DSP NETRA May 2024

Data & Risk Flash, India in Numbers

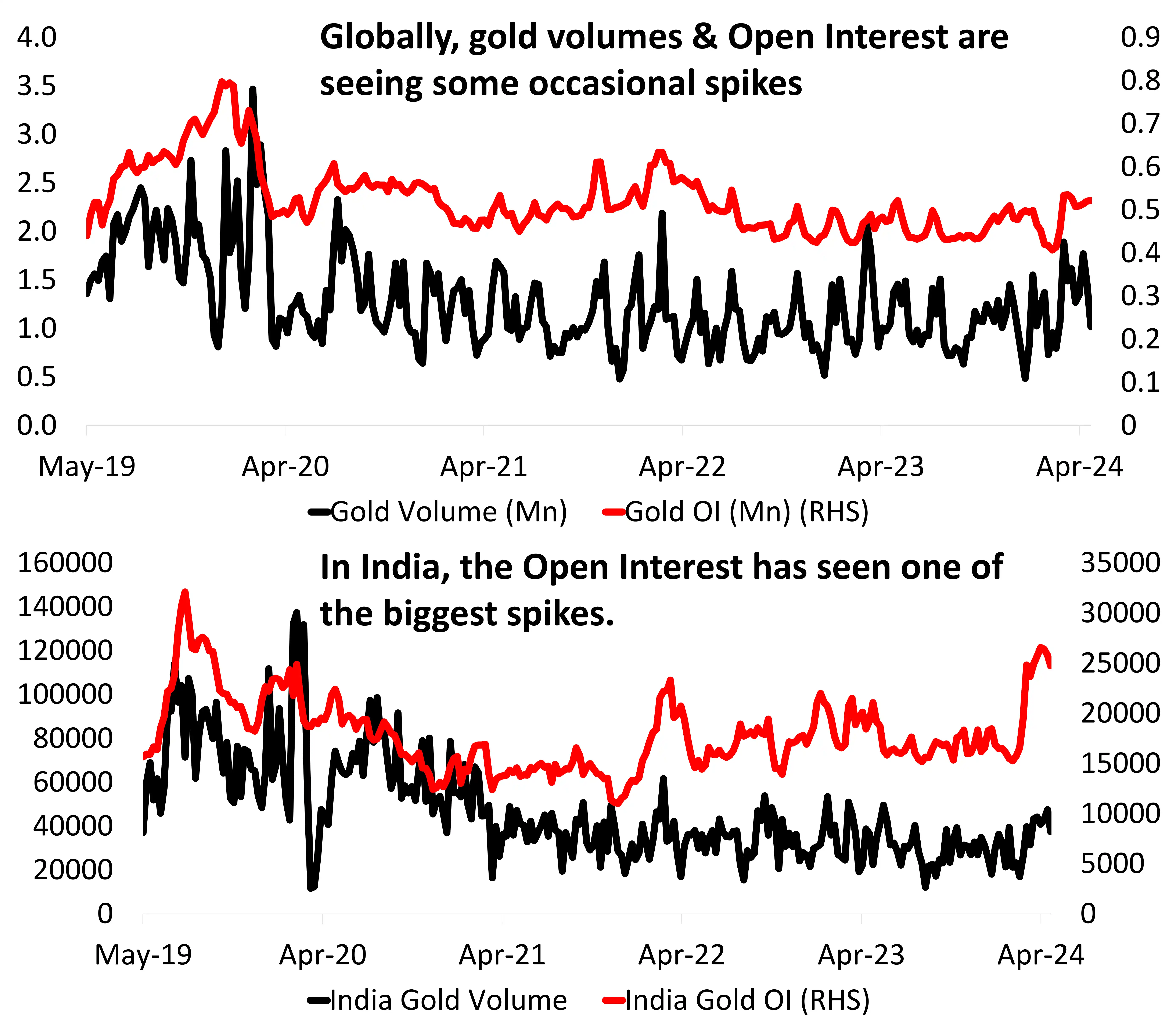

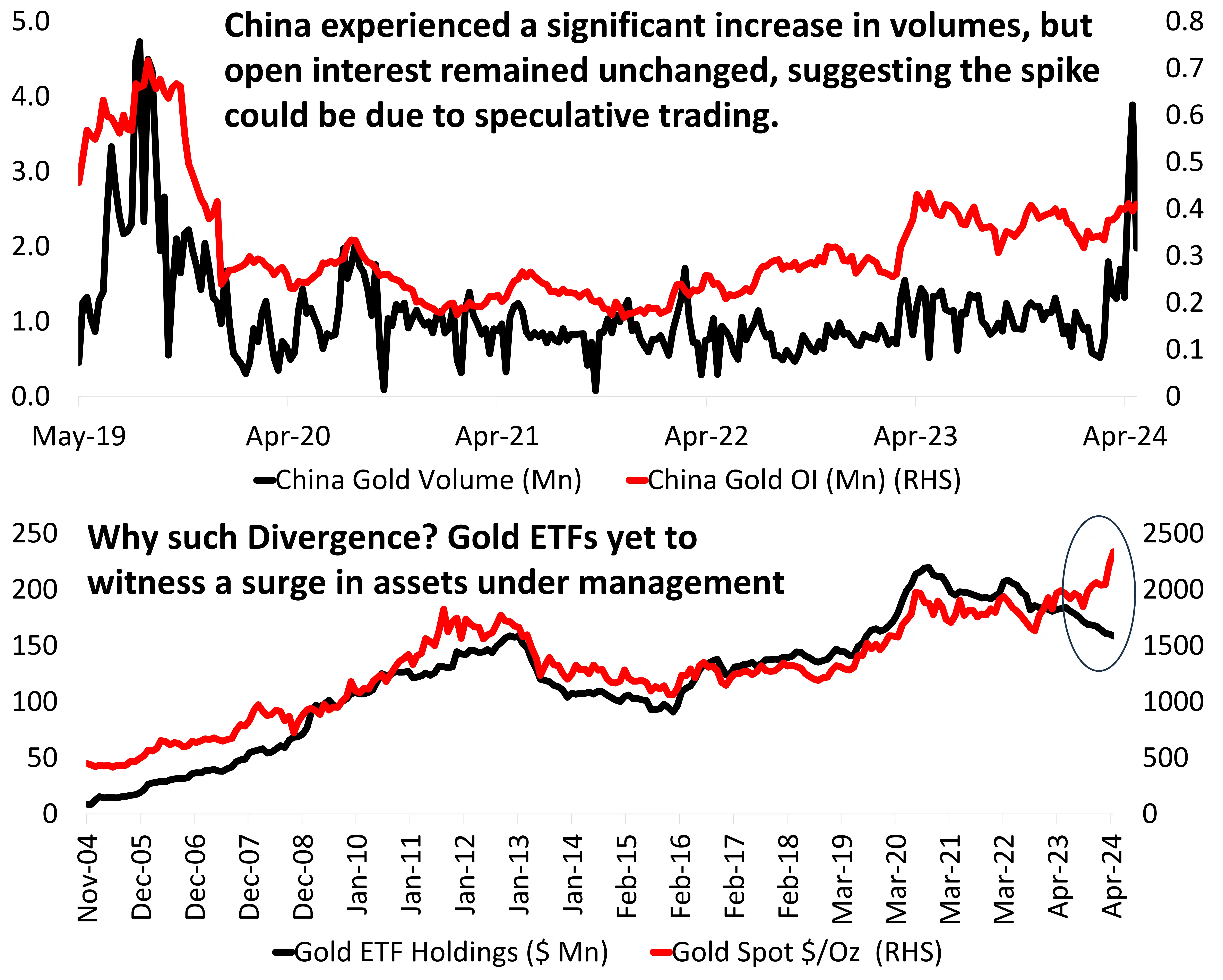

Data Flash: Gold Futures Showing Rising Confidence In Gold’s New Bull Market

Source: DSP, Bloomberg; Data as on Apr 2024.

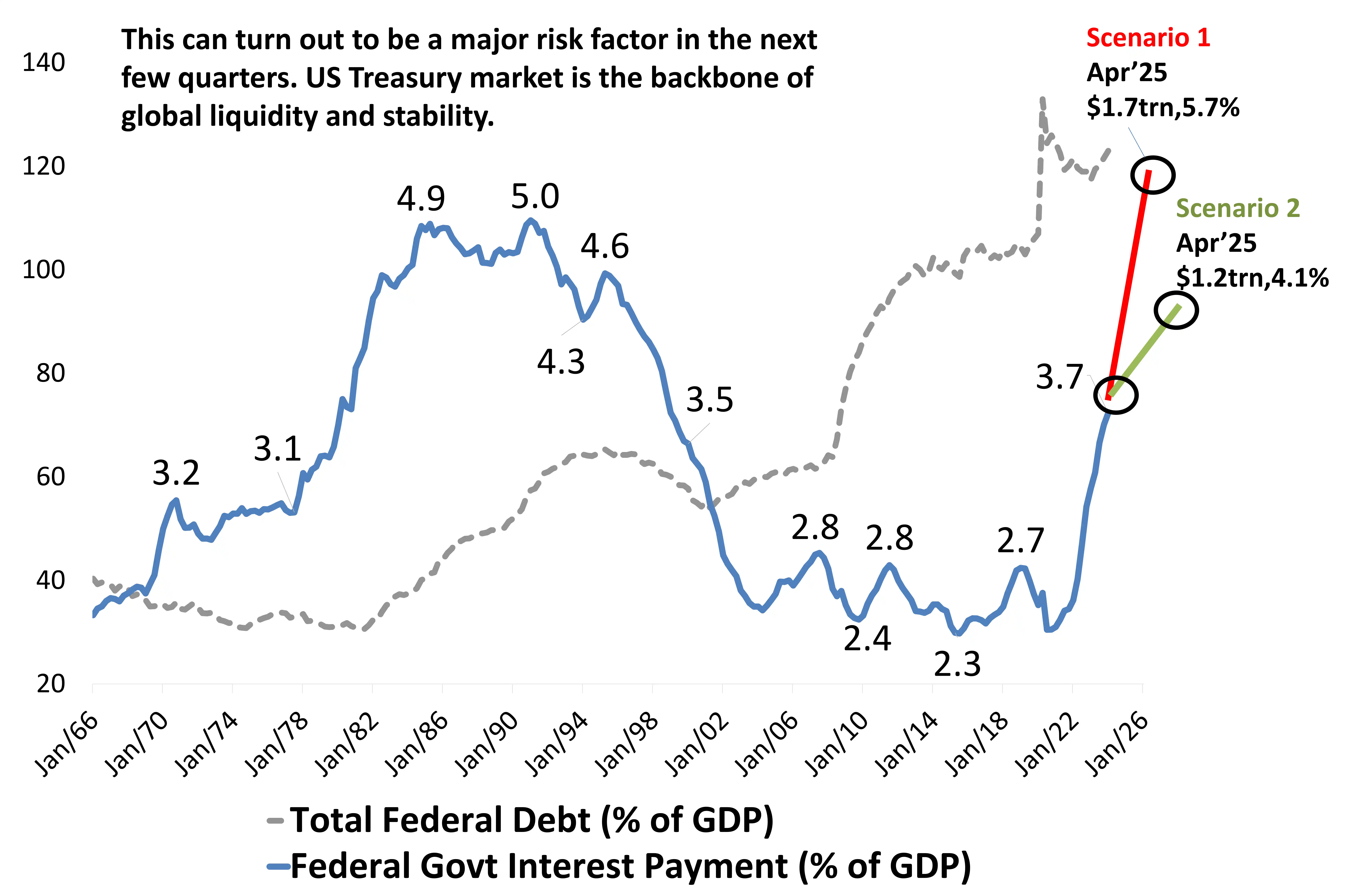

Risk Flash: US Interest Payment On An Unprecedent Ascent If the Fed Stays ‘Higher For Longer’

What path the US Federal Reserve chooses to take with respect to the interest rate trajectory is unknown. But based on Congressional Budgetary Office estimates, if US Federal Reserve keeps the Fed Funds rate as it is over the next 12 months, the US interest payments expenditure will rise to an all time high of 5.7% of GDP at $1.7trn (see scenario 1 in the graph on the right)

However, if the Fed embarks on shallow rate cuts and delivers 150bps of interest rate cut, the Federal Interest payment expense will rise to 4.1% of GDP, the highest levels in nearly 25 years (see scenario 2 in the graph on the right)

This means that US fiscal position is likely becoming more arduous as we get deeper into 2024. The ability of US treasury to continue its break-neck pace of borrowing will come into question. A reversal or reduction in fiscal expenditure at a time when interest rates are at multi decadal highs is likely to be growth negative and a headwind for equity markets dependent on earnings growth. US Federal interest payments touched $1trn last month.

Source: CBO, DSP; Data as on April 2024.

