We asked to invest in duration last month.

Continue investing in duration..

At this time, risks to yields rising are

limited

Our View – Summary

-

Risks to yields moving higher greatly diminished

We believe we are close to peak yields; thus risk/reward gravitatestowards a long duration position:

- Favorable Demand-Supply: Announced govt borrowing for FY24 is just 8% more than FY23. Demand expected to grow at faster pace. No more G-sec auction/supply for the rest of the month.

- RBI OMOs: In FY24, RBI will finally purchase govt bonds, after a gap of more than 1-year.

- Lag effect of rate hikes: The rate hikes have few quarter lag. The impact in economy will start showing now. Not just lower inflation, but economy slowdown and unknown event risks are heightened across the globe.

-

Risks to our view, however at current yields these risks seem to be priced in

We had mentioned three reasons for yields to be under pressure in this quarter.

- Rupee depreciation: We are confident that the BoP risks are still not behind us, despite rupee stability in recent weeks. However, these risks seem to be overshadowed by the positive drivers.

- Global inflationary pressures could recur: Inflation is a difficult beast to predict. While we expect inflation to come down globally – but who knows!

- Liquidity: Liquidity continues to tighten which has been pushing the short end yields up. But there is a risk that RBI might delay its liquidity infusion actions – especially if there is concern on currency.

-

Risk/Reward to buy duration

For long duration investment: With low chances of yields spiking up, we advise to add duration. The event risks also favor long bonds.

For money markets investment: We like the 1-year segment because of its high term premium. The high carry is lucrative. Central banks stance change will lead to fall in yields in this segment.

Fed: Federal Reserve; RBI: Reserve Bank of India; G-Sec: Government Securities; OMO: Open Market Operation

To start with,

What has changed since last

Converse edition?

Firstly, in India

Inflation surprised on the upside.

Driven by cereal prices statistical

anomaly.

El Nino a real possibility, though

not a major risk.

El Nino a very high possibility albeit may not be a major risk to inflation

-

CPI in Jan & Feb surprised on the upside, led by higher cereal prices

-

EL Nino risks, could impact monsoon

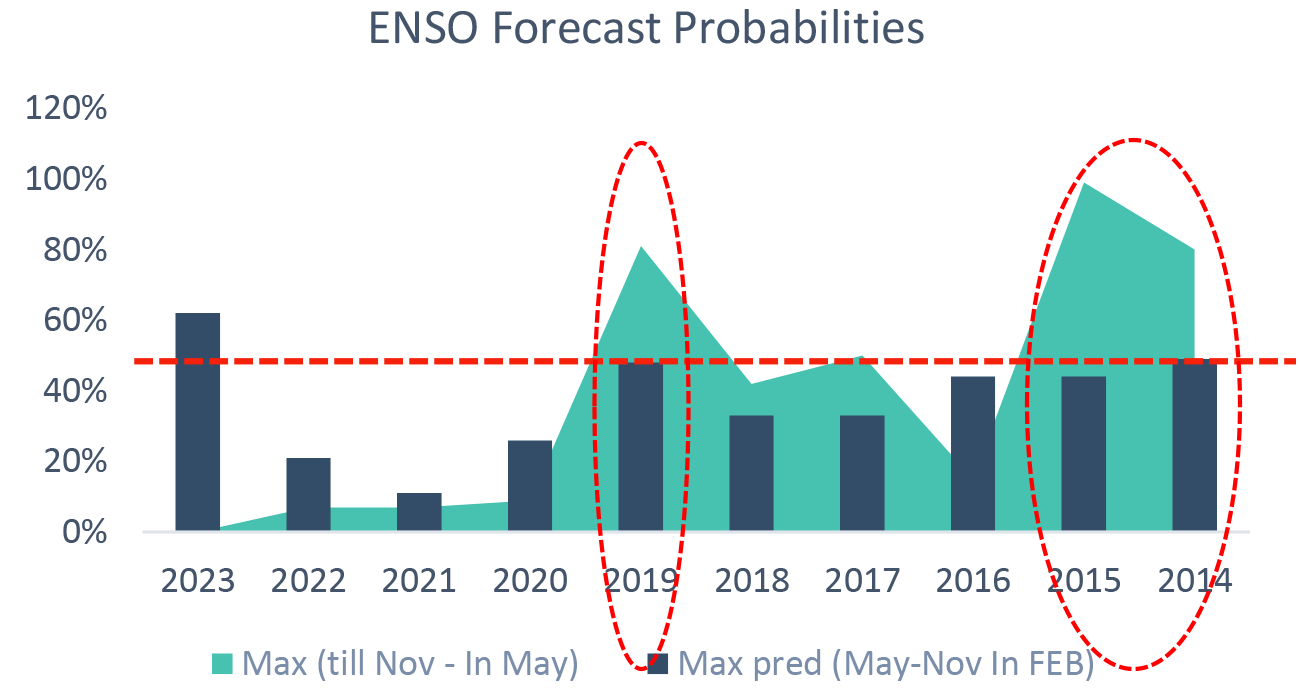

- EL Nino probability rises to 60% in May-Nov 23

- For comparison, EL Nino probability in previous occurrences was less than 50% (2014, 2015 and 2019)

-

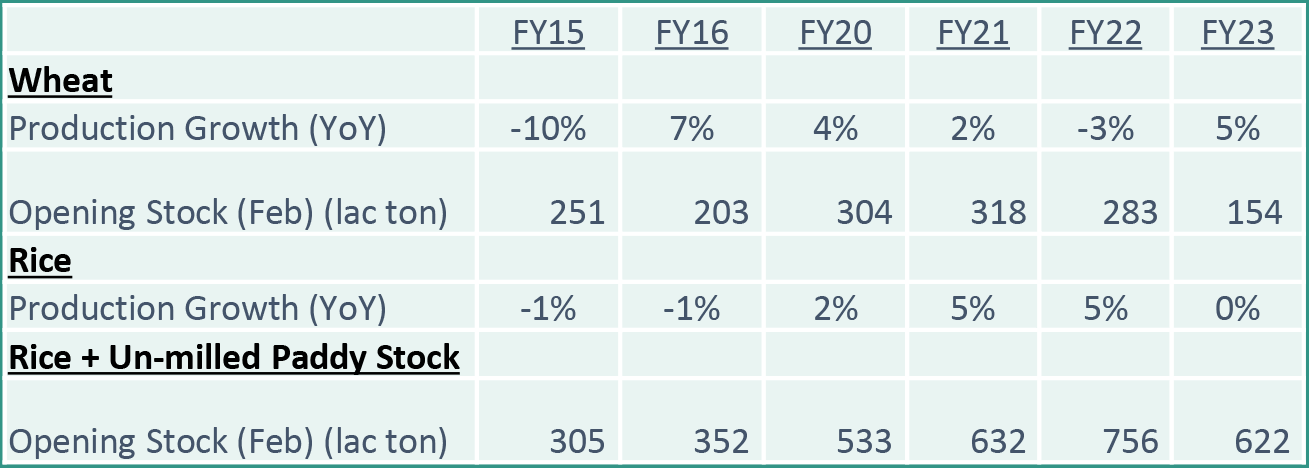

El Nino impact on cereal prices was inconclusive as per past data

- However, heat conditions could impact the wheat production

- With wheat reserves at very low levels (of 154 lakh tonnes), the supply could be tight

- Yet rice/paddy reserves are robust to absorb shocks

Takeaway:

El Nino looks like a likely possibility at this time. However, past data does not conclusively show any impact on cereal inflation

El Niño, La Niña, and the Southern Oscillation, or ENSO; Source: Columbia Climate School, Internal CPI: Consumer Price Index

Secondly, Global Central banks

remain Hawkish

- Labour markets remain tight in US

- Inflation remains high and sticky

- Stance may be diluted, due to banks contagion risk

But we don’t expect pause yet.

But most importantly,

Closer to a Pause in the rate cycle.

But we do expect another

hike by the MPC.

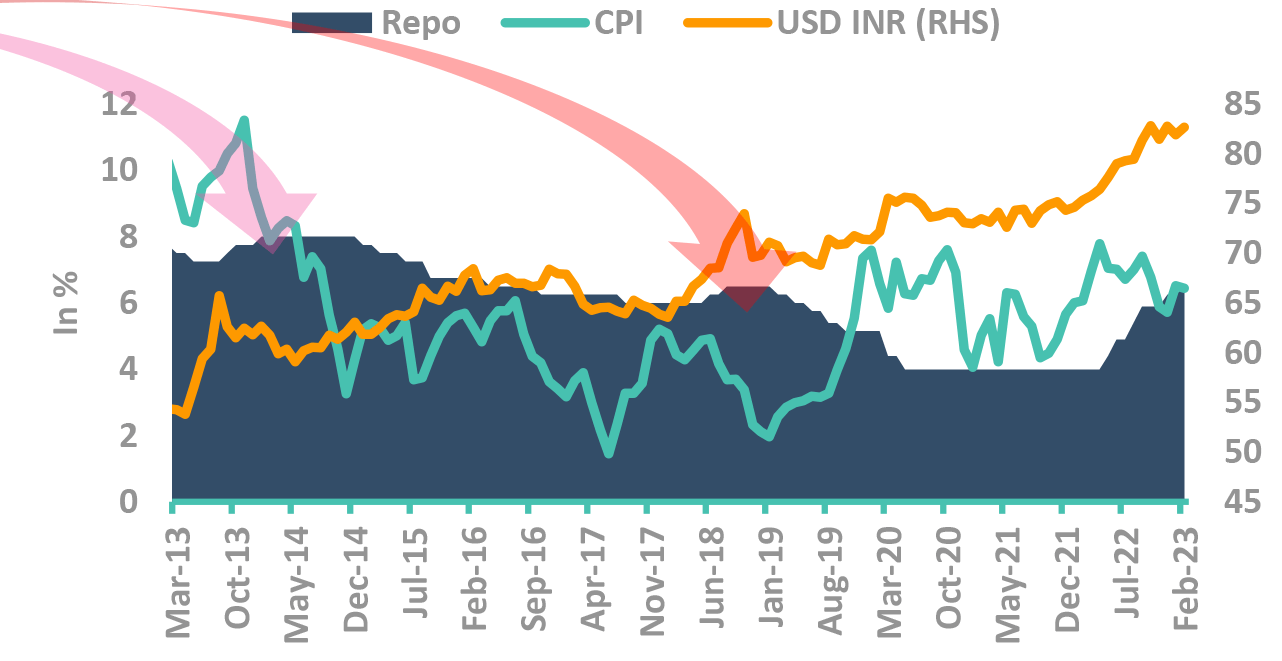

Why add duration when we expect policy rate hike?

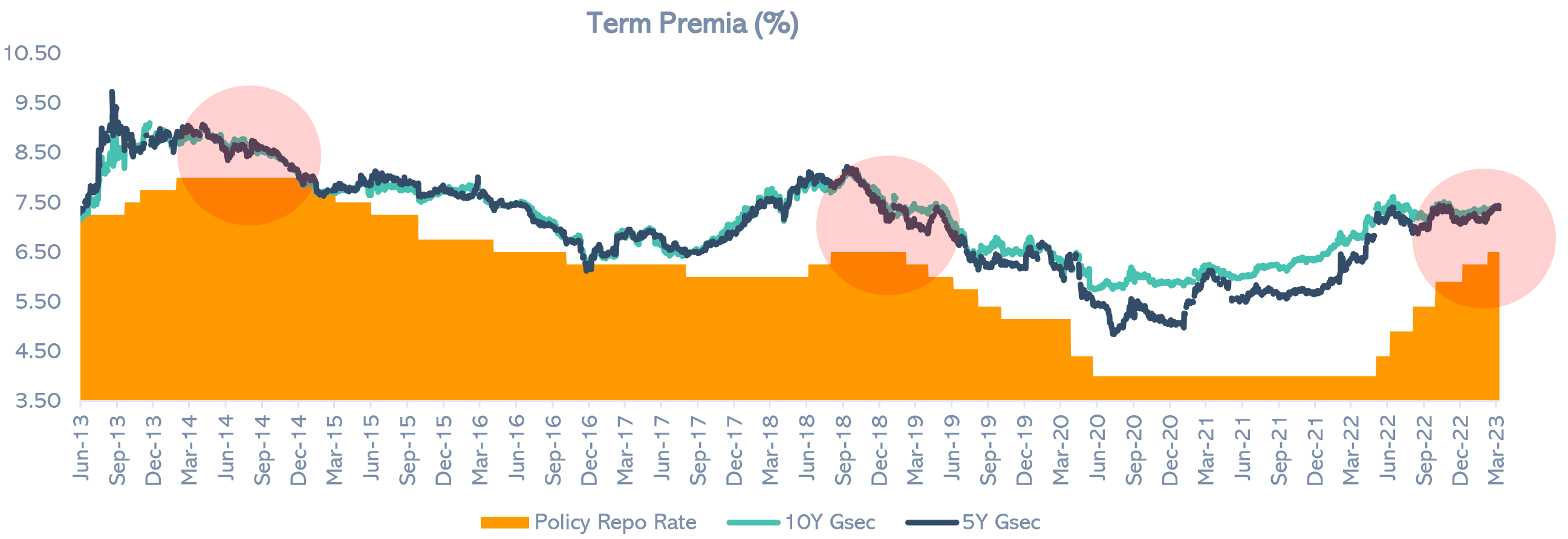

Closer to peak rates the term premia reduces considerably

- In 2014, the term premia reduced – with long term yields below repo before rate cuts

- In 2018, term premia crashed at peak rates

- Both these instances led to rally in duration yields

Thus further rate hike(s) may not lead to much increase in duration yields

Takeaway:

Term Premia has been low historically in years of high policy rates.

