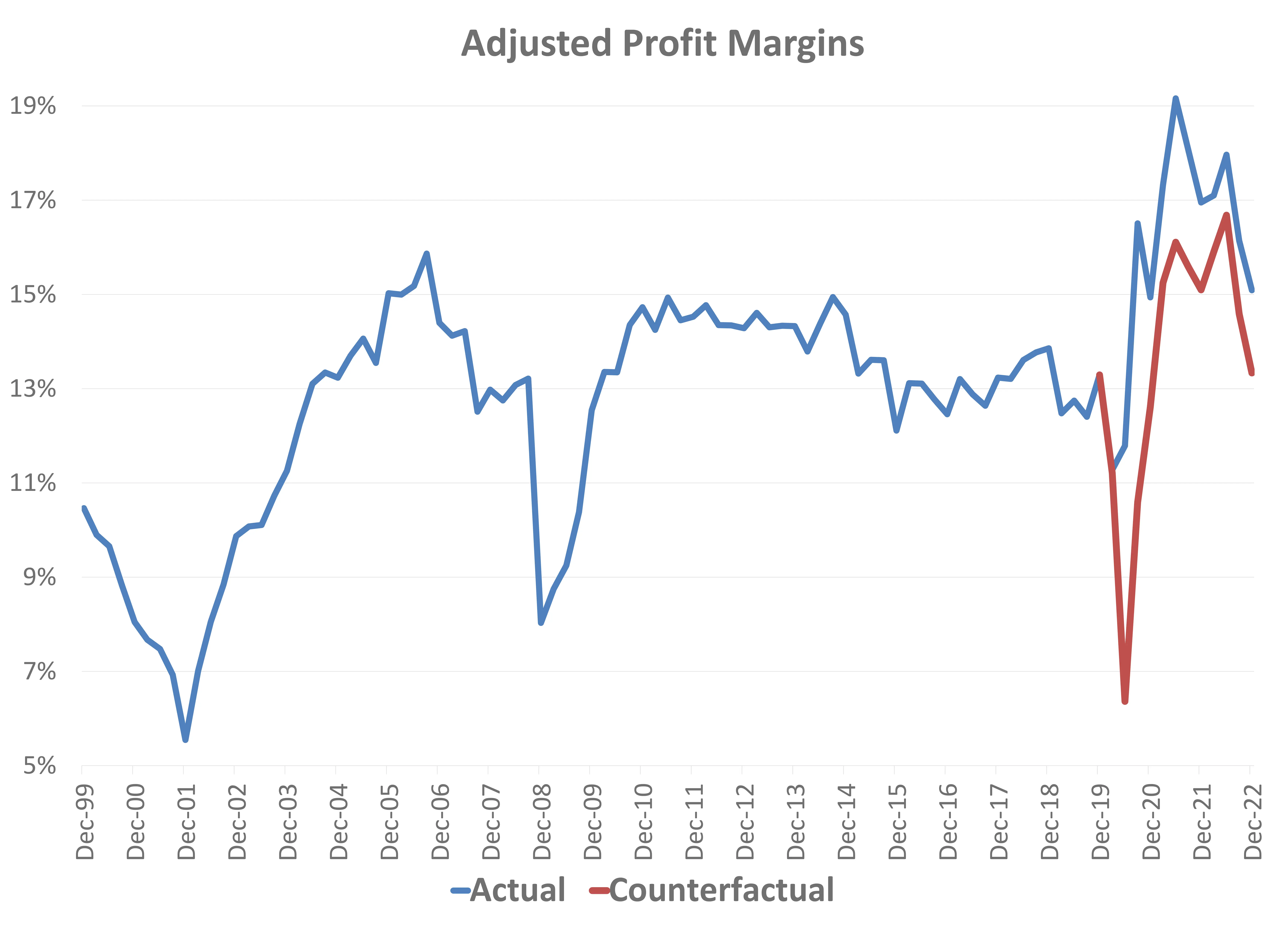

Excluding The Impact of Stimulus Corporate Profitability Is Ordinary

Assuming that

- The government component (costs) had remained fixed at its 2019q4 value over the period 2020q1-2022q4 and

- The net interest component would have stayed fixed at its 2019q4 value over the period 2020q1-2022q4

Without the historically outsized government fiscal intervention and accommodative monetary policy, nonfinancial profit margins during 2020-2021 would have been more in line with past episode of large economic downturns. Overall, profits margins would have been, on average, 25bps lower during the period 2020q2-2021q4.

The profit margin dynamics in the aftermath of COVID-19 is heavily affected by unprecedented government intervention, which contributed to a substantial increase in profit margins.

In 2024, both type of stimulus are likely to reverse. The Fed has already reversed course and 25 to 75bps of easing will not contribute to repricing of corporate debt rates downwards.