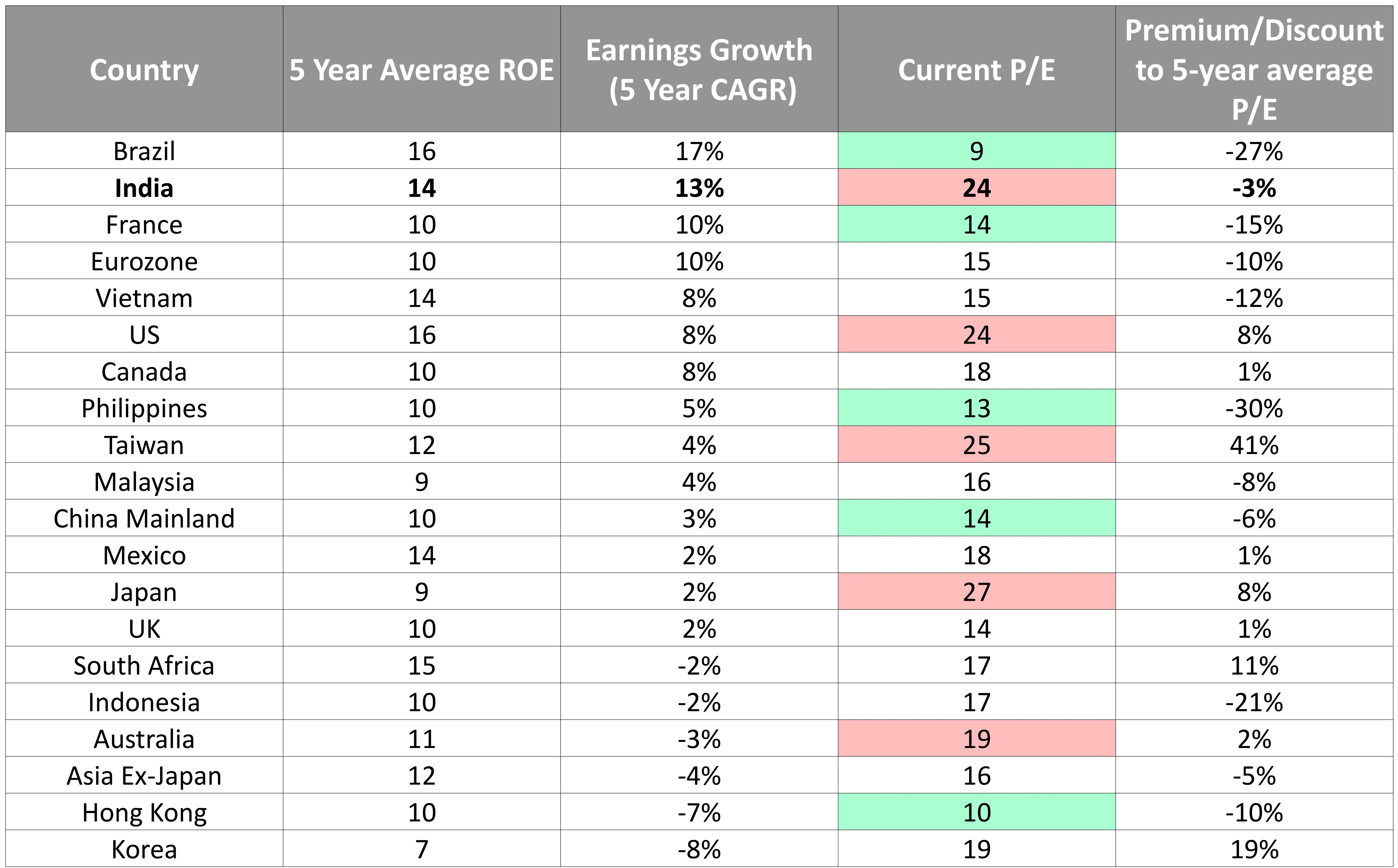

Data Stacking: The 5-Year Look Back For Equities

The global market is currently experiencing a phase of remarkable optimism, buoyed by robust corporate performance and substantial earnings growth. Notably, amidst this landscape, Brazil has emerged as a standout case. It not only exhibits significant earnings growth, but this growth is accompanied by an equally impressive valuation trend.

Brazil is expected to post an earnings growth of 20% in FY25 and the current valuations make it an even more lucrative investment opportunity within Emerging Markets.

China is facing some economic struggles, which have led to market declines. Even though earnings have been downgraded, the stocks are now available at good valuations. One of the lucrative sections of EM, by size.

India stands out for its impressive earnings growth, albeit accompanied by premium valuations. Consequently, Indian equities no longer represent a bargain opportunity. Indian equities lack margin of safety.

Source: DSP, Bloomberg; Data as on April 2024. Top 5 Most Expensive Markets (Red) & Bottom 5 Cheapest (Green)

