Fixed income or debt is an asset class where the primary investment objective is to get income as interest or coupons with relatively low risk. Fixed income as an asset class is one of the oldest forms of investment in India. Traditionally, fixed income investments have been associated with bank deposits, Government or Post Office small savings schemes etc. However, debt mutual funds are increasingly becoming popular among investors as versatile investment solutions catering to different investment needs and risk appetites. As per AMFI July 2023 data, the total asset under management (AUM) in actively managed debt mutual funds was more than Rs 14 lakh Crores (source: AMFI, 31st July 2023). Actively managed debt funds constitute more than 30% of total mutual fund AUM (source: AMFI, 31st July 2023).

What are the types of debt funds?

As mentioned before, debt fund schemes can offer investment solutions for a wide spectrum of investment tenures from a few days, weeks or months to several years and a wide spectrum of risk profiles. SEBI (Security and Exchange Board of India) has mandates for maturity/duration, issuer profiles and credit rating profiles for different categories of debt funds.

| Category | Maturity / Duration | Issuer Profile | Credit Quality |

|---|---|---|---|

| Overnight Funds | Maturity: Overnight | No restriction | No restriction |

| Liquid Funds | Maturity: Less than 91 days | No restriction | No restriction |

| Ultra-short duration Funds | Duration: 3 to 6 months | No restriction | No restriction |

| Low duration Funds | Duration: 6 to 12 months | No restriction | No restriction |

| Money market funds | Duration: Less than 12 months | No restriction | No restriction |

| Short duration funds | Duration: 1 to 3 years | No restriction | No restriction |

| Medium duration funds | Duration: 3 to 4 years | No restriction | No restriction |

| Medium to long-duration funds | Duration: 4 to 7 years | No restriction | No restriction |

| Long Duration funds | Duration: 4 to 7 years | No restriction | No restriction |

| Dynamic bond funds | No restriction (across durations) | No restriction | No restriction |

| Corporate bond funds | No restriction | No restriction | At least 80% of assets only in highest rated securities |

| Credit risk funds | No restriction | No restriction | At least 65% of assets in securities below the highest rating |

| Banking and PSU funds | No restriction | At least 80% of assets in securities issued by Banks, PSUs and PFIs | No restriction |

| Gilt Funds | No restriction | At least 80% of assets in instruments issued by the Government | Sovereign |

| Gilt Funds with a 10-year constant duration | Duration: 10 years | At least 80% of assets in instruments issued by the Government | Sovereign |

Source: SEBI Circular, 6th October 2017. Notes: (1) Duration refers to Macaulay Duration. (2) Overnight funds invest primarily in CBLOs which are backed by collateral in the form of G-Secs. Hence credit risk is very low. (3) PSUs and PFIs enjoy quasi-sovereign status as their majority ownership is with the Government. Banks are regulated by RBI, which strives to ensure capital adequacy to meet all debt obligations. The credit risk of these funds is usually low.

Frequently asked questions

What is a Debt Fund?

Debt funds are mutual fund schemes that invest in debt and money market securities. Debt funds invest in instruments like TREPS, Treasury Bills, Government Securities, State Development Loans, Commercial Papers, Certificates of Deposit, Non-Convertible Debentures, Corporate Bonds etc. Debt as an asset class is less volatile than equities or commodities. As mentioned earlier, the primary investment objective in debt funds is to generate income with relatively low capital risk.

Debt funds are mutual fund schemes that invest in debt and money market securities. Debt funds invest in instruments like TREPS, Treasury Bills, Government Securities, State Development Loans, Commercial Papers, Certificates of Deposit, Non-Convertible Debentures, Corporate Bonds etc. Debt as an asset class is less volatile than equities or commodities. As mentioned earlier, the primary investment objective in debt funds is to generate income with relatively low capital risk.

How do Debt funds work?

Debt fund returns have two components – income and price appreciation. Debt funds get periodic interest income or coupon from the debt and money market instruments in the portfolio. This interest income gets added to the Net Asset Value (NAV) of the scheme on a daily basis. For example, if a bond in a debt fund’s portfolio pays annual interest or coupon, then 1/365 part of the interest or coupon will get added to the NAV of the scheme on a daily basis.

