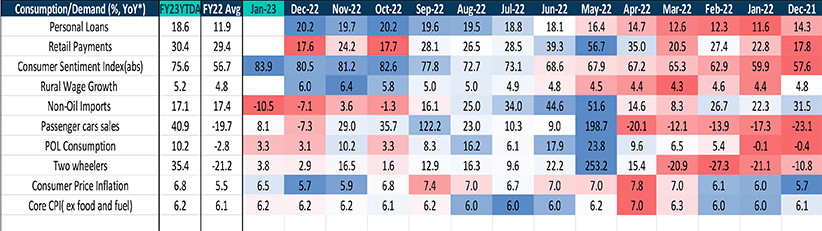

There is some normalisation visible in various consumption indicators, though it is far from being broad-based. Leading indicators such as consumer sentiment index continues to remain robust

Inflation surprised negatively in the January month as cereals price shot up in official data more than the market expected. Leading indicators still point to a downward trend in inflation

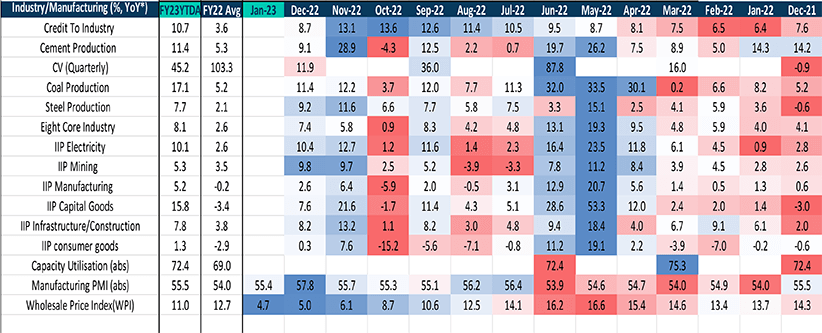

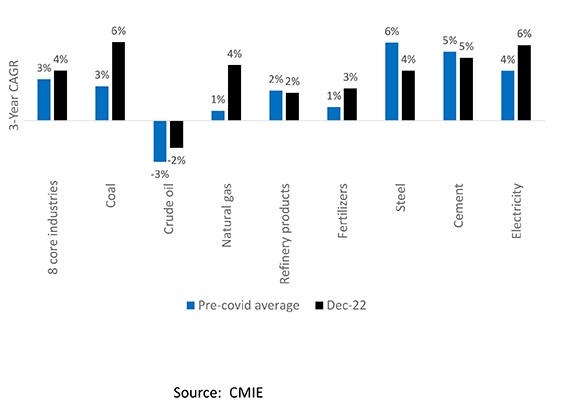

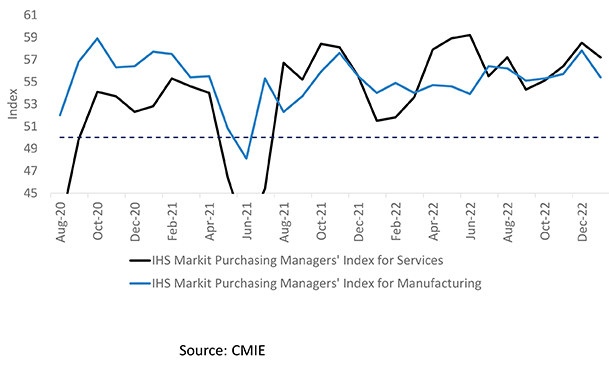

Manufacturing PMI eased a bit but remains in expansionary zone. Other industrial indicators such as eight core and IIP showed resilience

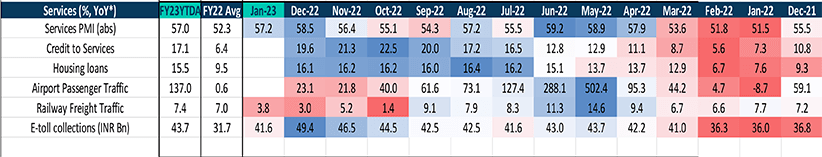

Services PMI marginally eased to 57.2,still showing significant strength. Services monthly export surplus is now averaging USD 11billion for FY23, a sizeable increase from pre-covid numbers

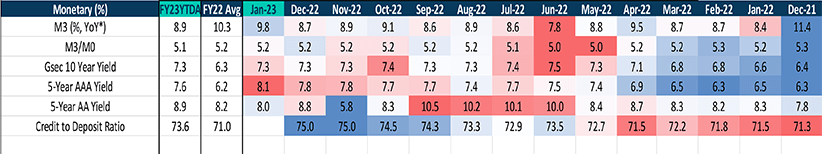

Gsec 10 year yield has been range bound, despite the union budget and RBI following Fed’s hawkish tone. We do not expect sizeable uptick in yields hereon

