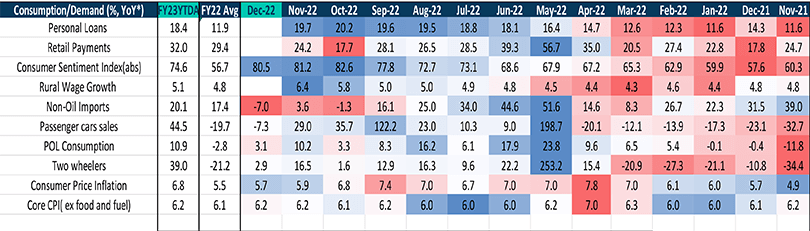

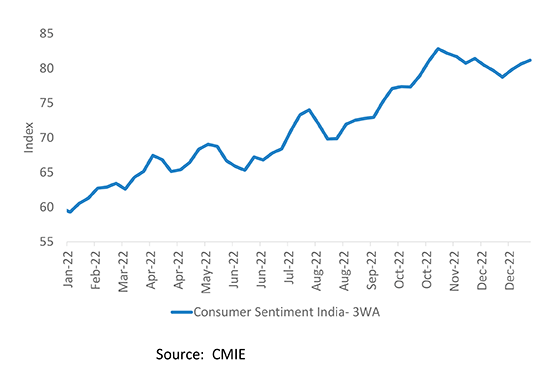

There is some normalisation visible in various consumption indicators, partly from stronger base and partly from some slowdown in momentum. However, consumer sentiment index continues to remain robust

Inflation eased in the last few months as commodity, energy and logistics prices ease. Q3FY23 inflation is clocking 6.1% vs RBI’s estimates of 6.6%

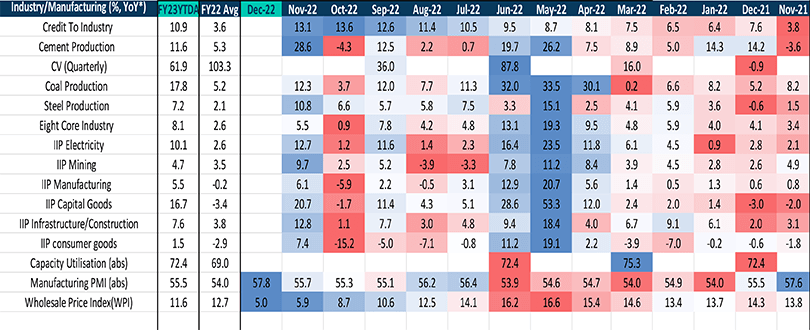

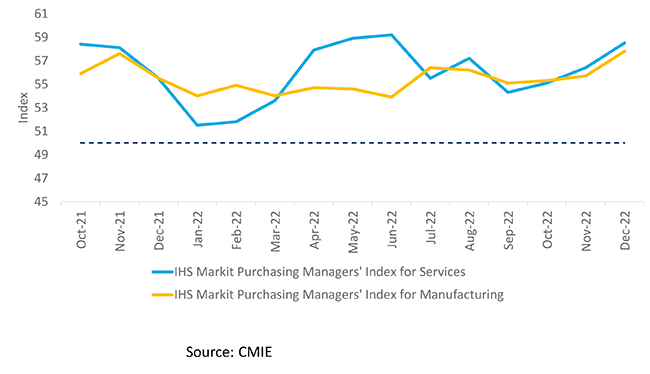

Manufacturing PMI at 57.8 shows continuous robust strength. The overall basket of industrial indicators shows improvement.

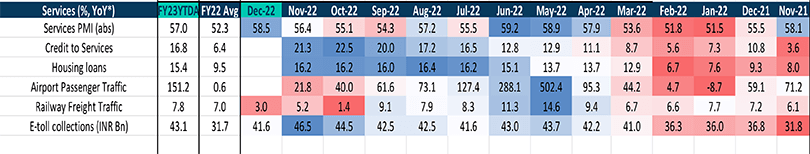

Services PMI increased to 58.5,showing significant strength. Services monthly export surplus is now averaging USD 10.5 billion, a sizeable increase from pre -covid numbers.

