DSP NETRA AUGUST 2023

Global Growth Slowdown, Valuations & Opportunities

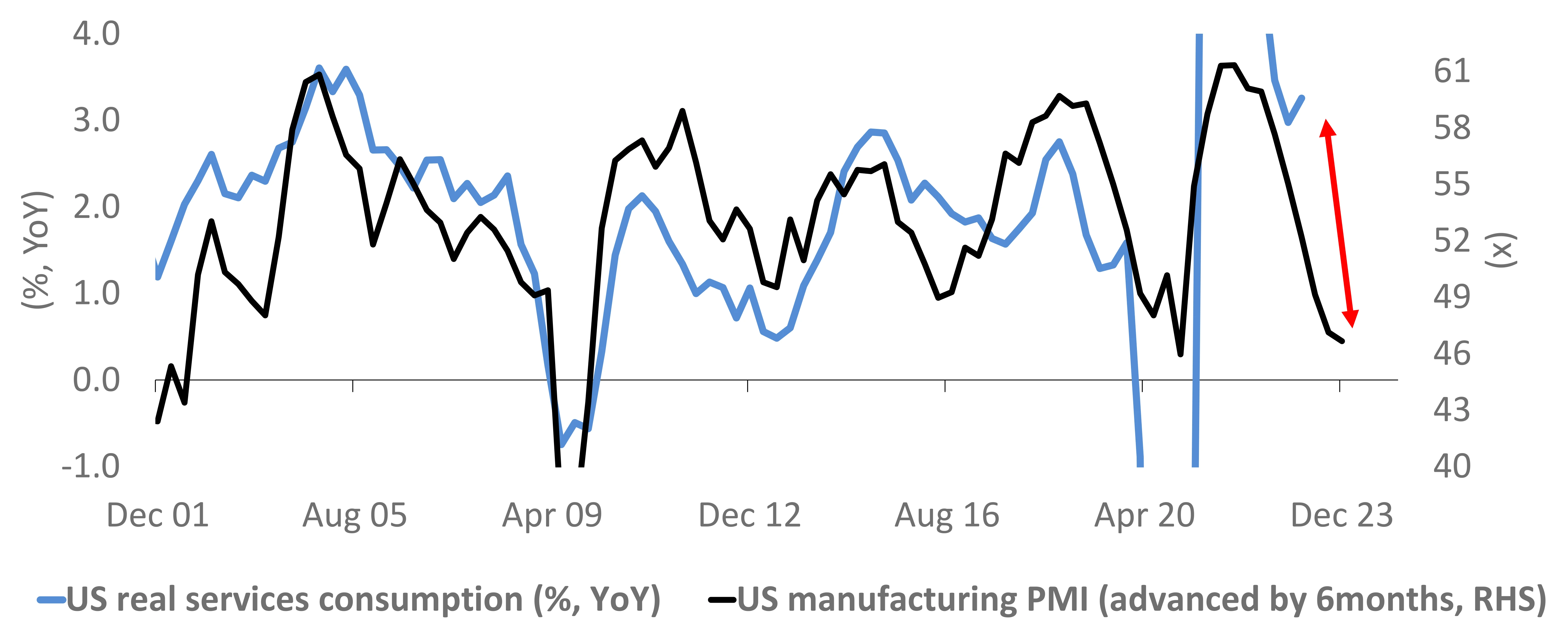

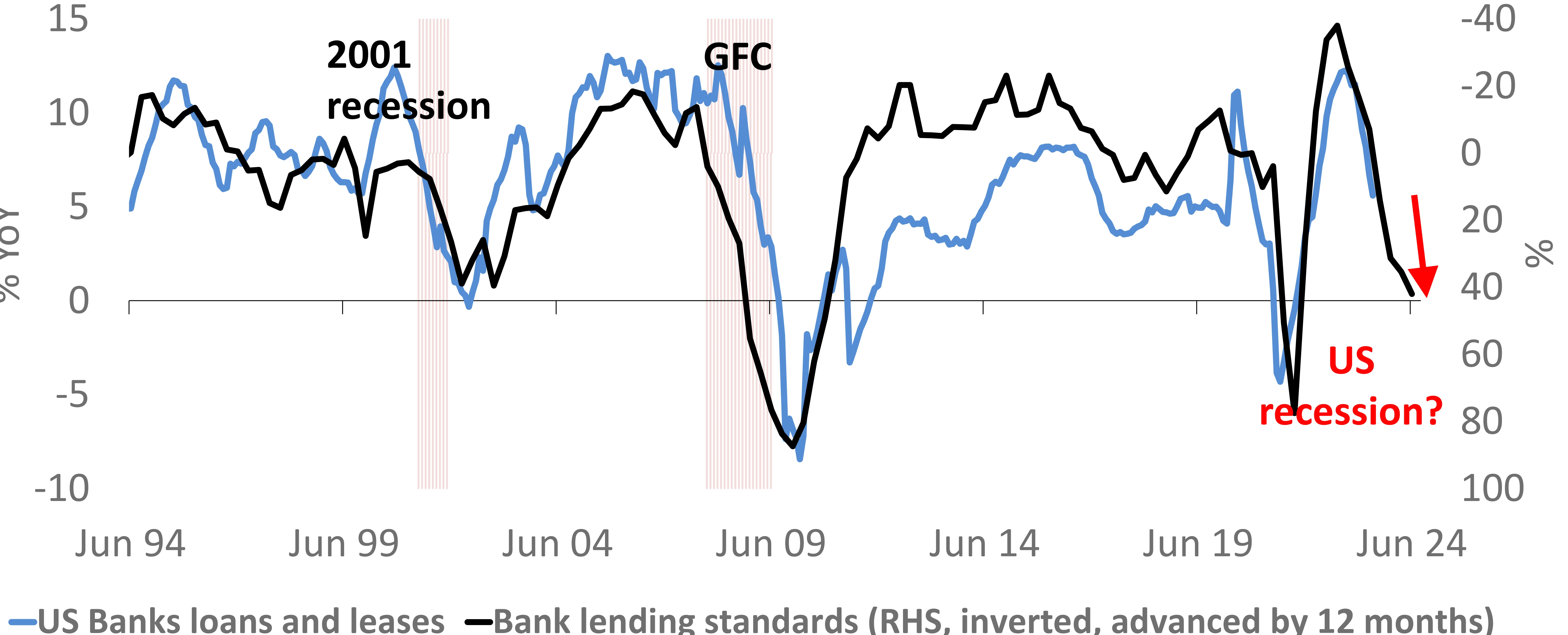

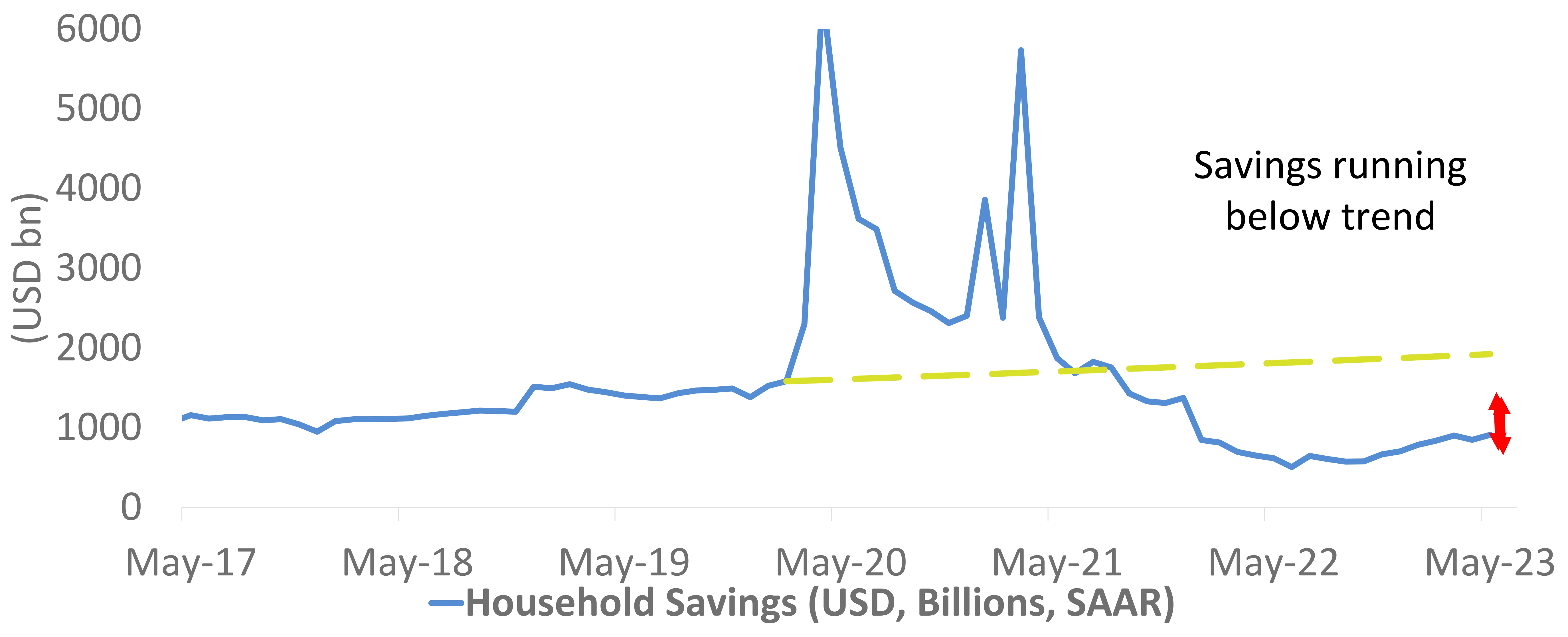

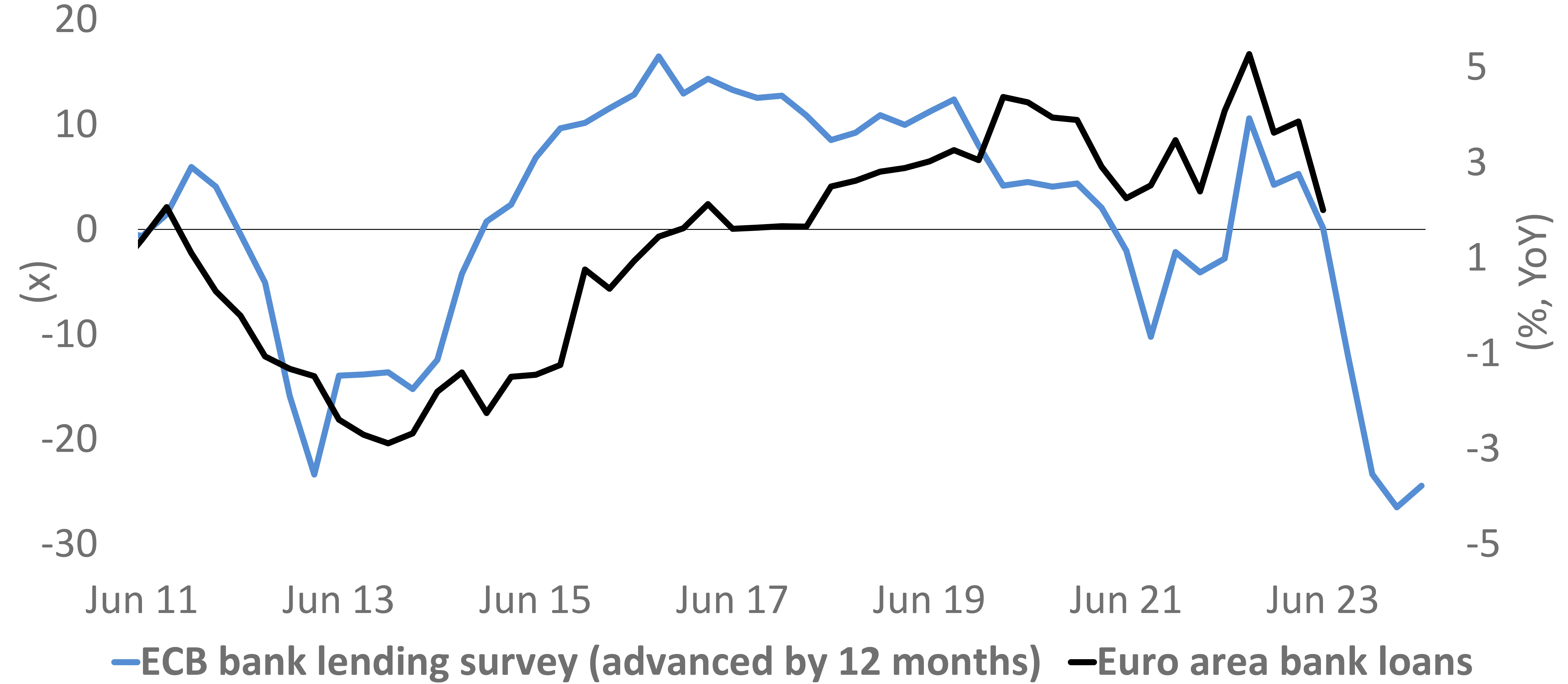

Global Growth: Advance Economies On Verge Of A Slowdown

Source: FRED, Bloomberg, Nuvama, DSP Data as on June 2023

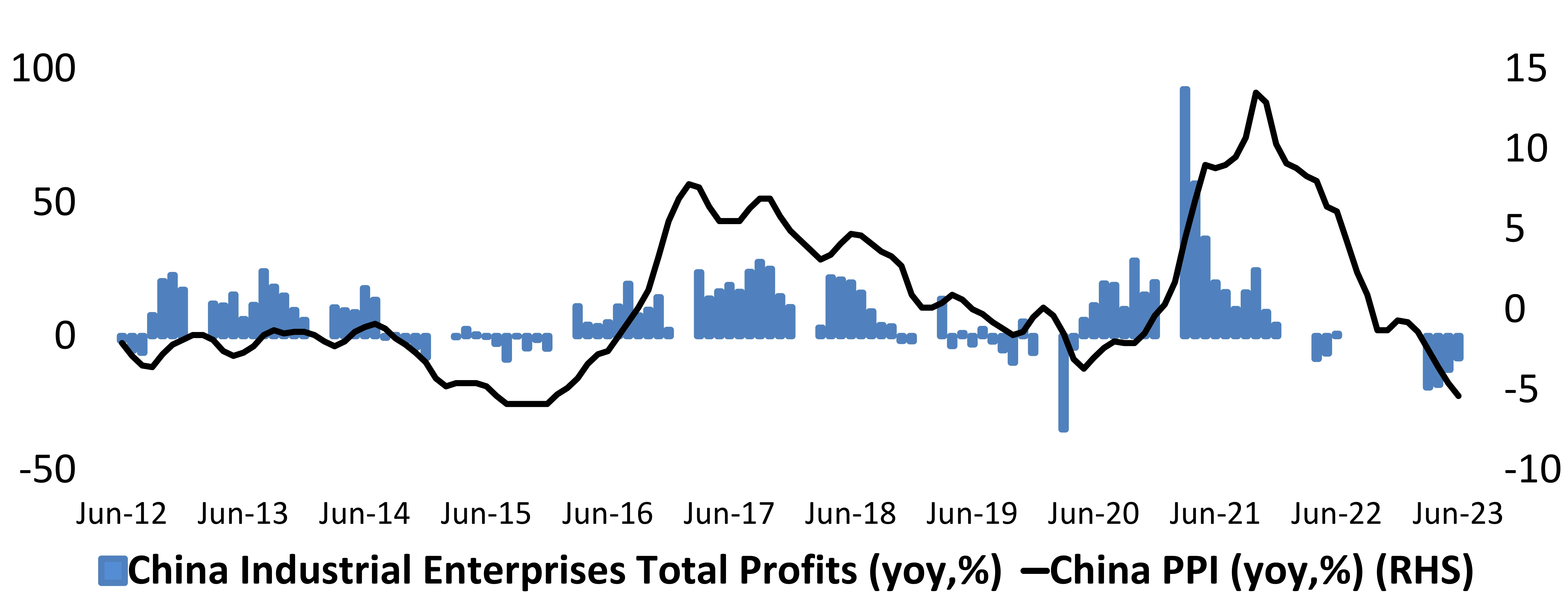

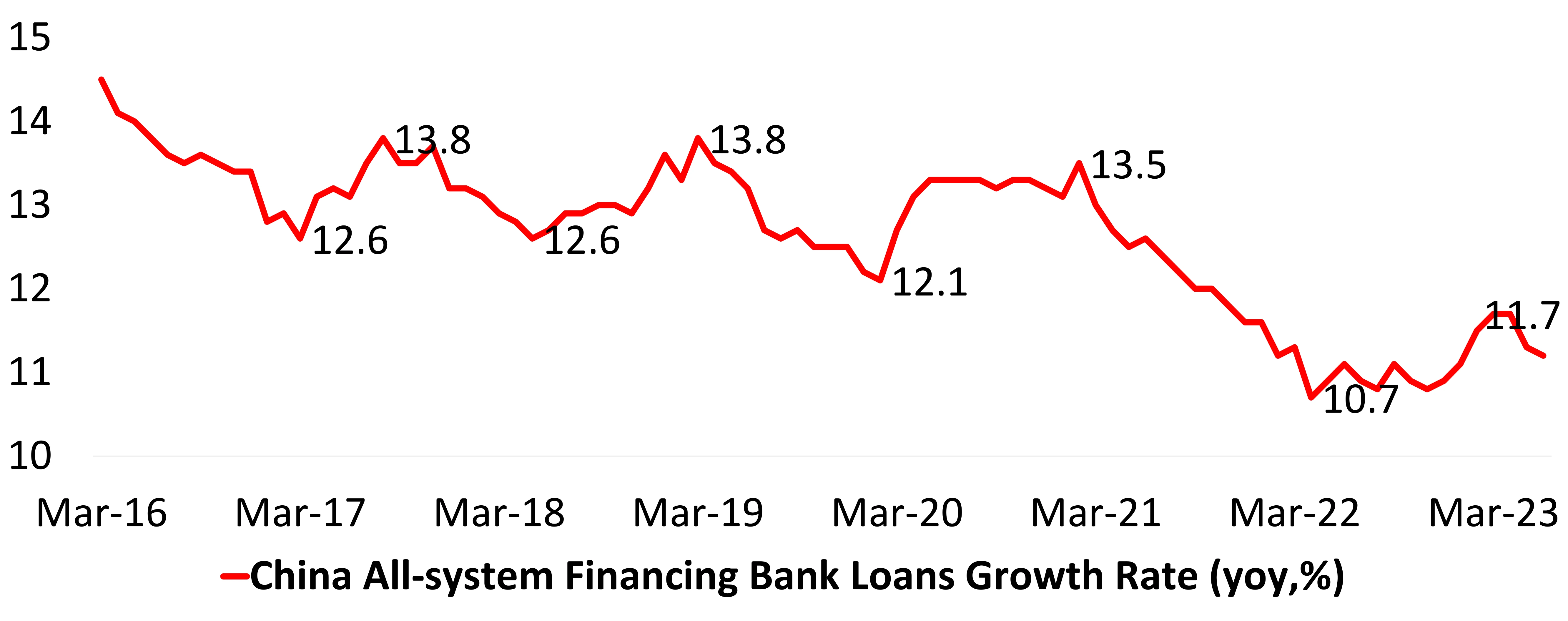

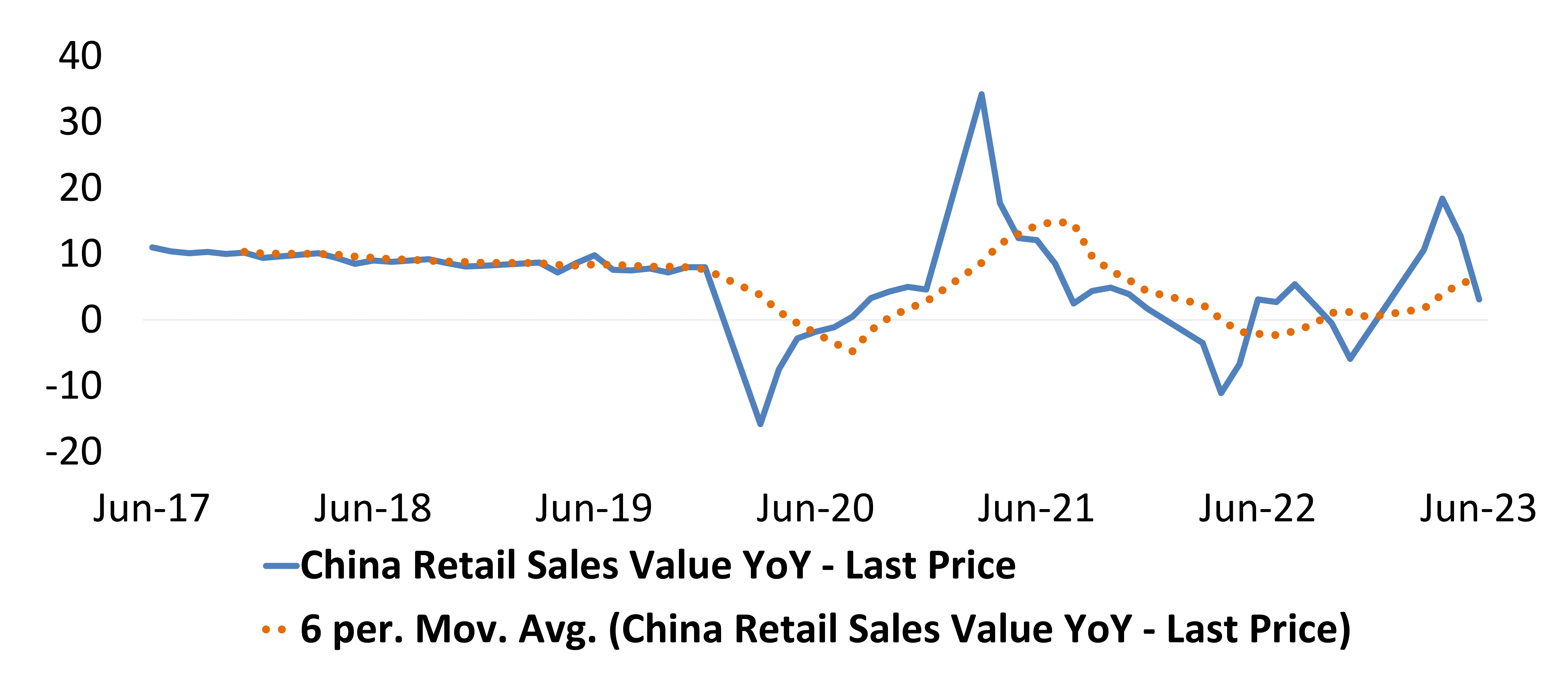

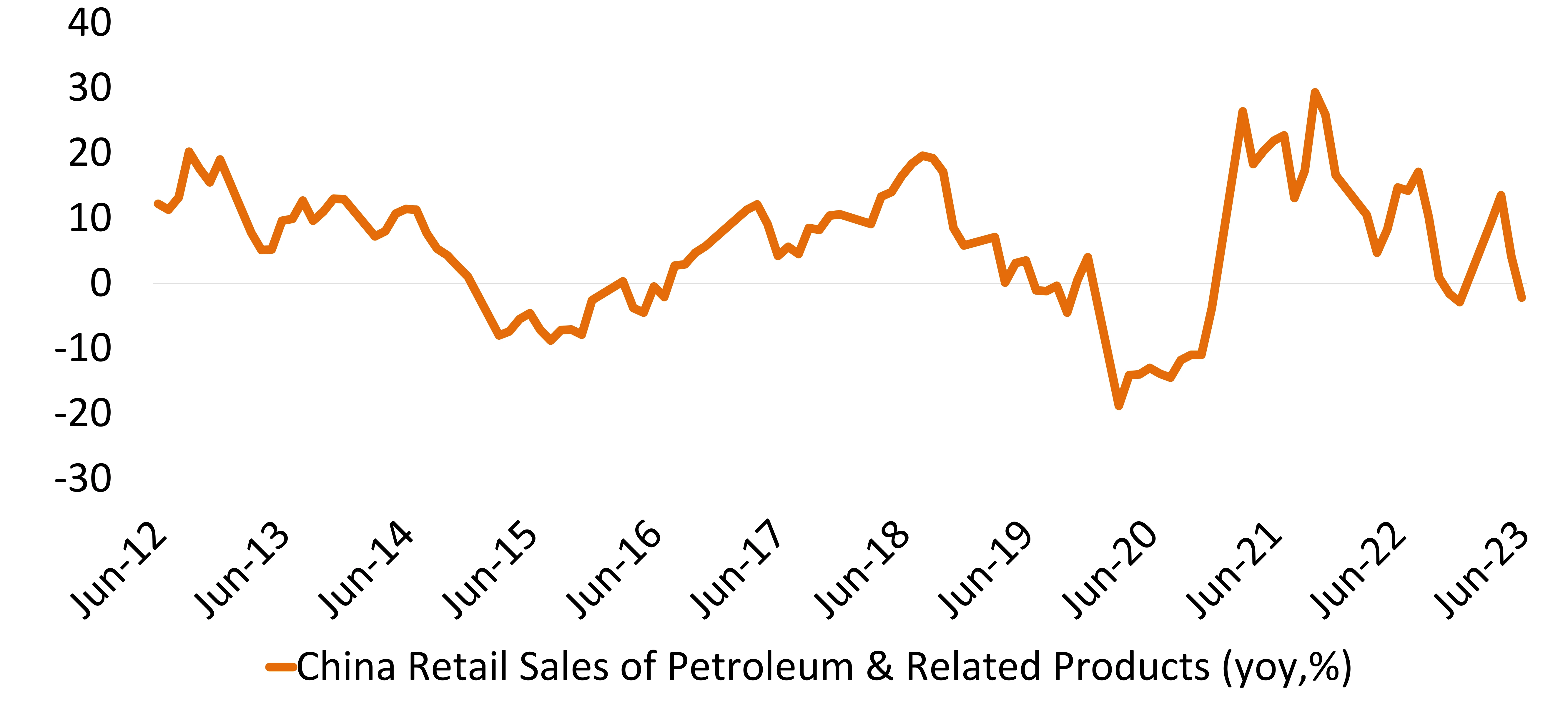

Global Growth: Chinese Growth Is Also Faltering After Reopen Uptick

Source: Bloomberg,, DSP Data as on July 2023

Global Growth: Headline Inflation Has Reversed, Core Inflation Likely To Fall As Growth Slows

Source: IMF, DSP as on July 2023

Global Slowdown: Can Hurt India’s Services Exports And Growth

India’s annual net services exports are now nearing $120Bn and gross services exports are $250bn on a rolling twelve-month basis. On a nominal GDP size of $3.5trn gross services exports are nearly 7% of GDP.

Over the last three years, net services exports have grown at a faster clip than nominal GDP and hence now contribute more to India’s growth. This contribution is up from 2014-2019 average of 30bps to now 1.5%.

In case of a global slowdown, India’s services exports growth is likely to be slow. This can have a sobering impact on India’s growth and on India’s core inflation. We believe that this risk is not appropriately priced in. In the next two quarters, this will become an important parameter to watch, especially if developed economies undergo a sharp slowdown.

