Gold, EMs, Midcaps & India

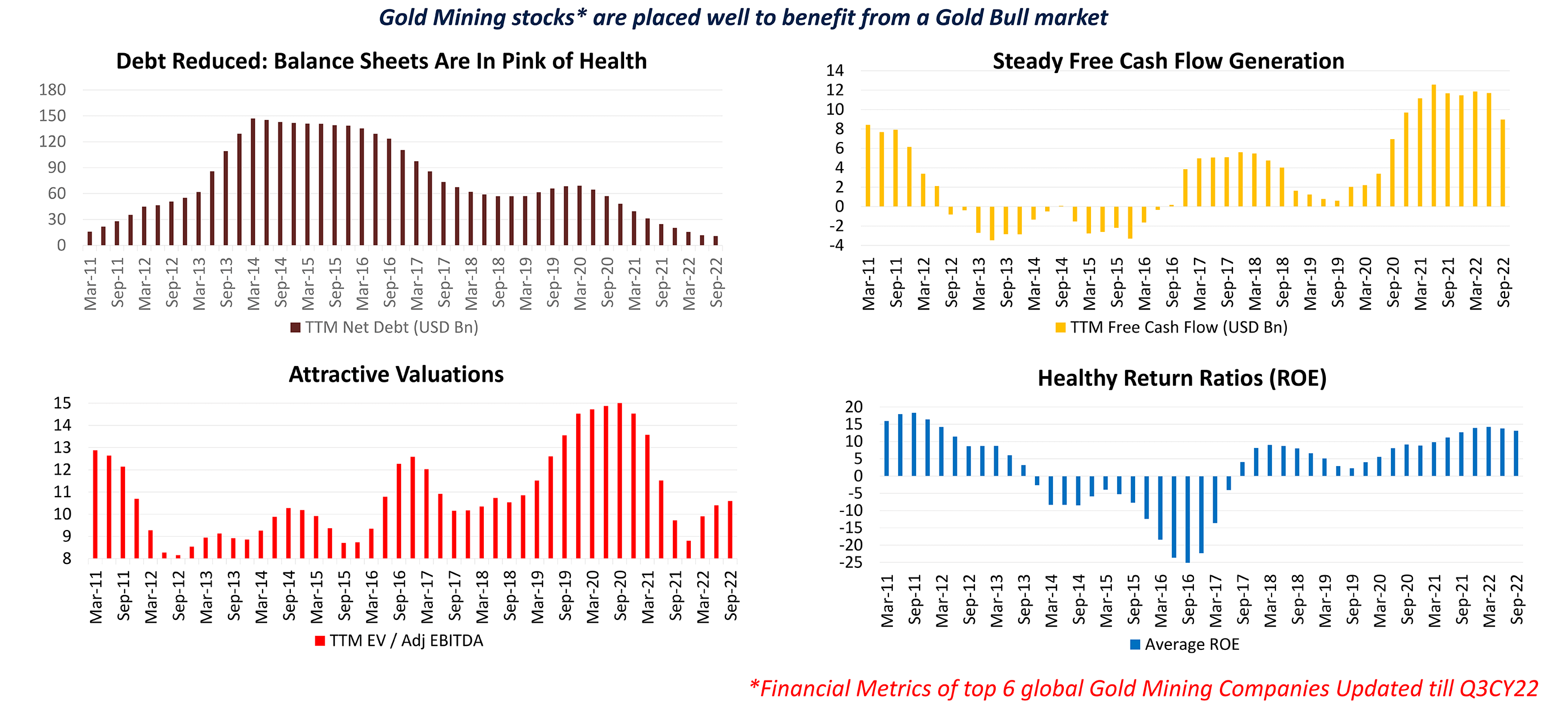

Gold Mining Stocks: An Opportunity Awaiting A Trigger

Source: Bloomberg, DSP As on Nov 2022

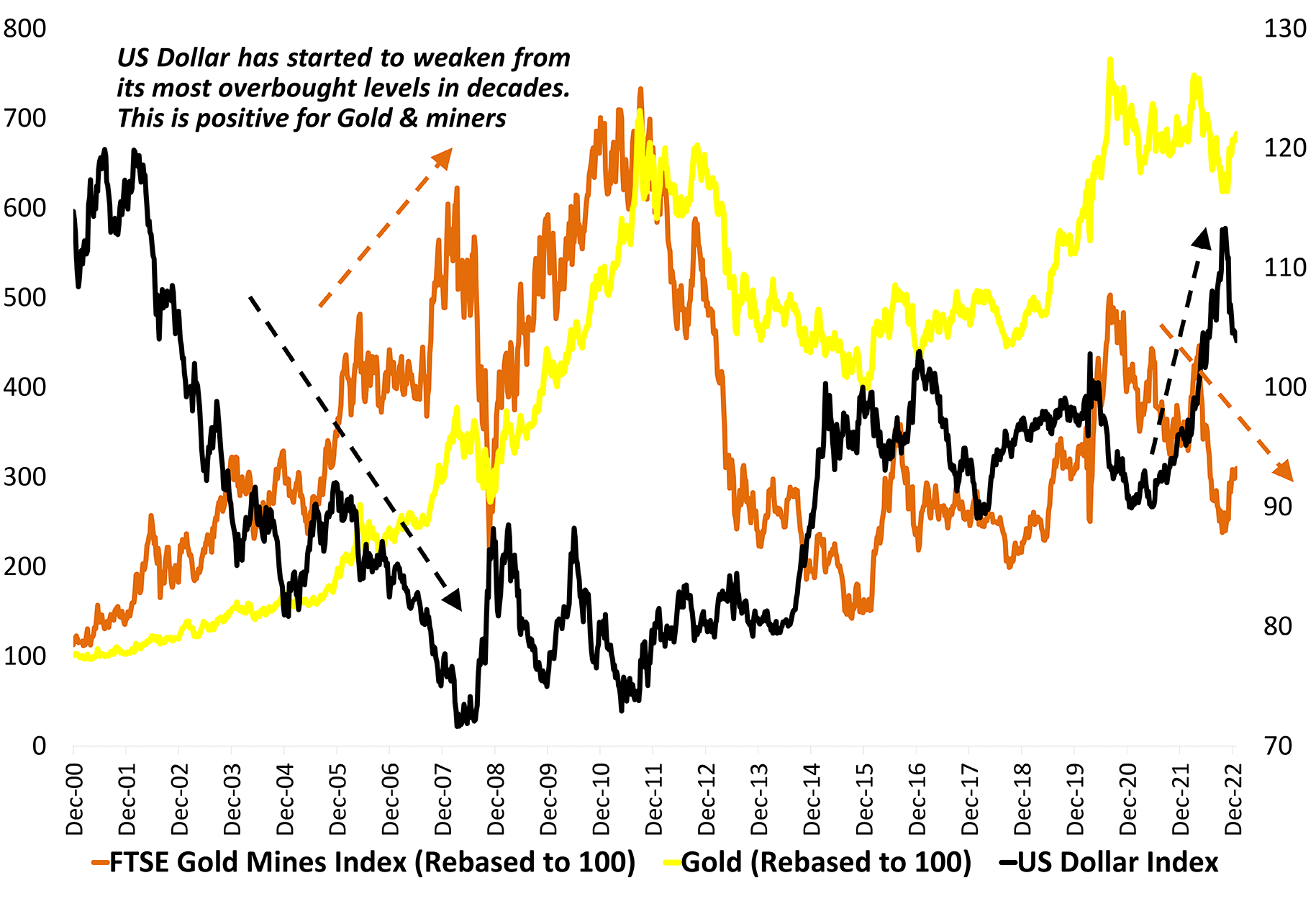

Gold & Gold Miners Have Been Held back by A Strong US Dollar. That’s Changing Now

Gold moves in the opposite direction of the US Dollar. Since Gold is priced in fiat currencies, the weakness or strength of the currency is reflected in Gold prices. In the last 18 months US Dollar Index rose nearly 27% (90 to 114.8). This, among other reasons, led to a halt in Gold’s bull run which began in 2018. Over the last 2 years Gold prices have not been able to exceed the highs made in Aug 2020.

Recently, the US Dollar Index peaked & corrected nearly 10% infusing bullishness in Gold prices. Gold mining equities have lagged this uptick in Gold.

Historically, miners have enjoyed strong price performance when Gold prices breakout to new life highs. Can 2023 be the year in which Gold prices breakout? It’s possible. This means Gold miners could be the place to be in 2023 and beyond.