Source – Bloomberg; Data as on 10/3/2023 OIS – Overnight Indexed Swap

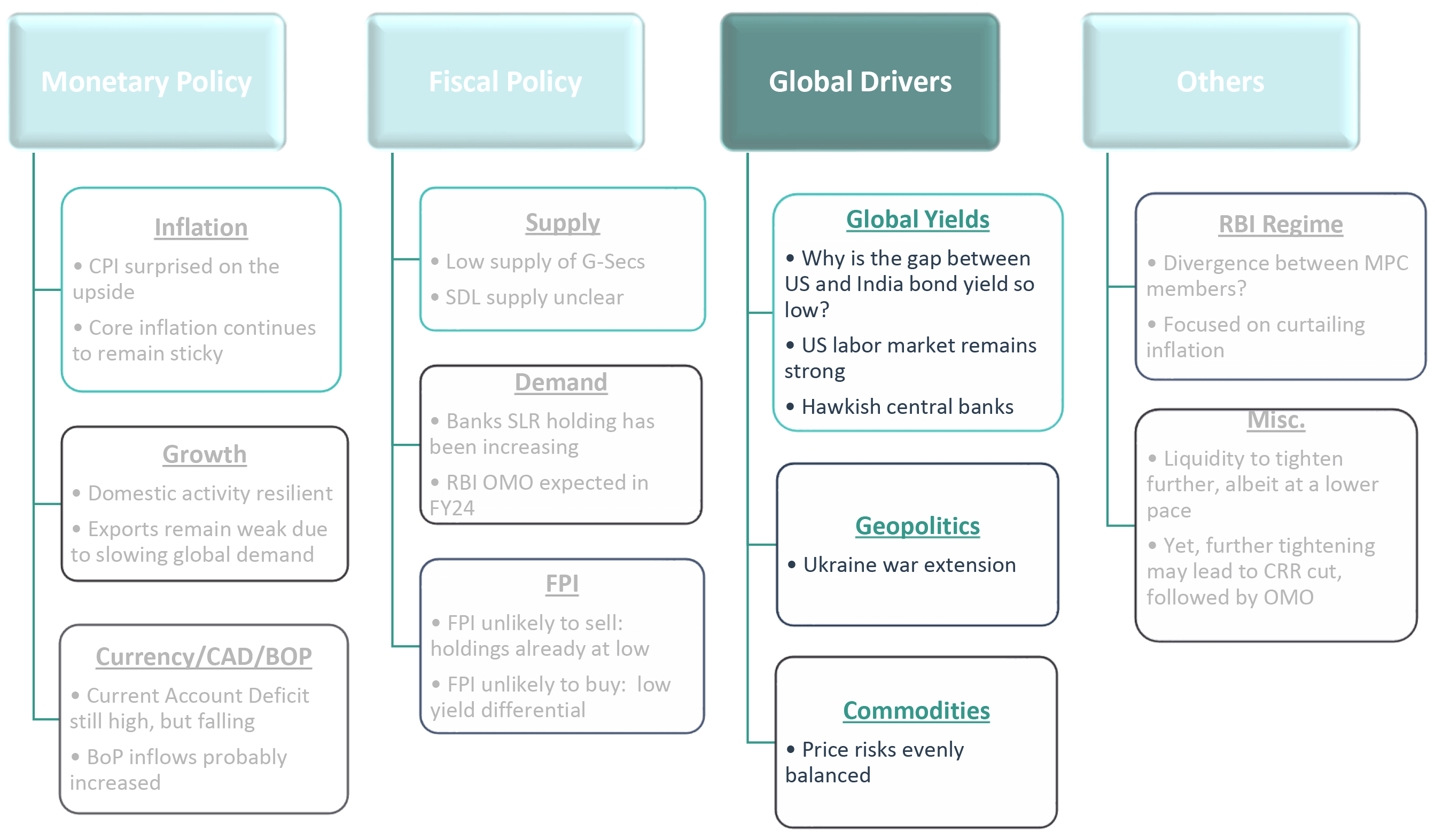

Now our framework

And

What we track

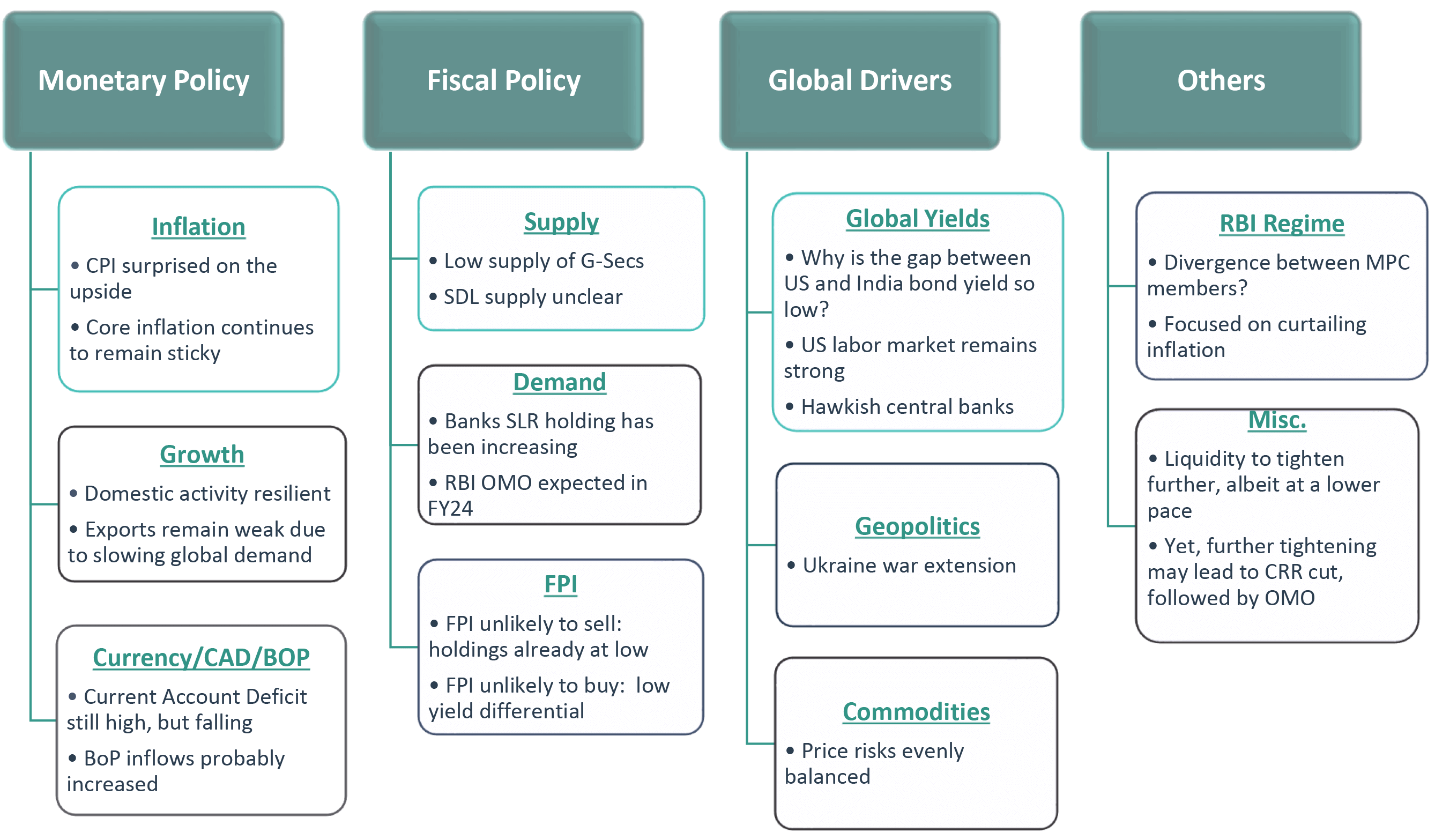

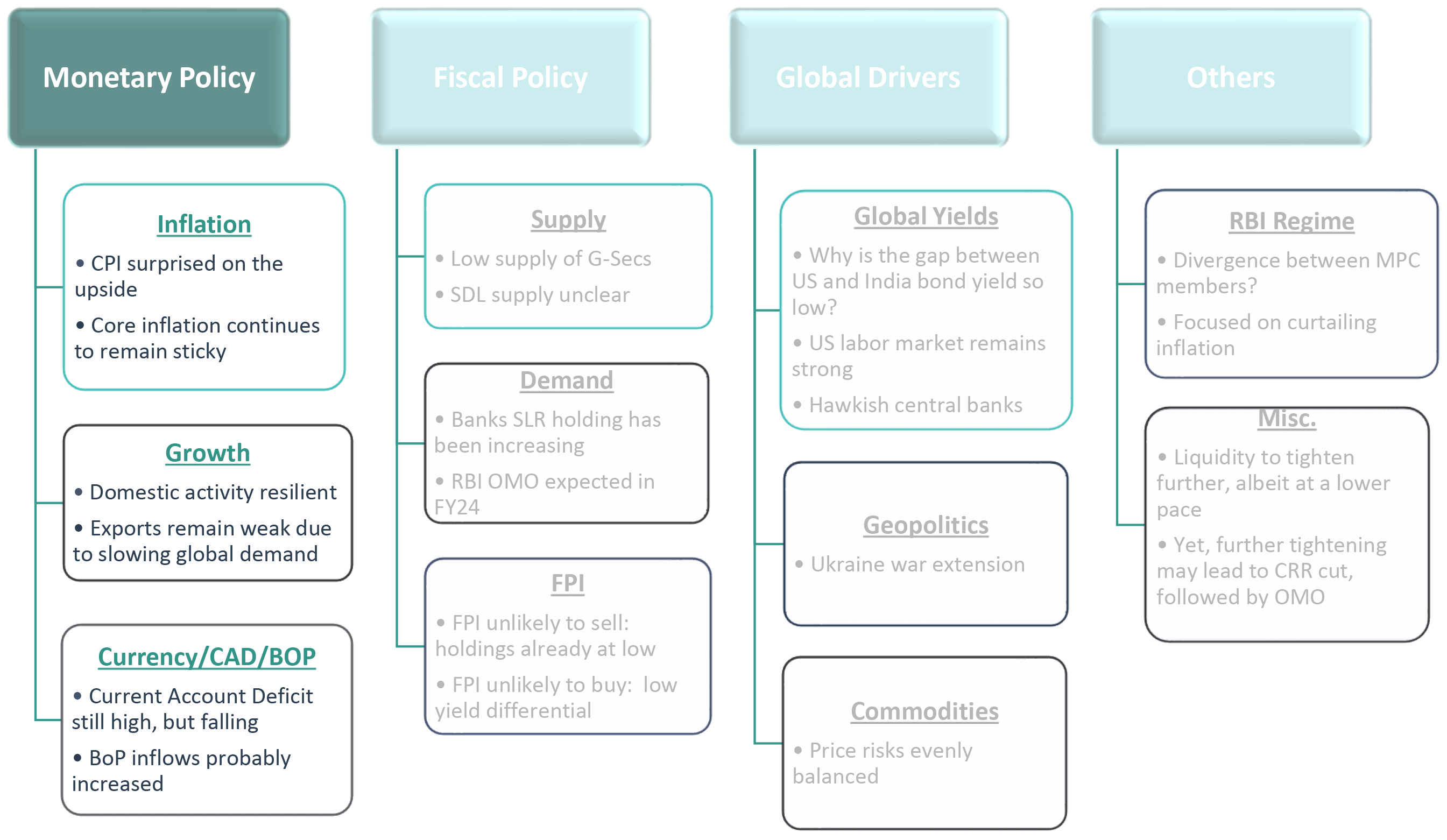

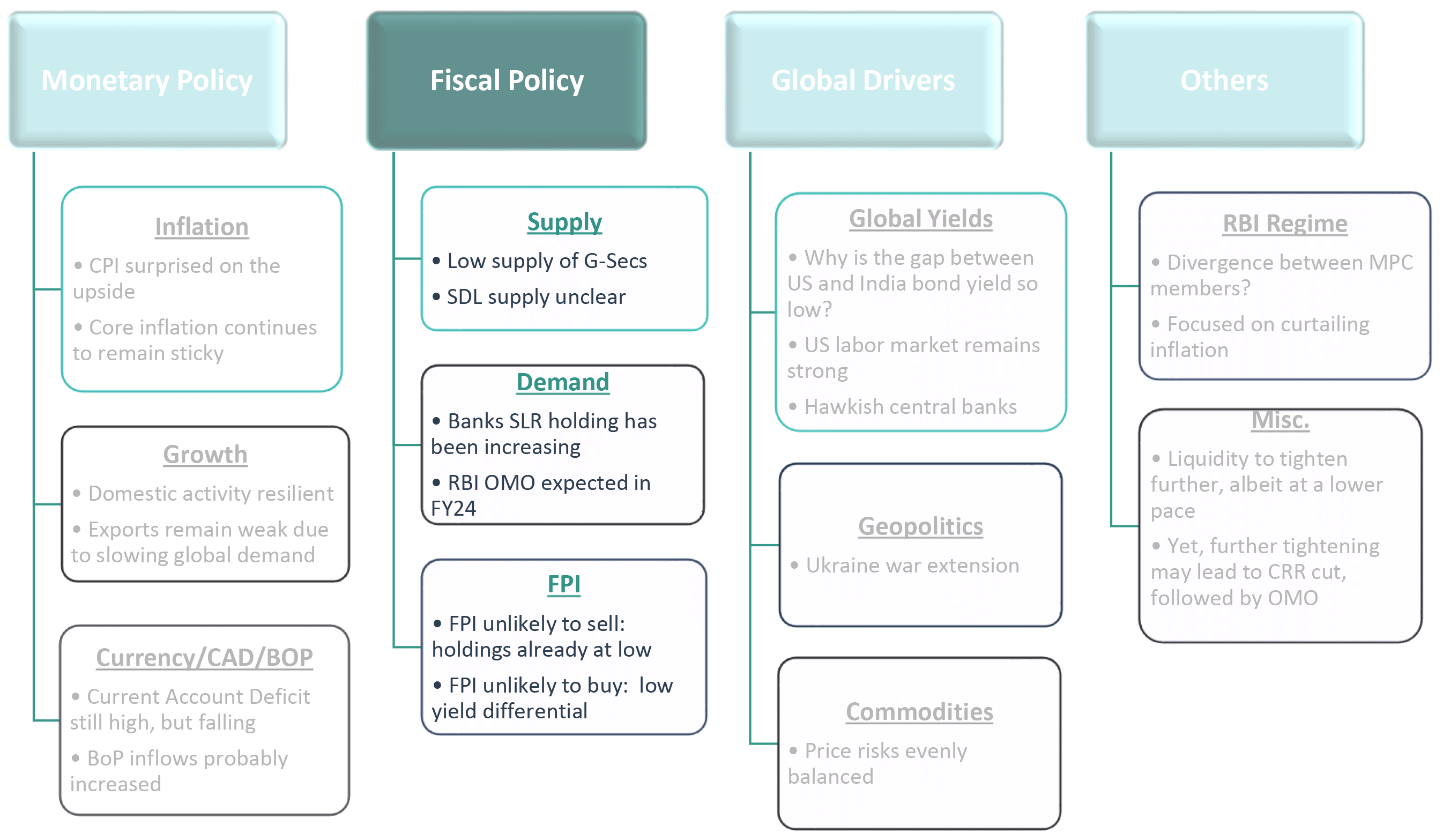

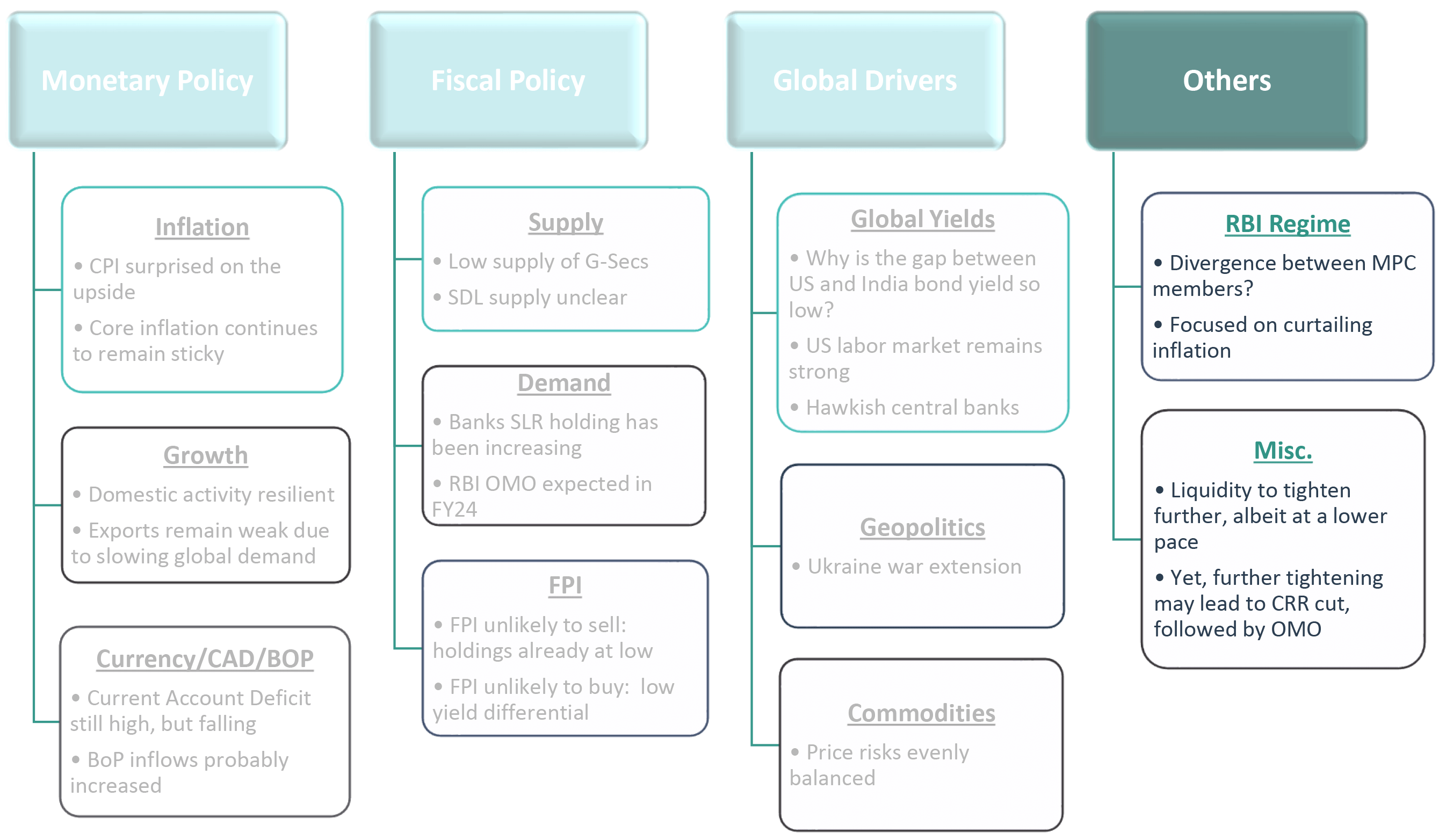

