DSP TATHYA - August 2023

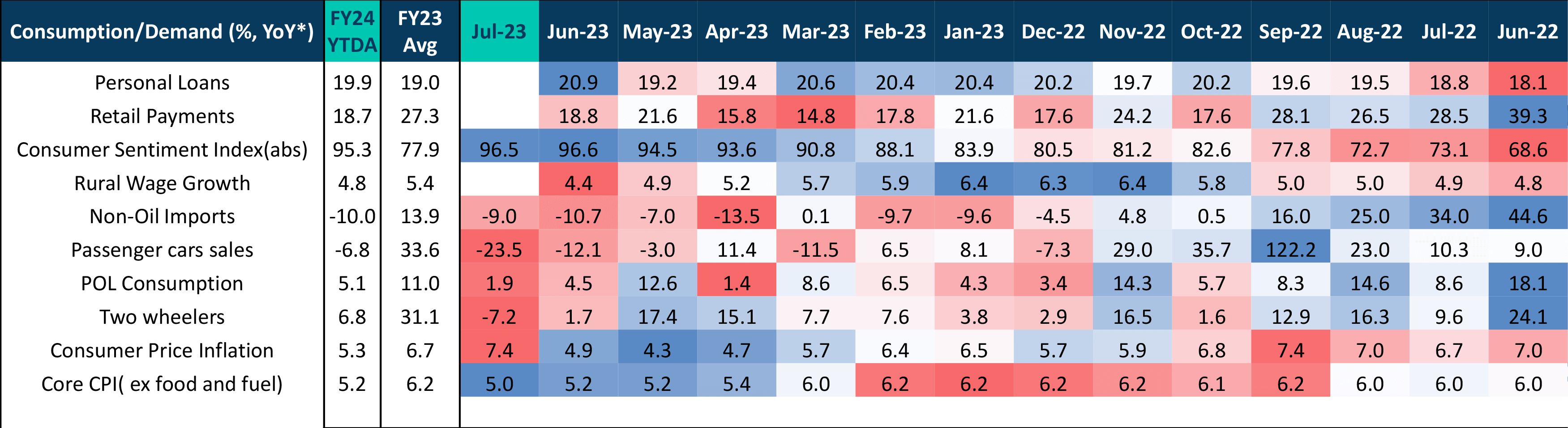

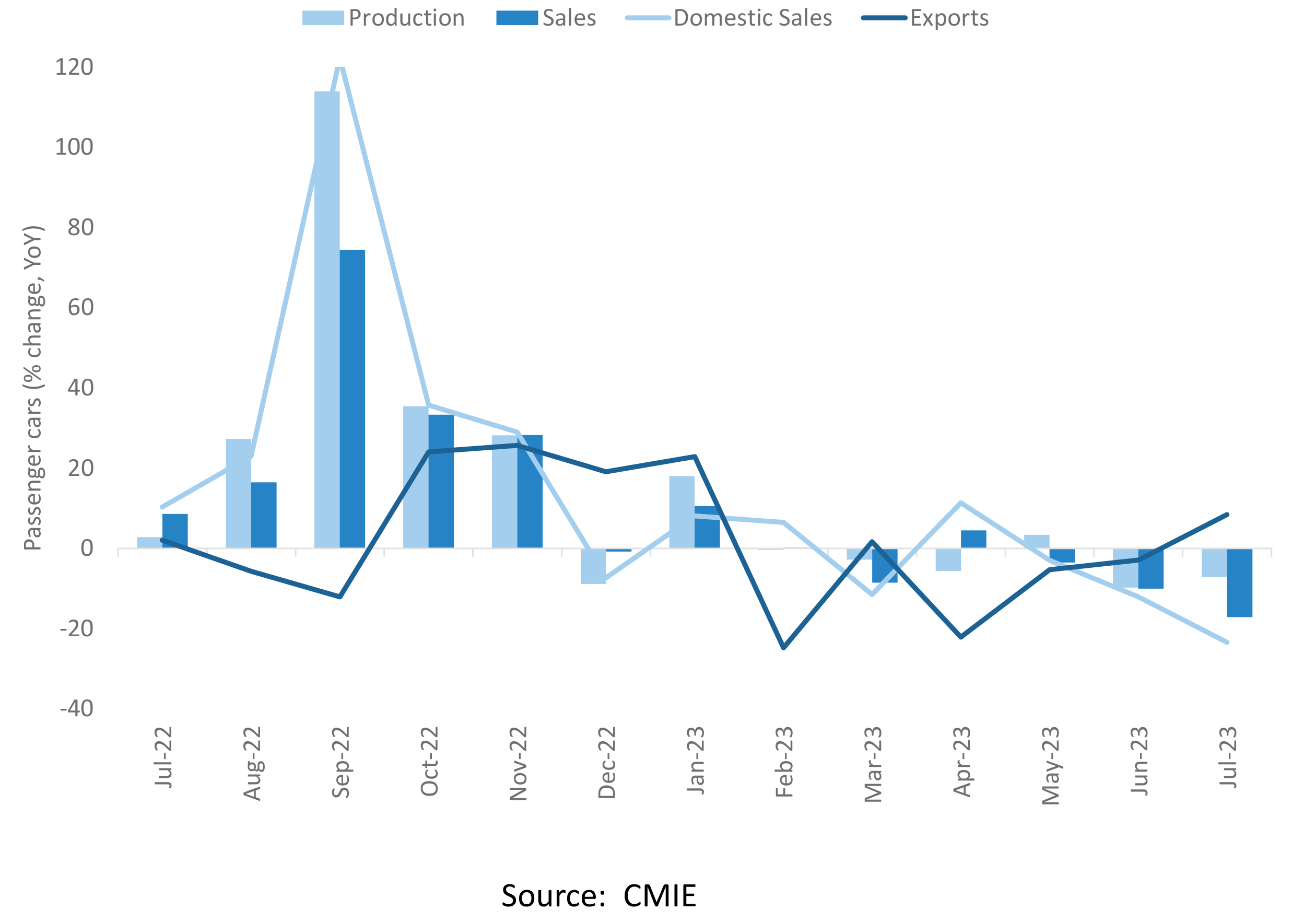

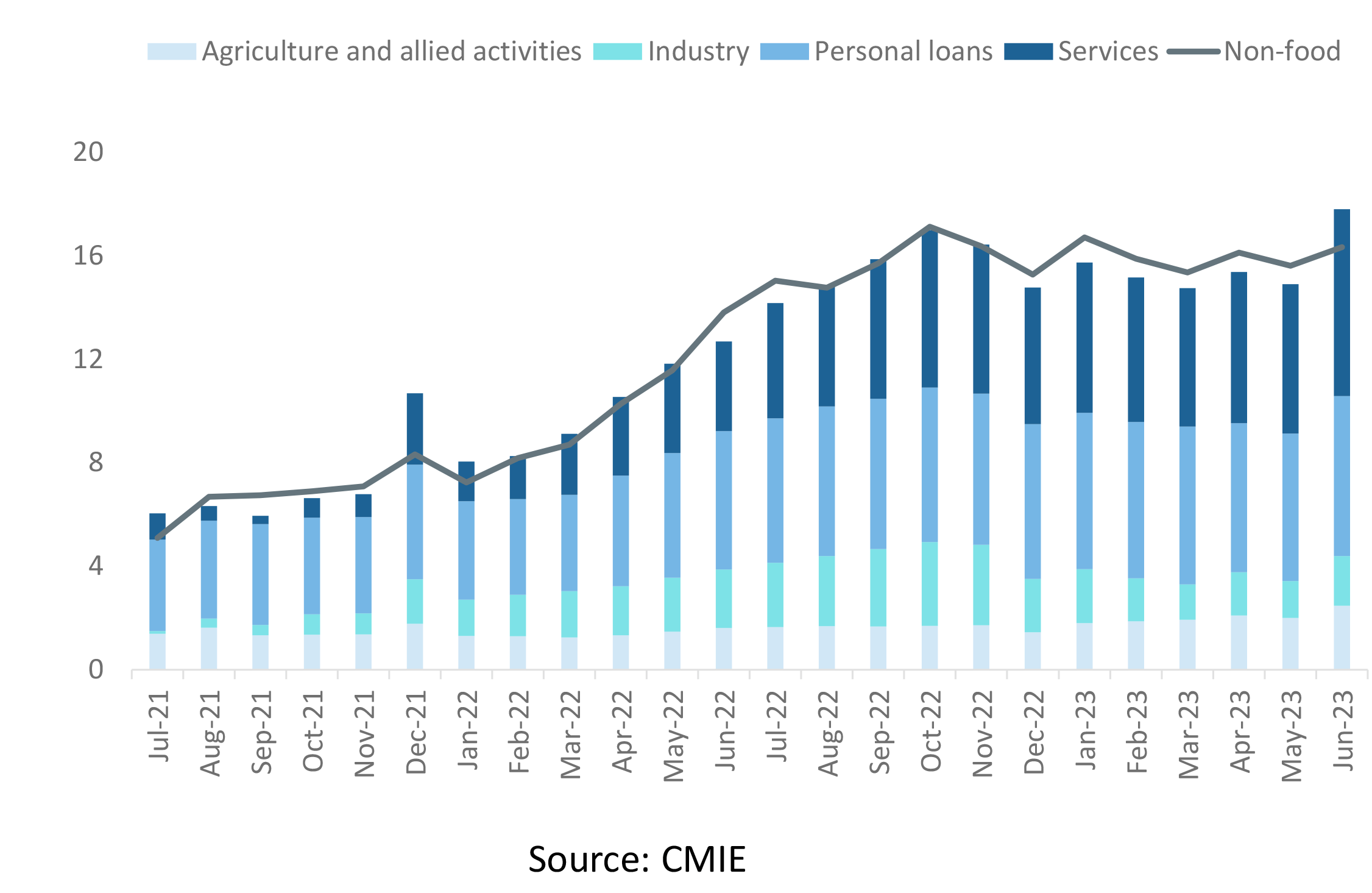

Consumer confidence remains strong, as reflected by the