DSP TATHYA - June 2023

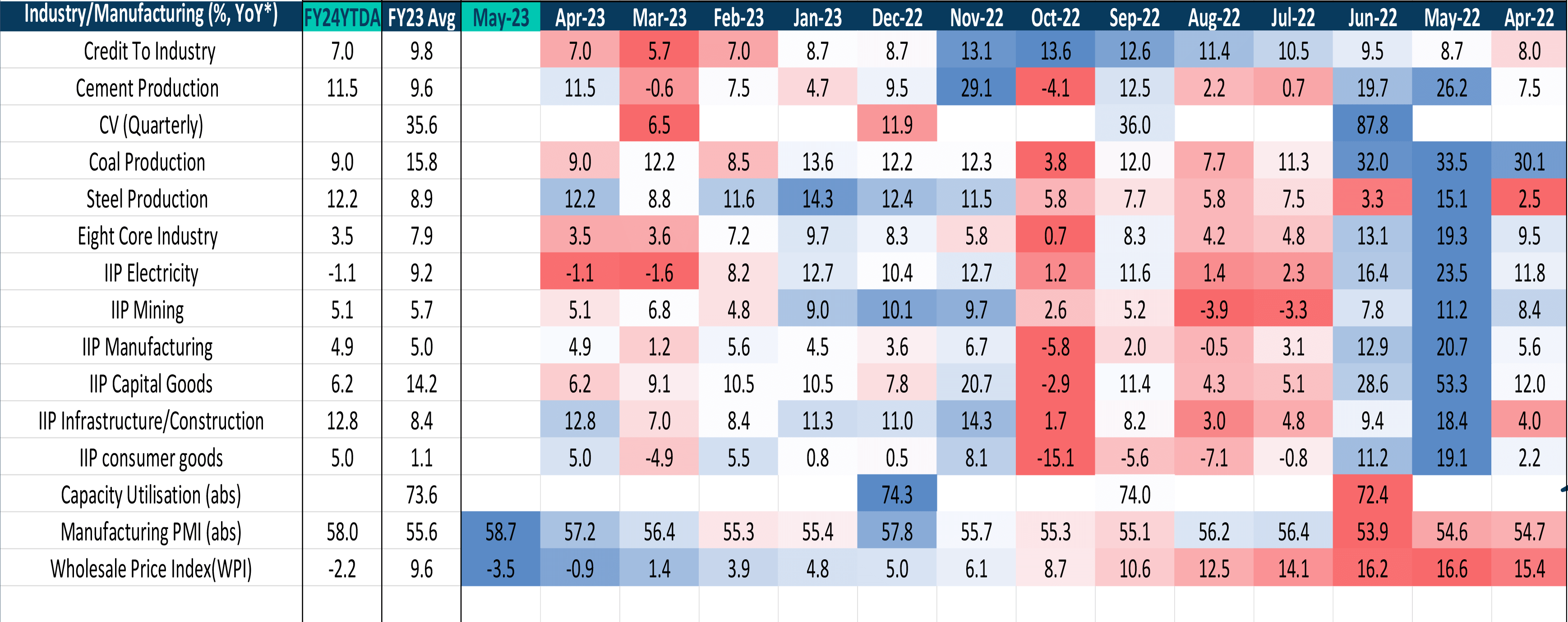

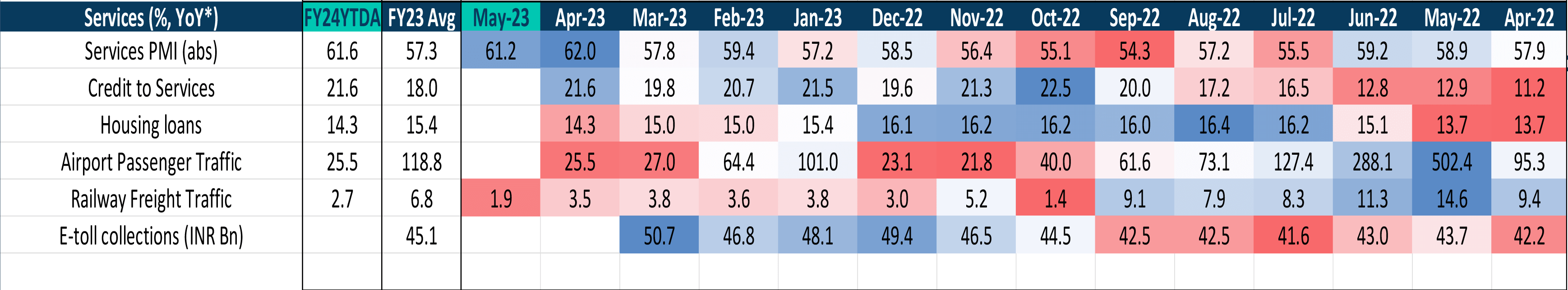

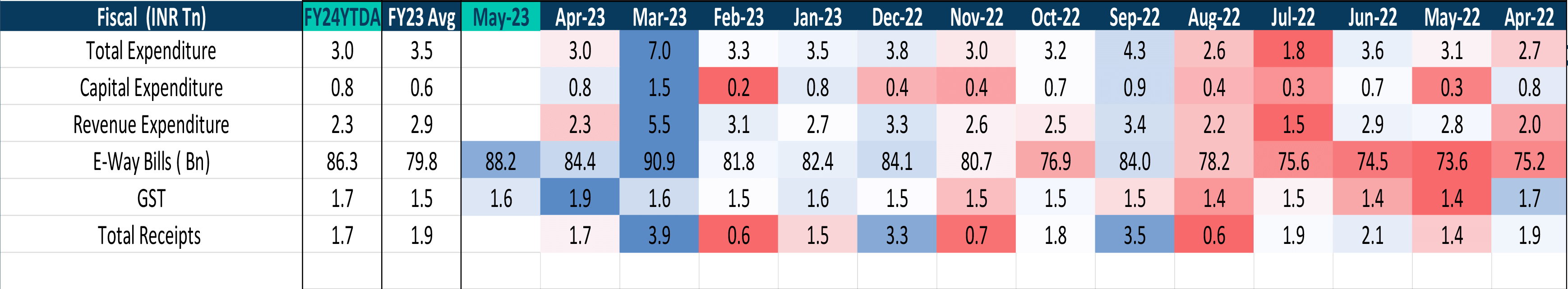

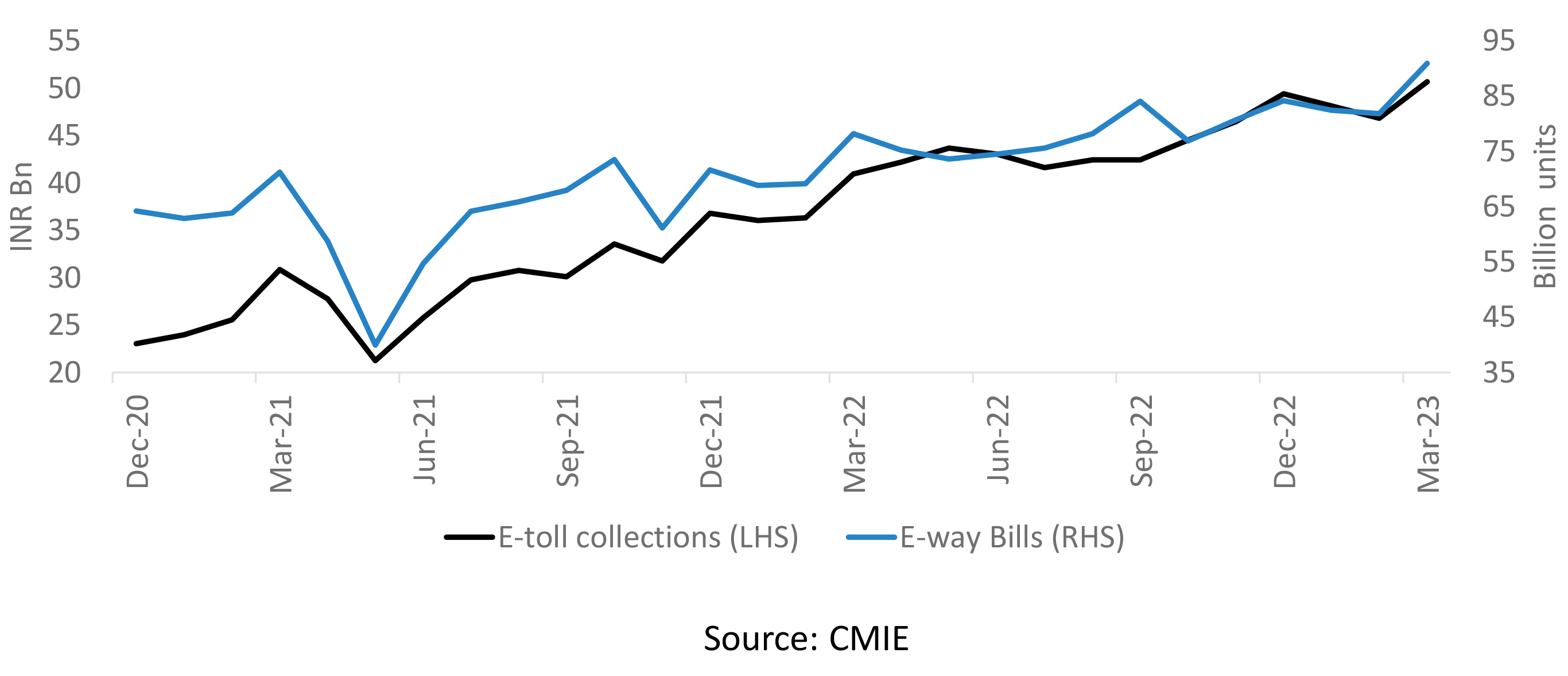

Consumer sentiment is clocking record