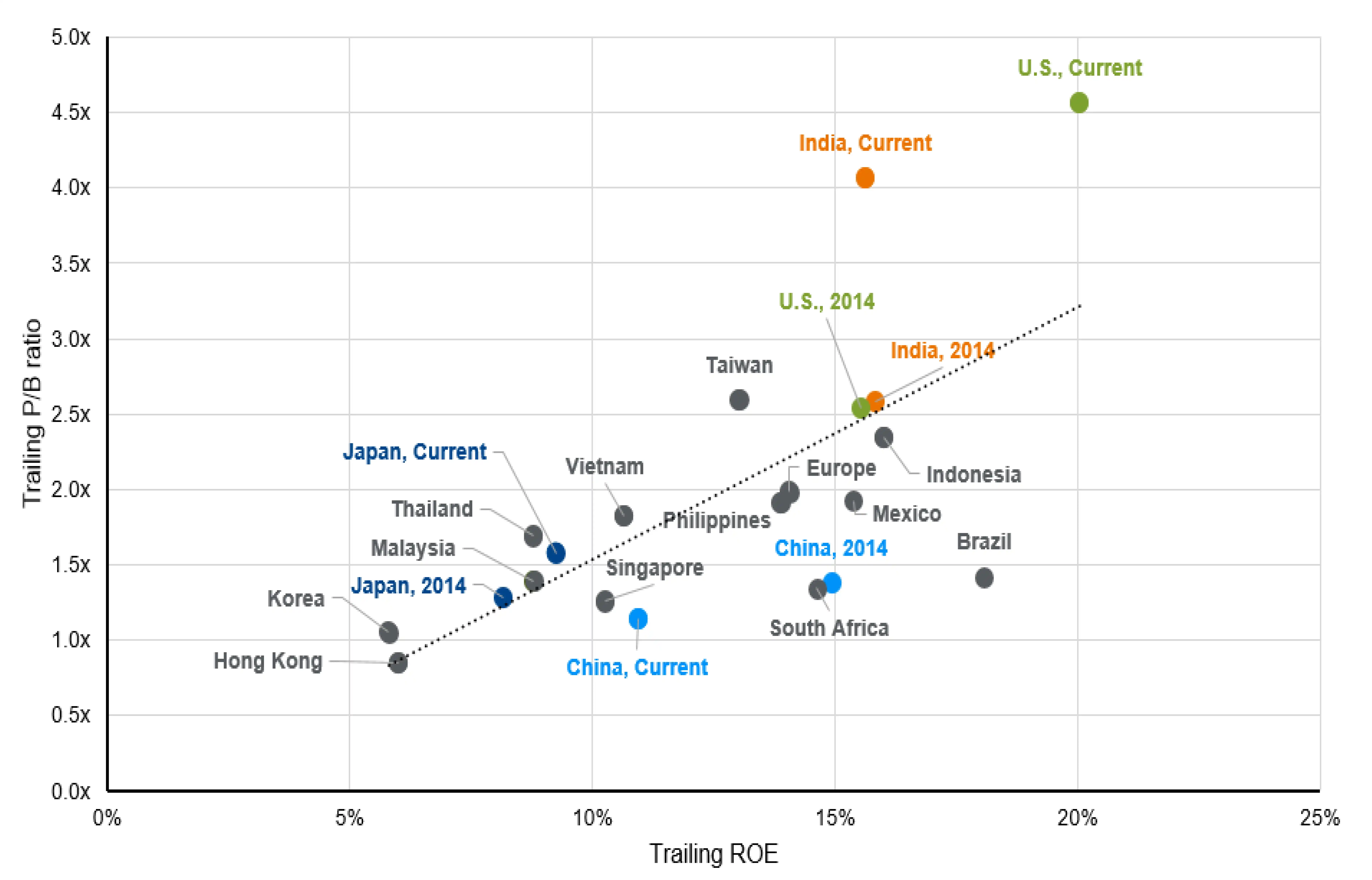

Data Stacking: The Current Picture for Equities

Emerging markets vary widely in quality, with India considered high-quality and traditionally expensive, while China and South Korea are perceived as lower quality and cheaper. Investors should assess these markets differently.

India's appeal stems from favorable demographics, economic reforms, and supply chain realignment. Despite its high price-tobook ratio (over 4x, akin to the U.S.), its returnon-equity matches that of the U.S., justifying a premium valuation. If India were to cheapen significantly, it could offer an excellent entry point for long term investors.

Similarly, the U.S. market features quality companies with elevated valuations, contrasting with Japan's historically opposite traits.

However, recent corporate governance reforms in Japan are driving improvements in ROE and P/B, offering investors a rare opportunity for market revaluation.

Source: DSP, Bloomberg, FactSet, MSCI, J.P. Morgan Asset Management. Numbers are based on MSCI indices except for the U.S. which is based on the S&P 500 Index. ROE = return-onequity and P/B = price-to-book ratio. Last 12-months' figures. Guide to Investing in Asia. Data are as of April 26, 2024.

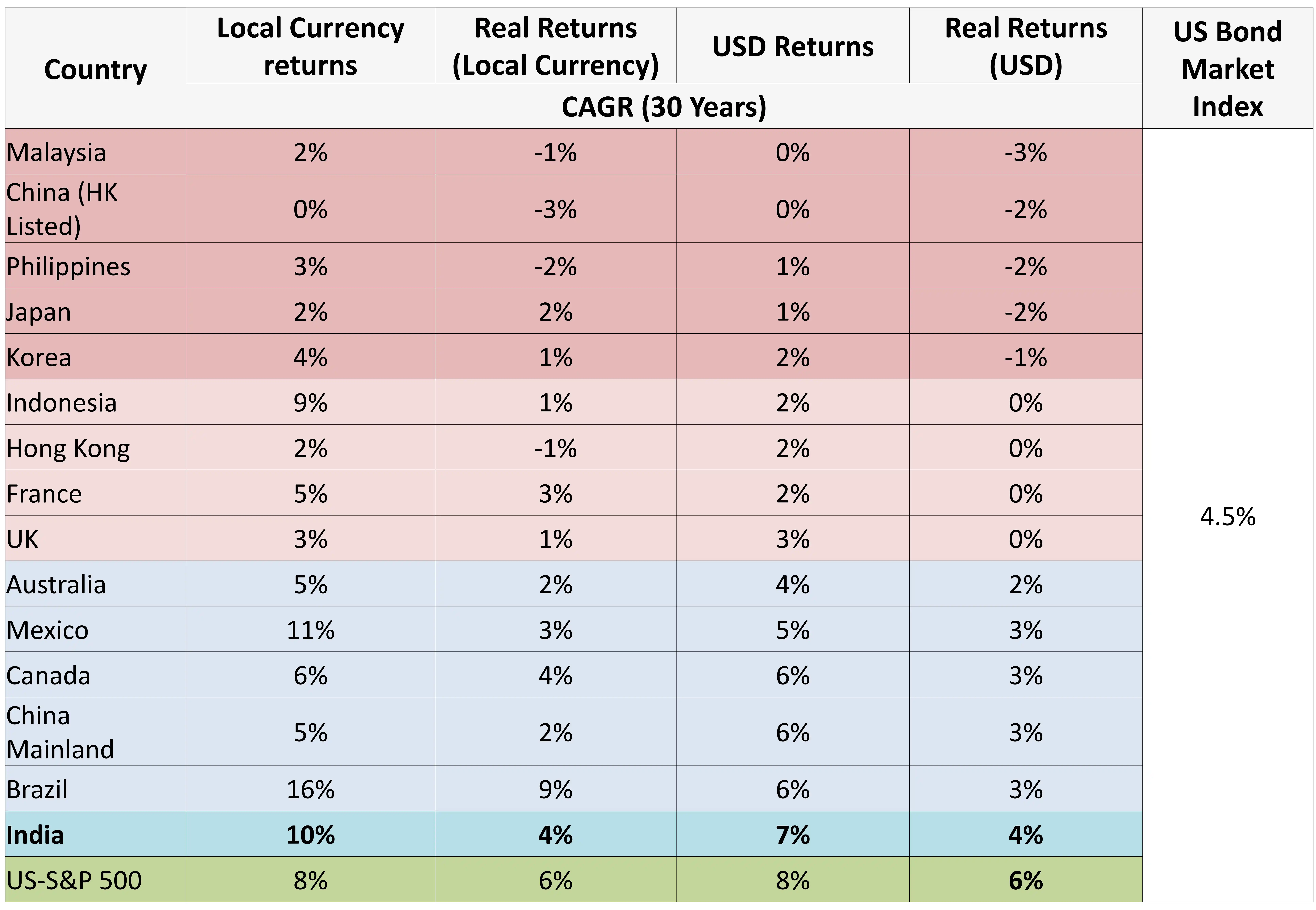

Data Stacking: Long Term Equity Returns Are An Exception, Not the Norm

Most equity investors believe that equity markets deliver superior returns over the long term. This is true. But only in a very few markets. Long term equity returns are an exception, not the norm

Over the past 30 years, among the 16 major indices, only US market has generated returns higher than US Bonds.

In USD terms, more than half of these markets have generated nil to negative real returns over the past 30 years.

Even in local currency terms, there is no index which has generated double digit real returns over the last three decades.

Source: Bloomberg; Data as on Apr 2024. Bloomberg US Aggregate Index is considered for US Bond Market Index.