steady expansion in personal loans. The downward trajectory of automobile sales could persist through August, and its reversal is expected only when the festive season commences.

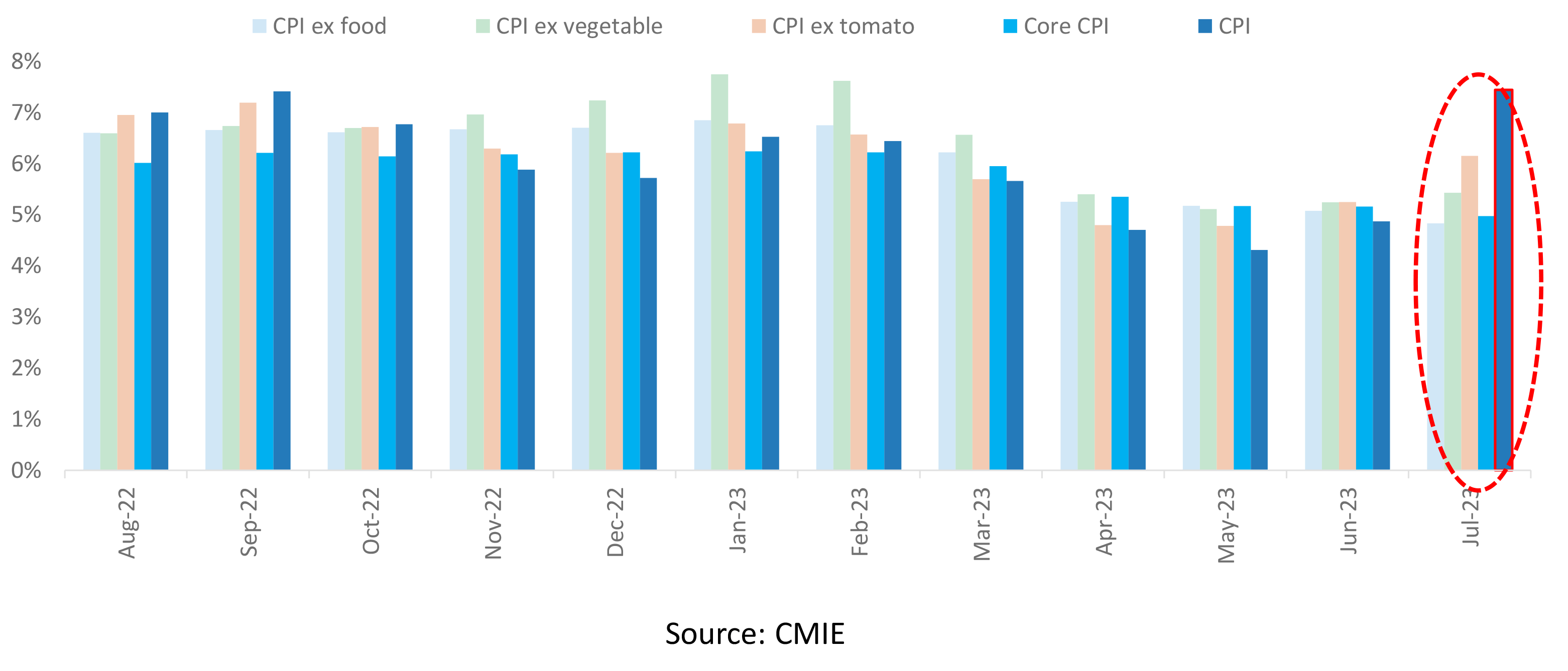

The dramatic rise in headline inflation is majorly driven by food inflation, especially vegetables. Core CPI, thus, with no surprise, continues to fall, recording it’s lowest print since Aprl’20