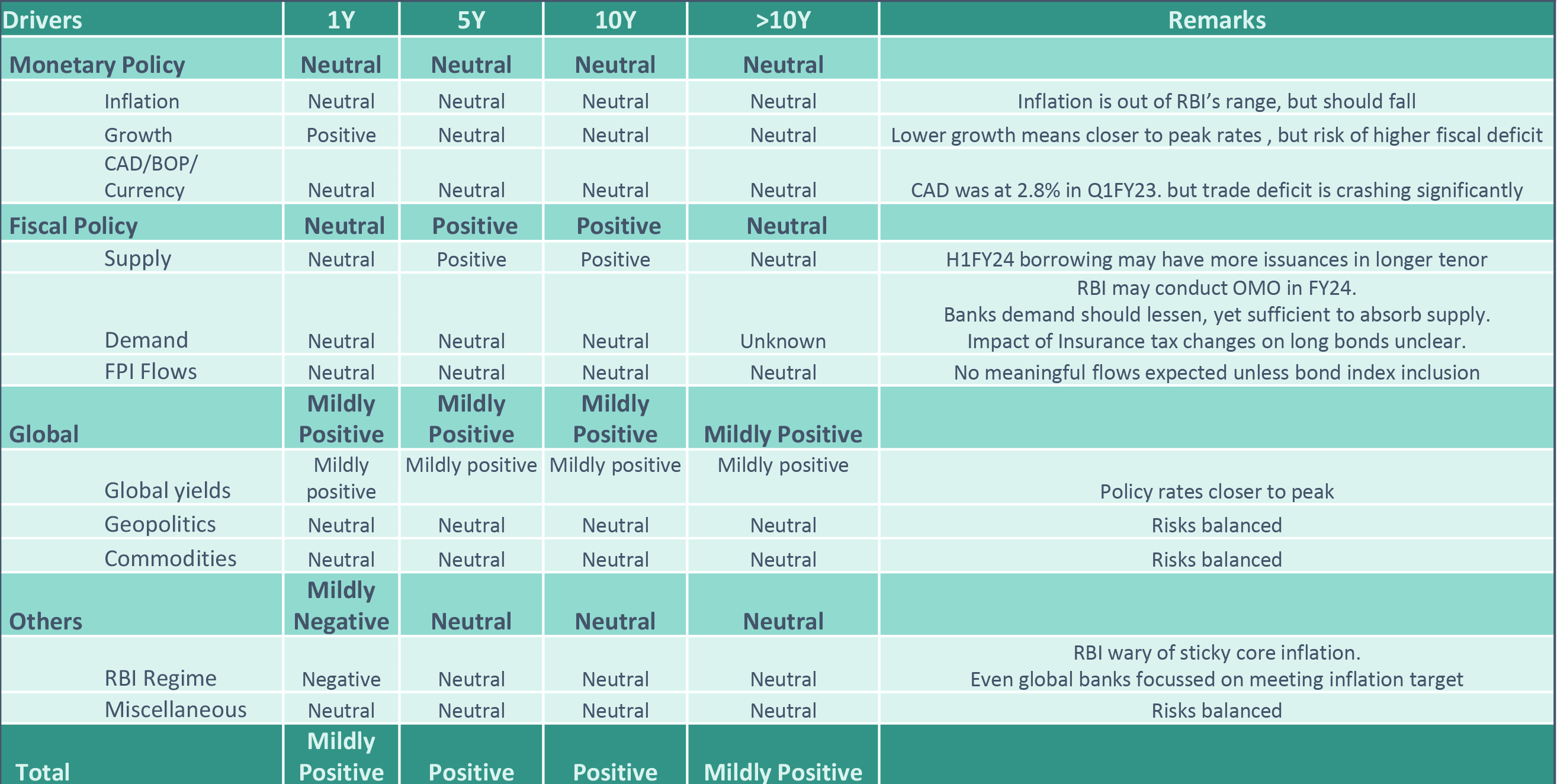

Our Framework

Takeaway:

Parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

Let’s take a look at

Monetary policy

Likely to be less hawkish than in

past…

Will keep short-term rates capped

Our Framework

Takeaway:

Parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

How persistent is core inflation?