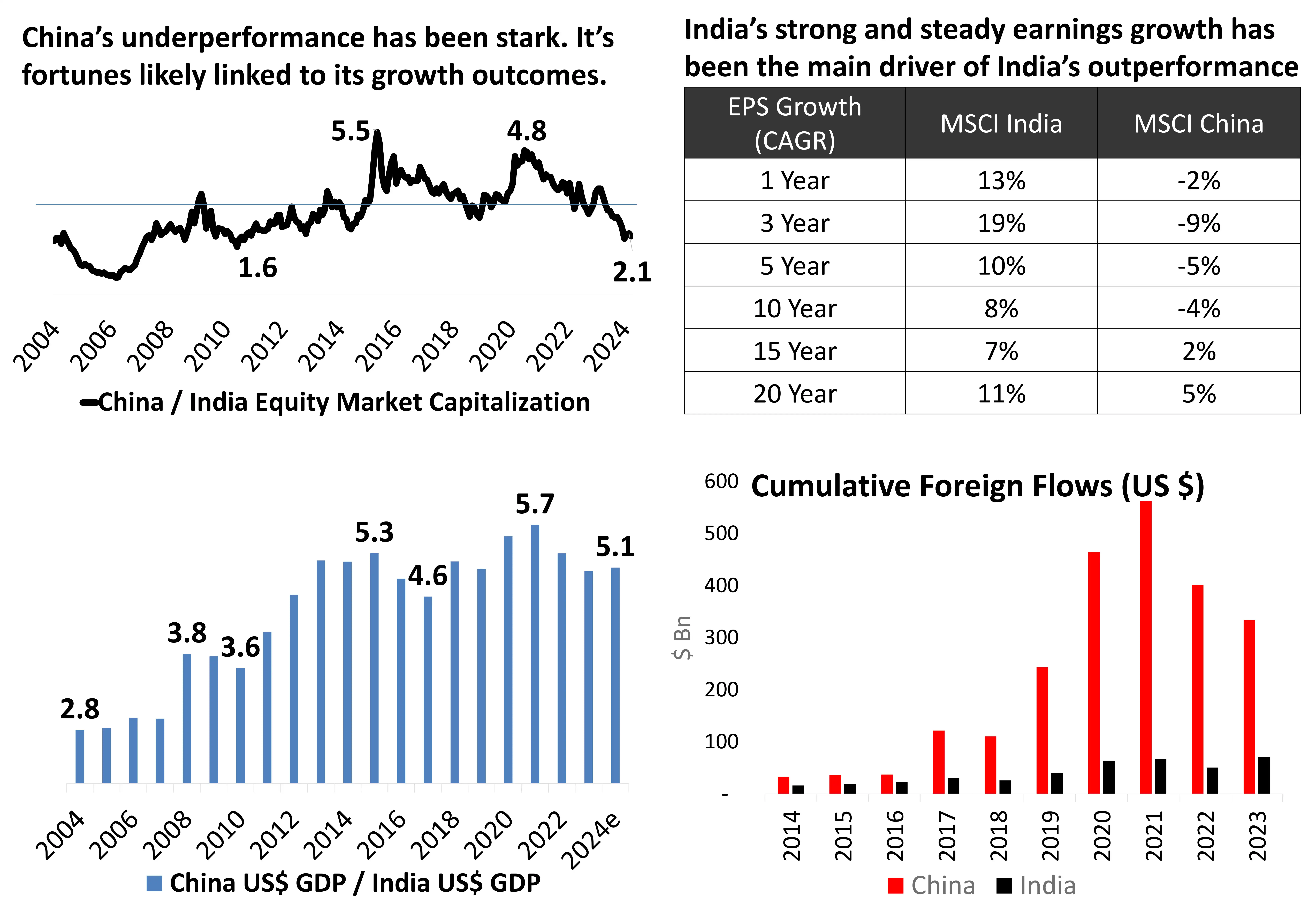

China's Equity Lags Despite Boasting a Far Larger GDP

China’s equity markets have lagged Indian equity by a long stretch. China’s current equity market capitalization is double that of India, at a time when it’s GDP is 5 times that of Indian GDP.

Between 2004 and 2021, China’s economy outgrew India’s GDP at a ferocious pace, but has lost some relative momentum since. Over the past 3 years, Indian economy and equity markets have outperformed China.

At this juncture, India’s frontline stock index, the Nifty 50 Index trades at 23x trailing earnings, while the Shanghai Composite trades at 11x trailing earnings.

Can these valuations differential sustain? Can the size of the economy begin to converge, and India outgrow China over the next few years?

The market is behaving as if the answer to these two questions is a yes. But valuations attractiveness could be a major hurdle.

Source: DSP, Bloomberg; Data as on April 2024.