Source: Bloomberg, DSP As on Nov 2022

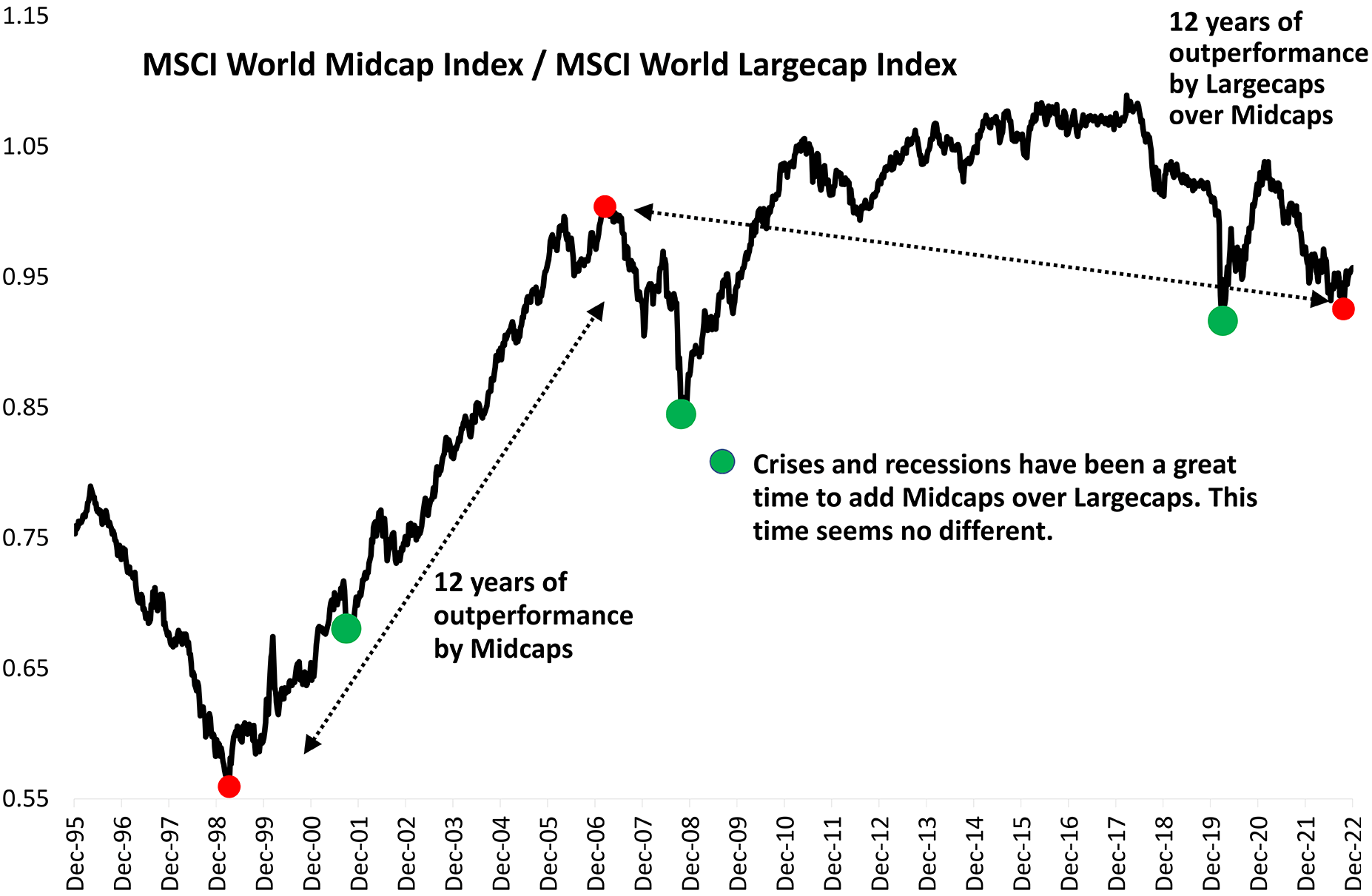

Is It Time For Large-cap Outperformance To End?

Over the last 10 years, the earning per share (EPS) of the MSCI World Midcap Index has compounded at a CAGR of ~11%, that’s double the large cap index CAGR of 5.5% during the same period. However, during this time the Midcap index has underperformed the largecap index. This is because the starting valuation a decade ago (the price to earnings ratio or the PE) for the Midcap Index was at a 30% premium to Largecaps. This valuation premium has since shrunk, and now the Midcap index PE is at a 10% discount to large cap index PE.

