DSP TATHYA - April 2024

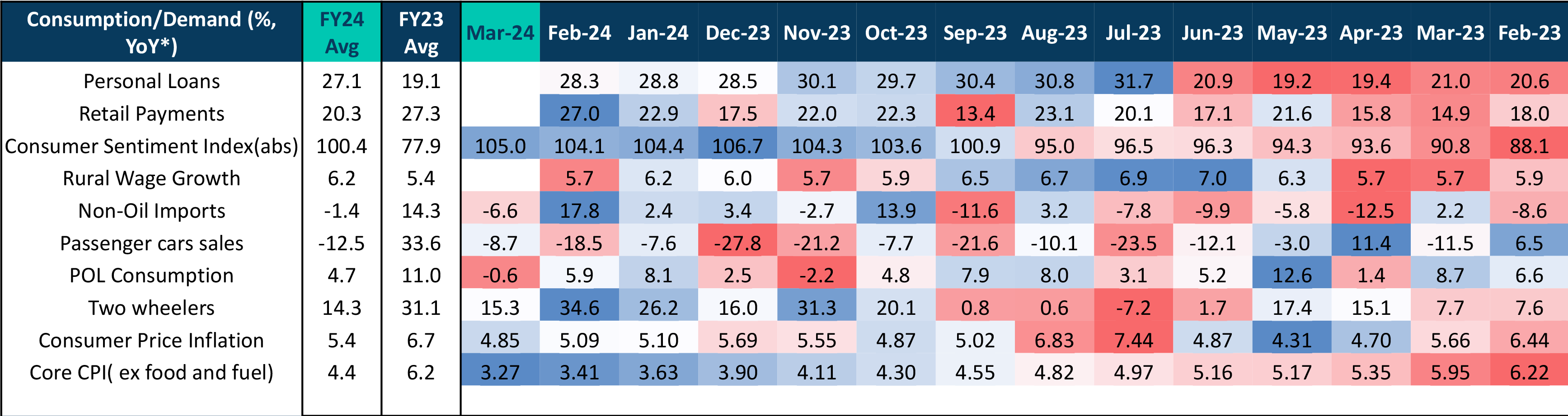

The demand dynamics present decent recovery. However, the rural recovery continues to be a worry, especially in the face of rising food prices. The blip in the consumption of petroleum products could sustain into a longer-term trend, with oil prices rising.