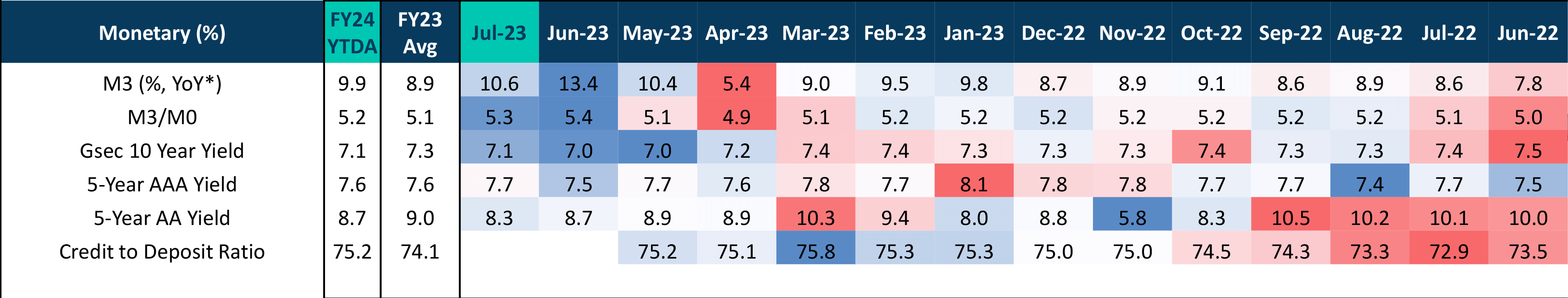

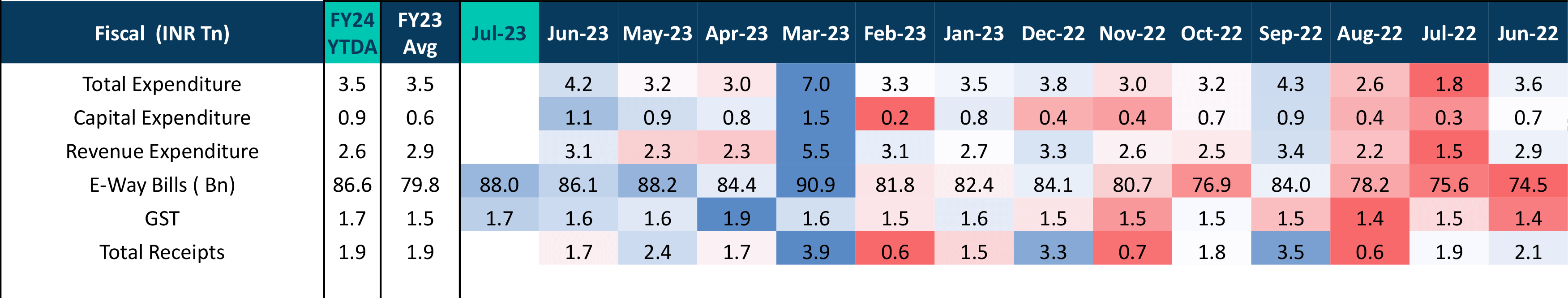

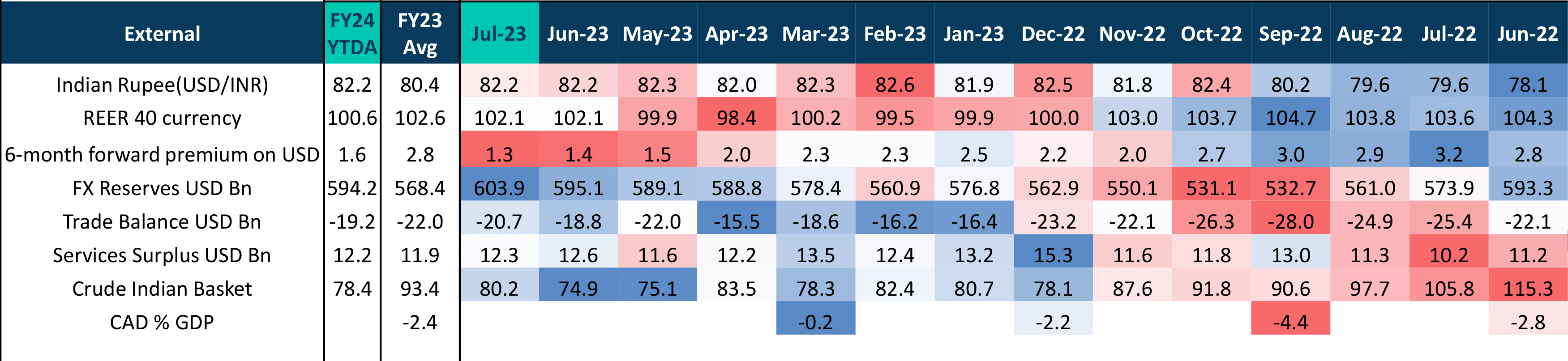

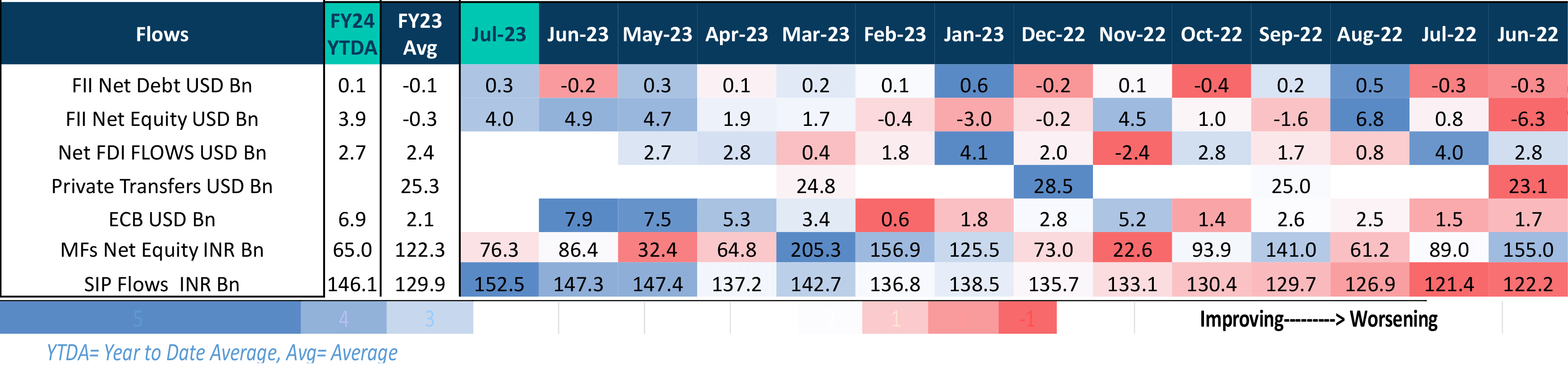

While FII flows are robust in equity, the debt portion has also revived after a temporary fall. We re-iterate that given India is appearing a steady ship in choppy waters, it is likely to get its fair share of FII flows. Even though MF equity flows have slowed, the SIP book experienced a notable increase.

Exhibit 1: While the decline in passenger car production has disproportionately impacted sales, the effect is more pronounced within the domestic market, whereas exports have exhibited a notable recovery.

