DSP NETRA February 2024

The Unsettling Calm of Low Volatility

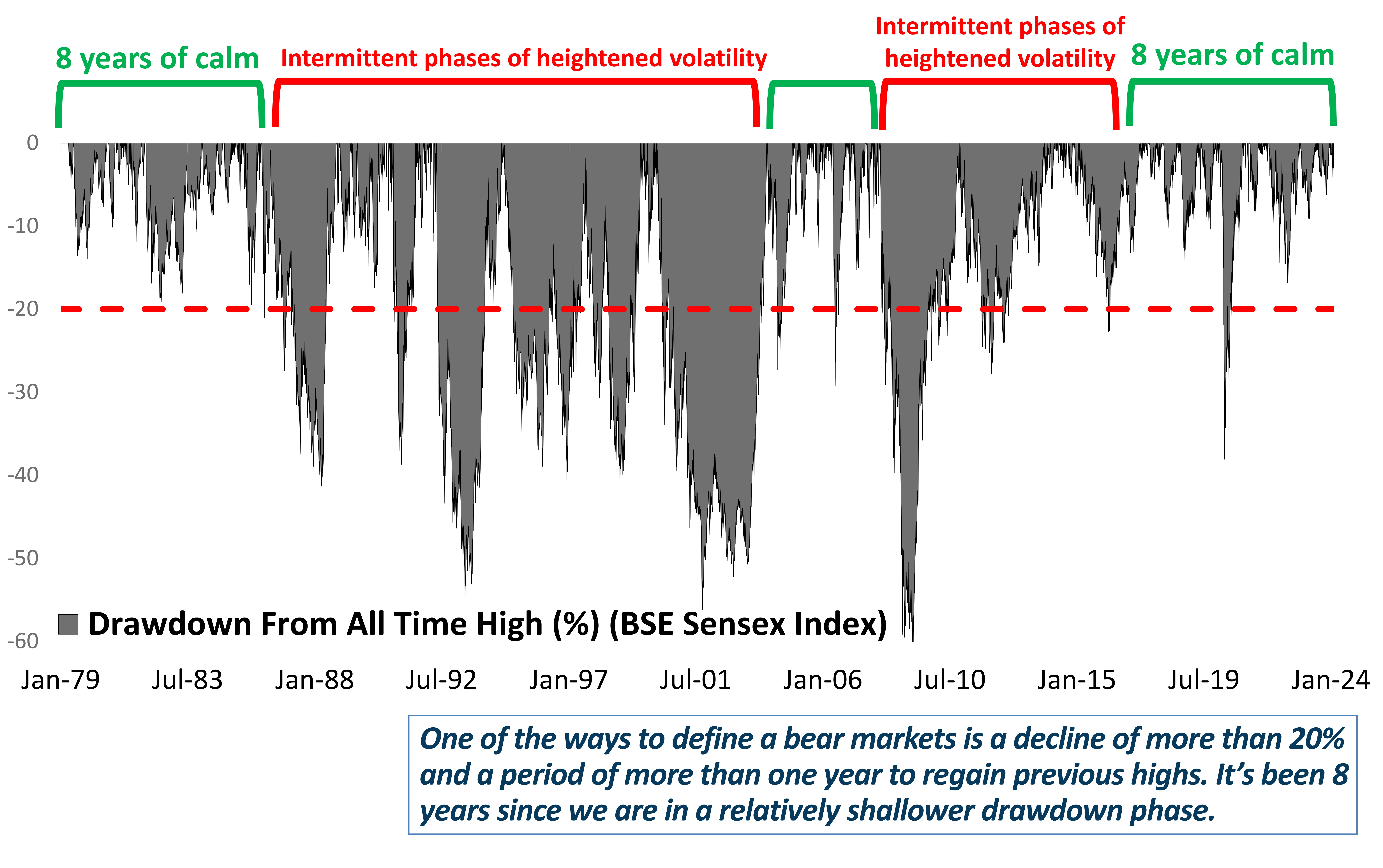

8 Years of Calm Rivals 1980s Low Volatility Era

BSE Sensex Index has now gone for almost 8 years without a bear market.

Defining a bear market:

One of the ways to define a bear markets is a decline of more than 20% and a time period of more than one year to regain previous highs. COVID decline was much deeper but the markets recovered in about 9 months to reclaim all time highs. This made sure that participants avoided the long-drawn periods of pain when stocks don’t deliver returns.

The previous period of such a stable and smooth market was way back in 1980s. Volatility moves in clusters and current cluster of low volatility would likely give way to higher volatility. We don’t know when or why, though. But history tends to rhyme more often.