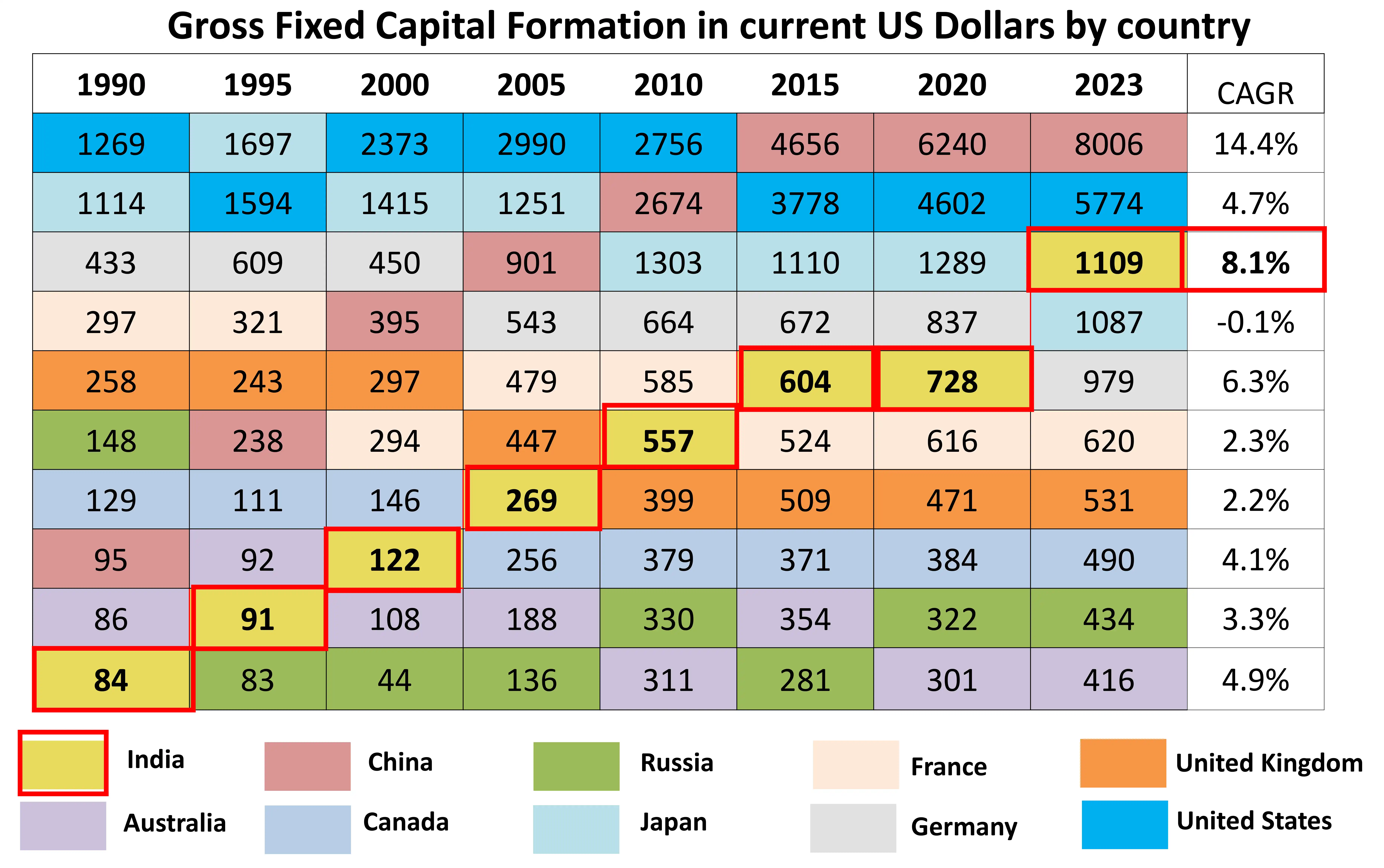

India: A Trillion Dollar of Annual Investments

India has come out of an investment winter. The investment to GDP ratio (measured as Gross Fixed Capital Formation to GDP) peaked in 2011 and remained low until the COVID-led disruption upended the supply chains. Post COVID recovery and a large push through government expenditure, the investments are making a come back.

Over the last seven and a half decades, $14trn has been spent on investments since independence. This includes spending on housing by households, infrastructure creation by the government, and private capital expenditure. India has spent $8trn on new investments over the last 10 years. As the base becomes large this number will repeat itself in the next 5 years.

What does this mean? The size of India’s annual investments is becoming large enough for it to get your immediate attention.

Source: World Development Indicators, Bloomberg, DSP; Data as of Apr 2024

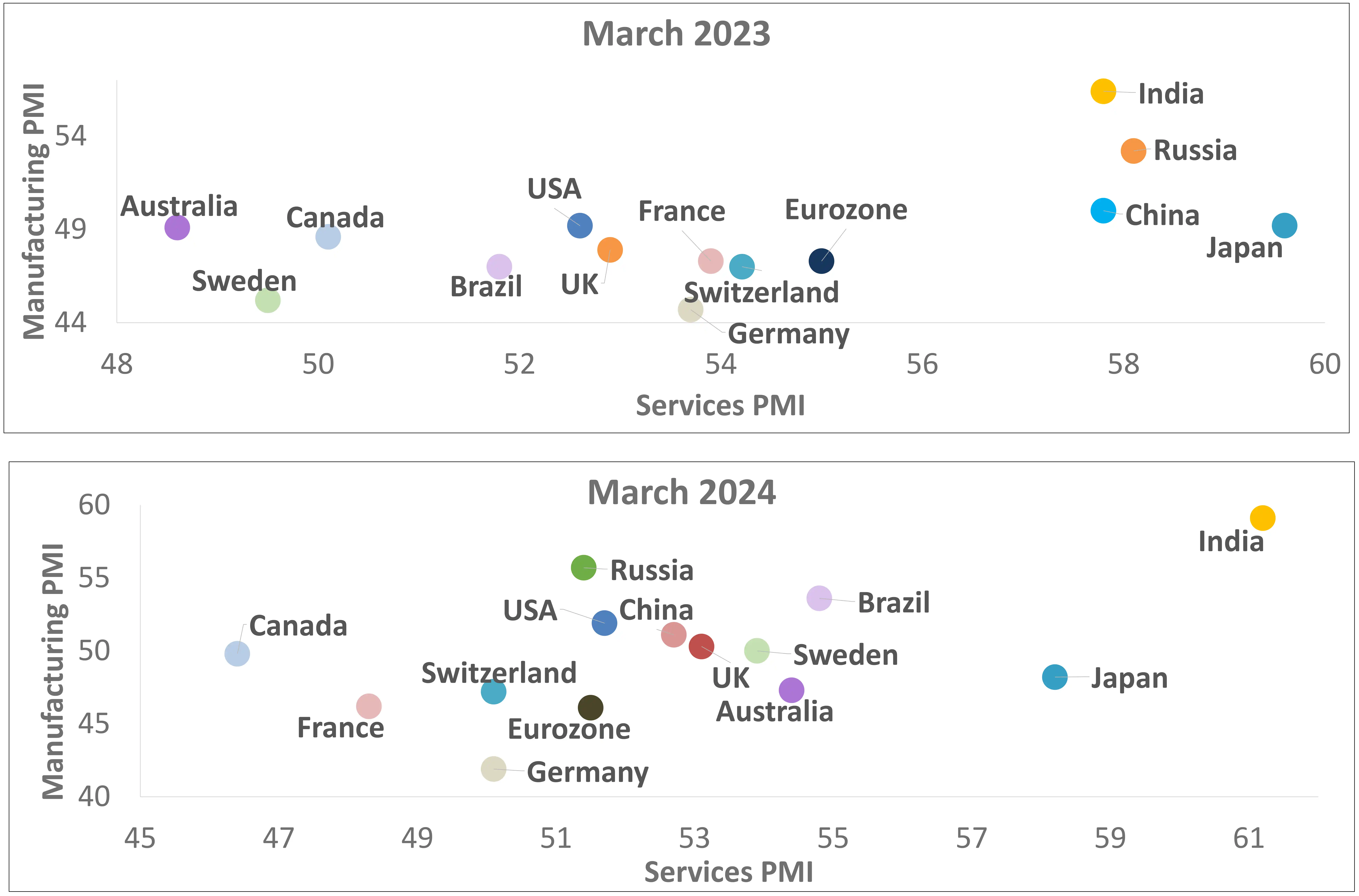

Indian Economy Dancing To Its Own Tune

While the global economic landscape has been a bit wobbly, India has remained a steady ship in choppy waters. The economic growth has been consistently strong with corporate top line and profit growing steadily.

As is visible from the graph on the right, over the past 12 months, most economies have seen a slowdown in their manufacturing sector or services, or both. India, over the past year, has seen a consistent growth in economic output and business sentiment.

Its divergent economic trends have long been an outcome ‘in-waiting’, though never realized. But over the past year, India has shown a consistency which is probably the first evidence suggesting that India’s economic and businesses cycle can withstand global turbulence of manageable magnitude.

The reason? A stable external situation. Read ahead.

