DSP NETRA SEPTEMBER 2023

US Economic Data Trends, India Valuation, Sectors & Opportunities

Restrictive Monetary Policy Is Here. Higher Rates To Hit US Corp Profitability Ahead

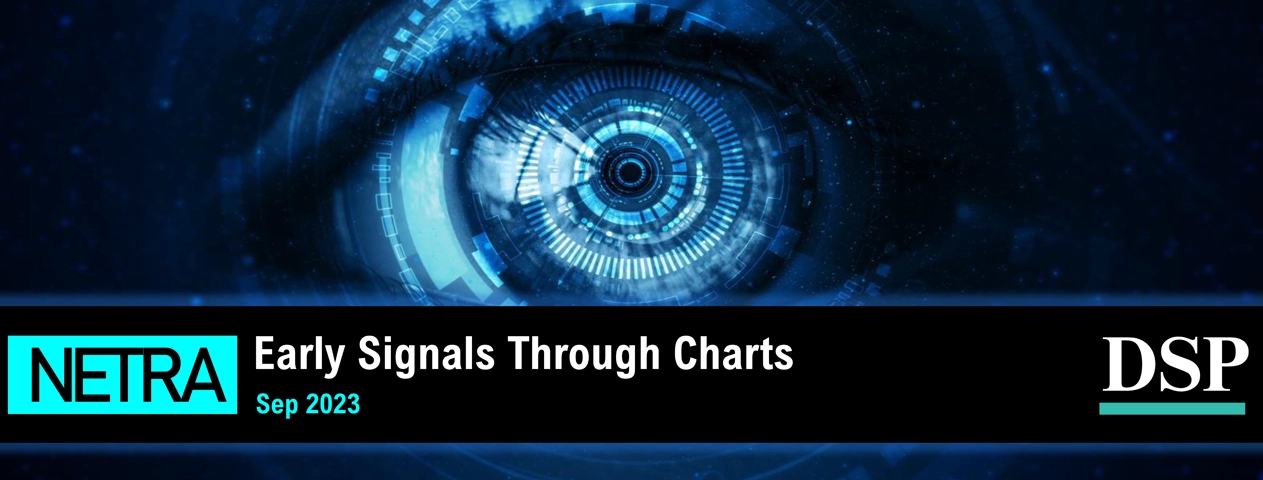

Corporate earnings are the biggest drivers of stock price moves. US corporations have enjoyed healthy profit growth in the aftermath of COVID due to a sharp decline in input prices and excellent topline growth. For the S&P 500, net profit margins peaked at 13% in the second quarter of 2021 before beginning their descent. The decline was due to a sharp reversal in commodity prices, which dragged margins down. But declining interest costs, the paring down of debt, and abundant liquidity have helped corporations report better than expected profit margins.

The net interest payments by corporations are at their lowest levels in half a century. This trend has hit rock bottom, and high-frequency indicators suggest that US corporate profitability can decrease as the cost of borrowing rises and liquidity becomes scarce.

This is likely to cause a headache for US stocks. A similar story is likely playing out in the EU and the UK. Expensive valuations of US equities aren’t helpful in the face of such a headwind.