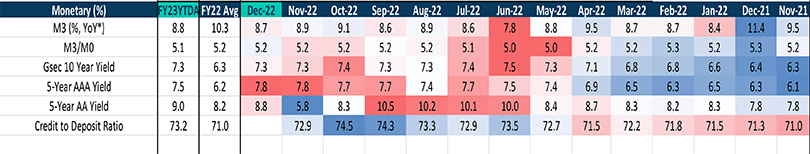

Gsec 10 year yield has been range bound. We believe peak rate hikes are behind us and 2023 will see more neutral policies

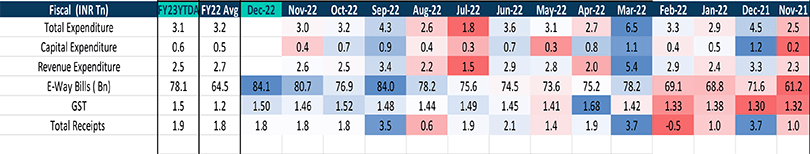

India’s fiscal authorities are likely to find success in avoiding extra borrowings this year. Nominal GDP for FY23 is likely to be higher than the budgeted 11%, keeping headline deficit under check. All eyes will now be on glide path from FY24 onwards

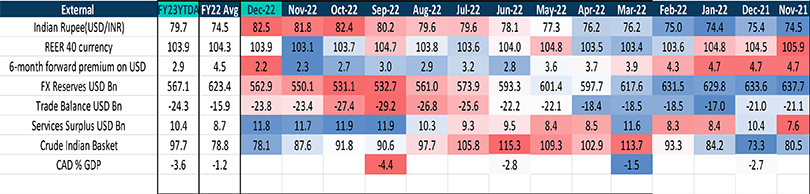

External headwinds have mildly eased as crude prices fell and monetary policies appeared softer than previously expected. Even now, however, external conditions are tighter than last year

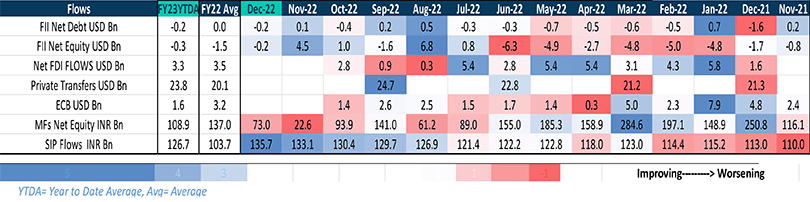

India saw small outflows in equity and debt from FIIs. With dollar easing, we think EMs (and specifically India) will see good flows. Domestic MF flows picked some pace while SIP book was resilient. FDI flows have been benign in last 3 months.

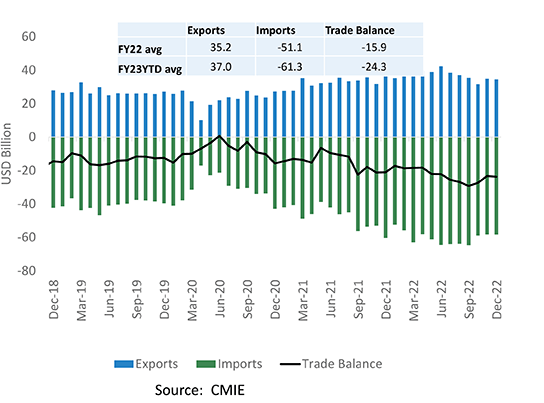

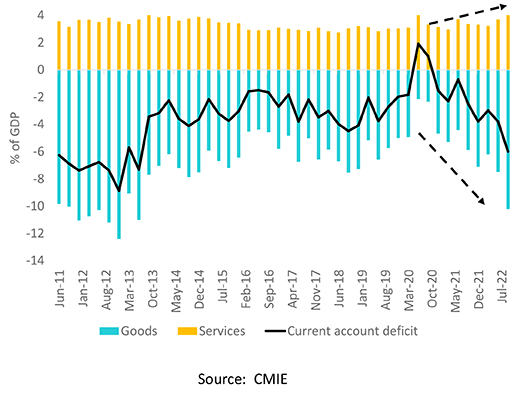

Exhibit 1: Trade balance has been clocking a sub-USD 25 bn reading in last 2 months as exports picked some pace but overall, FY23 is set to have ~USD 100 bn higher in goods deficit

Exhibit 2: Services surplus has been improving and has helped curtailed the damage from goods deficit.

Exhibit 3: After some slowdown in momentum, consumer sentiment index has started to inch up again

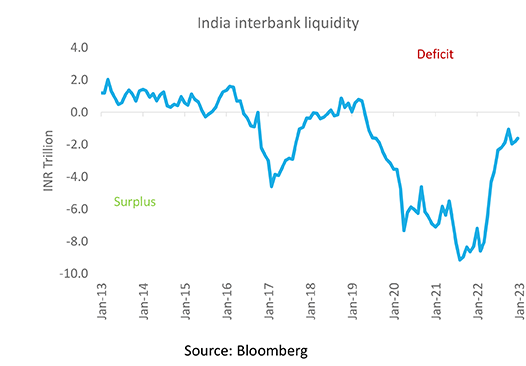

Exhibit 4: India’s interbank liquidity is back to surplus of

INR 1.5 tn+

Exhibit 3: After some slowdown in momentum, consumer sentiment index has started to inch up again

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.