Today, midcap valuations globally are relatively better than large caps. Midcap earnings could also be better because we have come out of a COVID shock where ‘Big Became Bigger’. The larger companies gained more market share because smaller ones found it difficult to survive. That tide may have turned. Thus, pay attention to mid and small cap stocks.

Source: Bloomberg, DSP As on Nov 2022

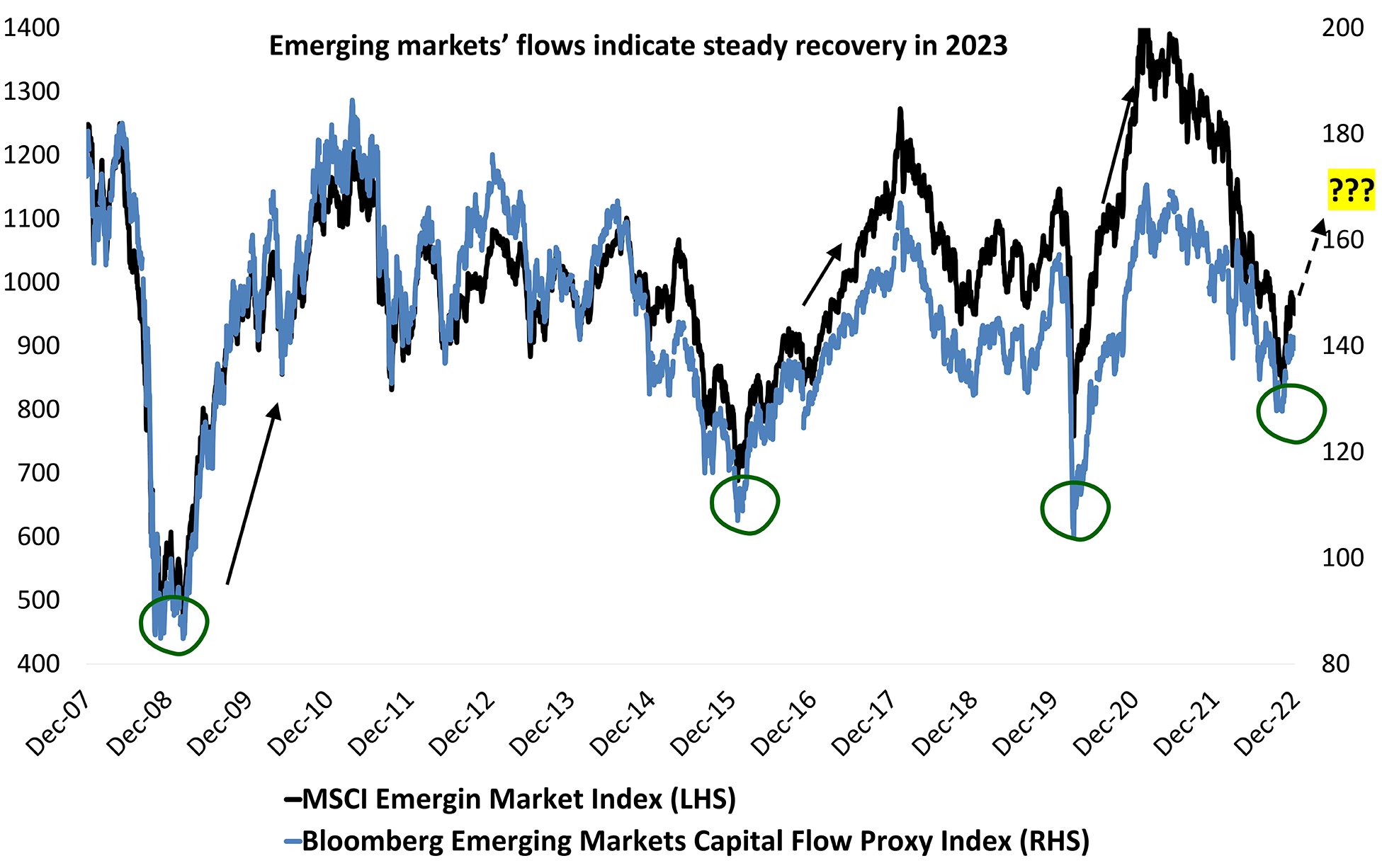

Emerging Market Flow Proxy Suggesting Continued Strength?

