DSP TATHYA - July 2023

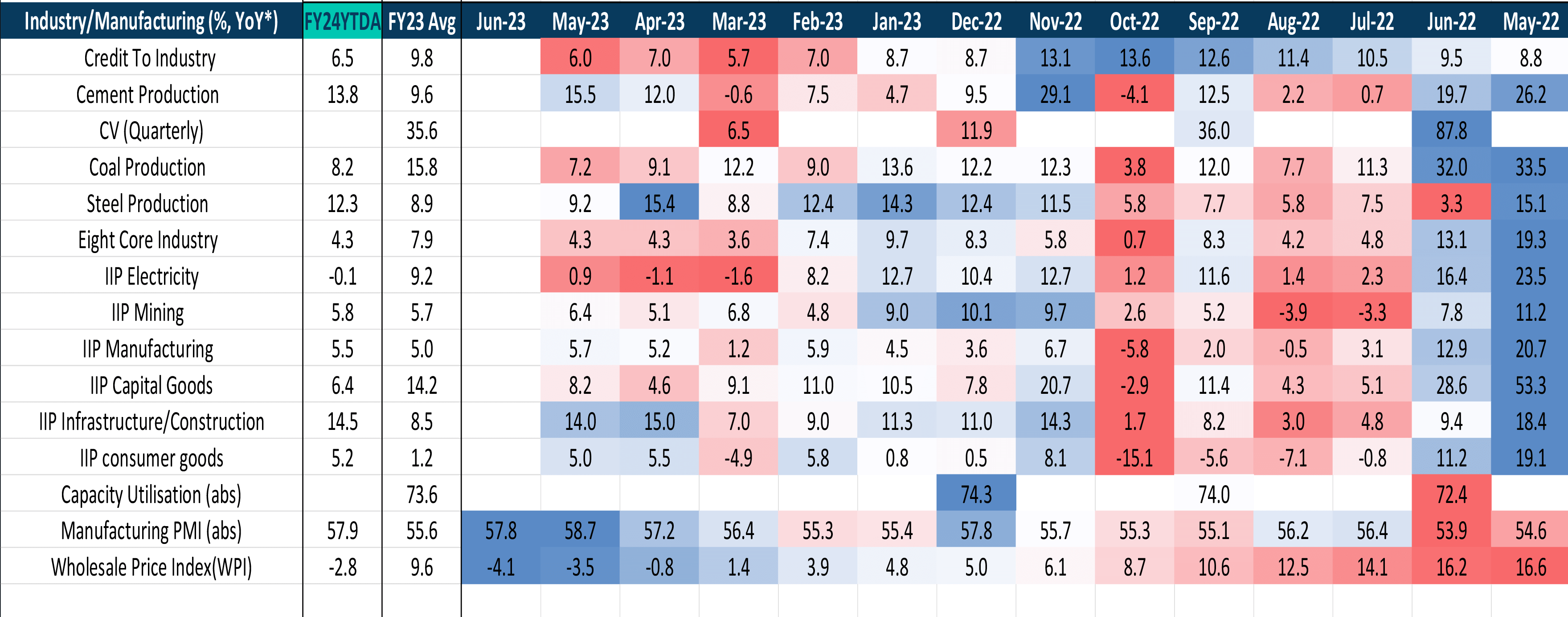

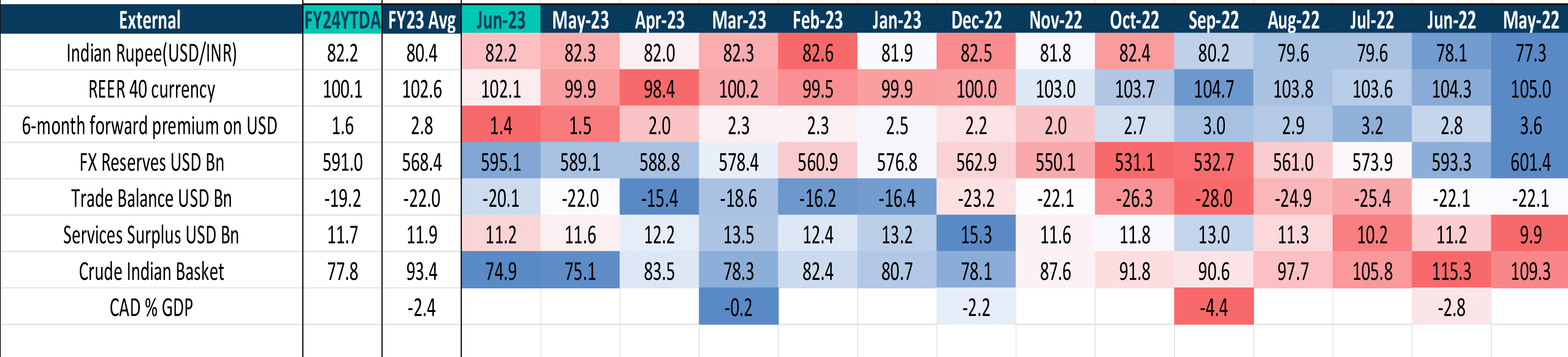

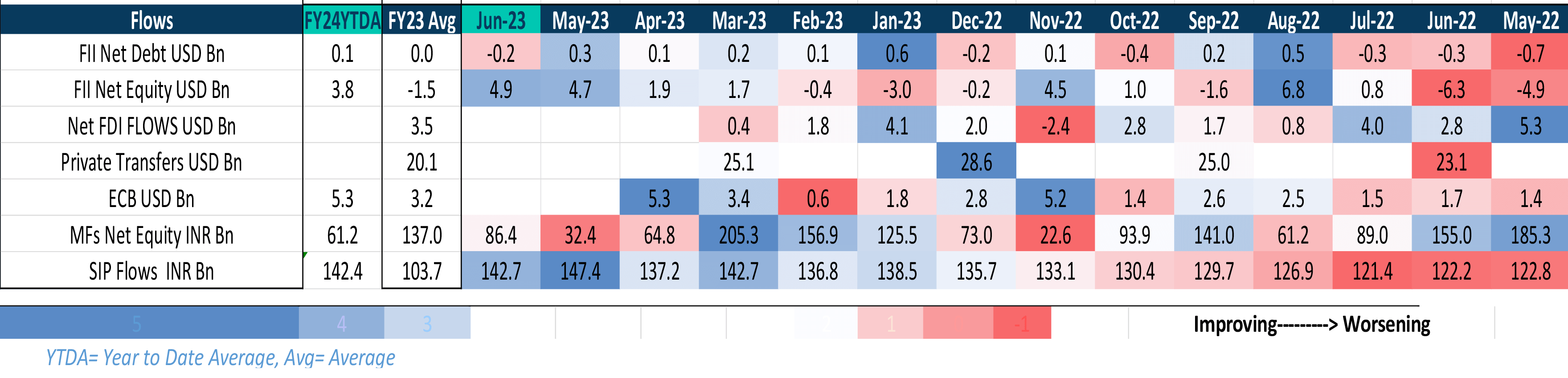

Consumer sentiment remains high, despite a slight moderation in personal loans. Non-oil imports falling is partly a price effect. Lower POL consumption comes on account of soft car sales.

Even though headline came in higher than the consensus, it was majorly driven by a surge in food inflation . Core remaining steady at 5 . 2 %, comes as a comfort .