Source: BEA, FRED, DSP; Data as on Dec 2023

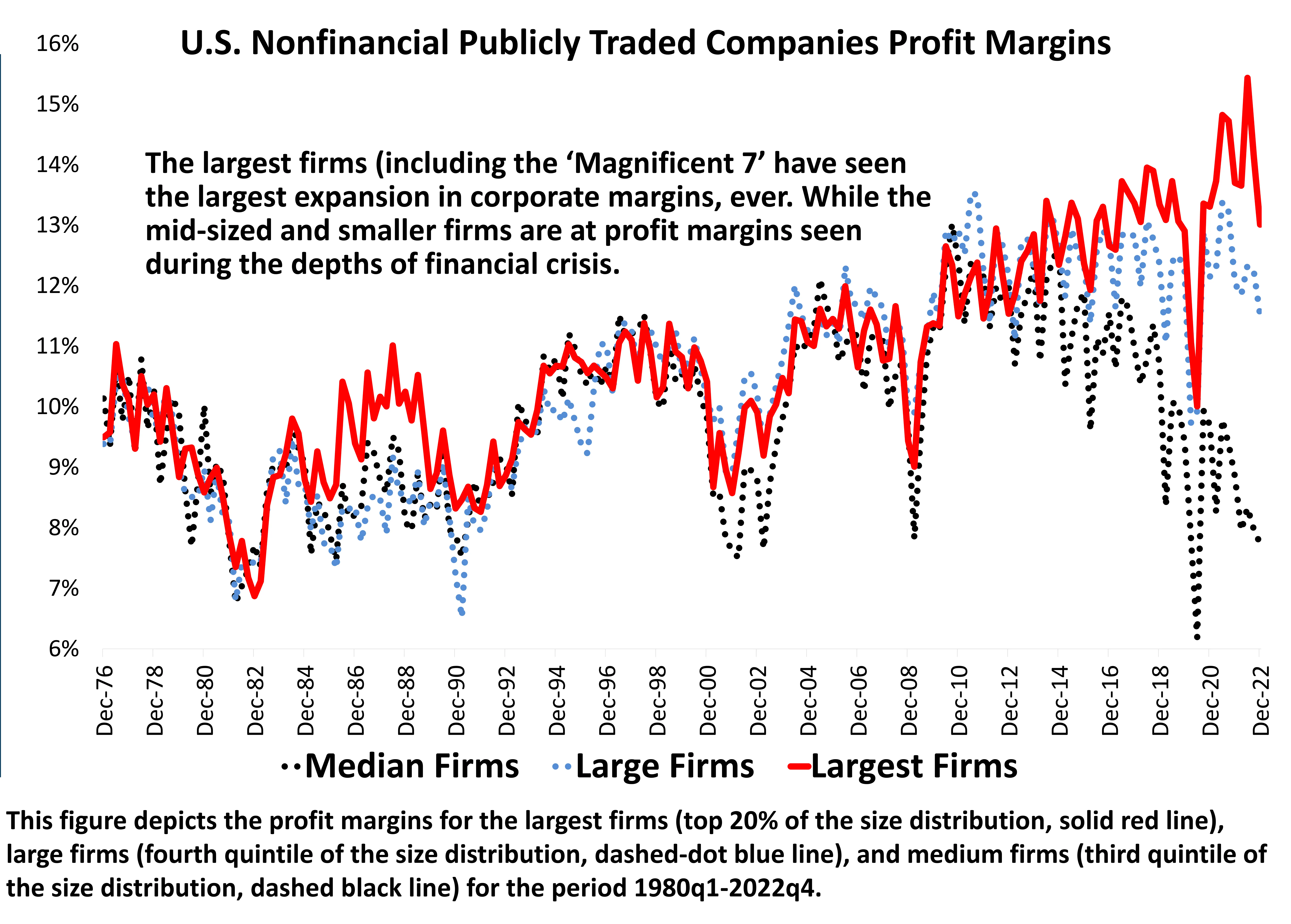

Can US Firms Continue To Report Record Profit Margins?

The profit margins across the three size categories moved very close together until the beginning of the 2010s, after that we see three distinct patterns: the largest firms profit margins display an increasing trend, the large firms profit margins are flat, and the medium firms profit margins follow a decreasing trend.

For the firms in the two largest groups we do not see a pronounced deviation from their pre-covid19 trend, we see a clear deviation from trend for the medium-sized firms. In the latter case, profit margins have remained constantly below their precovid19 trend and they have diverged dramatically from the profit margins of the largest firms. Although all firms benefited from unprecedented stimulus, the smaller firms were hit the most once the easy conditions reversed.

This means US firms will find it tough to report record profit margins as stimulus reverses. The question for investors is what would happen to equity prices?

