India Infra: Steady Progress

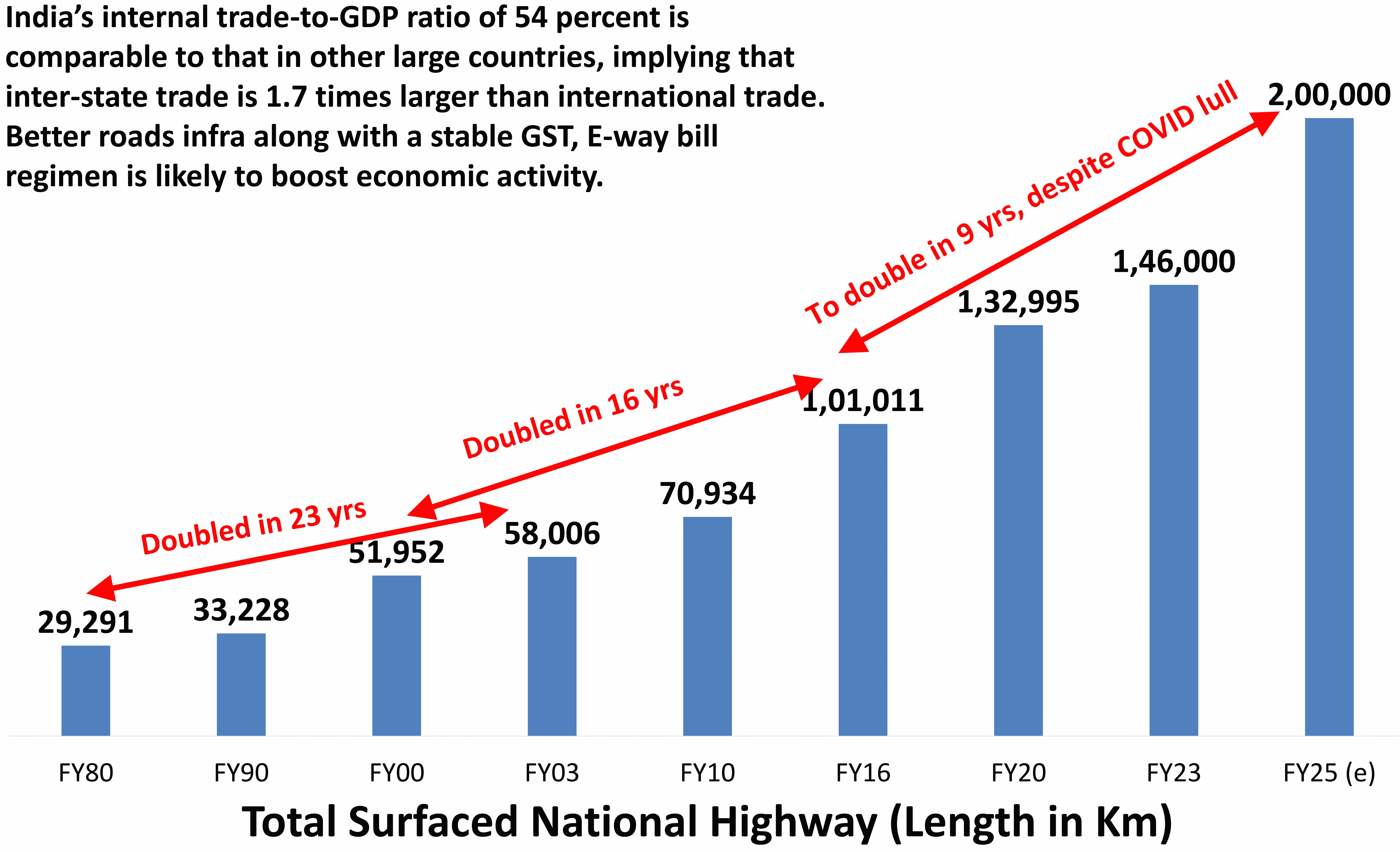

Roads – A Highway To Robust Economic Growth

Roads are arteries of economic activity. Roads link producers with consumers, workers with employers, and therefore play an essential role in any development agenda. Expansion of road infrastructure in the form of highways promises to increase wealth & create new opportunities for local businesses & households.

India’s internal trade-to-GDP ratio of 54 percent is comparable to that in other large countries, implying that inter-state trade is 1.7 times larger than international trade.

A large and robust network of road infrastructure can help India’s interstate trade and, hence, economic growth. Very little research has gone into the multiplicity of this infrastructure development and its impact on economic growth.

This decade will likely create large, profitable opportunities in this space and enhance India’s economic prospects.

