Summary

Reflect on 25 years of investment flexibility. See how adapting strategies over time can help achieve financial success. Learn from examples of how flexibility has benefited long-term investors. This blog provides in-depth analysis and practical advice. These funds are suitable for long-term investors looking to save on taxes. They offer a unique combination of tax savings and potential for high returns over time.

The graph of additional learning from reading investment books plateaus fast. After all, the first principles of investing are quite ubiquitous.

Discipline seems to be a pretty constant narrative, no matter where one looks for investment advice. But when we analyze the actual data from investors, we have to hold a mirror and be pained to admit that most people tend to be irrational. This is not a remark upon the intelligence of man, but simply a reflection of the fact that emotional decisions impact the best of us.

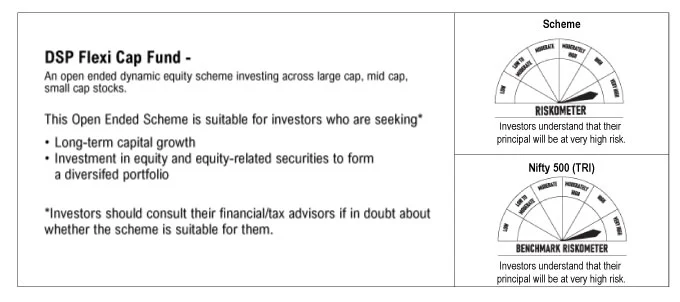

The spotlight today is onDSP Flexi Cap fund, a fund completing 25 years as I write this blog. But would it be a surprise if we told you that less than 40 investors have remained invested from Day 1 of the fund till date? Allowing themselves to grow their investment more than 75 times since their investment at inception?

Fact: Consistency and grit paid off- even if for a rare few. Here’s stepping into the shoes of an investor to understand what the journey would have been like.

Zoya started investing in 1997, just when the IT bubble was about to hit. No doubt, to her, the tech space looked attractive. In the early 2000s, consumption and export-focused sectors grabbed all the attention. By the 2010s, it was a mixed bag, but chemicals ultimately stole the limelight.

Part of investing is narrative (which is usually in hindsight), the more important part is fundamentals. The truth, nonetheless, is that for most of us, investing is never a full-time role. That calls for expertise. Do we withdraw from funds that are not owning high weights concurrent with the current narrative? Or do we invest in such funds knowing that trends eventually tend to revert to mean? I guess the second would be a more rational approach to investing. Trends change, but fundamentals remain. There are no new eras- excesses are never permanent. As Bob Farrell rightly puts it, “When all the experts and forecasts agree, something else is going to happen.”

Without a doubt, all fund managers aim to buy quality businesses. The million-dollar question is how does one define quality and what are we willing to pay for it? Like I said, investing knowledge plateaus fast. Therefore, one needs the expert eye which can measure quality somewhat precisely. For example, there is an auto leader which lost market share off-late and that has reflected in lower prices as well. Would you want to own it against the momentum? The answer likely should be yes, if the other fundamentals such as return on equity, cash flows, debt to equity are satisfactory. Cherry on the cake will be a history of sound management, and probably, its ability to tactically add new car models which in a few years will get their share back as well. Many such successful stock stories get lost in the everyday narrative, but they are the backdrop of alpha generation.

Again, while investing, some thought needs to be put into the market cap of stocks- in simpler words - size of companies. Investors need to balance across large, mid and small caps, and a simple diversified fund can come to the rescue.

Let’s go back to Zoya’s story. From 1997 to late 1999, it would have been a pretty ride for her, but when markets corrected by 50% in the run up to 2002, things went as ugly as a mad 50% correction at the extreme end. Does she sell? No. The ideal strategy would have been to invest even more at this time and do what’s called ‘averaging the cost’ of NAVs.

Looking back to a time 20 years ago, we can say, that the 50% fall didn’t really matter and was indeed followed by a stellar 150% positive returns in the next 2 years! Maybe that’s when Zoya renovated her living room from her fancy capital gains. Maybe she learnt a terrific lesson and went out to tell her friends that holding on to corrections may be the best thing.

Your personal experiences with money make up maybe 0.00000001% of what’s happened in the world, but maybe 80% of how you think the world works.

We need to make sure we learn the right lessons. Fear and greed are stronger than long term resolve and winning these two games matters more for the final investor than the tension of identifying and investing in the ‘right funds’. In a diversified fund that is picking the right fundamentals, staying invested is almost always the right advice. Especially if you don’t really need the cash right now.

In the past 25 years, for any 1-year time period, the DSP Flexi Cap Fund has given returns greater than 20%, almost 46% of times. It has also delivered negative returns in 25% of all 1 year periods*. What matters, however, is that periods of underperformance have been followed by alpha generation almost 100% of the time. Clearly, discipline and staying invested was the very simple key to success, for those who did remain.

Let’s look at SIPs, which most experts suggest are a great way to build discipline, if not to earn big returns. If Zoya started a monthly SIP in DSP Flexi Cap Fund of Rs 10,000 on Apr 29, 1997, then by April 30, 2022, Zoya’s total amount invested would have been Rs 30 lakh but her investment value would be close to Rs 4.8 crore- a fabulous 16X growth*.

This is the beauty of disciplined investing via SIPs and one must aim to ace this simple strategy- it really is so simple that anyone can do it.