Source: BEA, DSP; Data as on Dec 2023

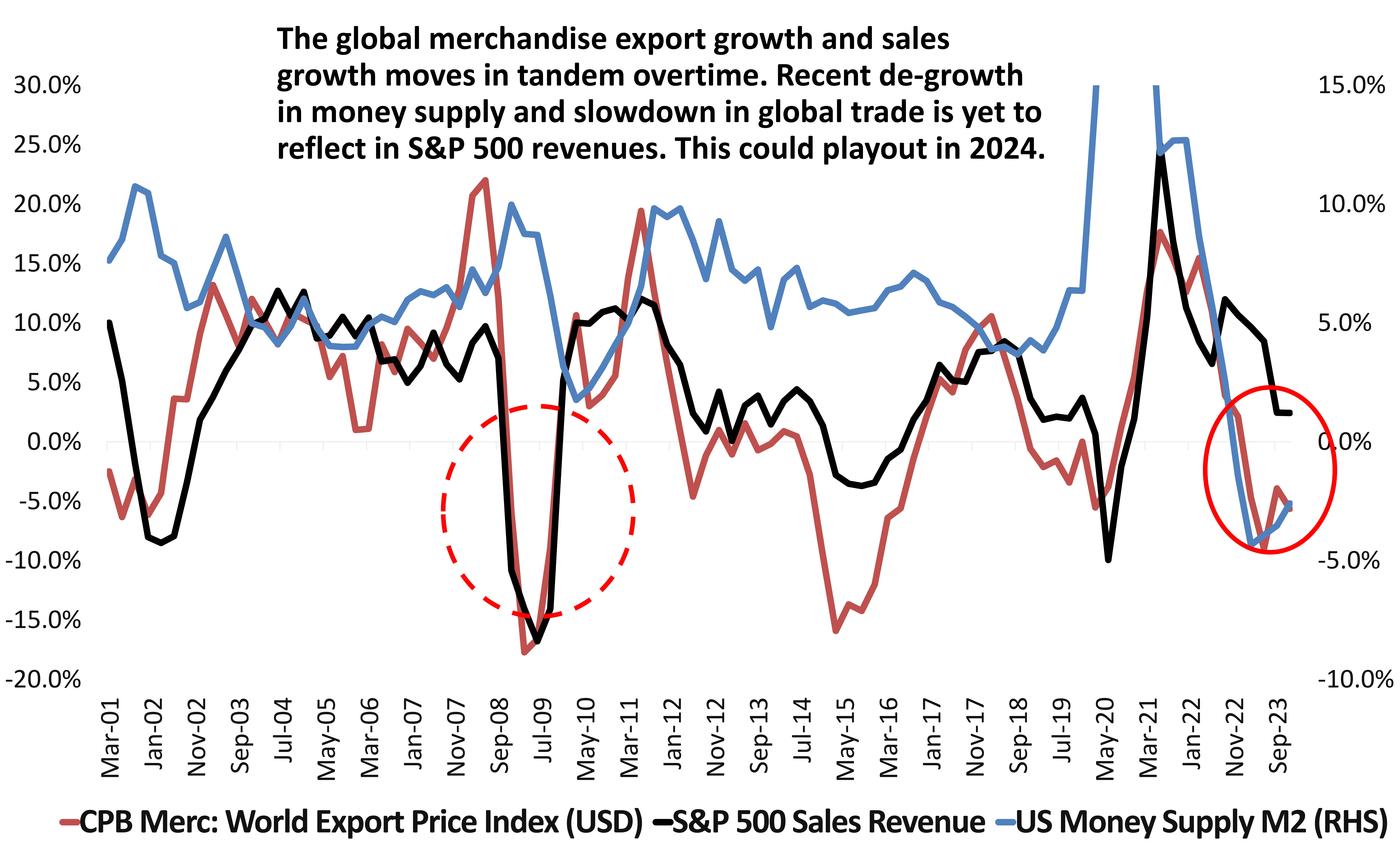

Money Supply, Global Growth Can Pressurize Sales Growth

World trade volume growth has flattened this year (YTD 0.1% growth) as per CPB data. This has coincided with a sharp contraction in money supply across US, EU, UK and China.

Most central banks in the world are trying to unwind the ultra loose monetary policy that was constituted in the aftermath of COVID pandemic.

The result is a gradual slowdown in global growth as suggested by both volume and value of global trade.

However, over the last 3 months, financial conditions have once again eased so much that US Financial conditions index is back to levels where it was when the US Fed BEGAN raising rates for the first time in March 2022.

History shows that a tightness in money supply and a decline in global trade could be a precursor of a slowdown in sales growth momentum and corporate earnings.

Source: Bloomberg, DSP; Data as on Dec 2023

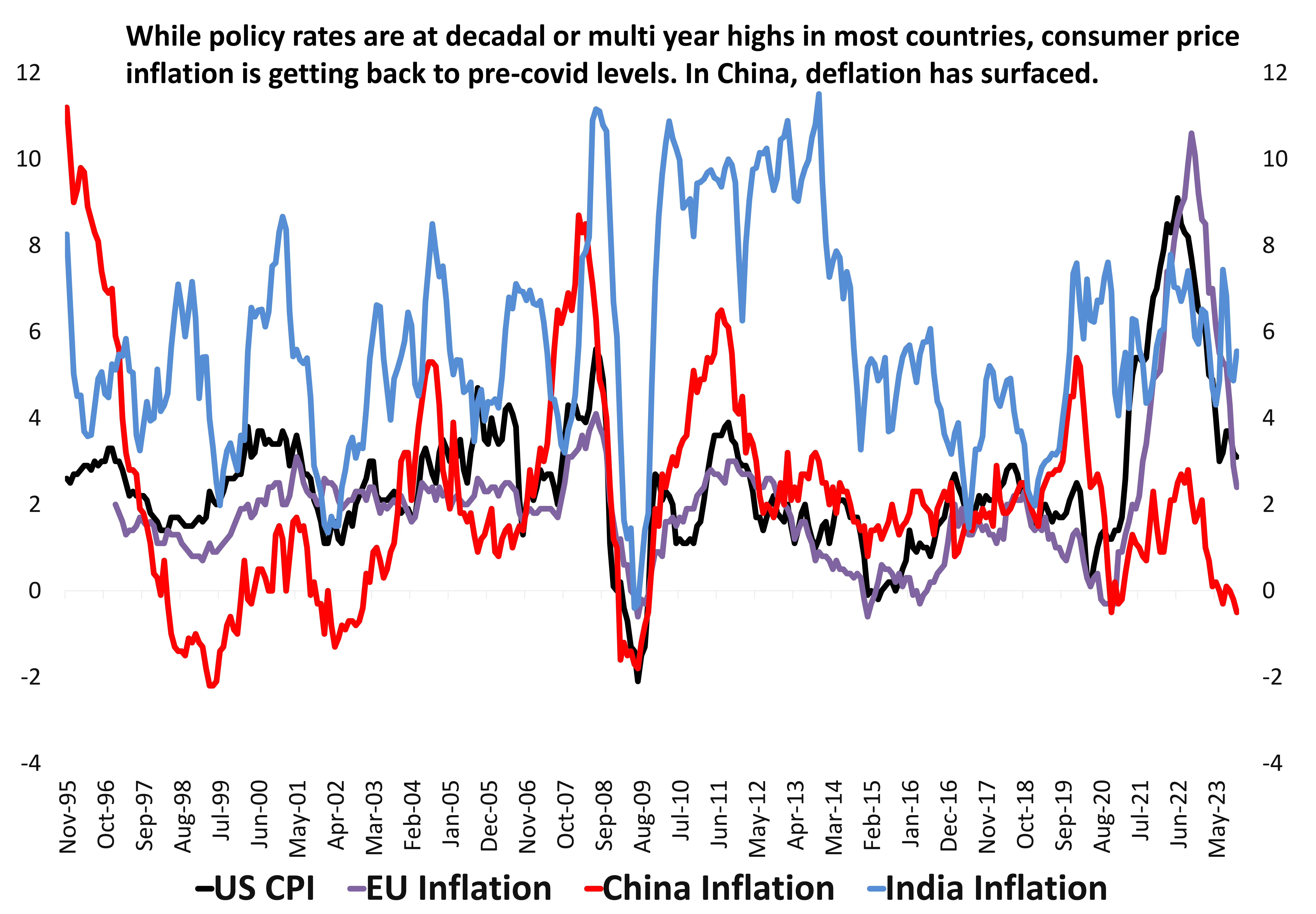

Disinflation Can Turn To Deflation?