Source: BSE, DSP; Data as on Jan 2024

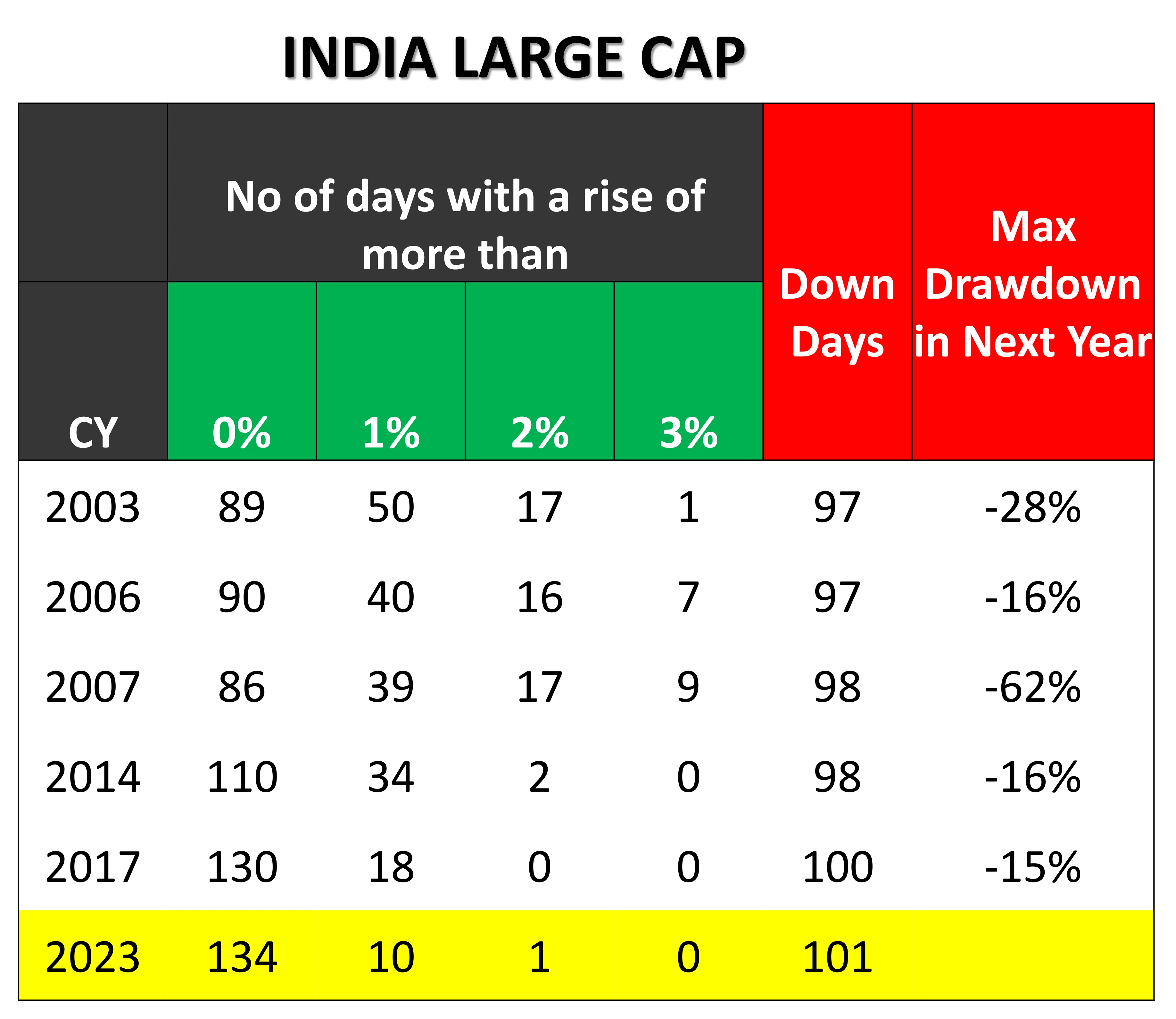

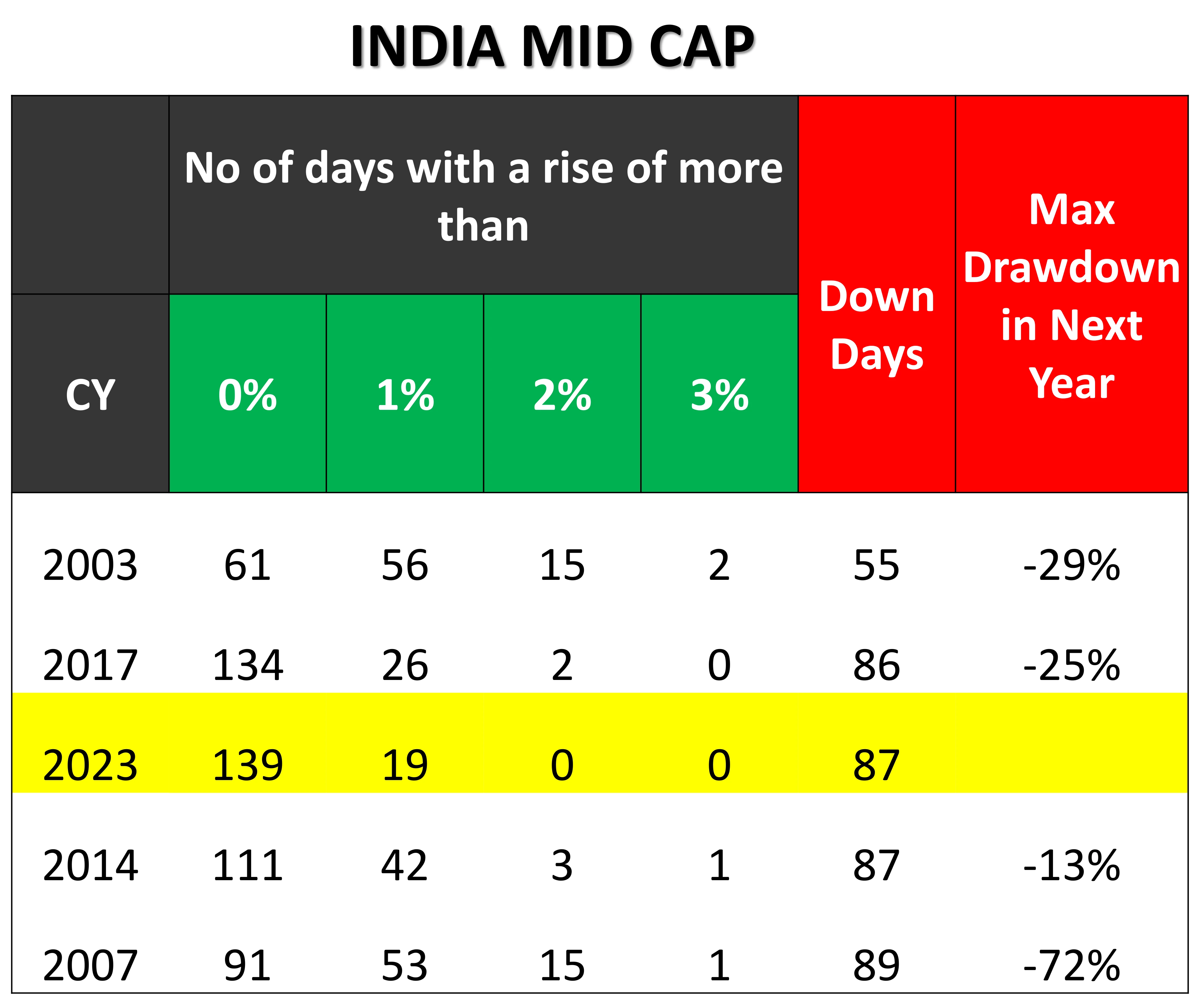

Recent Readings In SMID Indicate Unsettling Calm

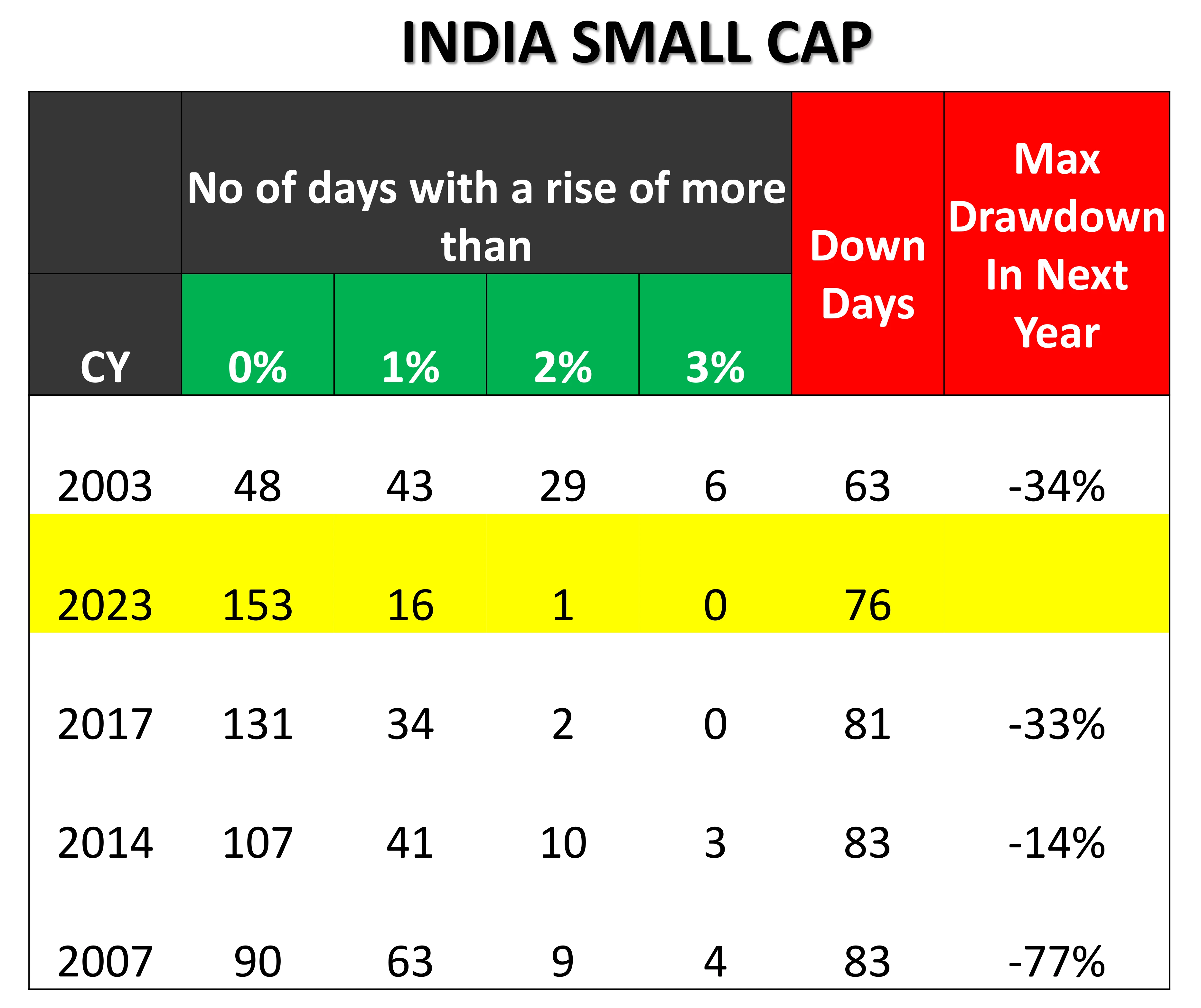

The number of days the Small & Midcap indices have risen by 1% or more neared previous best years in 2023. Such broad, ‘all boats sailing’ uptrend years are rare. In the past, such years have been followed by more than average drawdowns in the following year.

On average, calendar year drawdowns for largecap, midcap and smallcap are 19%, 23% & 26%, respectively. But the year following a bullish ‘unsettling calm’ year, the average drawdowns for top 5 of such years are 27%, 32% & 37% for largecap, midcap and smallcap indices respectively. This indicates that these calm years are followed by heightened volatility and drawdowns. Means, expect markets to become volatile in 2024