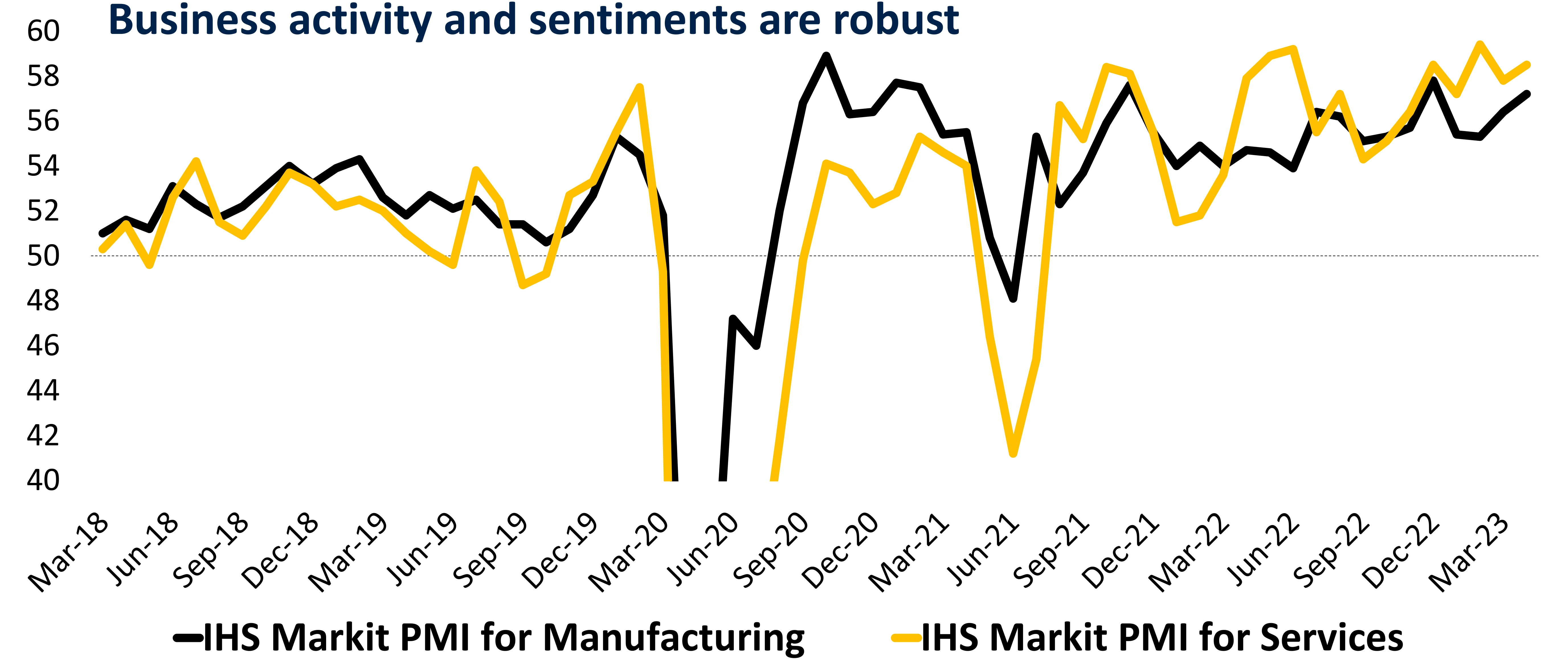

Domestic growth would have to take the baton, and it can

Source: CMIE, Bloomberg, Investec, DSP Data as on July 2023

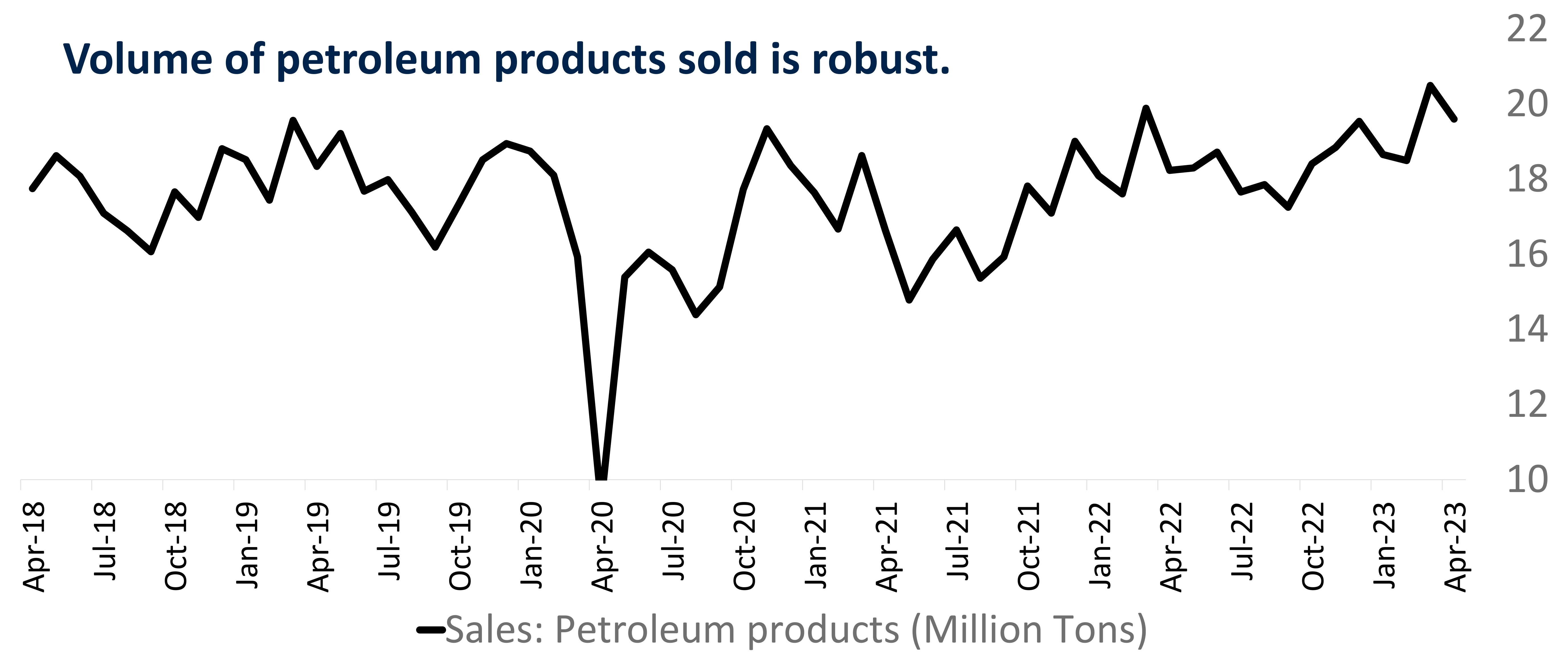

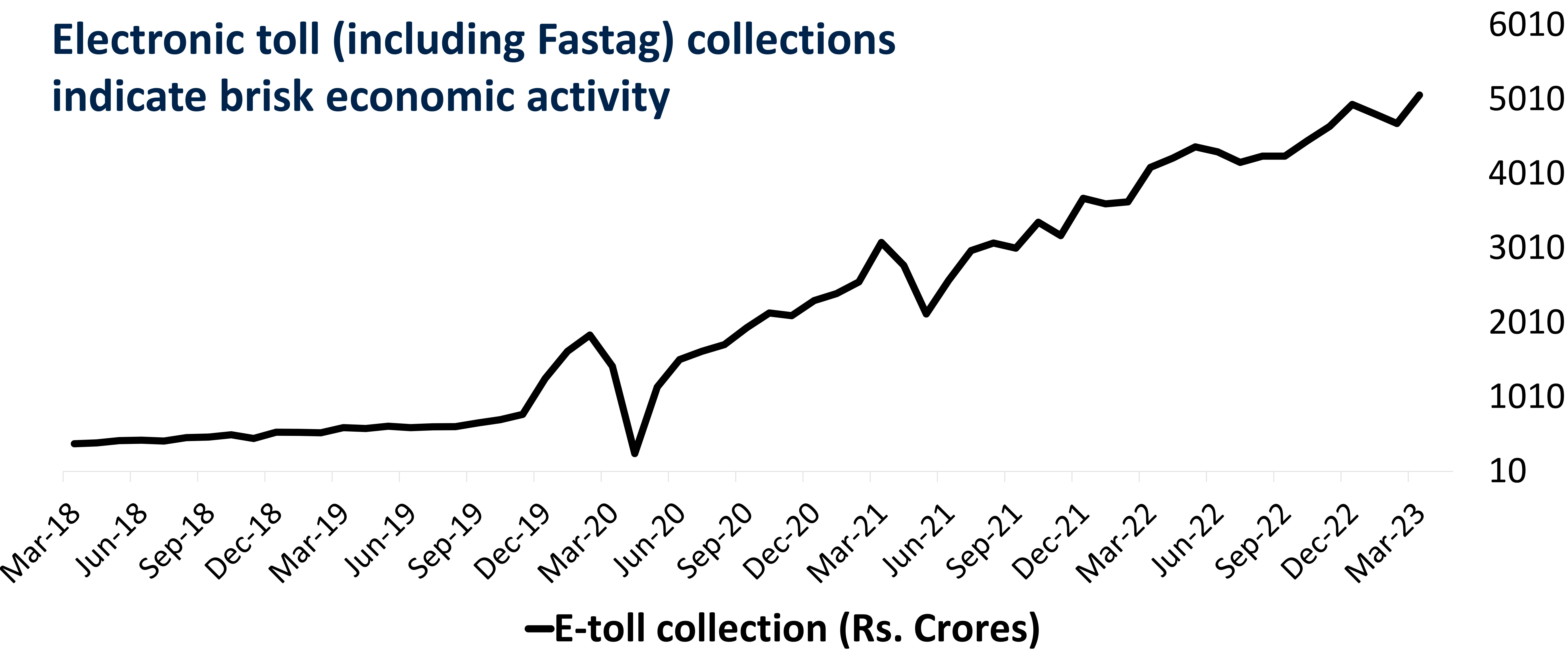

But India Continues To See Steady Growth, So Far…

Source: CMIE, DSP As on July 2023

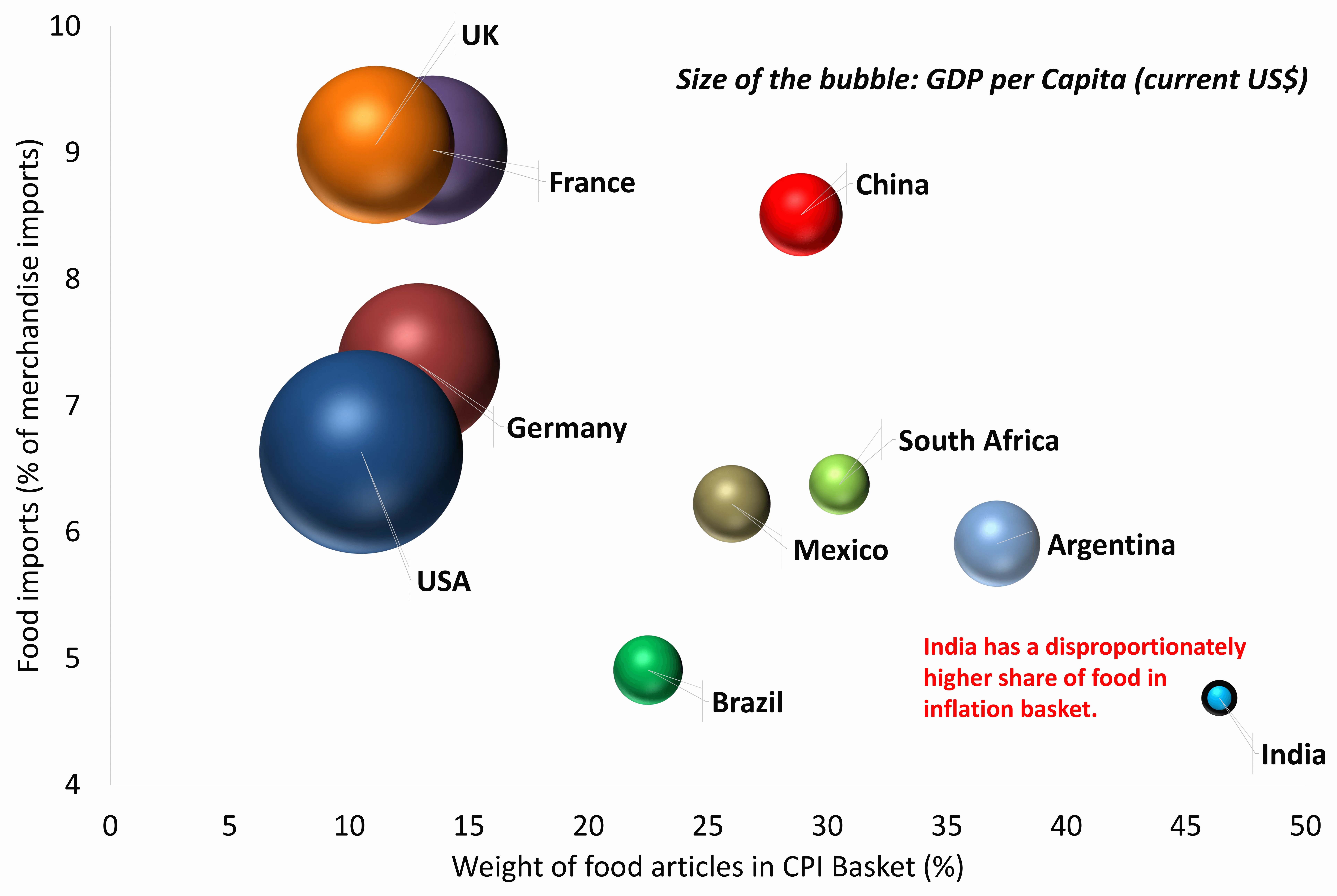

India’s Inflation Trajectory Is Benign But Vulnerable To Change in Food Prices

With almost half of the CPI basket comprising food items, any price changes in this category have a substantial effect on the overall inflation rate in India. So, even small fluctuations in food prices can have a significant impact on the cost of living for the average Indian consumer.

