Summary

The blog emphasizes the strength of Multi-Asset Allocation (MAA) in investing, highlighting its effectiveness in reducing risk and enhancing returns through diversification across different asset classes with low correlations. It advocates for a strategic approach akin to building a balanced football team, where each asset class plays a distinct role in achieving overall portfolio stability and long-term growth.

It’s boring, but in the investing world, it’s the truth: "Don't put all your eggs in one basket".

This golden rule states the importance of diversifying your investments across various asset classes. Spreading your investments across different asset types helps reduce risk and potentially even enhance long-term returns. Because independently, any one single basket could fail, cracking all the eggs at one go!

In our previous blog, we wrote about why asset allocation is critical for any investor. In this blog, we will talk about the how.

The art behind multi-asset investing

A well-constructed investment portfolio should be like a puzzle with pieces that individually look good, but when combined, look even better!

Think of it as combining different skills to improve overall performance. This strategy is known as Multi-Asset Allocation (MAA).

Now, there are many ways to achieve what appears to be diversification. But are all ways effective? Let’s analyse this.

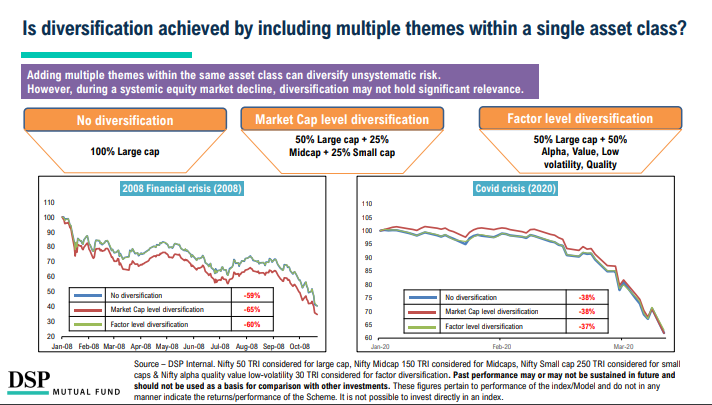

What if you simply diversified among different themes, but all within the equity asset class? Result: Negligible benefit. See the image below.

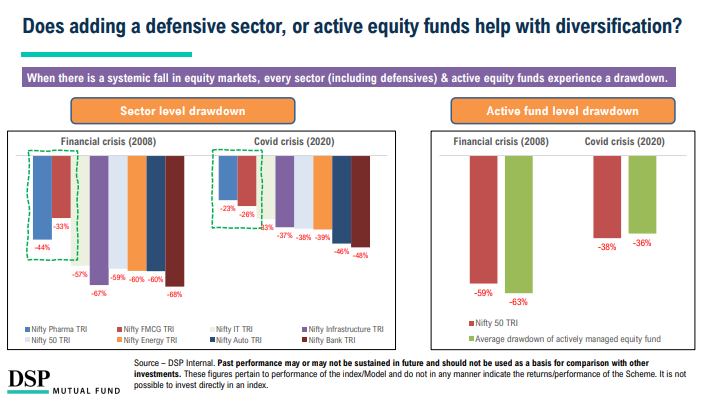

What if you added defensive sectors to your equity portfolio, or used different actively managed equity funds? Result: Again, negligible benefit. See the image below.

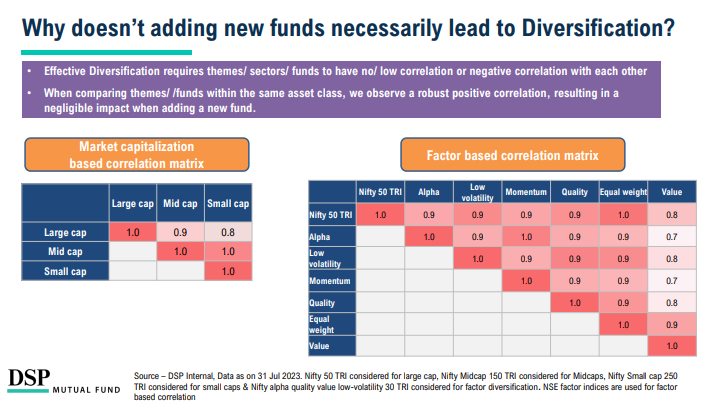

And why does adding different styles of equity investing, or adding different sized companies not make a significant difference? Simple: The correlation between different styles or different sized companies is high- so when one moves up, others do too- same for when they go down. See the image below.