Source: FRED, DSP Data as on Aug 2023

But India Continues To See Steady Growth, So Far…

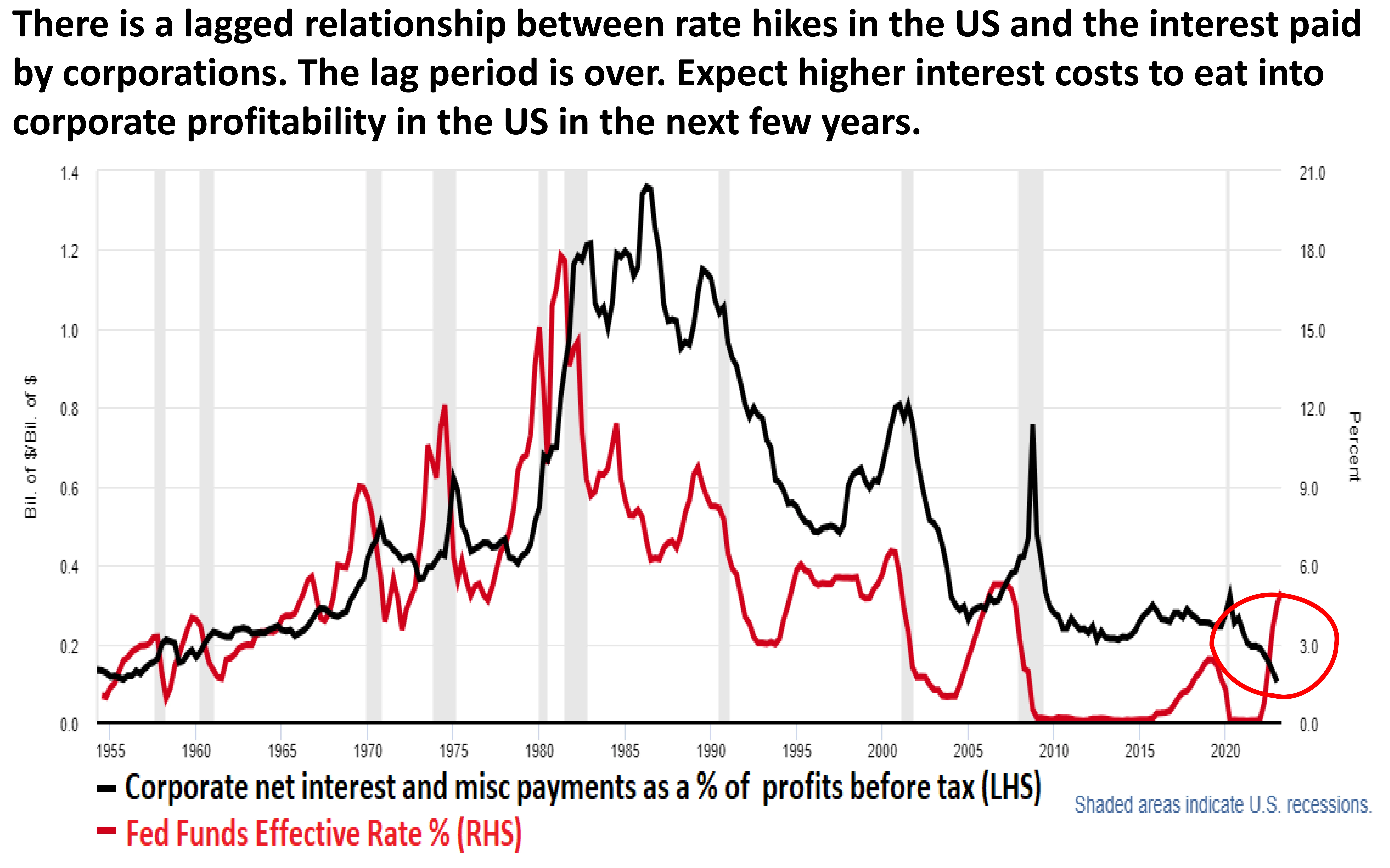

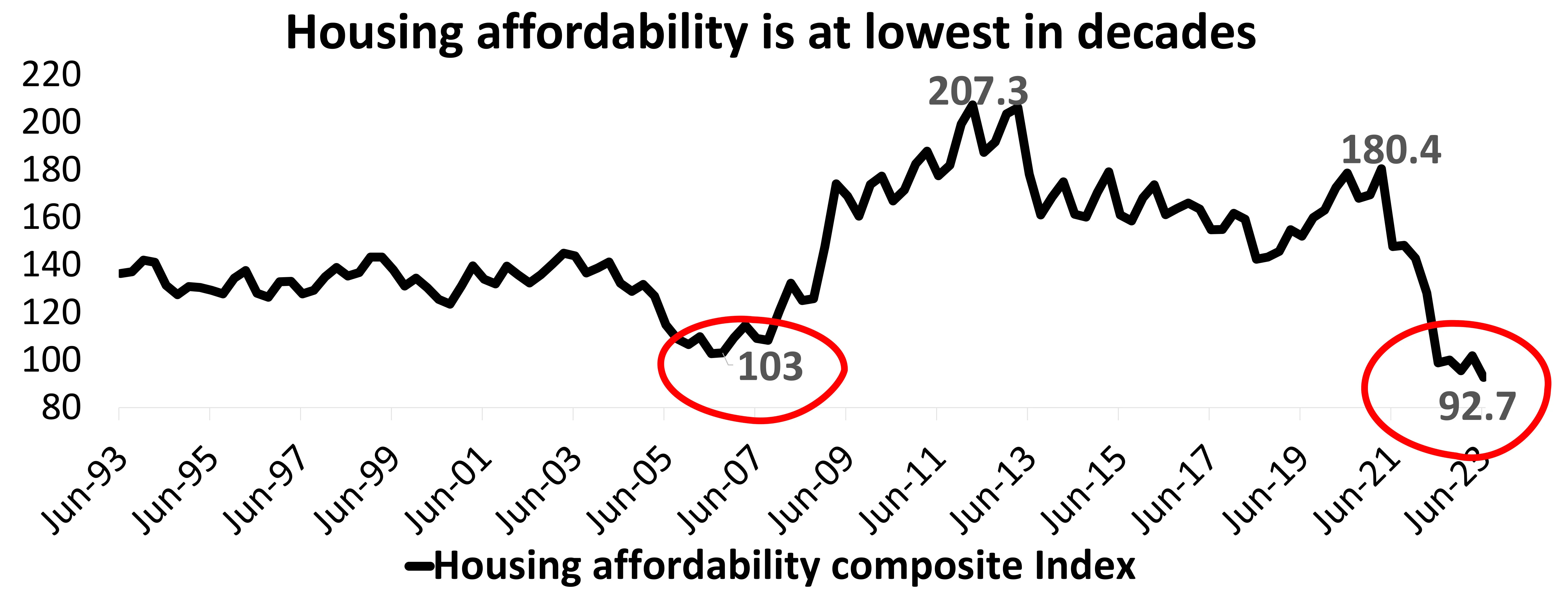

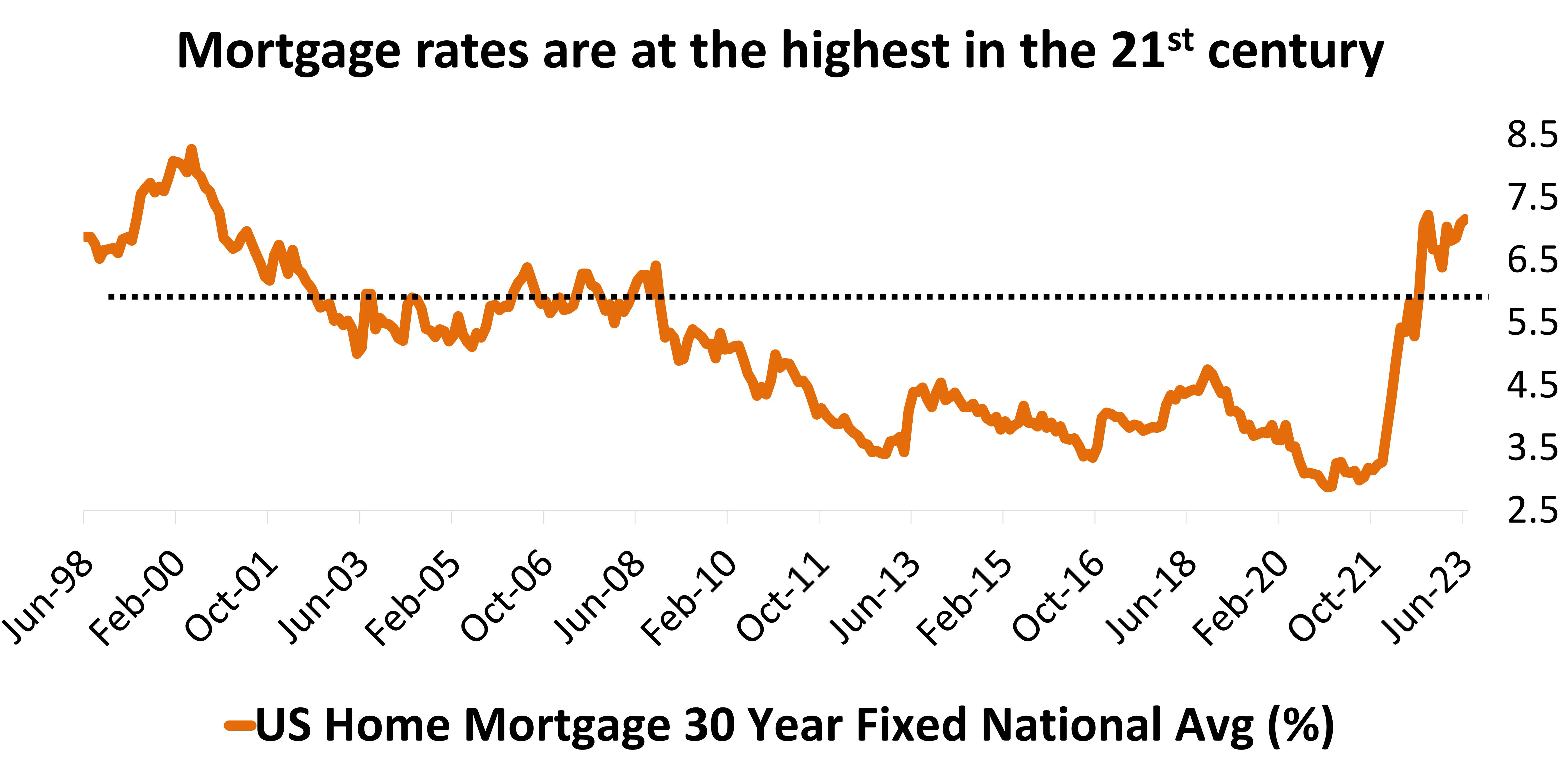

The area of the economy most severely impacted by the Federal Reserve's highrate policies is the housing sector. Some mortgage lenders have been severely impacted by the consequent slowdown in refinancing and purchase activity, which has slowed economic growth and resulted in tens of thousands of job losses in the sector.

An average buyer in US is unable to qualify for a new home in US (median price of $416,000) with a 10% down payment because the qualifying income, to secure a mortgage, has more than doubled in last 3 years.

Ultra high mortgage rates are likely to keep this sector under duress. Incidentally, a very large part of US inflation is exhibiting stickiness due to housing services inflation. Data suggest that services inflation could also crack, going ahead.

Source: NAR, FRED, Bloomberg, DSP Data as on Aug 2023

US Housing Market: Can It Repeat The Pandemic Goldilocks of Govt Doles & Record Low Rates?