EM Capital Flow Proxy Index is a daily composite index of the performance of four asset classes that appear to mimic the flow of money into and out of emerging markets (where growing values are indicative of inflow and shrinking values are indicative of outflow).

Last month the EM Capital Flow Proxy Index has recovered. This shows that capital flows are returning to Emerging Markets after an extremely volatile period marked by massive outflows.

Within EMs, India is also beginning to get FII inflows. This trend is likely to continue in the first half of 2023.

Source: Bloomberg, DSP As on Nov 2022

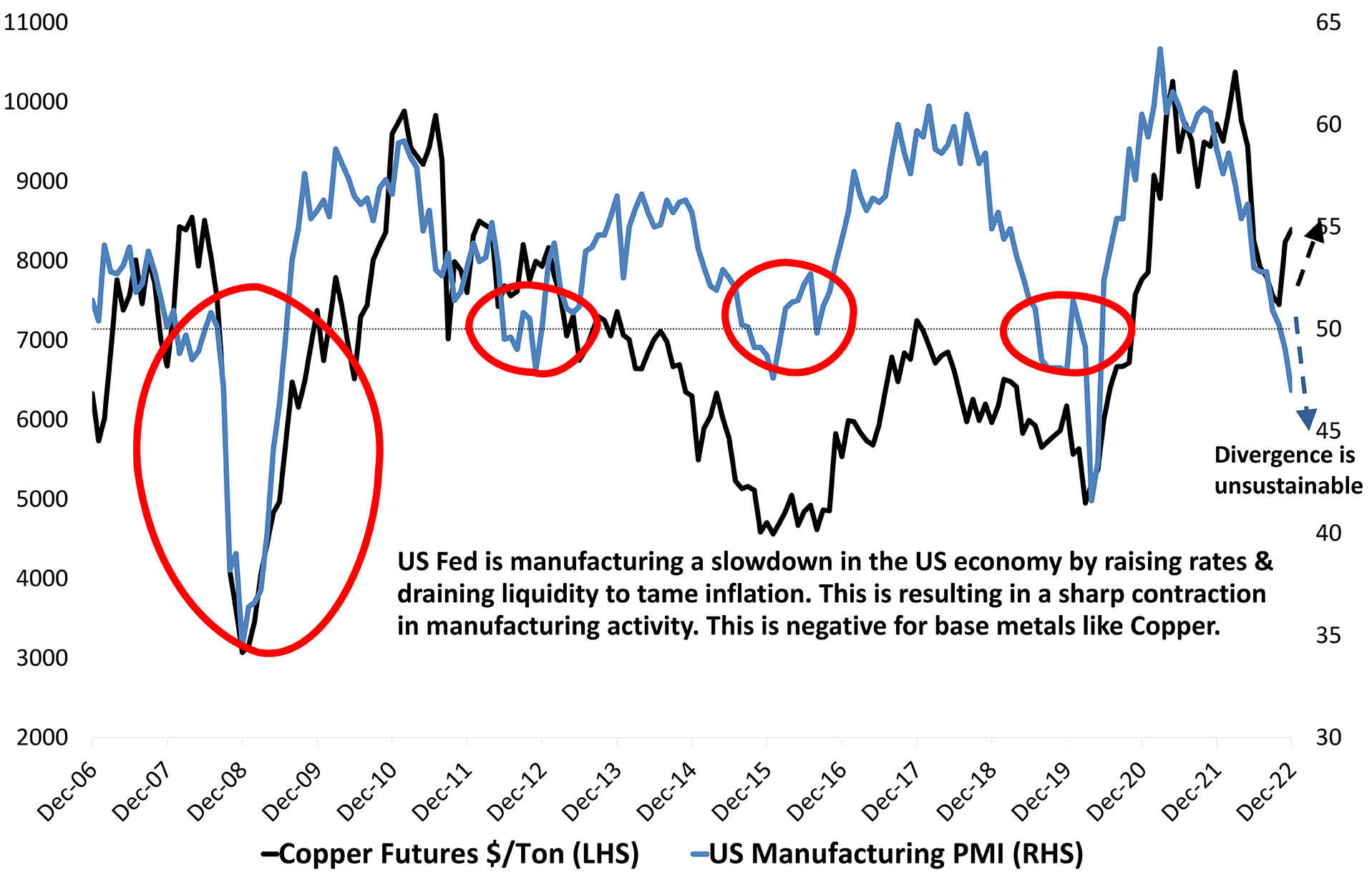

Contraction in Manufacturing Activity To Weigh On Metal Prices

Manufacturing activity in US, EU, China and Japan which represents more than 3/4th of global manufacturing is witnessing a contraction, a de-growth.

This will weigh on commodity prices and may pressure a specific part of the market, the base metals, which are more closely aligned with this segment of the economy.

Recently there has been a rebound in Copper & other metal prices. This rebound needs support from a recovery in manufacturing activity or it may fizzle out soon.

With policy makers aligned to tame inflation by slowing down the economy, the outlook for base metals remains patchy & cautious.