high, showing faith in the Indian economy. It is hard to find signals of marked slowdown in India’s high and low frequency indicators. The moderation in passenger vehicles is partly owed to high base

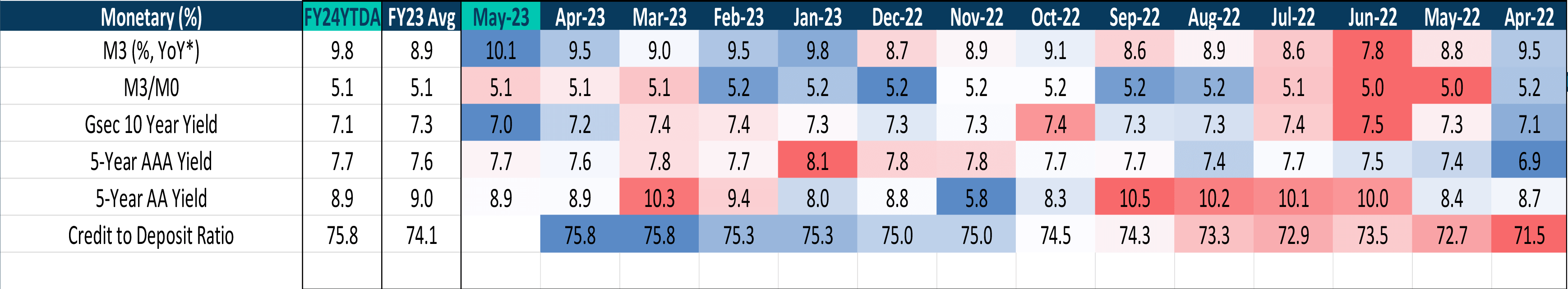