Price change of debt and money market instrument also gets marked to market a debt fund’s NAV. Price of a debt or money market instrument can change due changes in interest rates or credit ratings. If interest rates go down, prices of debt or money market instruments go up and vice versa. So if interest rates go down the NAV of a debt scheme will go up and if interest rates go up, the NAV of a debt scheme will fall, other things remaining constant. Similarly credit rating changes also will have an impact on price of debt or money market instruments and consequently scheme NAVs. The price of a debt or money market instrument will go up if the credit rating of the instrument is upgraded and will down if the credit rating of the instrument is downgraded.

The return of a debt fund will have the combined effect of income and capital appreciation.

Debt fund returns have two components – income and price appreciation. Debt funds get periodic interest income or coupon from the debt and money market instruments in the portfolio. This interest income gets added to the Net Asset Value (NAV) of the scheme on a daily basis. For example, if a bond in a debt fund’s portfolio pays annual interest or coupon, then 1/365 part of the interest or coupon will get added to the NAV of the scheme on a daily basis. Price change of debt and money market instrument also gets marked to market a debt fund’s NAV. Price of a debt or money market instrument can change due changes in interest rates or credit ratings. If interest rates go down, prices of debt or money market instruments go up and vice versa. So if interest rates go down the NAV of a debt scheme will go up and if interest rates go up, the NAV of a debt scheme will fall, other things remaining constant. Similarly credit rating changes also will have an impact on price of debt or money market instruments and consequently scheme NAVs. The price of a debt or money market instrument will go up if the credit rating of the instrument is upgraded and will down if the credit rating of the instrument is downgraded. The return of a debt fund will have the combined effect of income and capital appreciation.

What are important investment concepts in Debt Funds?

You should understand the following concepts when you are investing in debt mutual funds?

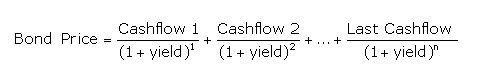

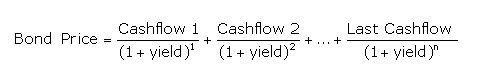

- Yield to maturity: Yield to Maturity or YTM is the expected annualized return from your debt instrument if you hold the debt/money market instrument till its maturity. YTM takes into account all the cashflows from debt or money market instruments. The equation for calculating yield to maturity (YTM) is as follows:-

The cash-flows are the coupon payments made by the bond. The last cash-flow will have both coupon and the maturity amount (face value). If you know how much you paid for the bond, then you can calculate the yield (YTM) based on the above equation. The YTM of a debt fund is the average of the YTMs of all the debt and/or money market instruments in the debt funds scheme portfolio. The higher the YTM, the higher will be the returns of a debt fund.

The cash-flows are the coupon payments made by the bond. The last cash-flow will have both coupon and the maturity amount (face value). If you know how much you paid for the bond, then you can calculate the yield (YTM) based on the above equation. The YTM of a debt fund is the average of the YTMs of all the debt and/or money market instruments in the debt funds scheme portfolio. The higher the YTM, the higher will be the returns of a debt fund.

- Maturity: Debt and money market securities are issued for a fixed tenure. Upon maturity of the security, the issuer (borrower) pays back the principal or face value to the investor (lender). The average maturity of debt fund schemes is the average of the maturities of all the debt and/or money market instruments in the debt mutual fund schemes portfolio.

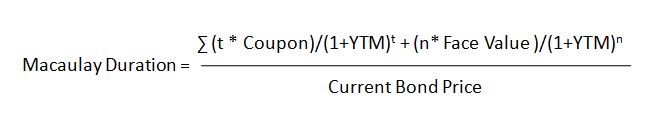

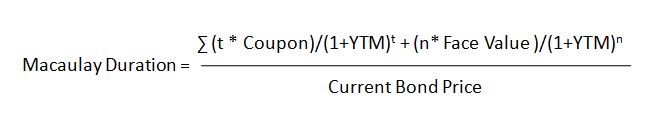

- Macaulay Duration: Macaulay Duration measures the time taken by an investor to recover his invested money in a bond after taking into account interest receipts and principal repayment. The calculation of Macaulay duration is the weighted average term to maturity of the cash flows from fixed-income security. Macaulay Duration depends on the maturity and the cash-flows (coupons) of the bond. Macaulay duration is linked to interest rate risk.