Source: Bloomberg, DSP As on Nov 2022

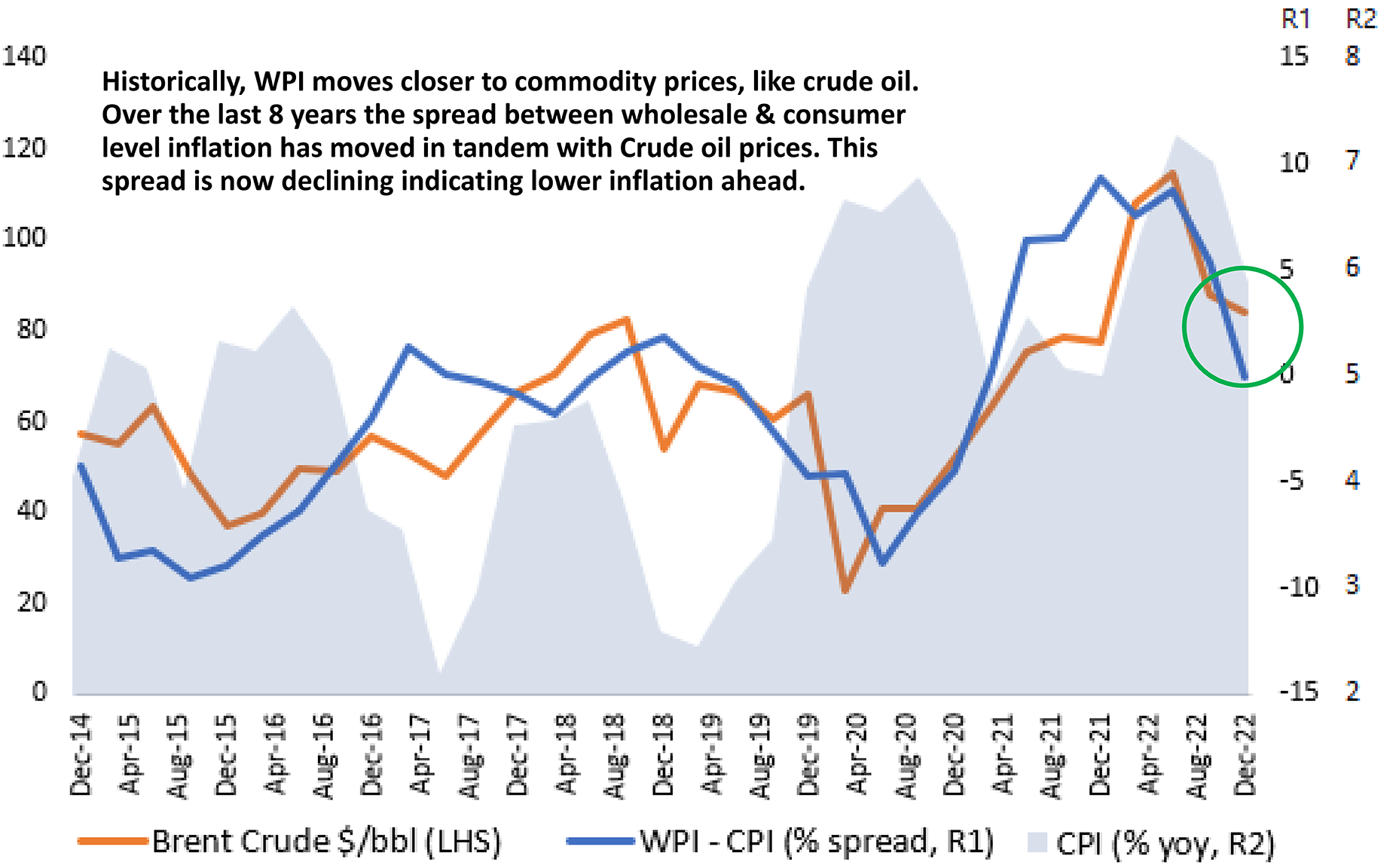

Decelerating Wholesale Prices To Lead Consumer Inflation Lower

Wholesale price inflation has a large weight of primary articles like commodities. Crude oil has a sizeable bearing on India’s inflation. Over the last 18 months wholesale inflation shot up, reflecting a huge jump in crude oil & other commodity prices. A part of this was passed on to consumers which is evident by a rise in CPI. However, not all of it was passed on as retail fuel prices were not raised as much as they should have been. OMCs absorbed a part of these losses.

Now, the wholesale price inflation has started to slide based on falling commodity prices & a very large base. Historically, we have seen this leads to a sizeable drop in overall inflation no.sin India.

Expect CPI to bring forth some positive surprises by falling quicker than most participants expect. This will give more room to RBI to maneuver its monetary policy by softening its hawkish stance.