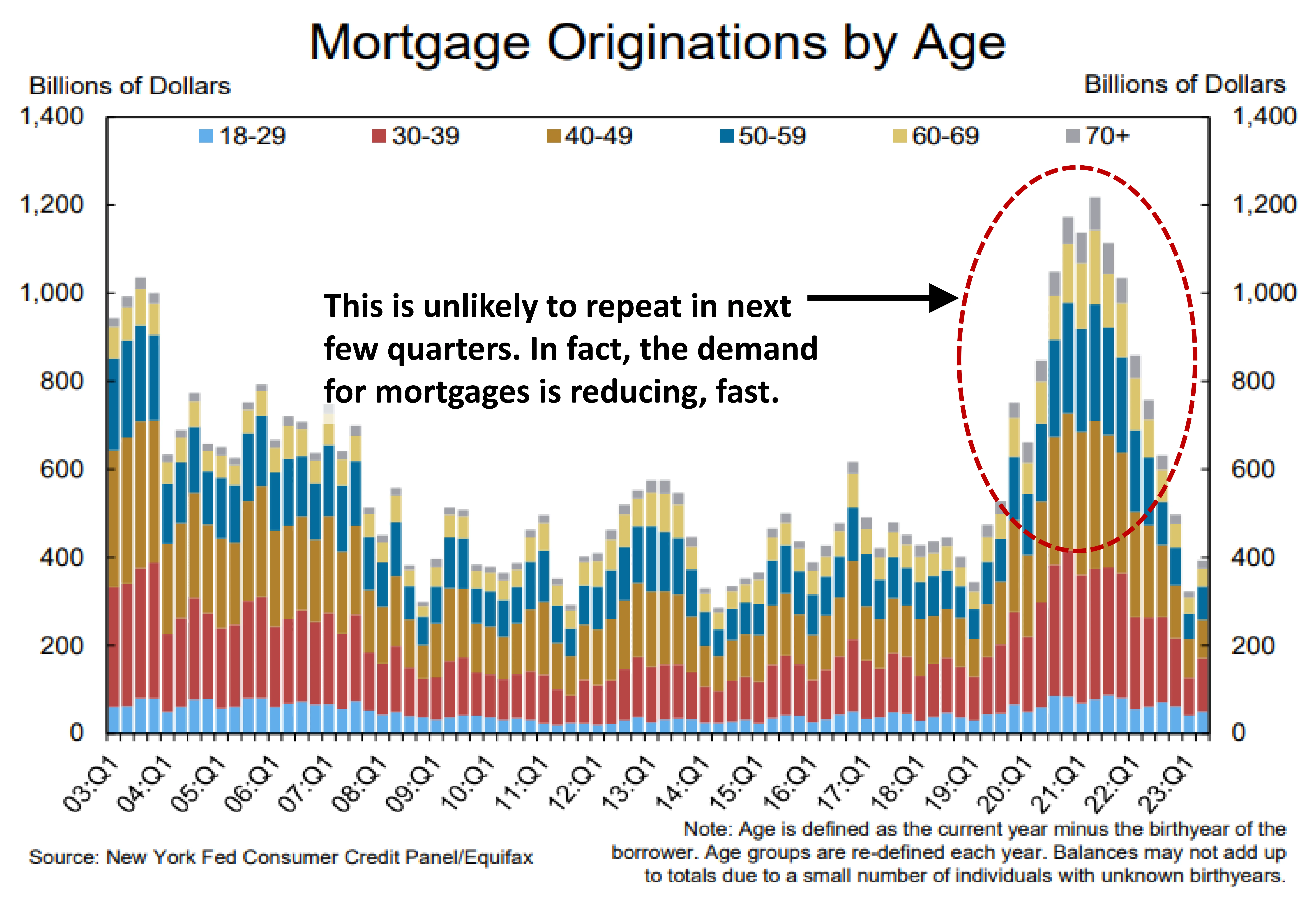

WHEN THE pandemic shut down the world’s economies, it might have been assumed that housing markets would be severely impacted. However, this wasn't the case. House prices experienced an average increase of 5% in the 12- month period post pandemic up until April 2021.

In the United States, they surged by 11% in the year leading up to Jan’21. Similarly, in the UK, there was an 8% rise. Even in nearly COVID-free New Zealand, house prices saw a remarkable surge of 22%. Similar to various other asset prices, the value of houses was bolstered by extremely low interest rates and fiscal support.

In July 2020, the mortgage rate fell below 3% for the first time, but it didn’t stop there. Mortgage rates would continue dropping, hitting an all-time low of 2.65% in January 2021. The average mortgage rate for the year was 2.96%, making it an incredibly affordable time for homebuyers and those looking to refinance their existing mortgages. The aberration is unlikely to repeat soon, at least not in the next few quarters. The opposite, a decline in demand is likely underway.

Source: NY Fed, DSP Data as on Aug 2023

World Equities Have Diverged From Liquidity Squeeze, Can This Correct in H2 2023?

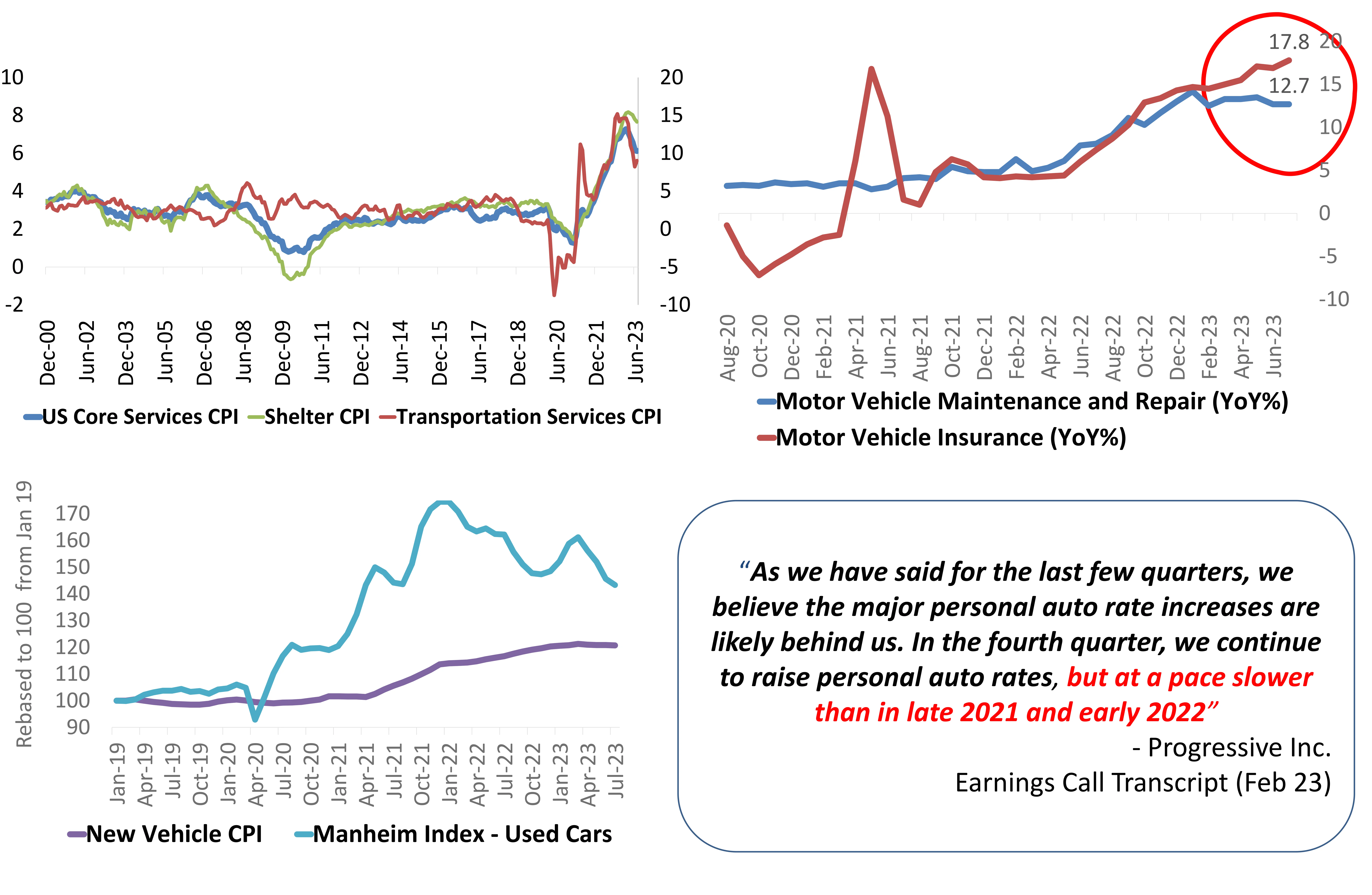

One of the main reasons for the increase in US Core Services Inflation was higher motor insurance costs. This happened because car prices went up due to supply chain issues, and there were more accidents after the pandemic.

One big reason for this was the increase in prices for used cars, which is starting to slow down, although not as much as new car prices.

Additionally, the difference between the cost of car repairs and what insurance companies charge has become more favorable, which could help insurance companies make more money and reduce the need for big increase in insurance premium rates. This will likely slowdown the rising motor insurance premium and tame transportation inflation.

Two important parts of US Core Services inflation, which are Transportation Services and Housing Services, are expected to decrease as the economy slows down. This will give the Federal Reserve more room to manage inflation.