Headline Producer prices are declining on a 3 month (yoy) basis in US, EU, China, UK and India. Consumer price indices have come close to or below the central bank’s inflation targets in most countries. Core inflation (which strips out food & fuel prices) are recording multi year lows in Asia and are beginning to see a rapid decline in advanced economies.

A slight deceleration in growth from current levels, especially the services sector in advanced economies, can send inflationary readings way lower. This could come as a surprise for multi year high interest rates set by various central banks.

This scenario can happen only with a backdrop of slowing demand and growth which sends cautionary signals for equities. It also tells us to be constructive on duration and buy bonds with longer maturities in India.

Source: Bloomberg, DSP; Data as on Dec 2023

Every Fed Rate Hike Cycle Has Ended With A Crisis

Source: Bloomberg, DSP; Data as on Dec 2023

It’s More Important To Ask – ‘Why Would Central Banks Cut Rates?’

US fed rate cuts haven’t been kind because they have been a reaction to a crisis. On most occasions when central banks become dovish they err on the side of reducing rates slowly to prop up economy. At present benchmark rates in US, EU are at multi decade high. The central banks are selling bonds via quantitative tightening. They are likely to turn dovish as growth slows and inflation cracks lower.

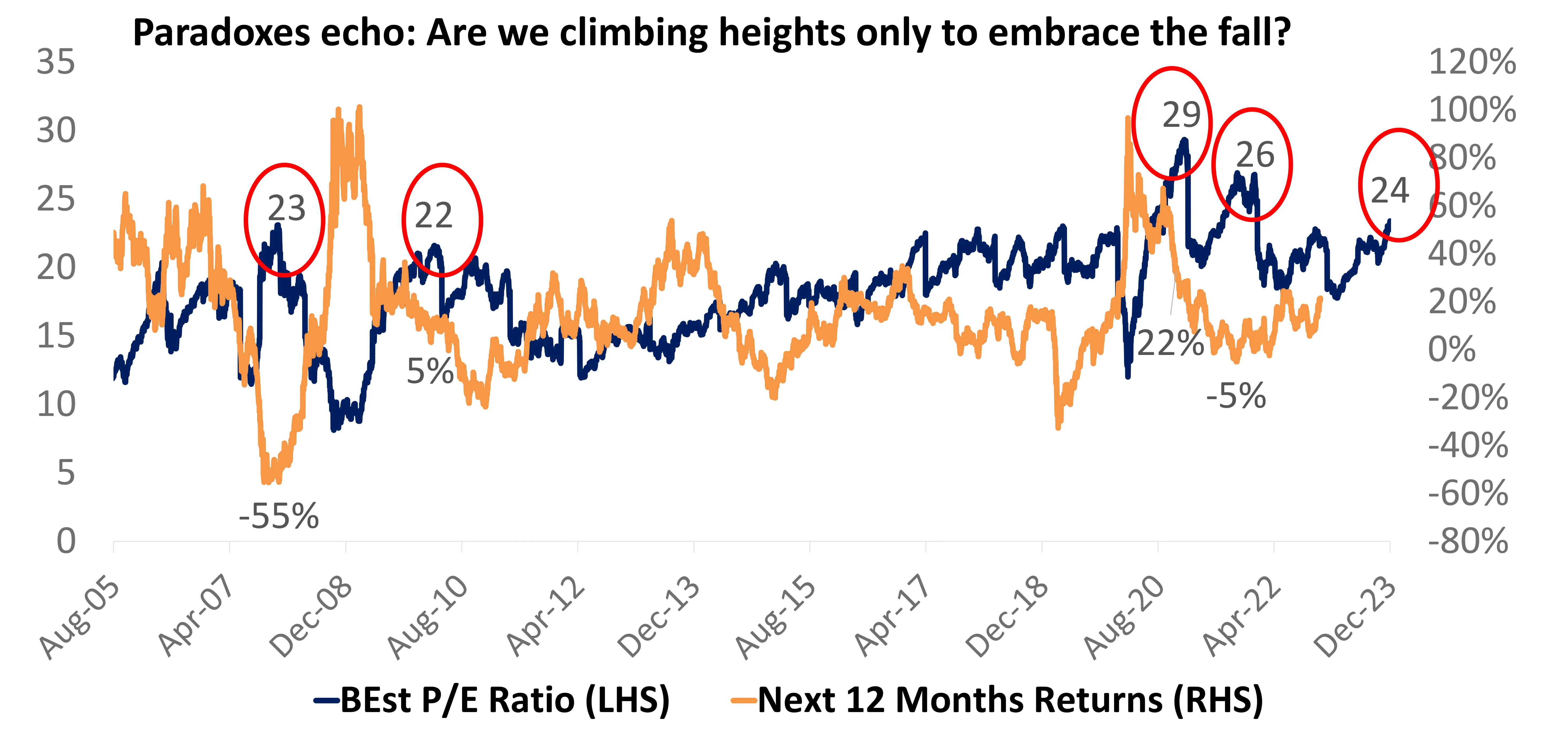

The stock markets on the other hand have already priced in a part of rate cuts by re-rating the PE ratio, valuation multiple higher.

Forward P/E change since 27th Oct low in US indices: S&P 500 +14.5% (the index is up 16.5%) S&P 400 MidCap +21.3% S&P 600 Smallcap +28.3%

Fed Funds rate expectations during this period: 5 rate cuts. Total EPS change in this phase 1%. The market seem to have discounted policy easing which is yet to begin. Earnings growth is the other lever which may disappoint due to slower growth.

Source: Bloomberg, FRED, DSP; Data as on Dec 2023

Valuations, Earnings & Opportunities

India High Frequency Indicators Are Slowing

Source: CMIE, DSP As on Dec 2023

Sales Growth Is Slowing To Low Double Digits Ex of BFSI & Consumer Discretionary

Source: Bloomberg, Investec, DSP; Data as on Dec 2023

Declining Input Costs To Help Profit Margins Make A Comeback

Corporate margins rebounded sharply over the last few quarters. A complete collapse of wholesale prices and input prices helped margins expand.

