Summary

Michael Schacht, a 70-year-old clothing shop owner from Hamburg, Germany, recently invested his savings in stocks after his bank started charging 0.5% on deposits, illustrating the impact of liquidity-driven asset price inflation. Both equities and bonds are currently at historically high valuations, with bonds experiencing negative yields globally totaling around $12 trillion. Amid expansive monetary and fiscal policies and rising inflation expectations, investors are questioning the viability of traditional 60:40 portfolios, favoring sectors resilient to inflation like asset-heavy businesses. As uncertainties persist, strategies involving diversification, cautious allocation, and considering inflation-resistant assets like Gold are becoming increasingly relevant.

The Wall Street Journal, earlier this month, reported that Michael Schacht, a 70-year-old clothing shop owner in Hamburg, Germany put all his savings in the stock market when his bank decided to charge him 0.5% on deposits. Mr. Schacht had never considered investing in stocks before. When you hear about ‘liquidity-driven asset price inflation’ – this is what it means.

At no point in history have both equities and bonds, together, been as expensive as they are today. Shiller Cape PE for S&P 500 (back-calculated up to the late 1800s) was higher only during the Tech Bubble. Approximately $12 tn of bonds are currently trading at a negative yield globally. In one year post the pandemic, the balance sheet of the largest central banks across the world expanded by more than it did in the whole preceding decade.

US, EU, Japan, UK Central Bank Balance Sheets1The monetary and fiscal expansion combined with soaring commodity prices has led to rising inflation expectations. Any rise in interest rates might end up hurting both equities and debt. Is it time to reconsider the 60:40 portfolios?

Supply disruption due to Covid might be transitory. Technology has been a deflationary factor and will probably continue to be so. Globalization, another deflationary factor, for political as well as self-sufficiency reasons, might see some headwinds. Lastly, the increase in debt in recent years has been on government balance sheets while households and corporations have deleveraged.

I don’t know if we are going to see a bout of inflation. But I would want my portfolio to be prepared for it.

“If you’re not a little confused by what’s going on, you don’t understand it. We’re in uncharted territory...With everything boomed up so high and interest rates so low, what’s going to happen is the millennial generation is going to have a hell of a time getting rich compared to our generation”.

We often think of the future as discrete binary events. It’s tiresome to think of it as multiple possibilities with varying degrees of likelihood. Even on occasions when we force ourselves to consider the possibilities, we end up focusing on trying to maximize our “payoffs” in favorable scenarios. A better approach is to try to limit our downsides in case of adverse outcomes.

Invert. Take care of the left tails.

Inflation & Equities

The value of a fixed coupon bond goes down as interest rates go up. If we think of stocks as bonds with variable and uncertain coupons, then, the value of these stocks too is inversely correlated with interest rates.

Warren Buffett, in a 1977 Forbes article, says the only way equities as an aggregate could deliver higher returns when inflations goes up is by increasing their return on equity. The return of all equity investors as an aggregate will be the same as the ROE of the market, assuming everybody bought at book value.

Let's say a zero growth stock is making 10% ROE when the inflation & interest rates are at 10%. Assuming a book value of Rs. 100, the stocks generate Rs. 10 in earnings (10% ROE). This is paid out as dividends. The value of this cash flow is 100 (Annuity Formula: Pay-out/Interest Rate, in this case, 10/10%). The stock will trade at book value and there are no real returns being made.

Now assume the inflation goes to 20% and interest rates follow. To give zero real returns the stock will have to generate 20% ROE now. The value of the stock is still 100 or 1X Book (20/20%). But now the stock is trading at 5X PE vs. 10X earlier. That is the nominal PE gets de-rated. In case the stock is not able to increase the ROE the PB will also de-rate. At 10% ROE the stock in the new environment will start trading at 0.5X book. The new investor who buys the stock at 0.5X book is now being fully compensated for the increase in interest rates. His return is 20% (Rs. 10 on Rs. 50).

There are only five ways to increase ROEs:

-

Higher asset turnovers (but over time, assets will be replaced at higher prices in an inflationary environment)

-

Cheaper leverage (hard to come by as interests rates go up)

-

More leverage (possible, riskier)

-

Lower taxes (hope is a good thing)

-

Wider margins

NSE 500’s operating margins have hovered around 12% for two decades now, irrespective of the inflation.

Buffett noticed in 1977 that, for many decades, the ROE for US corporations as well had not moved from 12%. He said he would still rather hold equities than anything else. In recent years, the ROE of the S&P 500 has actually diverged from the CPI (Consumer Price Index) Inflation. Buybacks have contributed significantly to this. In India, the ROEs have tracked inflation better. Equities have proven to be good inflation hedges over long periods of time, but over 5 years, that may not be true.

