DSP TATHYA - February 2024

Consumer sentiment index dropped for the first time, after showing a consistent rise for a year. There seems to be a significant recovery in the sale of passenger cars, after having suffered a major dip in the delayed festive season of 2023. The rural wage growth, however, comes in as a major disappointment, and coupled with a rising food inflation, it only makes it worse.

The lowest CPI core inflation recorded is 3.44% in Oct'19. The latest reading is only a few bps away from this low. The constant drag in the core number also speaks of a slowing consumption economy, indicating a normalization of post-covid demand rush.

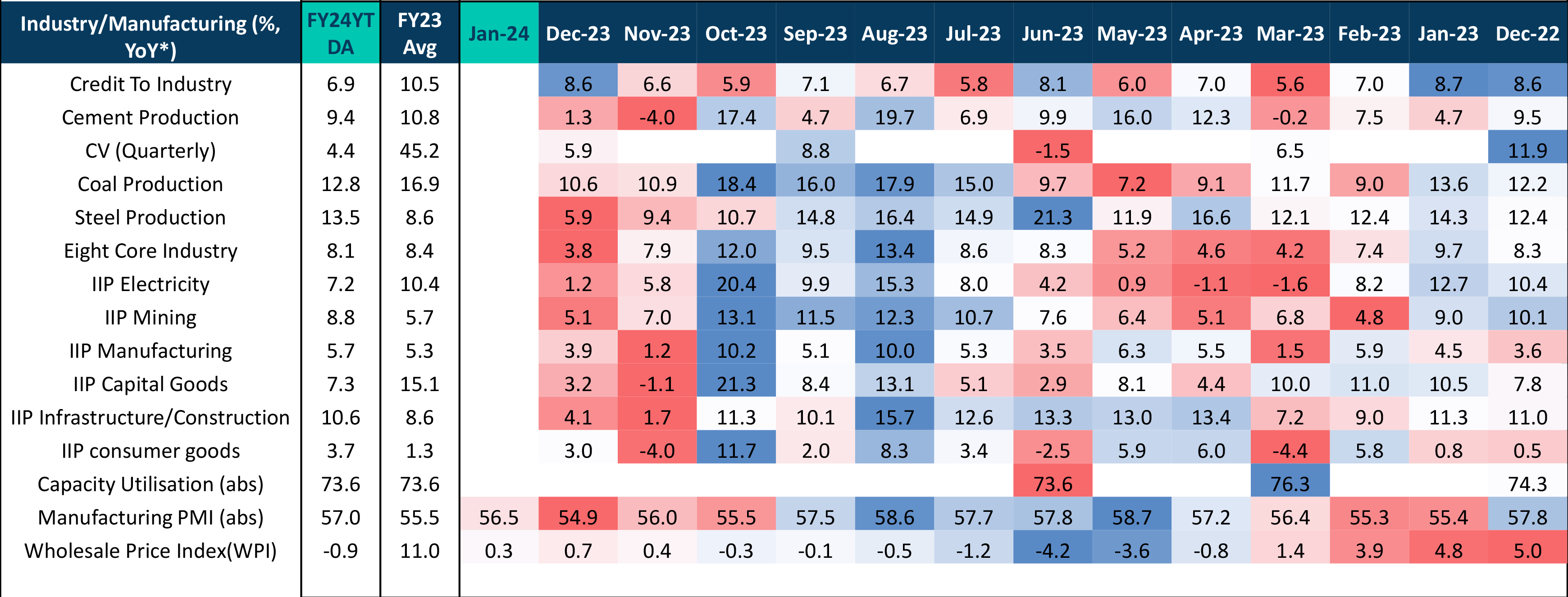

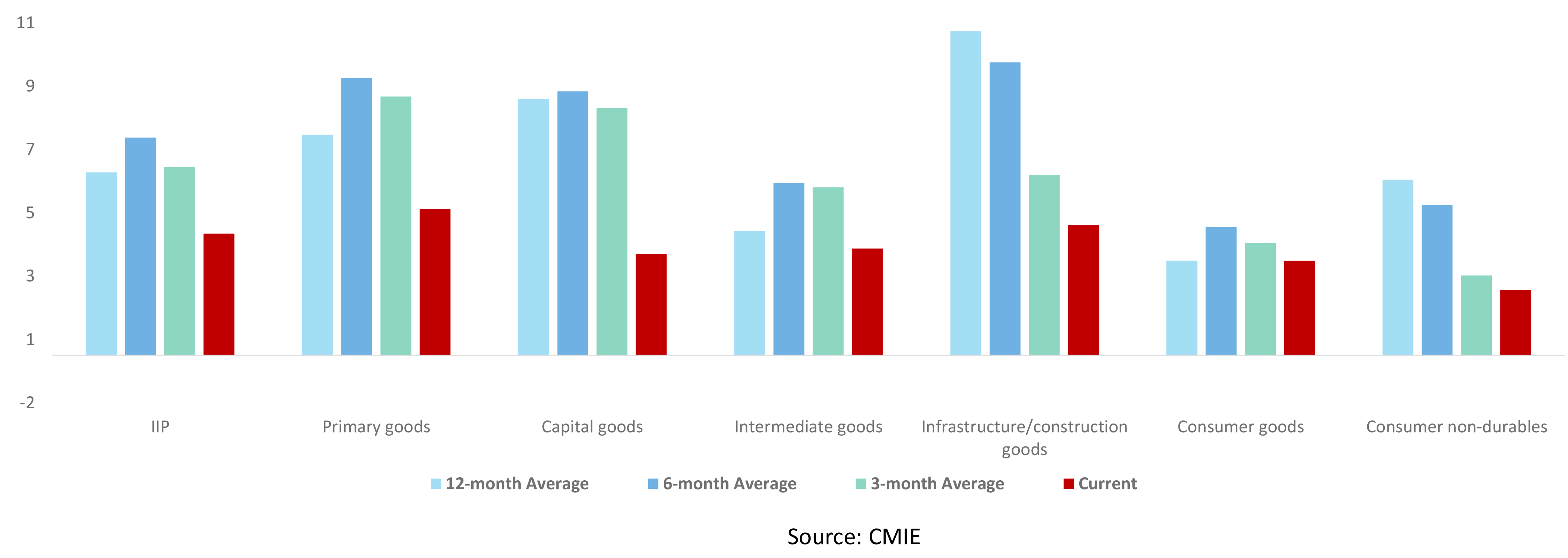

