DSP Tathya - January 2024

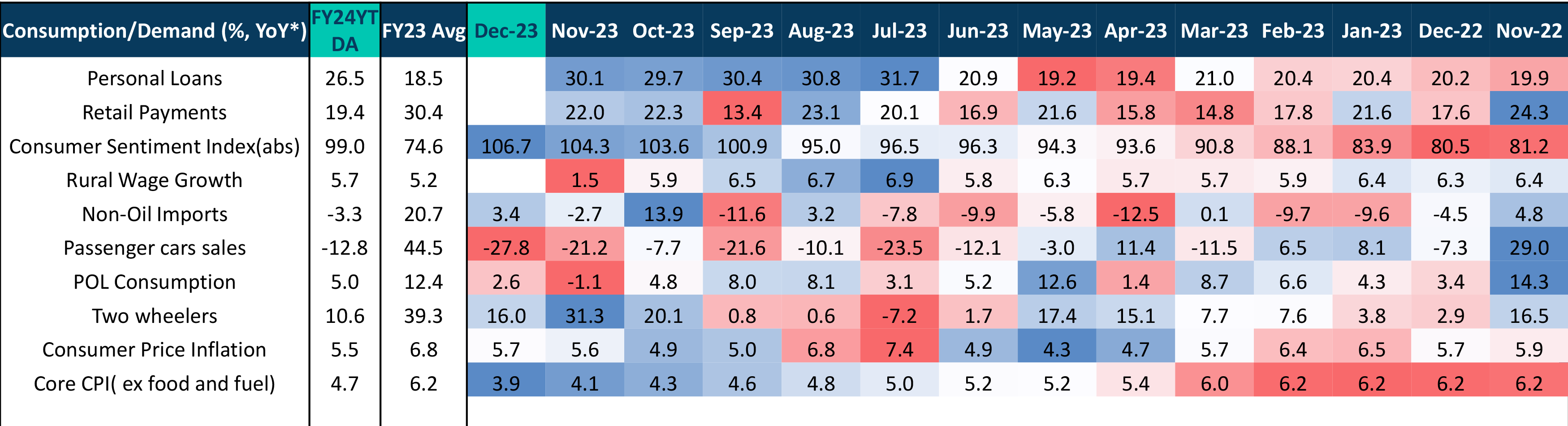

While the consumer sentiment index displays a positive red-to-blue shift, suggesting a strong belief in India's growth story, the reality of consumption, particularly in passenger car sales, tells a different tale. Rural wage growth appears subdued.

The core number with no surprise continues it’s disinflationary trend, printing the lowest number since Mar’20. Although the headline figure is still above the target, it's not a cause for concern, given that most numbers have stabilized, attributing the deviation to a temporary spike due to an inconsistent monsoon.