Source: FRED, Bloomberg DSP Data as on Aug 2023

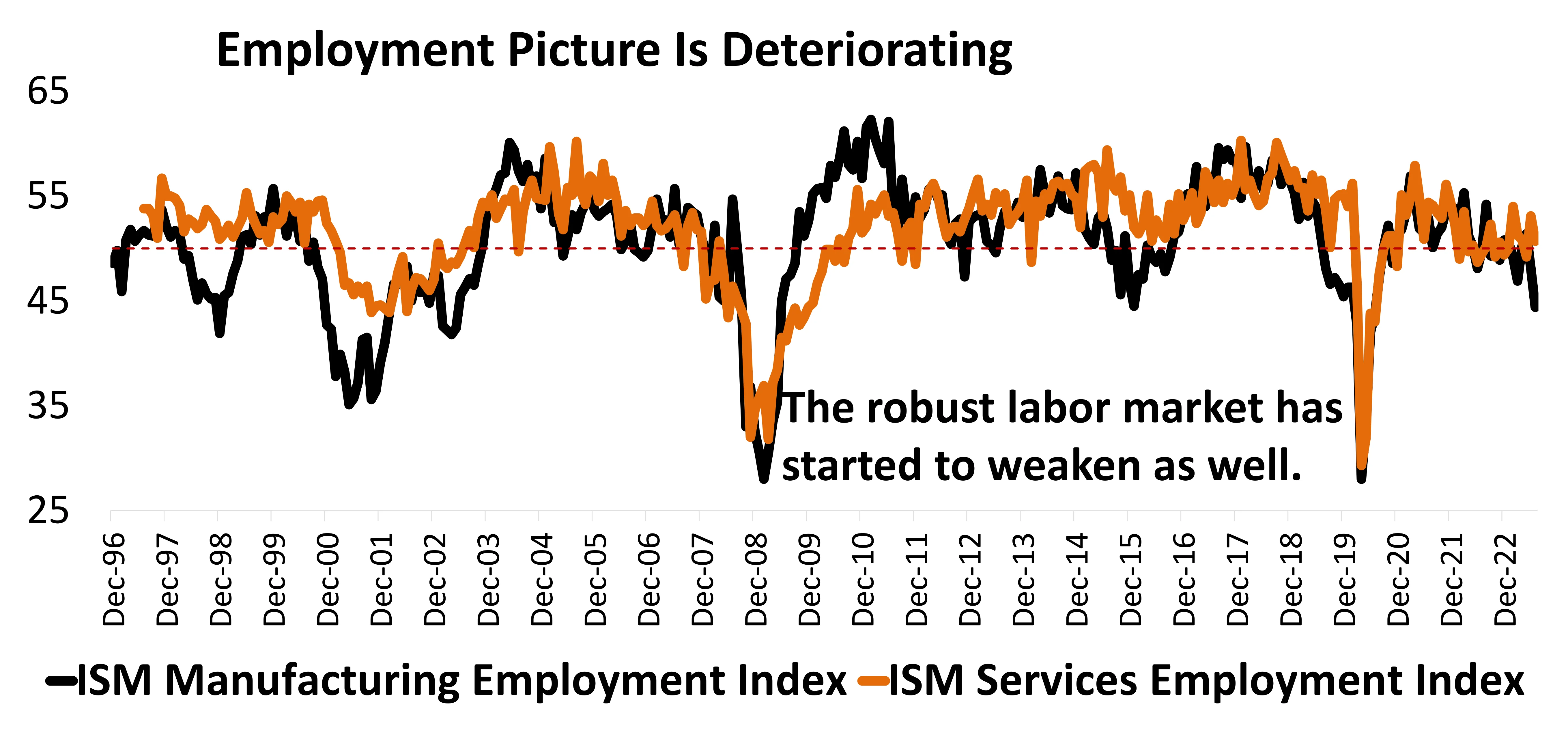

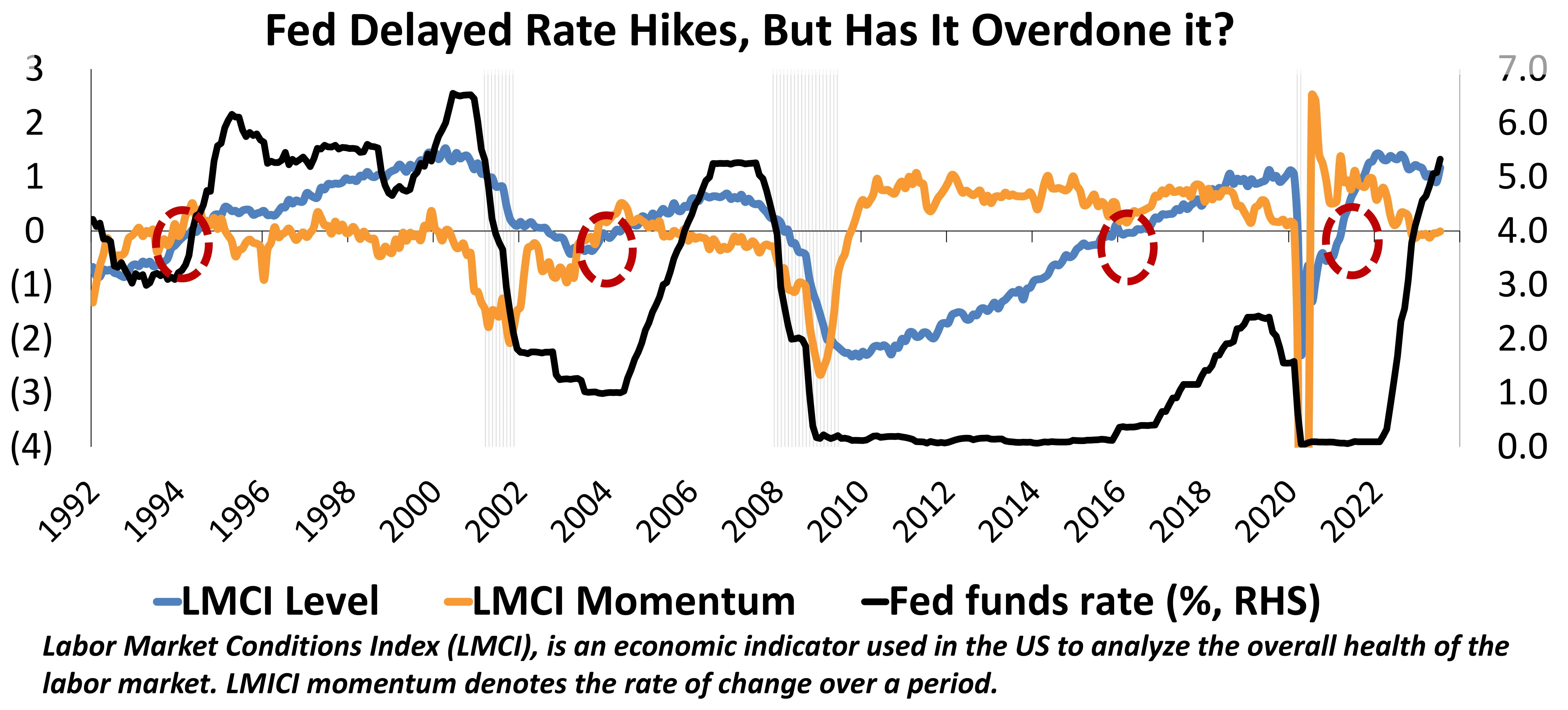

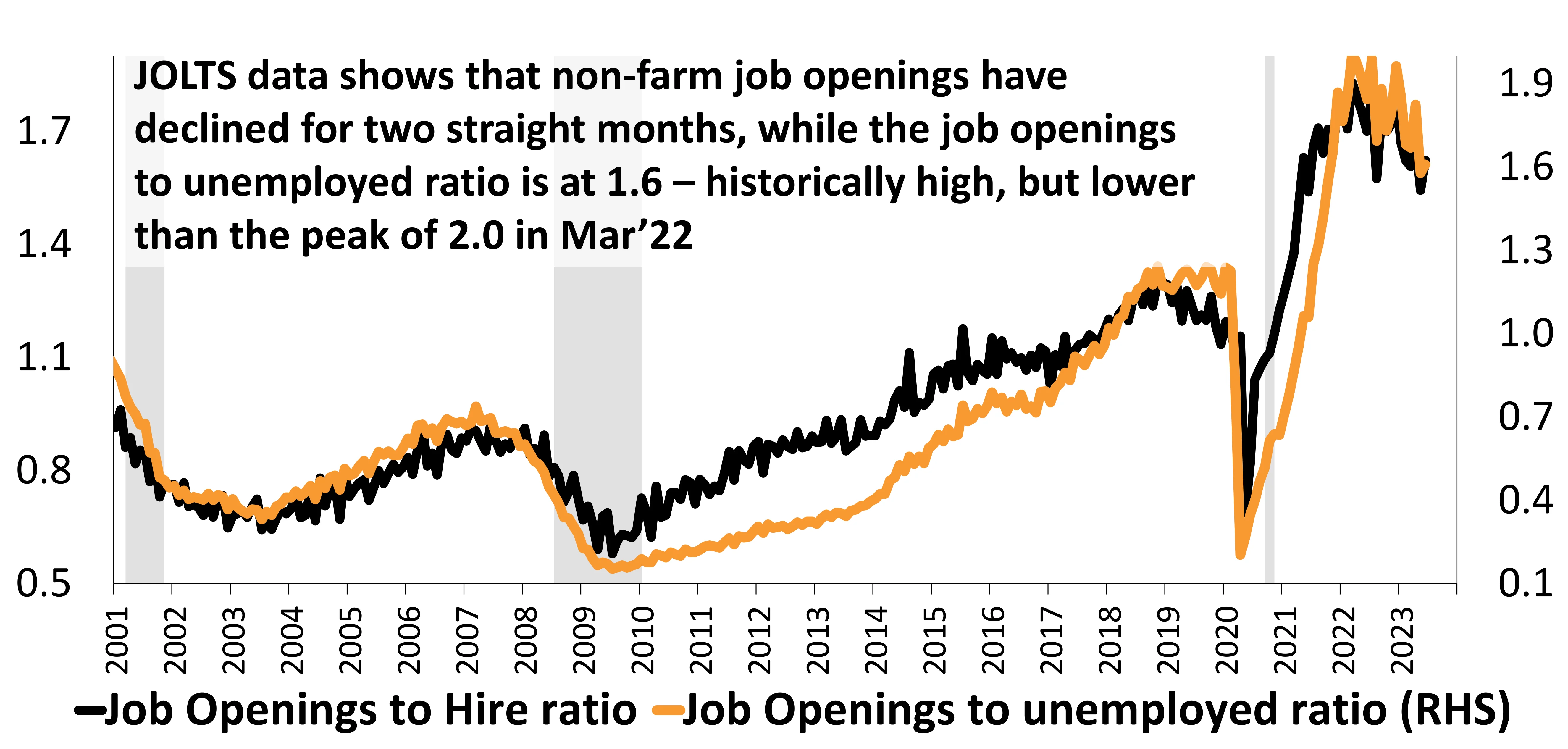

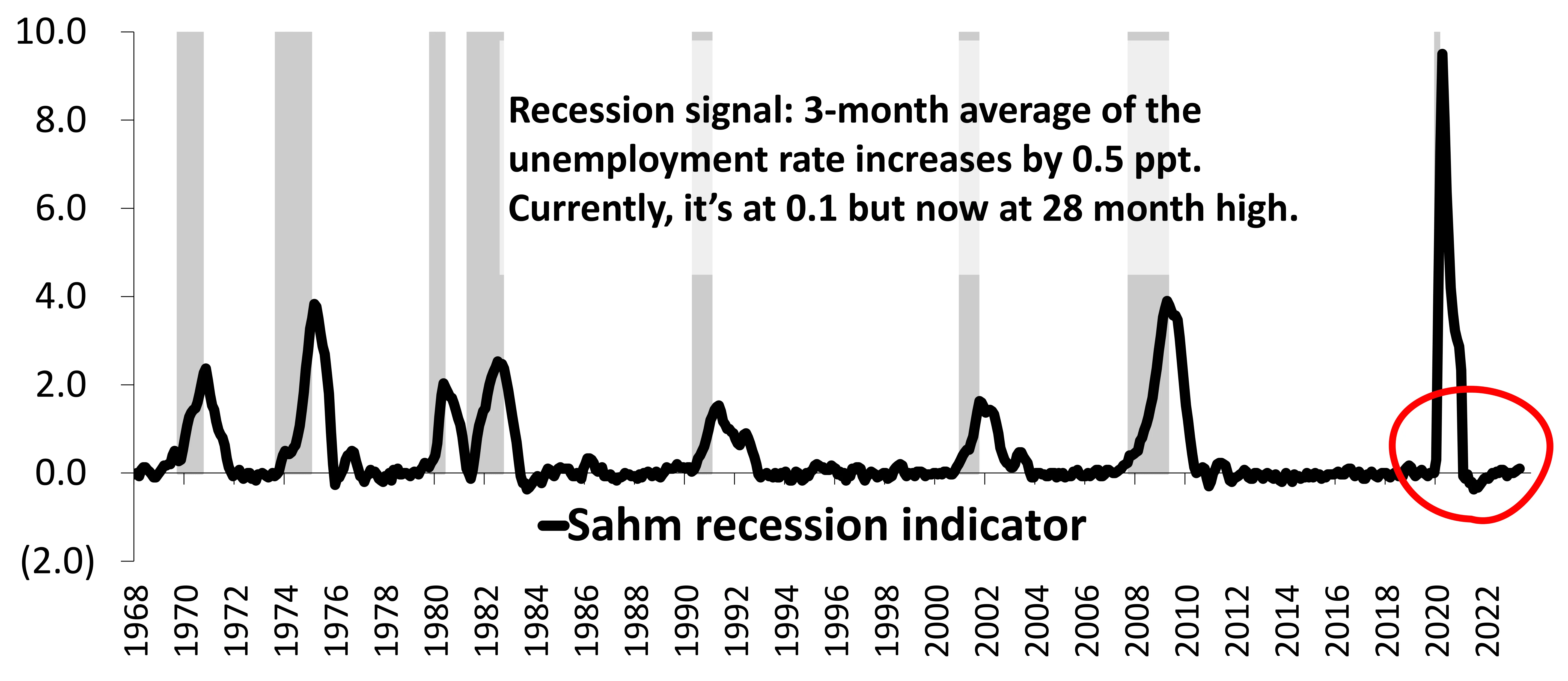

US Employment, The Backbone of This Cycle, Is Rolling Over

Source: Madhavi Arora, Emkay Research, DSP, Data as on Aug 2023

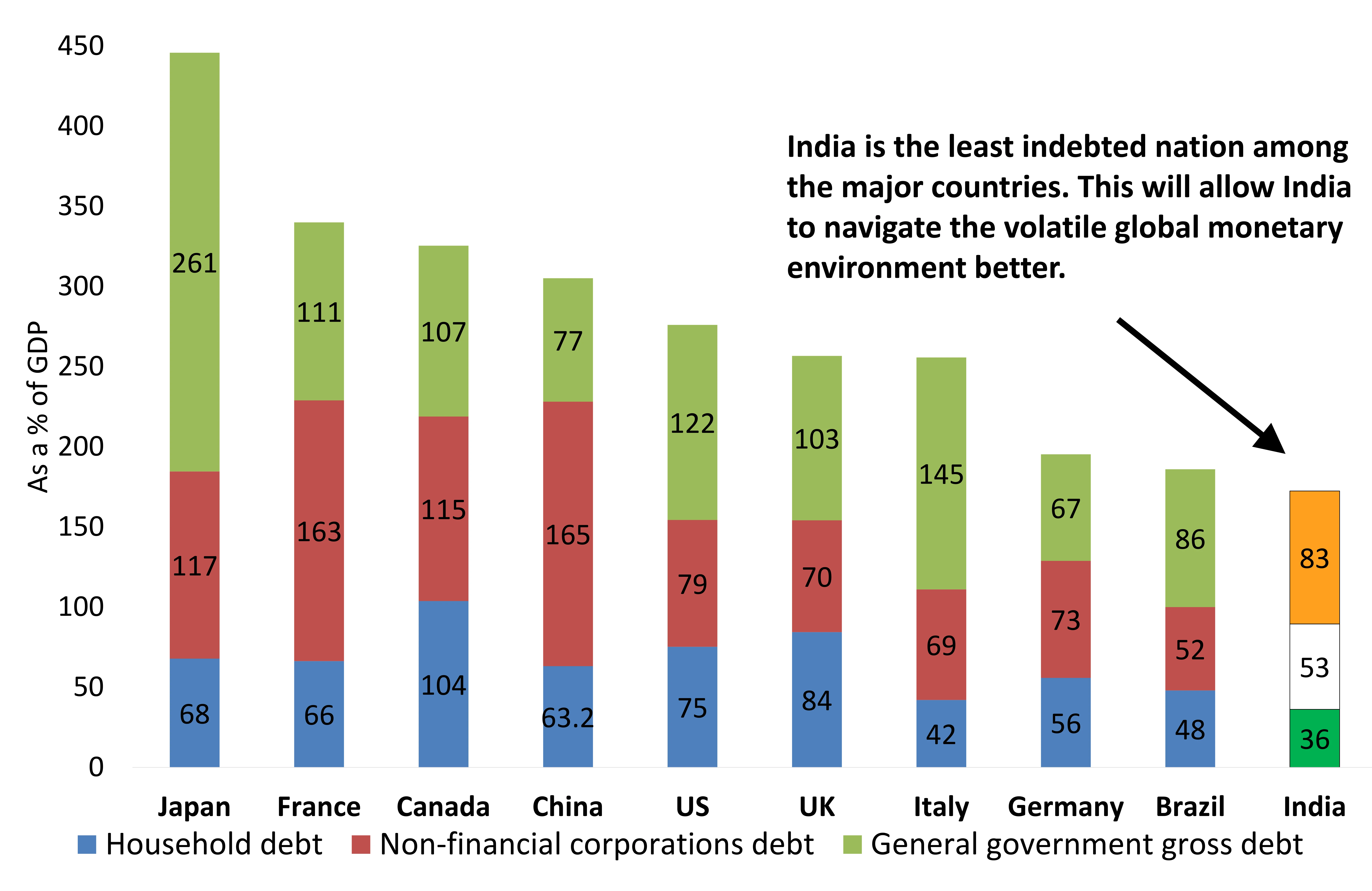

‘Less Leveraged’ India Could Be The Least Vulnerable To High Interest Rates

On a global scale, interest rates in numerous countries have reached levels that haven't been seen in nearly two decades. Both the United States and the European Union are experiencing benchmark interest rates that are approaching the highest points observed in the past 25 years.