S&P ROE vs. CPI2 NSE 500 ROE vs. CPI3Is inflation worse for some kinds of equities than others? Consider the following zero-coupon bonds. Bond A pays Rs 259 after 10 years, while B pays Rs 11,739 after 50 years. At 10% interest rates, they are both valued at Rs 100 today. But if interest rates were to move to 11%, the value of Bond A declines by only 9% while Bond B crashes by 36%.

Stocks whose value comes from cash flows far out in the future are the ones that get affected more in rising interest rate scenarios – typically the growth stocks.

Sensitivity of value to interest rates

| 10% Interest Rates | 11% Interest Rates | |||

| Bond A | Bond B | Bond A | Bond B | |

| Price Today | 100 | 100 | 91 | 64 |

| Pay-out in 10 Years | 259 | 0 | 259 | 0 |

| Pay-out in 50 Years | 0 | 11,739 | 0 | 11,739 |

Are there some sectors that do better than others in an inflationary environment? Unfortunately, I don’t have enough data to analyze the 30s, 40s, and 70s in the US. From 2001 to 2007, as Fed Fund Rates moved up along with CPI inflation, the asset-heavy sectors were the best performers.

The performance was almost a mirror-opposite of this during 2008 to 2016 as inflation declined.

In India, 2009 to 2013 was an inflationary period that was accompanied by a minor currency crisis. As a result, the exporters - Pharma, FMCG, & IT - did well. Pharma had other tailwinds which subsided in the latter half of the decade.

The growth in FMCG, Pharma and IT was on the back of strong earnings delivery.

In a narrower market like India, idiosyncrasies dominate. Private Banks have flourished in both periods and infra and metals have struggled. I would give more weightage to the US experience where the asset-heavy, old-world, cash flow-generating businesses did well in inflationary periods. The representation of these value buckets has also come down in the Index (Nifty 50) over time.

Metals, Capital Goods, Utilities and Oil & Gas (Ex Reliance) had a 26.5% weight in 2010. It is down to 8.8% in Mar-2021.

In a non-domestic currency debt crisis, the answer has always been Gold. Buying Gold essentially is equivalent to taking money out of the country in such cases. Ray Dalio gives multiple examples of these in his book Principles for Navigating Big Debt Crises.

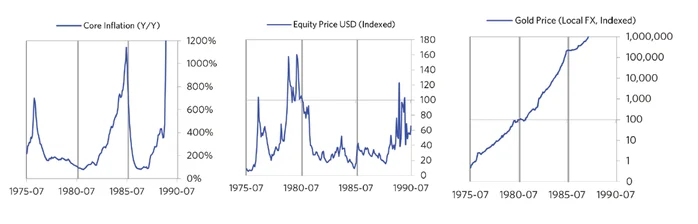

Germany 1918 to 1925

Argentina 1977 to 1988

Inflation and Factors

A 10-year correlation of the 5 Fama-French factors (Data from Kenneth French’s website) for the US shows that profitability factor is negatively correlated with inflation. This means companies with lower multiples, lower size, lower growth in assets, and lower profitability have done well in an inflationary environment. The last one is probably because firms with high profitability also have higher multiples and end up derating more than ones where the multiples are less dear. The value stocks generally also have higher leverage and they tend to benefit in a high inflation environment as the nominal value of the debt remains the same. Although, the dynamic here is not clear.

HML: High Book to Market Long, Low Book to Market Short (Value factor)

SMB: Long companies will smaller market capitalization, Short companies with higher market capitalization, the size factor

Rf: The Risk-free rate

Mkt-RF: Market returns – Risk Free Return (Real return)

RMW: Robust Long, Weak Short (Profitability measure, similar to ROE)

CMA: Conservative Long, Aggressive Short (Long companies with lowest change in Gross Assets and Inventories as a % of Book Value and short companies with highest changes)

There is research showing bonds and commodities adjust faster to inflation. Equities are slower to react as the discount values (cost of capital) people use are sticky. So if inflation was to go up 2% overnight and stay there, bonds would correct to compensate for this instantaneously. Equities too will correct but the immediate correction will not be enough to compensate for the higher cost of capital. The full adjustment might take longer.

Inflation and Gold

The average of 5-year rolling returns for Gold has been 7.8% in excess of inflation in the US since 1945 (post-Bretton Woods). Inflation, by definition, is higher commodity prices. But Gold not being a consumption asset, this chart still makes sense. Gold is also negatively correlated with the money supply in the US.