Remains Above 6%

Another 25bps hike on the cards

Inflation concerns continue; El Nino not a major risk

-

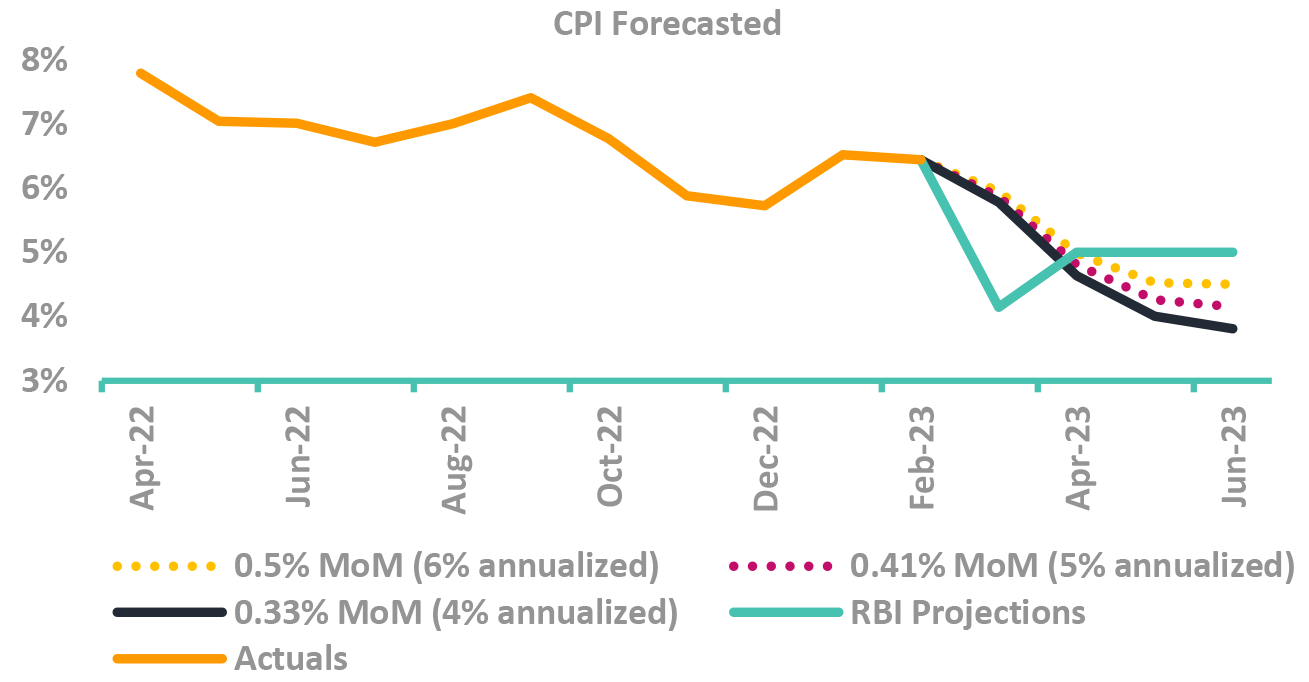

CPI higher than expectation for both Jan & Feb 23

- Driven by high food prices and higher core inflation

- Cereal prices led to statistically higher inflation

- Followed two months of low CPI in Dec 22 & Nov 22

- Core continues to remain sticky & elevated

- Driven by high food prices and higher core inflation

-

RBI’s revised Q4 target of 5.7% looks difficult now

-

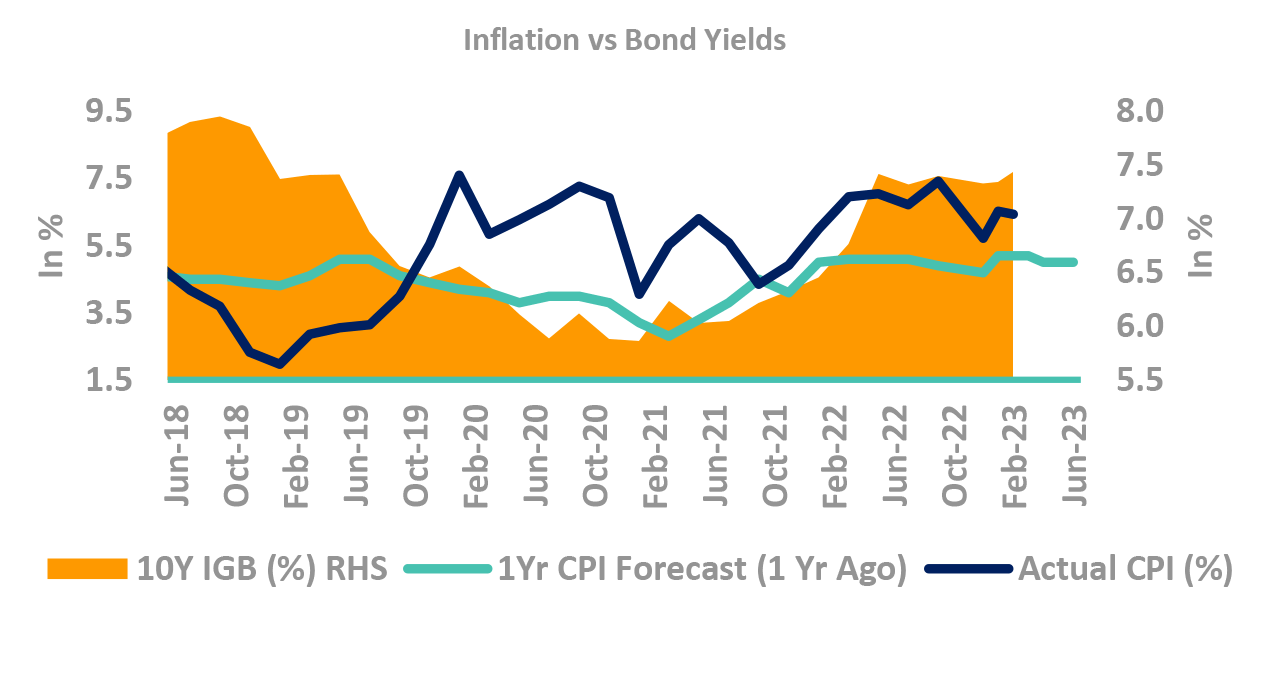

Do yields track inflation projection? No.

- Orange area (chart) is 10Y yields, Black line is CPI

-

Can forecasters predict Indian CPI? No.

- Green line is forecasters prediction of CPI 1-Year later

- Black line where inflation actually came.

- Guess the error of margin!

-

CPI projections corelated (not causality) to yields.

- Low predictive power, high current corelation

Takeaway:

Sticky core should lead to RBI rate hike of 25bps in April unless Fed action surprises in the next policy.

Source – RBI, CSO, Bloomberg CPI: Consumer Price Inflation; RBI: Reserve Bank of India; IGB: India Government Bond

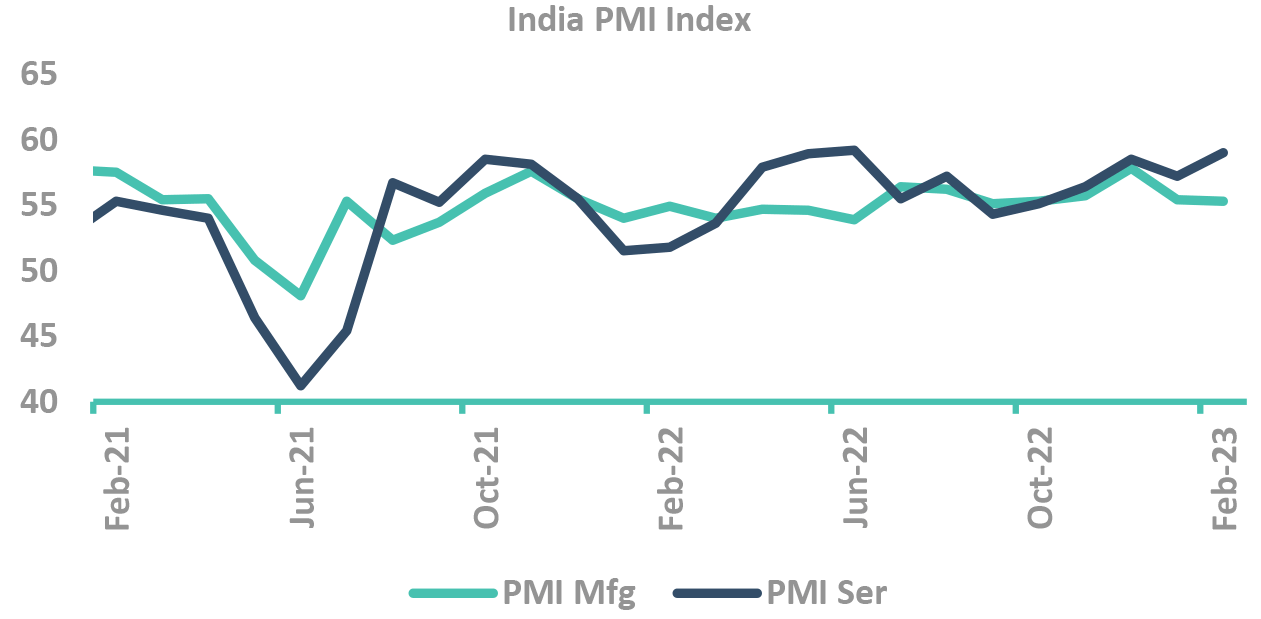

Growth not a big driver right now

skip the next slide if in hurry

Will global slowdown test domestic resilience?

-

Domestic growth resilient as PMI continues to be in expansionary mode

- Feb ‘23 Mfg. PMI at 55.3 vs 55.4 in Jan 23

- Services PMI up to 59 (vs 57.5 previous month)

- GST collections picked up

- ✓ Feb 23 collections stood at INR 1.5tn (up 12% y-o-y)

- ✓ Above ₹ 1.4 tn for last 12 months

-

Risks of global slowdown are playing out

- Trade deficit narrowed to USD 17.7bn in Jan 23

- Exports continue to decline, due to decline in global demand

-

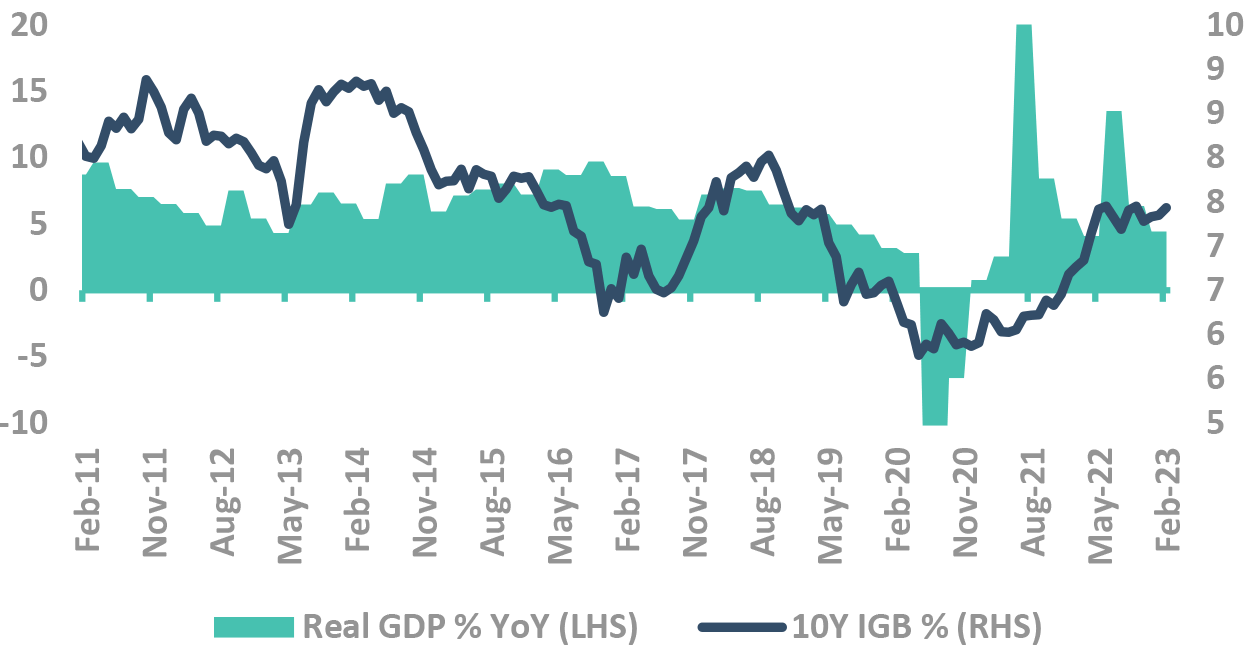

How closely do yields track growth?

- Yields have usually tracked GDP growth, with correlation being stronger when growth slows, barring

- ✓ 2013, when rupee depreciation and debt outflow

- ✓ 2017, during demonetization

- Yields have usually tracked GDP growth, with correlation being stronger when growth slows, barring

-

FY24, growth may not be big driver for yields

- Q3FY23 GDP came in at 4.4%, in line with RBI projections

Takeaway:

Domestic growth seems resilient despite global slowdown fears

Source – Bloomberg, GDP: Gross Domestic Product; PMI: Purchasing Managers’ Index; GST: Goods and Service Tax; IGB: India Government Bond; Mfg: Manufacturing

So far we have been mentioning

“When rupee depreciates

RBI hikes”

No matter what the inflation!

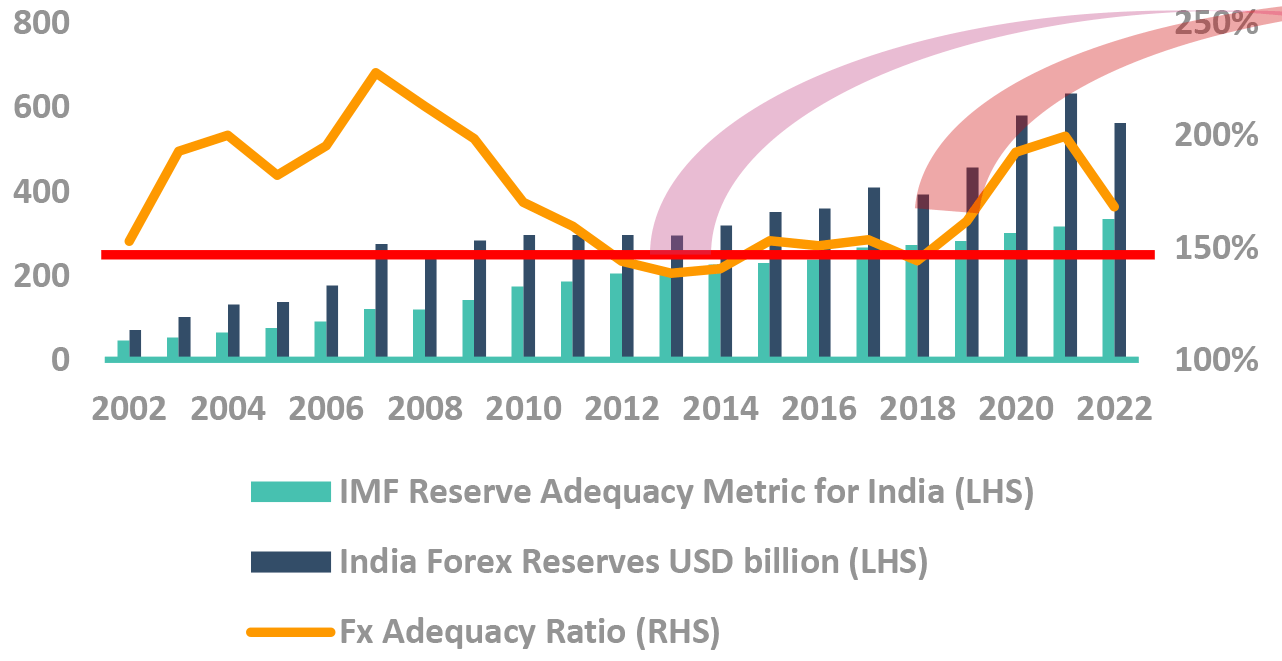

Did you know – when our Fx reserves dip, RBI hikes

-

RBI FX reserves on a downtrend

- Forex reserves down from USD574 bn (in Jan 23) to USD562 bn (Mar 23)

- Majority of the change in reserves caused by valuation

-

RBI FX Reserve / IMF FX adequacy ratio declined sharply

- Buffer of ~USD 70 bn to reach 2013 and 2018 levels (~150% ratio)

-

RBI only hiked rates twice in past 10 years, barring now

- Increased rates to control rupee, not inflation

-

RBI has tolerance for inflation, not rupee fall

- In 2018, inflation was within RBI’s target levels

- In 2013, inflation was high for long yet RBI cut

- When RBI FX reserve fall

- RBI avoids using reserves and does rate hikes to control rupee.

Takeaway:

Foreign exchange reserves continue to remain low

Source – Bloomberg, RBI: Reserve Bank of India; IMF: International Monetary Fund; US FED: US Federal Reserve; FX: Forex; CPI: Consumer Price Inflation

But question now is not hikes,

But what will make RBI

Pause the rates!