Source: S&P BSE, Bloomberg. Data as on Jan 2024

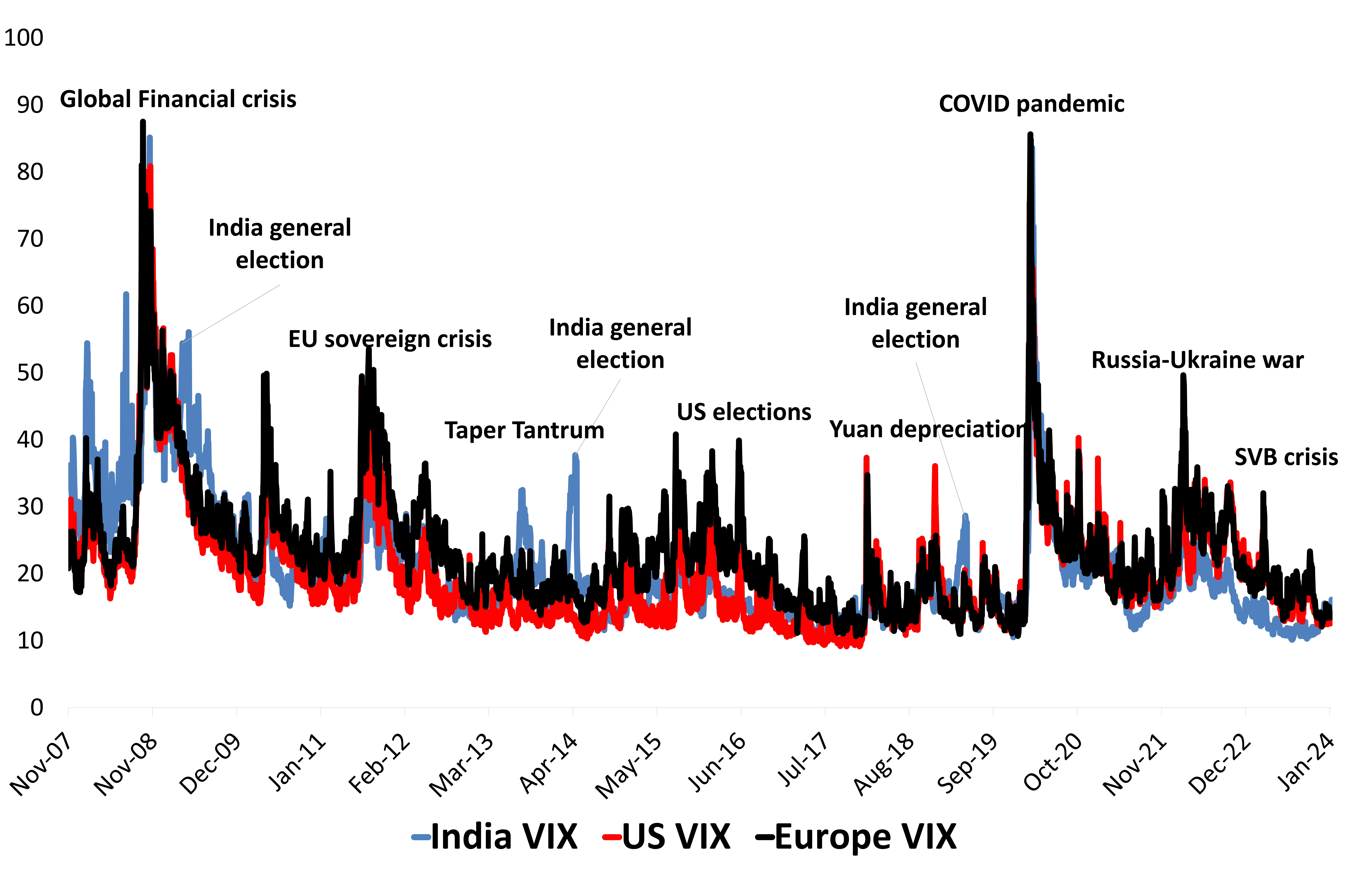

Global Equity Volatility Is In Hibernation

Volatility readings across the world are subdued. Nearly half the world population is going to vote in the next 11 months which will introduce a lot of uncertainty from a policy making standpoint. Historically this has been a source of heightened price swings.

A significant red flag is the emergence of strategies involving the sale of 0DTE (zero days to expiration) options in ETF format. The daily notional trading value of these 0DTE options has surged to approximately $1 trillion in the United States. These novel financial products employ a strategy aimed at generating income by selling put options priced either at-the-money or up to five percent in-the-money every day. This approach is not only reminiscent of picking up pennies in front of a steamroller but also introduces systemic risk to the market. On a broader scale, it underscores the level of comfort investors have in the market persistently maintaining an uptrend. An unsettling calm.

