Summary

This blog covers an important topic in investing, providing useful insights and practical advice for readers. It helps you make informed decisions and improve your financial strategies. This blog provides in-depth analysis and practical advice. These funds are suitable for long-term investors looking to save on taxes. They offer a unique combination of tax savings and potential for high returns over time.

I am moving. No, it’s not a shift of place. I refer to the shift beyond the quarter-life crisis. It’s gradual and slow but also sudden - from bachelorhood to a woman with a family and dependents, from being the youngest on the office floor to learning about K-drama from the actual youngsters. Has money changed for me? It has increased, of course, but opposite to all theories of demand, it has become more scarce, more precious. I look back to life at 21 when investing was a fun activity. Though I believe I have always been very sincere with money, here’s what I lost and how. And here’s how I’d suggest you should NOT invest.

1. Whenever you feel like it

Use investing as a way to inculcate discipline. Like you probably started working out - sometimes it’s just about getting up at the same time every day. Some days, you smash it with 500 calories burned, but other days, you just want to walk. What would the health benefits be if you worked out only when you feel like it? Mental peace, yes, but physical fitness-wise, not much. Similarly, whether you invest Rs 5000 or Rs 500 every month, it doesn’t matter. While any money saved is money earned, investing at a pre-defined regular interval may reap you better benefits and higher profits over time.

2. Spend then invest the rest

This really isn’t new advice, but one that may be tough to follow-through for beginners - Always invest, then spend. The desire to take the next foreign trip or buy new sneakers are palpable. The difference between now and my younger self was I had no weekend readings, no guilt of not skilling up and crazy energy, so I traveled as much as I could. Travelling is a great thing but only up to a point when it’s not digging a deeper hole than you can climb out of. Invest a small portion every month, go consume the rest.

3. Invest it all

Too much of anything is bad, including financial investing. At a younger age, one must invest in themselves. That means spending money on lifestyle, networking, value-add courses, building finer tastes etc. If you invest in yourself, you’re likely to earn way more in later years and higher earnings and consequent higher savings will offset smaller losses of savings from the youth days. As my father puts it, “if you don’t know the taste of wealth, you wouldn’t want to be wealthy”

And here is a tip:

4. DIY is so cool

We are all learned souls, or at least we believe so in our youth. I started my career in the broking industry and bought direct equity based on stories at workplace during the peak of the cycle, only to sell some of it at deep losses half a year later when I needed money. Then I learnt about asset allocation and went all out on debt to balance my equity holdings. Honestly, that didn’t work either.

When young, work towards reducing the tuition fee to the market. You’d pay some any way but having a right advisor/playing with safer instruments will go a long way. As one of my senior colleague puts it, “Simply avoid losing money when you’re young”. Short-term 5% and 7% conversations are meaningless in the larger scheme of things.

5. Long term is the only term

While we strongly propagate long-term investing, goal-setting is actually more important. At a younger age, it may be wiser to have short-term goals. It is good to save for that foreign university course or that dream trip to Europe. Every time the thought strikes on why you’re saving and how stupid it is to save for retirement because YOLO and FOMO want you to live in the present, remind yourself of a ‘bigger’ short-term goal. It is an excellent way to build long-term habits. Remember, small acts go a long way, and good long-term investing habits are a real asset.

6. Panic when the bear knocks

The market is super dynamic ranging between highs and lows daily. Even when you invest in fundamentally strong stocks and research hard enough to find the next multibagger, there are going to be periods when the market and the stock dip.

The key is to not panic when this happens- the ups and downs in a market cycle are not a cause for worry as long as the company’s fundamentals are strong.

And as legendary investor Peter Lynch once said,

In the stock market, the most important organ is the stomach. It’s not the brain.

Learn to stomach momentary dips in the market that actually, are a great opportunity to expand your portfolio!

7. Appearing for the exam without reading the book

Would you want a nurse to perform complex surgeries on you? Or engage a newbie with no market knowledge to design your new home?

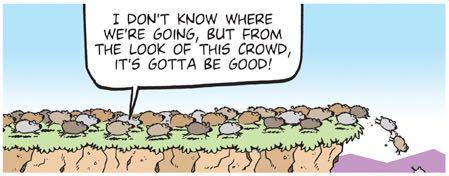

Entering the stock market without understanding how it works is very similar to the situations described above. When you are young and naive, you probably are easily waylaid by your friends and family giving you stock tips to make a quick buck. Investment gurus and channels push our buttons, presenting a very rosy picture of the stock market’s potential to make money.

Just because you have some cash at hand and don’t want it sitting idle in a savings account is not a good enough reason to enter the market on a fine sunny day. Understand the nuances of how markets and investments work, get a crash course on it, and then put your hard-earned money in the market in select products suitable to your risk profile.

What is risk profiling? Watch the video here:

8. Buying the narrative blindfolded

There’s no point switching from a keto diet to intermittent fasting and then to paleo eating and to the next most well-advertised diet scheme. That’s only going to ruin your health and not make you any fitter. Similarly, switching asset classes/stocks and investing style may not be the best strategy to employ to become wealthy. Remain balanced, determine your macros, make it easy for yourself and stick to it. That’s the way to actually feel comfortable with your finances.

The word “person” in personal finance is everything. Stick to it - define yourself, your goals, your way of doing things and align investing to it. Inculcate the right habits on the way - condition yourself. Let investing bring the right kind of joy!

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Comments

Total 1

Ramprasad

24-09-2024

Very nicely written. Thanks for sharing your learnings. Could relate to lot of things that my friends and I were discussing when we started out.

Write a comment