Source: Bloomberg, DSP As on Nov 2022

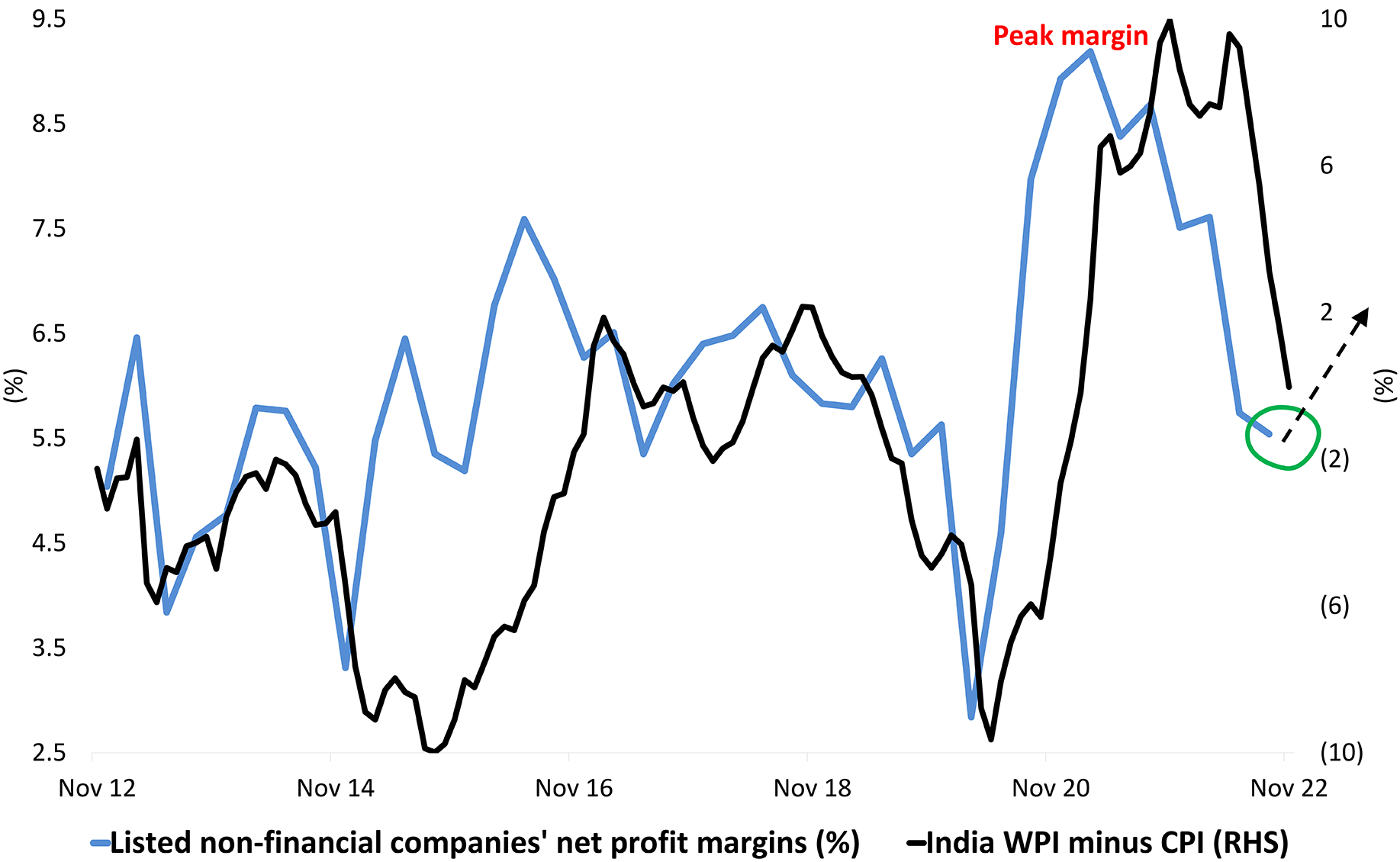

Declining Input Costs To Help Profit Margins Make A Comeback

Corporate margins declined over the last few quarters driven by high input prices. Supply side issues & Russia-Ukraine war led to an increase in raw material costs & other operational costs for corporates.

This is likely to reverse in the next two quarters as wholesale inflation eases at a faster rate than consumer level inflation.

Corporates have gradually passed on the rise in input costs or are in the process of completing the input price pass-on to consumers. This trend is likely to support corporate earnings in FY24.

This will ease earnings pressure and make Indian equities more attractive.