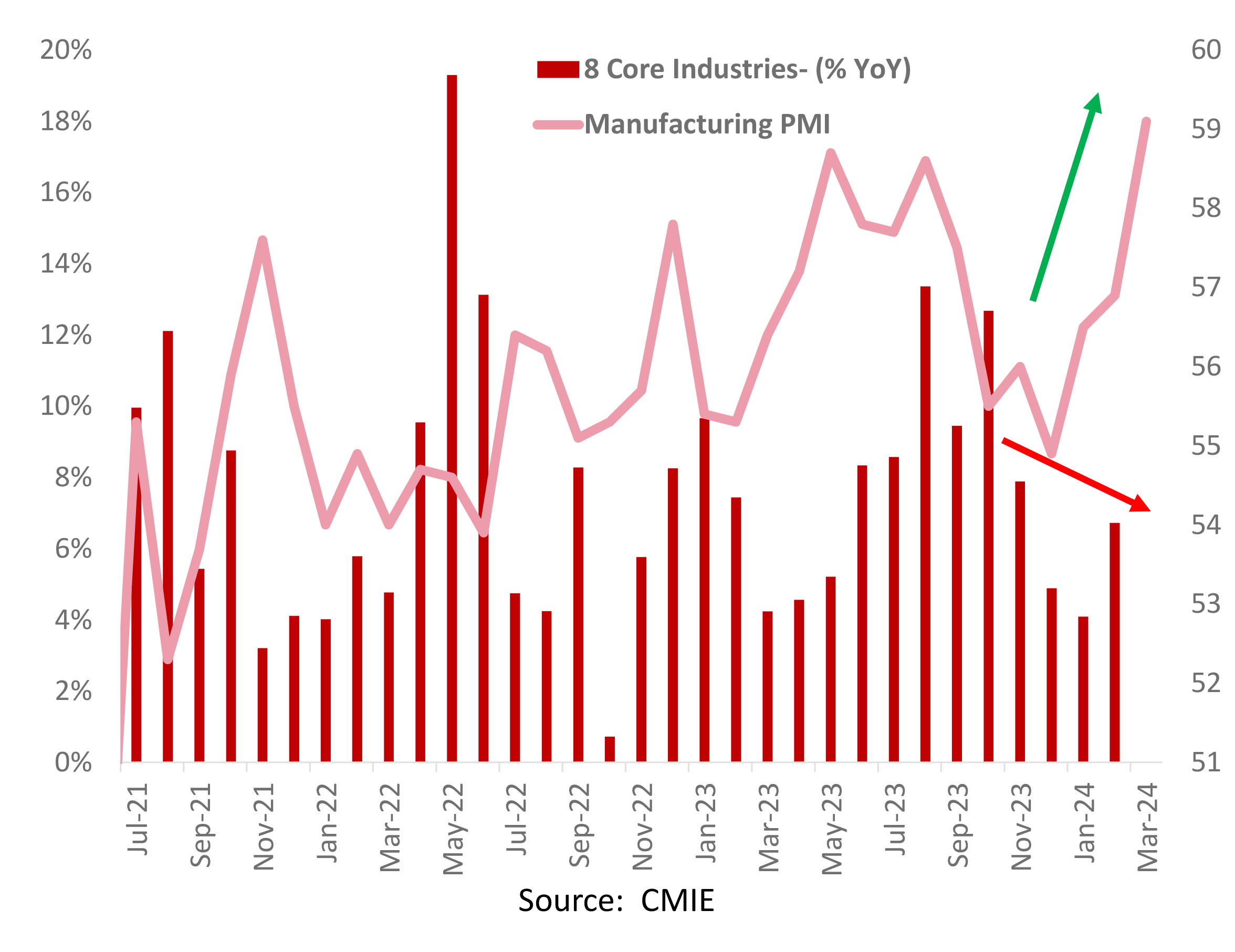

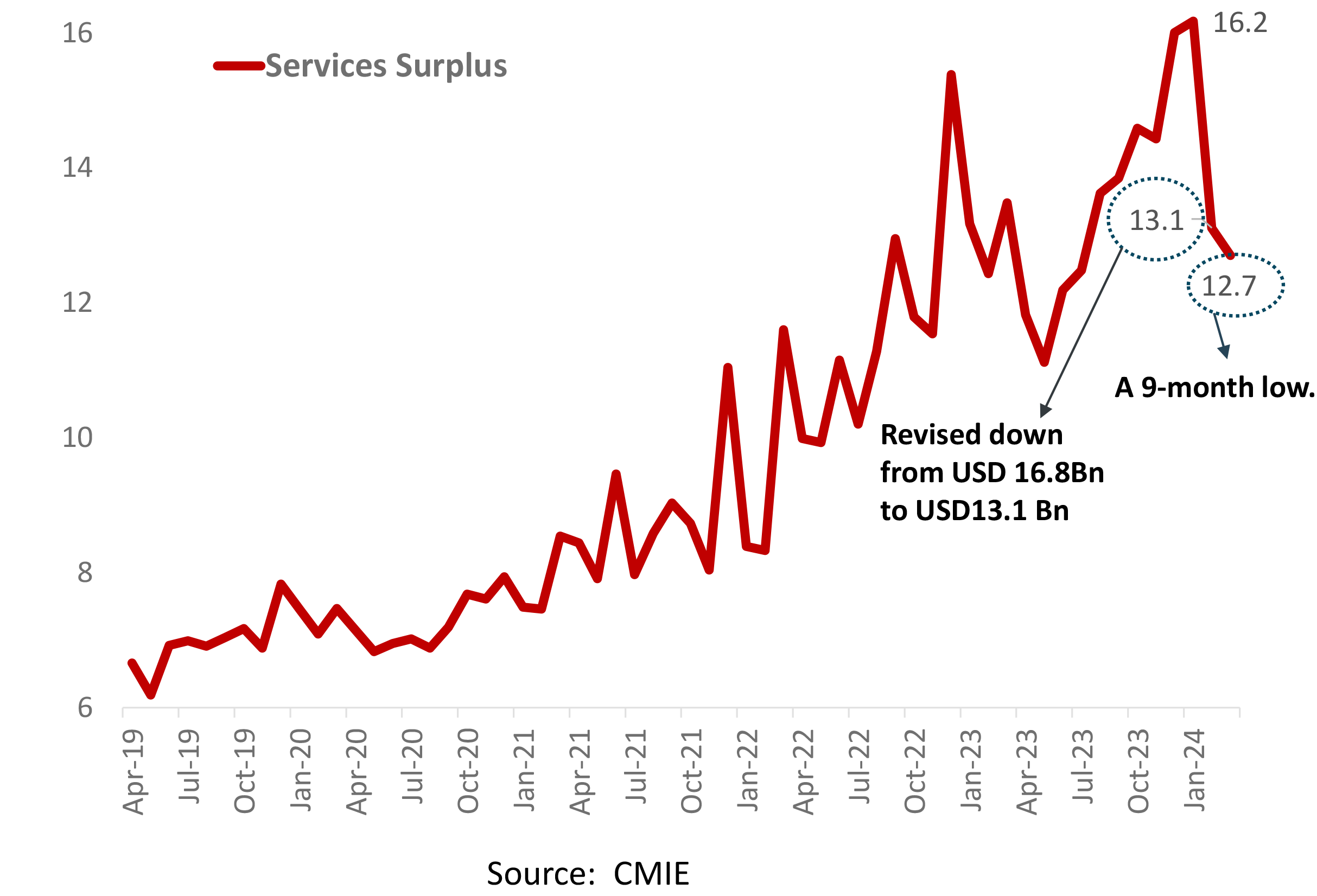

The disinflationary trend in core CPI has sustained the longest time since the start of the series, printing the lowest number with each new release at 3.27% YoY. Sequentially, CPI has remained steady, registering a 0% MoM growth, however, it recorded a 9-month low reading, and the second lowest reading since the repo rate pause.