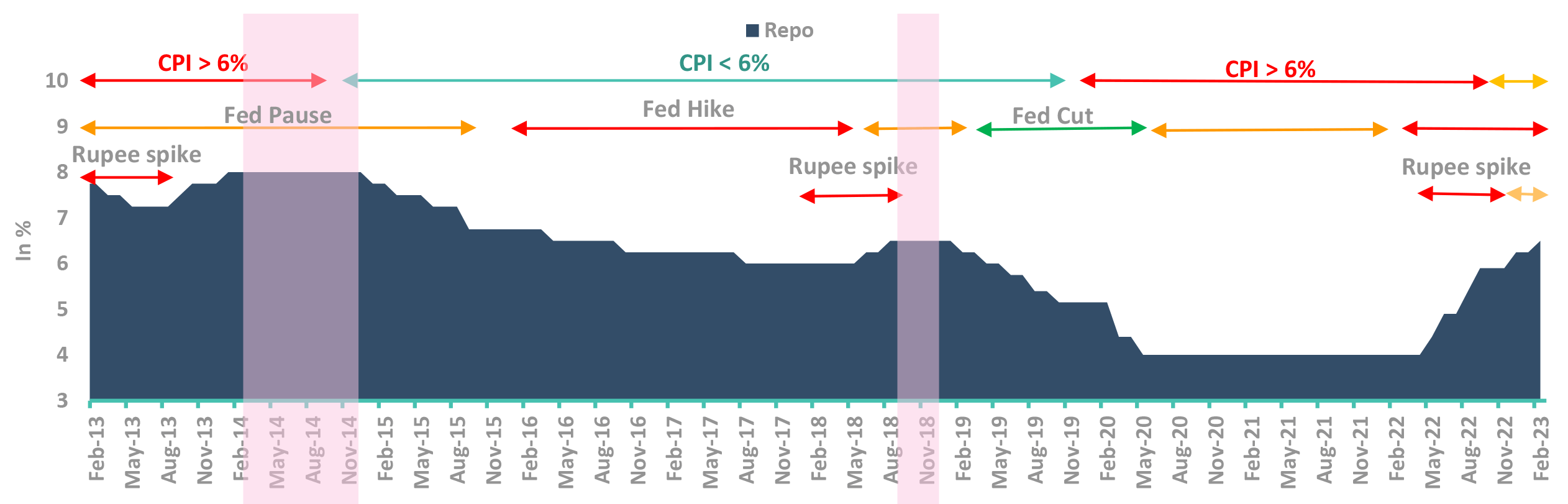

What drives pauses: Series of hygiene factors

The checklist for pause:

-

When the US Fed starts pausing

- Reduces risk of capital outflows

-

When inflation is within comfort

- Reduces risk of inflationary policy

- Barring 2014, when RBI did not have 6% CPI target

- But CPI was falling in 2014

-

When BoP (and currency) is stable

- Reduces inflationary / external risks

How is the checklist now?

- ↔

US FED has indicated lower ongoing hikes

- US yields much lower, expecting rate cuts in CY23

- RBI talking in Fed’s voice

- ✓

Inflation moderating to comfort zone

- While CPI >6%, but base effect will bring it lower

- х

BoP (rupee) still remains a concern

- Most economist expect muted BoP of around USD 10bn

- However valuation gains have increased FX reserves

Takeaway:

We expect another rate hike, yet closer to pause

Source – RBI, Bloomberg RBI: Reserve Bank of India; IMF: International Monetary Fund; US FED: US Federal Reserve; BoP – Balance of Payment

We expect RBI to tone down its

stance

Either 25bp hike, with chances of

future pause.

Or,

a pause, with chance of future hike

Let’s turn to Fiscal policy

Generally, it drives the long bond

yields

It is reflected in demand/supply

mismatch

Our Framework

Takeaway:

Parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

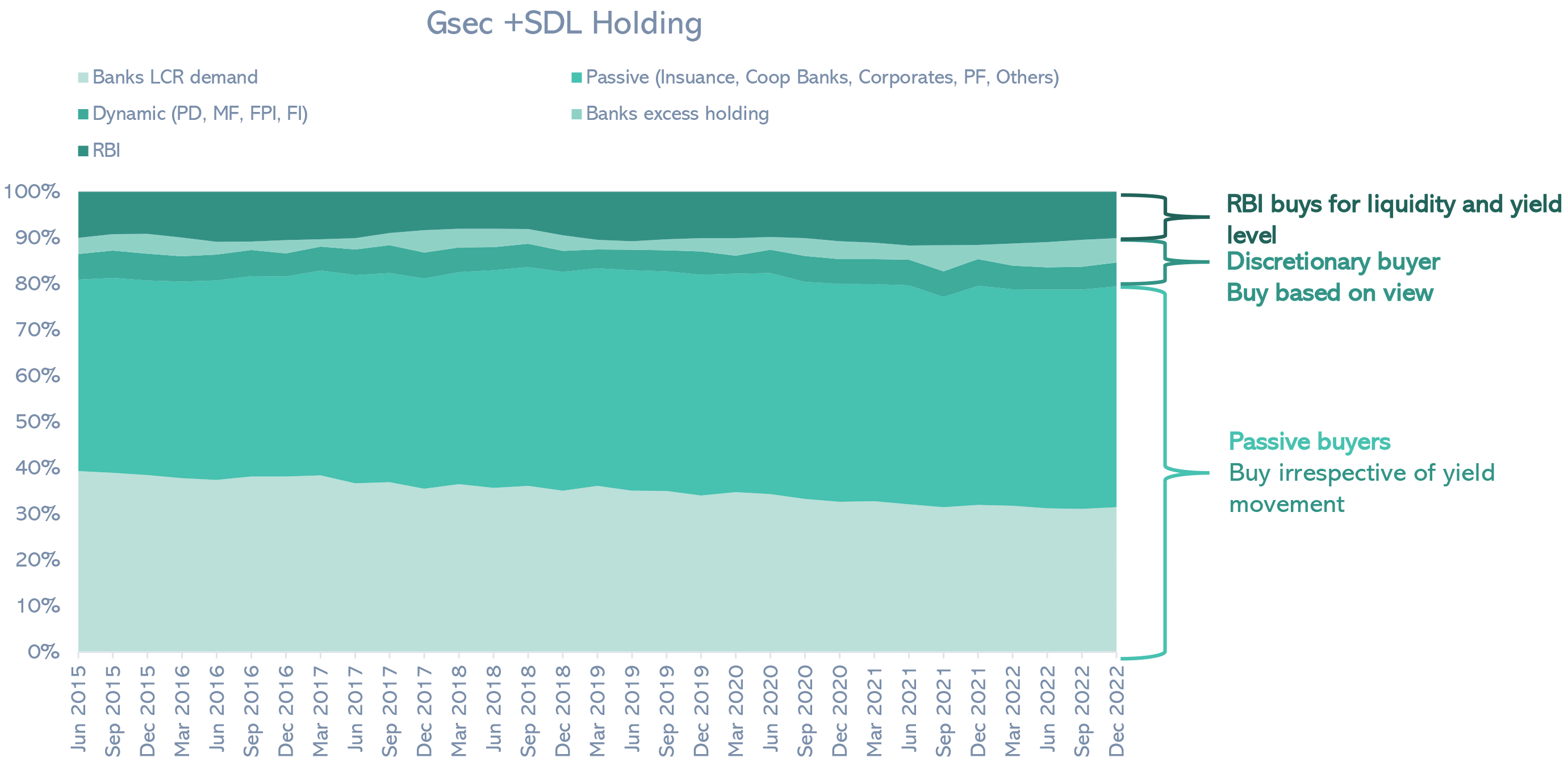

Only small part of bond buyers are

discretionary buyers.

They drive yields.

Supply fluctuations is borne by

these buyers.

Gsec market still driven by lumpy institutions

Takeaway:

Increase in supply impacts the discretionary buying. Banks excess holding and Passive buyers have absorbed the supply so far.

Source – DBIE LCR – Liquidity Coverage Ratio; SDL – State Development Loans; PF – Provident Funds; PD – Primary Dealerships; MF – Mutual Funds; FPI – Foreign Portfolio Investors; FI – Financial Institutions; RBI: Reserve Bank of India; G-Sec: Government Securities; SDL: State Development Loans

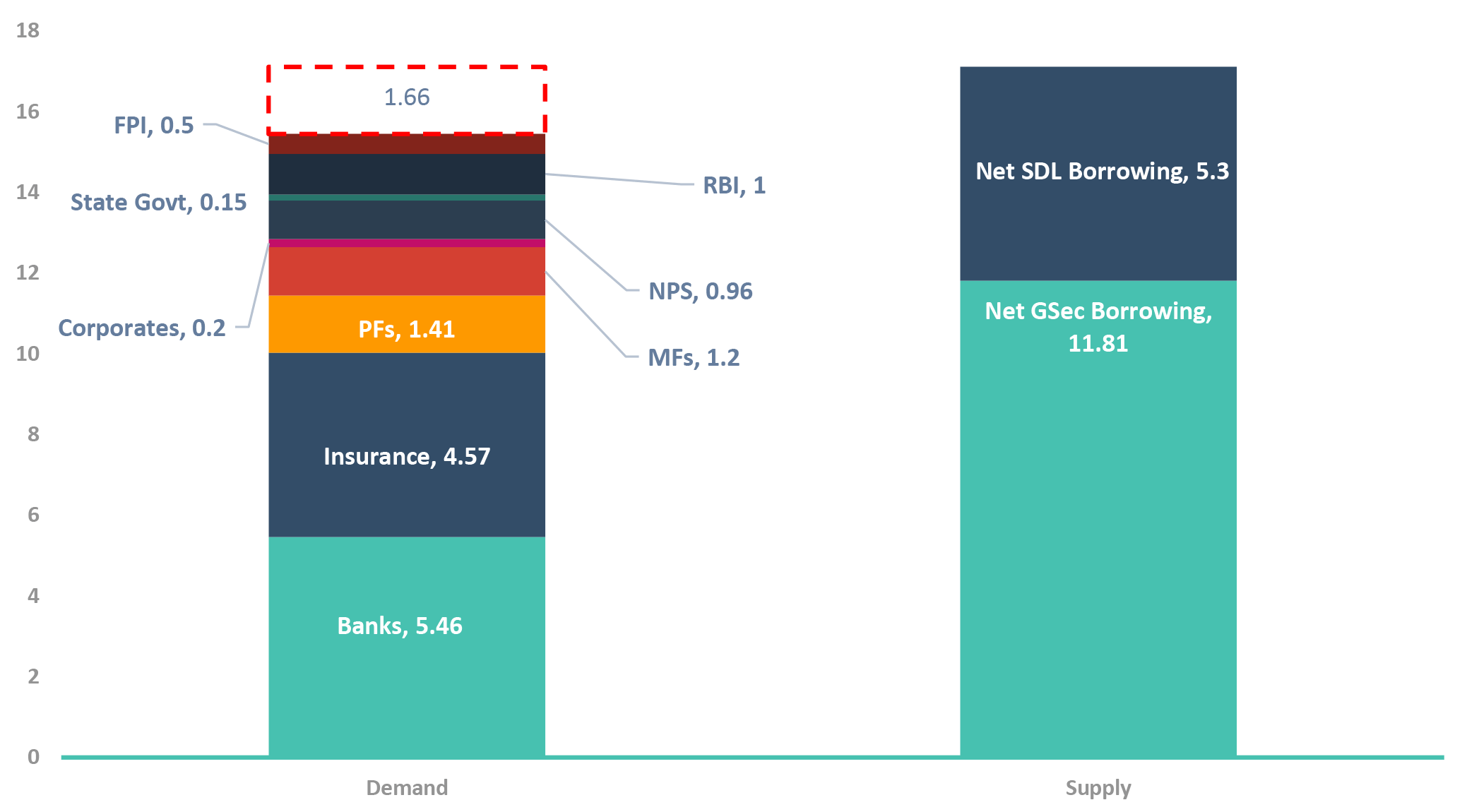

Comfortable supply/demand

dynamics for FY24

Supply is just about ₹ 1.7 lac cr.

more than natural demand

How much is the excess supply

Excess supply can be matched by

- G-sec supply higher only by 7% over FY23, however demand is expected to rise much more

- Continuing strong demand from Banks and long end investors like EPFO, Insurance and PFs