Source: DSP, CMIE, Govt Documents, Data as on March 2023

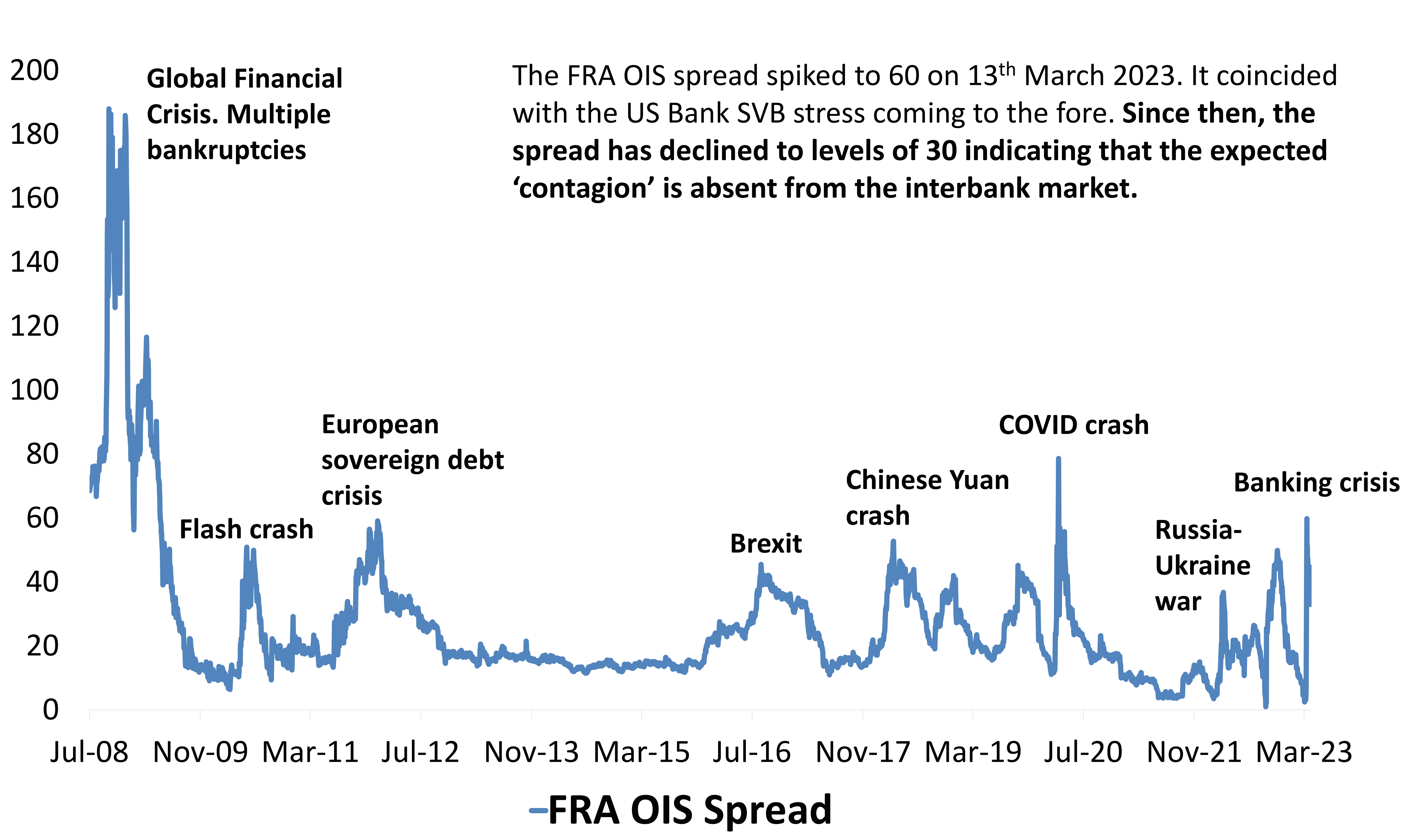

Measures of Risk: Is There A Contagion?

Measures of Risk: Interbank Market Doesn’t Indicate A Contagion, For Now

The FRA-OIS spread measures the gap between the U.S. three-month forward rate agreement and the OIS rate. This spread is widely seen as a proxy for banking sector risk, and a higher reading reflects rising interbank lending risk.

It gives a peek into counterparty confidence in the interbank market. A banking crisis should ideally lead to a loss of confidence and show up here through an elevated FRA-OIS spread.

This indicator is not a crystal ball. It can’t predict a crisis, but it is a good coincidental indicator that tells us whether the interbank risk is rising or not. These risks are like those of epidemic contagion. They rise exponentially if a crisis is lethal. But epidemics also come in waves, so we need to track them for the next few months.

For now, it doesn’t indicate a contagion is in force, as widely believed.