This is likely to reverse in the next two quarters as consumer level inflation has eased at a faster rate than wholesale prices.

Corporates have gradually taken the benefit of decline in input costs. This trend is likely to weigh on corporate earnings in FY24.

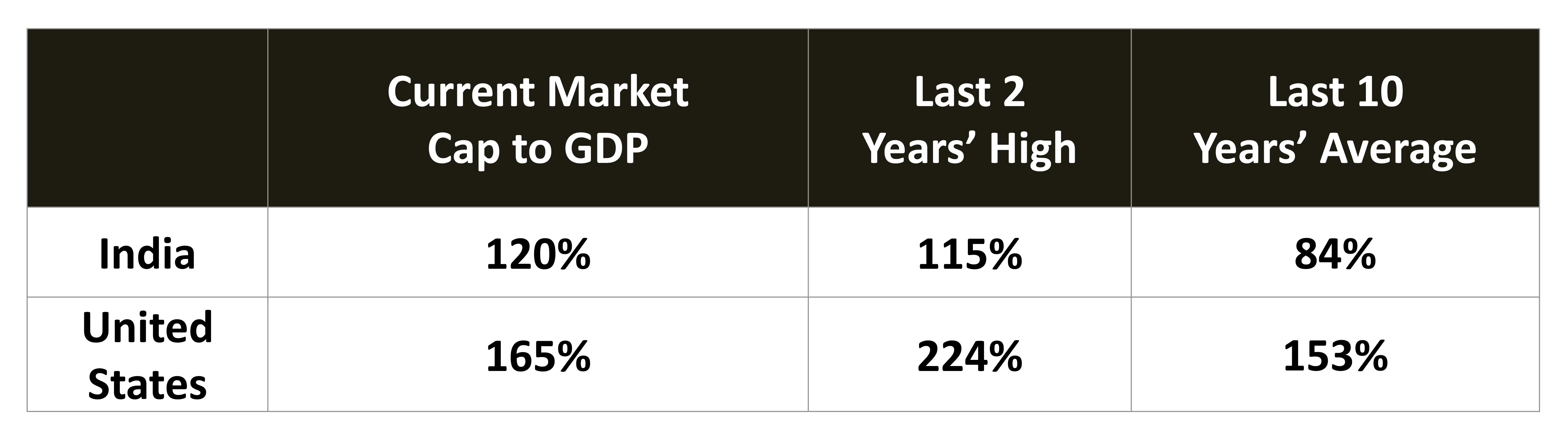

This can cause earnings growth to slowdown and make Indian equities unattractive.