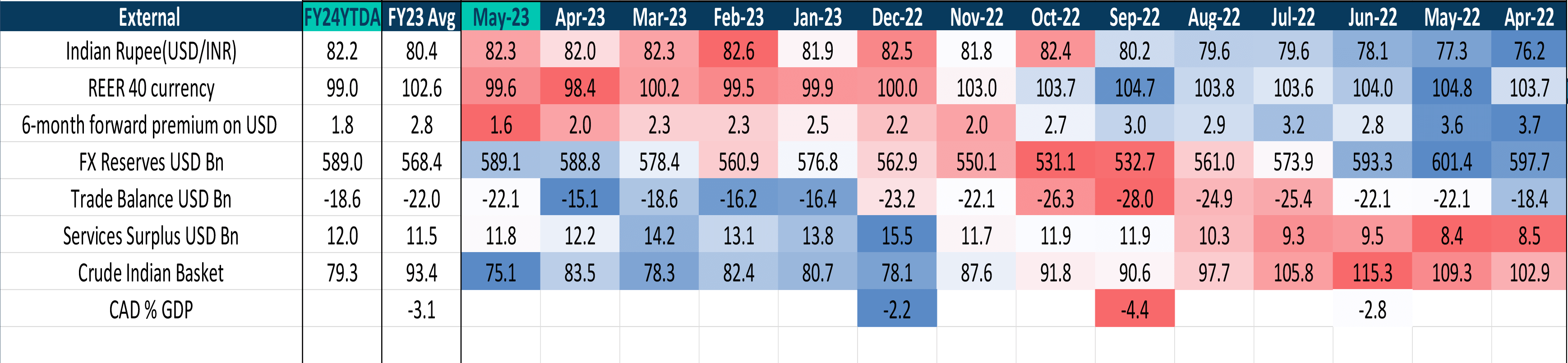

Inflation eased to 4.3% in May-23 as food inflation eased. Core inflation is off-highs now but services inflation can ease further. There’s a case for inflation to surprise on downside

