Summary

The allure of small-cap stocks' potential is for significant returns often triggers FOMO among investors. However, the small-cap universe is vast, with most stocks not living upto expectations due to high volatility or underperfomance. To mitigate risks, focusing on high-quality small-caps-- those with strong fundamentals like return on equity and consistent earnings growth--is recommended. The Nifty Smallcap 250 Quality 50 TRI exemplifies this approach, consistently outperforming it's broader small-cap counterpart over various time frames wit reduced risk. For investors seeking clarity, expert guidance can navigate the comlexities of small-cap investing effectively

In the recent past, there’s a good chance you've come across reports of small-cap stocks and their impressive performance. And this might've led to FOMO (fear of missing out) and a renewed interest in small-cap investing on your part.

But here’s the thing. The small-cap universe has hundreds of stocks. And only a tiny fraction of them are likely to end up being multi-baggers. The rest could easily exhibit underperformance, relatively large levels of volatility, or both.

This means you have two options if you really want to enter the small-cap space:

-

Carry out detailed research into the fundamentals of small-caps (which is not something most of us can pull off), or

-

Focus on high-quality small-cap stocks that have been carefully selected based on key criteria, including strong return on equity, manageable leverage levels, and consistent earnings per share growth.

We’re guessing the second option looks far more attractive to you as well.

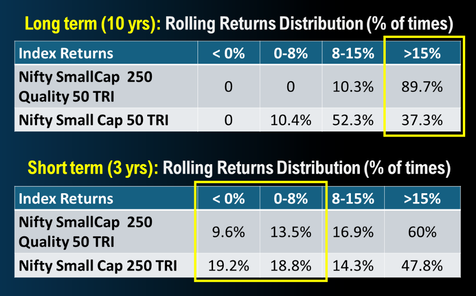

Let’s look at some numbers. When you compare the quality-oriented Nifty Smallcap 250 Quality 50 TRI with the Nifty Smallcap 250 TRI, you see that the former performed better regardless of the investment duration:

- Long-term: it delivered returns of >15% much more frequently

- Short-term: it delivered returns of <8% less frequently

Source: DSP Internal. Rolling returns, time period: Apr 1, 2005 to Jun 12, 2024.

The Nifty Smallcap 250 Quality 50 TRI also reduces the chances of capital loss, and recovers more quickly after major corrections.

So if you want a piece of the small-cap pie while keeping risk levels low, you should probably take ‘quality’ very seriously.

And if you find all this difficult to comprehend, you can always take guidance from our experts: simply click here.

Industry insights you wouldn't want to miss out on.

Disclaimer

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. This note is for information purposes only. In this material, DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. All opinions/ figures/ charts/ graphs are as of the date of publishing (or as at the mentioned date) and are subject to change without notice.

Large-caps are defined as top 100 stocks on market capitalization, mid-caps as 101-250, small-caps as 251 and above. Data provided is as of April 2024 (unless otherwise specified). It is not possible to invest directly in an index. For complete details on investment objective, investment strategy, asset allocation, scheme specific risk factors and more details, please read the Scheme Information Document, Statement of Additional Information and Key Information Memorandum of the scheme available on ISC of AMC also available on www.dspim.com. Investors are advised to consult their own legal, tax and financial advisors to determine possible tax, legal and other financial implications or consequence of subscribing to the units of the schemes of DSP Mutual Fund. The statements contained herein may include statements of future expectations and other forward looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Comments

Total 3

Aravindhan

29-07-2024

Agreed. Quality is the key to build wealth. Instead of trying to find the next best idea, we should try focusing on the long term wealth creators and try to average out the entry cost.

Ram

29-07-2024

+1

Naresh

29-07-2024

How is the Quality 250 different from the actively managed small cap fund ?

Write a comment