Some food items, especially essentials like vegetables, grains, and dairy, tend to have relatively inelastic demand. This means that changes in their prices lead to disproportionate changes in overall spending, as people cannot easily reduce consumption even if prices increase. As a result, food inflation can quickly affect household budgets and lead to decreased purchasing power.

Although RBI usually sees through any transient food price changes, but a series of supply side disruptions can raise inflation expectations.

For now, India remains insolated from any major food price upward spiral, but this is something to be monitored in case supply side challenges resurface.

Source: IMF, CMIE, DSP Data as on July 2023

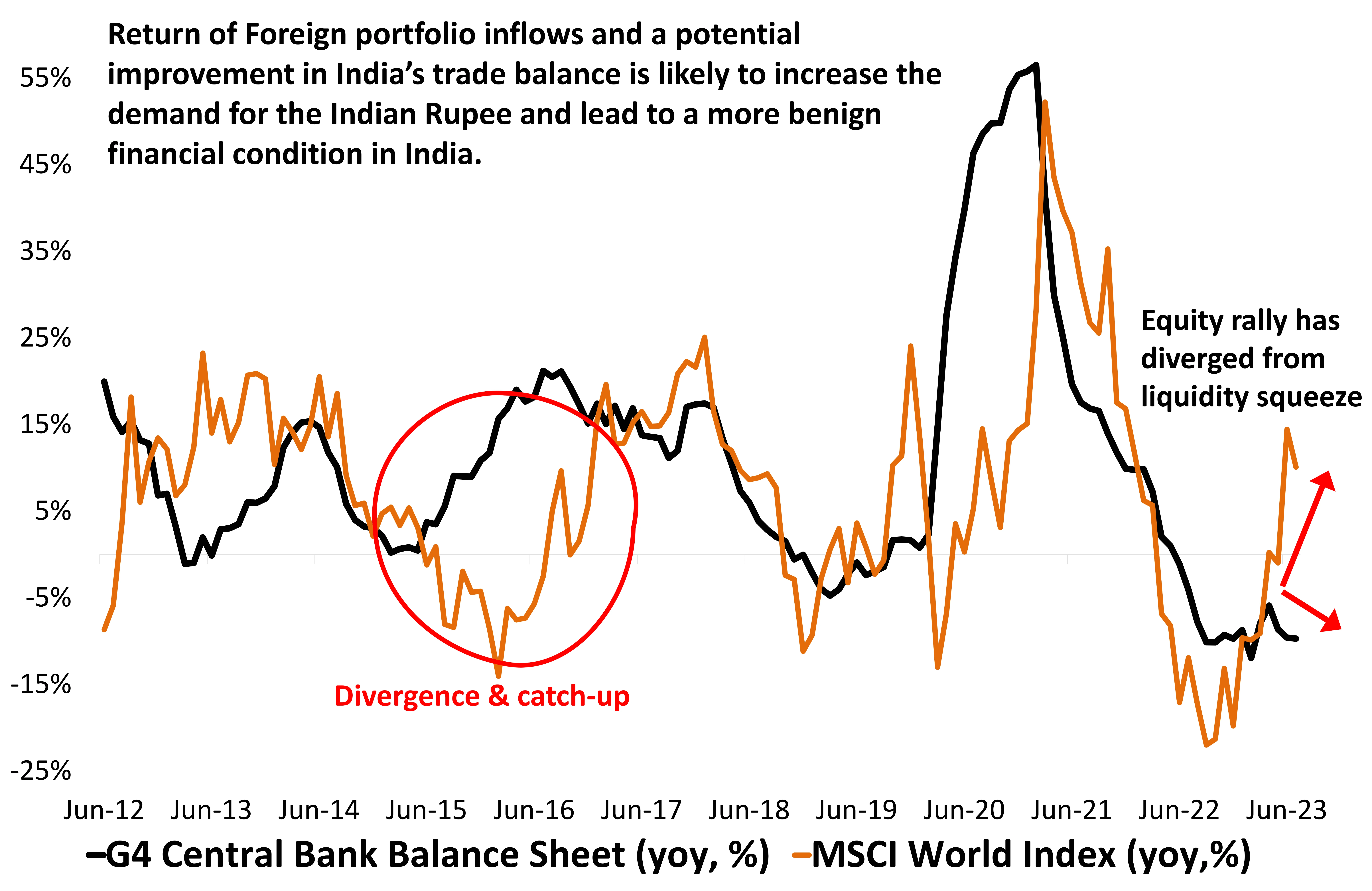

World Equities Have Diverged From Liquidity Squeeze, Can This Correct in H2 2023?