Source: Bloomberg, DSP As on Nov 2022

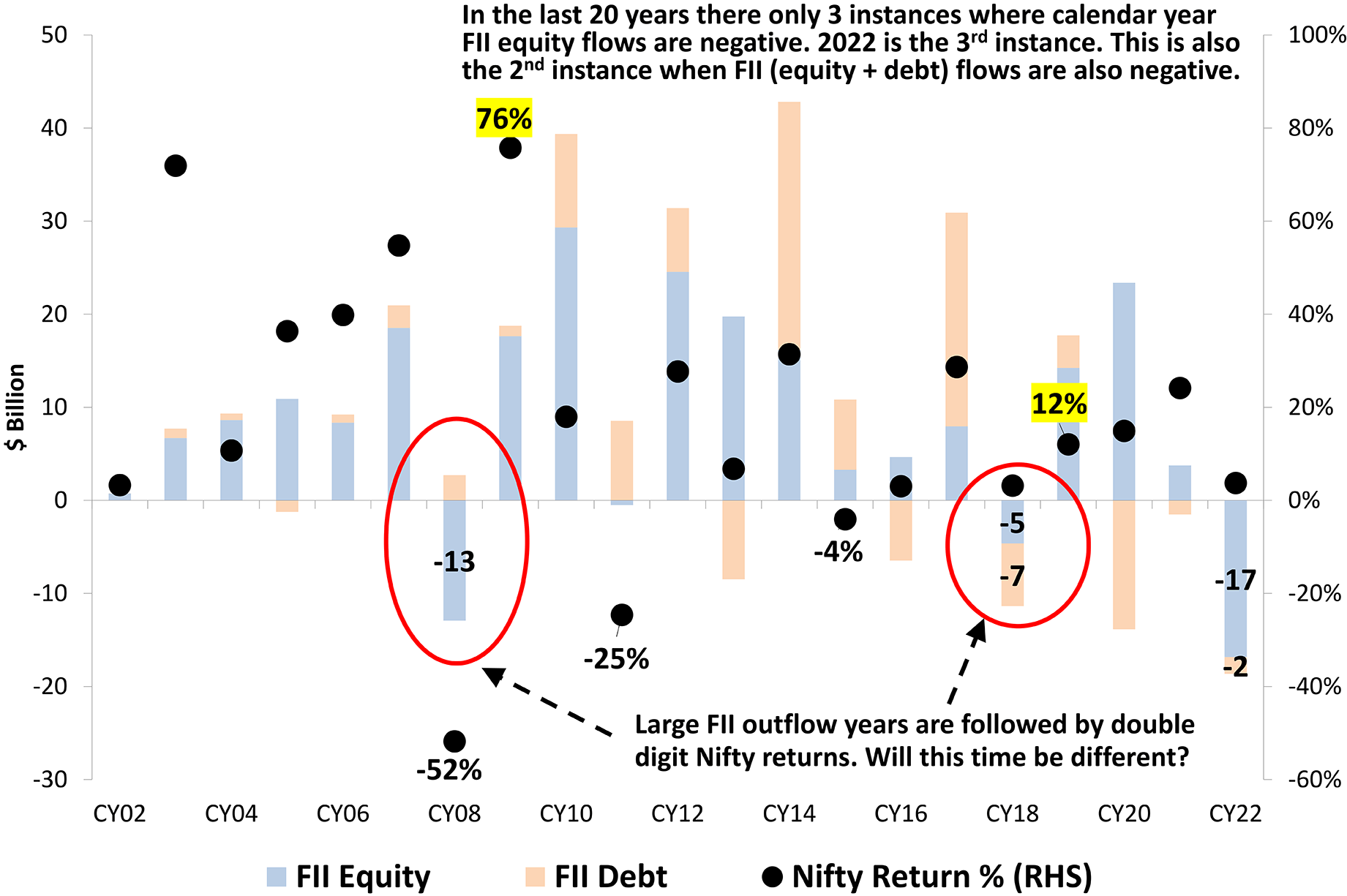

Record FII Outflows In CY22, What Does The History Say?

Every time FII flows have turned negative in a calendar year the Nifty Index has delivered double digit returns in the subsequent years led by healthy inflows.

In 2022, FII equity & debt outflows total $19Bn. This is the largest annual outflow that India’s capital markets have witnessed. This led to large volatile in capital markets but didn’t result in massive drawdowns as was the case in the past two instance.

In 2023, India’s economic growth & earnings growth differentials over its peer set could lead to inflows from foreign institutional investors.

If history repeats itself, it could augur well for Indian equities.

Source: Bloomberg, DSP As on Nov 2022

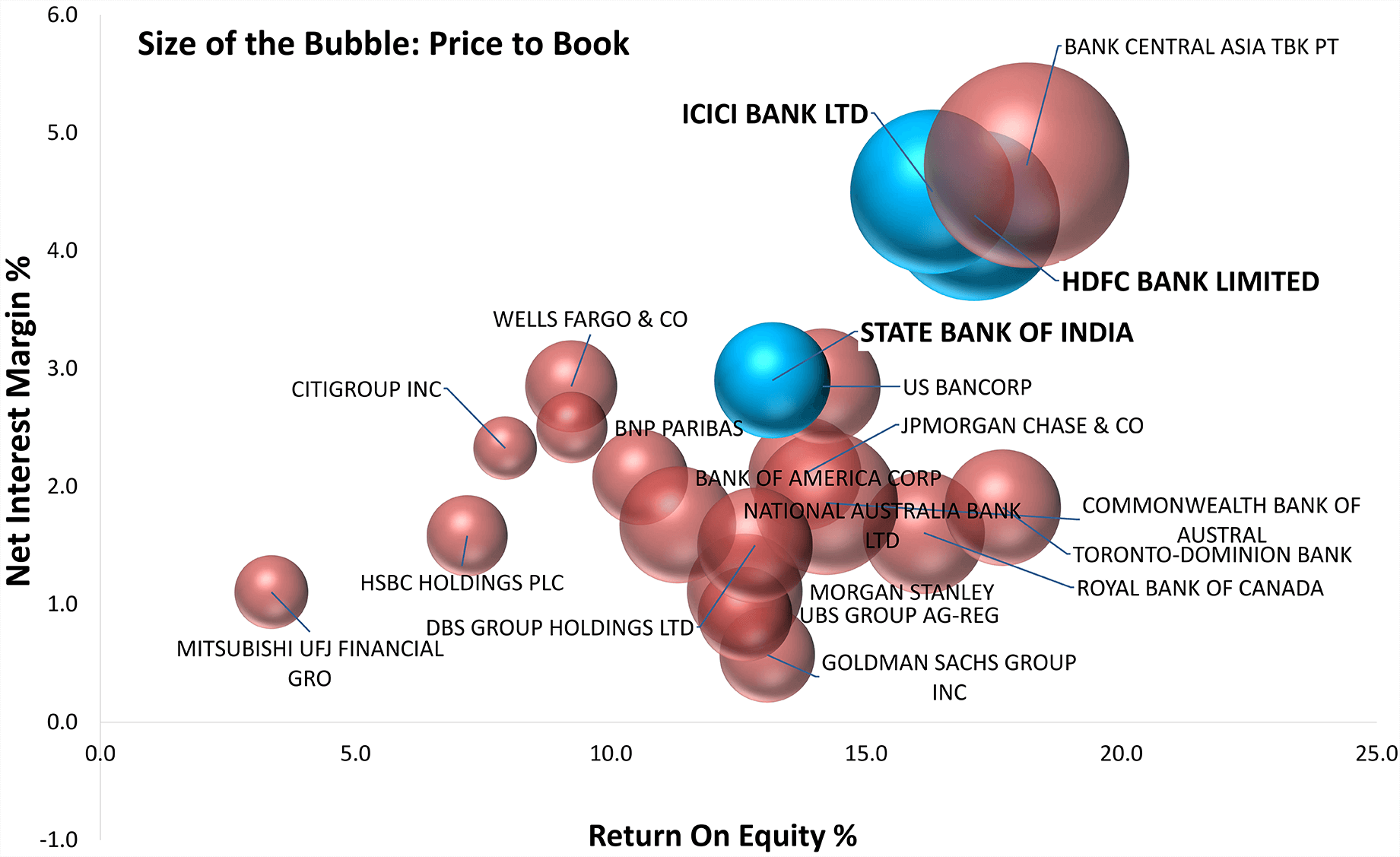

Three Indian Banks Among The Top Banks In The World

There are now three Indian banks among the largest Banks by Market Capitalization (Ex of China). Even if we include China Banks, there are two Indian Banks among the top 20 banks.