Source: Bloomberg, DSP; Data as on Jan 2024

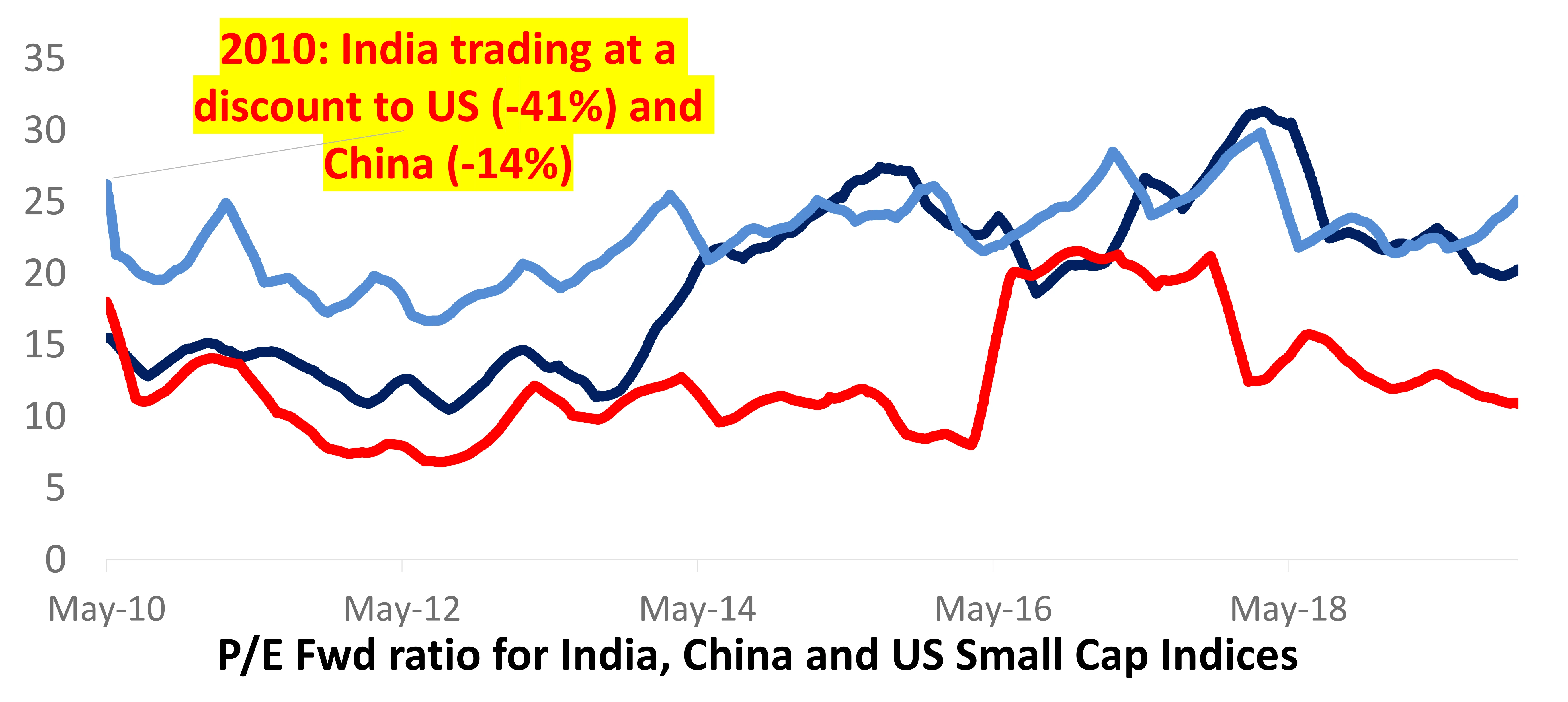

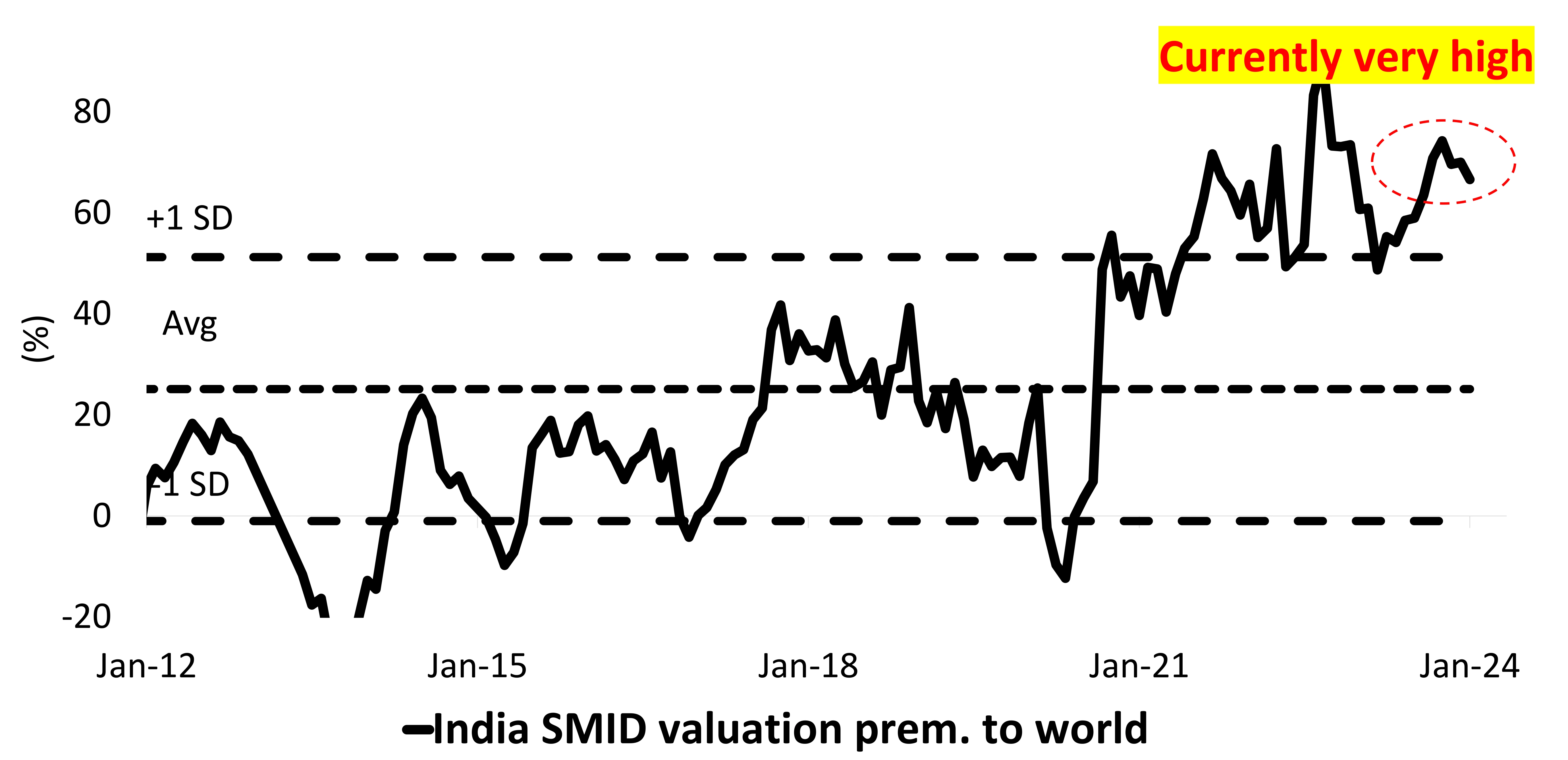

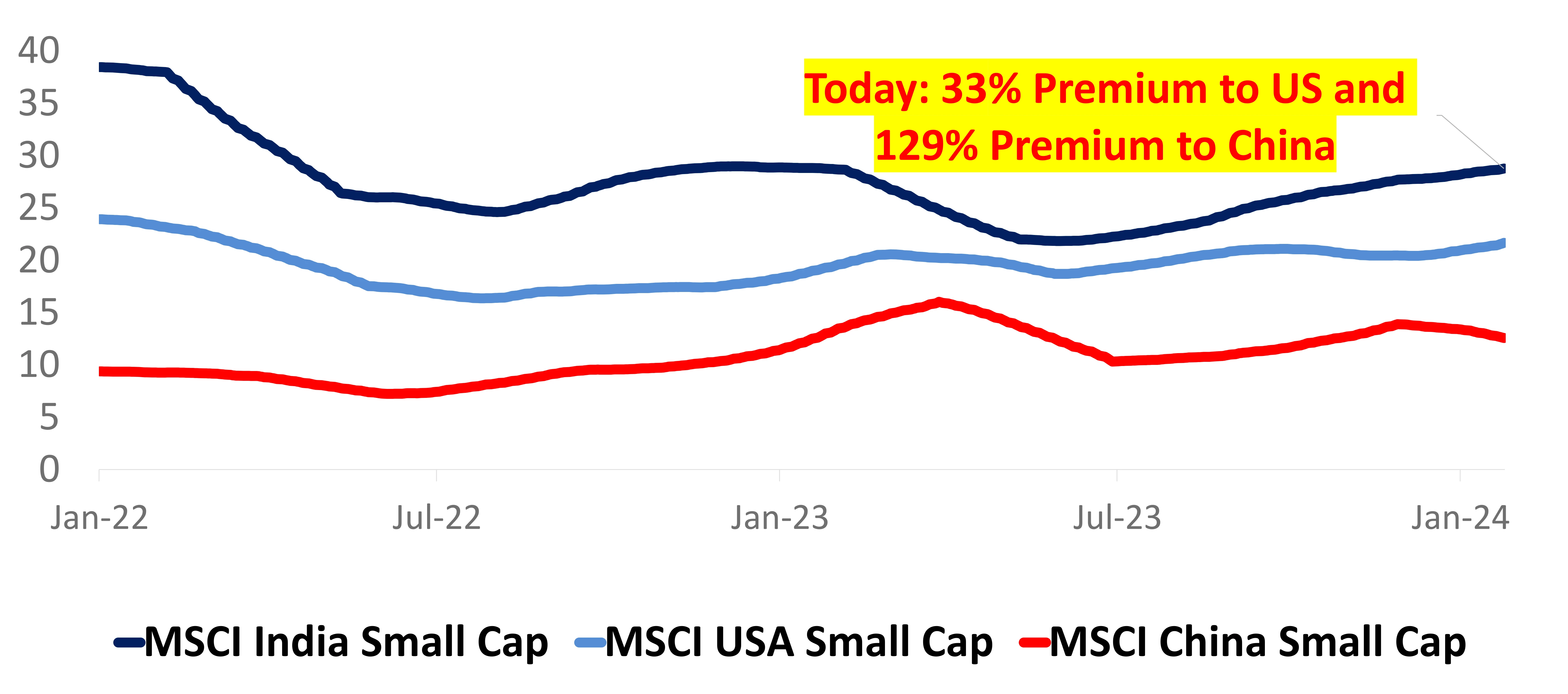

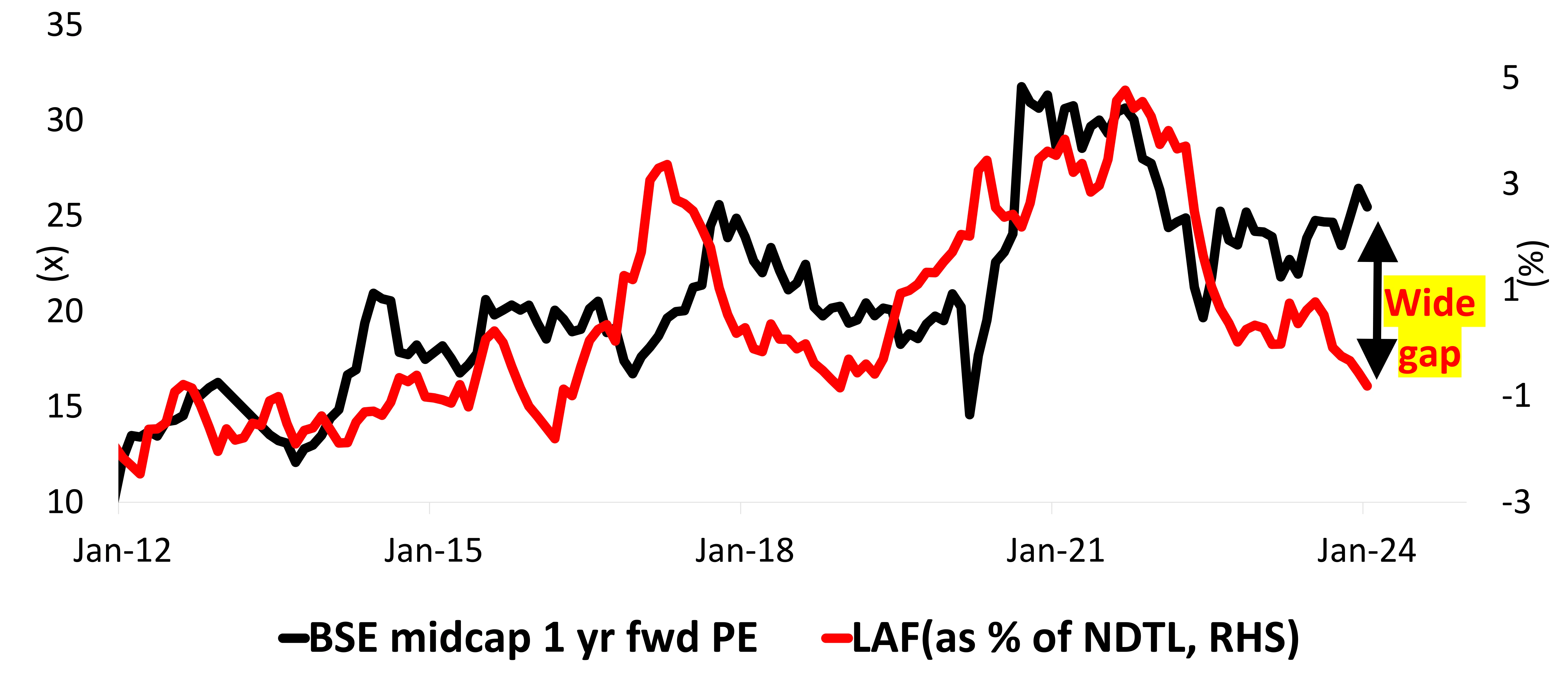

India SMID Valuations Nearing Record Vs The World

Source: Bloomberg, DSP; Nuvama, Data as on Jan 2024

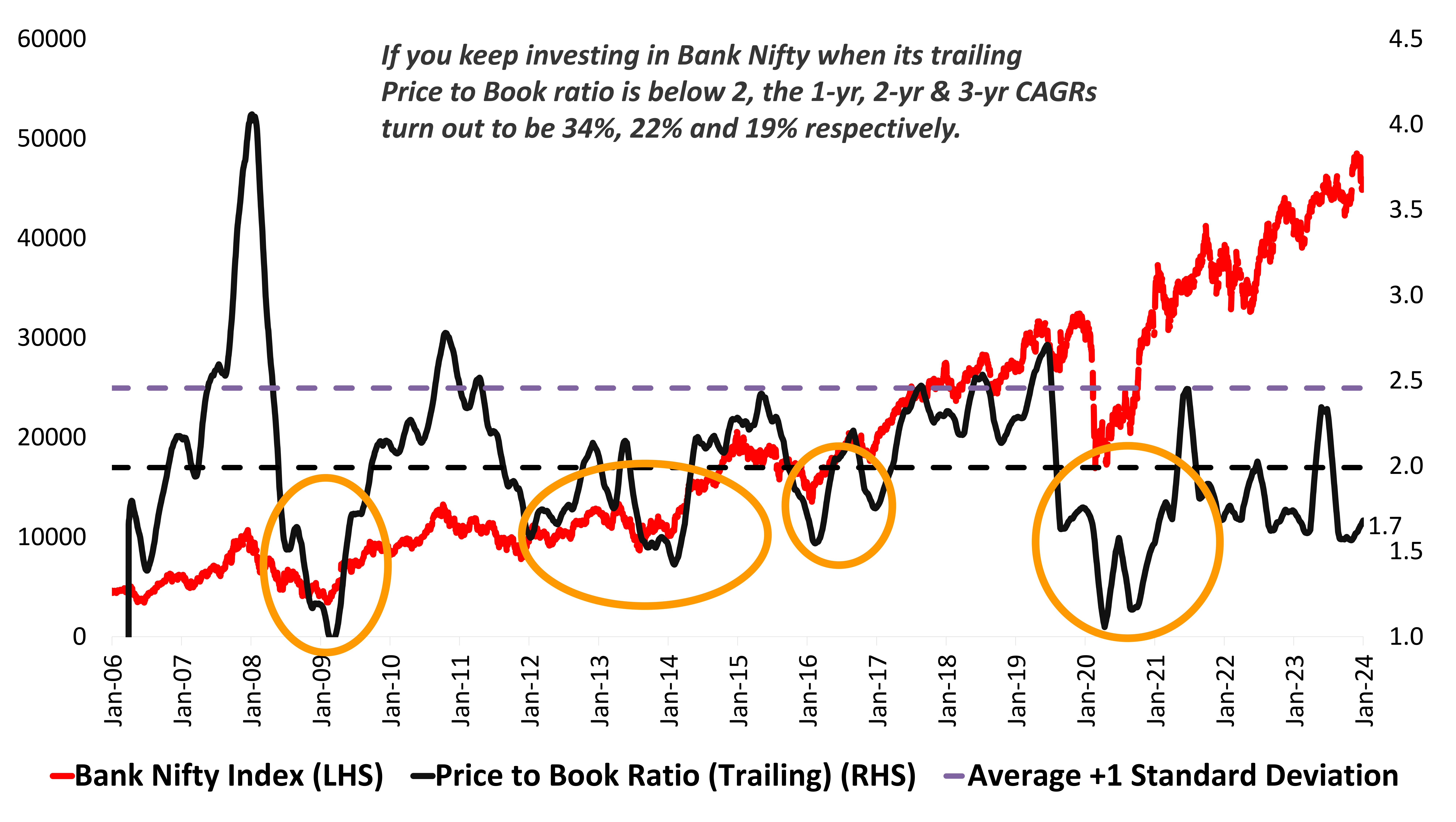

Bright Spot: What Happens When You Invest In Indian Banks Below 2X P/B

Banking sector stocks (Nifty Bank Index) have underperformed Nifty Index in calendar year 2023, at the same time the valuations have gone through a churn.

As measured by Price to Book Value ratio (P/B), the Nifty Bank Index traded below 2X P/B in Jan 2024. Historically, if you were to keep investing in the Nifty Bank Index during periods when its P/B is below 2 times, it delivers exciting returns over the next few years.