Source: DSP, Bloomberg Data as on March 2023

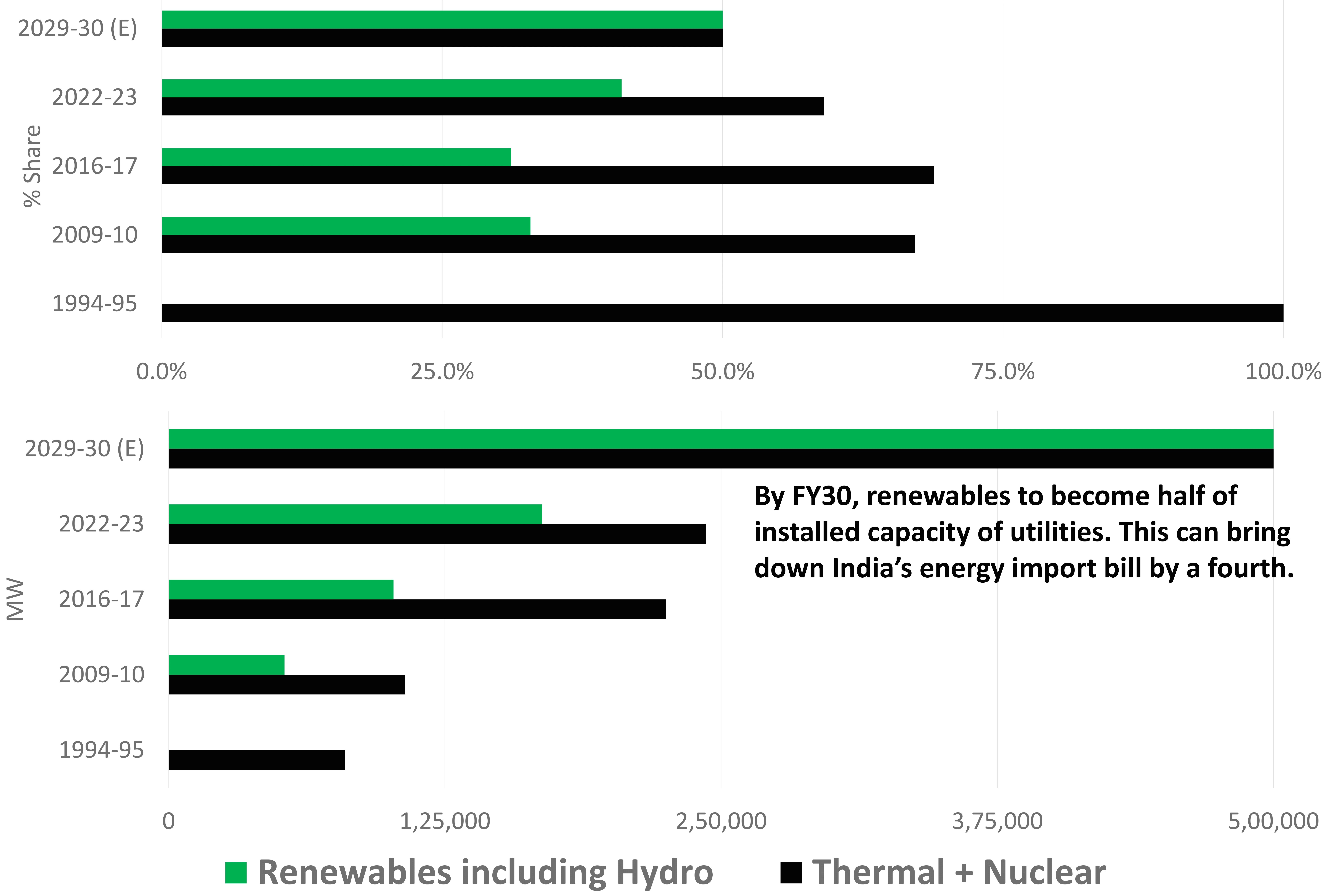

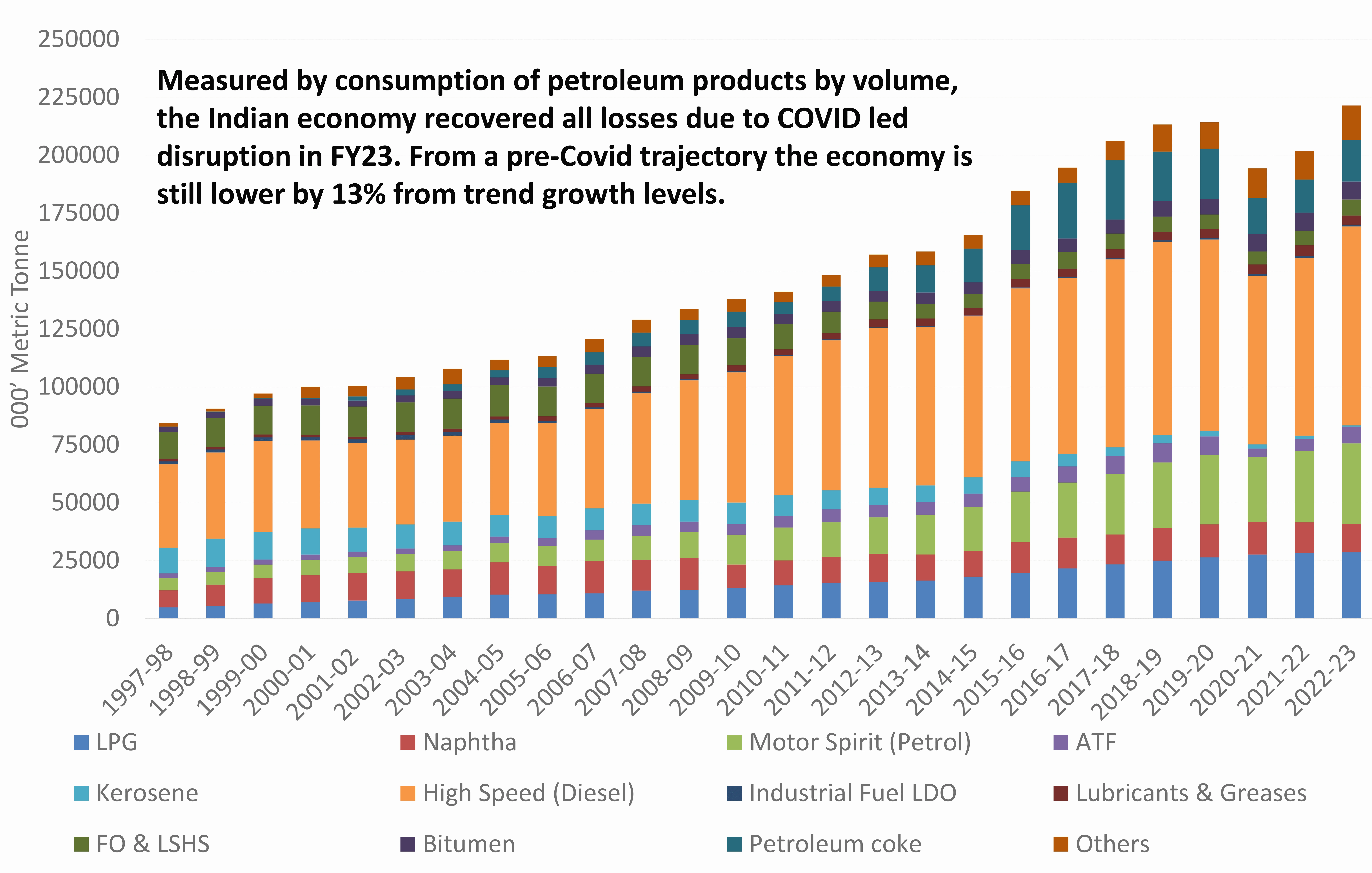

Petroleum Products’ Consumption Indicates Economy Has Recouped COVID Losses

The consumption of energy is one of the cleanest measures of tracking economic growth. It look three years for India to recover its losses fully from COVID led disruption.

However, when measured from a pre-COVID growth trajectory, the economic growth, measured by quantity of petroleum products consumed is still lower by 13% in comparison to its trend growth if COVID hadn’t happened.

This means that Indian economy is still in an early growth phase and is far from overheating or tipping over. Consumption of energy is likely to rise ahead which is likely to be supported by a big push for renewables.

Source: DSP, CMIE, Data as on March 2023

Measures of Risk: Is There A Contagion?

Measures of Risk: Interbank Market Doesn’t Indicate A Contagion, For Now

The FRA-OIS spread measures the gap between the U.S. three-month forward rate agreement and the OIS rate. This spread is widely seen as a proxy for banking sector risk, and a higher reading reflects rising interbank lending risk.

It gives a peek into counterparty confidence in the interbank market. A banking crisis should ideally lead to a loss of confidence and show up here through an elevated FRA-OIS spread.

This indicator is not a crystal ball. It can’t predict a crisis, but it is a good coincidental indicator that tells us whether the interbank risk is rising or not. These risks are like those of epidemic contagion. They rise exponentially if a crisis is lethal. But epidemics also come in waves, so we need to track them for the next few months.

For now, it doesn’t indicate a contagion is in force, as widely believed.