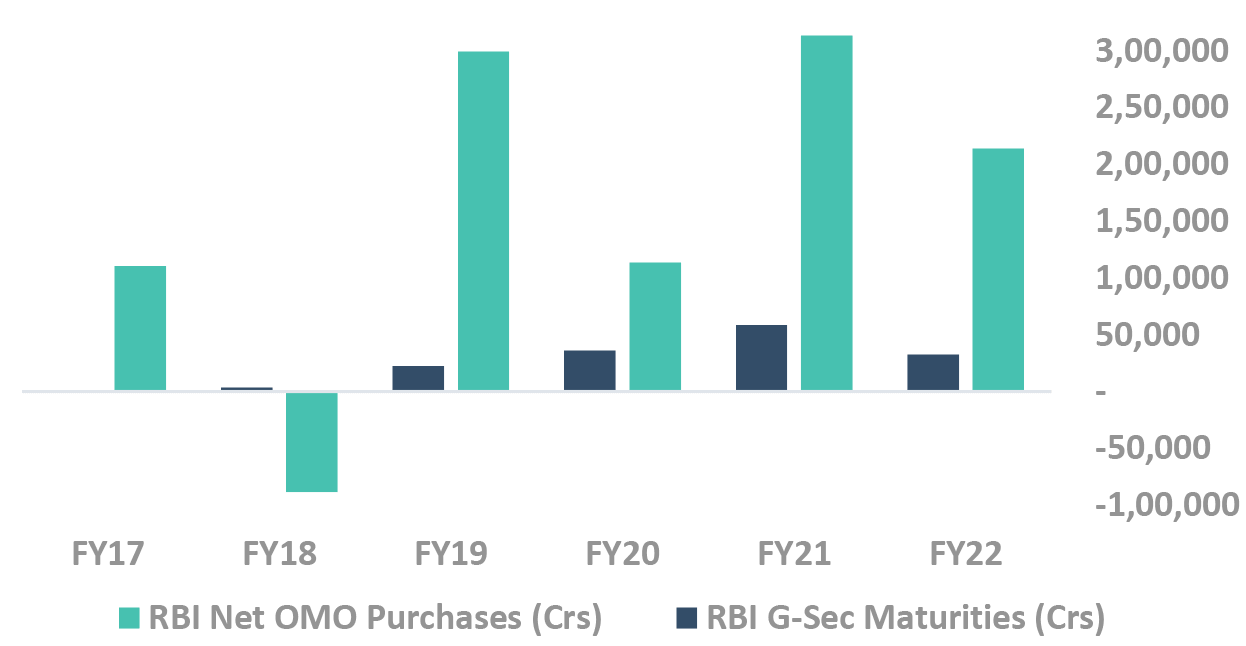

- Limited room for OMO purchases by RBI as minimal G-sec maturities this year

Takeaway:

Estimated excess supply of INR 1.67 tn not very significant, considering any increase in SLR holdings by banks can substantially reduce the gap

Source – Internal G-Sec: Government Securities; OMO: Open Market Operation; RBI: Reserve Bank of India; FPI: Foreign Portfolio Investment; NPS: National Pension System; MF: Mutual Fund; SDL: State Development Loans; SLR: Statutory Liquidity Ratio; PF: Provident Fund; EPFO: Employees’ Provident Fund Organisation

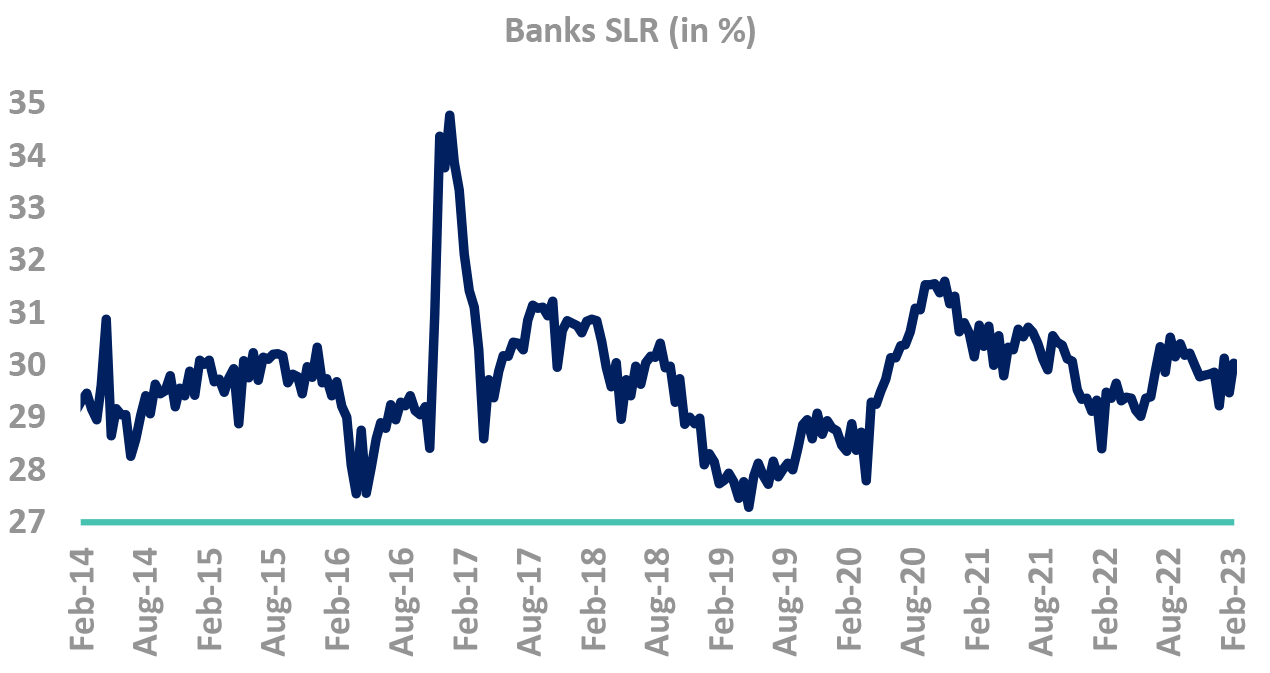

Demand – In neutral zone for FY24

-

Banks SLR holdings has risen sharply

- Part of SLR holding (~1%) is hedges of FRA & TRS, and not naked holdings

- Yet, considering tight liquidity, SLR holding remains high

-

While the holding ratio may reduce, on absolute levels demand will absorb supply

- SLR holding ratio will trim in FY24, but not substantially

- Natural NDTL growth will still lead to demand

-

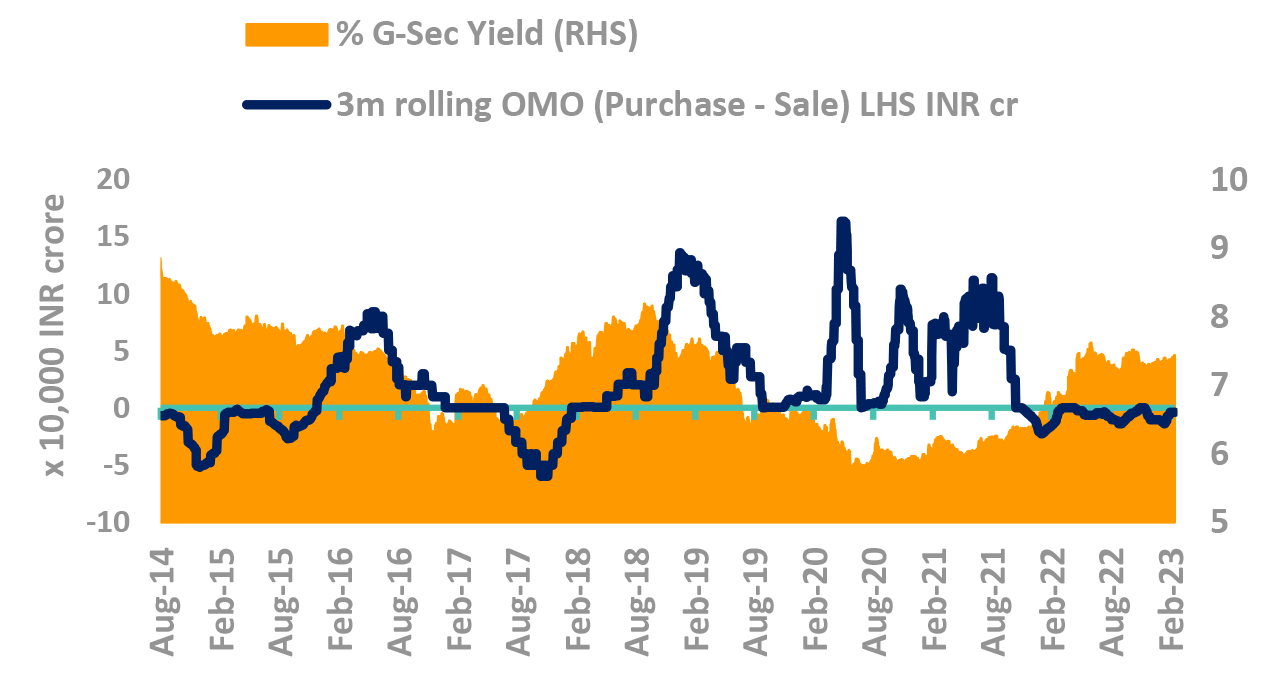

Yields track RBI OMO purchases

- Yields have strong correlation with RBI OMO actions

- Demand/Supply mismatch is usually filled in by RBI

-

RBI OMO expected in FY24 as

- RBI balance sheet rise muted due to less USD inflow

- Gap to be filled by OMO purchase & CRR

- Liquidity on path to neutrality due to CIC outflow

-

RBI OMO may be delayed, and not front ended

Takeaway:

Demand – Supply is broadly balanced, but new buyers can provide fillip

Source – Bloomberg, DBIE, Internal OMO – Open Market Operations, SLR – Statutory Liquidity Ratio; G-Sec – Government Securities; RBI: Reserve Bank of India; FRA: Forward Rate Agreement; TRS: Total Return Swap

RBI OMO: Delayed but coming in FY24

Liquidity will continue to tighten. Why?

-

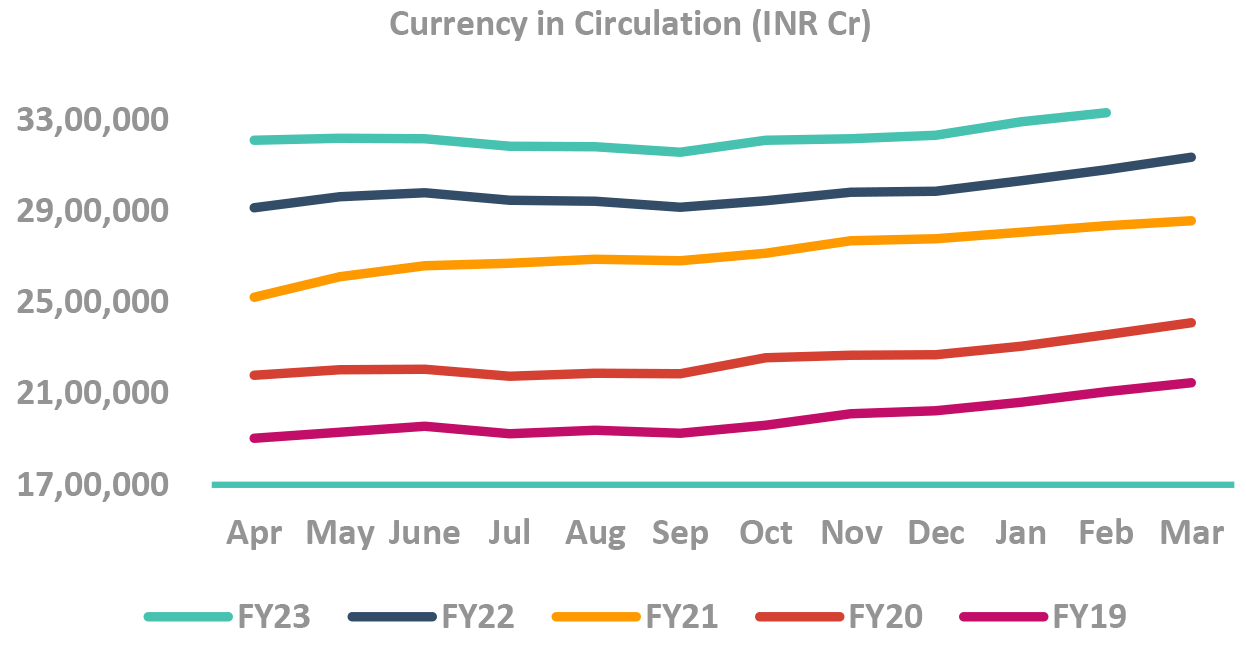

Firstly, Currency in circulation is cyclical

- Jan-May is when CIC increases

- Expect liquidity to tighten more by May

-

Secondly, unlikely that the BoP will be large

- Thus, reduces possibility of FX driven liquidity infusion

-

RBI OMO in FY24 likely when liquidity tightens further

Reasons why OMO may get delayed, but will occur:

-

RBI will possibly reverse FY23 CRR hike as first step

-

Bond maturities may not reduce RBI balance sheet

- RBI has switched short tenor bonds with Govt

- Natural reduction of balance sheet (& liquidity) is lesser

- Similar to FY17 (post demonetization)

- RBI exhausted its short term G-sec through OMO sale.