This trend is already manifesting itself in increased interest costs on government debt. While corporate interest payments remain relatively low compared to previous decades, they are starting to show a gradual rise. Household borrowing expenses, pertaining to consumer and housing loans, are escalating worldwide. As a result, this is anticipated to curtail economic growth and dampen the previously robust consumption trends witnessed in many nations.

In contrast, India, characterized by relatively low levels of leverage across sovereign, corporate, and household sectors, is poised to navigate this challenging landscape more effectively than other economies burdened with high debt and sluggish growth.

Source: IMF, CMIE, DSP Data as on Aug 2023

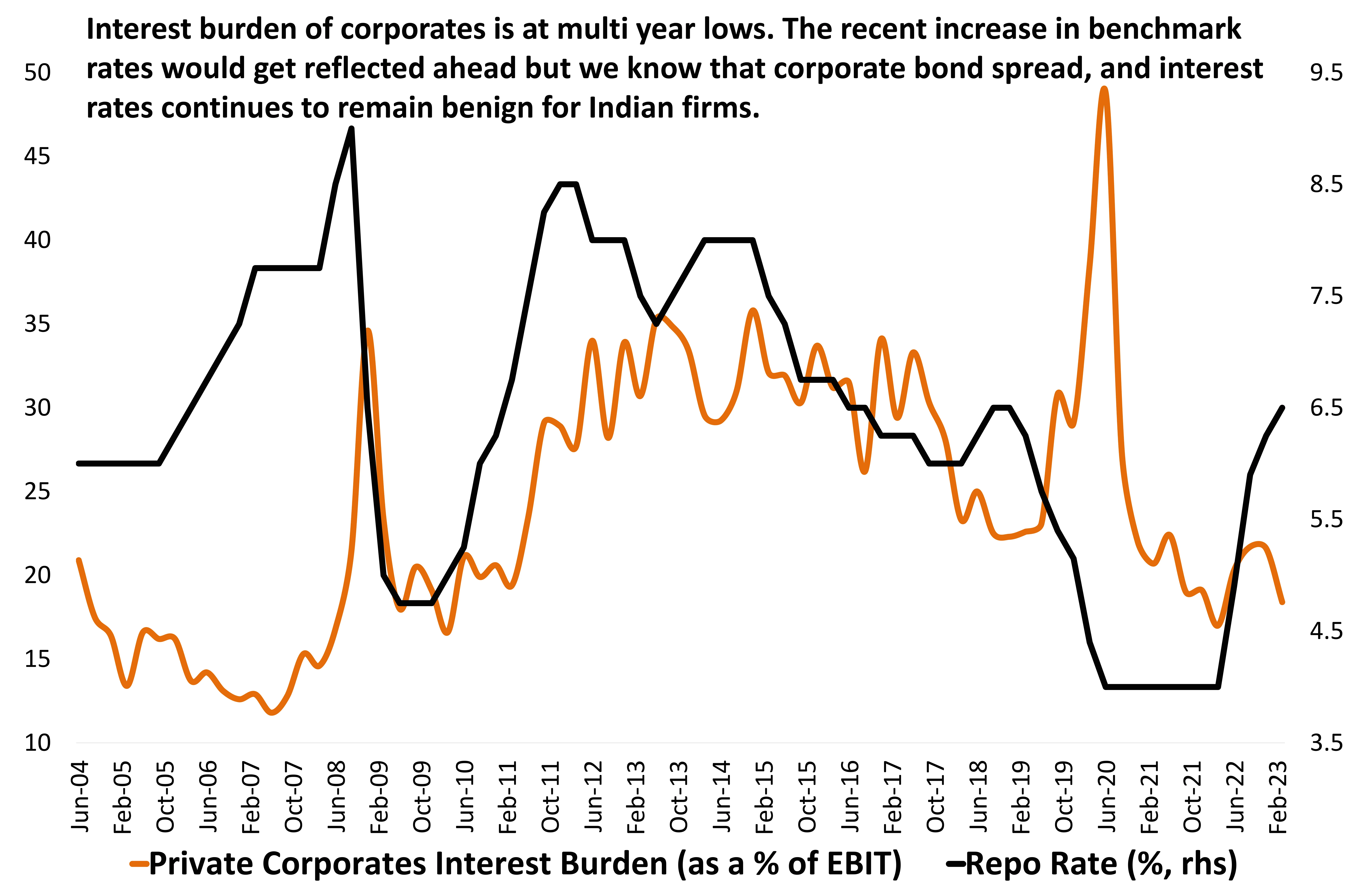

India Continues To Enjoy Easier Monetary Conditions In Spite of Rate Hikes

The interest burden on Indian corporations is one of the lowest in years. This is a result of lower borrowing costs due to thin spreads on corporate bonds, debt reduction by Indian corporations and a relatively abundant liquidity situation in the interbank market.

With RBI rate hikes getting passed through the system this number is likely to see some increase. This means that the interest burden for corporates is likely to go up, but not to alarming levels. It has risen to alarming levels in previous rates hike cycles. However, India is going through one of the least restrictive monetary tightening cycle. This means even after interest rate hikes, the corporate sector has not seen a big rise in its borrowing costs and interest payment burden.

This would eventually help corporations report better profitability and deliver better investor returns.