When Central Banks inject funds into the banking system by purchasing bonds, it facilitates easy access to money. This also helps equity markets to rally. The most likely reason is that expansionary & easy monetary policy has been able to increase the price to earnings ratio for stocks in addition to aiding better economic growth.

Over the last few quarters, the G4 central banks have taken a U-turn. US Fed, Bank of England, ECB have continued to raise rates and are no longer infusing liquidity but are reducing their balance sheet size, meaning, are sucking out liquidity.

In the next few months, G4 Central banks are likely to reduce the system wide liquidity even further. The strong H1 2023 performance by many global equity markets could come under threat of a correction.

The divergence in equity rally and a likely reduction in Central Banks liquidity is a key monitorable.

Source: Bloomberg, DSP Data as on July 2023

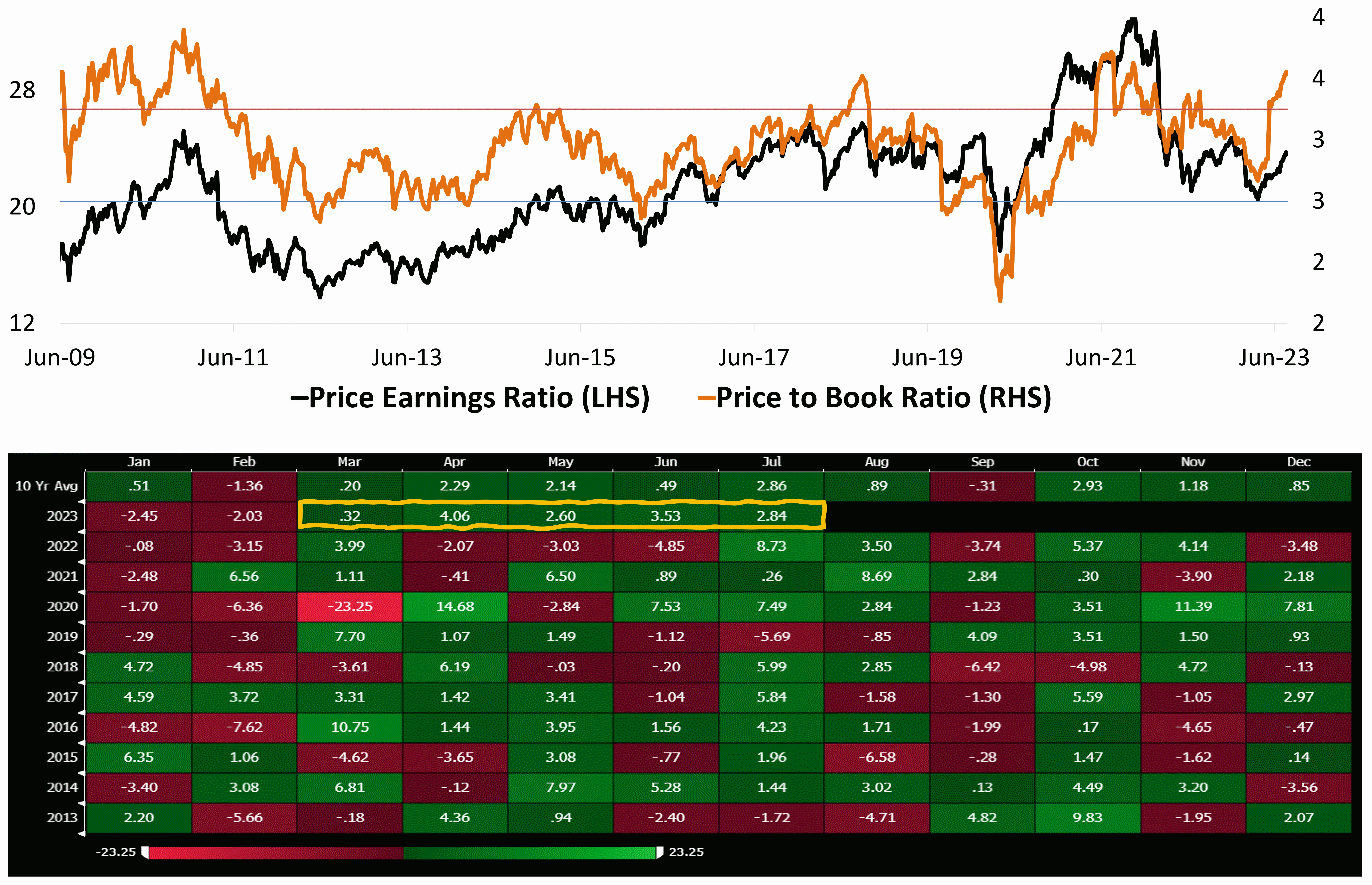

Caution: Recent Nifty Rally Of 5 Months Consecutive Positive Close Has Stretched Valuations

Nifty has rallied more than 12% over the last five months, stretching the index's short-term momentum readings and valuations, and attracting strong FPI inflows. In fact, FPI inflows in this financial year (Apr-Jul 2023) have reached $18 billion, making it one of the fastest 4-month inflows by FPIs ever.

Earnings growth, economic resilience, and investment flows continue to support Indian equities, but short-term upward moves could be blunted by momentum boundaries and stretched valuations.

With the Nifty Index's 200-day average now surpassing the 18,200-index level and accompanied by a rising EPS trajectory, it presents an appealing opportunity for equity investors to consider increasing their equity allocation within the range of 18,200 to the previous life highs of 18,600 index level. If the index approaches these levels, it may be prudent to review the outlook and consider staggered purchases for equity allocation.

Source: Bloomberg, DSP Data as on June 2023

A Correction Within A Larger Uptrend? Be Conservative For Now!

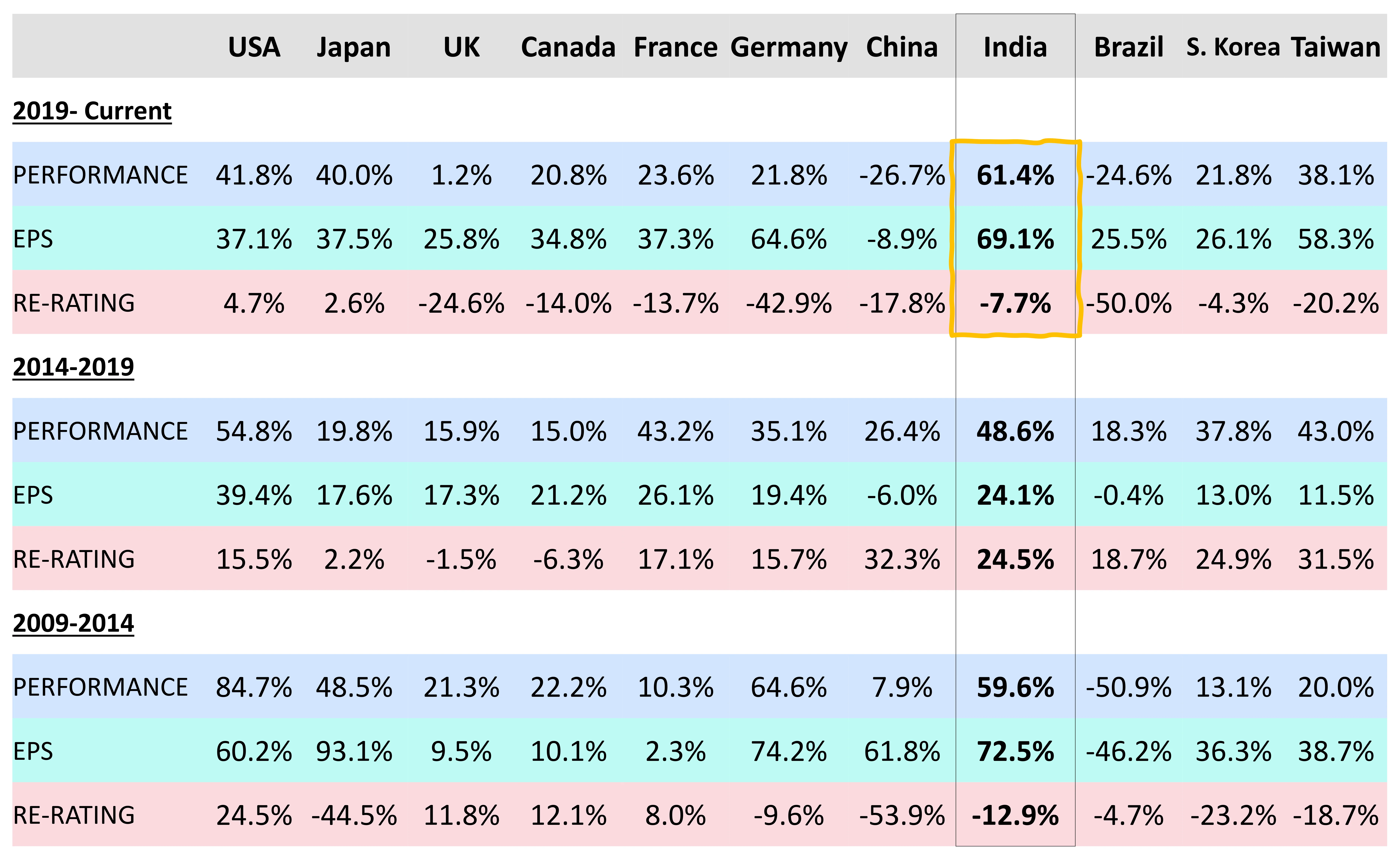

Most global equity markets have experienced a de-rating of valuations over time, particularly after reaching their peak in 2021. However, Indian equities have witnessed the most significant earnings growth compared to other major economies, resulting in a shallower derating of their multiples.

In relative terms, the trajectory of earnings growth in India remains healthier than that of its peers. As a result, Indian equities are likely to experience a correction within a broader structural bull market.

