DSP ASSET MANAGERS PRIVATE LIMITED (DSPAM) RESPONSIBLE INVESTMENTS POLICY

Introduction

DSP Asset Managers Private Limited (DSPAM) is an Indian asset management company (AMC), with a wide range of offerings across the risk-reward spectrum. We are backed by the 150+ year old DSP Group.

Our vision: To be an organization with a purpose - helping investors gain confidence by incorporating material environmental, social and governance (ESG) issues in investment analysis and portfolio construction decisions.

Our core value #InvestForGood is a philosophy built on our belief in integrity. We want our investor community to ‘do good’ for the world, not just focus on building a better future for themselves. Our strong belief in ethics and integrity will power our sustainable and responsible investment practices and aim to make a real difference to both people, and the planet. Our focus is on integration of an ESG lens into our investment process and framework and hence our Responsible Investment policy is applicable to the entirety of our equity investments.

Our Commitments to Responsible Investment

Since 2021, we are a signatory to the United Nations Principles for Responsible Investments (UN PRI) and are committed to implementing the six Principles for Responsible Investment. We strongly believe that a focus on material sustainability factors could serve to minimize risks and improve financial returns in the medium to long run, thus creating value for our clients.

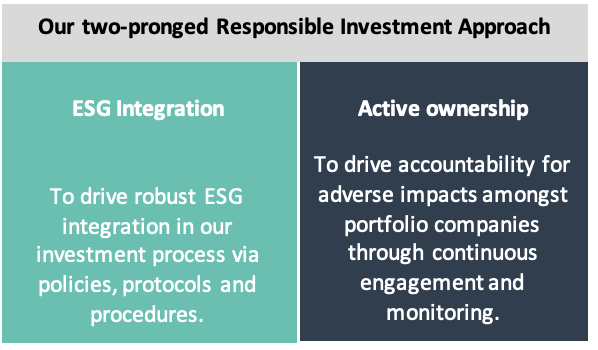

The following commitments guide and inform our responsible investment policy:

• To drive ESG integration in our investment decision-making process through robust policies, protocols, and procedures

• To drive accountability for adverse sustainable impacts amongst portfolio companies through active ownership

• To allocate resources for effective implementation of our Responsible Investment approach

• To enhance the firm’s ESG awareness, skills, and knowledge through capacity building and collaborations with key stakeholders in the industry

• To foster transparency on responsible investment through public disclosure of our policies and processes

• To promote wider implementation of responsible investment principles within the investment industry in India

• To continue to adapt and improve our responsible investment activities on an ongoing basis

Responsible Investment Approaches

We believe that ESG Integration is a part of our fiduciary duty towards our customers as it could help reduce risks and enable long-term value creation. We aim to ensure that robust ESG principles are integrated in our investment decisions and that our portfolio companies act in the interest of their stakeholders.

1. ESG Integration

At DSPAM, we have a diverse set of professionals in our equity investment team including fund managers, research analysts, a forensic analyst, ESG analysts, and investment strategists. We believe that it is critical to consider performance of companies on material ESG factors, during investment decision making. This will help identify risks and leverage investment opportunities. With the help of our dedicated Sustainable Investment team, we conduct detailed meetings with investee companies on material sustainability issues. The team leverages insights generated from our proprietary ESG assessment framework coupled with data from third-parties to incorporate material ESG factors into our investment process.

Our proprietary ESG framework is a risk-opportunity based framework, with 45 scored criteria, 60 analytical data points (qualitative and quantitative) covering these ESG criteria. The framework is used to measure ESG criteria in a systematic way - giving a common language for comparing the ESG profiles of companies and is designed specifically to help portfolio managers and analysts integrate ESG factors into their investment process. The sustainability criteria (indicators) used as part of the analysis involves collating and analysing data on stakeholder environmental/social concerns, board oversight of ESG matters (i.e., if there is a designated employee and/or member of the board of directors with responsibility for ESG matters) policies to monitor compliance with the UNGC principles, GHG emissions profile, long & short term climate targets, completeness and accuracy of investee companies’ disclosures relating to climate risk (decarbonisation strategies, techno-economical plans, and timelines), forest land, biodiversity, water & wastewater, energy, circular economy, innovation, human rights, decent work, diversity, human capital management, data privacy, product quality, safety, supplier engagement, selling practices and access & affordability etc. On governance we research on related party transactions, board & key management personnel (KMP) remuneration, board independence, promoters pledging, audit quality, controversies and credit rating parameters to name a few. Key inputs to the research include portfolio companies’ public disclosures, third-party rating reports and information received during periodic engagements.

However, ESG factors do not form the sole considerations for an investment decision. We understand that companies of different size, scale and industry are at different levels of maturity in their ESG journey. The implementation of the policy shall attempt to factor these.