Source: CMIE, Investec, DSP, Data as on Aug 2023

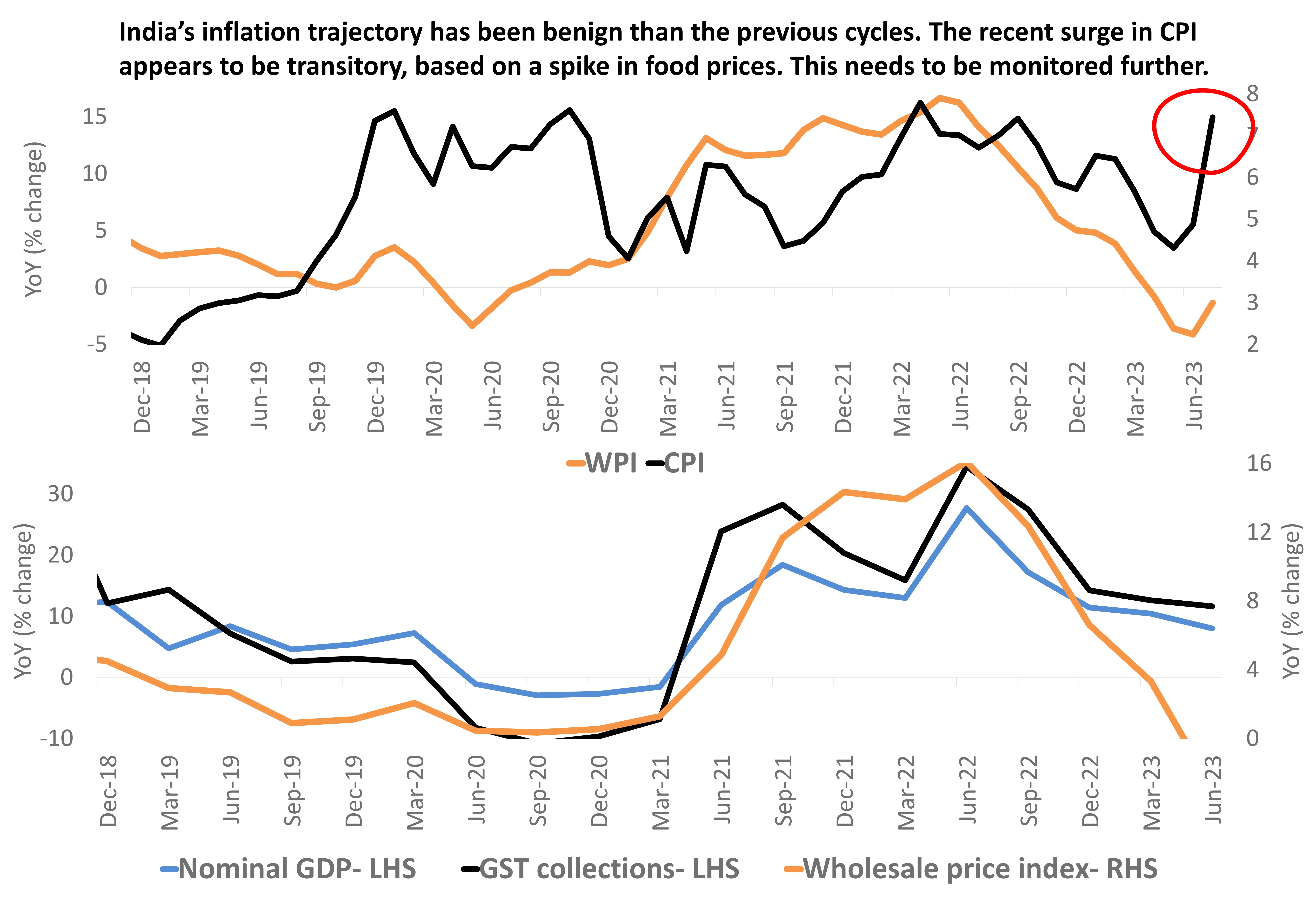

A Typical Disinflationary Cycle

India’s corporate profitability got a large boost from healthy trend in sales growth. In the last quarter, BSE500 topline growth slowed to 6% (yoy) with nearly 30% of them posting topline contraction.

The slowdown in inflation and commodity prices along with headwinds for globally linked sectors (like IT, metals) is likely to result in poor sales growth.

The chart clearly depicts how GST collections, Nominal GDP and wholesale prices move in tandem. This can have repercussions for companies which are unable to improve on their profit margins. As input price pressures recede, the RBI’s rate hike impact becomes visible, companies which can sustain healthy profit margins are likely to outperform their peers and the broader market.

This is a how a typical disinflation cycle plays out.

Source: CMIE, DSP Data as on Aug 2023

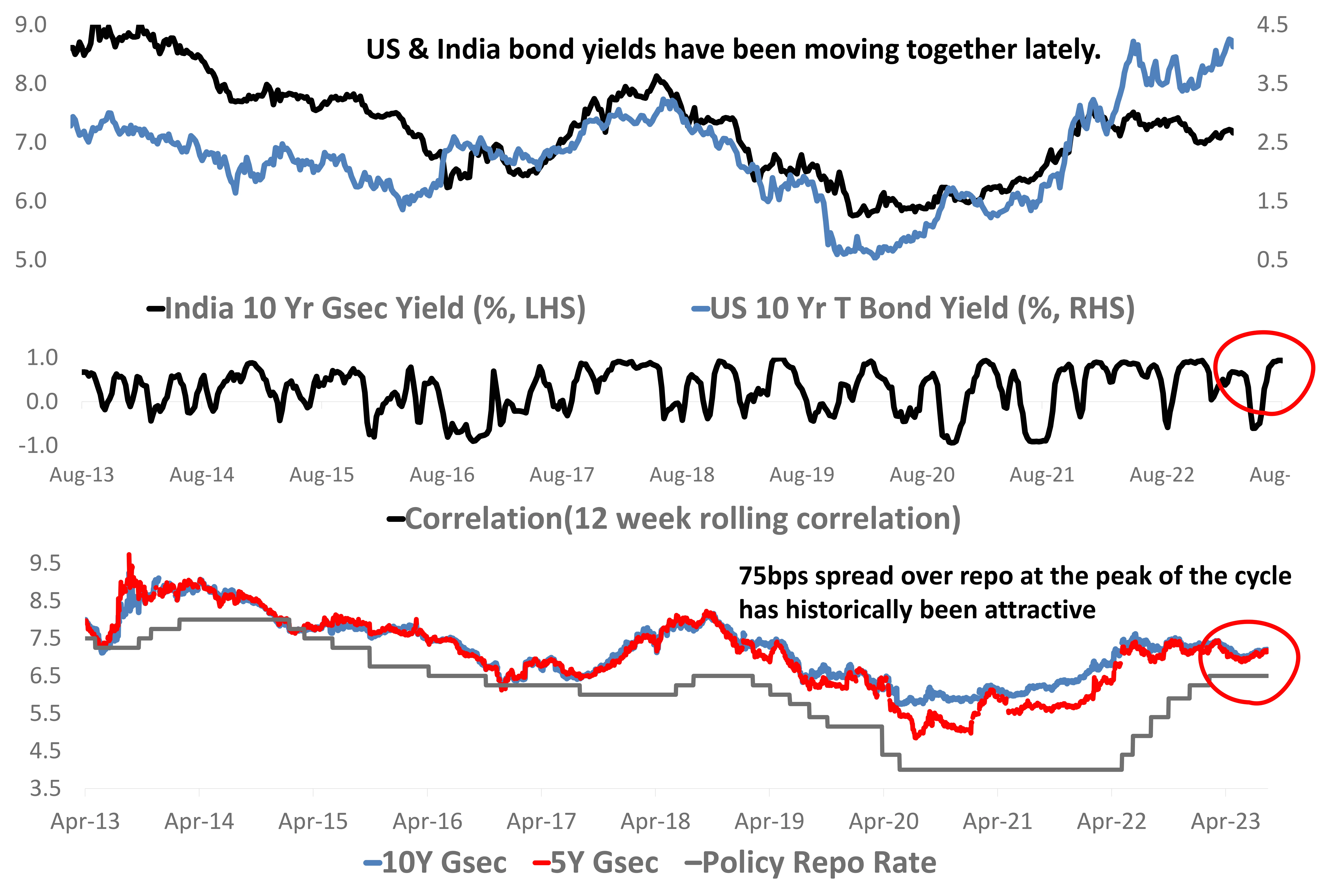

Add Duration: Why It’s Time To Buy Longer Dated India Bonds

Wary of data but attracted to valuations! We are bullish. Why? Because of Valuations! Markets are pricing in a lot of negativity. Yet, inconclusive evidence to justify fall in yields. Or rise in yields. Any positive news may cause a sharper rally, than a sell-off due to negative news.

Across the globe, the rate cuts are getting priced in, but in India rate hikes are priced. This asymmetry leads to asymmetrical odds – in favor of long bonds. India’s fiscal situation and inflation trajectory remains much more benign and creates an opportunity to own long bonds at 10Y yields which recorded a recent print of 7.25%

Recently, Indian bond yields are being driven by global yields rather than domestic drivers. This is an opportunity.

Read DSP Converse for more details.