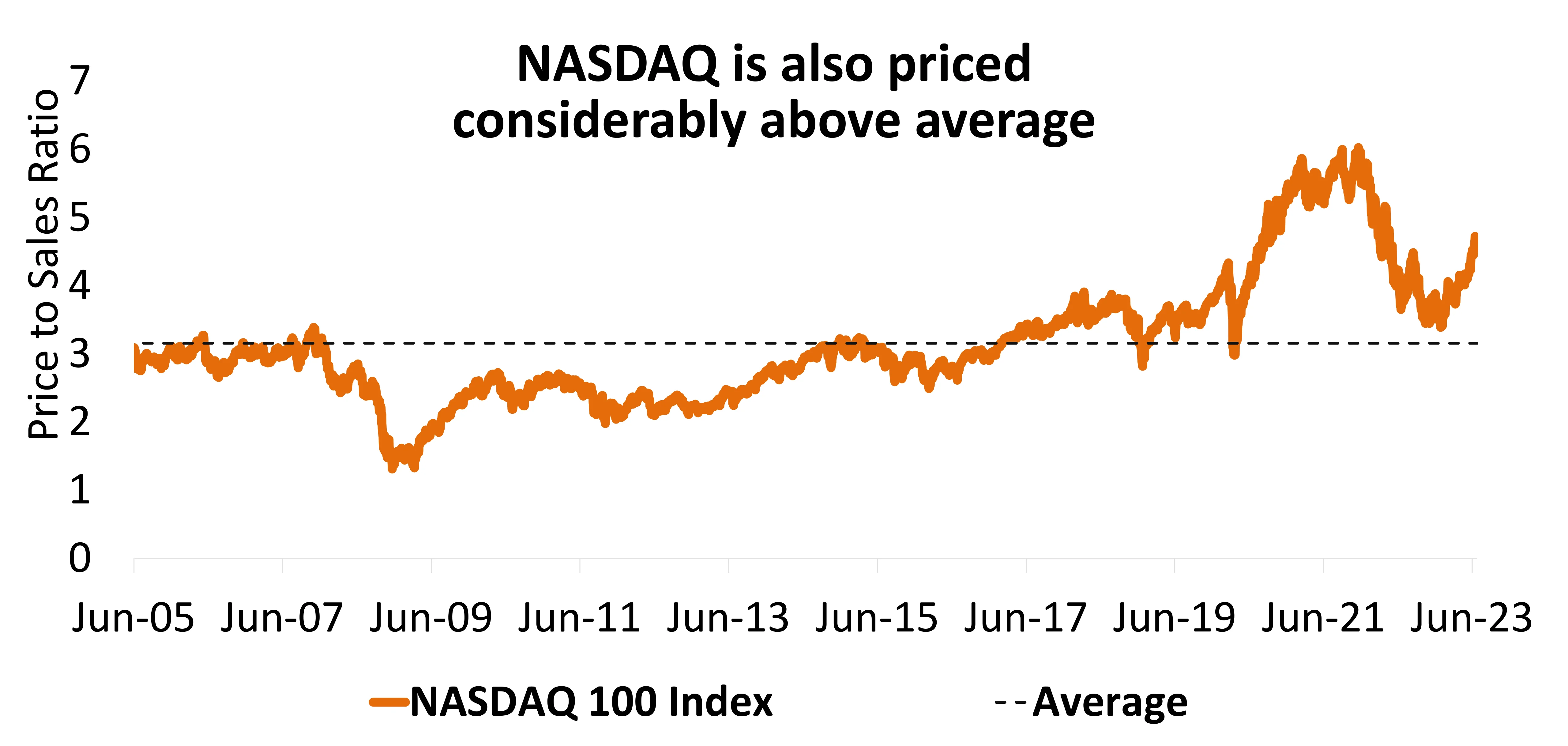

On the other hand, other markets, especially the US and Japan, may be more susceptible to deeper corrections due to their high valuation multiples and the persistent issue of narrow market breadth.

Source: Bloomberg, Investec, DSP Data as on July 2023

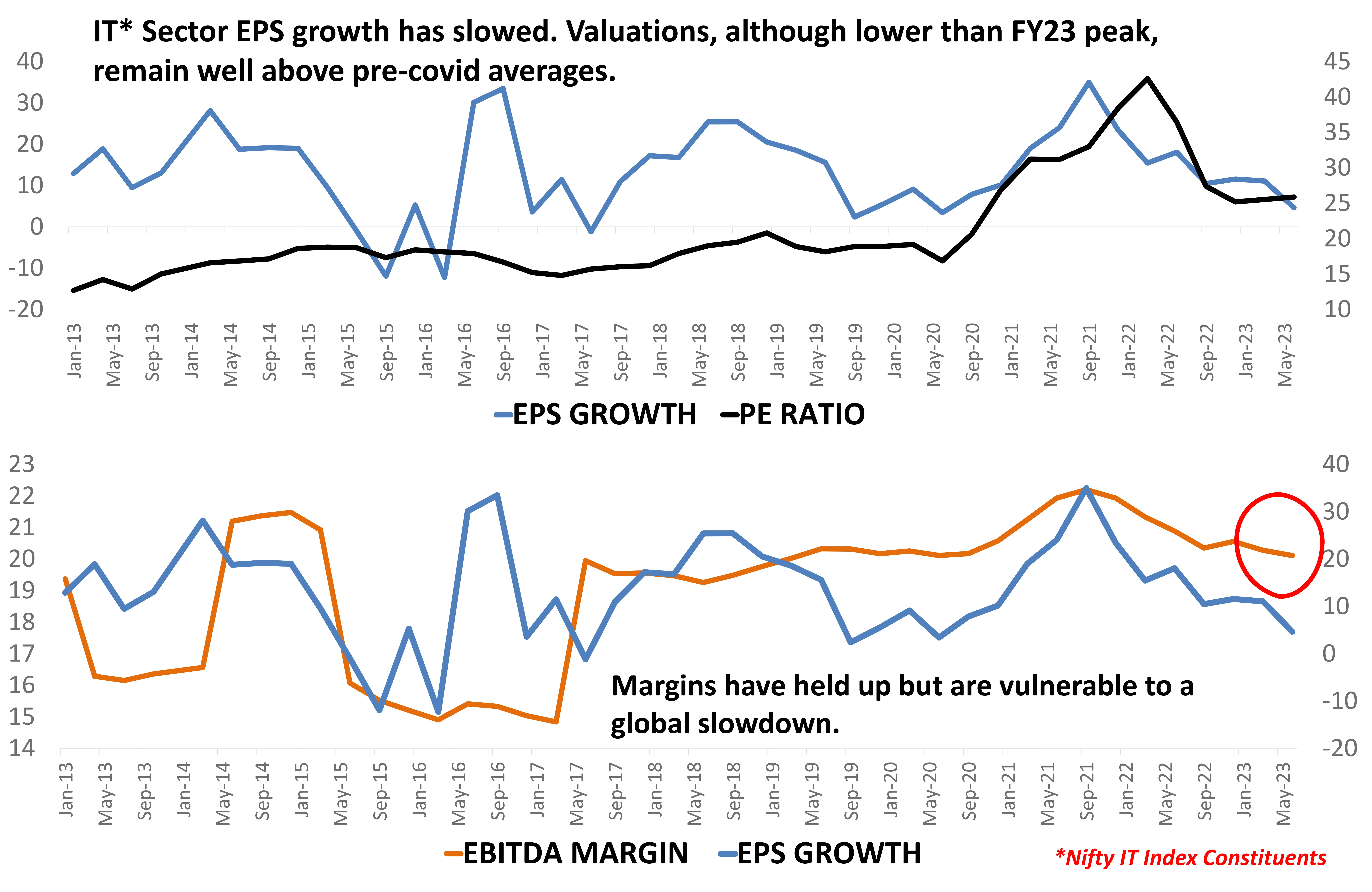

Indian IT Stocks Still Vulnerable To Vagaries of West, Margins

Nifty IT Index is down 25% from its peak Jan’22 but is up about 4% in 2023. The sector has oscillated between not so bad financial results and cautious management commentary.

In a weaker macro scenario discretionary demand pick-up is unlikely to happen. Even the improvement in CY24 is expected to be modest on S&P 500 revenue growth at 5% versus 4% in CY23, thus hopes of a sharp IT improvement might be misplaced. Also, as earnings growth of global clients is slowing, the pressure to cut cost will remain high, which could be negative for margins.

The current outlook remains uncertain, with increasing headwinds clouding the horizon. Valuations need to correct for this sector to become attractive and growth outlook needs to improve for the long-term trend to re-exert its momentum.