Source: Nuvama Research, Bloomberg; Data as on Dec 2032

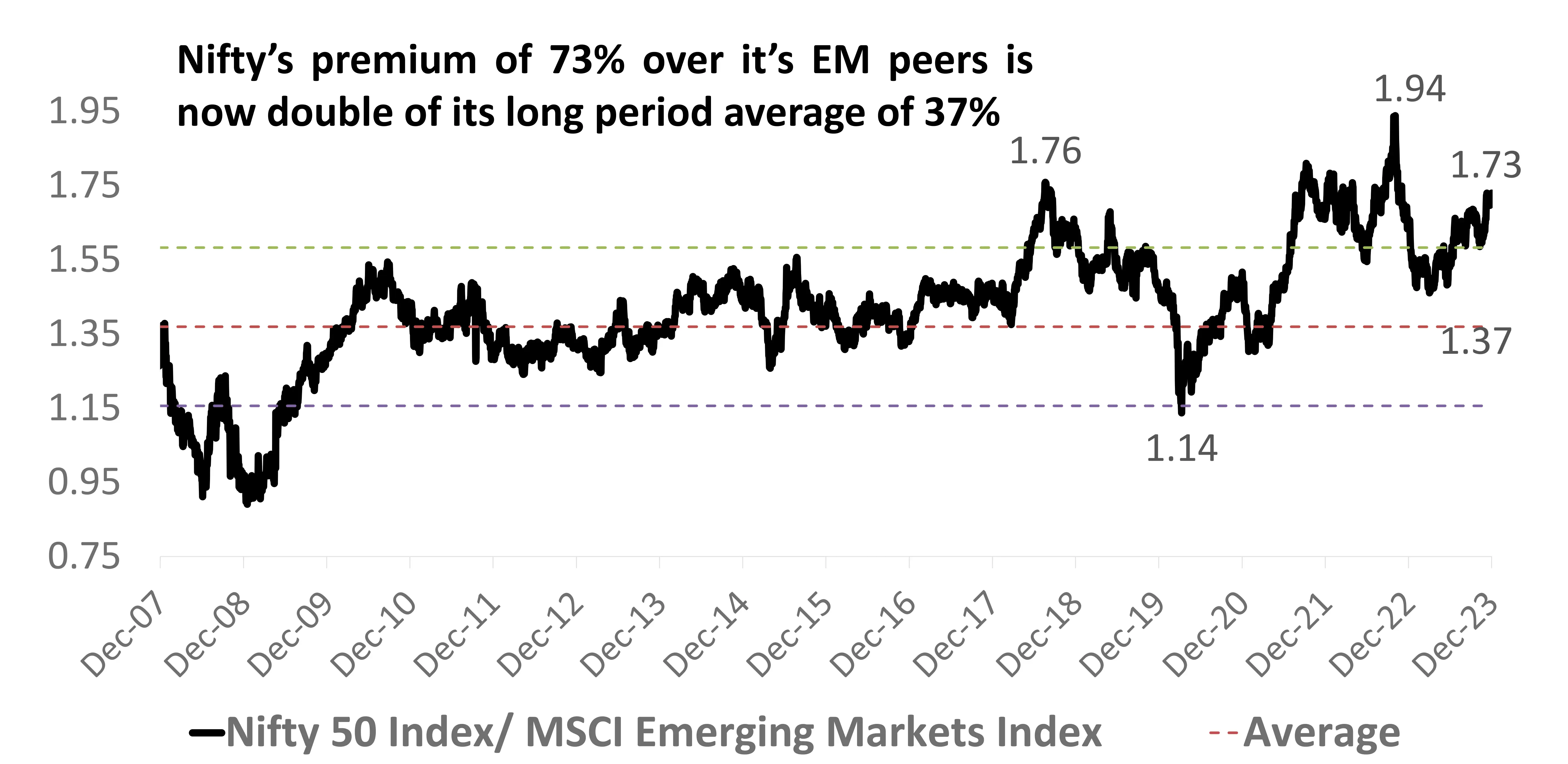

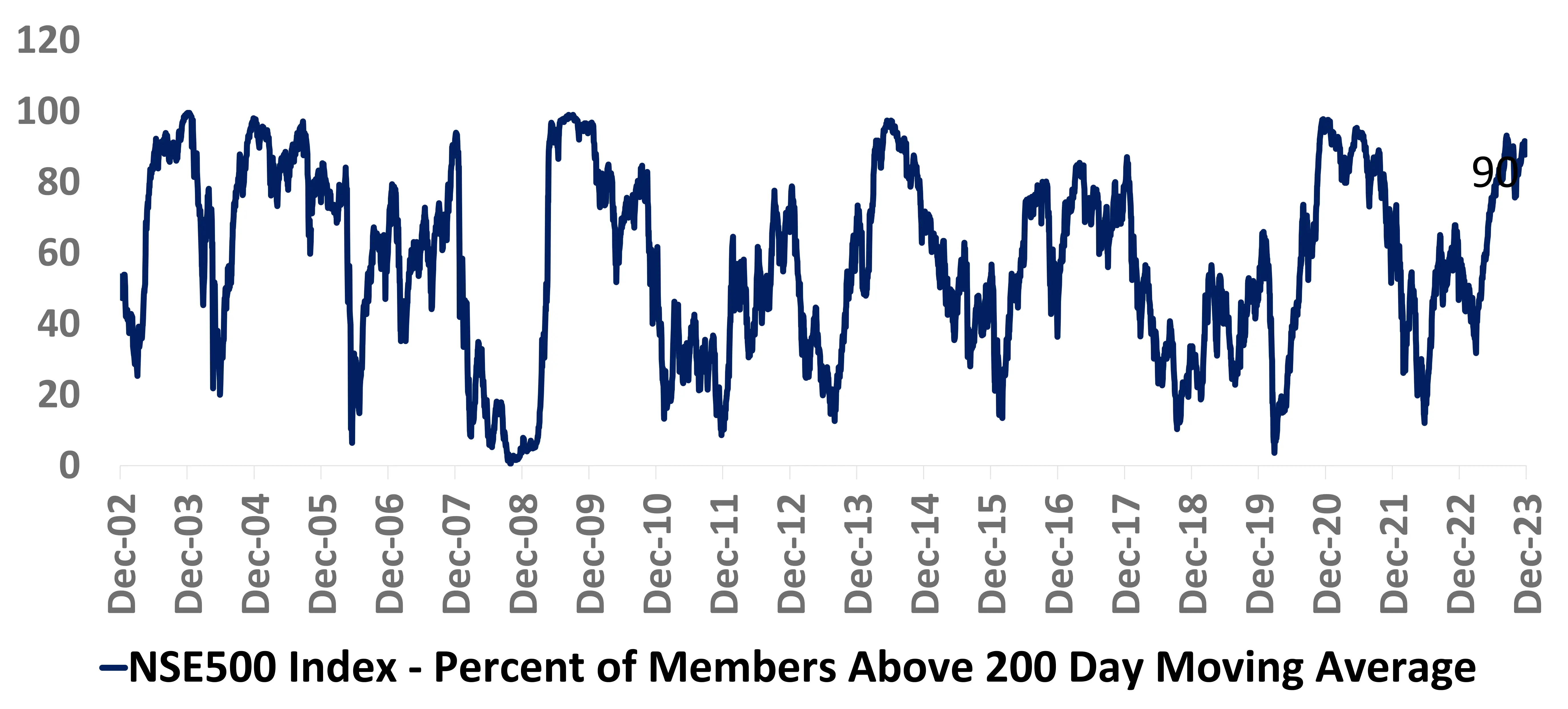

Indian Markets Snapshot

Source: Bloomberg, DSP; Data as on Dec 2023 DMA – Daily Moving Average, Best PE – Bloomberg Estimated PE, EM – Emerging Markets