We don’t know what will happen in the next few years, but history says buying Banking Sector Stocks when they are cheap can deliver superior returns.

We expect markets to experience a period of volatility, and if the banking sector faces the same price erosion, it would become more attractive. A sector to look forward to.

Source: Bloomberg, Data as on Jan 2024

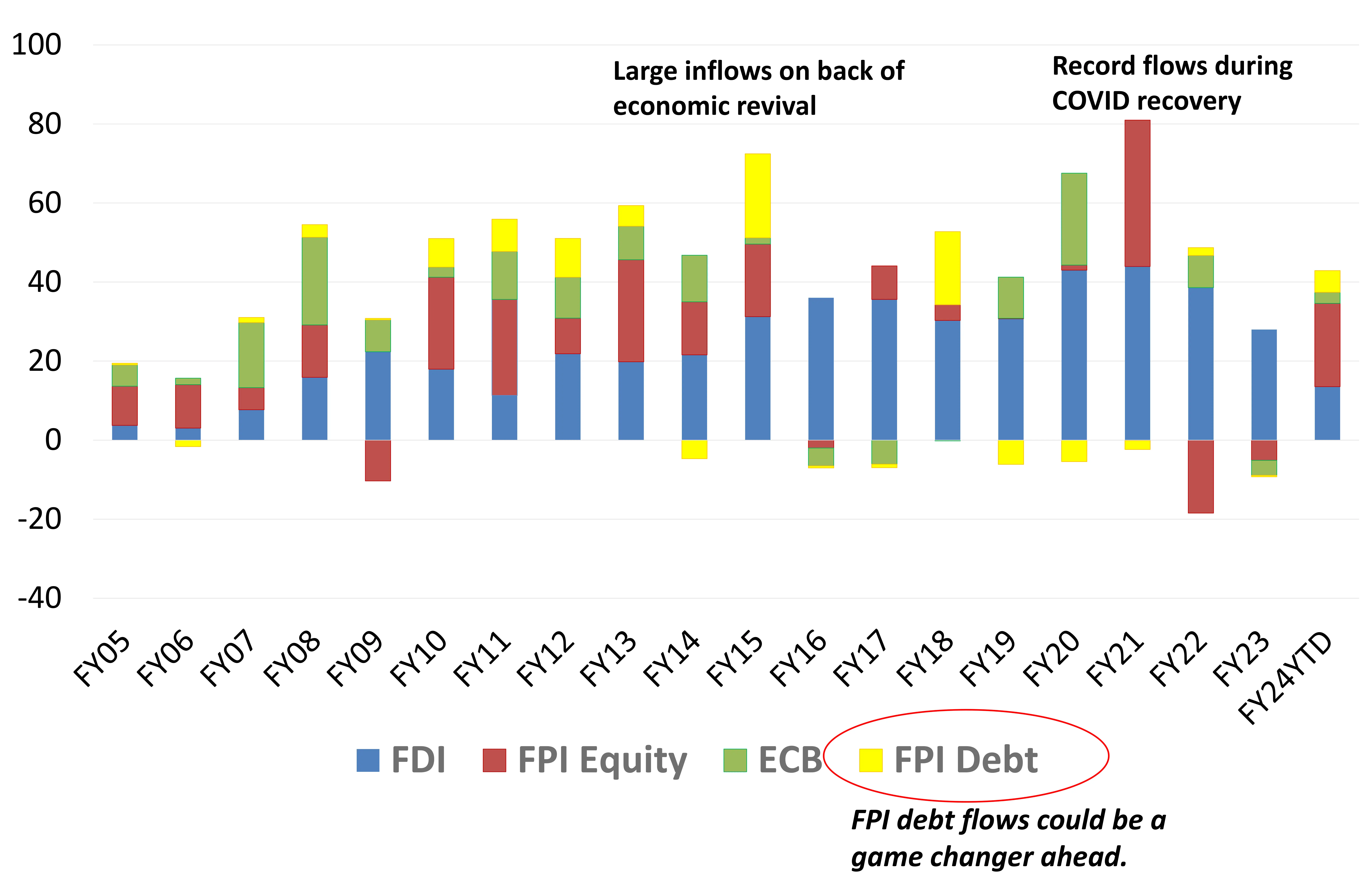

India Cumulative Foreign Investment Flows Yet To See A Surge

India has received large doses of foreign investments, but the record is patchy. India is ranked 5th in world GDP rankings in 2024. It has delivered steady returns in equity markets, no defaults in sovereign debt and now a relatively stable currency over the last 5 years.

These changes could result in large inflows of foreign investments but are yet to fructify in hard data. FPI equity and debt flows have been the most volatile.

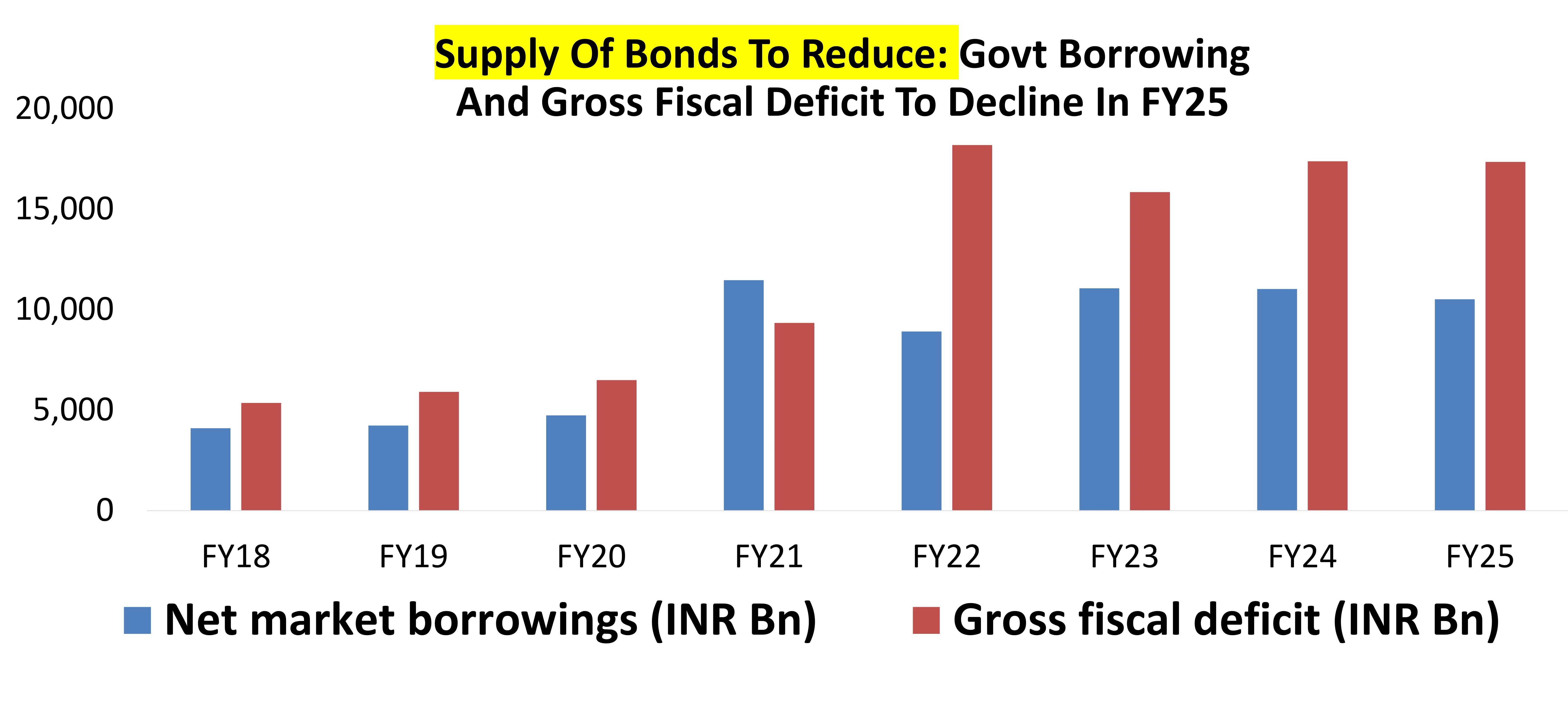

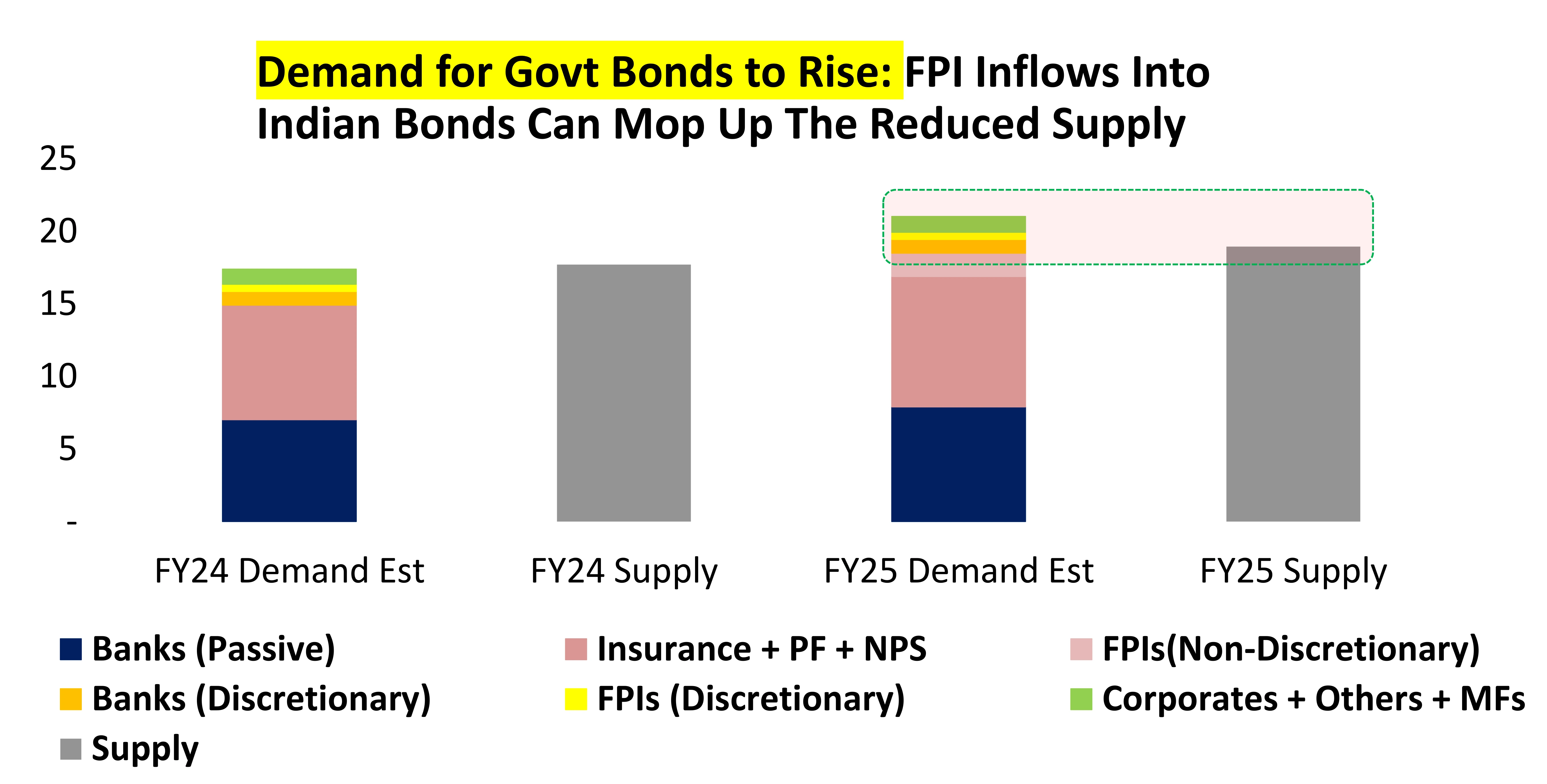

FPI debt flows are likely to pick up as India becomes the part of global bond indices. An opportunity to benefit from this trend may present itself in FY25 onwards by participating in long duration Govt. Securities in India. India is likely to receive $25bn in FPI inflows as it become the part of global bond indices. This can be a game changer for one category of debt funds. Funds which have bondsfor long maturity. Duration.

Source: NSDL, CMIE, CDSL,DSP; Data as on Jan 2024

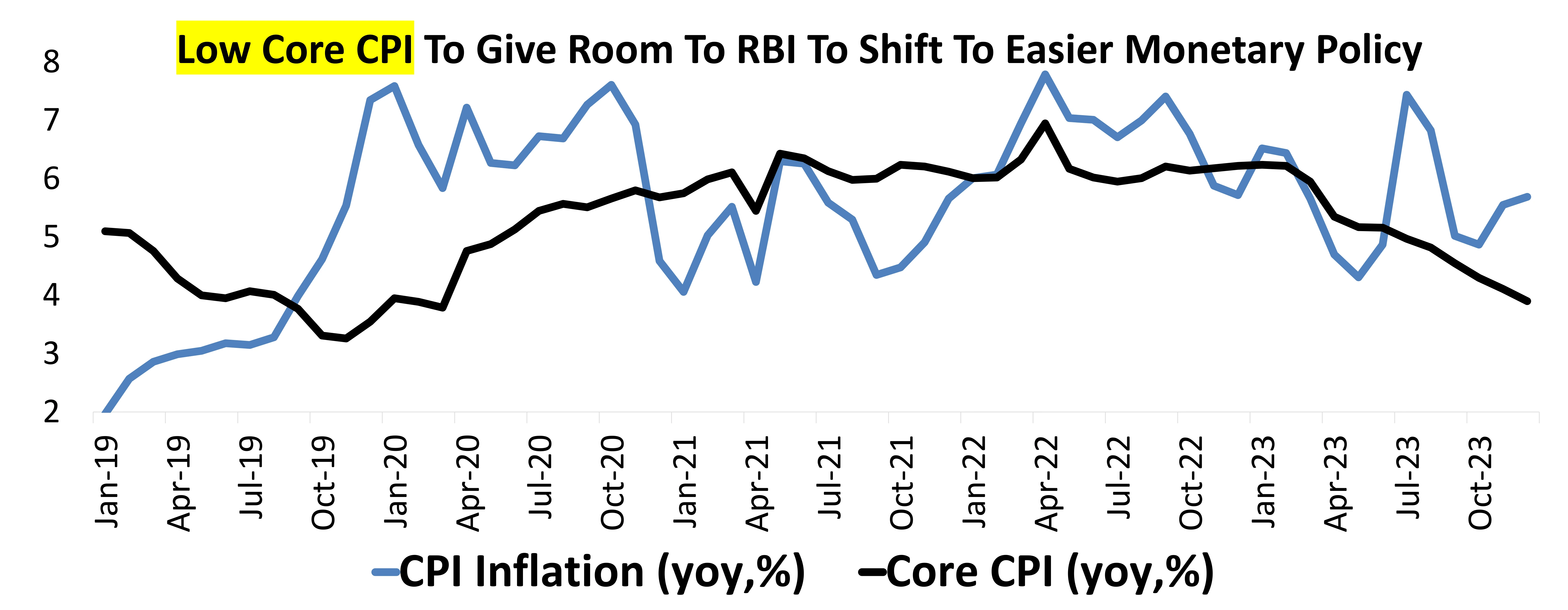

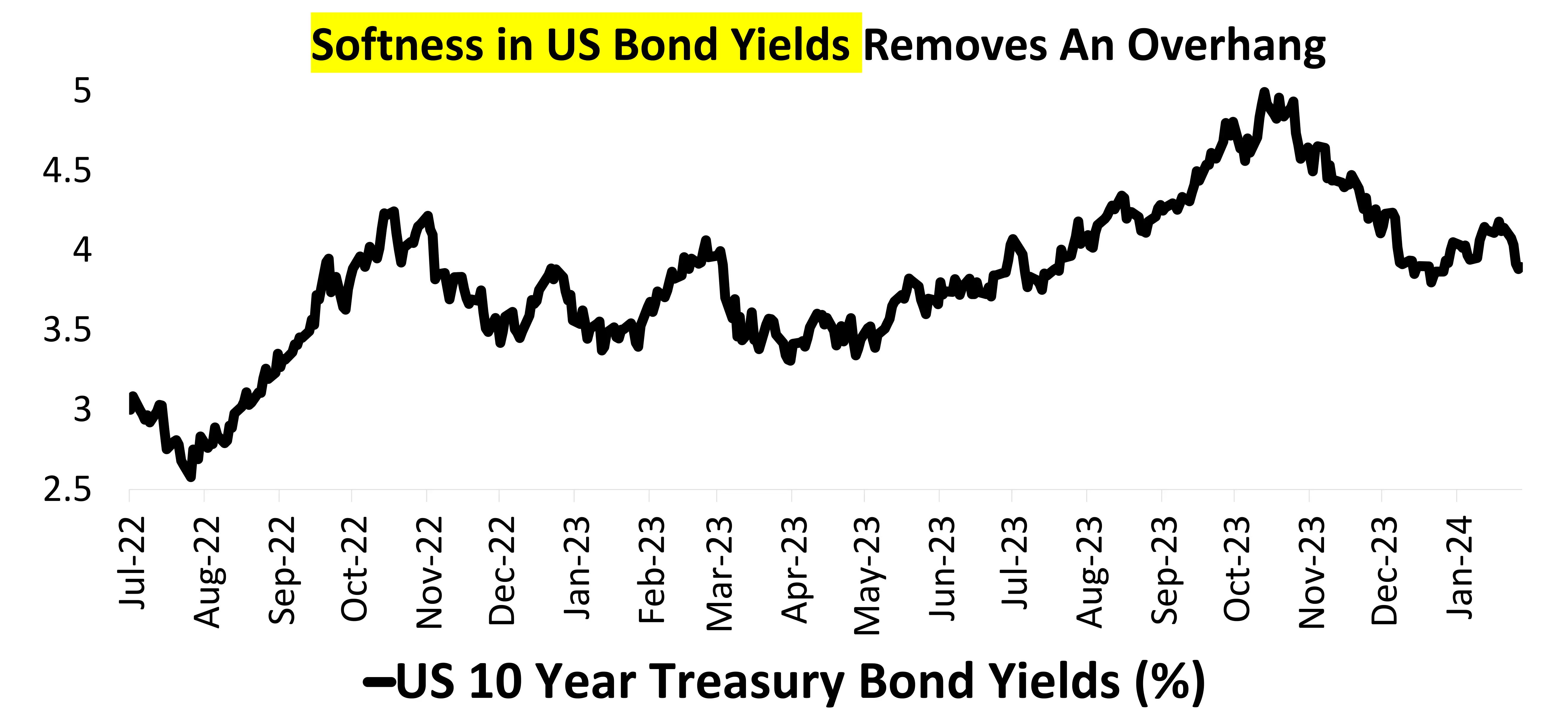

India Long Bond Duration Is Playing Out

Source: Bloomberg, CMIE, Budget Documents,DSP; Data as on Jan 2024

US Inflation & Rates

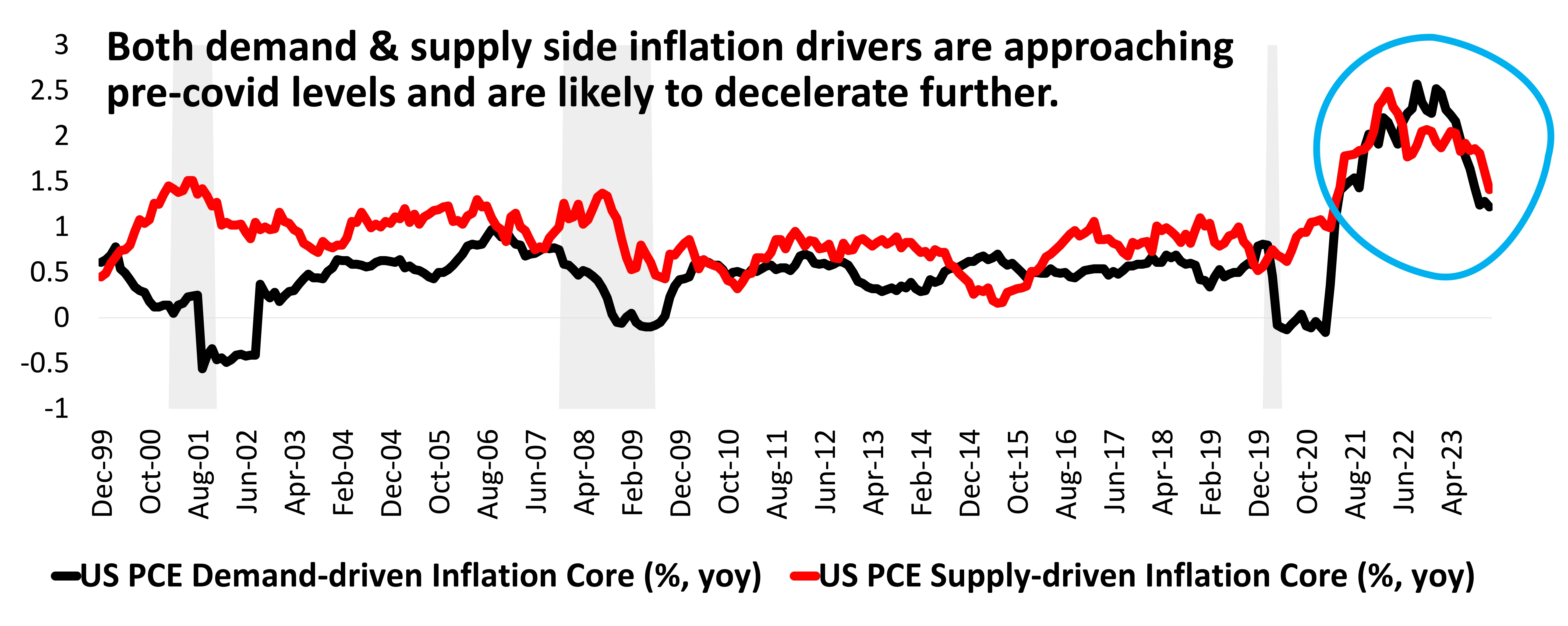

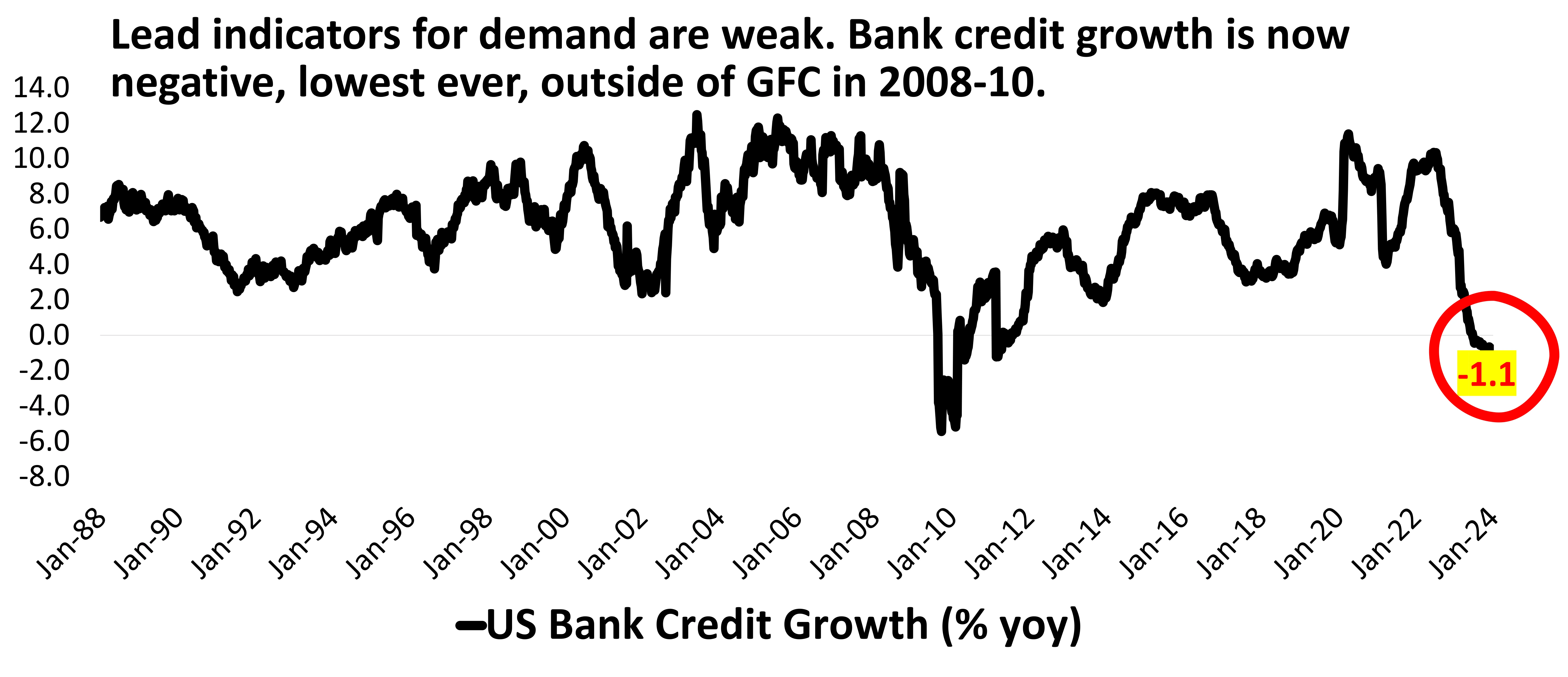

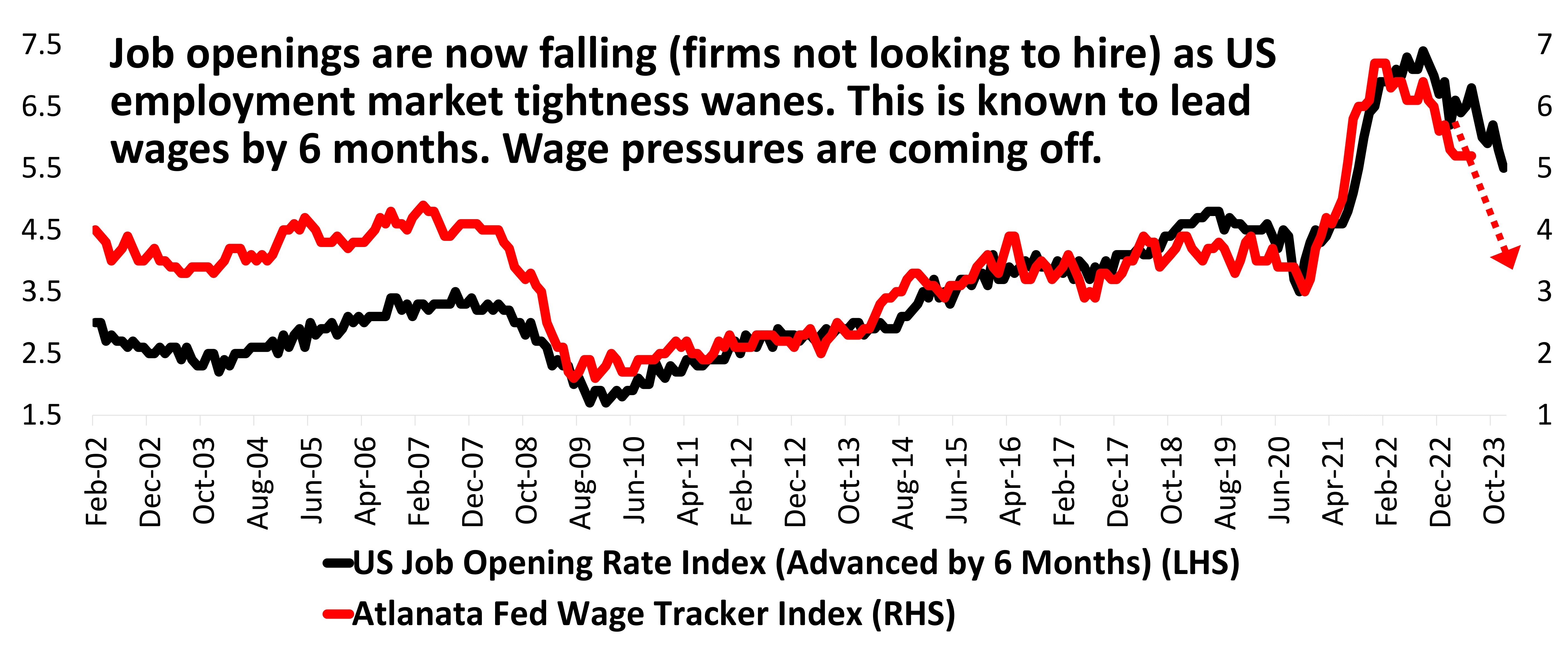

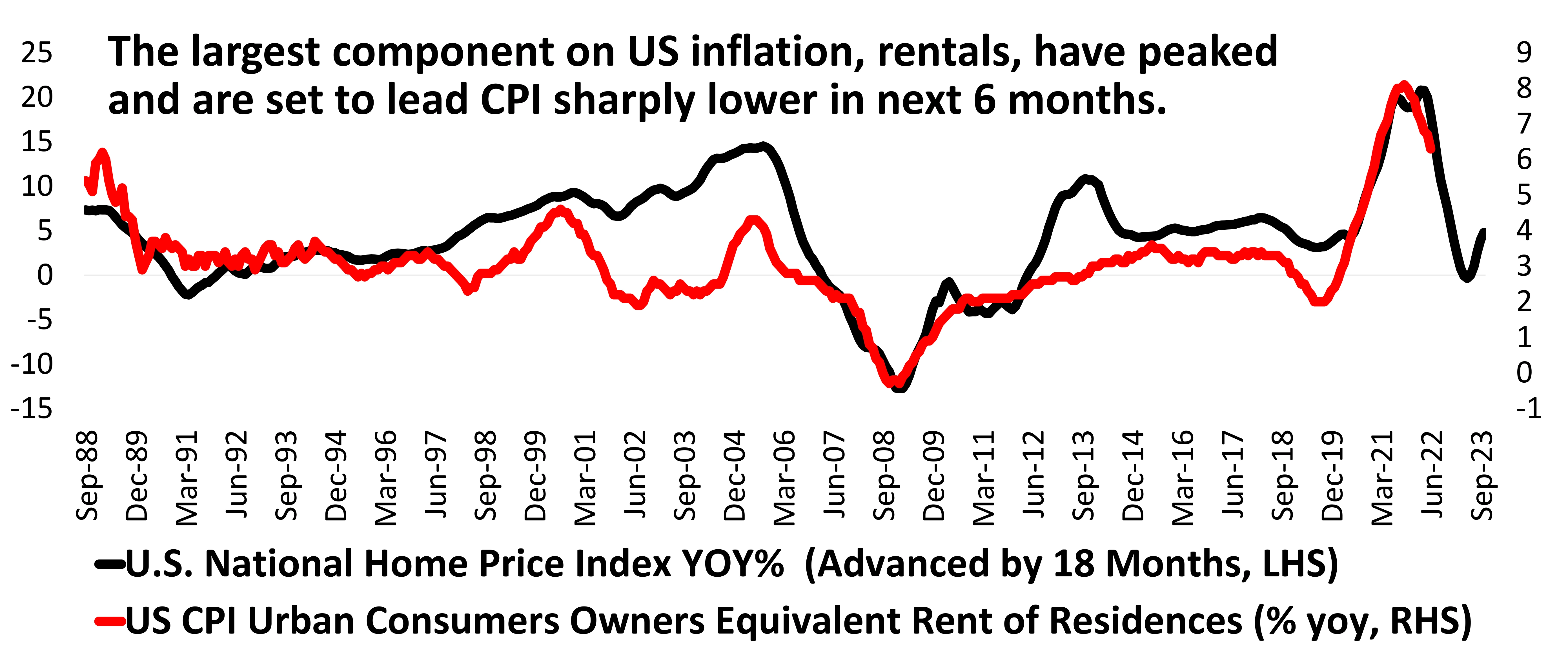

Inflation: The Driver of Fed’s Hawkish Stance Is Falling

Source: DSP, Bloomberg, Data as on Jan 2024

We Are Amidst The Longest Yield Curve Inversion on Record

Source: Bloomberg, Jan 2024

US Economic Expansion Is Now Over Long Period Average

Not only equity markets, but the US economy has also enjoyed one of the most stable labour market conditions (ex of the pandemic shock) and economic expansion.

COVID pandemic, a true Black Swan, disrupted the global economy but the recovery from the pandemic has been nothing short of incredible. The economy in United States contracted for merely two months (as per NBER) and began its course of continued expansion.

This means than US economy has expanded for the last 175 months, with only 2 months of steep contraction due to pandemic. This is the longest and most durable period of expansion ever.

As interest rates tightening begins to bite the economy and labour market tightness wanes, this long phases of expansion is likely to face headwinds.

Source: NBER, DSP; Data as on Jan 2024

Longest Phase of Economic Expansion Without A Policy Led Recession

Source: FRED, NBER, DSP; Data as on Jan 2024