Where,

t = period after which you receive a coupon payment.

n = total number of periods (t) till maturity. For example, if a 5-year bond makes annual coupon payments, then n = 5. If it makes quarterly coupon periods, then 5 x 4 = 20.

YTM = Yield to maturity.

The Macaulay Duration of a debt fund is the average of the Macaulay Durations of all the debt and/or money market instruments in the debt funds’ scheme portfolio.

Where,

t = period after which you receive a coupon payment.

n = total number of periods (t) till maturity. For example, if a 5-year bond makes annual coupon payments, then n = 5. If it makes quarterly coupon periods, then 5 x 4 = 20.

YTM = Yield to maturity.

The Macaulay Duration of a debt fund is the average of the Macaulay Durations of all the debt and/or money market instruments in the debt funds’ scheme portfolio.

- Modified Duration: Bond prices are inversely related to interest rates. Bond prices go up when interest rates fall and vice versa. Modified duration measures a bond price’s sensitivity to yield or interest rate changes. Modified duration is very closely related to Macaulay Duration. If the modified duration of a bond is 2 years, then for a 0.5% fall or rise in interest rate or yield, the bond price will go up or down by 1%. Modified duration is a direct measure of the interest rate risk of the fund. The Modified Duration of debt mutual funds is the average of the Modified Durations of all the debt and/or money market instruments in the debt funds’ scheme portfolio.

- Credit rating: Credit risk refers to the issuer’s inability to make interest or principal payments to the investors. Credit rating agencies measure credit risk and assign credit ratings to debt and money market instruments. For debt instruments (maturity > 1 year), AAA is the highest credit rating, while D is the lowest (default). For money market instruments (maturity < 1 year), A1 is the highest credit rating, while D is the lowest (default).

You can find the YTM, Average Maturity, Macaulay Duration, Modified Durationand credit rating of debt schemes in the monthly debt fund scheme factsheet.

You should understand the following concepts when you are investing in debt mutual funds?

- Yield to maturity: Yield to Maturity or YTM is the expected annualized return from your debt instrument if you hold the debt/money market instrument till its maturity. YTM takes into account all the cashflows from debt or money market instruments. The equation for calculating yield to maturity (YTM) is as follows:-

The cash-flows are the coupon payments made by the bond. The last cash-flow will have both coupon and the maturity amount (face value). If you know how much you paid for the bond, then you can calculate the yield (YTM) based on the above equation. The YTM of a debt fund is the average of the YTMs of all the debt and/or money market instruments in the debt funds scheme portfolio. The higher the YTM, the higher will be the returns of a debt fund.

The cash-flows are the coupon payments made by the bond. The last cash-flow will have both coupon and the maturity amount (face value). If you know how much you paid for the bond, then you can calculate the yield (YTM) based on the above equation. The YTM of a debt fund is the average of the YTMs of all the debt and/or money market instruments in the debt funds scheme portfolio. The higher the YTM, the higher will be the returns of a debt fund.

- Maturity: Debt and money market securities are issued for a fixed tenure. Upon maturity of the security, the issuer (borrower) pays back the principal or face value to the investor (lender). The average maturity of debt fund schemes is the average of the maturities of all the debt and/or money market instruments in the debt mutual fund schemes portfolio.

- Macaulay Duration: Macaulay Duration measures the time taken by an investor to recover his invested money in a bond after taking into account interest receipts and principal repayment. The calculation of Macaulay duration is the weighted average term to maturity of the cash flows from fixed-income security. Macaulay Duration depends on the maturity and the cash-flows (coupons) of the bond. Macaulay duration is linked to interest rate risk.

Where,

t = period after which you receive a coupon payment.

n = total number of periods (t) till maturity. For example, if a 5-year bond makes annual coupon payments, then n = 5. If it makes quarterly coupon periods, then 5 x 4 = 20.

YTM = Yield to maturity.

