Think of the global brands like Amazon, Google, Meta (Facebook), Apple, Netflix, Microsoft, etc that we use in our daily lives. You use Amazon for online shopping, Google for search, Facebook for communicating, Netflix for watching movies, Microsoft for work etc. These companies are deeply engraved in our lifestyles but do we ever think of owning these companies. Apart from the huge influence these companies have on lives of people all over the world, they have also been great wealth creators for investors.

An international fund allows Indian investors to diversify their portfolios by investing in foreign stocks from regions like the US, Europe, or Asia, thereby giving them a global exposure and at the same time mitigating the risk of concentrating their investments solely in the Indian market. However, these international mutual funds are not devoid of challenges; currency risk and political shifts in foreign nations can impact investments. Furthermore, it’s essential to consider macroeconomic influences, sectoral impacts, and the advantage of tapping into multiple economies when investing in an international fund.

There are around 70 international mutual funds in India, schemes investing primarily in international stocks. There are different structures of such schemes like fund-of-funds, actively managed funds, exchange traded funds (ETFs) and index funds. These schemes focus on specific countries, sectors, or themes. When investing, it’s crucial to understand your objectives, decide the type of fund that aligns with your goals, and possibly consult an investment advisor due to the complex nature of this investment segment.

Starting from April 2023, certain tax implications apply to the capital gains from these funds. Notably, gains from funds investing less than 35% in Indian equities will be taxed based on an individual's slab rate. However, there's no taxation on accrued returns, optimizing the compounding effect in debt funds.

Frequently asked questions

What are International Funds?

Indian investors can broaden their portfolios by allocating funds to international investments targeting companies in regions such as the United States, Europe, and Asia. This approach offers a safeguard against concentrating investments in a single market. Additionally, it provides the opportunity to capitalize on the growth of overseas economies that might not necessarily mirror India's economic path.

However, these international mutual funds do come with their set of challenges. Currency risk is a primary concern; investing in an international fund means investing in foreign currencies. A dip in the foreign currency's value can adversely impact your investment. Moreover, geo-political shifts can affect trade, foreign investments etc. in certain geographies affecting the companies the fund invests in.

While international mutual funds can be beneficial for those seeking portfolio diversification and tapping into foreign economies' growth, they might not be for everyone. You should have some understanding of the market, sector, theme etc. and the risk factors thereof. Also, you should not invest in international mutual funds in India simply to benefit from INR depreciation. There is ample research which shows that equity risks are far greater than currency risk in most developed or emerging markets. You should understand the risks and make informed investment decisions.

Types of International Funds

There are many different variations that are possible. For example, the structure of the international mutual funds in India can be passively managed through an index fund or an ETF following an international index, or it can be actively managed international fund, where the fund manager picks stocks in order to outperform the benchmark index. There can also be a fund of fund structure (FOF); as Indians, we are investing in a fund, and that fund is investing in a global fund or funds thatmay be actively or passively managed.

Structure

- Thematic Fund (active)

- Fund of Fund

- ETF

- Index Fund

Theme Specific

- ESG

- Consumer trends / Brands

- Innovation

- Alpha / Quality

Geographical Location

- Country

- Region

- Continent

Sector Specific

- Oil & Gas

- Technology

- Commodites

- REITs

Advantages of International Funds

- Diversification of single country risk: Most investors tend to ignore single country risk associated with their home country. But informed investors should take factor this risk when building their portfolio. You can diversify single country risk through investments in international mutual funds.

