TATHYA April 2023

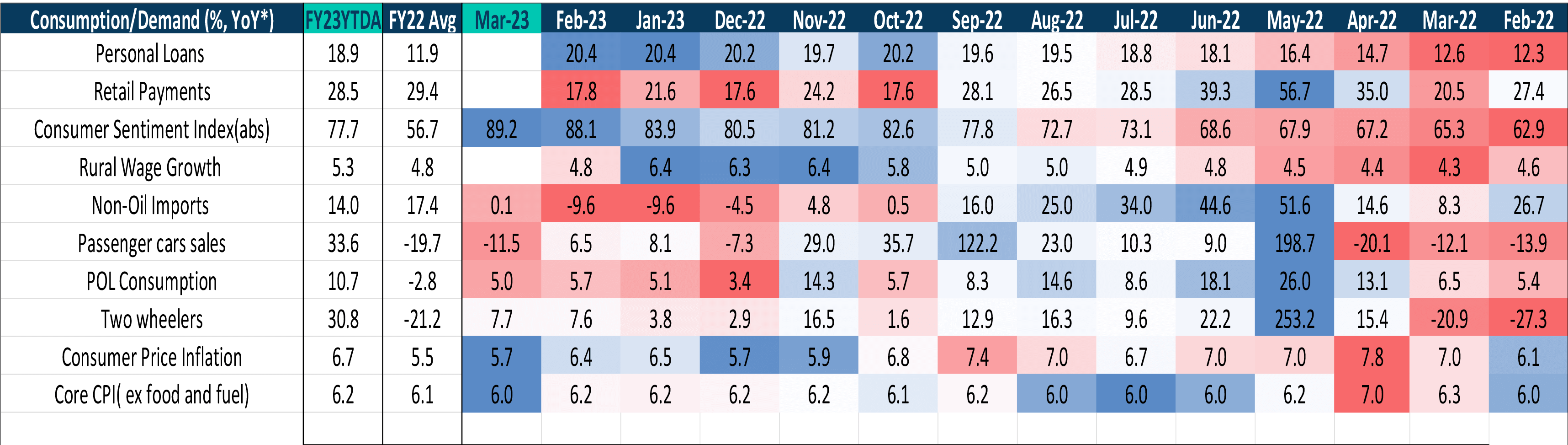

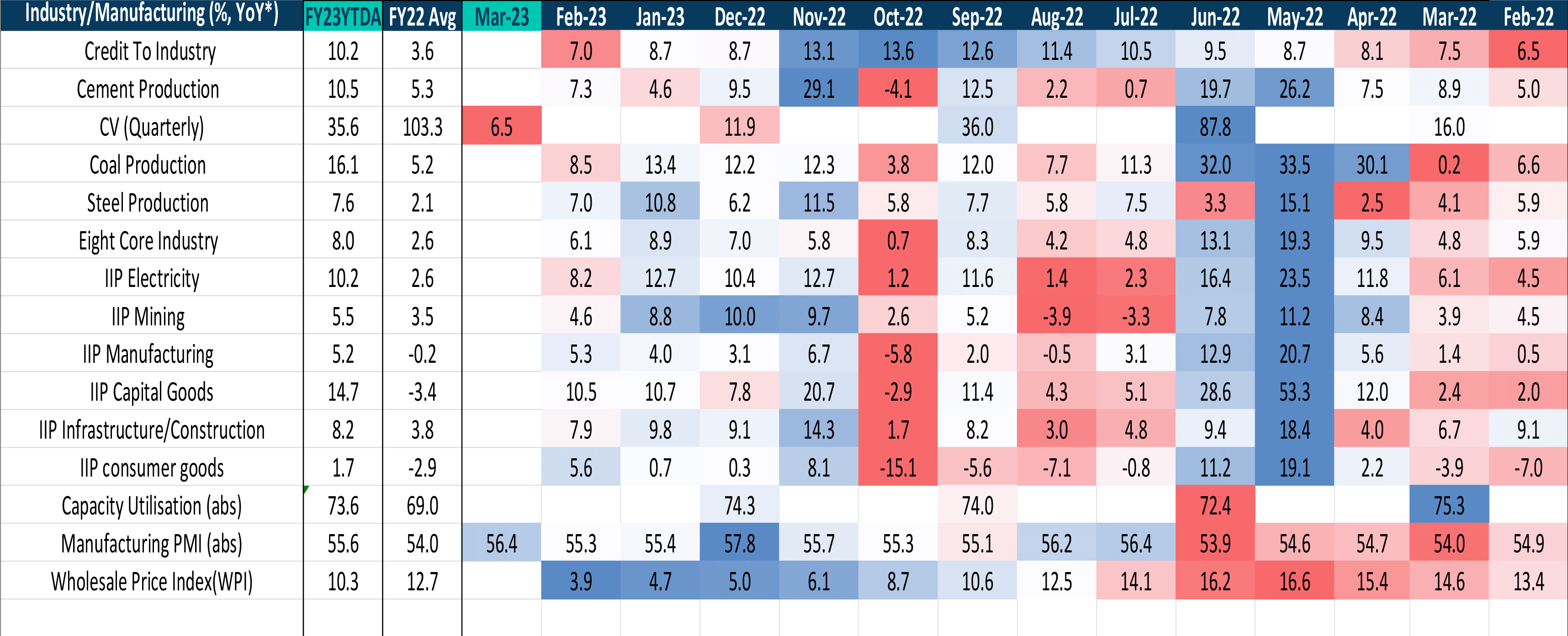

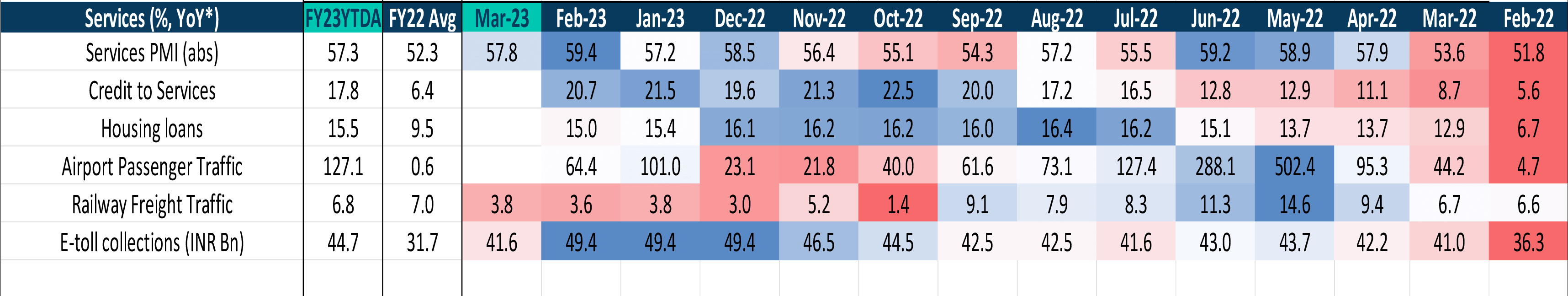

Consumer sentiments continue to be strong. POL consumption is now back to its pre-covid levels and auto demand is healthy. Overall, the slowdown, if any, is yet to be visible in hard data