Source: Bloomberg, DSP Data as on July 2023

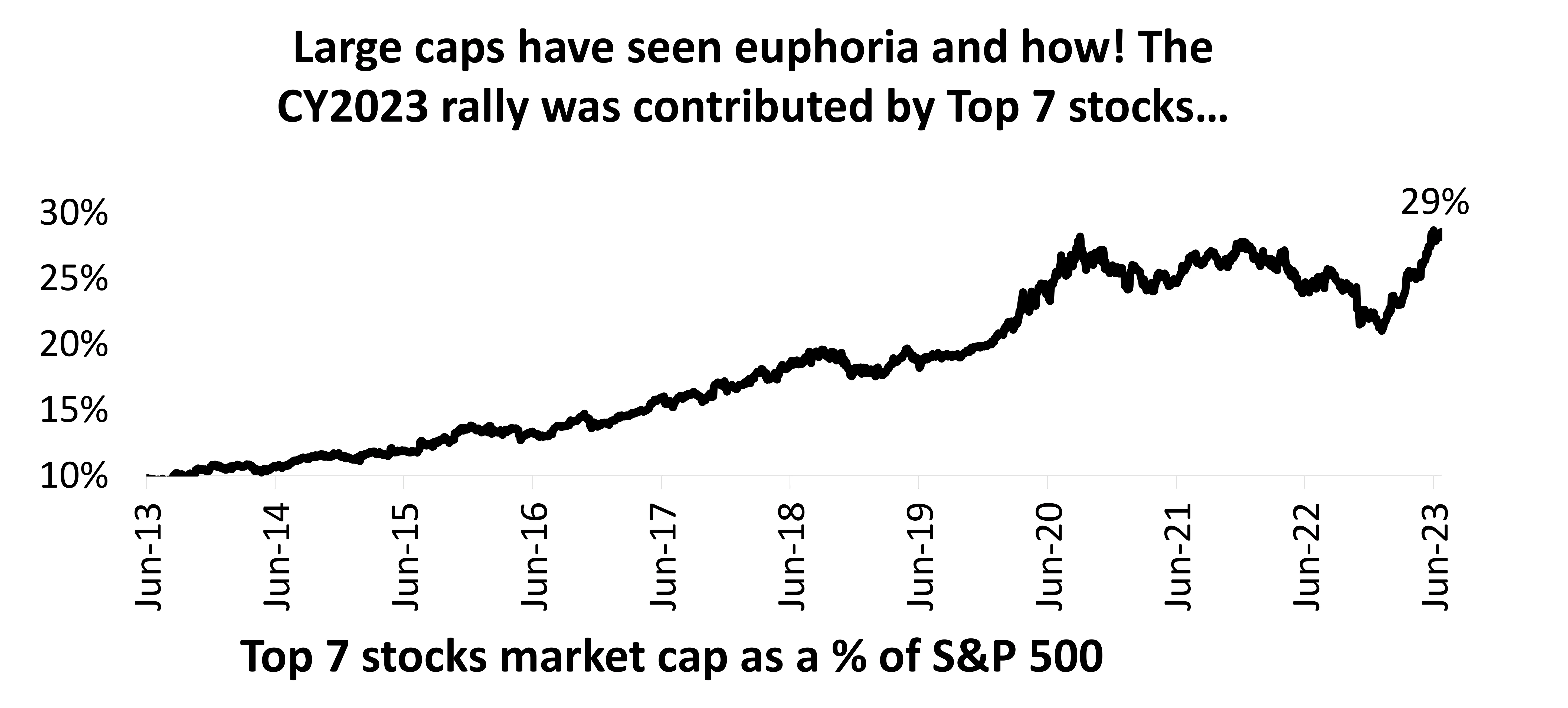

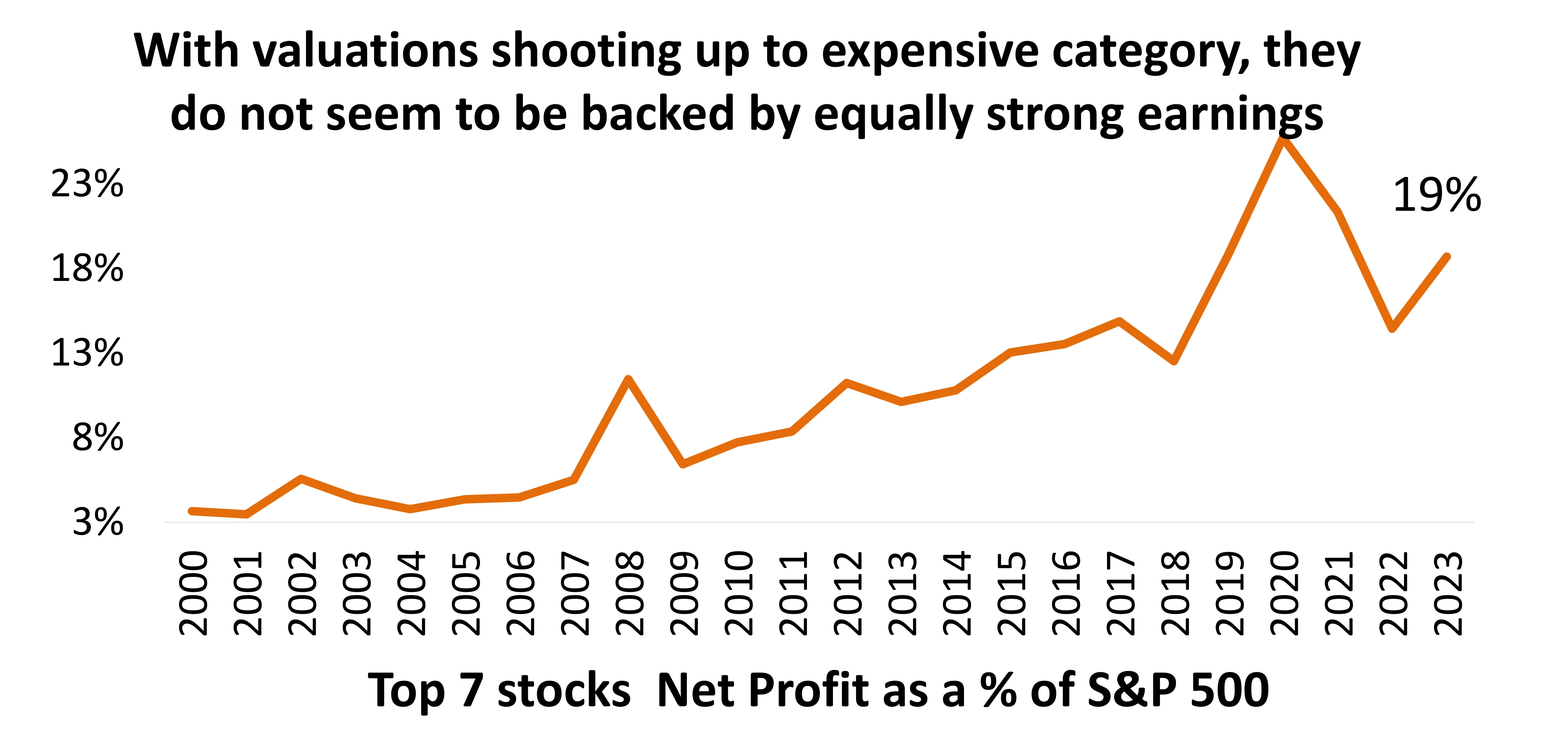

Global Tech Is Back To 2021 Like Froth?

Source: Bloomberg, DSP Data as on July 2023

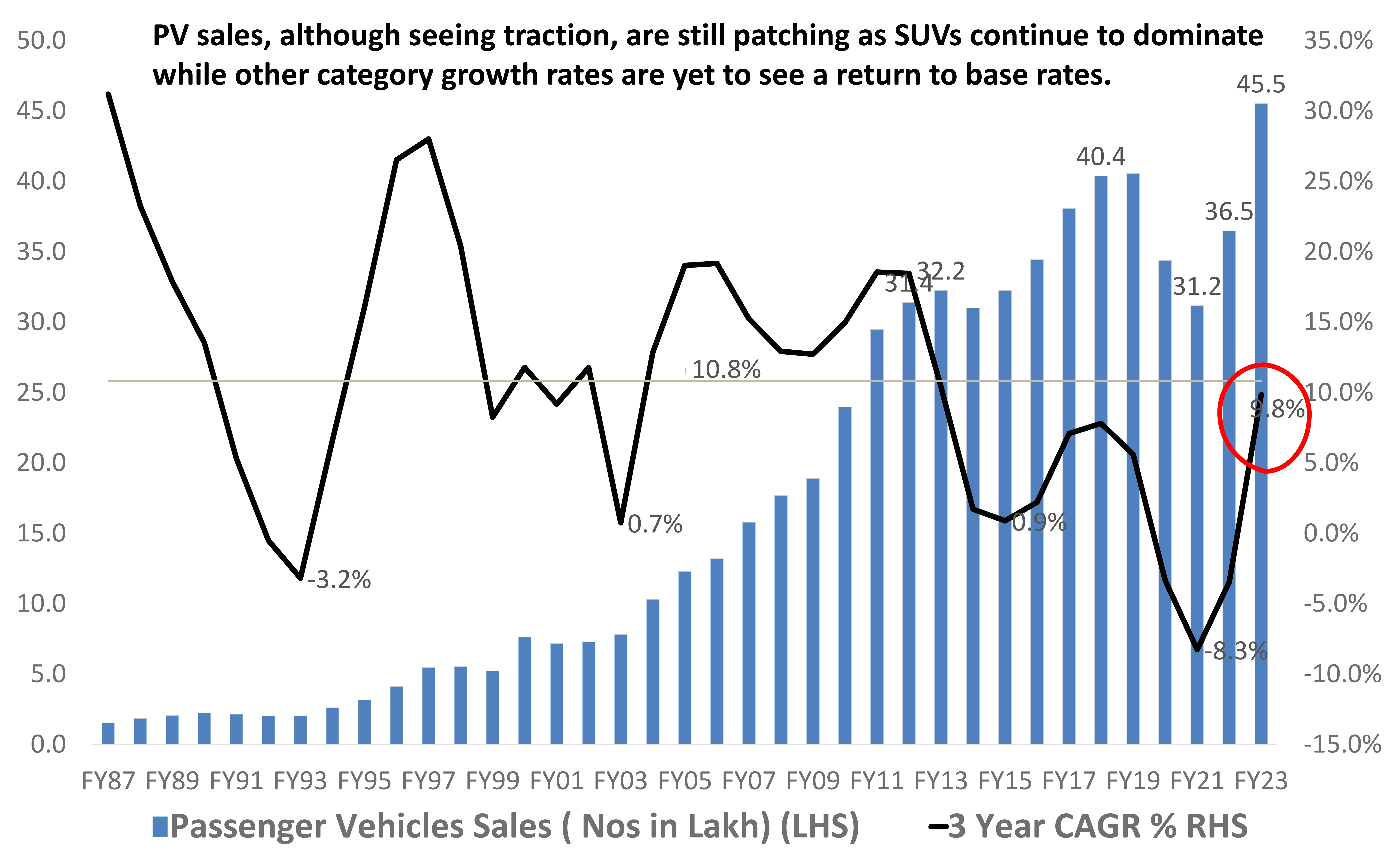

PV Sales 3-Yr CAGR Rises To Long Term Average After A Decade

Amidst the looming disruption posed by EVs, a far more influential and supportive reality is taking shape as consumers transition from small, economical cars to larger, high-ticket SUVs. Presently, auto stocks are primarily influenced by near-term volume concerns or valuation/FCF (Free Cash Flow) considerations, as demonstrated by Bajaj Autos and Hero over recent months and weeks. However, as the initial bullish excitement subsides, new concerns will emerge, albeit with a slightly different focus.

The SUV market has exploded. It now commands over 51% of the PV market. This means that near term disruption to this sector is going to come from fragmentation of the SUV market. The headwinds from EVs and the sentiment overhang could also be a contributor.

The long-term prospect for this sector remain bright as growth rates are reverting to long term trends. This sector is now likely to be a more bottoms up bet than the ‘for all’ rally of the last year and a half. Two-wheelers continue to remain attractive, but PVs need better valuations for now.