The Macaulay Duration of a debt fund is the average of the Macaulay Durations of all the debt and/or money market instruments in the debt funds’ scheme portfolio.

Where,

t = period after which you receive a coupon payment.

n = total number of periods (t) till maturity. For example, if a 5-year bond makes annual coupon payments, then n = 5. If it makes quarterly coupon periods, then 5 x 4 = 20.

YTM = Yield to maturity.

The Macaulay Duration of a debt fund is the average of the Macaulay Durations of all the debt and/or money market instruments in the debt funds’ scheme portfolio.

- Modified Duration: Bond prices are inversely related to interest rates. Bond prices go up when interest rates fall and vice versa. Modified duration measures a bond price’s sensitivity to yield or interest rate changes. Modified duration is very closely related to Macaulay Duration. If the modified duration of a bond is 2 years, then for a 0.5% fall or rise in interest rate or yield, the bond price will go up or down by 1%. Modified duration is a direct measure of the interest rate risk of the fund. The Modified Duration of debt mutual funds is the average of the Modified Durations of all the debt and/or money market instruments in the debt funds’ scheme portfolio.

- Credit rating: Credit risk refers to the issuer’s inability to make interest or principal payments to the investors. Credit rating agencies measure credit risk and assign credit ratings to debt and money market instruments. For debt instruments (maturity > 1 year), AAA is the highest credit rating, while D is the lowest (default). For money market instruments (maturity < 1 year), A1 is the highest credit rating, while D is the lowest (default).

You can find the YTM, Average Maturity, Macaulay Duration, Modified Durationand credit rating of debt schemes in the monthly debt fund scheme factsheet.

What are the risks in a debt fund?

You should understand that debt mutual funds are subject to market risks. There are two kinds of risk in debt funds:-

- Interest rate risk: This refers to the change in bond prices due to a change in interest rates. The Net Asset Value (NAVs) of debt funds are marked to market, which means that the change in the market price of the underlying debt or money market instruments must be reflected in the debt fund’s NAVs even though the instruments might be held till maturity. A debt fund’s NAV will increase if the interest rate falls and vice versa. The interest rate sensitivity of a debt mutual fund will depend on the Macaulay or Modified duration of the debt fund. The longer a debt fund's duration, the higher its interest rate risk will be. You should always invest according to your risk appetite.

- Credit risk: If the credit rating of a debt or money market instrument changes, the valuation of an instrument will also change. This change can be either positive or negative. If a bond gets downgraded, its valuation will fall and vice versa. As per SEBI’s regulations, a change in the valuation of a debt or money market instrument in a debt fund portfolio must be marked to market in the debt fund’s NAV. If a bond in a debt fund’s portfolio defaults, you may suffer a permanent loss. The yields of lower-rated papers are higher than the yields of higher-rated papers. In other words, debt mutual funds of lower credit quality can give higher returns than debt funds of higher quality, but the risk will also be higher. You should always invest according to your risk appetite.

- Liquidity risk: If the debt or money market instruments in the portfolio of a debt scheme is not frequently traded or if there is lack of sufficient buyers in the markets in certain market conditions then it gives rise to liquidity risk. Liquidity risk is a concern if the fund manager of a debt scheme wants to sell the underlying debt or money market instruments before maturity to meet redemption or any other need. If any underlying instrument are not sufficiently liquid then the fund manager may be forced to sell the debt or money market instruments at a loss.

You should understand that debt mutual funds are subject to market risks. There are two kinds of risk in debt funds:-

- Interest rate risk: This refers to the change in bond prices due to a change in interest rates. The Net Asset Value (NAVs) of debt funds are marked to market, which means that the change in the market price of the underlying debt or money market instruments must be reflected in the debt fund’s NAVs even though the instruments might be held till maturity. A debt fund’s NAV will increase if the interest rate falls and vice versa. The interest rate sensitivity of a debt mutual fund will depend on the Macaulay or Modified duration of the debt fund. The longer a debt fund's duration, the higher its interest rate risk will be. You should always invest according to your risk appetite.