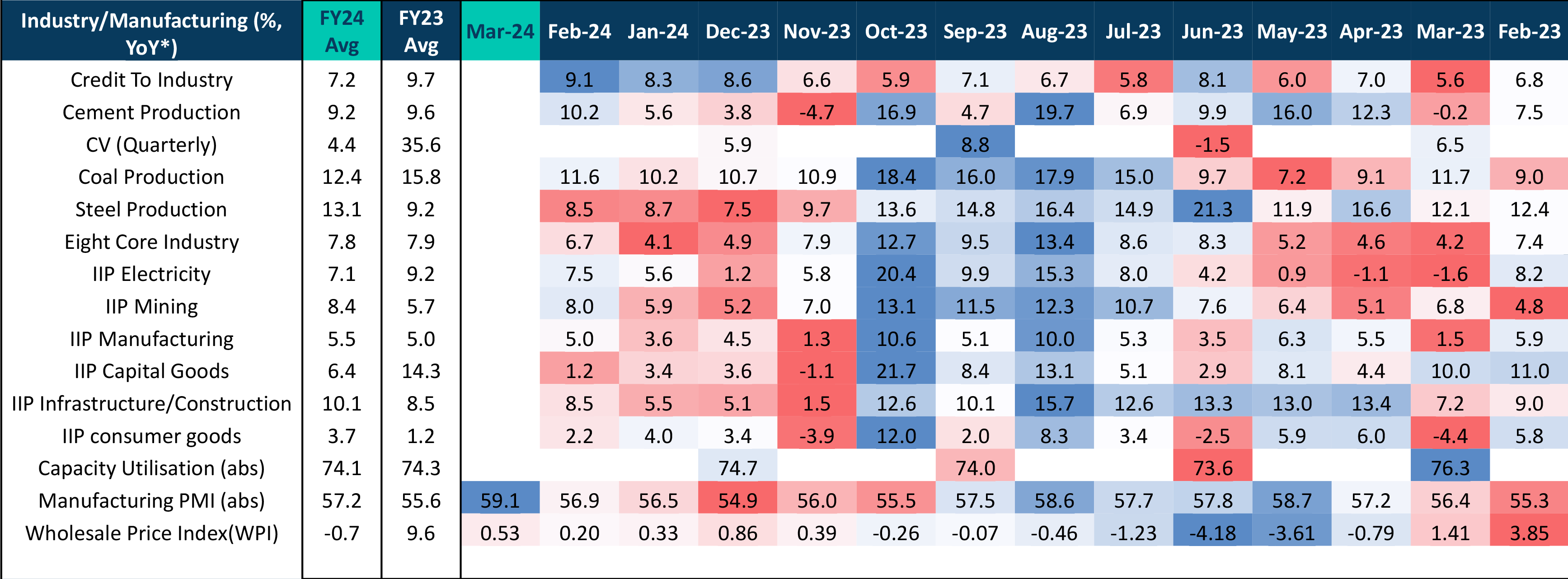

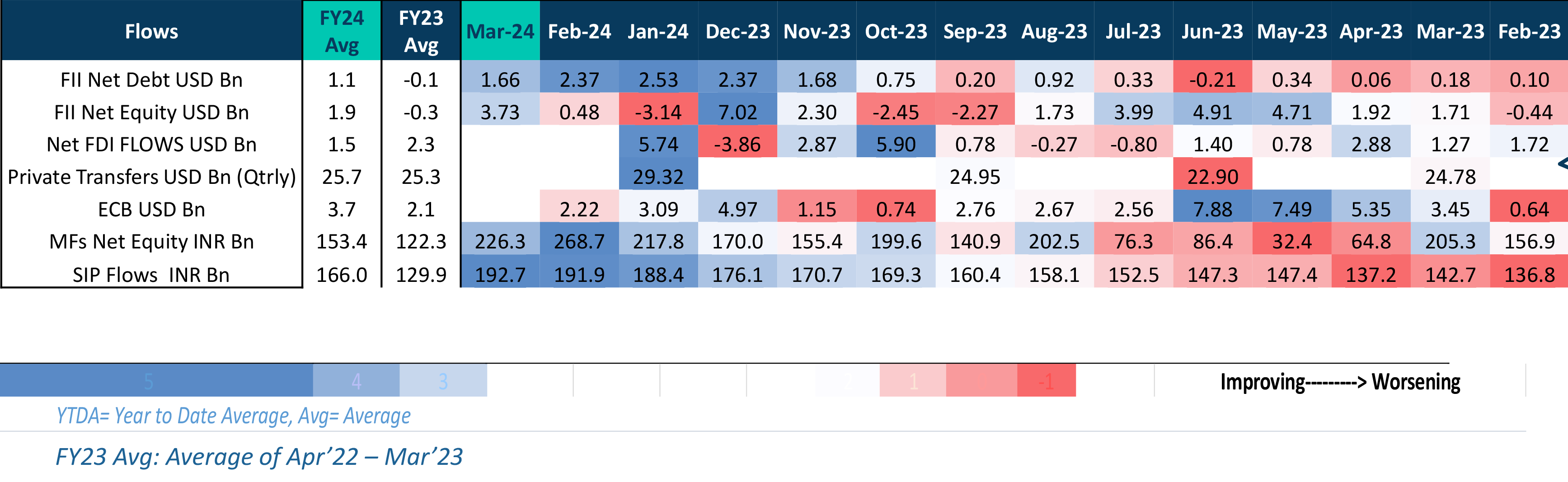

IIP numbers despite a normalized base, paint a not-so-positive picture, signaling subdued production. The bluest PMI ever since the series became available definitely gives reason for better IIP numbers in the upcoming release. An annual negative WPI is an exception, an exception of extremely low raw material costs, and that advantage has exhausted. And now when the exception is on a road towards normalization, the profits could take a hit, in the face of rising input costs.