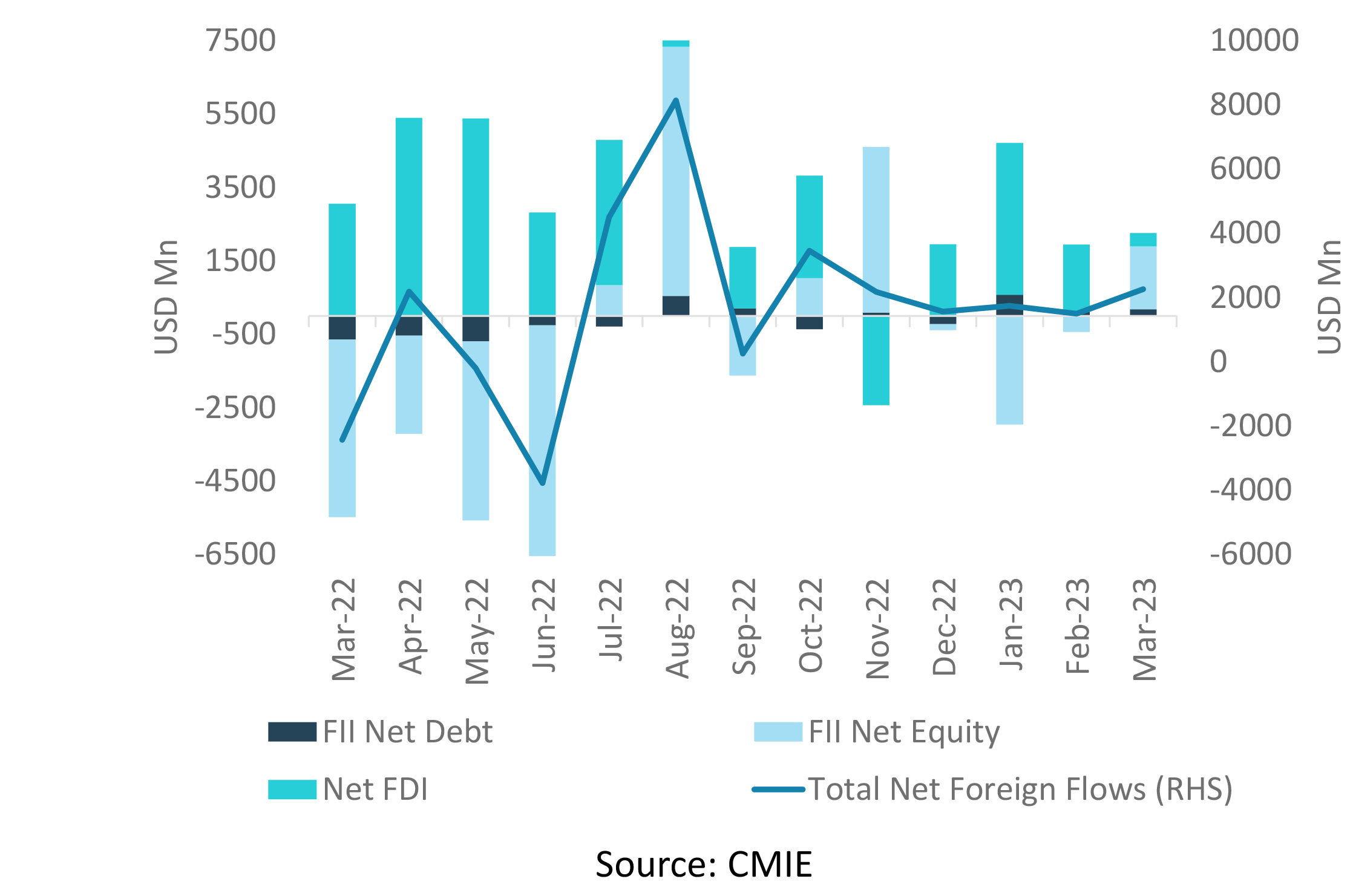

India saw FII inflows in both equity and debt. We re-iterate that given India is appearing a steady ship in choppy waters, it is likely to get its fair share of FII flows, MF equity flows slowed though the SIP book remained robust