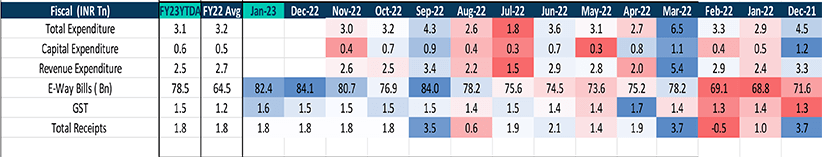

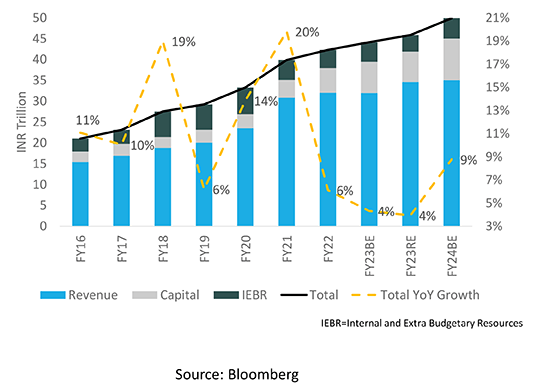

FY23 budget promised meeting of its headline fiscal deficit target, as was expected. FY24 budget appears to be one of credibility with enough fuel to support infrastructure driven growth

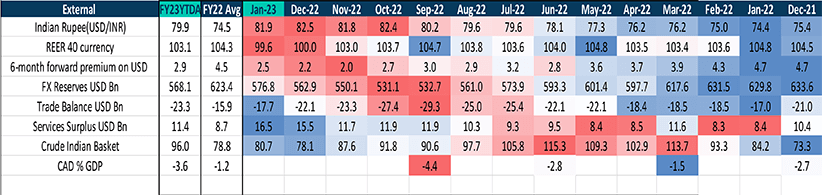

External headwinds have mildly eased as crude prices fell. Trade deficit eased as imports fell by ~USD 10 bn, owing to fall in crude bill as well as non-oil imports. Fundamental data points to likely currency appreciation

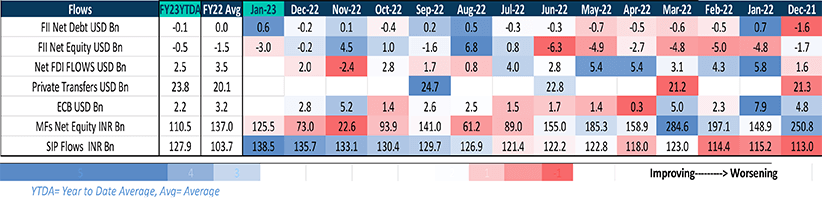

India saw outflows in equity from FIIs but small net inflows in debt. Domestic MF flows picked some pace while SIP book was resilient. FDI flows have been benign in last 3 months.

Exhibit 1: India’s eight core data is now better than pre-covid with coal/electricity/natural gas/fertilizers exceeding pre-covid growth

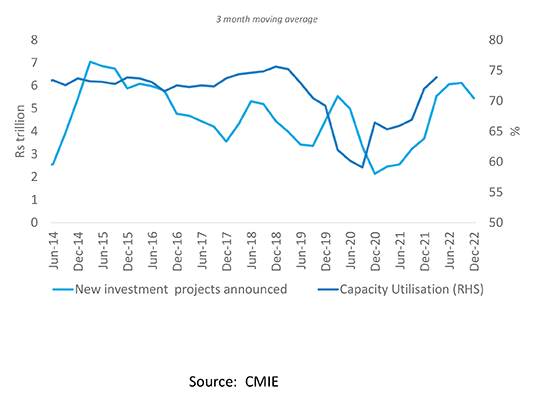

Exhibit 2: New investment projects announced remain healthy. Increased GOI capex + private capex is likely to keep India’s capital cycle resilient

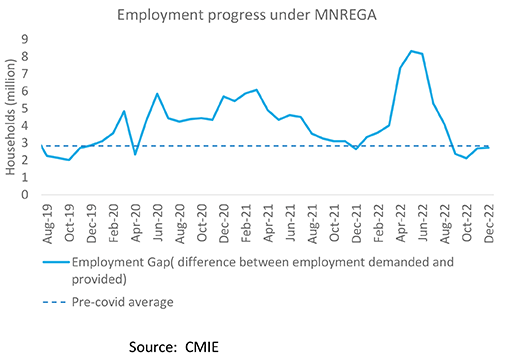

Exhibit 3: Rural Economy still doesn’t appear fully recovered, with employment demanded under MGNREGA increasing

Exhibit 4: The expenditure push by GOI is healthy and will support domestic growth amidst external uncertainties

Exhibit 5: India’s PMI is showing some downturn in momentum but remains clearly in expansionary zone

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.