Summary

Get the key takeaways from the May 2024 edition of Netra. This blog keeps you updated with the latest market insights. This blog provides in-depth analysis and practical advice. These funds are suitable for long-term investors looking to save on taxes. They offer a unique combination of tax savings and potential for high returns over time.

Welcome to the May 2024 edition of Netra, where we present data-driven market insights that can inform your investing decisions.

This month, we’ll talk about the reality of long-term equity returns, the relatively lacklustre performance of the Chinese equity markets, and the rapid growth of investments in India.

Long-term equity growth not a given?

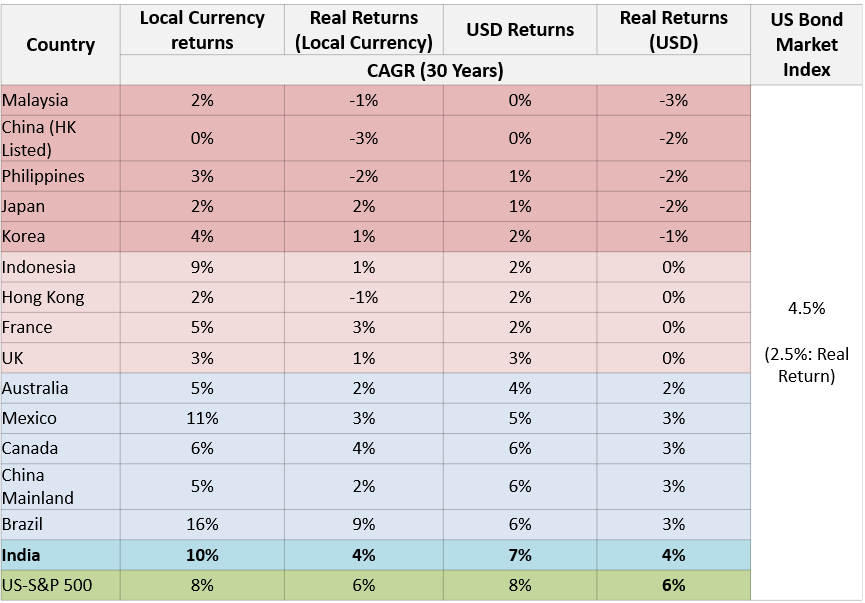

It’s often considered to be a truism that equity markets deliver superior returns over the long term. But it turns out that this is only true for a handful of markets: in general, outstanding long-term equity returns might be the exception, not the norm.

If we look at the performance of 16 major indices over the past 30 years, we see that relatively few markets have generated real returns (in USD terms) that are greater than the real returns of US bonds. In fact, more than half of these 16 markets have generated zero or negative real returns in USD terms. Even if we look at the real returns in terms of the local currencies, there is no index that has generated double-digit returns.

Source: Bloomberg; Data as on Apr 2024. Bloomberg US Aggregate Index is considered for US Bond Market Index

China’s equity markets fail to impress

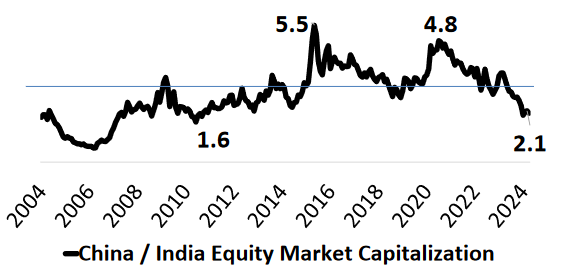

A comparison of the Indian and Chinese equity markets reveals that the latter have been posting underwhelming performance. China’s current equity market cap is two times that of India’s — this seems mighty impressive, but only until you realise that its GDP is five times that of India’s.

Source: DSP, Bloomberg; Data as on April 2024

Between 2004 and 2021, China’s economy outgrew India’s at breakneck speed, and its equity market cap was nearly five times that of India’s in 2021. But since the end of that period, it has lost some relative momentum, and India’s economy and equity markets have outperformed those of China’s over the past three years.

Currently, the Nifty 50 Index trades at 23x trailing earnings, while the Shanghai Composite trades at 11x trailing earnings. Will these valuation differentials persist for some time to come? Can the sizes of the two countries’ economies begin to converge, and India outgrow China over the next few years?