Takeaway:

RBI to conduct OMO Purchases when liquidity tightens. Expected to be in FY24

Source – Bloomberg RBI: Reserve Bank of India; CIC: Currency in Circulation; OMO: Open Market Operation; CRR: Cash Reserve Ratio; G-Sec: Government Securities; BoP: Balance of Payment

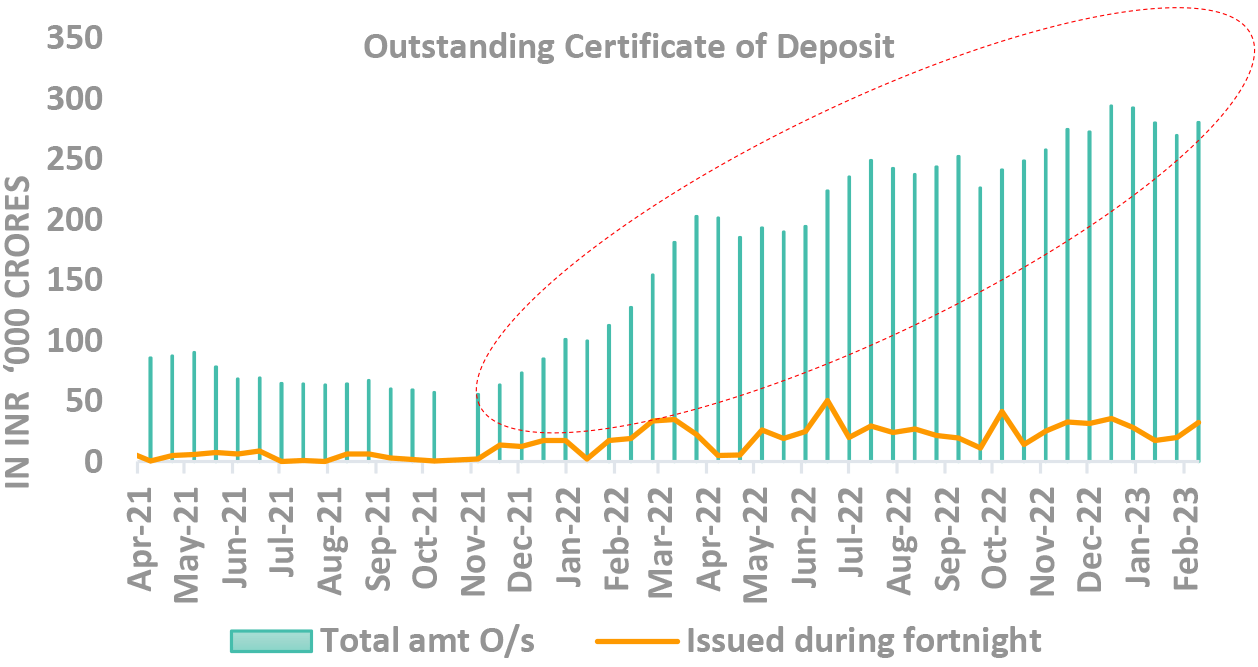

Attractive Spreads in

short tenor (~1 year)

may not last long into next FY

Where are the shorter end rates headed?

-

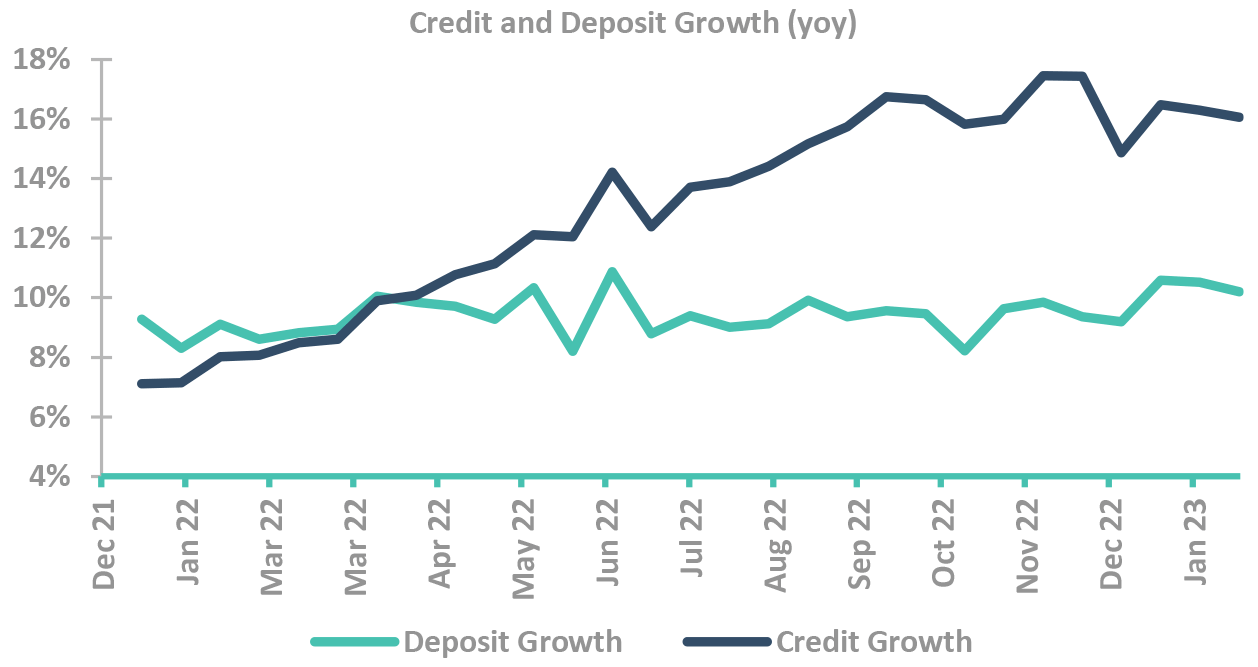

Pace of credit growth likely to taper

- It is already reduced from earlier highs

- Likely reduction in working capital requirements

- Easing commodity prices

- Lower supply chain bottlenecks

- Capex may get moderated with faltering global growth

- Growth of banks’ CDs may taper

- Signaling of future pauses will lead to yield rationalization

- However, tighter liquidity will limit the fall in short term rates

Takeaway:

Short term yields currently high due to supply pressures, any significant uptick from here unlikely

Source – Bloomberg RBI: Reserve Bank of India; CIC: Currency in Circulation; OMO: Open Market Operation; CRR: Cash Reserve Ratio; G-Sec: Government Securities; BoP: Balance of Payment

Is it possible to be completely

decoupled

from global actions?

Our Framework

Takeaway:

Parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

Should we be looking closely at

US yields movement?

It will create noise,

not trend.

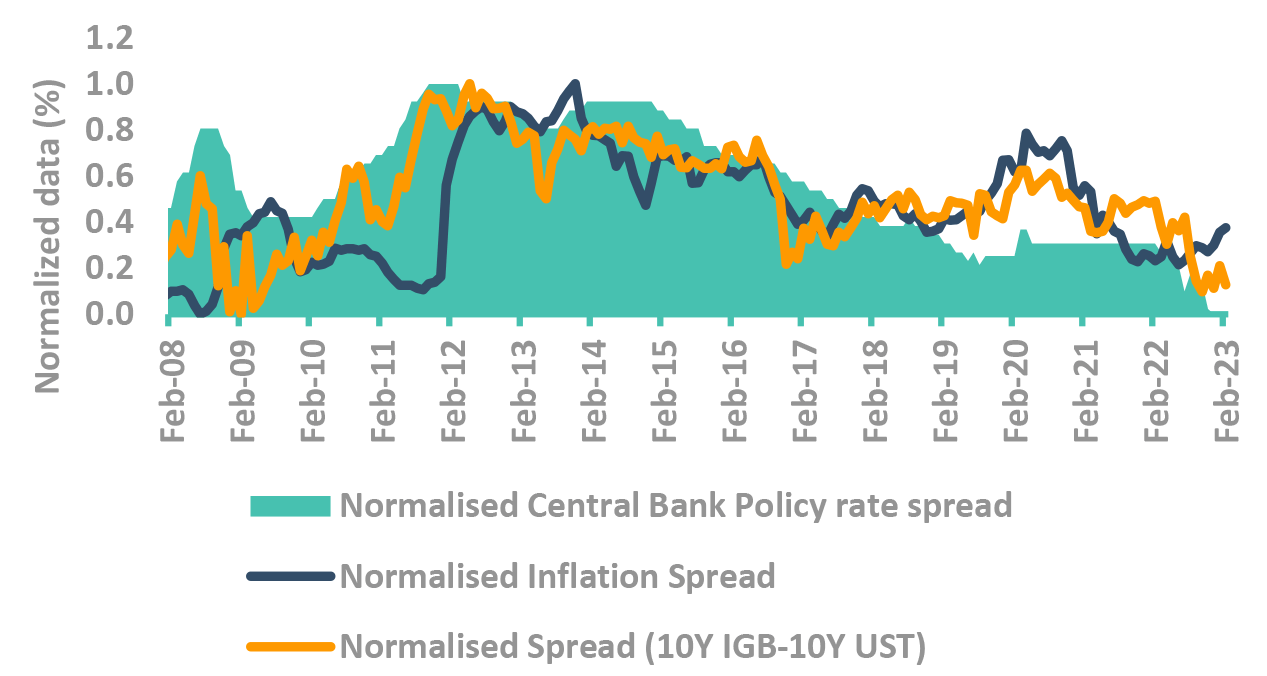

Is India de-coupled from global markets?

-

Fed hiked the rate by 25bps, with terminal rate now closer to 5% (market expectations)

- However, rates may go higher than market expectations

- US headline and core inflation came in strong

- Fed speakers indicated higher rates than anticipated

-

Are spreads of US Treasury and Indian Govt. Bonds low?

- But, Bond yield spread mimics the inflation and policy rate differential.

- ✓ RBI policy rate is low & has not tracked inflation spread

- ✓ 10Y yields seem to have priced in the inflation spread

- But, Bond yield spread mimics the inflation and policy rate differential.

-

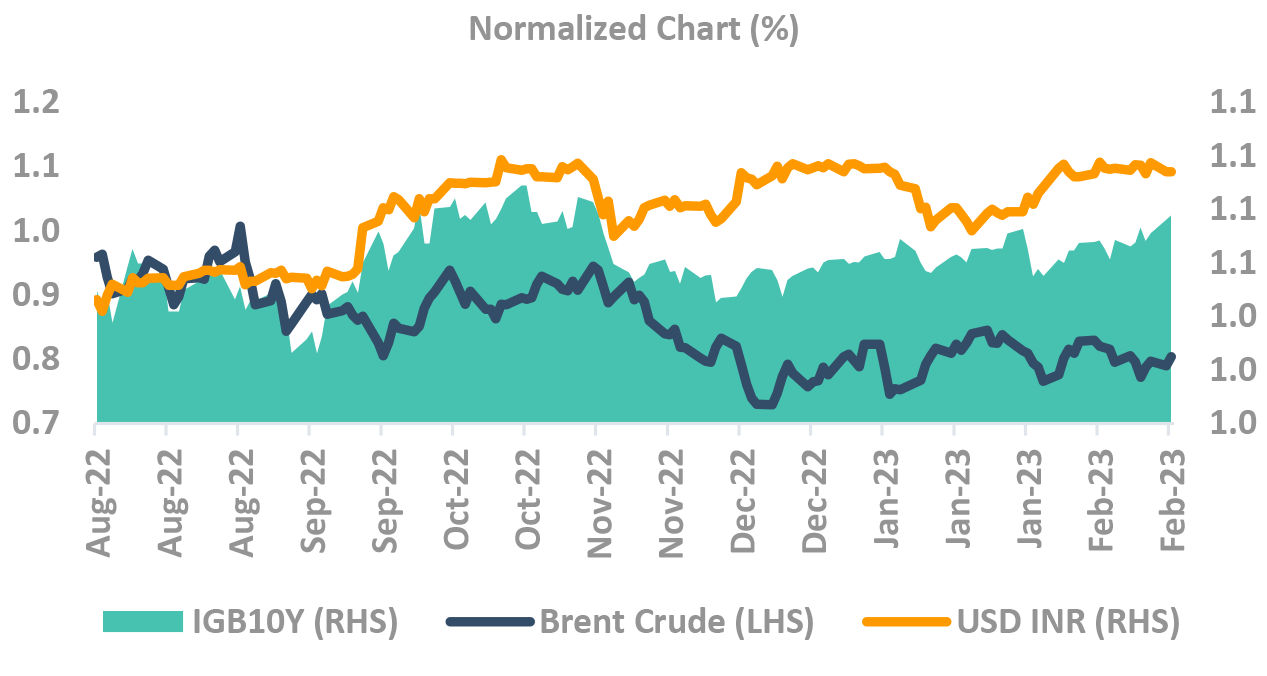

Are rupee risks impacting Indian yields?

-

Rupee has weakened substantially, but

- Currency tail risks looking less likely.

- ✓ Trade deficit has reduced substantially (from USD 30b+ to lower than USD 20b)

- ✓ Capital out flows have reduced

- However, risks of US FED taper remain

- Currency tail risks looking less likely.

- Bond yields uncorrelated with INR movement lately

- ✓ Shows currency fears abated

Takeaway:

India bond yields more driven by domestic factors than tracking global yields

Source – Bloomberg, Internal Fed: federal Reserve; CPI: Consumer Price Inflation; RBI: Reserve Bank of India; IGB: India Government Bond

What else

that

can’t be bunched up

Our Framework

Takeaway:

Most of the parameters point to lower yields. The risk/reward indicates a long position in bonds.