The slowed production does validate the subdued demand. For the past few months, the IIP number was being defended around high bases or lower production days due to festive season. However, with these factors no longer in play, the new year did not bring positive changes. Input prices are still decreasing due to lower oil prices, which may eventually lead to lower commodity prices.

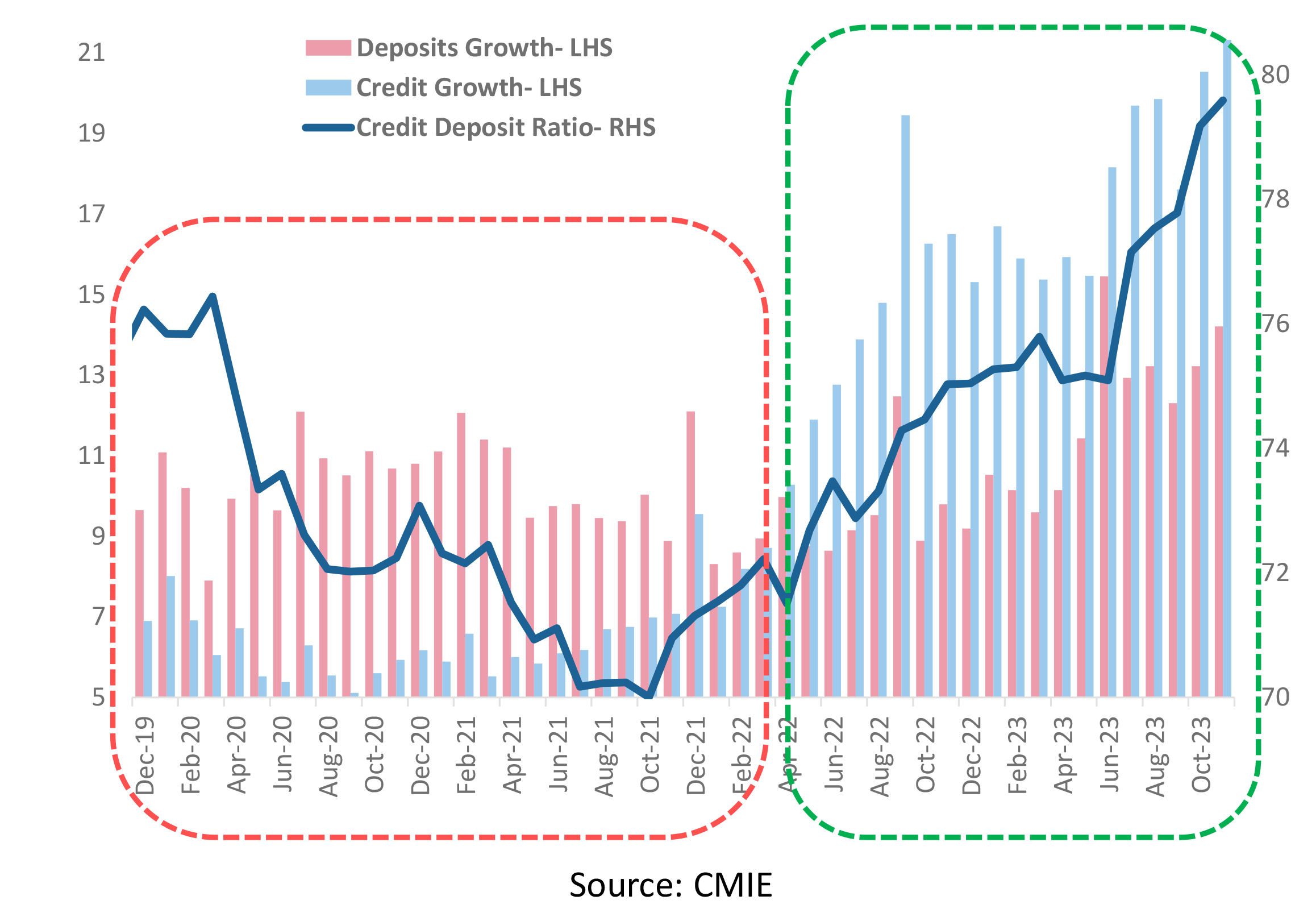

Debt investments from FIIs and ECBs have seen a notable uptick, attributed to India's inclusion in Bloomberg EM index after JP Morgan Bond Index. There has been greater traction towards managed money, thus, a significant rise in MFs and SIP books.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.