Source: DSP, Bloomberg Data as on March 2023

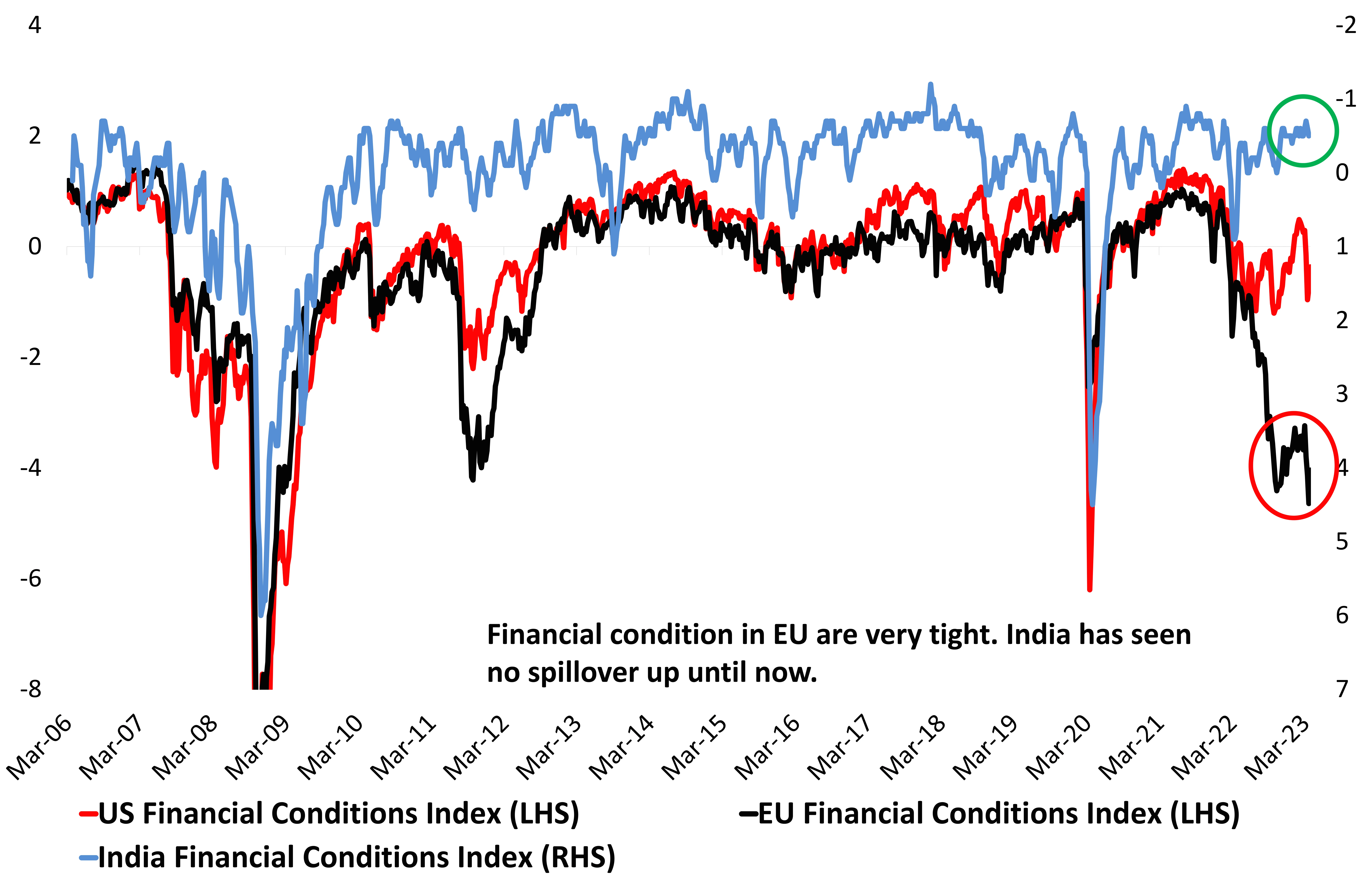

Measures of Risk: Financial Conditions Aren’t In Sync Like The Past

Crisis roils financial conditions. Businesses, especially financial institutions, find it difficult to borrow, and credit spreads widen. This is another symptom of a financial contagion.

In the current wave of crisis, financial conditions in the Eurozone are worse than during the previous crisis and only slightly better than during the global financial crisis of 2008. But financial conditions in the largest and most important market, the United States, are still normal. This again indicates that the malaise hasn't spread.

India is still a picture of calm. The financial conditions remain resilient and do not indicate the stress India has gone through historically when the West goes through a crisis.

