Summary

Get the key takeaways from the August 2023 edition of Netra. This blog keeps you updated with the latest market insights. This blog provides in-depth analysis and practical advice. These funds are suitable for long-term investors looking to save on taxes. They offer a unique combination of tax savings and potential for high returns over time.

The August edition of Netra is here and it delves into the intricate dynamics of India's economic landscape, offering a comprehensive analysis of key sectors and their strength and vulnerability amidst global uncertainties. In this edition, we shed light on three crucial facets that hold substantial relevance for India's economic growth and investment strategies. These include the potential impact of the global slowdown on India’s services exports, the stretched valuations because of Nifty’s 5-month rally and the challenges faced by Indian IT stocks.

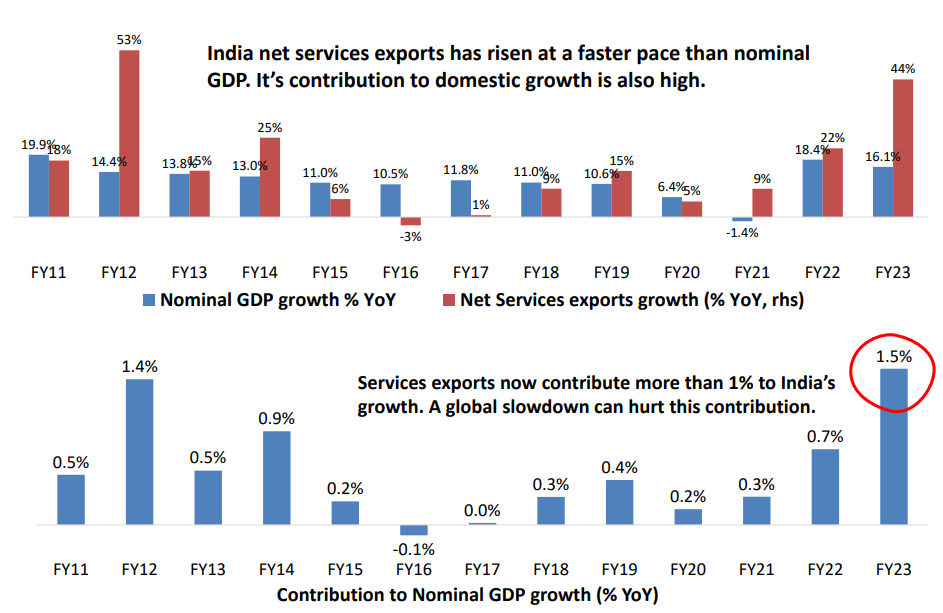

Vulnerability of India's Services Exports Amid Global Growth Uncertainty

The potential consequences of the recent worldwide economic slowdown can be detrimental on India's services exports and overall economic growth. India's services exports, valued at nearly $120 billion annually, along with gross services exports reaching $250 billion over a year, constitute a substantial portion of its economy. These exports contribute almost 7% to India's GDP.

Source: CMIE, Bloomberg, Investec, DSP Data as on July 2023

Over the past three years, the growth rate of India's net services exports has outpaced the growth of its overall economic output. This increased contribution from services exports to India's economic growth has risen from 0.30% on average between 2014 and 2019 to 1.5% recently.

The negative impact of a global economic slowdown on India's services exports is by virtue of reduced global demand during a slowdown which leads to lower consumption and investments. This reduction potentially results in a decline or slower growth in India's services exports.

As the services sector has become a more prominent driver of growth, any slowdown in this sector can dampen the country's economic expansion. Furthermore, this can also impact core inflation, which excludes volatile food and energy prices. Reduced economic activity can lead to lower demand-driven inflation.

These potential risks associated with a global slowdown are not currently being fully factored into the economic analysis. Going forward, it is essential to closely monitor the situation, especially if developed economies experience a sharp slowdown. The next two quarters are identified as a critical period to watch in this regard.