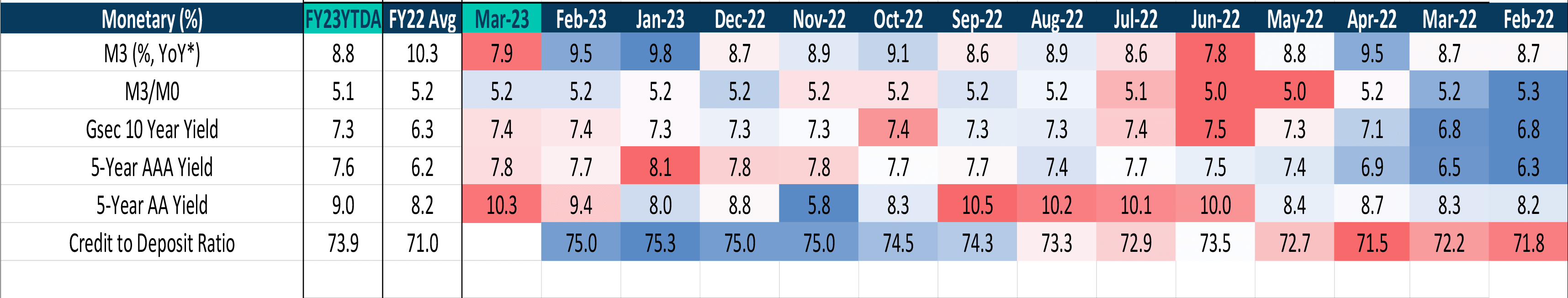

Inflation eased in Mar-23, aided partly by base and partly by slower momentum. Cereals’ prices contracted sequentially. Services inflation, however, remains reasonably sticky

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.