2. Active Ownership

We conduct periodic engagements on ESG performance with investee companies. We also exercise our (proxy) voting rights based on our stewardship and proxy voting policies. We also help companies evolve on their ESG journey, providing them with guidance towards improving disclosures, their ratings, their perception in the investor community etc.

A. Engagement

We encourage our investee companies to adopt sustainable and responsible practices through our stewardship activities. We discuss ESG issues and monitor their performance through our engagements with the Management of portfolio companies on a periodic basis. We encourage our portfolio companies to make disclosures on ESG performance (through sustainability reports or integrated within annual reports).

We view stewardship as both a responsibility and a privilege. We have a robust Stewardship Policy that is aligned to the six Principles defined by SEBI and defines the roles and responsibilities of the Stewardship Committee. This policy covers essential components such as conflicts of interest, scope and engagement approach on ESG issues, prioritization methods, monitoring, insider information, transparency of activities, escalation and service provider criteria.

B. Proxy Voting

We have a (Proxy) Voting Policy in place that is designed to ensure that we vote in the best interest of our clients. These procedures are overseen by our Stewardship Committee comprising of the President, Chief Operating Officer, Head of Equities, Head of Passive Investments, Head of Legal and Compliance and Head - Risk and Quantitative Analysis. We work with third party (proxy) voting advisers for support with voting decisions. Information on voting exercised and abstained along with the rationale is made available on our website, on a quarterly basis. Review of the Proxy Voting policy is conducted periodically by the Stewardship Committee.

Integrating Climate Risks and Opportunities

At DSPAM, we recognize climate change as a systemic and material risk with far-reaching implications for the global economy, financial markets, and long-term investment performance. As a responsible investor, we are committed to integrating climate-related considerations into our investment decision-making processes. We actively monitor the transition risks posed by evolving regulatory frameworks, technological advancements, and shifting market preferences, as well as physical risks such as extreme weather events and resource scarcity. Our approach involves evaluating portfolio companies' exposure to climate-related risks and opportunities, their emissions intensity, and their climate resilience strategies, in alignment with global frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) and the goals of the Paris Agreement.

We believe that proactive engagement and stewardship are critical tools in addressing climate change. DSP Asset Managers engages with investee companies to encourage robust climate governance, transparent disclosures, and science-based emissions reduction targets. Through these actions, we aim to safeguard the long-term value of our clients’ investments while contributing meaningfully to global climate resilience.

In addition to managing climate-related risks, DSPAM actively seeks investment opportunities that contribute to climate change mitigation and/or adaptation. We recognize that the transition to a low-carbon economy presents significant prospects across sectors such as renewable energy, energy efficiency, sustainable agriculture, water management, and climate-resilient infrastructure. We seek to identify companies that offer scalable solutions to reduce greenhouse gas emissions or enhance resilience to the physical impacts of climate change. By allocating capital to these areas, we not only aim to generate sustainable long-term returns for our clients but also to support broader environmental and societal goals, including India’s commitments under the Paris Agreement and the United Nations Sustainable Development Goals (SDGs).

ESG Oversight and Governance

The ESG Oversight Committee at DSP Asset Managers plays a central role in guiding and monitoring the firm’s ESG strategy and practices. Comprising senior representatives from investment, risk, compliance, and client relationship teams, the committee is responsible for ensuring that ESG principles are effectively integrated across the investment process and aligned with global best practices. Its key functions include setting ESG-related policies and objectives, overseeing the implementation of responsible investment initiatives, evaluating ESG risks and opportunities within portfolios, and reviewing engagement and voting activities. The committee also ensures that DSP remains responsive to evolving regulatory requirements and stakeholder expectations, fostering a culture of accountability and continuous improvement in ESG integration. Through quarterly meetings and cross-functional collaboration, the ESG Oversight Committee upholds DSP’s commitment to responsible investing.

Our approach towards implementing the RI policy makes use of both, third party data service providers for ESG risk rating and an internal ESG evaluation based on engagement. DSP has sole discretion to determine ESG materiality and interpret performance in the context of this RI Policy for its investment decisions. DSP is not liable to any other party with differing ESG risk interpretation or evaluation metrics for similar investments.

Reporting and Disclosures

We will publicly disclose our ESG related activities, practices and policies through our PRI transparency report and other periodic public disclosures. We will also maintain transparency by keeping our clients informed on the initiatives taken by us on Responsible Investment.

Review & Updates

This policy shall be reviewed at least once in a year or if significant changes occur to ensure its continuing suitability, adequacy, and effectiveness. This policy document and its updates shall be recommended by our Investment team and approved by the ESG Oversight Committee.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.