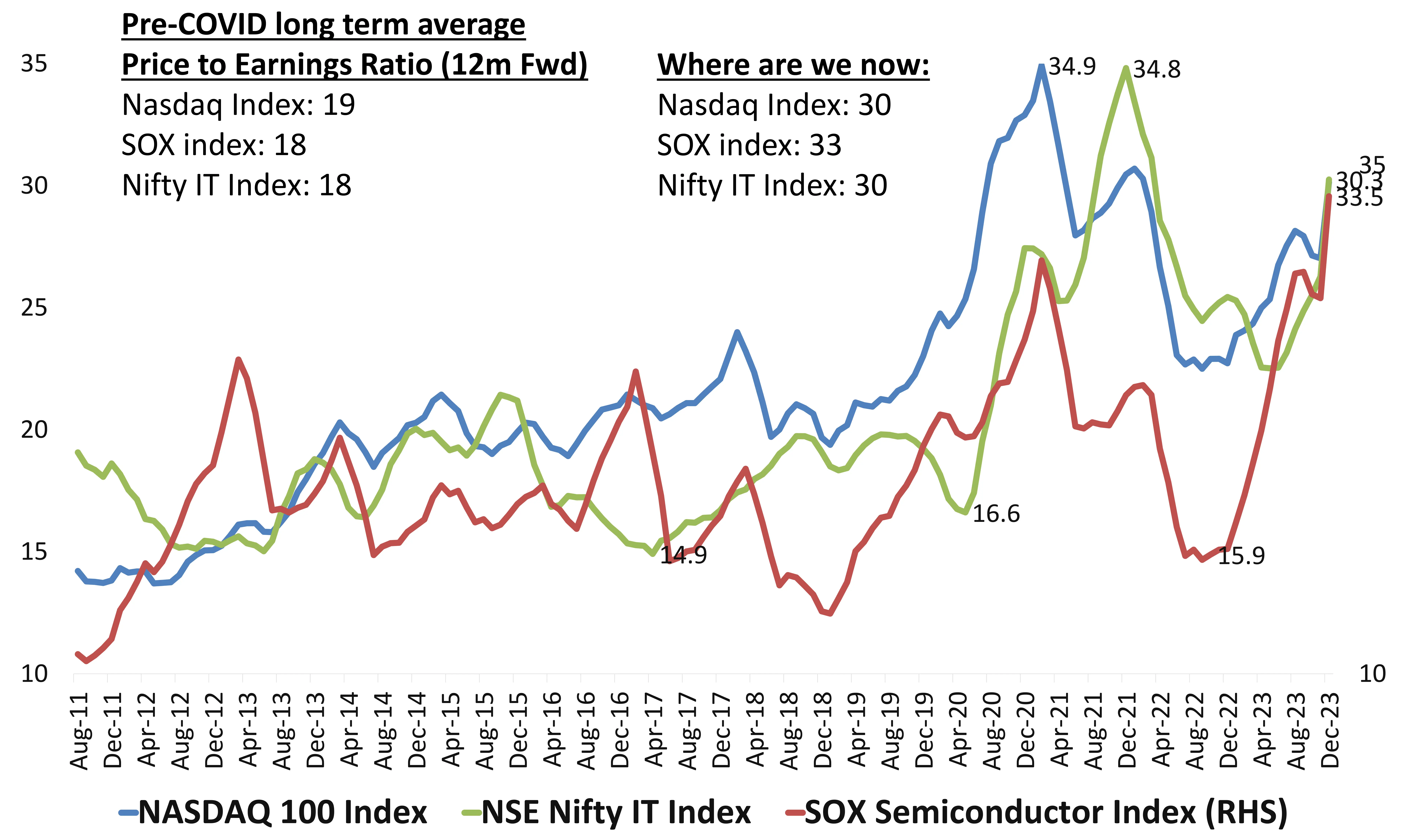

Tech Valuations Are Getting Closer To Post COVID Peak

A large rally in technology sector has brought back Price to earnings ratio for various indices back to expensive zone.

On an adjusted basis (due to delayed earning recovery during COVID) this sector is probably now at the highest 12m fwd valuations, ever!

History shows that it is prudent to remain conservative at such steep valuations even if the earnings trajectory is strong. The sector can face multiple headwinds of growth, slowing revenues and a trimming of valuation multiples.

Source: Bloomberg, DSP; Data as on Dec 2023

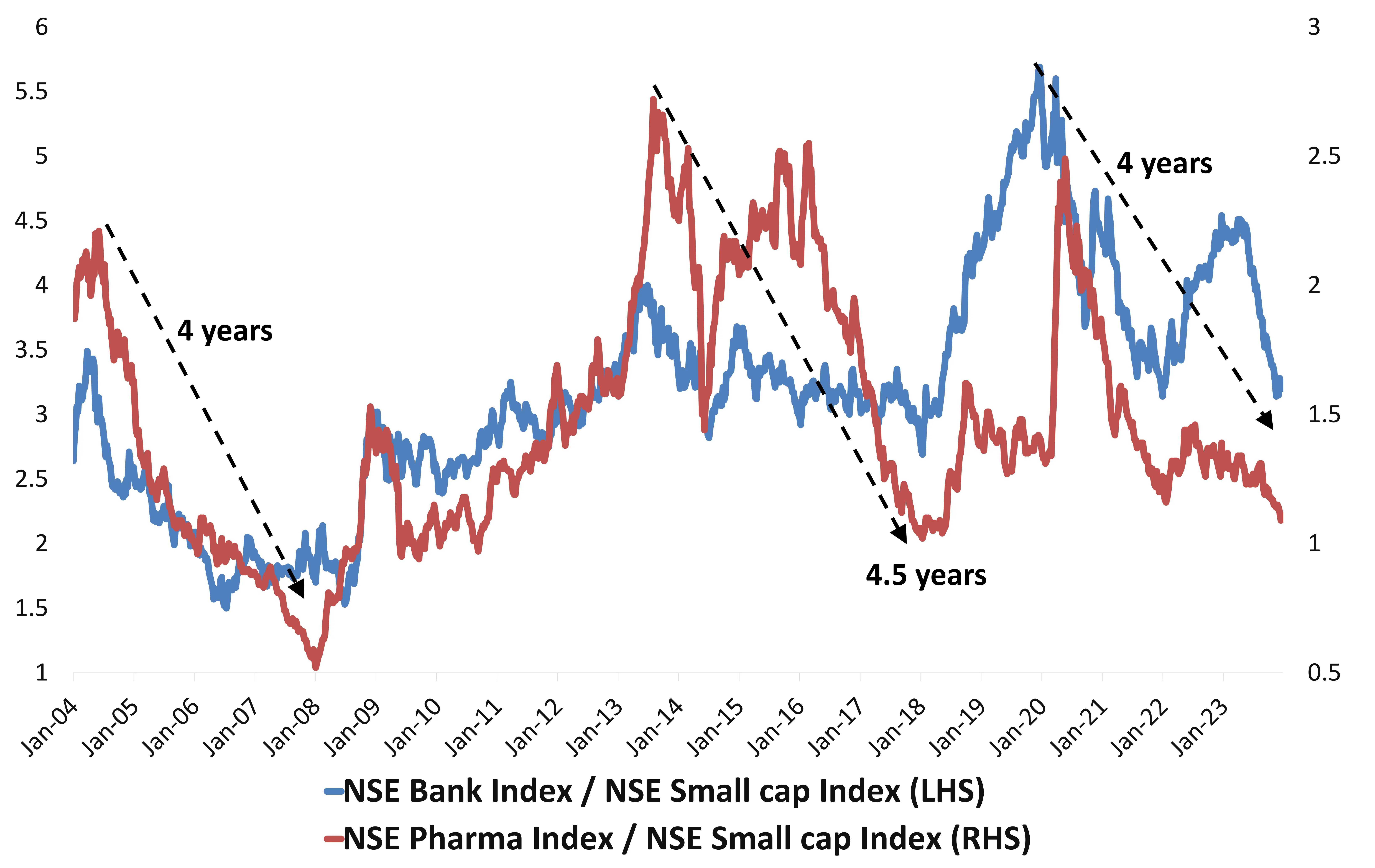

Banks & Pharma Are Attractively Priced Versus The Tail

BFSI & Healthcare are two sectors in India which are trading at average valuations and are witnessing continued improvement in financials.

