Summary

Want to invest like Yale and save tax while you're at it? There’s a smarter way to diversify and reduce your tax outgo especially if you earn between ₹4 -16 lakhs. One small detail in Multi Asset Allocation Funds could save you up to 5% in taxes every year. Read the blog to see how it works.

In investing, some models are so good, they become the gold standard. The Yale Endowment is one of them. Built by David Swensen, it broke the old rule of putting most money into just stocks and bonds. Instead, Yale invested across equities, bonds, real assets, commodities, and even private investments. The goal wasn’t just performance, but durability.

You don’t need to be Yale to invest like it. Today, retail investors can get a similar experience through Multi Asset Allocation Funds (MAAFs). These funds bring different asset classes together into one simple product and offer a smart way to invest, especially for those earning between ₹4 and ₹16 lakhs a year.

Watch this short explainer on the Yale strategy:

Why Multi Asset is a Better Category?

Multi Asset Allocation Funds don’t rely on just one or two types of investments. They usually combine Indian equities, debt instruments and gold - all in a single product.

That mix makes a difference. When stocks take a hit, bonds or gold might hold steady or even go up. This helps balance things out and makes your overall returns less bumpy, especially when markets are all over the place.

Someone put it really well on X:

Compared to traditional hybrid funds that combine equity and debt, Multi Asset Allocation Funds offer better portfolio diversification.

Understanding different types of MAAF based on taxation

Not all MAAFs are taxed the same. It depends on how much they invest in Indian equities.

-

Equity-oriented MAAFs invest 65 percent or more in Indian stocks. Short-term gains are taxed at 20 percent. Long-term gains after 12 months are taxed at 12.5 percent, with a ₹1.25 lakh exemption.

-

Non-equity-oriented MAAFs keep less than 65 percent in Indian equities, it’s treated differently. Here, short-term gains are taxed based on your income slab. Long-term gains are still taxed at 12.5 percent, but only after 24 months.

For middle-income investors, this one detail can make a big difference.

Why chasing equity taxation may not always be the best move?

Many Multi Asset Allocation Funds aim to go just above the 65 percent equity mark. That helps them qualify for equity taxation.

To stay there, they often use arbitrage. On paper, it counts as equity. But it doesn’t act like it. And because of that, there’s less room for other useful assets like debt, gold or global stocks, the kind that bring balance when markets are unstable.

Now think about the funds that don’t follow this approach.

When equity stays below 65 percent, there’s no need to fit in arbitrage. That opens space for more meaningful exposure to gold, debt and international equity. These funds tend to be more balanced, better at handling risk and steadier in their returns.

There’s another advantage too. If you earn between four and sixteen lakhs a year, these funds may also help you save on taxes. But many investors still don’t realise this.

The tax advantage you may be missing

One of the biggest benefits of non-equity Multi Asset Funds is the way your gains are taxed.

If your income is below twelve lakhs, after including any short-term capital gains, Section 87A allows you to pay zero tax on those gains. That’s a big deal. It means your profits from these funds could be completely tax-free.

Equity-oriented funds don’t give you that option. Once your income crosses four lakhs, they tax your short-term gains at a flat twenty percent. The Section 87A rebate doesn’t apply there.

For middle-income investors, this difference often goes unnoticed. But over time, it can leave more money in your hands.

A Sweet Spot for you

If you earn between ₹12 and ₹16 lakhs non-equity Multi Asset Funds still offer a tax break that’s worth noticing.

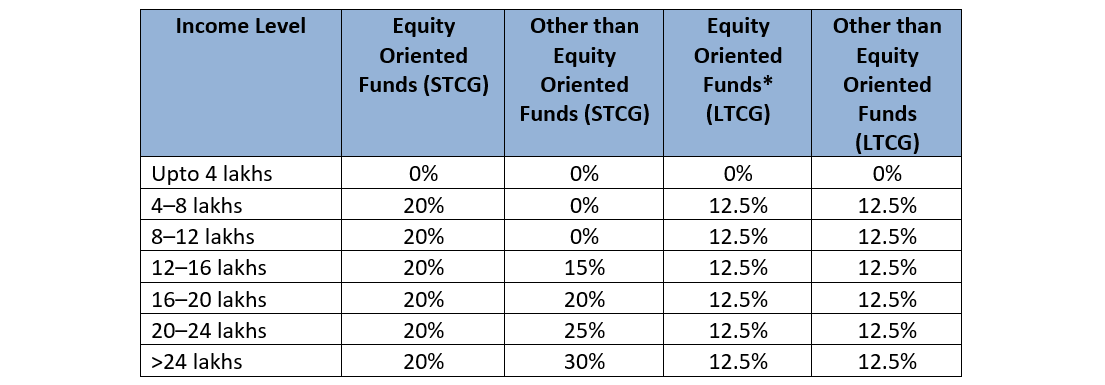

Take a look at how the numbers play out:

*Gains from equity oriented MAAF, listed equity shares & other equity-oriented funds collectively are eligible

for total exemption of ₹1.25 Lakhs.

That five percent tax savings can make a real difference when compounded over the years.

Quick recap: what you need to know about tax

- Equity MAAFs tax short-term gains at 20 percent

- Non-equity MAAFs tax short-term gains based on your income slab

- Long-term gains are 12.5 percent in both types

- Under ₹12 lakh income, short-term gains in non-equity MAAFs are tax-free

- Between ₹12-16 lakhs, you save 5 percent on STCG compared to equity MAAFs

A simple way to cut your tax even more (Rebalancing)

There’s a smart move that works well with non-equity Multi Asset Funds. If your income is below 12L, consider booking profits as short-term capital gains within two years and then reinvest the money.

By doing this, you stay within the short-term tax window where you may not have to pay any tax at all. And you also avoid the long-term capital gains tax later. It’s a small step that can quietly boost your returns after tax.

Build like Yale. Save like you mean it.

The Yale model didn’t chase performance. It pursued durability. That same principle is now available to individual investors through thoughtfully constructed Multi Asset Allocation Funds.

When equity stays below 65 percent, something subtle but powerful happens. Your returns may not just grow, they may stay with you longer, thanks to smarter taxation.

See how this idea works in practice

Because in the end, it’s not just about what you earn.

It’s about what you get to keep.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

In this document, DSP Asset Managers Private Limited (“the AMC”) has used information that is publicly available, including information developed in-house. While utmost care has been exercised while preparing this document, neither the AMC nor any person connected warrants the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s), before acting on any information herein, should make his/her/their own assessment and seek appropriate professional advice. Values shown are for illustration purpose only and to further provide conceptual clarity to understand Information Ratio.

Past performance may or may not sustain in future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in this scheme of DSP Mutual Fund.

All figures and other data given in this document for the fund are as on 30th July and the same may or may not be relevant in future and the same should not be considered as solicitation/ recommendation/guarantee of future investments by the AMC or its affiliates. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implication or consequence of subscribing to the units of the schemes of the DSP Mutual Fund. For scheme specific risk factors, asset allocation details, load structure, investment objective and more details, please read the Scheme Information Document and Key Information Memorandum of the scheme available at the Investor Service Centers of the AMC and also available on www.dspim.com. There is no assurance of any returns/capital protection/capital guarantee to the investors in this scheme of DSP Mutual Fund.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Comments

Total 1

Senthilkumar S

28-10-2025

I am a MFD . Today I got the clarity about non equity MAAF. Thanks

Write a comment