In the event of a global slowdown affecting India's services exports, the country's domestic economic growth would need to step in as a compensatory measure. This means that other components of the economy, such as domestic consumption, investments, and government spending, would need to play a more significant role in supporting economic growth.

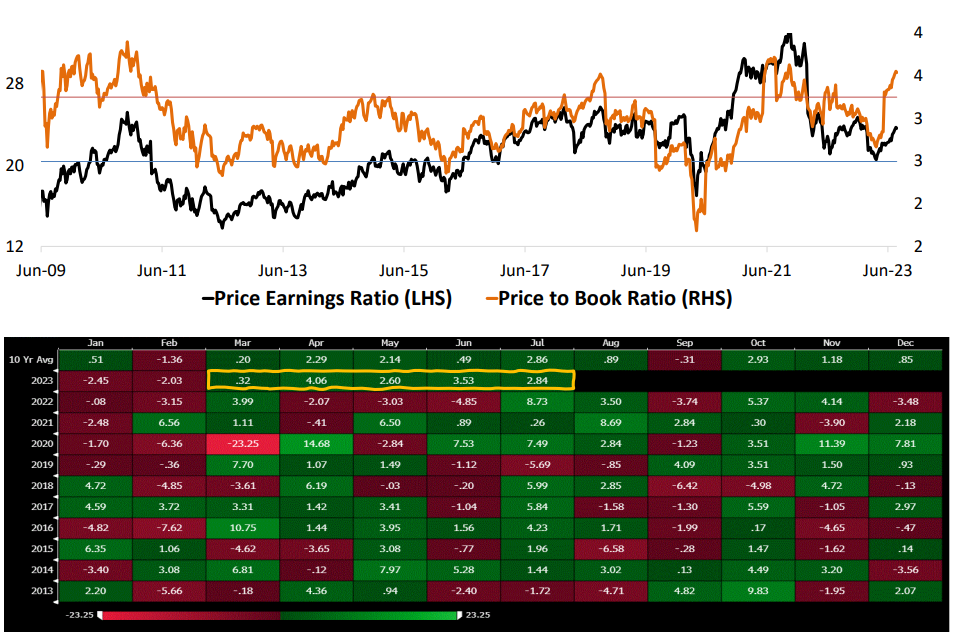

Caution Amidst Nifty's 5-Month Rally: Stretched Valuations and Investor Opportunities

Source: Bloomberg, DSP Data as on June 2023

The Nifty index has experienced a significant rally of over 12% in the past five months. Such consecutive positive closes indicate strong short-term momentum in the market. However, this rally has also led to stretched valuations, implying that the prices of stocks within the index may have risen to levels that are relatively high compared to their underlying fundamentals.

Foreign Portfolio Investors (FPIs) have been attracted to the Indian market due to the rally and favorable economic factors. The period from April to July 2023 has seen substantial FPI inflows of $18 billion, which is noted as one of the fastest inflows over a four-month period.

The continued growth in earnings, economic resilience, and investment flows have provided support to Indian equities. These factors contribute to the positive sentiment in the market and encourage investment.

While the positive factors support the market, the short-term upward movements may be blunted by momentum boundaries and stretched valuations. This suggests that the rapid pace of the rally might encounter resistance, and the high valuations could lead to a slowdown or correction in the market.

However, there still lies opportunity for equity investors. Nifty index's 200-day average has surpassed a certain level (18,200), and this is accompanied by a rising earnings-per-share (EPS) trajectory. This situation is seen as an appealing opportunity for equity investors to consider increasing their equity allocation. The suggested range for this allocation is between 18,200 and the previous life highs of 18,600 index levels.

If the Nifty index approaches the mentioned levels (18,200 to 18,600), it is best to review the outlook and consider staggered purchases for equity allocation. Staggered purchases involve spreading out investment over time to reduce the impact of market volatility.