The market is behaving as if the answer to these two questions is ‘yes’. But the high valuations in the Indian equities market could prove to be speed breakers down the line. In addition, India will probably have to do almost everything right in order to retain any advantage it might currently have.

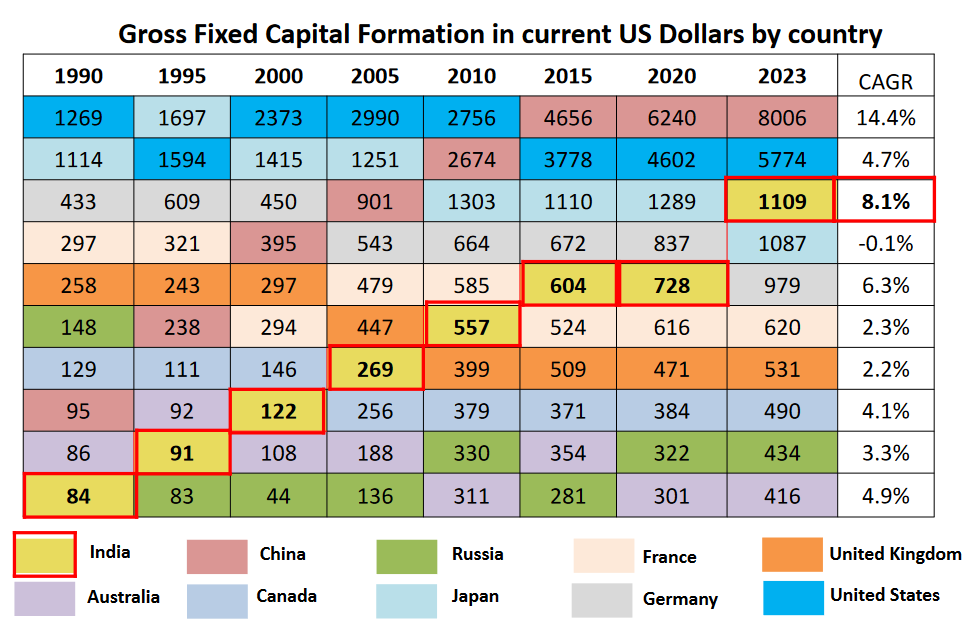

India crosses the trillion-dollar annual investment mark

It seems safe to say that India has come out of an investment winter. The investment-to-GDP ratio (with investments being measured using a metric known as Gross Fixed Capital Formation or GFCF) peaked in 2011 and remained low until Covid threw supply chains into disarray. In the wake of the post-Covid recovery and thanks in part to rising government expenditure, investments are making a strong comeback, and India crossed $1 trillion in annual investments for the first time in 2023.

Source: World Development Indicators, Bloomberg, DSP; Data as of Apr 2024

Since independence, India has spent $14 trillion on investments. This includes spending on housing by households, infrastructure creation by the government, and private capital expenditure. Of that amount, $8 trillion were spent in just the last 10 years. As the base becomes large, $8 trillion more are likely to be spent over the next 5 years.

Such a high investment growth rate is likely to uncover several new opportunities over the coming years, and investors would do well to keep an eye out for them.

The bottom line

Equities certainly are long-term wealth creators, but the data indicate that there’s more nuance to the picture than is usually believed. In addition, India’s equity markets are apparently performing better than those of China, but it remains to be seen if India can hold on to this advantage. Lastly, Indian investments are going through the roof, and investors should keep their eyes peeled for any novel opportunities that might result from this trend.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This document is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as on December 31, 2023 (unless otherwise specified and are subject to change without notice). Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in above mentioned scheme. The portfolio of the scheme is subject to changes within the provisions of the Scheme Information document of the scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.. The sector(s)/stock(s)/issuer(s) mentioned herein do not constitute any research report/recommendation of the same and the scheme/ Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). The strategy / investment approach / framework mentioned herein is currently followed by the scheme and the same may change in future depending on market conditions and other factors.

For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, and Key Information Memorandum of the scheme available on ISC of AMC and also available on www.dspim.com. For Index disclaimer click here. Large-caps are defined as top 100 stocks on market capitalization, mid-caps as 101-250 , small-caps as 251 and above. The strategy mentioned has been currently followed by the Scheme and the same may change in future depending on market conditions and other factors.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully..

Other Blogs

Sort by

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Write a comment