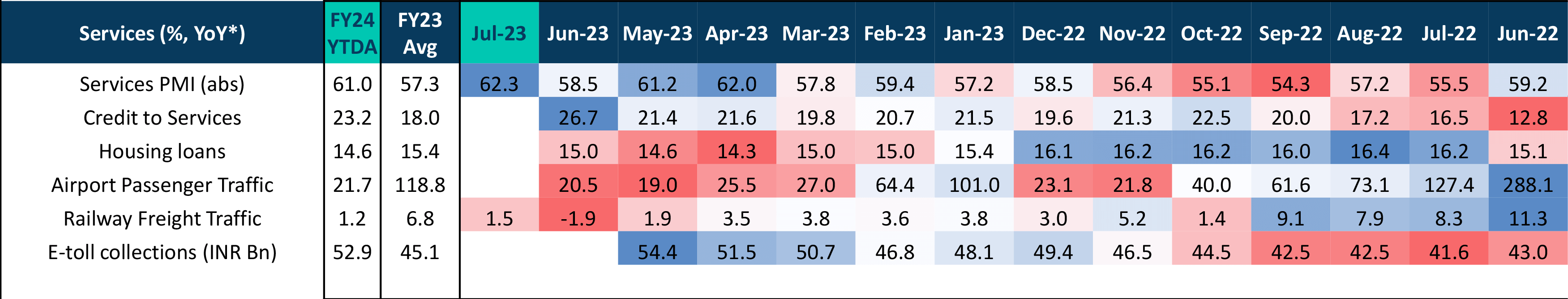

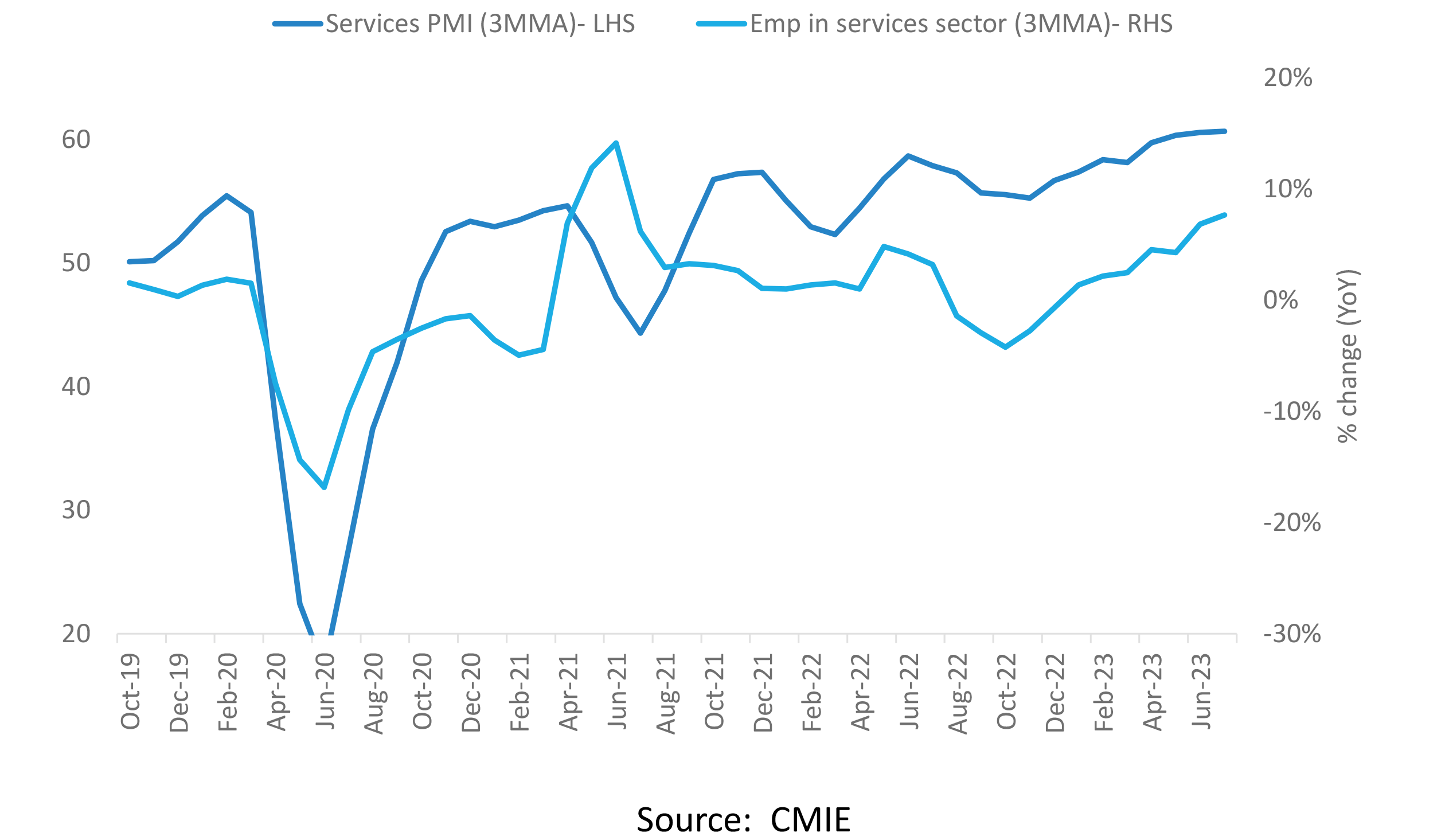

Exhibit 3: The sustained growth in the services PMI is supported by a robust expansion in employment in the services sector, even in the face of prevailing global headwinds

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.