Source: Bloomberg, DSP; Data as on Apr 2024

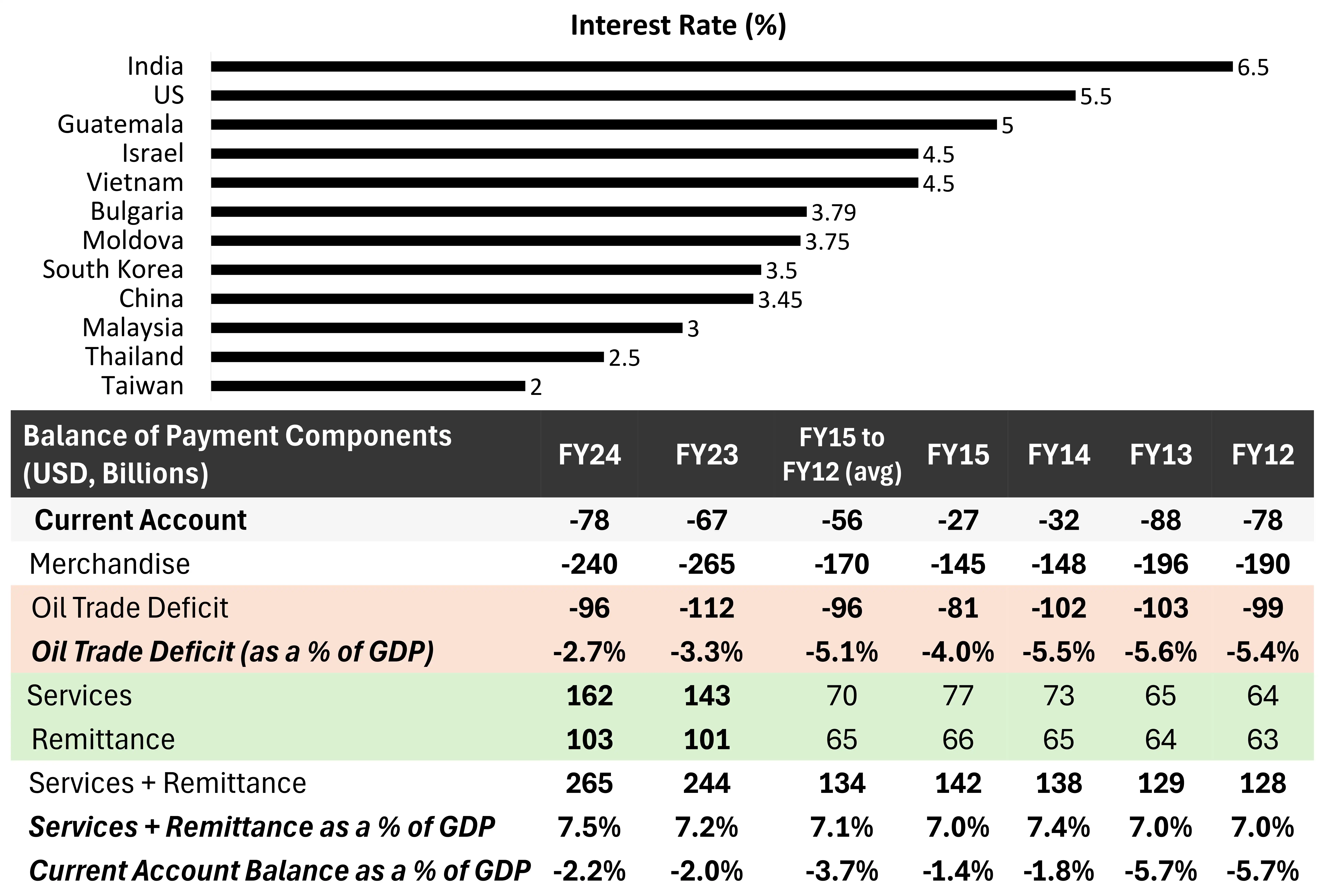

India Stands Out With High Real Rates

Most emerging market currencies are struggling with negative carry against the US Dollar. This has forced the central banks of these countries to be cautious in FX policy and setting their interest rates.

Recently, Indonesia has raised rates to 6.25% to support its currency as US Dollar strengthens. For India, a mix of strong current account, strong FPI inflows, especially in debt markets, and RBI’s wait and watch approach has helped the currency. Strong services flows and remittances have been a big pillar of support which has kept India’s macroeconomic outlook stable.

This circle of reinforcements has allowed monetary policy to remain stable in the face of a wobbly globe.

The biggest risk to this hypothesis flows from domestic price pressures, which for the time being remain benign, and through any spike in crude oil prices.

Source: Bloomberg, CMIE; Data as on Apr 2024.