- Credit risk: If the credit rating of a debt or money market instrument changes, the valuation of an instrument will also change. This change can be either positive or negative. If a bond gets downgraded, its valuation will fall and vice versa. As per SEBI’s regulations, a change in the valuation of a debt or money market instrument in a debt fund portfolio must be marked to market in the debt fund’s NAV. If a bond in a debt fund’s portfolio defaults, you may suffer a permanent loss. The yields of lower-rated papers are higher than the yields of higher-rated papers. In other words, debt mutual funds of lower credit quality can give higher returns than debt funds of higher quality, but the risk will also be higher. You should always invest according to your risk appetite.

- Liquidity risk: If the debt or money market instruments in the portfolio of a debt scheme is not frequently traded or if there is lack of sufficient buyers in the markets in certain market conditions then it gives rise to liquidity risk. Liquidity risk is a concern if the fund manager of a debt scheme wants to sell the underlying debt or money market instruments before maturity to meet redemption or any other need. If any underlying instrument are not sufficiently liquid then the fund manager may be forced to sell the debt or money market instruments at a loss.

Who should invest in debt funds?

Investors looking for income generation along with relatively low risks can invest in debt funds. These funds are suitable for investors with low to moderate-risk appetites. Debt funds can offer investment solutions for a wide spectrum of investment tenures from a few days, weeks, or monthsto several years. You should select the right debt fund according to your investment needs (tenure) and risk appetite.

Investors looking for income generation along with relatively low risks can invest in debt funds. These funds are suitable for investors with low to moderate-risk appetites. Debt funds can offer investment solutions for a wide spectrum of investment tenures from a few days, weeks, or monthsto several years. You should select the right debt fund according to your investment needs (tenure) and risk appetite.

What are the advantages of debt funds?

- Lower risk: Debt funds have much less volatility than equity funds and can be suitable for investors with low to moderate risk appetites.

- Regular income: Some investors,e.g. retirees, may need regular income from their investments. Debt funds can provide income solutions to investors.

- Diversification through asset allocation: Asset allocation is essential for risk diversification and, at the same time, provides adequate returns to help you meet your financial goals. A mix of debt and equity in your investment portfolio is required for asset allocation.

- Liquidity: You should have a contingency fund that can be easily converted into cash for emergencies like sudden loss of employment, medical emergencies of family members etc. Debt funds will be required for your liquidity needs.

- Lower risk: Debt funds have much less volatility than equity funds and can be suitable for investors with low to moderate risk appetites.

- Regular income: Some investors,e.g. retirees, may need regular income from their investments. Debt funds can provide income solutions to investors.

- Diversification through asset allocation: Asset allocation is essential for risk diversification and, at the same time, provides adequate returns to help you meet your financial goals. A mix of debt and equity in your investment portfolio is required for asset allocation.

- Liquidity: You should have a contingency fund that can be easily converted into cash for emergencies like sudden loss of employment, medical emergencies of family members etc. Debt funds will be required for your liquidity needs.

Are debt funds better than FDs?

Bank Fixed Deposits give assured returns (fixed interest rate) to investors. There is virtually no capital risk unless there is a bank run. Corporate or company FDs also give fixed interest rates but are subject to credit risks. Debt mutual funds do not guarantee capital protection, nor debt mutual funds returns are assured. However, with interest rates seeing a secular decline over the past 20 years or so, many investors are considering investing in debt mutual funds.

When comparing bank FD with debt mutual fund schemes, you should understand that a market-linked product always has the potential to give higher returns than a risk-free product. Let us explain why? Debt funds invest in debt and money market instruments. The issuer of a debt or money market instrument will have to pay a higher interest rate or coupon compared to Bank FD. If the company does not pay a higher interest rate than bank FD, why will you invest in its debt or money market instrument? In general, the interest rate of a risk-free investment will be only slightly higher than the inflation rate; on a post-tax basis, the returns from a risk-free product can be lower than the inflation rate. A market-linked investment will usually give higher returns than a fixed-interest investment.

From a taxation viewpoint, Bank FD interest and debt mutual fund returns are taxed as per the investor's income tax rate. However, in the case of Bank FDs, you will have to pay tax on the accrued interest during the term of the FD; the bank will deduct TDS, and you will have to pay tax either as advance tax or at the time of filing Income Tax Returns (ITR) if the TDS rate is lower than your income tax rate. There is no TDS in debt mutual funds. Furthermore, only realized gains (after redemption) are taxed in debt funds. Since there is no taxation on accrued returns, you can benefit from the compounding effect in debt funds.