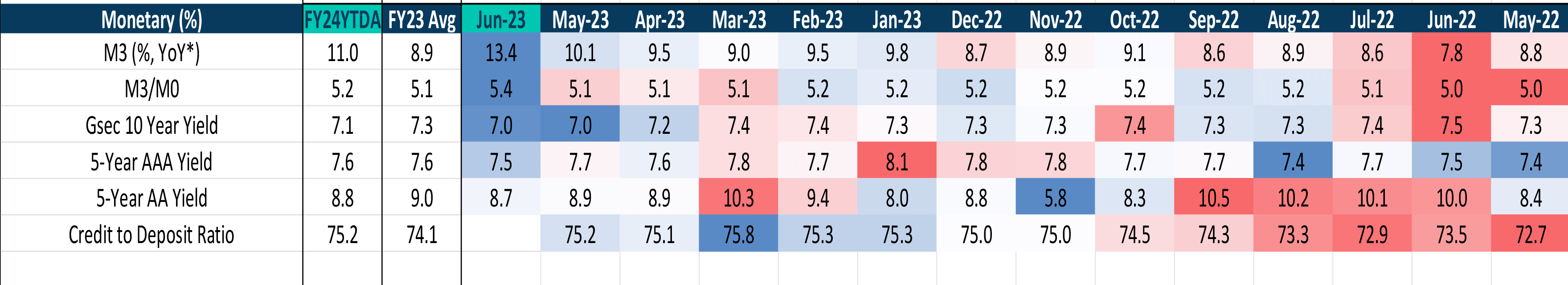

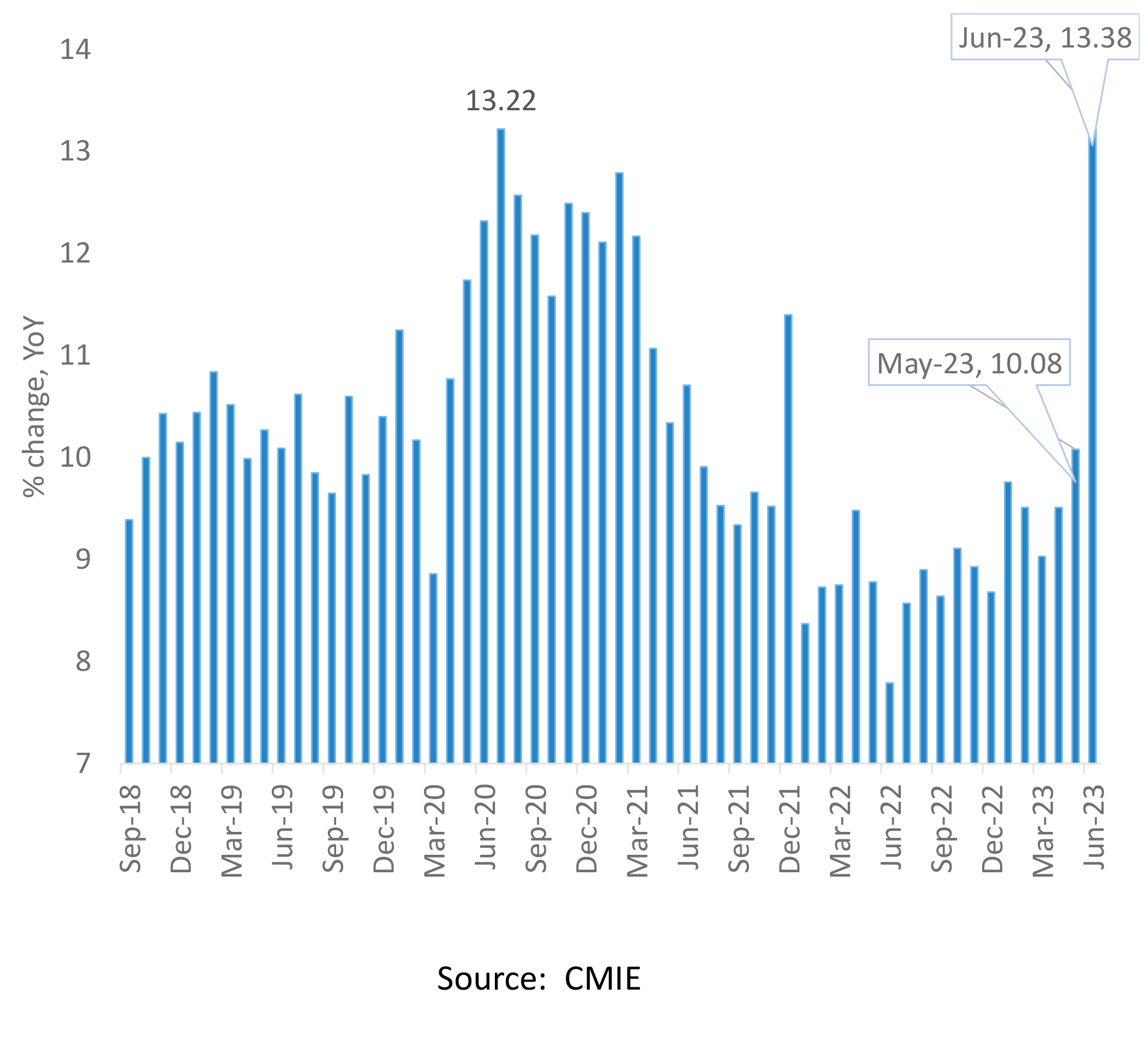

The prevailing money supply has surpassed the peak recorded in July’20 of 13.2%. This development serves to reinforce the notion that the current monetary policy is notably less restrictive in nature. 10-year Gsec yields have remained stable, after easing from highs. A fall in risk premia is reflected in lower corporate bond yields.

Exhibit 3: The decrease in the CPI is evidently aligned with the decline observed in the WPI. However, the temporary surge in Food Inflation keeps the Headline Inflation from experiencing a more pronounced reduction.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.