E-toll have registered the highest collection, largely fueled by the widespread adoption of Fastag and the speeded highway construction at the eve of elections. The sudden downtick in Railway Freight traffic could be a temporary blip, and move towards normalization, once it resumes to normal business. The red streak across the Airport Passenger Traffic is the influence of a distorted base because of the covid dip.

On fiscal front, considering elections are underway, it has been quite surprising to not see a major shift in expenditure numbers, remaining aligned with the nonelection years, establishing an average on 3.5Tr, similar to that of 2023, a nonelection year. But with the model code of conduct in effect, this number might see a downtick in the coming months.

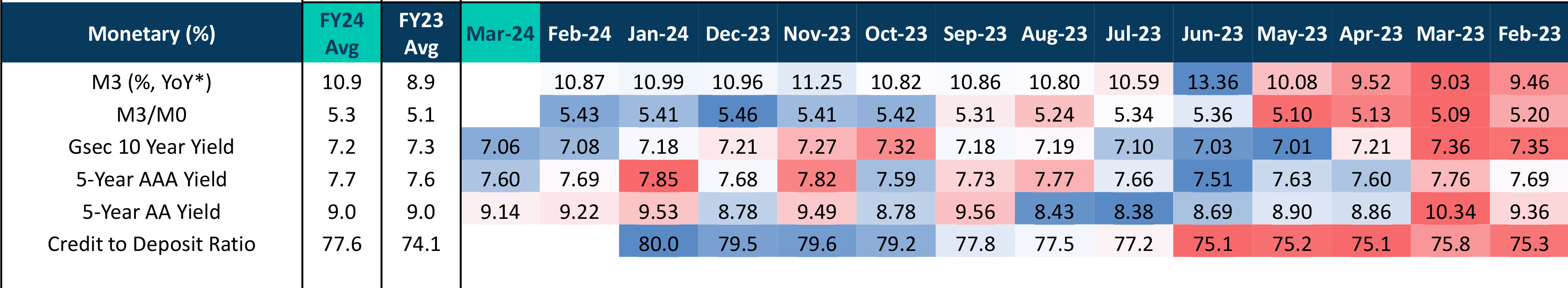

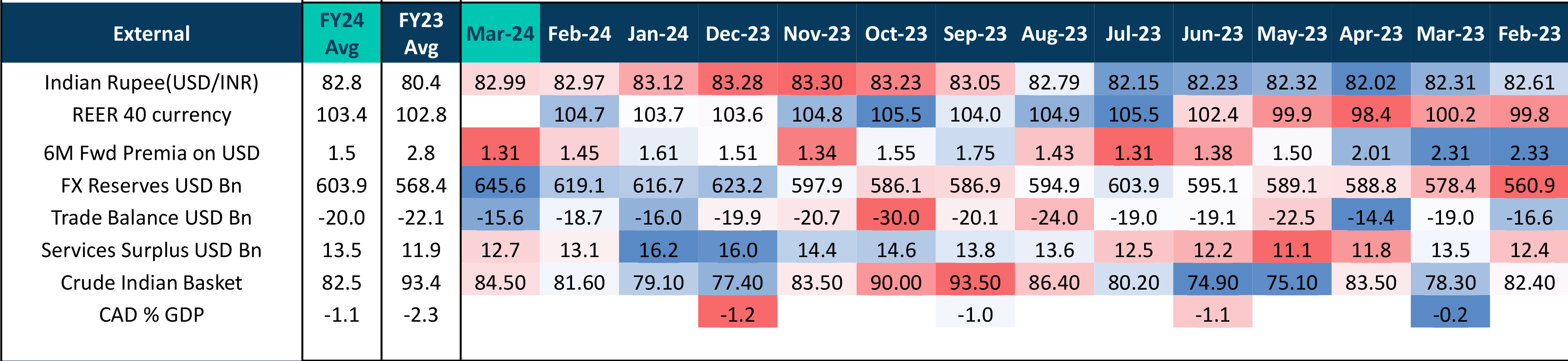

Debt investments from FIIs and ECBs have seen a notable uptick, attributed to India's inclusion in Bloomberg EM index after JP Morgan Bond Index. There has been greater traction towards managed money, thus, a significant rise in MFs and SIPs.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.