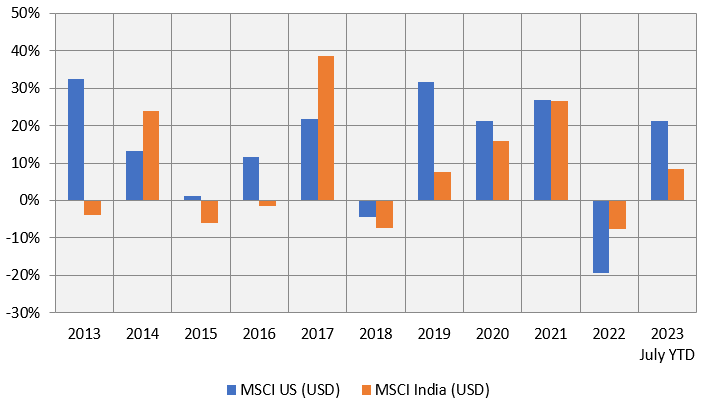

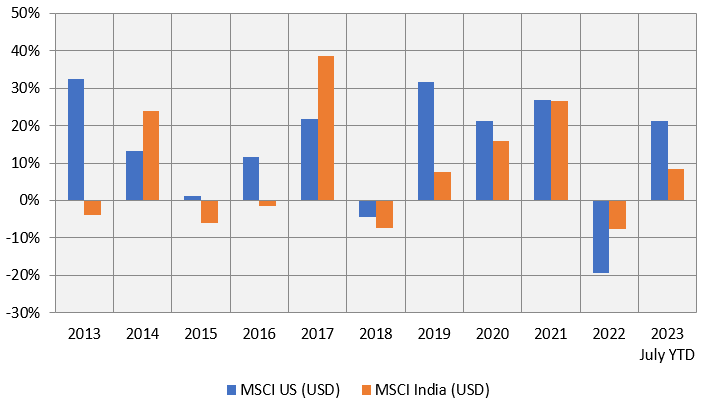

- Provides portfolio stability: There is low or even negative correlation between returns of the different countries (see the chart below). One market may outperform when the other market underperforms. Having international mutual funds in your portfolio will add diversification and provide stability to your equity portfolio.

Source: MSCI, as on 31stJuly 2023. All returns are in USD terms. Disclaimer: Past performance may or may not be sustained in the future.

Source: MSCI, as on 31stJuly 2023. All returns are in USD terms. Disclaimer: Past performance may or may not be sustained in the future.

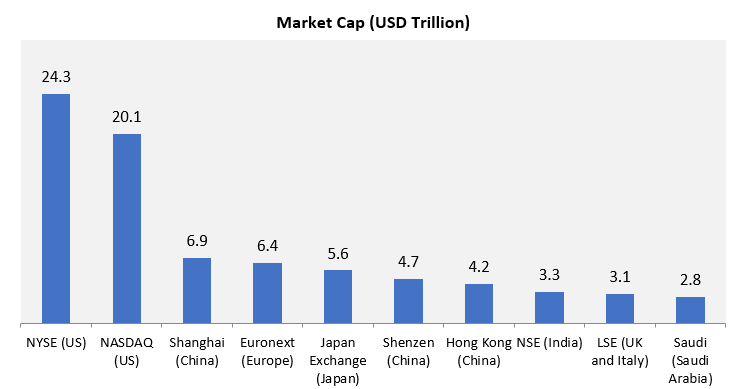

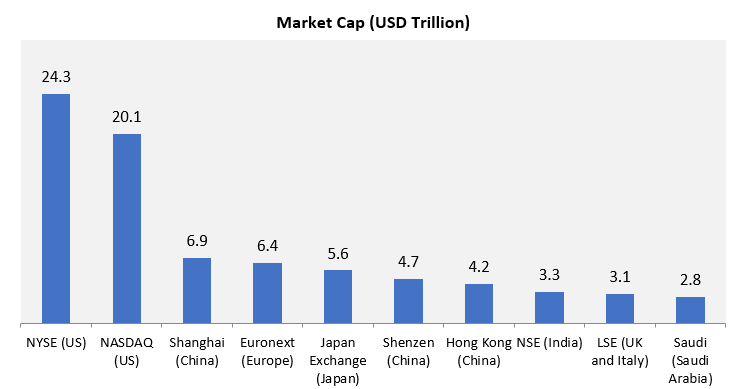

- Exposure to vast opportunities beyond India: There is a vast set of investment opportunities beyond the Indian market. The chart below shows percentage of world market capitalization contributed by different markets. Even though India is the 5th largest economy and is one of the fastest growing economies in the world, there are huge market opportunities outside India for investors.

Source: Statista, as on 30th June 2023. All figures are in USD trillions.

Source: Statista, as on 30th June 2023. All figures are in USD trillions.

- Exposure to global themes / megatrends: The Indian stock market is still dominated by traditional industry sectors e.g. banking and finance, oil and gas, traditional IT operations / outsourcing, FMCG, Pharma, automobile, cement and constructions etc. However in developed markets, technology centric companies are market leaders. United States is the global leader in technology. China is not only one of the largest markets for technology it is also one of the leading exporters of technology. Taiwan is the largest manufacturer of semiconductors, which powers most electronic and digital devices. After technology, international investing provides exposure to other global themes like cyber security, fintech, e-Commerce, social media and more.

- Benefit from currency depreciation: In two countries the difference in the rates of inflation should equal the currency depreciation of the higher inflation country. Since the inflation rate in India is higher than those in developed markets, we expect Indian currency to depreciate against these currencies in the medium to long term. Currency depreciation will add to the returns in international investing.