Source: DSP, Bloomberg Data as on March 2023

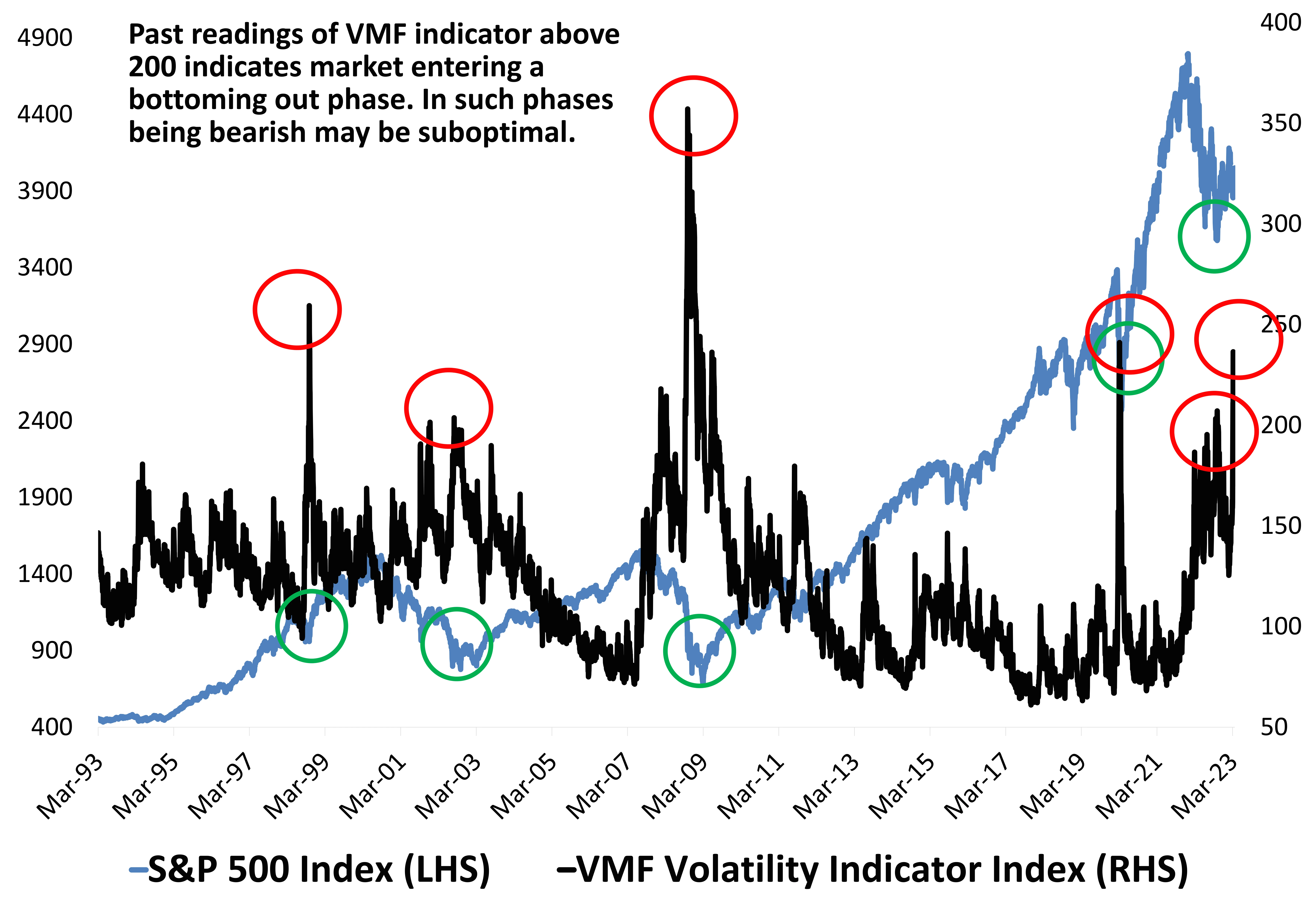

Measures of Risk: The VMF Indicator Spiked & Fell

VMF(VIX, MOVE and FX volatility index) indicator is our inhouse indicator which measures the combined volatility in stocks, bonds and currency markets. Elevated readings in this indicator means that all three asset classes are under stress at the same time.

Currently, we are witnessing heightened readings across all the three underlying indices of these asset classes. In the first week of Oct’22, this indicator reached a level which signaled the possibility of a bottoming out process in markets. During the March’23 banking crisis the indicator once again spiked and has begun to cool off. The ‘Risk-off’ has run too far.

This proved to be another indicator which shows it could be more prudent to be positive on stocks. Nifty Index has underperformed in 2023 so far and investors may benefit from a positive outlook on Indian stocks from 17,000 Index levels.

