Summary

Warren Buffett's 2024 shareholder letter pays tribute to Charlie Munger and imparts timeless investing wisdom, emphasizing principles like capital preservation, skepticism towards financial pundits, the value of long-term investments, and the inevitability of learning from mistakes. These insights underscore Buffett's enduring influence on investment philosophy and strategy.

Warren Buffett is the kind of person who, even if he were simply ordering a Coke at a McDonalds or an Oreo Cookie Blizzard at a Dairy Queen, would probably end up inadvertently dropping some pearls of wisdom.

After all, the billionaire CEO of Berkshire Hathaway isn’t known as the Oracle of Omaha for nothing.

So imagine what insights you could get when he consciously decides to share his learnings, philosophy, and outlook. No wonder, then, that investors and financial enthusiasts alike eagerly await Warren Buffett’s shareholder letters every year. And of course, the man’s sparkling wit and engaging writing style don’t hurt either.

The 2024 letter

Buffett’s latest letter, which came out just a few days ago, certainly doesn’t disappoint on the investing wisdom front. But this year’s letter was also special for another reason: it carried a poignant tribute to Charlie Munger, Buffett’s long-time business partner who passed away last year.

Munger, who first met Buffett in 1959, had a profound influence on his life. Munger gave Buffett advice on money management, and urged him to focus on adding excellent businesses to Berkshire Hathaway’s portfolio rather than seeking undervalued ones. Buffett makes it clear that despite having no financial stake in Berkshire initially, Munger's guidance was key to the company’s success.

Over time, Munger's role evolved into that of a partner who’d offer sage advice and steer Buffett towards sound decisions. Buffett acknowledges that Munger was the “architect” of Berkshire's triumphs, and that Munger’s humility and wisdom have left an indelible mark on Buffett personally and on Berkshire as a whole.

As an aside, one of our favourite Munger quotes goes:

Our job is to find a few intelligent things to do, not to keep up with every damn thing in the world.

We find this to be true for investing, and even truer for life as a whole.

Now, while the rest of Buffett’s letter mostly focuses on the performance of Berkshire Hathaway (as it should), there are still several bits of wisdom peppered throughout. We’ve distilled this wisdom into four key insights that we believe every investor should internalise.

1. To thrive, first survive

This is how we’re rendering the folksy Hindi saying that’ll help you stay grounded when the markets make your emotions run wild: sir salaamat toh pagdi pachaas (literally: as long as your head is intact, you can put on fifty turbans).

One of Buffett’s cardinal rules of investing is that you can never risk permanent loss of capital. In effect, you need to be equally good at offence and defence. Playing offence means building a strong portfolio; playing defence means protecting your portfolio against mistakes and downturns that can harm its growth irreparably.

How does Berkshire guard itself against nasty surprises?

By being over-prepared. The firm has a variety of income streams and offers no dividends, resulting in it sitting on a gargantuan pile of readily deployable cash. So when a crisis strikes, its operations can carry on relatively smoothly, and it can even pick up stocks of distressed but high-quality companies on the cheap!

The average investor has it much simpler: a reasonably diversified portfolio with holdings in reliable, well-managed companies should be enough to protect your capital.

2. Trust talking heads at your own peril

Buffett makes his disdain for financial pundits clear: after all, if someone truly knew which stock would go up tomorrow, letting other people know about it would, in his words, be like “finding gold and then handing a map to the neighbours showing its location”.

He also cautions that when the markets are highly active, “whatever foolishness can be marketed will be vigorously marketed — not by everyone but always by someone”.

So sure, go ahead and watch some finance news, but don’t take everything you hear too seriously. It’s on you, the investor, to recognise snake-oil salesmen for what they are. Caveat emptor.

3. In investing, less is often more

Over the last 20+ years, Berkshire hasn’t traded any shares of Coca Cola and American Express1, two of its key holdings. And it’s been handsomely rewarded for this restraint in the form of excellent earnings and steadily increasing dividends.

Buffett also recounts how his sister Bertie, who at one point owned some mutual fund units and used to actively trade stocks, sold everything except the mutual fund units and Berkshire stock in 1980, and then didn’t carry out any new trades for the next 43 years. Needless to say, this made her very wealthy.

The point here is that once you’ve homed in on a great stock or fund that you have confidence in, you need to back off and let it grow, rather than getting tempted to sell it every time it’s in the red.

As Buffett puts it:

When you find a truly wonderful business, stick with it. Patience pays, and one wonderful business can offset the many mediocre decisions that are inevitable.

This segues rather neatly into the next insight, which is that…

4. Mistakes are an inevitable part of growth

Buffett candidly admits that two of Berkshire’s holdings, BNSF (Burlington Northern Santa Fe Corporation) and BHE (Berkshire Hathaway Energy), fared worse in terms of their 2023 earnings than he’d expected. While he still believes that the sectors they operate in (railroads and energy respectively) will continue to see good growth, he acknowledges that they could face some choppiness in the years to come.

Does this admission mean Buffett’s lost his Midas touch, and that Berkshire investors should look to bail out?

Not in the least. Every investor, including the very best ones, will be dead wrong from time to time. This is perfectly normal. What really matters is how well you can learn from your mistakes.

So when your fund manager makes a misstep, don’t start shopping around for a new fund right away. Instead, wait to see whether they address the issue, and how they plan to avoid it going forwards.

Also, remember that a well-diversified portfolio is more tolerant of mistakes than investments in 2 or 3 individual stocks. So if you’re currently only investing in hot companies making the headlines, you’re likely taking an unacceptably big risk.

Value above all

One of the main reasons why Buffett has endeared himself to the investing public is that his value investing framework makes the whole enterprise of wealth-building so much more approachable for the average retail investor.

Simply put, value investing focuses on finding and investing in high-quality companies that are undervalued for some reason, whether due to investor irrationality, ongoing market mayhem, or even scanty media coverage. In effect, you snap up fundamentally sound companies at a great discount, and then wait for their stock prices to catch up with their “true” or “intrinsic” values.

If you find such an approach attractive, then you should consider DSP Value Fund, which diligently follows value investing principles while aiming to invest in high-quality Indian and international companies at reasonable prices. In addition, Berkshire Hathaway is one of this fund’s key holdings, which means that it lets you benefit directly from Warren Buffett’s investing principles.

We’ll be back in 2025 with an analysis of Buffett’s next letter as well. Until then, we hope you’ll enjoy the regular stream of incisive and insightful articles that go up on our blog.

1 Page 9 of Warren Buffett’s annual shareholder letter dated February 2024

|

DSP Value Fund |

|

|

DSP Value Fund - An open ended equity scheme following a value investment strategy |

|

|

Product Suitability |

|

|

This product is suitable for investors who are seeking*

* Investors should consult their financial advisers if in doubt about whether the Scheme is suitable for them. |

|

|

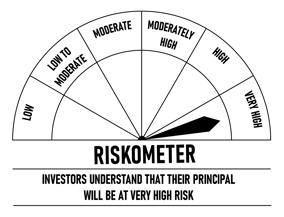

SCHEME RISKOMETER |

BENCHMARK RISKOMETER |

|

|

|

Industry insights you wouldn't want to miss out on.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

This material is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice.The investment approach / framework/ strategy mentioned herein are currently followed by the scheme and the same may change in future depending on market conditions and other factors. The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as on February 12, 2024 (unless otherwise specified and are subject to change without notice). Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in the above mentioned scheme

For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, and Key Information Memorandum of the scheme available on ISC of AMC and also available on[object Object]. All opinions/ figures/ charts/ graphs are as on date of publishing and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Write a comment