Factors to consider when investing in International Mutual Funds in India

It’s crucial to consider the following factors when investing in International Mutual Funds in India:

- Risk of currencies: International funds come with a set of challenges. A notable one is the currency risk. For instance, if you put money into a US-centric fund and the rupee depreciates against the dollar, the Net Asset Value (NAV) of your fund rises. This happens because each dollar now translates to more rupees. Conversely, should the rupee appreciate, the NAV would decrease.

- Influence of macroeconomics: A nation’s political stability and its socio-economic climate significantly influence the performance of international funds. Therefore, it’s imperative to have a thorough grasp of these elements and remain vigilant about market trends and developments.

- Sector impact: When investing in global sectoral funds, it is essential that we understand how the global sector cycle works and, hence, what impact it will have on the international fund, especially in the case of sectoral funds.

- Advantage of multiple economies: Taking the international mutual funds route presents an opportunity to capitalise on growth across different economies, potentially resulting in superior returns. This approach also provides a broader diversification scope, enhancing the robustness of your investment portfolio.

Indian investors can broaden their portfolios by allocating funds to international investments targeting companies in regions such as the United States, Europe, and Asia. This approach offers a safeguard against concentrating investments in a single market. Additionally, it provides the opportunity to capitalize on the growth of overseas economies that might not necessarily mirror India's economic path. However, these international mutual funds do come with their set of challenges. Currency risk is a primary concern; investing in an international fund means investing in foreign currencies. A dip in the foreign currency's value can adversely impact your investment. Moreover, geo-political shifts can affect trade, foreign investments etc. in certain geographies affecting the companies the fund invests in. While international mutual funds can be beneficial for those seeking portfolio diversification and tapping into foreign economies' growth, they might not be for everyone. You should have some understanding of the market, sector, theme etc. and the risk factors thereof. Also, you should not invest in international mutual funds in India simply to benefit from INR depreciation. There is ample research which shows that equity risks are far greater than currency risk in most developed or emerging markets. You should understand the risks and make informed investment decisions. Types of International Funds There are many different variations that are possible. For example, the structure of the international mutual funds in India can be passively managed through an index fund or an ETF following an international index, or it can be actively managed international fund, where the fund manager picks stocks in order to outperform the benchmark index. There can also be a fund of fund structure (FOF); as Indians, we are investing in a fund, and that fund is investing in a global fund or funds thatmay be actively or passively managed.

Structure

- Thematic Fund (active)

- Fund of Fund

- ETF

- Index Fund

Theme Specific

- ESG

- Consumer trends / Brands

- Innovation

- Alpha / Quality

Geographical Location

- Country

- Region

- Continent

Sector Specific

- Oil & Gas

- Technology

- Commodites

- REITs

Advantages of International Funds

- Diversification of single country risk: Most investors tend to ignore single country risk associated with their home country. But informed investors should take factor this risk when building their portfolio. You can diversify single country risk through investments in international mutual funds.

- Provides portfolio stability: There is low or even negative correlation between returns of the different countries (see the chart below). One market may outperform when the other market underperforms. Having international mutual funds in your portfolio will add diversification and provide stability to your equity portfolio.

Source: MSCI, as on 31stJuly 2023. All returns are in USD terms. Disclaimer: Past performance may or may not be sustained in the future.

Source: MSCI, as on 31stJuly 2023. All returns are in USD terms. Disclaimer: Past performance may or may not be sustained in the future. - Exposure to vast opportunities beyond India: There is a vast set of investment opportunities beyond the Indian market. The chart below shows percentage of world market capitalization contributed by different markets. Even though India is the 5th largest economy and is one of the fastest growing economies in the world, there are huge market opportunities outside India for investors.

Source: Statista, as on 30th June 2023. All figures are in USD trillions.

Source: Statista, as on 30th June 2023. All figures are in USD trillions. - Exposure to global themes / megatrends: The Indian stock market is still dominated by traditional industry sectors e.g. banking and finance, oil and gas, traditional IT operations / outsourcing, FMCG, Pharma, automobile, cement and constructions etc. However in developed markets, technology centric companies are market leaders. United States is the global leader in technology. China is not only one of the largest markets for technology it is also one of the leading exporters of technology. Taiwan is the largest manufacturer of semiconductors, which powers most electronic and digital devices. After technology, international investing provides exposure to other global themes like cyber security, fintech, e-Commerce, social media and more.

- Benefit from currency depreciation: In two countries the difference in the rates of inflation should equal the currency depreciation of the higher inflation country. Since the inflation rate in India is higher than those in developed markets, we expect Indian currency to depreciate against these currencies in the medium to long term. Currency depreciation will add to the returns in international investing.