Source: DSP, Bloomberg Data as on March 2023

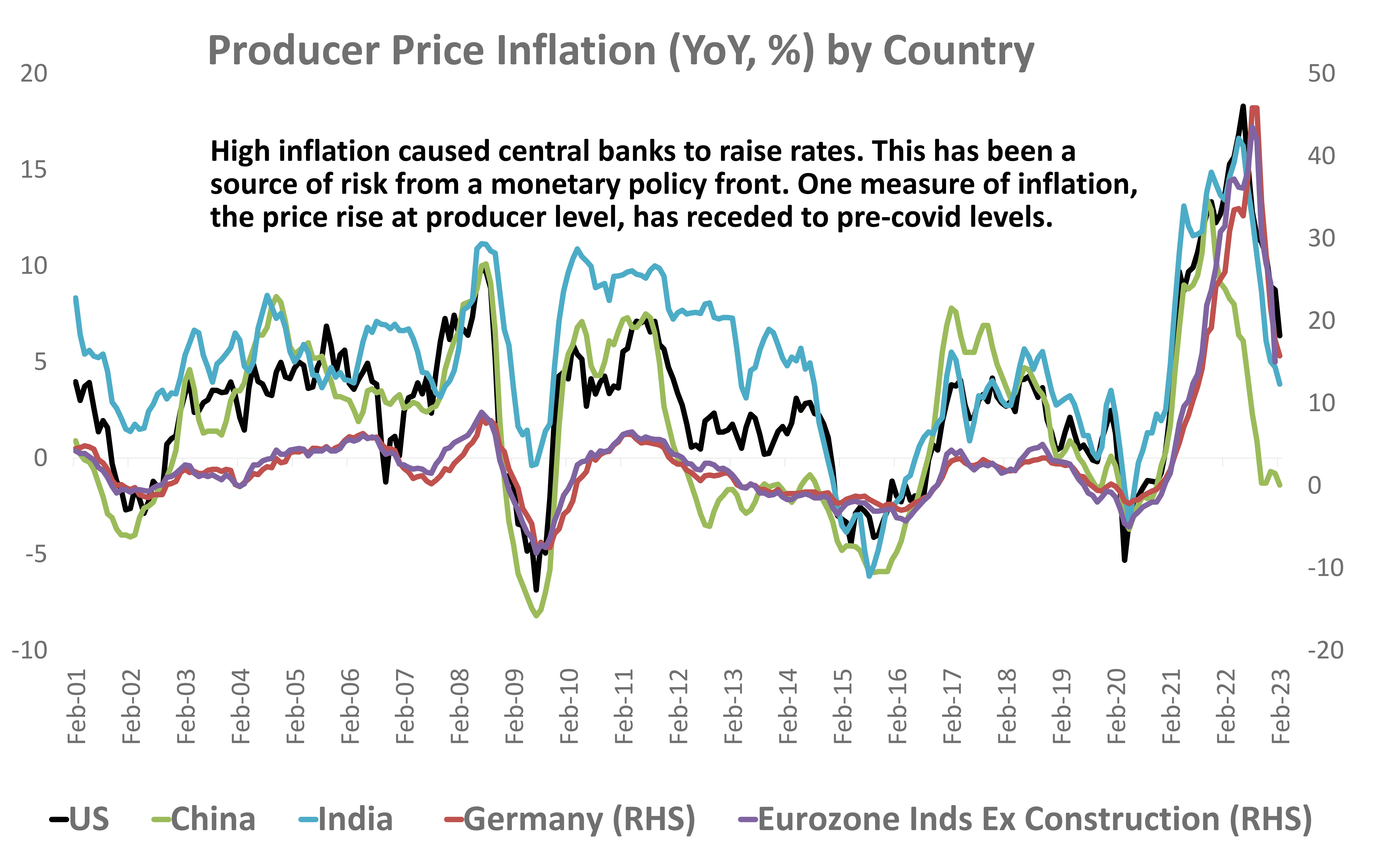

Measures of Risk: Inflation Cools At The Producer Levels

Inflation has been steadily declining from multi decade highs in most economies. The recent cool-off in commodity prices is causing input prices to decline.

This is visible in a fall in rate of inflation at the producer level, the PPI or producer price index in most countries are now rising at a slower pace than in last two years.

In China, the factory of the world, producer prices are deflating. This trend in producer prices would eventually translate to lower consumer price inflation in the coming months and would give more reasons for central banks to adopt a less hawkish stance.

Source: DSP, Bloomberg Data as on March 2023

Valuations & Opportunities

India’s Premium Over EMs Washed Off

India was trading at a 90% premium to its emerging market peers six months ago. A 10% correction in Indian stocks, a sharp rally in EM peers, and a catch-up in earnings have reduced this premium.

The Nifty Index is now trading at valuations close to its long-term average versus the emerging markets.

This means that the headwinds from active foreign investors due to the relative expensiveness of the Indian market are no longer valid. Expect better foreign investment flows into India based on relative valuations.