Source: CMIE, DSP Data as on July 2023

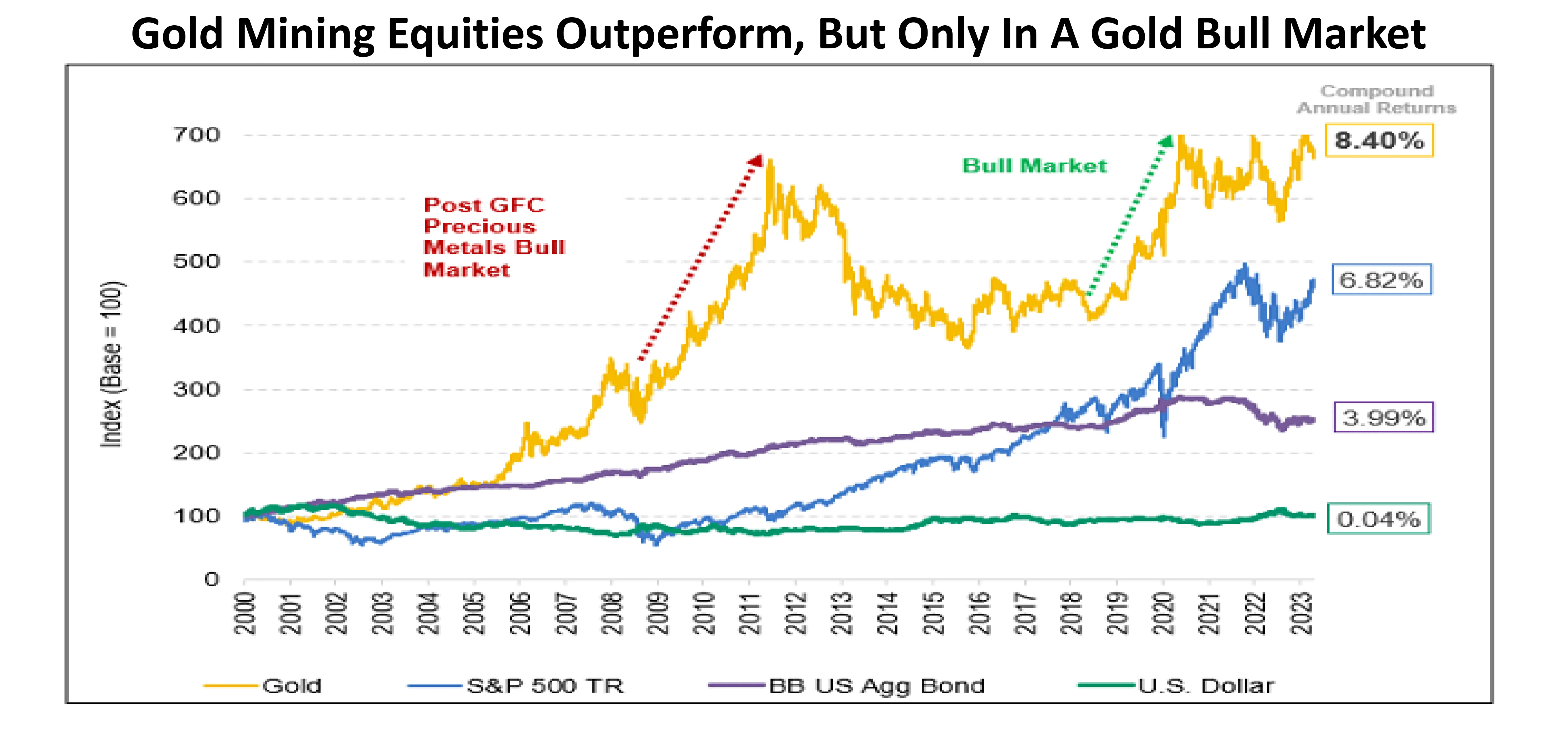

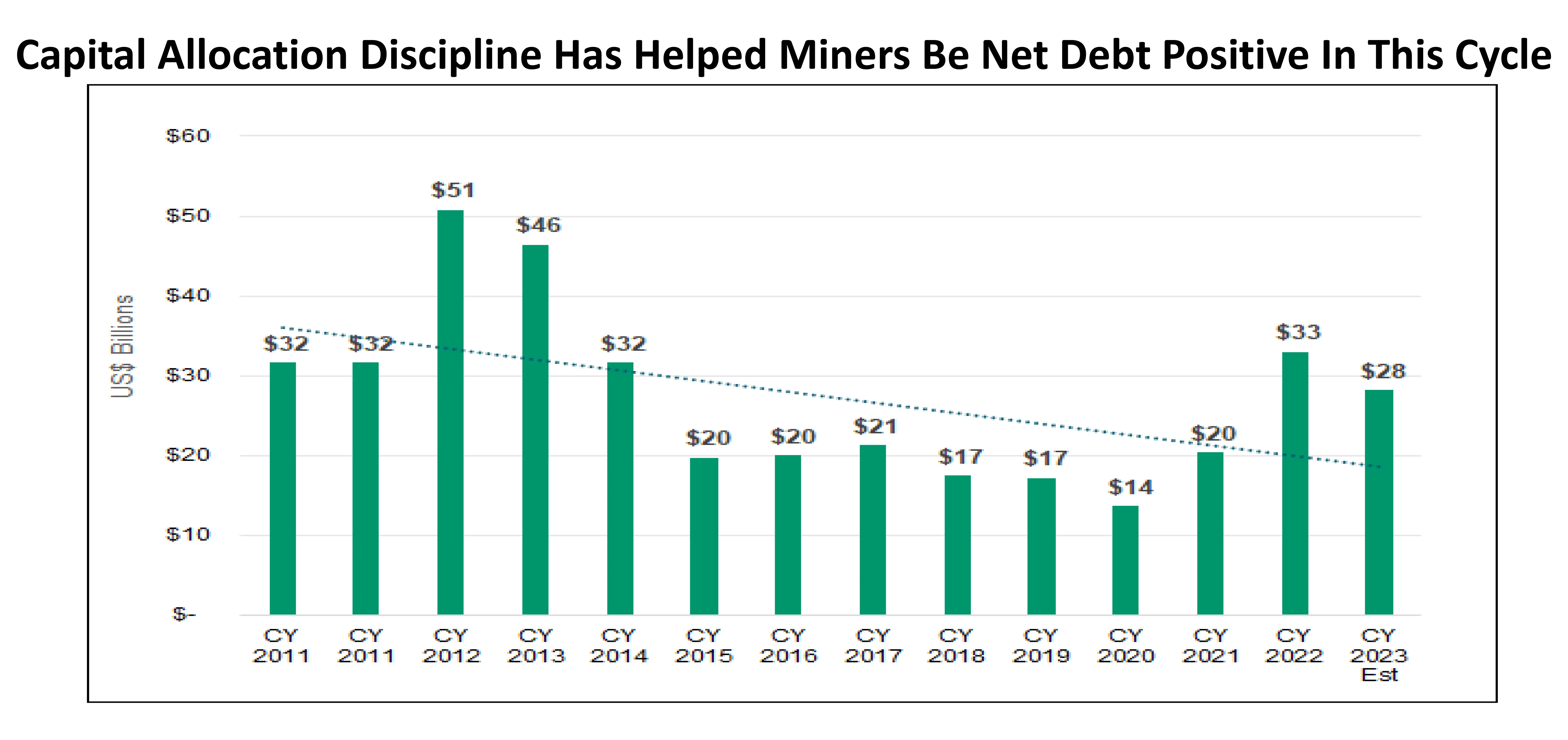

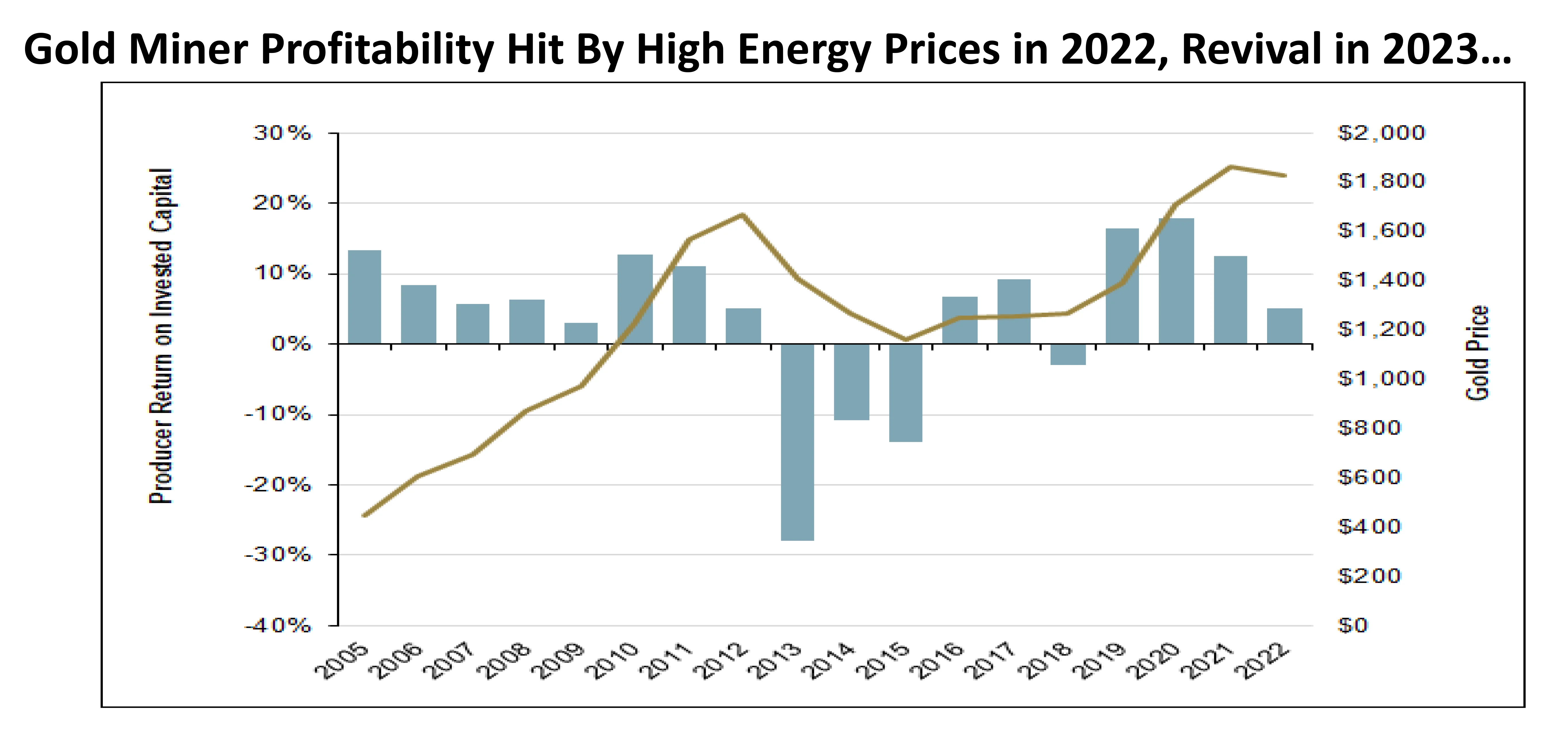

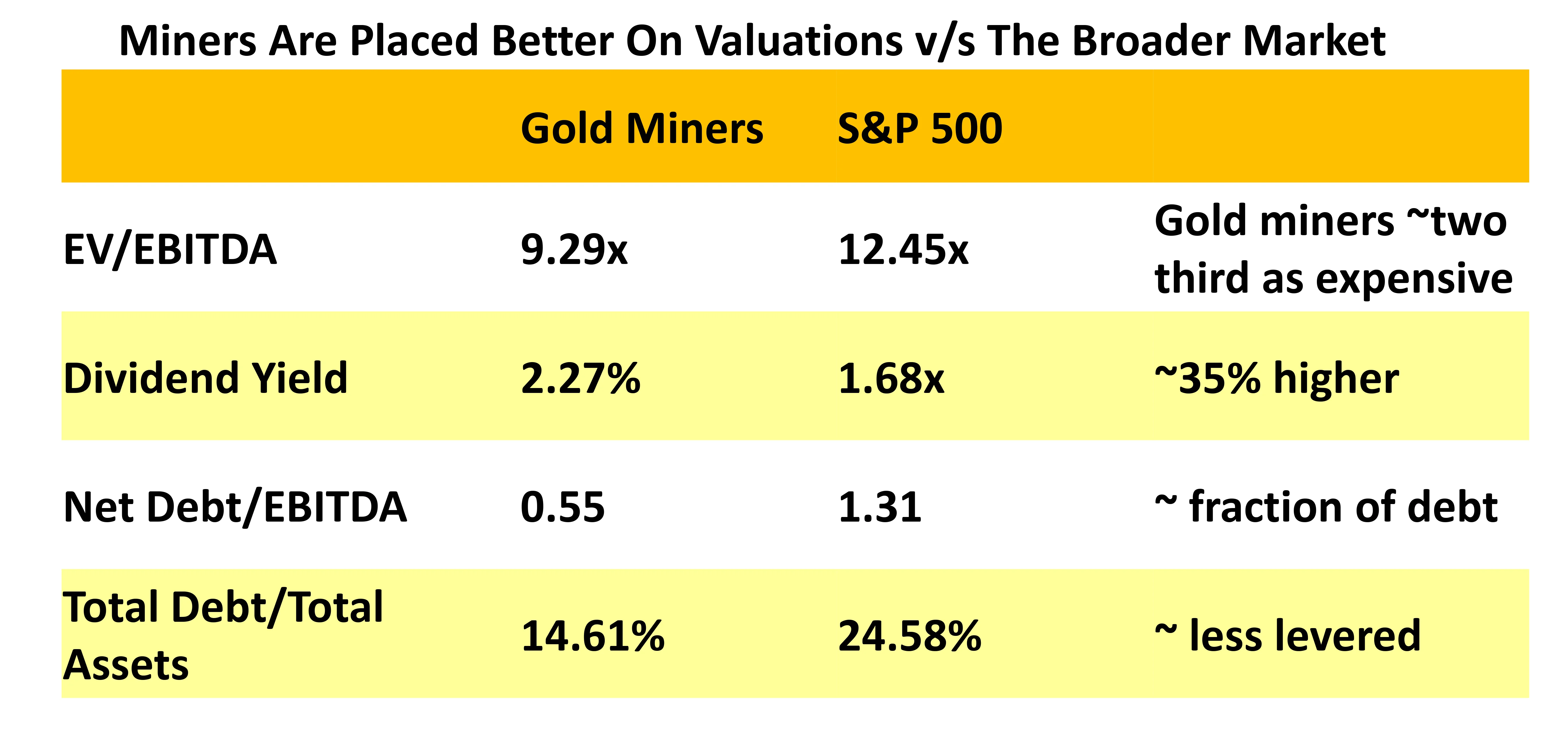

Gold Miners Still In Slumber, But For How Long? Breakout Ahead?

Source: KITCO.com, Sprott Research

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.