Factors to consider when investing in International Mutual Funds in India It’s crucial to consider the following factors when investing in International Mutual Funds in India:

- Risk of currencies: International funds come with a set of challenges. A notable one is the currency risk. For instance, if you put money into a US-centric fund and the rupee depreciates against the dollar, the Net Asset Value (NAV) of your fund rises. This happens because each dollar now translates to more rupees. Conversely, should the rupee appreciate, the NAV would decrease.

- Influence of macroeconomics: A nation’s political stability and its socio-economic climate significantly influence the performance of international funds. Therefore, it’s imperative to have a thorough grasp of these elements and remain vigilant about market trends and developments.

- Sector impact: When investing in global sectoral funds, it is essential that we understand how the global sector cycle works and, hence, what impact it will have on the international fund, especially in the case of sectoral funds.

- Advantage of multiple economies: Taking the international mutual funds route presents an opportunity to capitalise on growth across different economies, potentially resulting in superior returns. This approach also provides a broader diversification scope, enhancing the robustness of your investment portfolio.

Who Should Invest in International Funds?

- Investors looking to diversify single country risk by diversifying their investments in international markets.

- Investors with very high risk appetites. International funds have both equity risk and currency risks. These funds may not be suitable for new investors.

- Investors who have financial goals in foreign currency e.g. children’s education in a foreign university, planning an overseas vacation, purchasing a property in a foreign country etc.

- Investors with long investment horizons. You should have minimum 5 year investment tenures for international fund.

- Your core asset allocation should be in domestic equity and fixed income (debt) for your different life stage goals. In addition to your core asset allocation you can have allocations to other asset classes like gold (for children’s marriage, diversifying portfolio risks etc) and international equity (for children’s foreign education, vacation planning, wealth creation etc).

- You should have knowledge of international markets, understand global risk factors, exchange rate risks etc if you are investing in international funds. You should consult with a financial advisor who has experience in international funds if you need help in understanding the risk factors and selecting the suitable international fund for your portfolio.

Taxation on International Mutual Fund

Starting from April 1, 2023, the capital gains made on international fundsthat invest less than 35 per cent in Indian equities — will be added to your income and taxed at the slab rate applicable to you.The benefit of investing in international mutual funds is also there from the accrual of dividends;there is no taxation on accrued returns, thereby you can benefit from the compounding effect in debt funds.

- Investors looking to diversify single country risk by diversifying their investments in international markets.

- Investors with very high risk appetites. International funds have both equity risk and currency risks. These funds may not be suitable for new investors.

- Investors who have financial goals in foreign currency e.g. children’s education in a foreign university, planning an overseas vacation, purchasing a property in a foreign country etc.

- Investors with long investment horizons. You should have minimum 5 year investment tenures for international fund.

- Your core asset allocation should be in domestic equity and fixed income (debt) for your different life stage goals. In addition to your core asset allocation you can have allocations to other asset classes like gold (for children’s marriage, diversifying portfolio risks etc) and international equity (for children’s foreign education, vacation planning, wealth creation etc).

- You should have knowledge of international markets, understand global risk factors, exchange rate risks etc if you are investing in international funds. You should consult with a financial advisor who has experience in international funds if you need help in understanding the risk factors and selecting the suitable international fund for your portfolio.

Taxation on International Mutual Fund Starting from April 1, 2023, the capital gains made on international fundsthat invest less than 35 per cent in Indian equities — will be added to your income and taxed at the slab rate applicable to you.The benefit of investing in international mutual funds is also there from the accrual of dividends;there is no taxation on accrued returns, thereby you can benefit from the compounding effect in debt funds.

How to invest in International Funds?

The process of investing in International mutual Funds is like investing in regular Mutual Funds. You need to first get your KYC done. Followed by deciding on the purpose of choosing the fund. This will allow you to decide on which type of fund to invest, should it have a tilt towards a particular sector, country, or investment style.

Then you can check for what structure of funds are available given your needs --- Fund of Fund, Passive, or Active.

Consult an investment advisor or a mutual fund distributor if you need help in investing in best international mutual funds in Indiaas thisis not a simple segment to invest in.

The process of investing in International mutual Funds is like investing in regular Mutual Funds. You need to first get your KYC done. Followed by deciding on the purpose of choosing the fund. This will allow you to decide on which type of fund to invest, should it have a tilt towards a particular sector, country, or investment style. Then you can check for what structure of funds are available given your needs --- Fund of Fund, Passive, or Active. Consult an investment advisor or a mutual fund distributor if you need help in investing in best international mutual funds in Indiaas thisis not a simple segment to invest in.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.