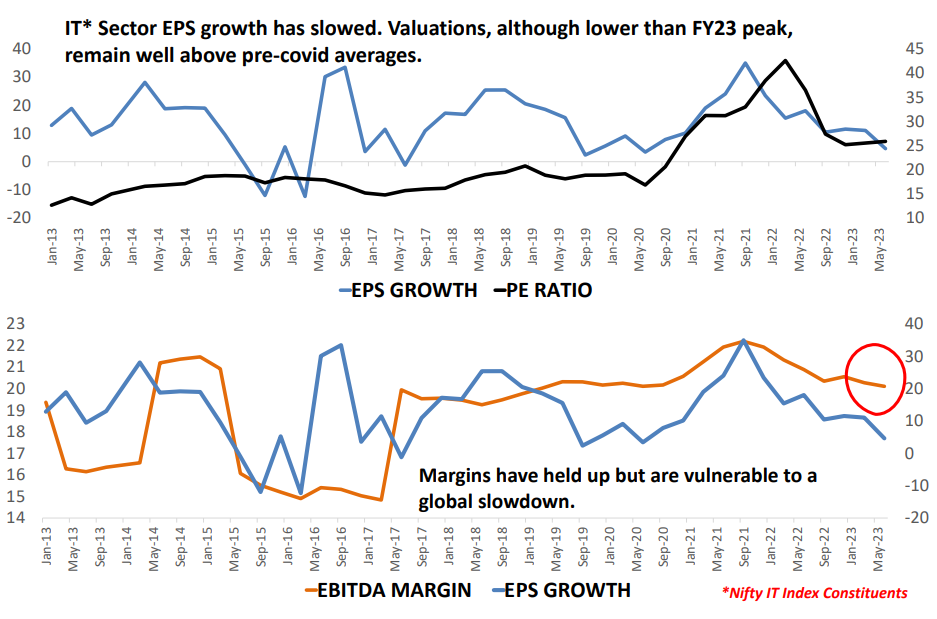

The challenges faced by Indian IT stocks in the current global market environment

Source: Bloomberg, DSP Data as on July 2023

The Nifty IT Index, which represents the performance of the IT sector in the Indian stock market, has experienced a significant decline of 25% from its peak in January 2022. However, it has shown a modest recovery of about 4% in the year 2023.

The IT sector has displayed a mixed pattern of financial results, with some periods of decent performance and cautious commentary from management. This suggests a level of uncertainty and variability in the sector's performance.

In a scenario where the broader economic conditions are weaker, the demand for discretionary IT services may not see a significant uptick. This implies that companies might not experience a substantial increase in demand for their services from customers who have the flexibility to choose when and how to spend on IT.

Even in the coming year (CY24), any improvement in the IT sector is anticipated to be moderate. This is based on the projection that S&P 500 revenue growth is expected to be around 5%, slightly higher than the 4% growth seen in CY23. This expectation challenges the notion of a sharp improvement in the IT sector.

The slowing earnings growth of global clients (companies that use IT services) could increase pressure on IT companies to cut costs. Such cost-cutting measures could negatively impact profit margins for IT firms.

The overall outlook for the IT sector seems uncertain, with various challenges and obstacles clouding the sector's future prospects. This uncertainty adds an element of risk to investment decisions.

To become an attractive investment opportunity, the valuations of IT stocks need to adjust in consideration of the sector's challenges. Additionally, for a positive trend to regain its momentum over the long term, there should be an improvement in the growth outlook for the IT sector.

The bottom line

These insights from August 2023 edition of Netra underscore the potential impact of global slowdown on services exports, the balance between Nifty's rally and stretched valuations, and the challenges confronting Indian IT stocks. As economic dynamics continue to evolve, Netra equips readers with essential insights to navigate uncertainties, seize opportunities, and make informed decisions that drive stability and growth.

Apart from these, August 2023 edition of Netra offers several other key insights. You can download the full report here.

Industry insights you wouldn't want to miss out on.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the schemes of DSP mutual fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment