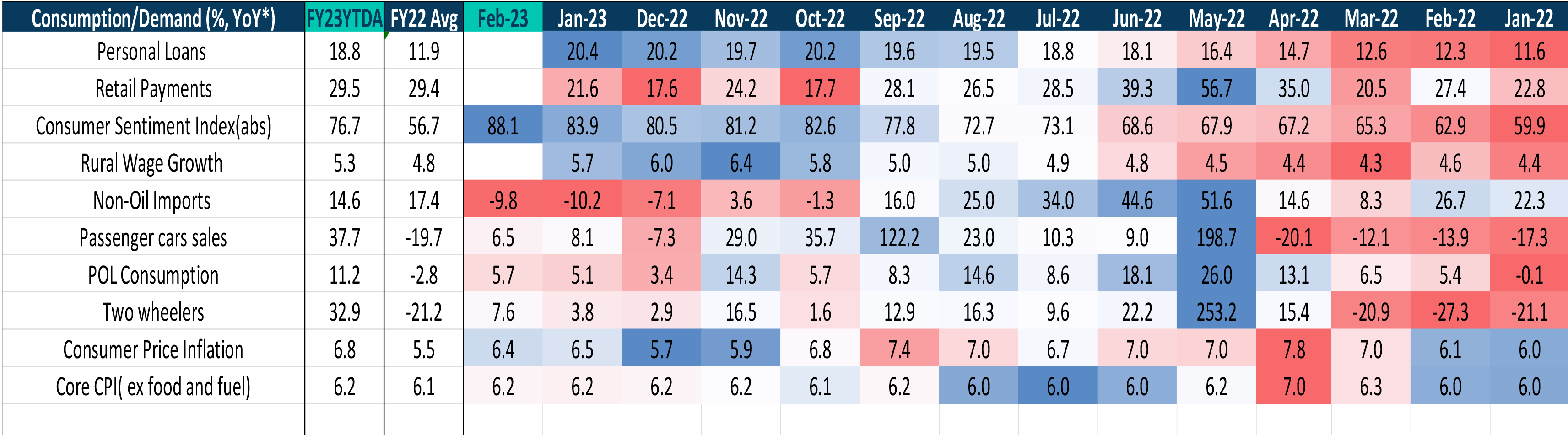

The demand indicators are resilient. While the narrative of slowdown continues to pick pace, hard data does not show visible signs yet

Inflation eased marginally in February but remains sticky owing to cereal prices and services inflation. Inflation is overshooting RBI’s expectations for Q4FY23 but should the MPC wait for trickle down to happen?

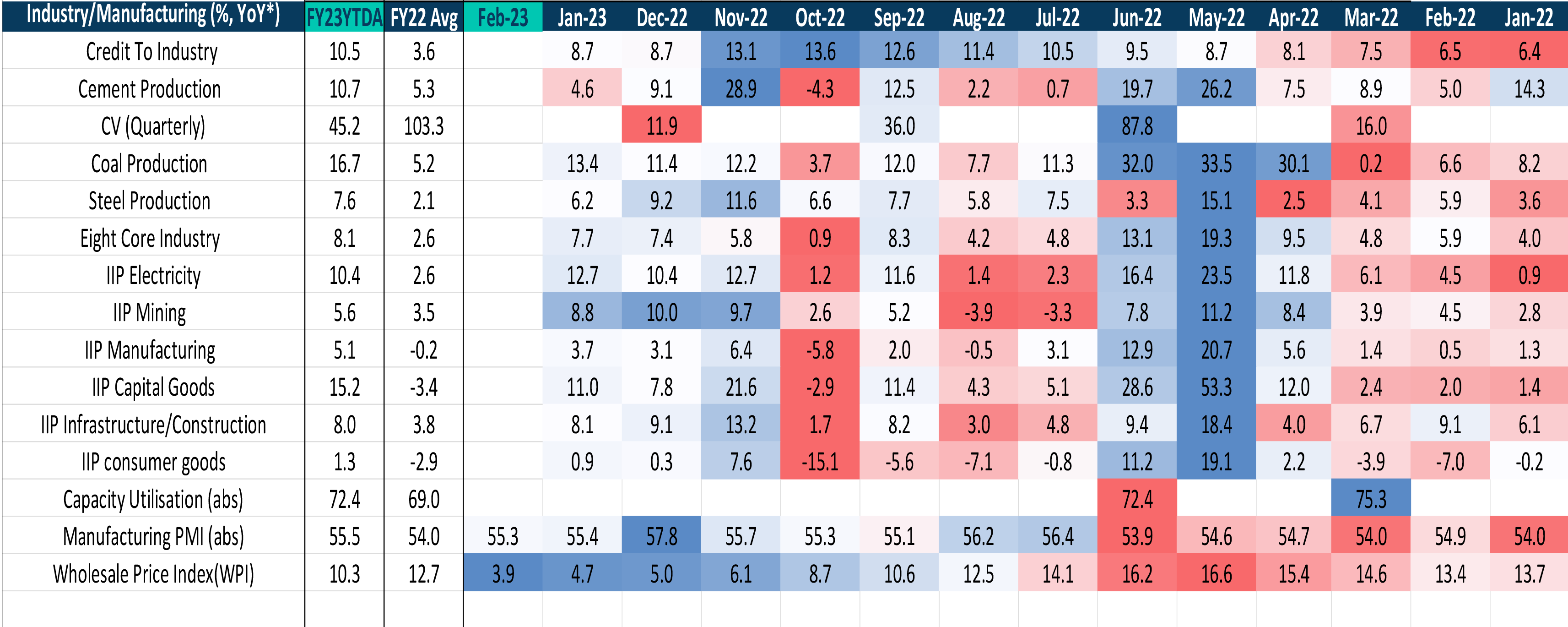

Manufacturing PMI remains in expansionary zone. Wholesale Prices have considerably eased across all groups

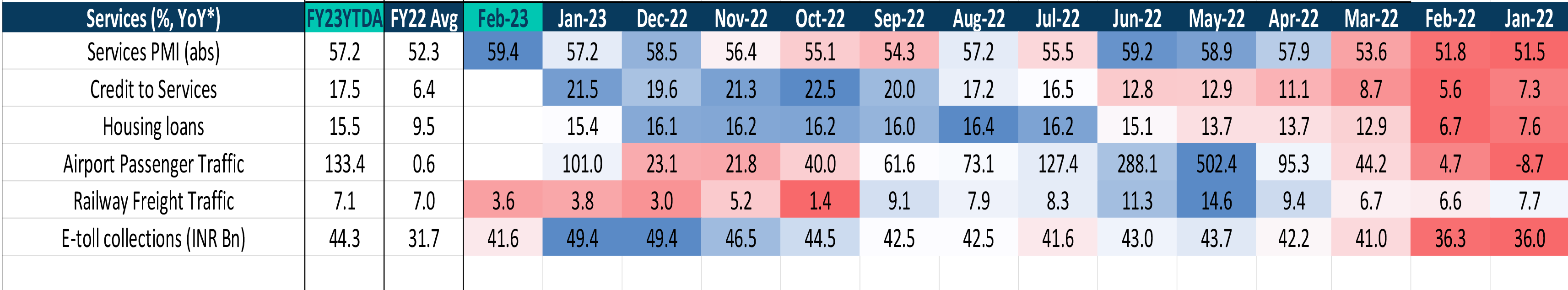

Services PMI shows record strength. All other services indicators remain strong. There’s, however, some slowdown in e-toll collections. Air/Rail passenger traffic remains strong

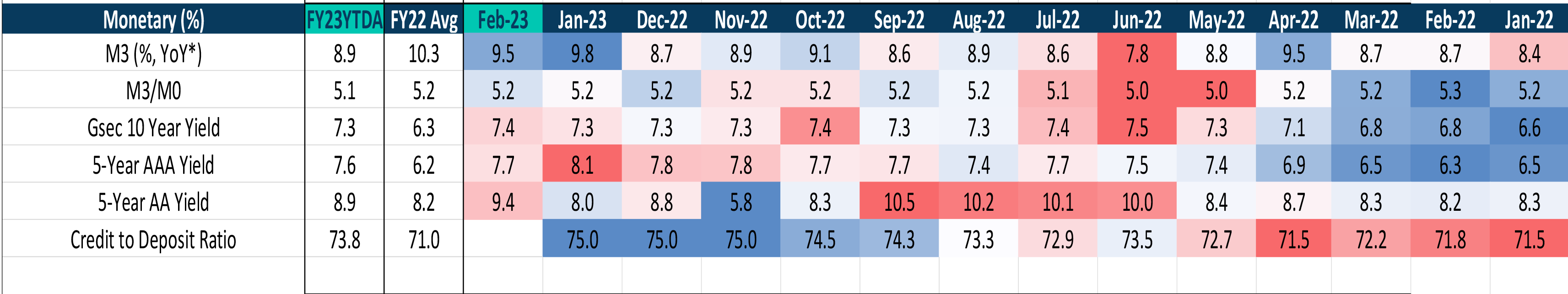

G-Sec 10-year yields continue to be sticky. Fed’s policy this week will act as an indicator for RBI’s policy later this month. We prescribe RBI should take a pause hereon to protect growth

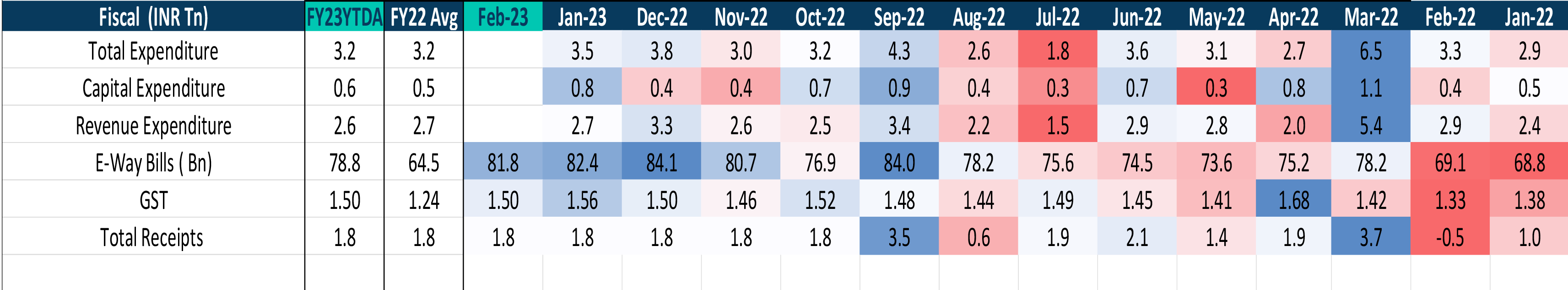

FY23 fiscal numbers are progressing in line with expectations. Any surprises are unlikely. Slight moderation in GST is in line with seasonality trends

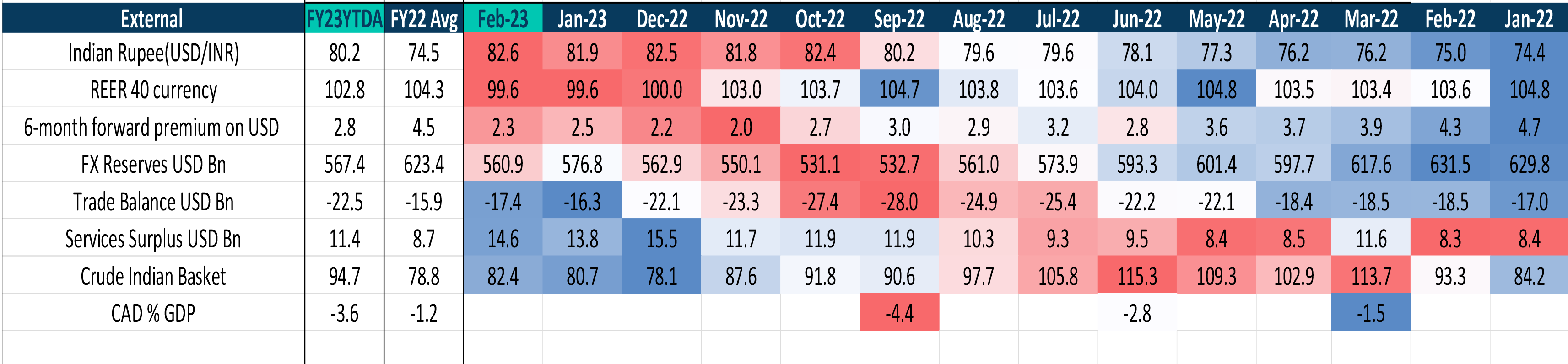

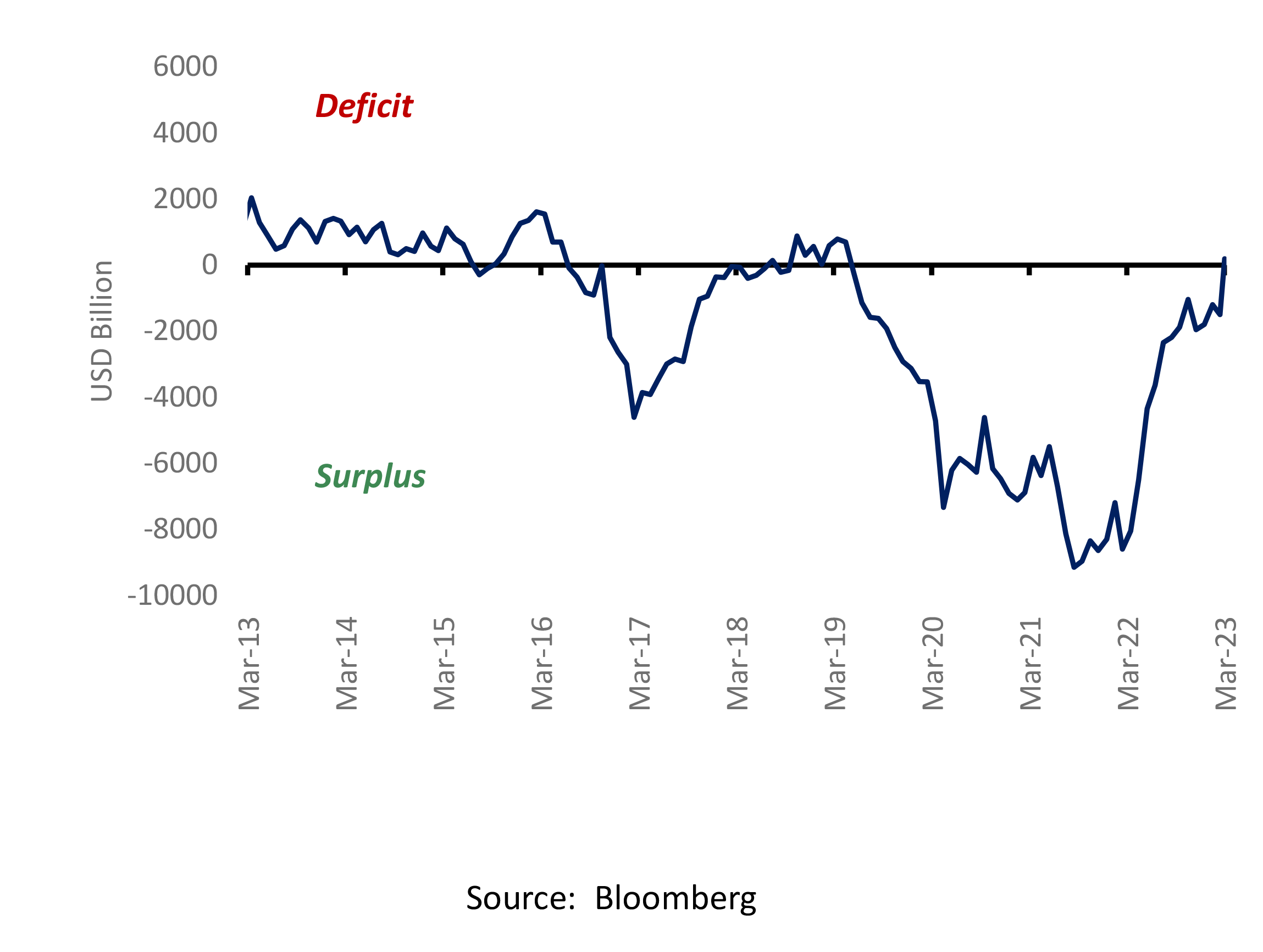

External headwinds have mildly eased as crude prices fell. Trade deficit is now close to previous years’ averages. The currency is yet to reflect improvement in external situation

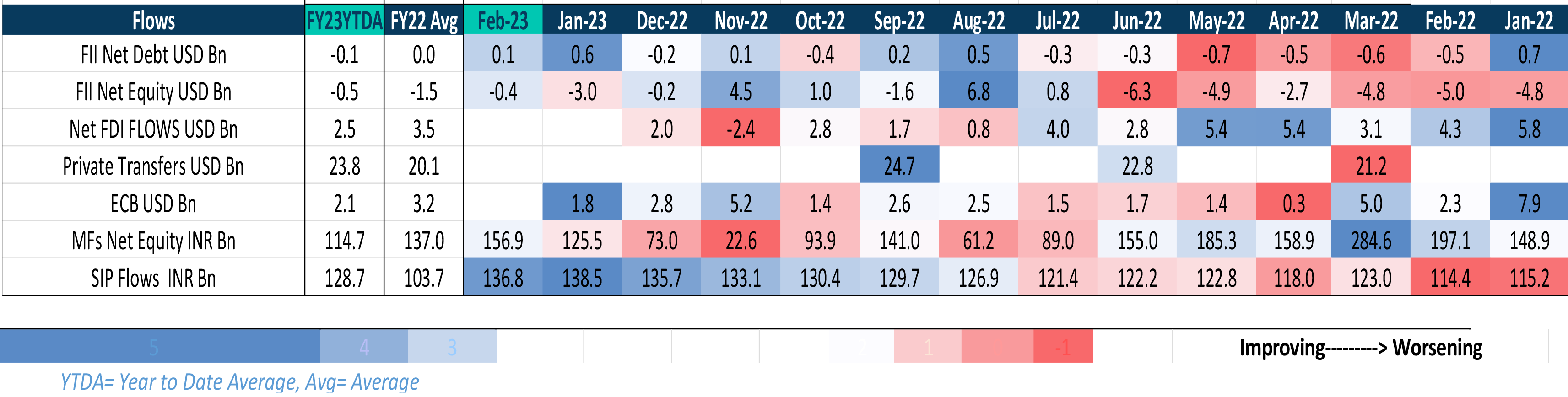

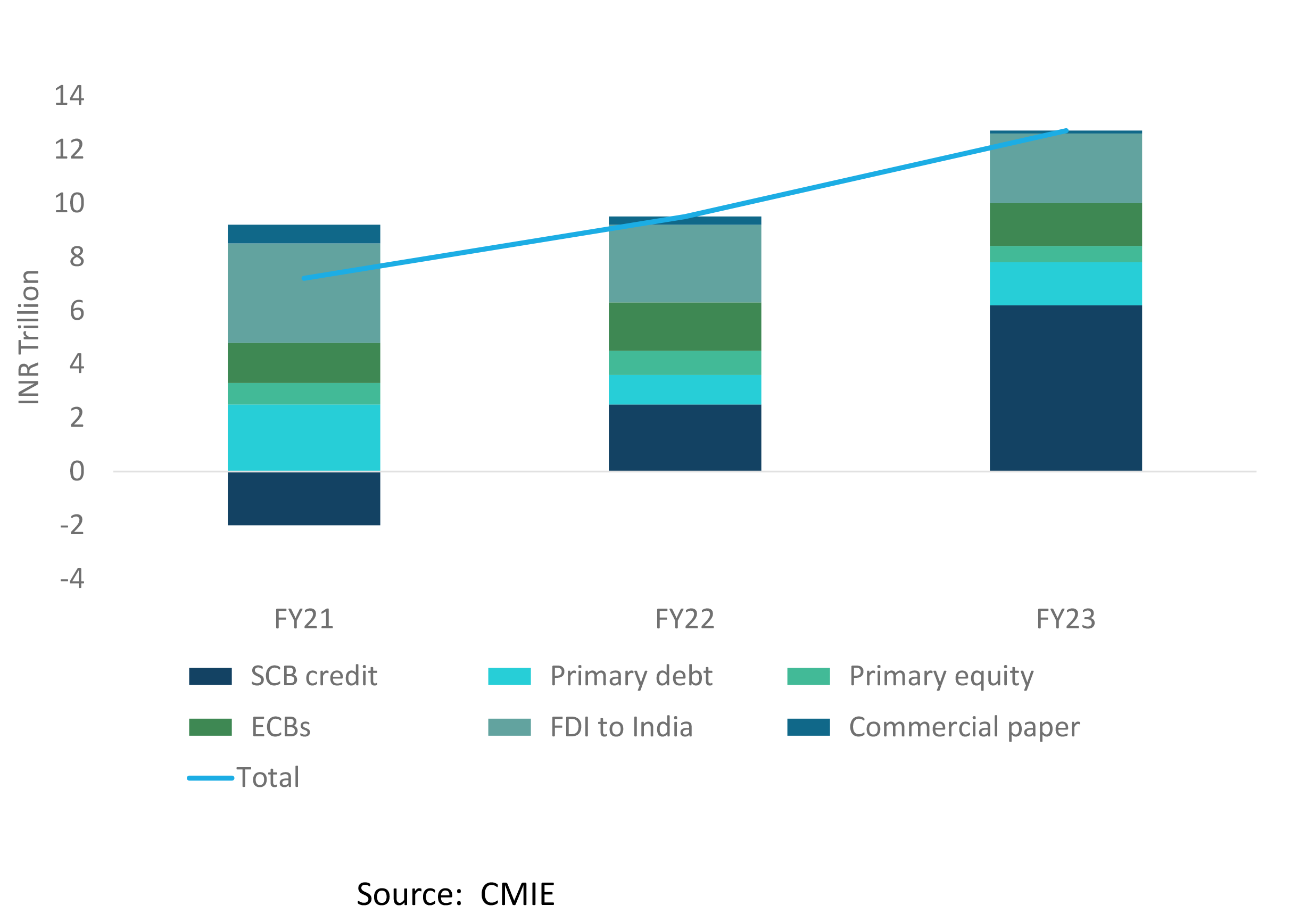

India saw FII outflows in Equity but some minor inflows in debt. External Commercial Borrowings have fallen but bank credit remains strong, driving the overall credit.

Exhibit 1: The share of bank credit has picked up in FY23

Exhibit 2: Owing to advance tax payments, liquidity has tightened despite the INR 1 trillion VRR from RBI- more is needed!

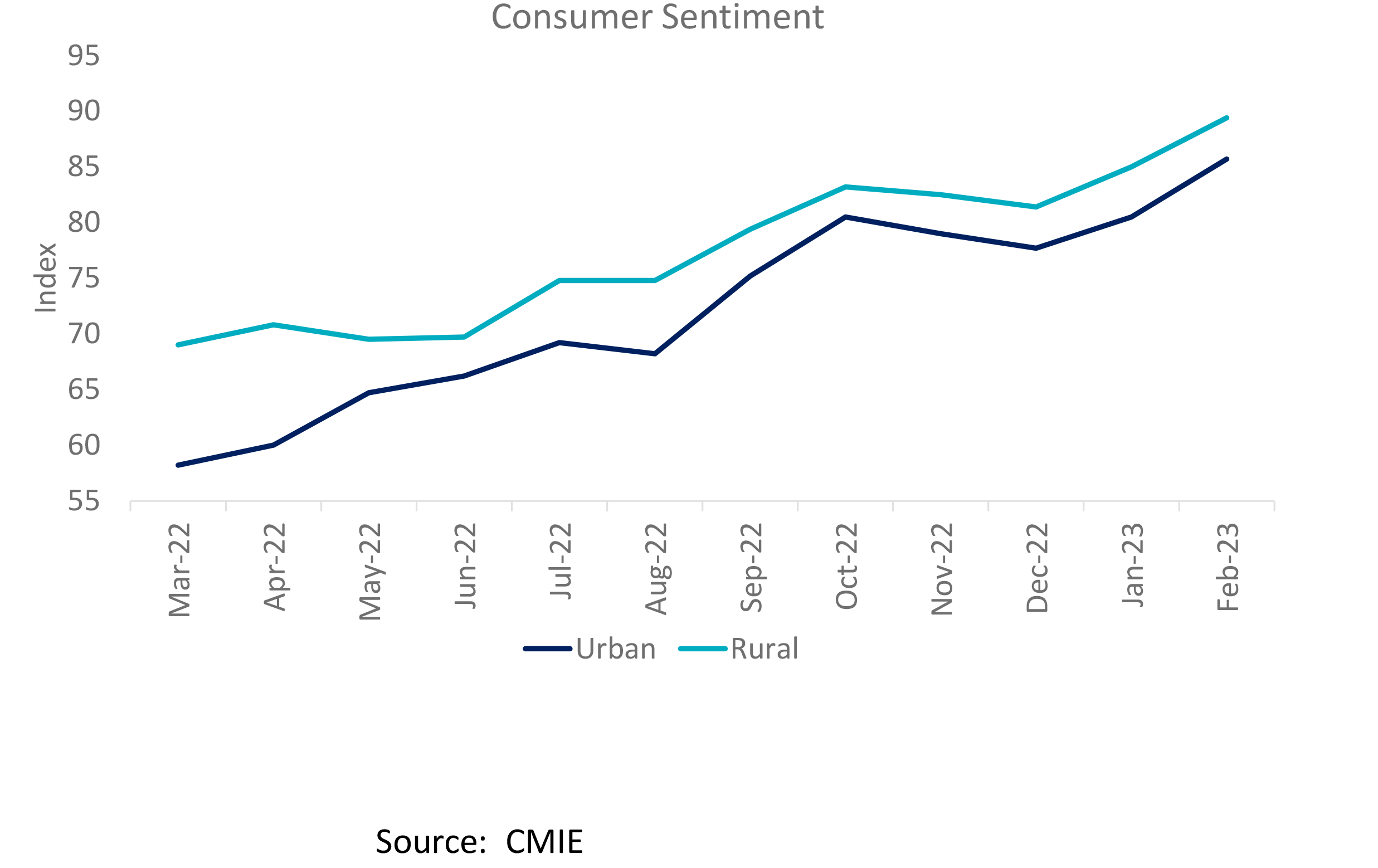

Exhibit 3: Consumer sentiments in India improved in the past two months, coupled with better sentiments from purchasing managers and fall in unemployment rate

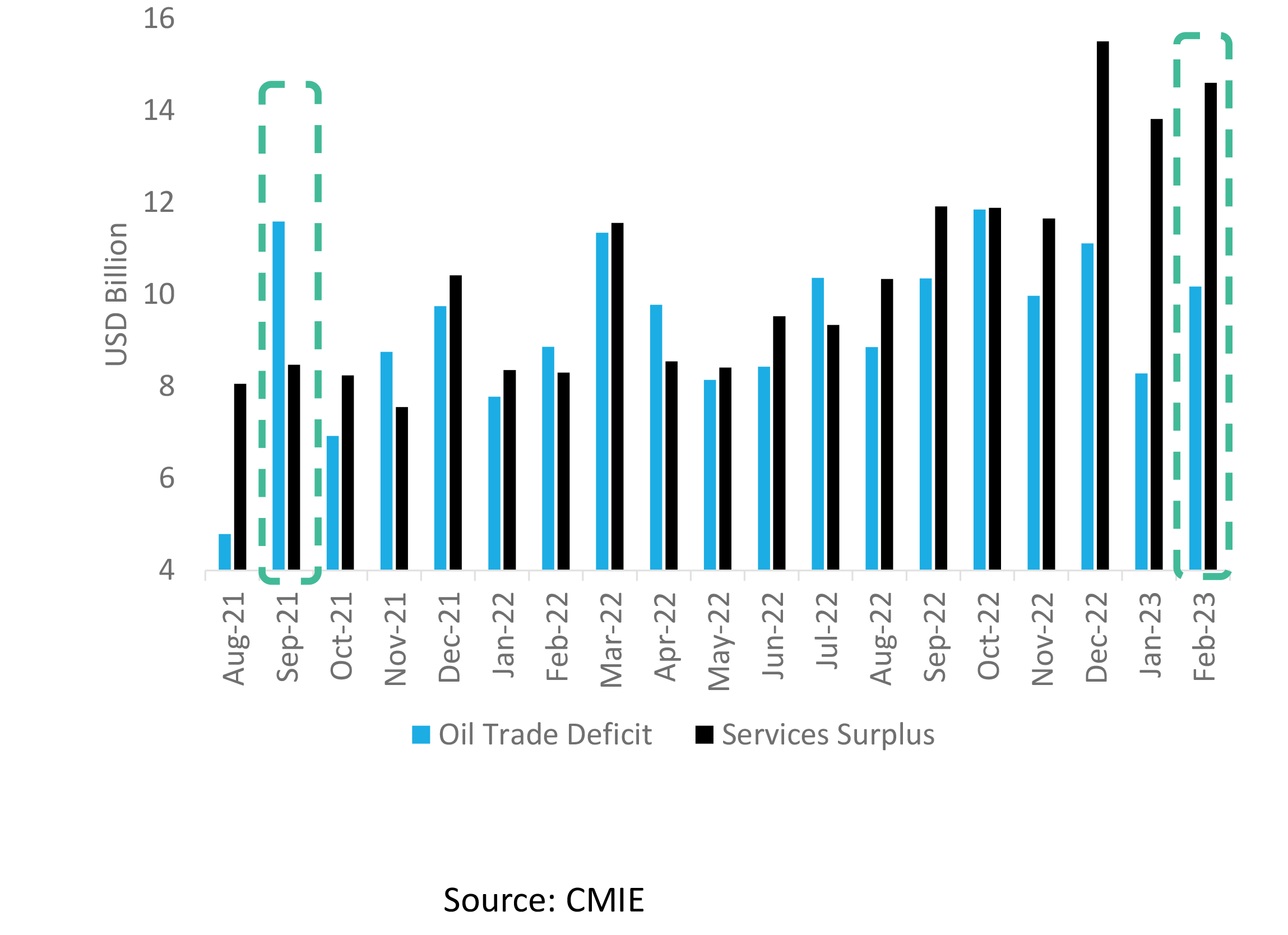

Exhibit 4: Services surplus is now handsomely exceeding oil deficit, making a favorable case for India’s external position

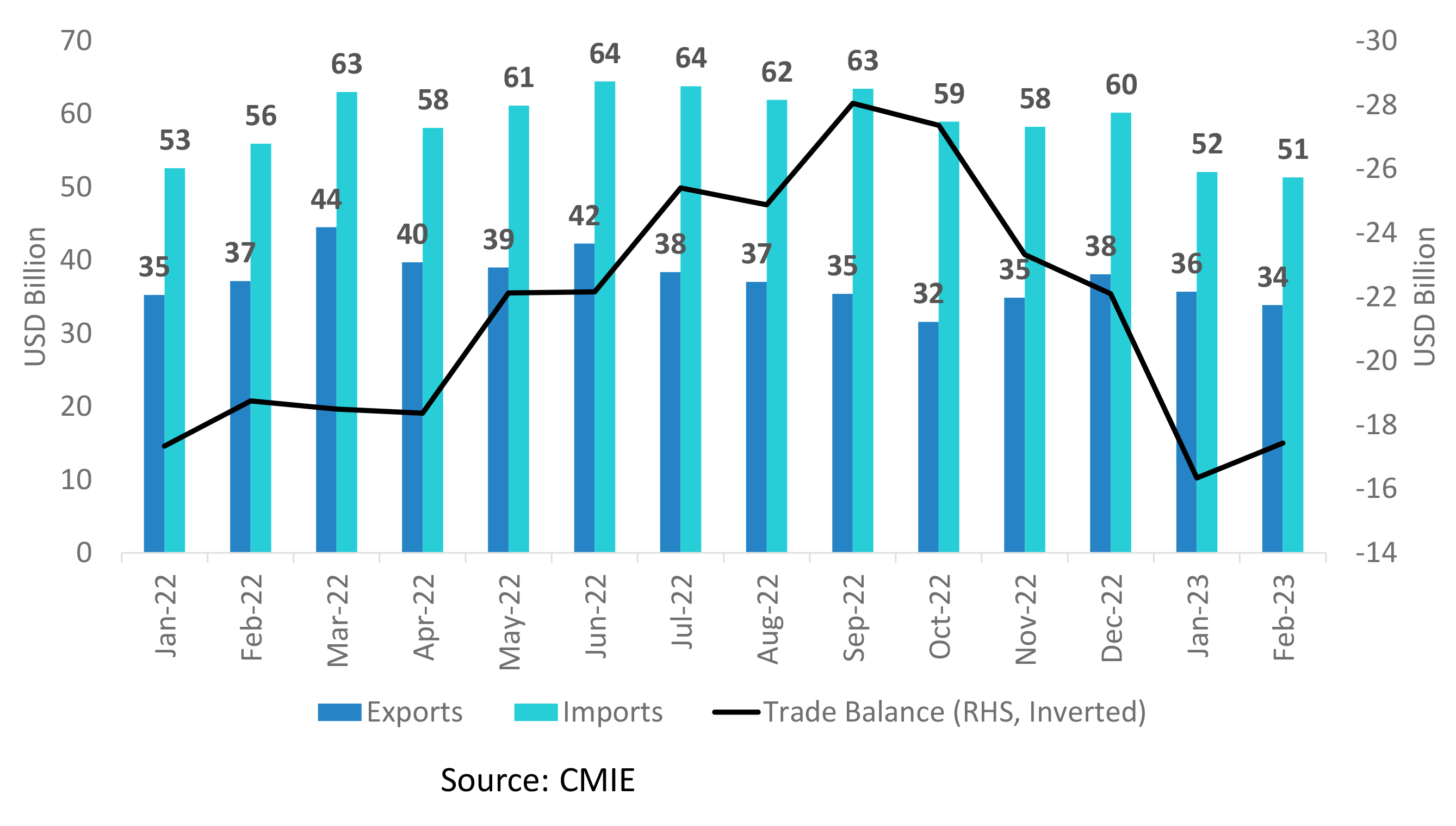

Exhibit 5: India’s trade deficit has eased substantially as imports fell while exports remained reasonably resilient

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.