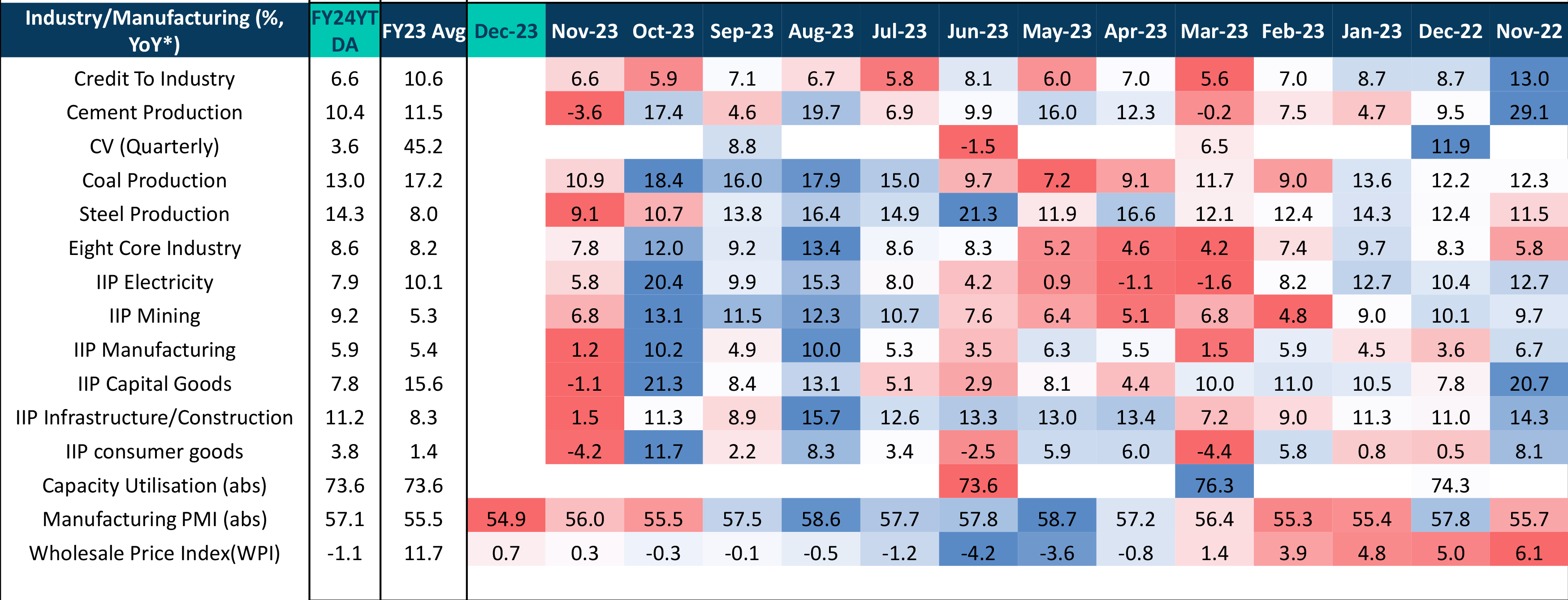

The recent IIP figures reflect a significant impact from the high base effect, with November having fewer production days due to festivities. Last year, October's festivities resulted in higher production days for November '22. Manufacturing PMI has declined, suggesting a potential slowdown in December's IIP growth. Additionally, the WPI numbers indicate a return to an inflationary trend. These variations are currently more influenced by statistical base effects than a clear, sustained trend.