Bank Fixed Deposits give assured returns (fixed interest rate) to investors. There is virtually no capital risk unless there is a bank run. Corporate or company FDs also give fixed interest rates but are subject to credit risks. Debt mutual funds do not guarantee capital protection, nor debt mutual funds returns are assured. However, with interest rates seeing a secular decline over the past 20 years or so, many investors are considering investing in debt mutual funds. When comparing bank FD with debt mutual fund schemes, you should understand that a market-linked product always has the potential to give higher returns than a risk-free product. Let us explain why? Debt funds invest in debt and money market instruments. The issuer of a debt or money market instrument will have to pay a higher interest rate or coupon compared to Bank FD. If the company does not pay a higher interest rate than bank FD, why will you invest in its debt or money market instrument? In general, the interest rate of a risk-free investment will be only slightly higher than the inflation rate; on a post-tax basis, the returns from a risk-free product can be lower than the inflation rate. A market-linked investment will usually give higher returns than a fixed-interest investment. From a taxation viewpoint, Bank FD interest and debt mutual fund returns are taxed as per the investor's income tax rate. However, in the case of Bank FDs, you will have to pay tax on the accrued interest during the term of the FD; the bank will deduct TDS, and you will have to pay tax either as advance tax or at the time of filing Income Tax Returns (ITR) if the TDS rate is lower than your income tax rate. There is no TDS in debt mutual funds. Furthermore, only realized gains (after redemption) are taxed in debt funds. Since there is no taxation on accrued returns, you can benefit from the compounding effect in debt funds.

How to invest in debt funds?

You can invest in debt funds directly with the AMC or through a mutual fund distributor. You need to be KYC compliant to invest in debt mutual funds. To complete your KYC, you must fill out the KYC form, provide your identity proof, address proof, and photographs and submit the KYC documents to the Asset Management Company (AMC) or the Registrar and Transfer Agent (RTA). Your mutual fund distributor can help you fulfil KYC requirements. Along with KYC documents, you need to provide bank details to invest in mutual funds. Once you are KYC compliant, you can start investing in debt funds. You should select a fund suitable for your investment needs and risk appetite. You should consult with your financial advisor or mutual fund distributor if you need help in selecting the best debt mutual funds that is suitable for your needs.

You can invest in debt funds directly with the AMC or through a mutual fund distributor. You need to be KYC compliant to invest in debt mutual funds. To complete your KYC, you must fill out the KYC form, provide your identity proof, address proof, and photographs and submit the KYC documents to the Asset Management Company (AMC) or the Registrar and Transfer Agent (RTA). Your mutual fund distributor can help you fulfil KYC requirements. Along with KYC documents, you need to provide bank details to invest in mutual funds. Once you are KYC compliant, you can start investing in debt funds. You should select a fund suitable for your investment needs and risk appetite. You should consult with your financial advisor or mutual fund distributor if you need help in selecting the best debt mutual funds that is suitable for your needs.

How are debt mutual funds taxed?

Capital gains in debt funds, irrespective of holding period, are added to income to investor and taxed as per the income tax slab of the investor. Please note that there is no taxation on unrealized gains in debt funds; only realized gains are taxed. Income Distribution cum Capital Withdrawals (IDCW) in debt funds are also taxed as per the income tax rate of the investor. Further please note that there is no Tax Deducted at Source (TDS) for Resident Indians. For Non Resident Indians (NRI) TDS will be applicable at 20% for income from debt funds.

Capital gains in debt funds, irrespective of holding period, are added to income to investor and taxed as per the income tax slab of the investor. Please note that there is no taxation on unrealized gains in debt funds; only realized gains are taxed. Income Distribution cum Capital Withdrawals (IDCW) in debt funds are also taxed as per the income tax rate of the investor. Further please note that there is no Tax Deducted at Source (TDS) for Resident Indians. For Non Resident Indians (NRI) TDS will be applicable at 20% for income from debt funds.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us