From a positioning point of view, these two sectors have underperformed the tail of the markets. The tail here refers to the broader small cap universe which usually sees great performance when valuations are rated upwards and investor sentiment is robust.

Historically, there have been three cycles of 4 to 4.5 years in the past when Banks and Pharma sector stocks have underperformed the broader tails by a significant degree. This is the third instance.

Considering the superior earnings trend and better valuations for lender and pharma firms, it is prudent to raise weights in this space and keep the tail exposure limited to where valuations are attractive.

Source: Bloomberg, DSP; Data as on Dec 2023

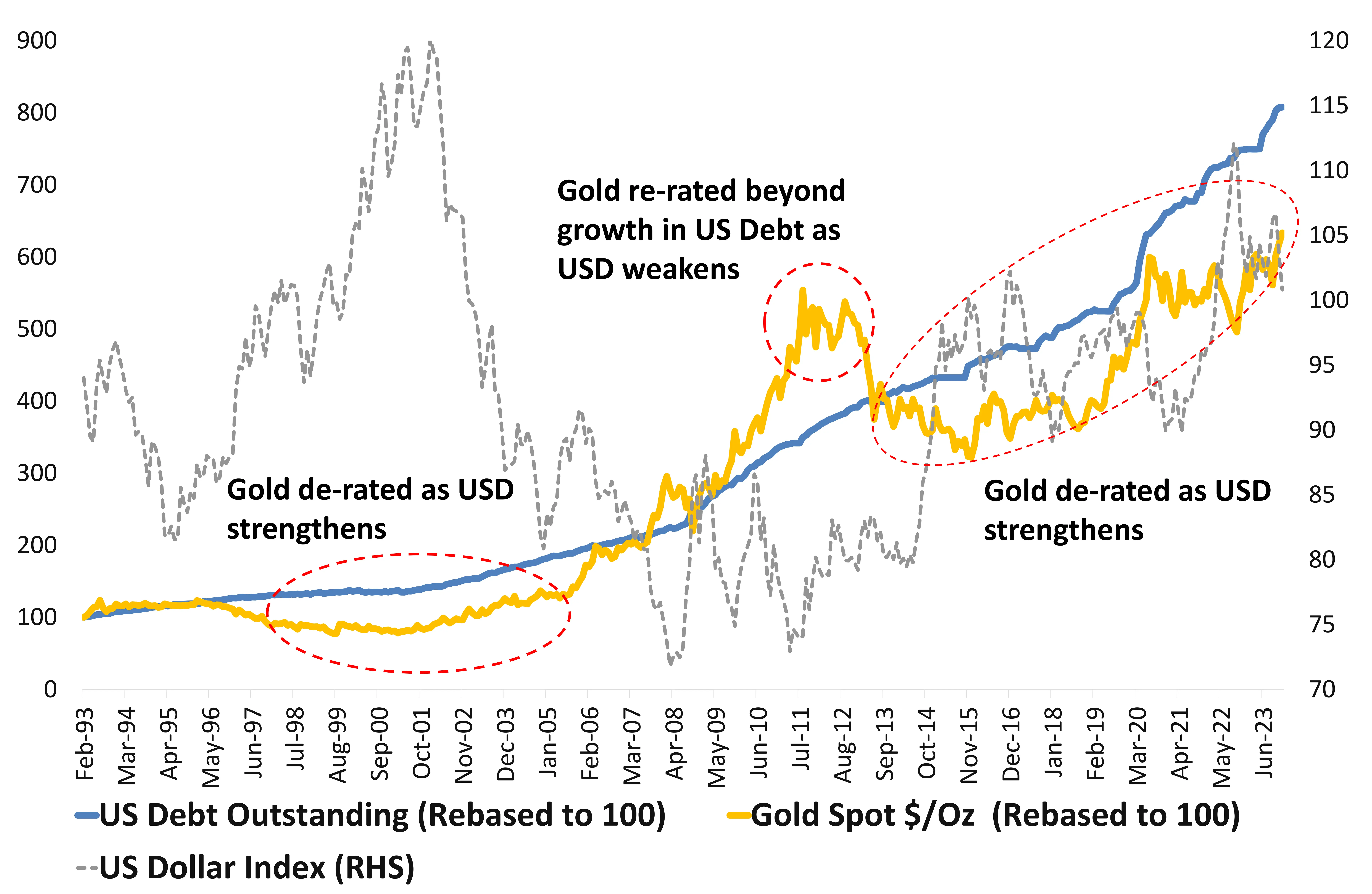

USD Weakness Can Awaken Gold Bugs

Gold prices have historically tracked the rise in indebtedness in US. In cycles where US is accumulating more and more debt, Gold prices respond positively.

The degree to which prices move also depends on the strength of the US Dollar. In period where US Dollar has weakened and US Debt as risen sharply, gold prices have staged multi year bull markets.

Over the last 4 years, US debt has seen a sharp increase which has aided gold prices broadly. However, the US Dollar strength has played to gold’s advantage. In case of a weaker or stabler US Dollar, expect gold prices to embark on a multi year uptrend.

Keeping a strategy of adding gold on dips to your overall exposure could help smoothen portfolio volatility and add to returns.

Source: Bloomberg, DSP; Data as on Dec 2023

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.