Gold vs. US GDP/M26What would I do?

-

Continue to hold equities at lower than peak allocation

-

Shift exposure from high-growth/high-PE names to the value buckets – more weight to cash flows and valuations. Low profitability growth stocks should be particularly vulnerable in a lower liquidity, higher cost of capital environment.

-

Asses the overall portfolio including real estate investments. REITs could be an inflation hedge and a suitable proxy for physical real estate as the market develops.

-

Have exposure to multiple markets/currencies

-

Have Gold in the portfolio (5% to 10%): I don’t expect to make a lot of money on my gold allocation. I also expect and hope to lose my term insurance premiums

What I would not do?

A lot of savers, like Mr. Schacht, are feeling the pinch of lower returns on their savings. The temptation to reach for yields by taking duration, credit, liquidity or drawdown risks is high. I would resist this. I would not go chasing yields. I would refrain from taking drastic steps of moving completely in or out of any asset class, especially asset classes that have emerged recently. I would not be lazy with my asset allocation.

Your portfolio’s structure today, should be your safety net. Not your choices post a crisis.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

[1] Source: Bloomberg

[2] Source: Bloomberg, CPI (RHS)

[3] Source: Bloomberg, CPI (RHS)

[4],[5] Source:Principles For Navigating Big Debt Crises

[6] Source: Bloomberg

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Comments

Total 13

Samir Gandhi

25-09-2024

Very genuine and correct guidance

Srikanth matrubai

25-09-2024

Amazing insights Deep perspective. Very well articulated thanks for sharing this

Sohrab Nania

25-09-2024

Very enlightening. Thanks Will go through in much detail.

ANIL Patil

25-09-2024

Present market scenario is ery aptly summed up

PRASAD

25-09-2024

Very good insight. Made me look at my portfolio.

Mukul Kukreti

25-09-2024

Excellent analysis and insightful article. Cheers!

Akhilesh kumar pandey

25-09-2024

So nice article , I learnt a lot .

Anand

25-09-2024

Investors are confused between growth and value selection because of biased approach of companies and manipulation of data to sell what they want to sell. Selling Pandemic is the best business approach in present time as timelines of investment are drastically changing and disruptive concepts are the best investment horizon which was once the core business. Many talk about international market but how many of us have actual access to it and how much practical will it be to refer here in our scenario where we simple follow domestic model and do not experiment much on our investment as our traditional approach. That may be the reason we survive in any scenario not like others.

AMIT

25-09-2024

Nice research report/analysis.

Tushar K

25-09-2024

More clarity on the recommendations needed. 1. Continue to hold equities at lower than peak allocation: Lower than peak means how much, 60%, 50%, 40%? 2. Shift exposure from high-growth/high-PE names to the value buckets – more weight to cash flows and valuations. : Considering sky high valuations for even value bucket stocks, is it a wise move? 4. Have exposure to multiple markets/currencies: This is as good as saying diversify across markets and currencies. Not an actionable insight. 5. Have Gold in the portfolio (5% to 10%): I don’t expect to make a lot of money on my gold allocation. I also expect and hope to lose my term insurance premiums.: What does hope to lose term insurance premium means?

Ranganathan Venkataraman

25-09-2024

Analysis is too technical and not helpful. Just dropping names and meandering with graphs only signals the author's intent to showcase his theoretical stuff. Not specific to India, in any case. Yes, headline is catchy.

Sameer Thakor

25-09-2024

What would I do? 5. Have Gold in the portfolio (5% to 10%): I don’t expect to make a lot of money on my gold allocation. I also expect and hope to lose my term insurance premiums. I didn't got this point what do you mean by "lose my term insurance premiums"?

Srivatsa

25-09-2024

Good perspectives. Inverse thinking as propogated by Munger is good risk management. Looking at the worst case is useful What you need to do is more work on translating this to model portfolios that Indians need to therefore have. For example % allocation in countries and in different asset classes. (Note - you should also be conscious of Indians holding real estate and how you would fuse that with the financial assets in the allocation or propose to keep it seperate and out of scope). You could also think of Portfolios for different stages of life and different genre of people ie HNI, regular salaried class, business people (who will have most of their net worth in their business). The need for regular portfolio hedging is largely ignored. Lastly you should project the future asset classes as you lookout over the next 25 years and work backwards with a proposal on how to build to safeguard (eg crytocurrencies etc).

Write a comment