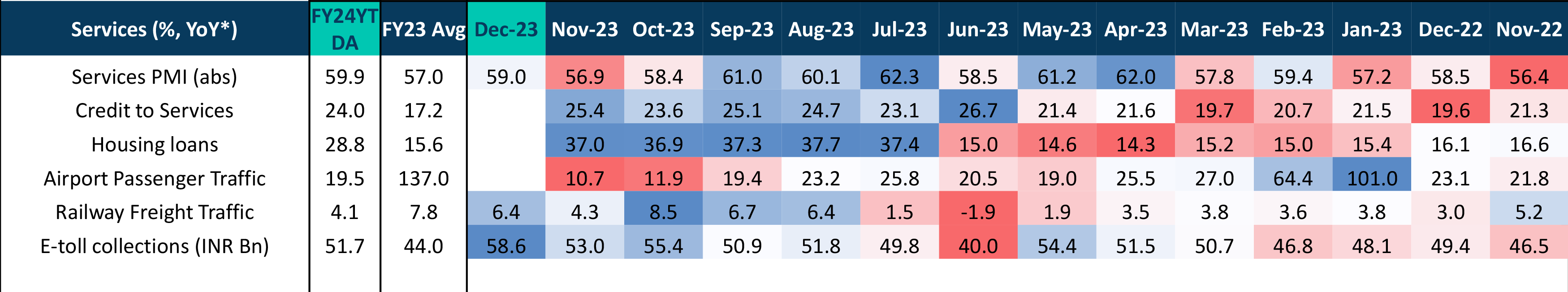

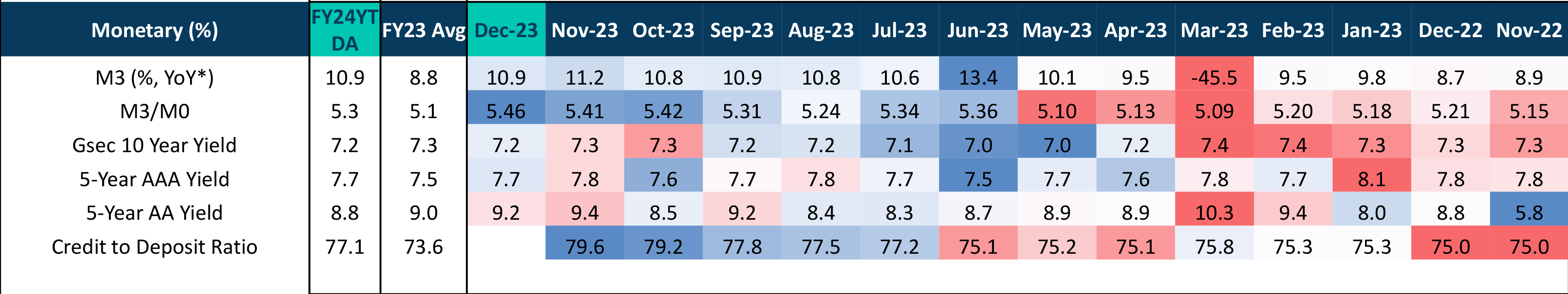

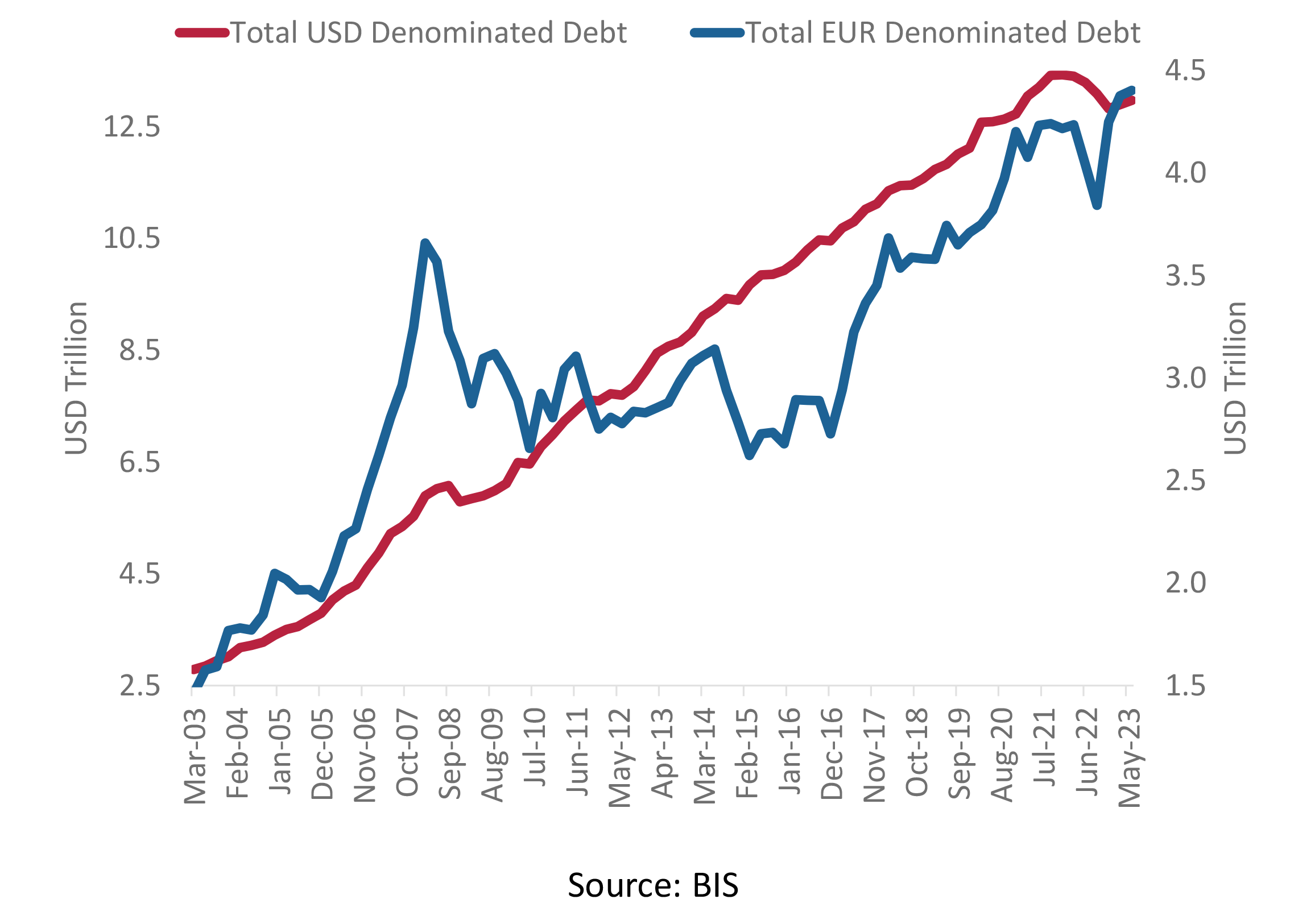

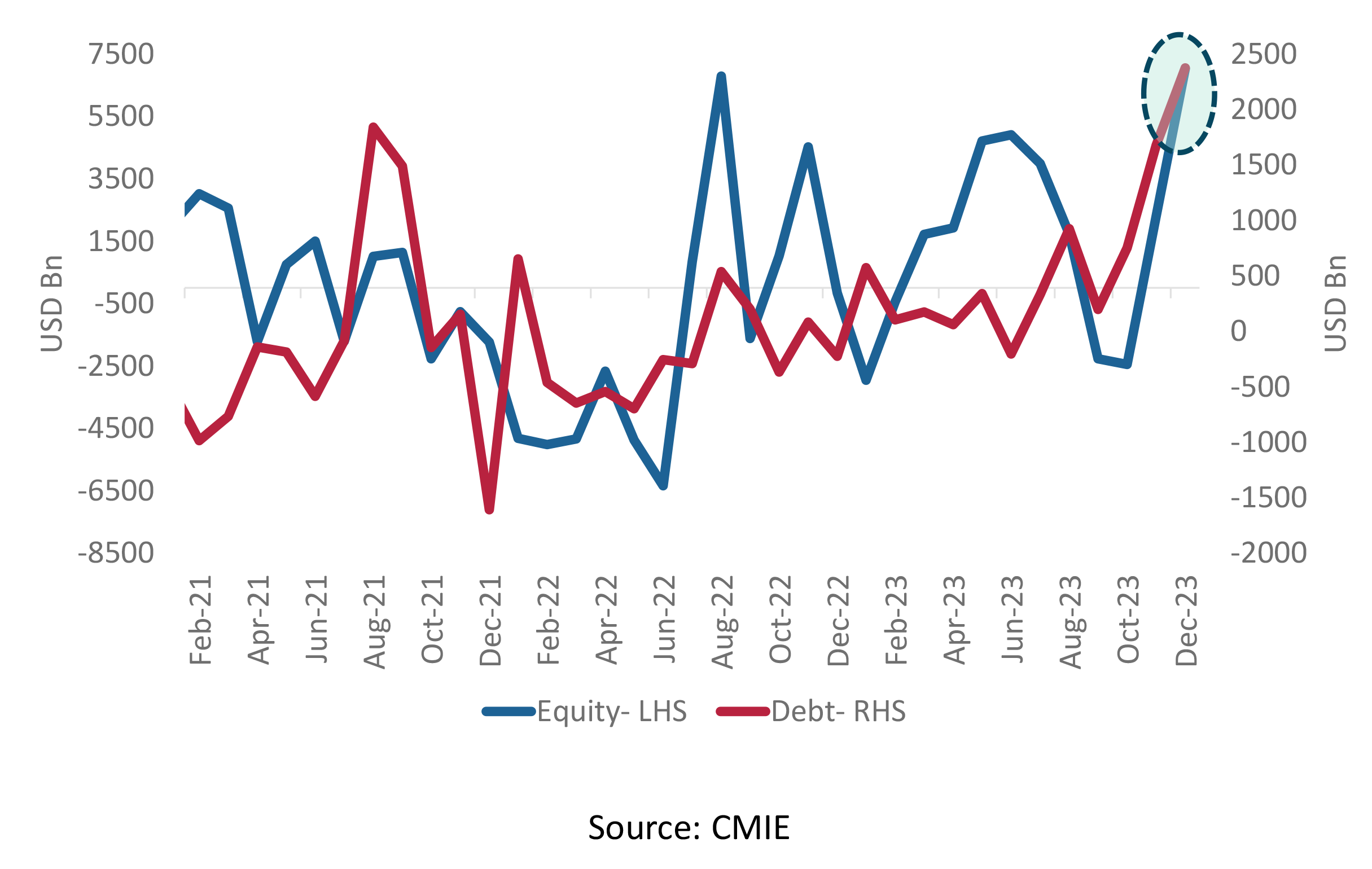

Debt investments from FIIs have seen a notable uptick, attributed to India's inclusion in Bloomberg EM index after JP Morgan Bond Index. The increased confidence in India's growth narrative is evident in substantial equity inflows, possibly reflecting a deeper belief in India. The SIP book remains robust.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.