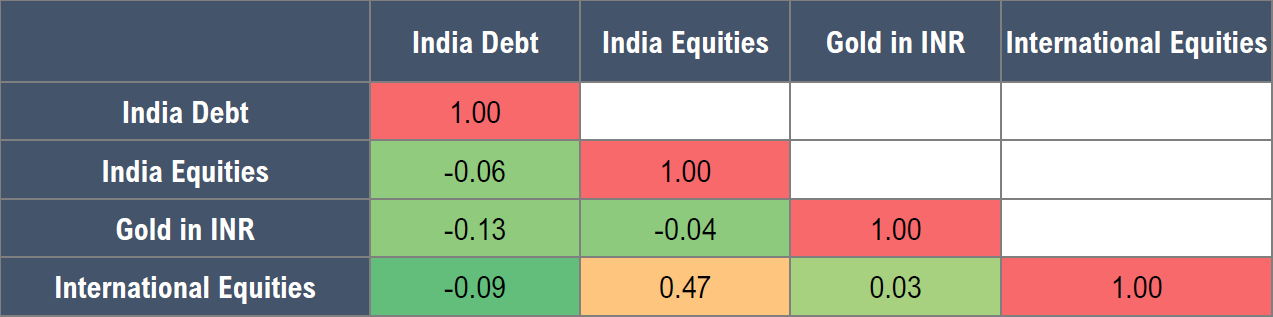

A multi-asset allocation strategy just hits differently. The entire game is that of low or negative correlations. See the image below.

Source - DSP Internal, Bloomberg. Data as on 31 Jul 2023.Nifty 50 TRI, CRISIL Ultra Short Duration Debt B-I Index, XAU/INR, MSCI ACWI TRI considered for Indian Equities, Indian Debt, Gold & International equities, respectively.

MAA's effectiveness lies in its ability to extract value from low correlations between different asset classes. When assets have low or negative correlations, they don't all move in the same direction simultaneously. For example:

- When stocks do well, gold may not (e.g., 2013 to 2016).

- When stocks underperform, bonds may excel (e.g., 2000 to 2003).

- In periods when gold thrives, stocks may struggle (e.g., 2008 to 2013).

It's challenging to predict which asset class will outperform in the short term. MAA helps you navigate this uncertainty by mixing it up, ensuring your portfolio isn't overly dependent on one asset class's performance.

But how do you decide how much to invest in which asset class? Start with simplicity.

The friendship strategy

Let's look at a "friendship" strategy that combines four asset classes equally: domestic equity, international equity, gold, and debt. Allocate 25% of your portfolio to each asset class from 2000 to July 2023, resulting in a 23-year investment history.

The results are remarkable:

Average annual returns of 11%, compared to 12.8% in the Nifty 50 index.

Significantly lower volatility, with a standard deviation of 8% versus 22% in the Nifty 50.

This approach may appear conservative compared to high-conviction investing, but it offers a choice between higher returns with more risk or slightly lower returns with much less volatility. It's about finding the right balance that aligns with your comfort level and long-term goals.

On the other hand, if you were able to asset allocate perfectly or even semi-perfectly each year, the results look astonishing- with a MAA strategy significantly outperforming Indian equities- generally considered to be the star player of your investment team.

Check this out to see the results!

Which asset class has given most returns over the last ~23 years to Indian investors?

— DSP Mutual Fund (@dspmf) September 4, 2023

𝗦𝗶𝗺𝗽𝗹𝗲: 𝗜𝗻𝗱𝗶𝗮𝗻 𝗘𝗾𝘂𝗶𝘁𝗶𝗲𝘀⚡

However, to earn those returns, you should have actually REMAINED INVESTED through all the ups & downs- including the Dot Com bubble bust in 2000,… pic.twitter.com/CJyDeKuxpr

How to make the right choice

It’s straightforward, really. If you can tolerate possibly many years of poor returns in the quest to earn the best returns over the long term, make the choice that most do. But then stick to it and don’t panic or exit when the market inevitable fluctuates.

On the other hand, if you value stability and recognize the most important contributor to your investing outcomes is longevity (time), you will want to stay invested for longer durations. And a MAA strategy will help you last longer in that journey.

A good way to add strength to your portfolio

Remember that the road to financial prosperity often meanders through a landscape of uncertainty. Yet, with the compass of diversification as your guide, you can navigate this terrain with confidence.

Whether you choose the path of chasing higher but fluctuating returns or prioritizing stability and longevity, the message is resoundingly clear: Diversify to Strengthen.

Embrace the wisdom of diversification, for it is in measured steps, not heroic leaps, that lasting financial success is composed.

Before I close, I’ll share an anecdote that impressed me. My colleague Devang recently shared his way of explaining multi-asset allocation effectively, using an analogy from the construction of football team. If you’re the manager, would you really be able to build a consistently winning team with only forwards or only defenders?

A MAA strategy is like a well thought out football team- with forwards (attackers), midfielders (the play-makers and connectors) and defenders (protectors). Think of domestic equities (Large, Mid, Small sized companies) as attackers. International equities (Developed or emerging markets) are like mid fielders. Perhaps Gold, Put options, Other commodities, REITs and Invits are like defenders and finally debt is like goal keepers.

Together, the game is much stronger than individually. That’s really all there is to investing.

Industry insights you wouldn't want to miss out on.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The sector(s)/stock(s)/issuer(s) mentioned in this presentation do not constitute any research report/recommendation of the same and the schemes of DSP mutual fund may or may not have any future position in these sector(s)/stock(s)/issuer(s). All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index.All data source is Internal unless specifically mentioned, and is up to Jul 31, 2023

Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment