DSP TATHYA - March 2024

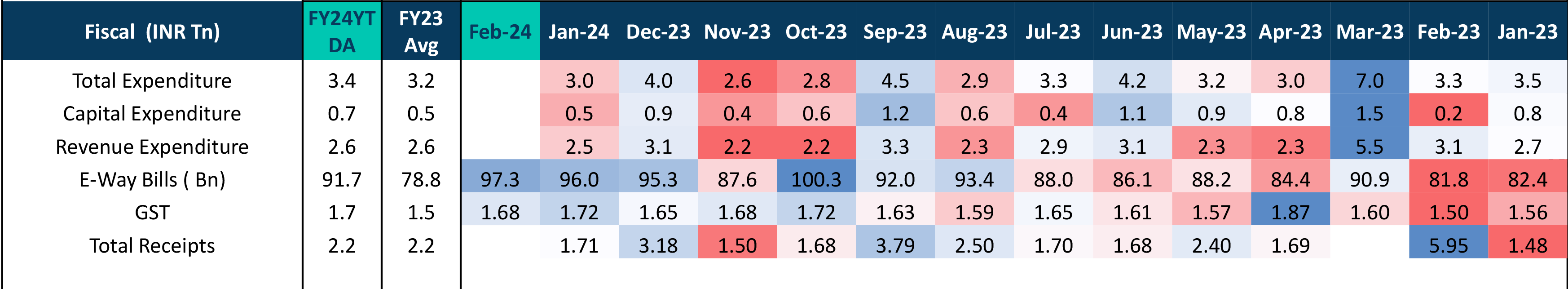

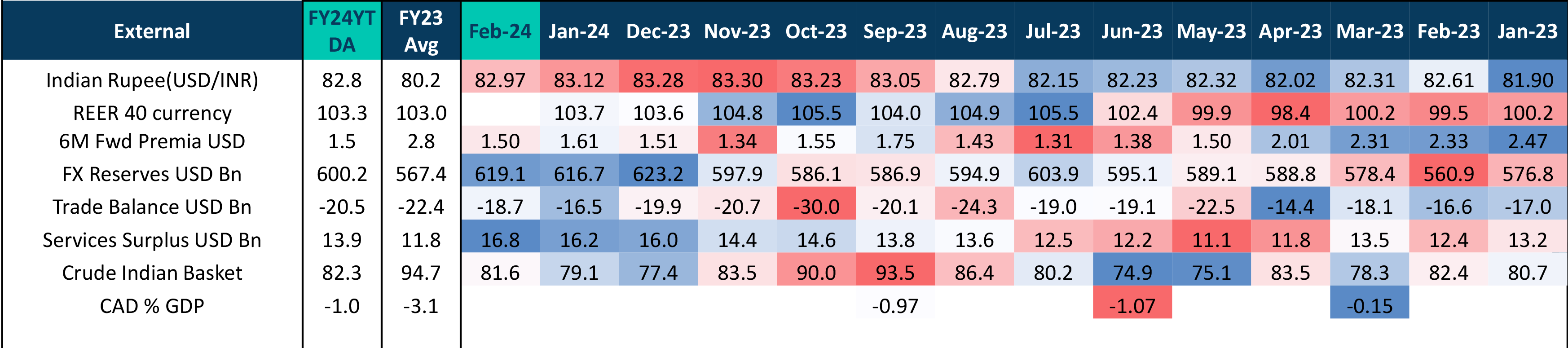

Personal loans have remained steady, and so have retail payments. Consumer sentiment has continued to register a fall for second consecutive month. The massive rise in non-oil imports is because of a very low base. The stable rise in two wheelers could be seen as a sign of much-awaited rural recovery.

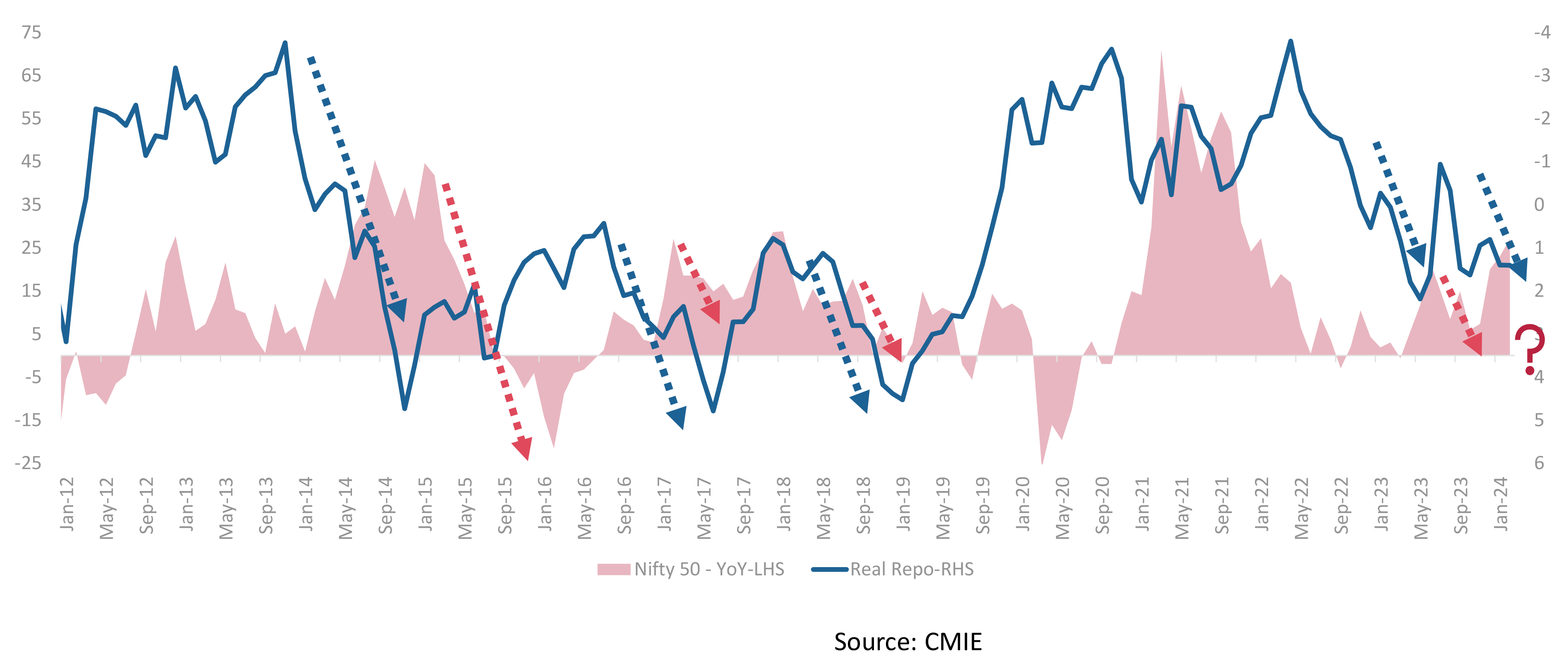

The disinflationary trend in core CPI has passed the downside surprise stage, and might begin to add some worry with how the growth of the economy has been sustained at the levels it has with the core number coming down consistently.

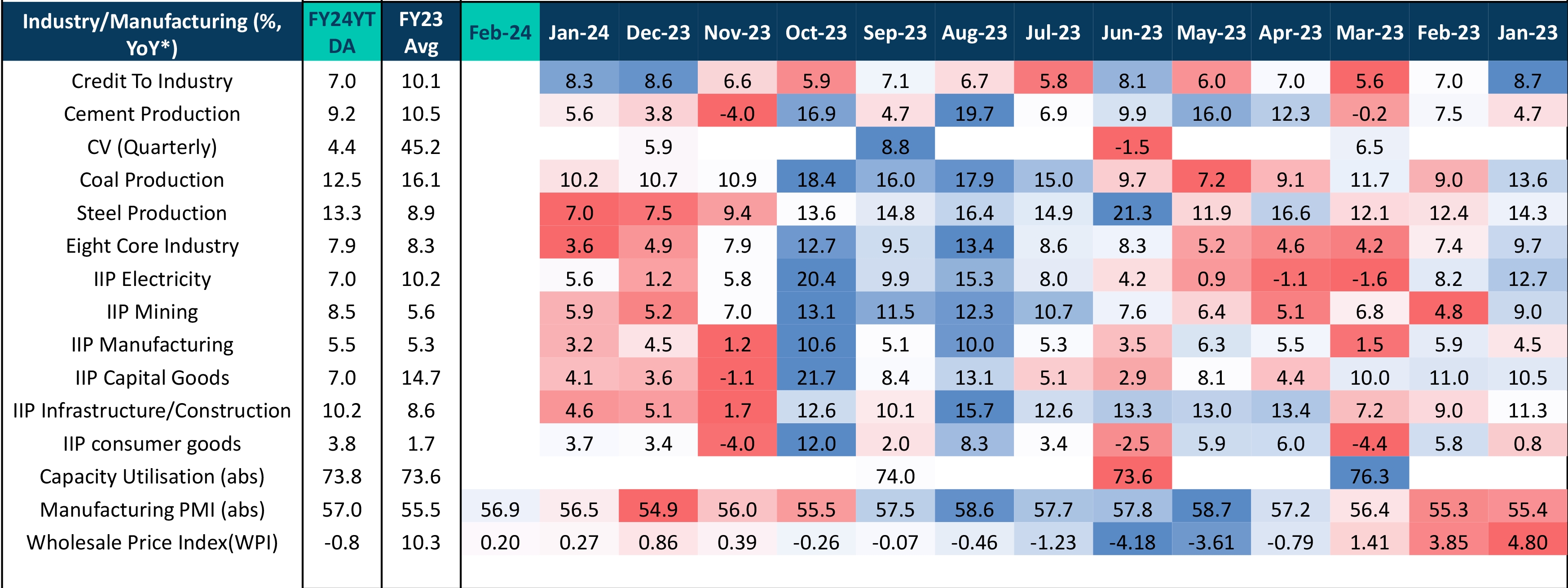

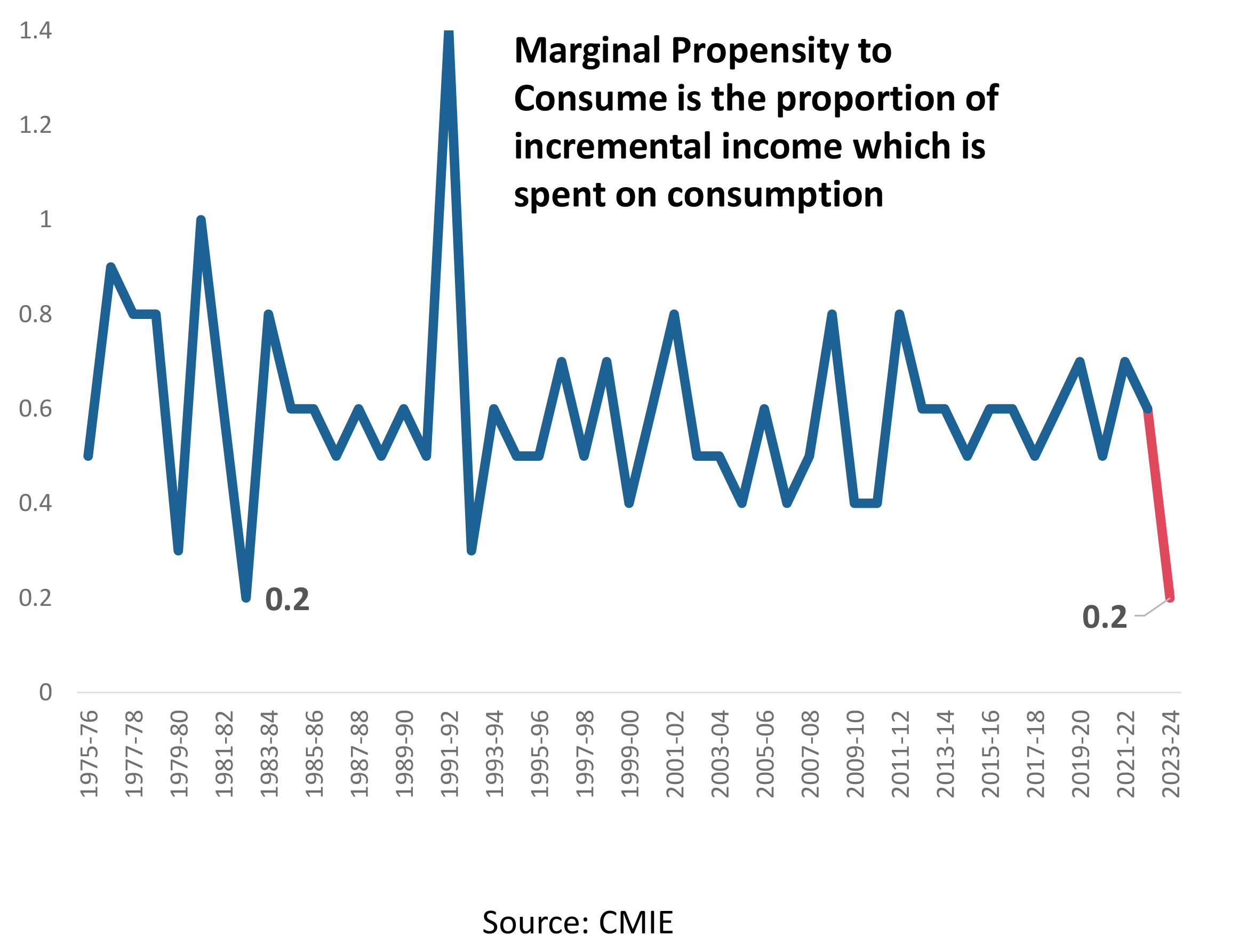

The 11% YoY growth in Manufacturing GVA is notable, but with a modest 5-year CAGR of 3%, suggesting stagnant supply-side dynamics likely to persist into Q4FY24. Initial Q4FY24 IIP numbers indicate a downward trend, possibly continuing throughout the quarter. Consumer durables show decent growth, but consumer non-durables remain subdued, possibly due to rising food prices impacting rural incomes. An average FY24TD WPI of -0.8% is unusual for India. Although there are signs of recovery, if deflation in the start of the FY continues to dominate the statistical average, it could lead to an annual negative WPI.

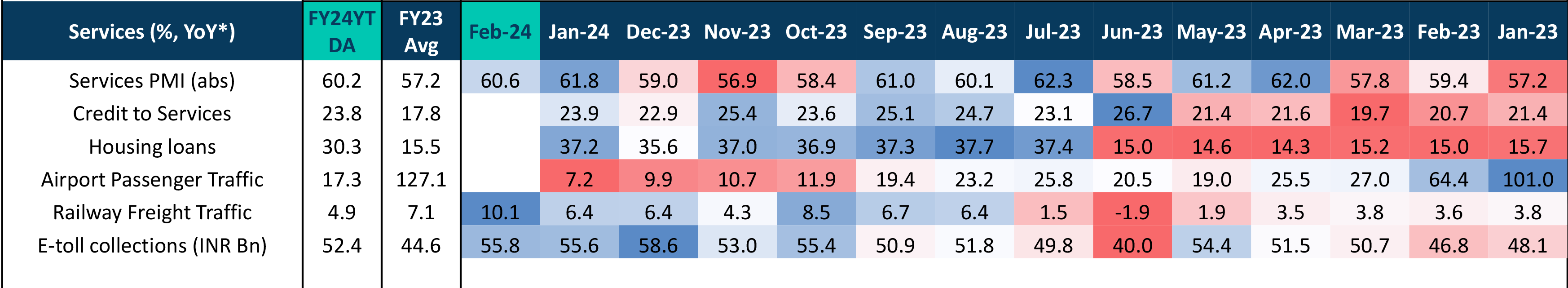

E-toll collections have surged with an impressive 63% CAGR over the past six years, largely fueled by the widespread adoption of Fastag. Now that the transition to Fastag is nearly complete, the growth rate has stabilized. Additionally, there has been a notable increase in railway freight traffic, indicating a positive uptick in economic activity.

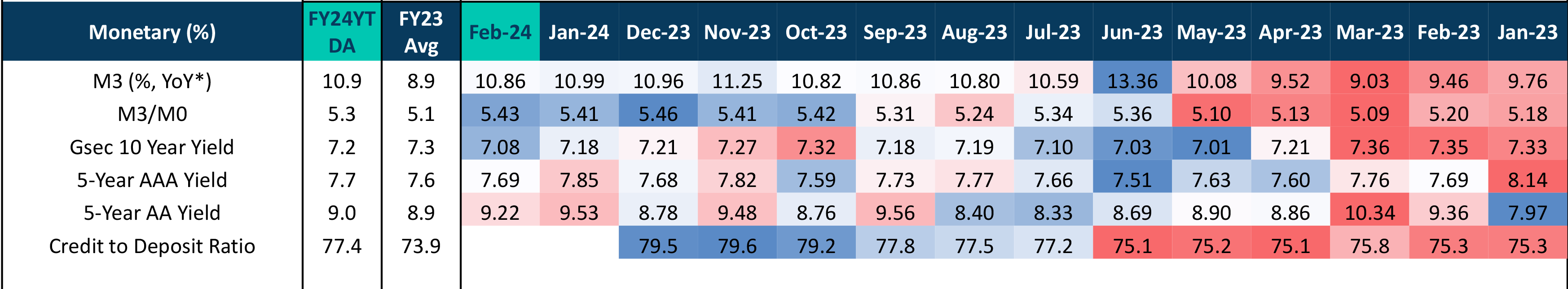

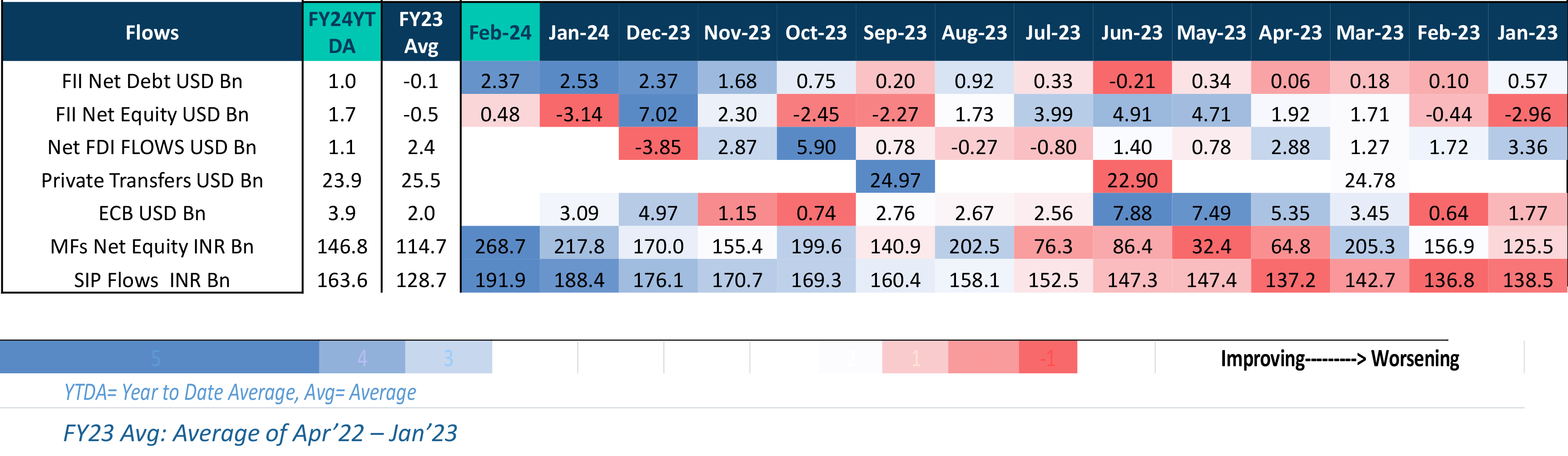

Debt investments from FIIs and ECBs have seen a notable uptick, attributed to India's inclusion in Bloomberg EM index after JP Morgan Bond Index. There has been greater traction towards managed money, thus, a significant rise in MFs and SIP books.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.