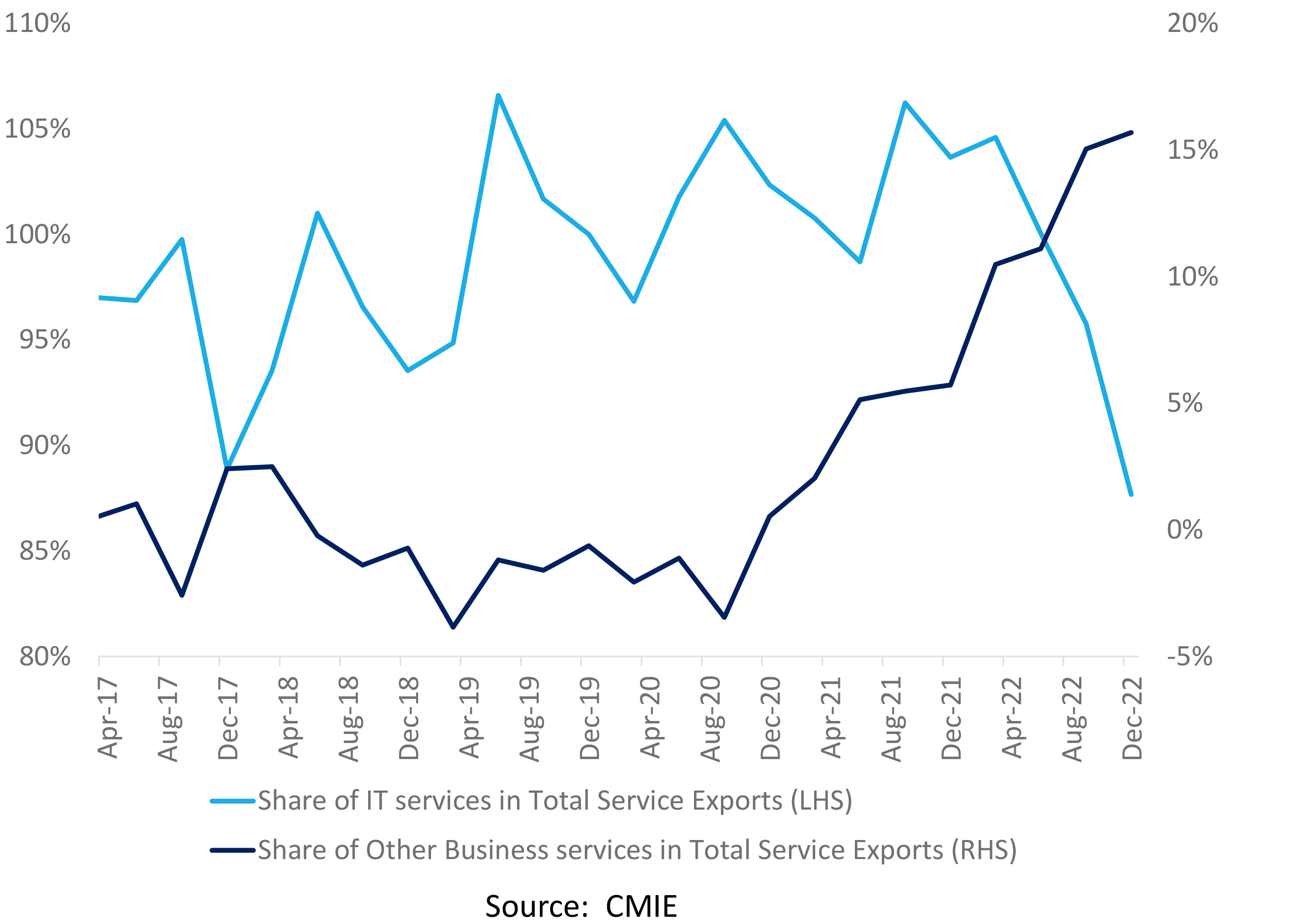

Exhibit 1: While IT continues to dominate services exports, other business services are fast picking. Can services exports continue to aid our external position in coming years? Possibly, yes.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.