Has The Fed Tightened Enough To Cause A Slowdown. Buy US Treasury Bonds

Historically, whenever the US Fed raises rates such that the Federal Funds effective rate is higher than the nominal GDP growth rates (yoy), a slowdown ensues.

There are instances when a slowdown in US hasn’t resulted in recessions (like 1984, 1985) but were architects of global troubles like savings & loans crisis (1985 to 1989) and Asian currency crisis (1997).

This means that the current level of US Fed Funds rate at 5.33%, a 25 year high, is too tight for economic growth to continue unabated.

The longer the Fed holds rate at this level, the more fragile the system become in face of slowing growth.

This opens an opportunity to buy US treasury bonds as inflation slows further and Fed begins to embark on a cycle of rate cuts later in the year. The ideal entry point could be closer to US T10 yr at 4.25% to 4.40%.

Source: FRED, BEA, DSP; Data as on Jan 2024

Long Term Return Belong To The Long-Term Investors. Those Who Wait

“…their delusion lies in the conception of time. The great stock-market bull seeks to condense the future into a few days, to discount the long march of history, and capture the present value of all future riches. It is his strident demand for everything right now – to own the future in money right now – that cannot tolerate even the notion of futurity – that dissolves the speculator into the psychopath….” - James Buchan

Source: The Price of Time: The Real Story of Interest by Edward Chancellor

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.