Source: Bloomberg Data as on March 2023

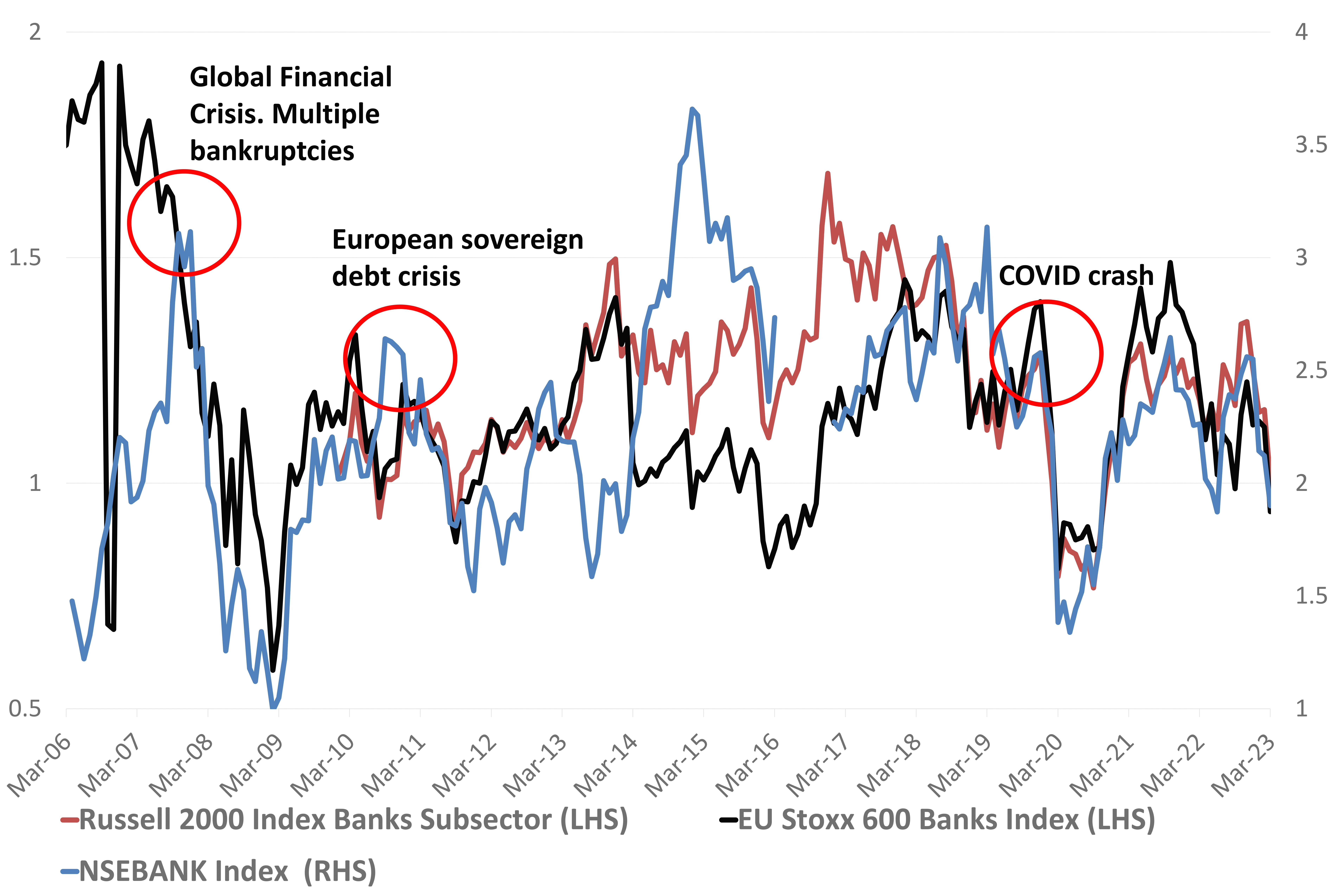

Banking Sector Valuations Are Lower Than Most Previous Crises

When equity valuations are frothy, there is a large room for equity prices to cause marketwide panic. In most previous crises, the starting point of financial sector troubles was higher from a valuation standpoint.

Contrast this to today, when most banks, the world over and less leveraged, have better asset quality and higher provisioning in comparison to almost all past instances of crisis. There are, of course, weaker institutions that pose risks to others.

In India, banks are now trading at valuations that are higher than COVID lows but lower than they have been anytime in the past 7 years. This is happening at a time when credit growth is robust, asset quality is better, and earnings growth is steady. This is a bullish phase for Banks.

Source: DSP, Bloomberg Data as on March 2023

Healthcare: Margin of Safety Due To Attractive Valuations

A study of nearly 96 pharma, hospital, API & CDMO players and path labs indicate that more stocks in the healthcare segment are cheaper than their own past.

Two third of the universe is trading below their past 13-year average Price to earnings & nearly similar number of companies are trading below their historical EV/EBITDA multiples.

Valuations are attractive. In fact, healthcare stocks have been as cheap only a few times over the past decade.

What do you own in healthcare?

Source: DSP, Bloomberg Data as on March 2023

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.