However, one needs a fund that makes it worth your while to be disciplined in the first place; one that does let your journey be too patchy. To choose one such fund, there is a need to choose diversified sectors and diversified market caps, with a good bottom-up approach being followed in stock selection.

So now you know the ingredients that will let your ‘flex’ work well - A good dependable fund, long-term investment commitment (possibly via SIPs), and finally, your own ability to display rational behavior on most occasions.

Zoya reminds us of Morgan Housel’s beautiful words from his book, The Psychology of Money:

“Doing well with money has a little to do with how smart you are and a lot to do with how you behave. And behavior is hard to teach, even to really smart people. A genius who loses control of their emotions can be a financial disaster. The opposite is also true. Ordinary folks with no financial education can be wealthy if they have a handful of behavioral skills that have nothing to do with formal measures of intelligence".

As I close, let’s all say cheers and raise a toast to 25 years of DSP Flexi Cap Fund. A fund that has always focused on the simple rules of good investing- investing in good managements, in good sectors, and sticking to them till they execute. A fund that likes to invest even more in the same stocks when they correct. A fund that is flexible enough to invest in larger, medium sized or small companies, only focusing on how good they are to potentially grow market share, products and cash flows, year on year.

DSP Flexicap Fund - a fund that reminds us all: Old is Gold.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

*All the data for DSP Flexi Cap Fund is for the Regular, IDCW Plan as on Apr 30, 2022; Date of inception - April 29, 1997, Source: Internal. For product labelling/ disclaimers/ performance in SEBI prescribed format for DSP Flexi Cap Fund, click this link.

There is no guarantee of returns/ income generation in the Scheme. Further, there is no assurance of any capital protection/ capital guarantee to the investors in the Scheme.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

This note is for information purposes only. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/ stock(s)/ issuer(s) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments.

Mutual fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Comments

Total 22

Arif Ahmed

23-09-2024

Mind enlightening write up. Share your universal knowledge on the subject for learning financial management of common people.

Moyukh Roy Choudhury

23-09-2024

Excellent read on discipline approach of investing and patience for long term wealth creation .

Dr.Haresh V. Mavadia

23-09-2024

Excellent

Yogesh Laddha

23-09-2024

Thanks for Sharing this Article, It's the real situation of all investors......

Jitu Pran Das

23-09-2024

Guarantee 👍

Saroj Kumar behuria

24-09-2024

Nice topic

Bhanu

24-09-2024

Beautifully penned down. Touches the right chord with the investors

Vikram Shah

24-09-2024

Great Article!

Chandra Bhushan Singh

24-09-2024

Yes patient is the key for equity investment. I remember the opportunity which I missed in 2008 Lehman Brother Crisis, The nav of DSP Tax saver was Rs 5 but now it is 80 i.e. whatever invented that time would have been converted to 16 times today. That is righ moment this blog is talking about.

Pradeep

24-09-2024

This is very interesting & a very lucid way to carry the story forward without making it a text book reading. Thanks for presenting this story to us.

Saroj behuria

25-09-2024

It's very encouraging.

Deborshi Bhattacharjee

25-09-2024

Your writing is so powerful, you put into words exactly what I struggle to convey.

Karnalsingh Bajaj

25-09-2024

Very correct, very authentic, true to life. Money is not every thing. Values of life count too.

MUSADDIQUE HUSSAIN

25-09-2024

Thank you for making me aware of such an important issue. I appreciate your insights.

Partha Sarathi Chandra

25-09-2024

It’s really encouraging

RAFIQUDDIN AHMED

25-09-2024

Very informative

Reny Gomes

25-09-2024

I didn't know something like LRS even existed. Good one. Very different way of talking about a boring concept. Thanks for sharing.

Jitendra

24-09-2024

Excellent explanation. Agreed with your views and are absolutely right.

Pallav Tewari

24-09-2024

This is your first ever blog😊 , you have really displayed excellent creativity, and I am really pleased with how well you have started . Insightful & excellent analogy between cricket & investment. I 100%agree that investing is like playing a test match & not 20-20. Patience is the key in achieving success in both . I am sure you must have already received many positive comments in your first ever blog . Keep up the excellent work !! Looking for more such interesting blogs 👍

Rizwan

25-09-2024

Ehsan that's a great read buddy, I am doing one for my son tomorrow.

Madhulika Sanghvi

25-09-2024

This is indeed so very well written - Firstly the dare to dream big but through small disciplined actions over time. Most of us imagine that one stroke of luck , that one big jump or only being a business owner or having a very senior well paying role is what creates wealth for us. Secondly the analogy to religion & human behavior that is so easy to connect to with the flow of yout writing. An excellent reminder that daily doses of discipline , is important not just in wealth creation but also in work, health, relationships and life. Thanks for this piece Ehsanur!

Abhisek Mitra

25-09-2024

The parallels drawn here to illustrate the human psychology and behavior towards investing is very very apt... However the motivating factor of building a 100cr legacy for your child over a period of time with strict financial discipline is something put across the mind very thoughtfully... It's definitely a message that needs to be put across to all investors as a thought provoking one and finally help them in their pursuit of achieving this much cherished goal of "creating a 100cr legacy" by starting immediately with their SIP...

Write a comment