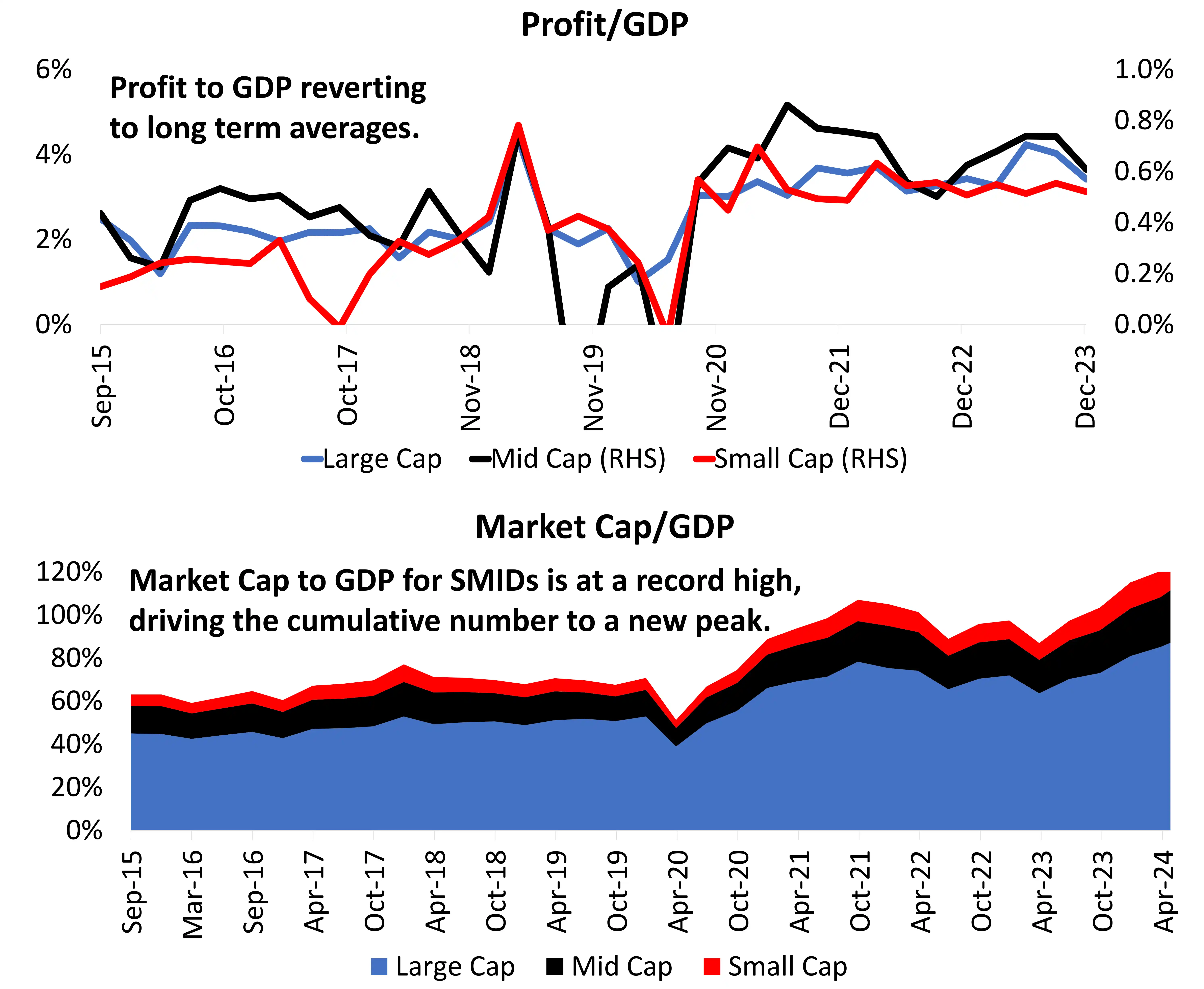

India’s Market Cap to GDP At Record, Profits Lag

Source: DSP, Capitaline; Data as on Apr 2024.

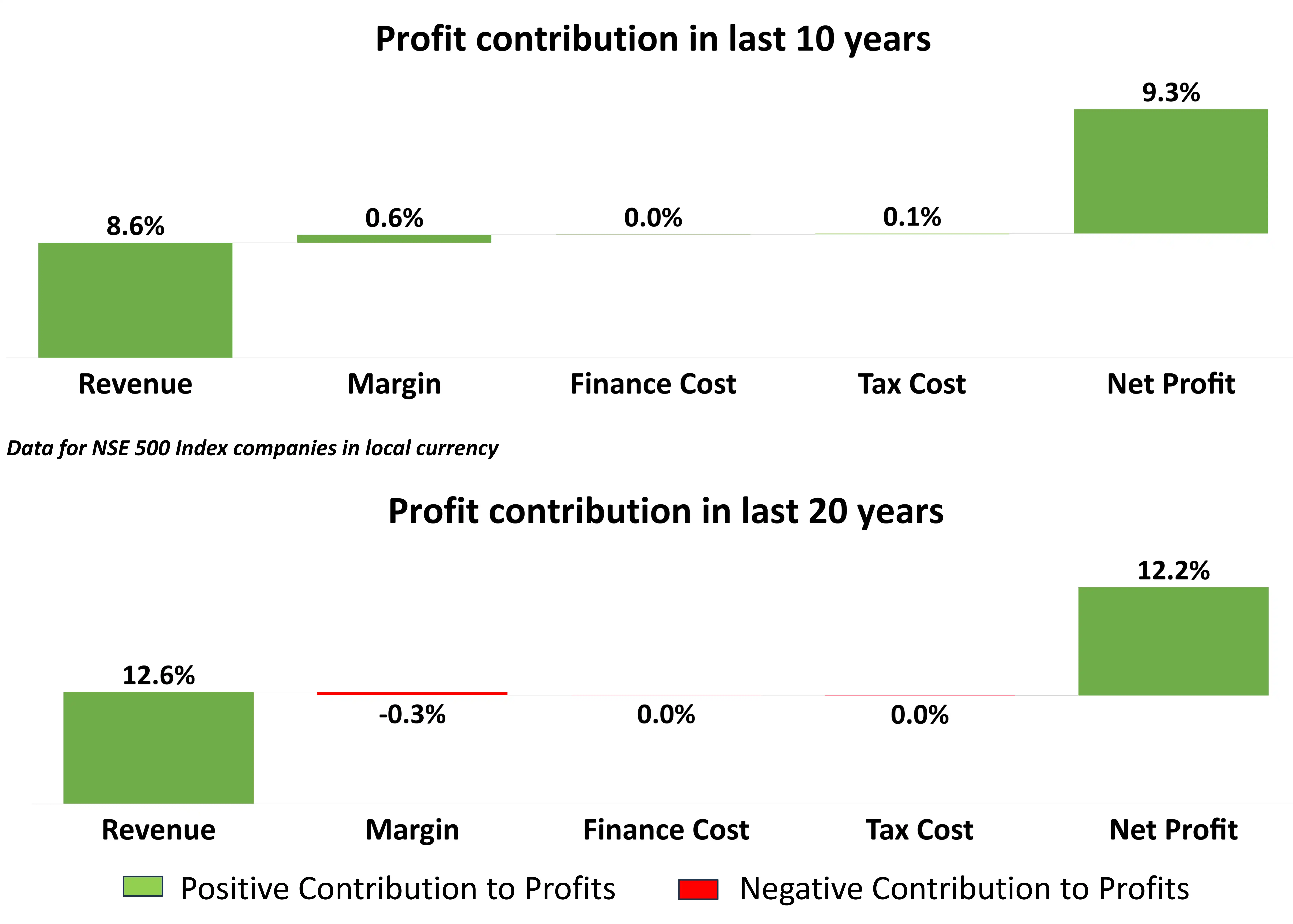

What Has Contributed To Corporate Profit Growth In India?

India has now become the second largest equity market in Emerging Markets. India’s share in emerging markets has increased from 7.8% in 2020 to 17.7% at present. This substantial growth is primarily attributed to the increased profitability of companies, surpassing their pre-COVID growth rates, and to consistent performance of equity indices.

What contributed to healthy levels of profit for

corporate India?

A growing topline and stable profit margins for

Indian companies and a relatively stable

financial and tax regimen. The effect is a

double-digit Net Income/Profit Growth at a

broad level over the last 20 years.

A deeper analysis reveals that this feat was achieved through enhanced capacity utilization and increased capital expenditure, which propelled revenue growth and consequently, profit growth.

Source: DSP, Bloomberg; Data as of Apr 2024. The data is of Nifty 500 companies.

Cyclicals Have Dominated This Bull Market Earnings Growth

From the last quarterly earnings (March 2020), before COVID led disruptions hit corporate earnings till the end of FY24, there is diverse performance from companies.

A significant portion of companies in the Commodities sector have seen their earnings double or more during this period. Sectors such as Commodities, Energy, and Utilities have exhibited robust earnings growth, suggesting a favorable environment for cyclical companies. However, the sustainability of this growth remains a pivotal question.

Conversely, major sectors including consumer discretionary, IT, and FMCG have experienced subdued earnings growth—a departure from the norm during periods of robust market performance. The prevalence of a bull market driven by cyclical companies introduces a degree of apprehension, as such markets are inherently prone to correction.

Source: DSP, Bloomberg; Data as on Apr 2024.

What’s your seesaw to success?

Source: Money Visuals, LLC

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.