The Indian Banking sector displays some of the best Net Interest Margins & best Return on equity profiles. This is the reason why Indian Banks trade at lofty Price to Book multiples versus Banks in other countries.

It is well documented that banks which can compound more profitably & at scale continue to command premium valuations.

Judging by the trend in domestic lending sector, positive outlook for Indian Banks could lead to this leadership position continuing for years to come.

Source: Bloomberg, DSP As on Nov 2022

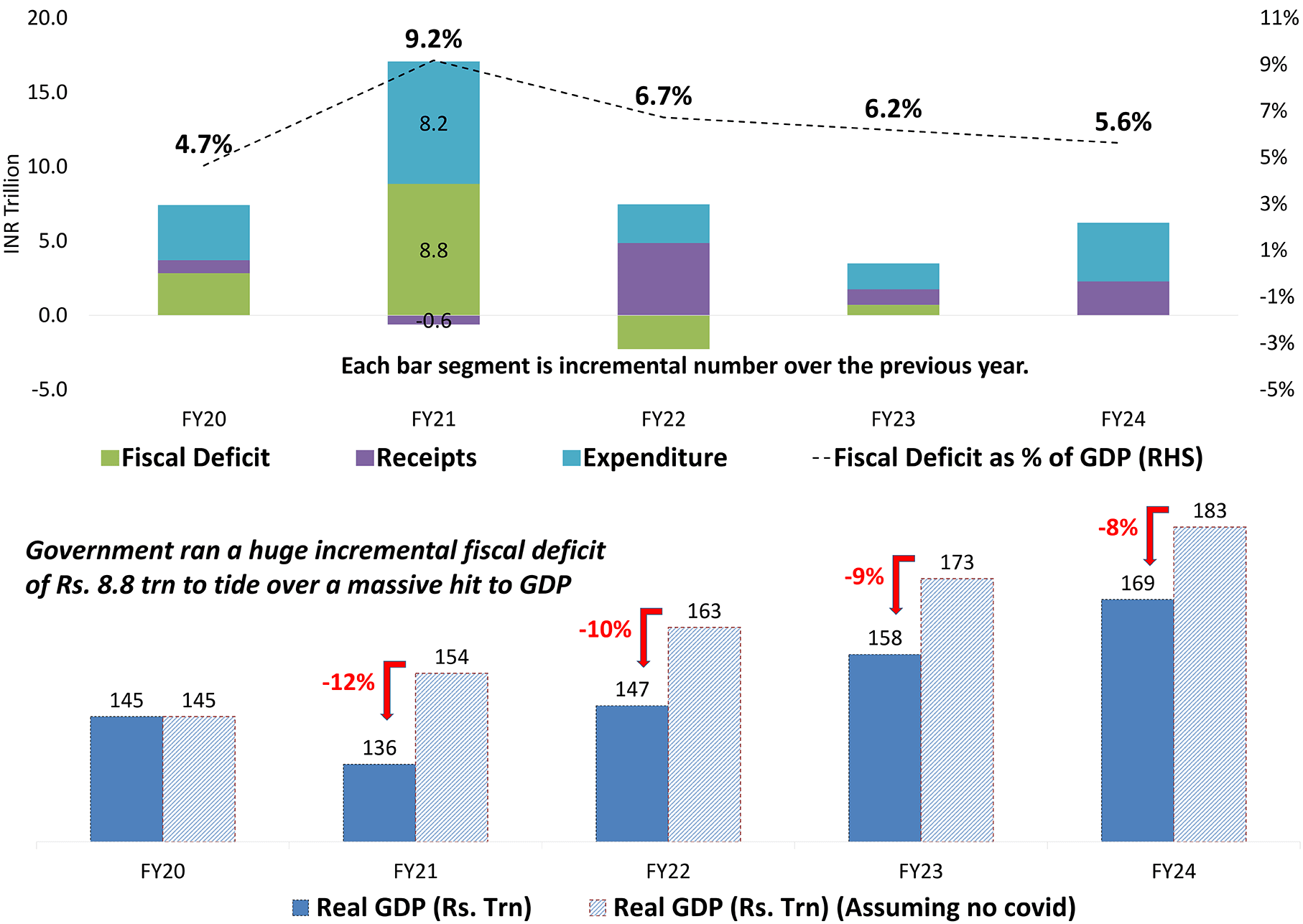

Fiscal Deficit Worries Tapering As Growth Recovers

COVID-led disruption caused a massive dent to India’s GDP. To tide over the shortfall in growth over the trend growth the Central Govt enacted a large fiscal spend for which it borrowed record amounts.

India’s fiscal expense was lower in comparison to its peers; hence it has enjoyed lower inflation but at the cost of a shallower recovery.

One reason for India’s steadier growth trajectory versus the volatile & patchy growth in the rest of the world is a shallower & slower recovery in India. From hereon as recovery becomes stronger and tax revenues recover, the fiscal concern will begin to slowly fade away giving more room to policy makers. As inflation cools, the monetary policy may come back as a tool of choice to support recovery. This means: Look for a more benign policy environment in FY24.

Source: Bloomberg, DSP As on Nov 2022

Rules Based Funds Are The Ponderosa Pine

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.