Source: CMIE, DSP Data as on Aug 2023

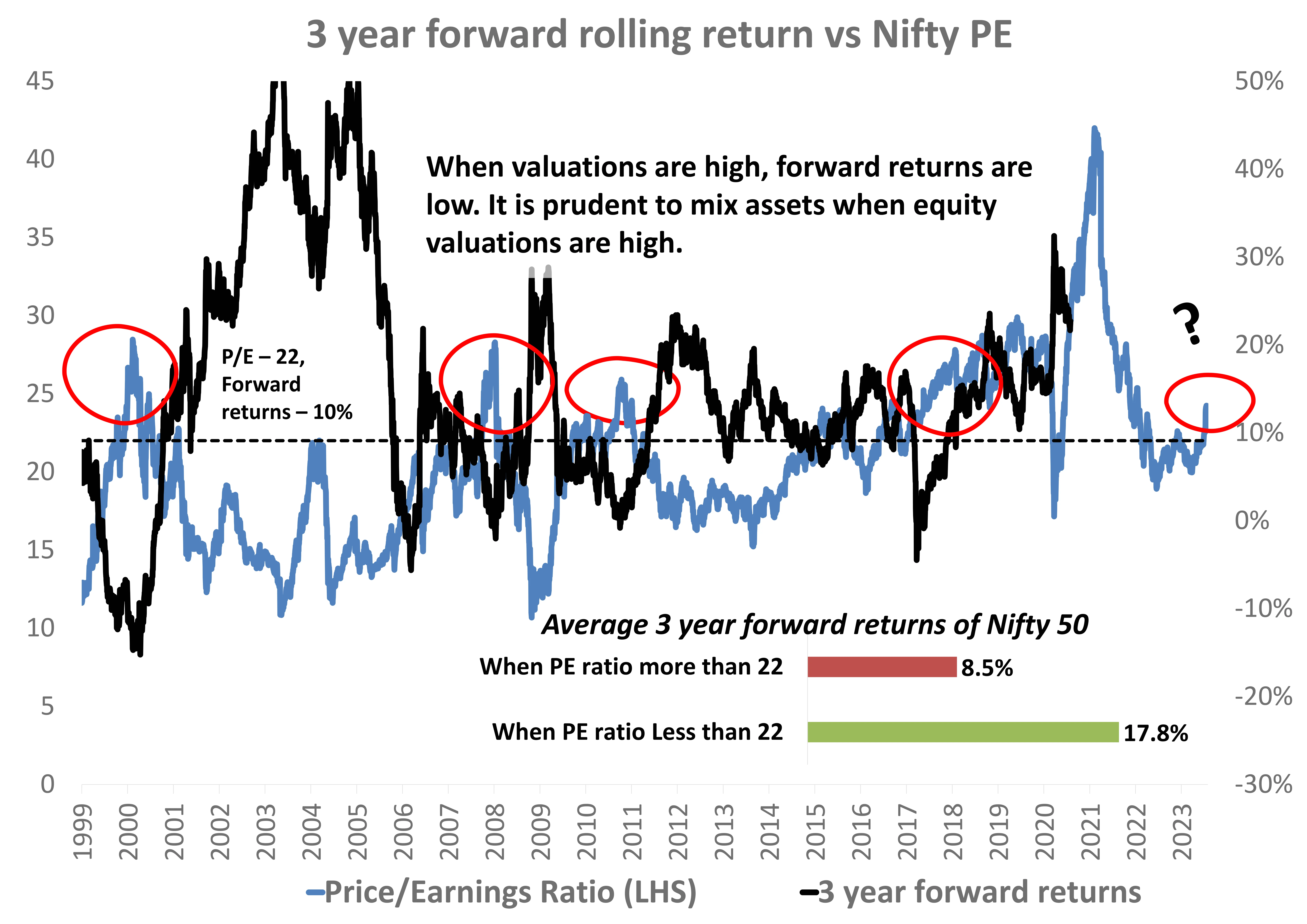

#ValuationsMatter, Be Cautious

The Margin of Safety is an important aspect in equity investing, and the absence of it can cause investors to earn subpar returns. Valuations are one of the key indicators that can help investors determine whether equities have a margin of safety.

Currently, the P/E ratio of Nifty 50 is at 22.5x. Historically, whenever an investment has been made when the PE ratio is more than 22x, 3- year forward returns have been subdued. Thus, an investor contemplating investing in equities with the backdrop of India's growth story should also consider the margin of safety

Higher growth expectation but with expensive valuation have more often led to lower returns for investors from equities.

There are exceptions as well. In post COVID crisis recovery, equities performed well even though markets were trading at all time high valuation.

Stagger purchases, go for SIPs., mix assets.

Source: NSE, DSP Data as on 31 Jul 2023

What Happens When You Invest In Indian Banks Below 2X P/B

Banking sector stocks (Nifty Bank Index) have underperformed Nifty Index this calendar year, at the same time the valuations have gone through a churn.

As measured by Price to Book Value ratio (P/B), the Nifty Bank Index traded below 2X P/B in Aug 2023. Historically, if you were to keep investing in the Nifty Bank Index during periods when its P/B is below 2 times, it delivers exciting returns over the next few years.

We don’t know what will happen in the next few years, but history says buying Banking Sector Stocks when they are cheap can deliver superior returns.

We expect markets to undergo a correction. If the banking sector falls in line with the market, this could be an attractive sector.

Source: Bloomberg, Data as on Aug 2023

Auto: Two-Wheeler Sector Showing Promising Trends

Source: CMIE, DSP Data as on Aug 2023

Engineering & Capital Goods – Best of Times, But Not Cheap. Stock Selection Key

There is a strong demand in traditional and new-age sectors such as power, water treatment, electronics, defense, and railways.

Margin expansion is visible in both product and project business models due to improved product mix, export-oriented focus, high and rising capacity utilization, and firmer price realization.

There is a brewing multi-year capex cycle led by the government’s thrust on building capacity in power (thermal + RE + transmission) and rail infrastructure given shortages thereof. This will benefit players throughout the entire value chain.

However, despite the favorable conditions for engineering and capital goods companies, it is essential to be mindful of valuations. Therefore, a more active, bottom-up approach is necessary for this sector..

Source: Nuvama, DSP, Data as on Aug 2023

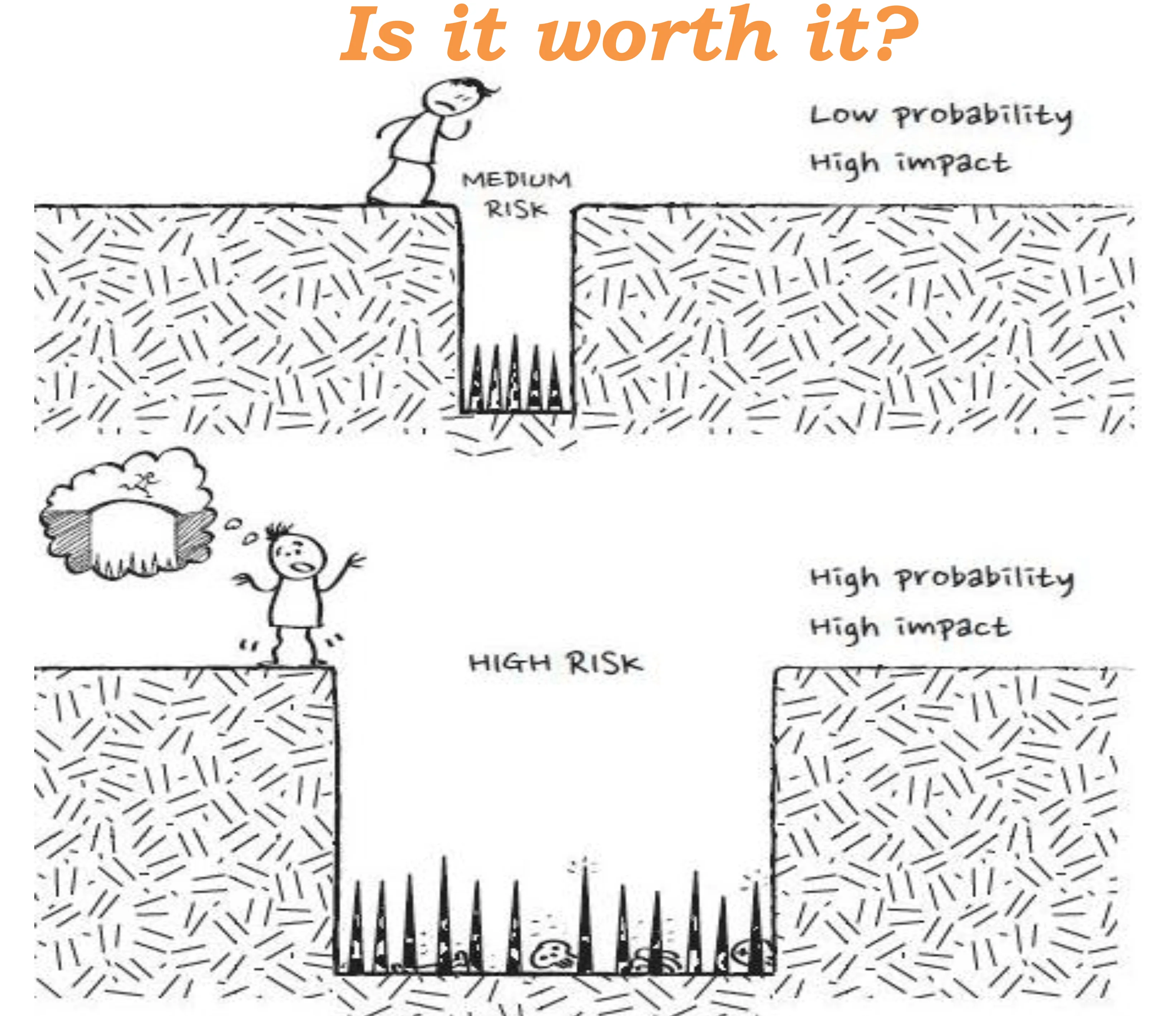

Two Question To Ask On Risk Every Time

In Conclusion

- The US equity market exhibits overvaluation, indicating the potential for a correction amid economic deceleration.

- Possibility of a worldwide correction affecting Indian markets, with anticipated milder declines compared to other markets. Be cautious.

- Buy longer dated-bonds, add duration.

- Valuations matter, more so today; diversify across assets to mitigate fluctuations in equity investments.

- Expect ongoing changes in market sectors; on corrections, consider increasing allocation in equity segments displaying strong or improving business fundamentals.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.