Source – Internal CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; CPI: Consumer Price Index; MSP: Minimum Support Price; OMO: Open Market Operation; FPI: Foreign Portfolio Investment; MPC: Monetary Policy Committee

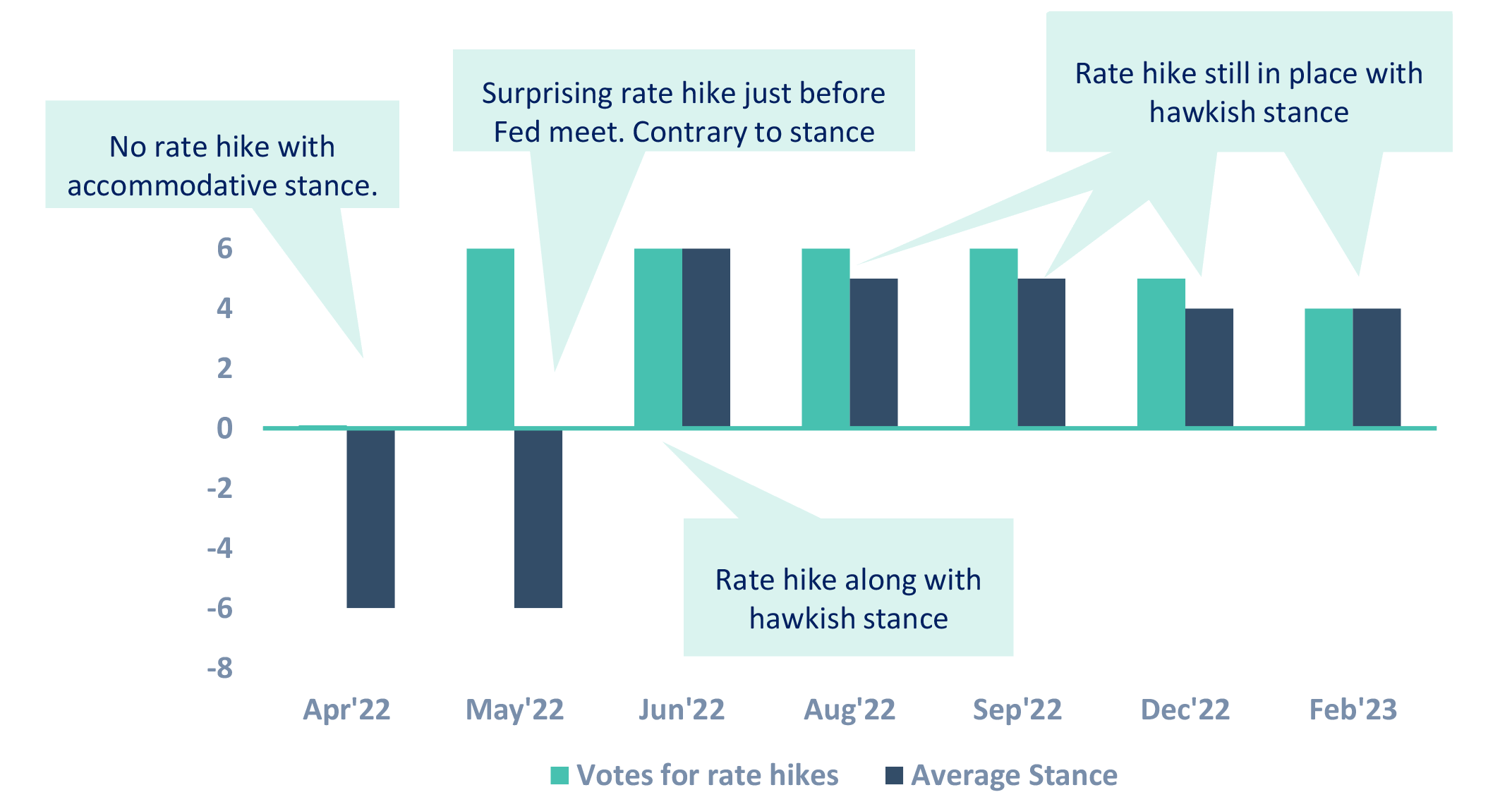

Currently MPC had Hawkish Tilt

with

Similar underlying Data

RBI regime – Still hawkish, with some divergence

Key highlights of the Feb 23 MPC Minutes -

- "The continuously high core inflation points to the persistence in 'steady inflation', which warrants caution. Thus, it will be premature to pause when there are no definitive signs of slowdown in inflation, particularly core inflation." - Dr Ranjan

- "Although it seems to have peaked, inflation remains high and, in my view, it is the biggest threat to the macroeconomic outlook." - Dr Patra

- Dr Goyal and Prof Varma showed concerns around overtightening

Takeaway:

The voting pattern for rate hikes moved from 6-0 to 4-2. However, persistence of sticky core inflation a worry for the MPC

Source – RBI RBI: Reserve Bank of India, MPC: Monetary Policy Committee; CPI: Consumer Price Inflation

Our View – Summary

-

Risks to yields moving higher greatly diminished

We believe we are close to peak yields; thus risk/reward gravitatestowards a long duration position:

- Favorable Demand-Supply: Announced govt borrowing for FY24 is just 8% more than FY23. Demand expected to grow at faster pace. No more G-sec auction/supply for the rest of the month.

- RBI OMOs: In FY24, RBI will finally purchase govt bonds, after a gap of more than 1-year.

- Lag effect of rate hikes: The rate hikes have few quarter lag. The impact in economy will start showing now. Not just lower inflation, but economy slowdown and unknown event risks are heightened across the globe.

-

Risks to our view, however at current yields these risks seem to be priced in

We had mentioned three reasons for yields to be under pressure in this quarter.

- Rupee depreciation: We are confident that the BoP risks are still not behind us, despite rupee stability in recent weeks. However, these risks seem to be overshadowed by the positive drivers.

- Global inflationary pressures could recur: Inflation is a difficult beast to predict. While we expect inflation to come down globally – but who knows!

- Liquidity: Liquidity continues to tighten which has been pushing the short end yields up. But there is a risk that RBI might delay its liquidity infusion actions – especially if there is concern on currency.

-

Risk/Reward to buy duration

For long duration investment: With low chances of yields spiking up, we advise to add duration. The event risks also favor long bonds.

For money markets investment: We like the 1-year segment because of its high term premium. The high carry is lucrative. Central banks stance change will lead to fall in yields in this segment.

Fed: Federal Reserve; RBI: Reserve Bank of India; G-Sec: Government Securities; OMO: Open Market Operation

DSP FI Framework checklist : What is our view on yields movement?

Takeaway:

Markets should consolidate – risk of event led rallies – currency risks not over.

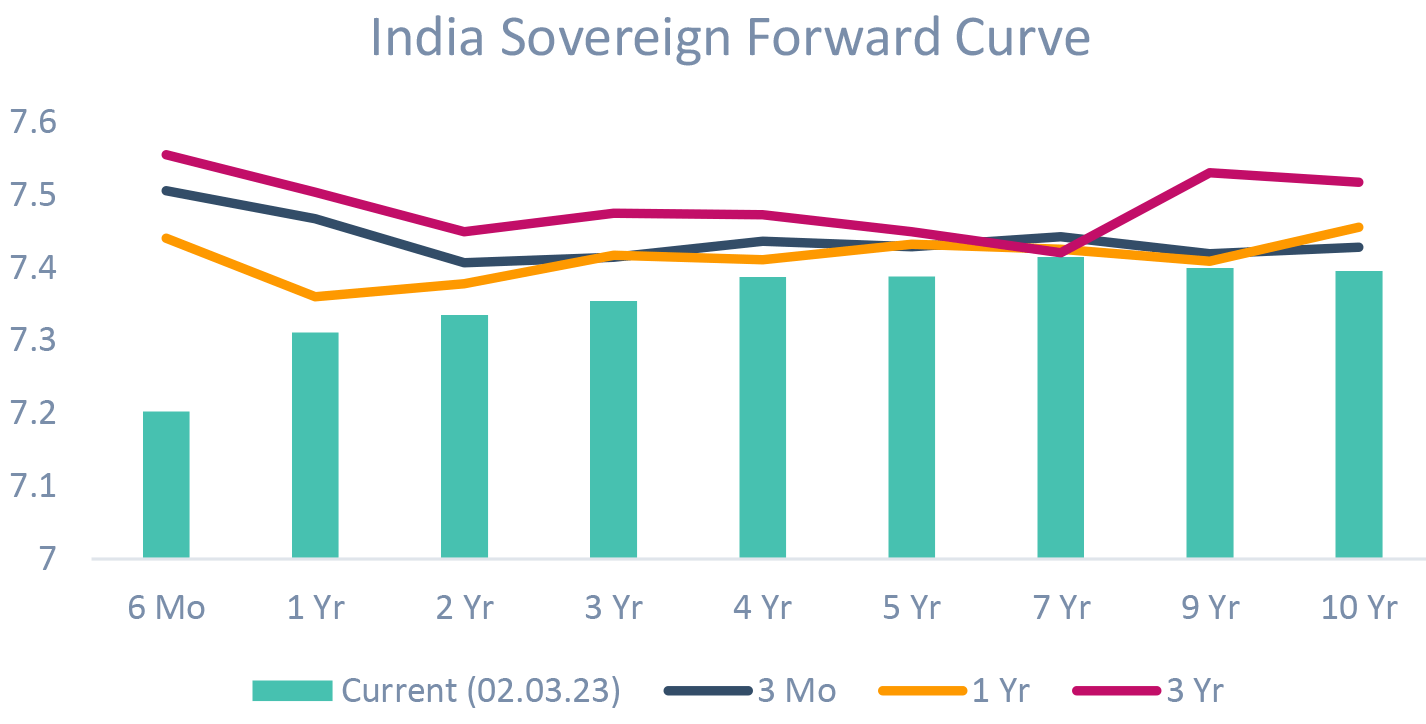

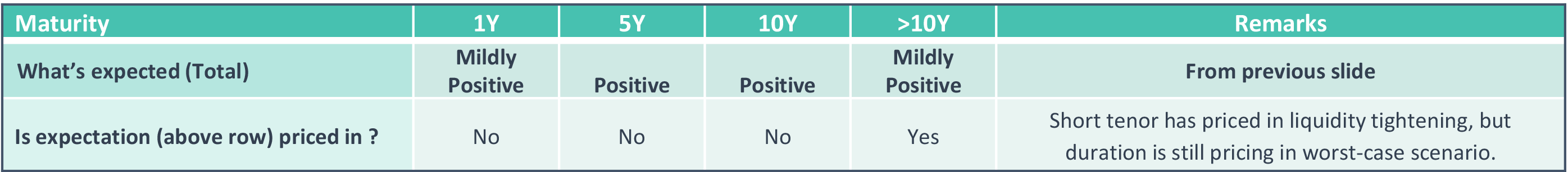

DSP Duration decision: How much of yield movement is priced in?

The chart shows how much yield rise is already priced in the current curve. Large gap between the current yield and forward yield shows that yield rise spike is priced in – and yield uptick may not lead to losses. Similarly small gap means that the market is not pricing yields to rise significantly.

- In short tenor the bearishness is priced in

- Upside risks are largely priced in –seen in the sharp uptick in short tenor in forward curve

- The roll-down benefit negates the impact of yield uptick

- In long tenor, the bearishness is partially priced in

- The longer tenor forward curve is pricing just 5bp-10bp up-move.

- Where to invest?

- Short tenor yields have moved higher, and have already priced in further rate hikes.

- To find the best maturity to invest, one needs to take into account higher price risk in longer duration.

Source – Bloomberg

Done with our market view

framework?

Now

Our Portfolio creation framework

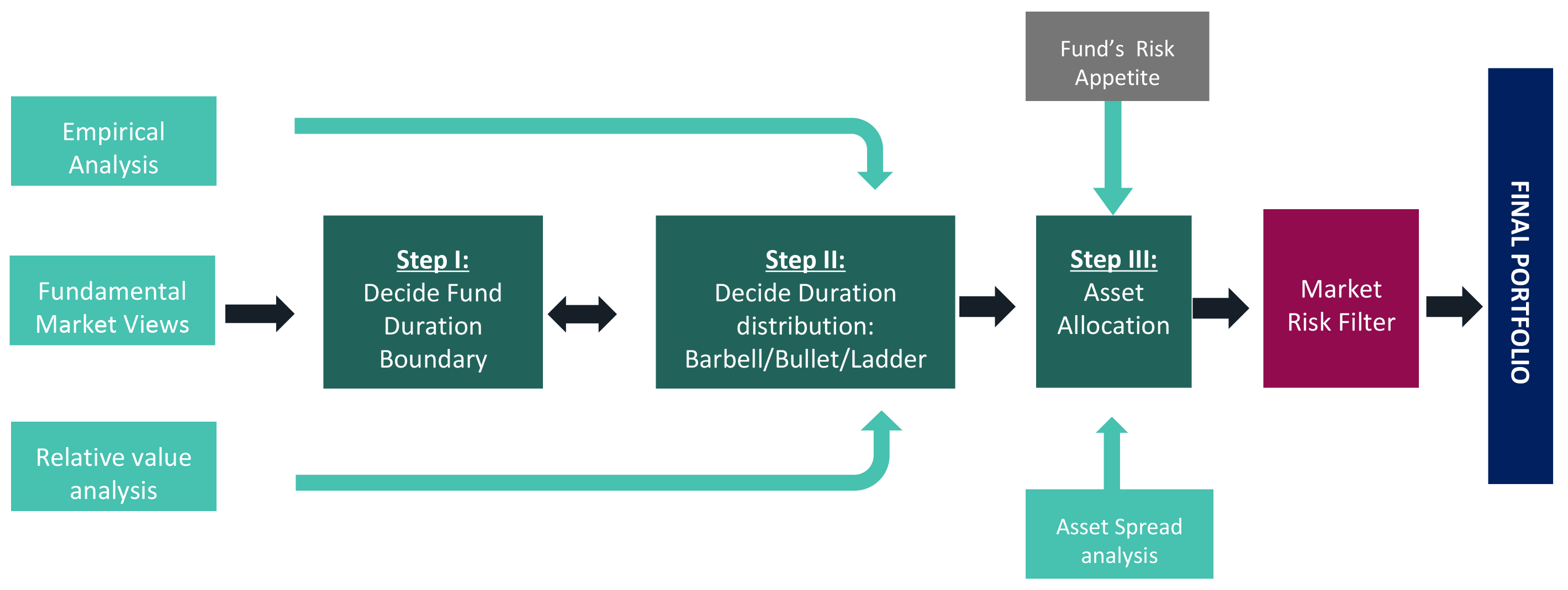

DSP Portfolio Creation: Multi-step process

DSP Fixed Income Funds follow a defined methodology for fund portfolio construction

- We apply market risk filter which can help the Fund Managers not to take extreme risks. Thus, Value at Risk is limited by ensuring the positions are balanced.

Investment approach / framework/ strategy mentioned herein is currently followed & same may change in future depending on market conditions & other factors.

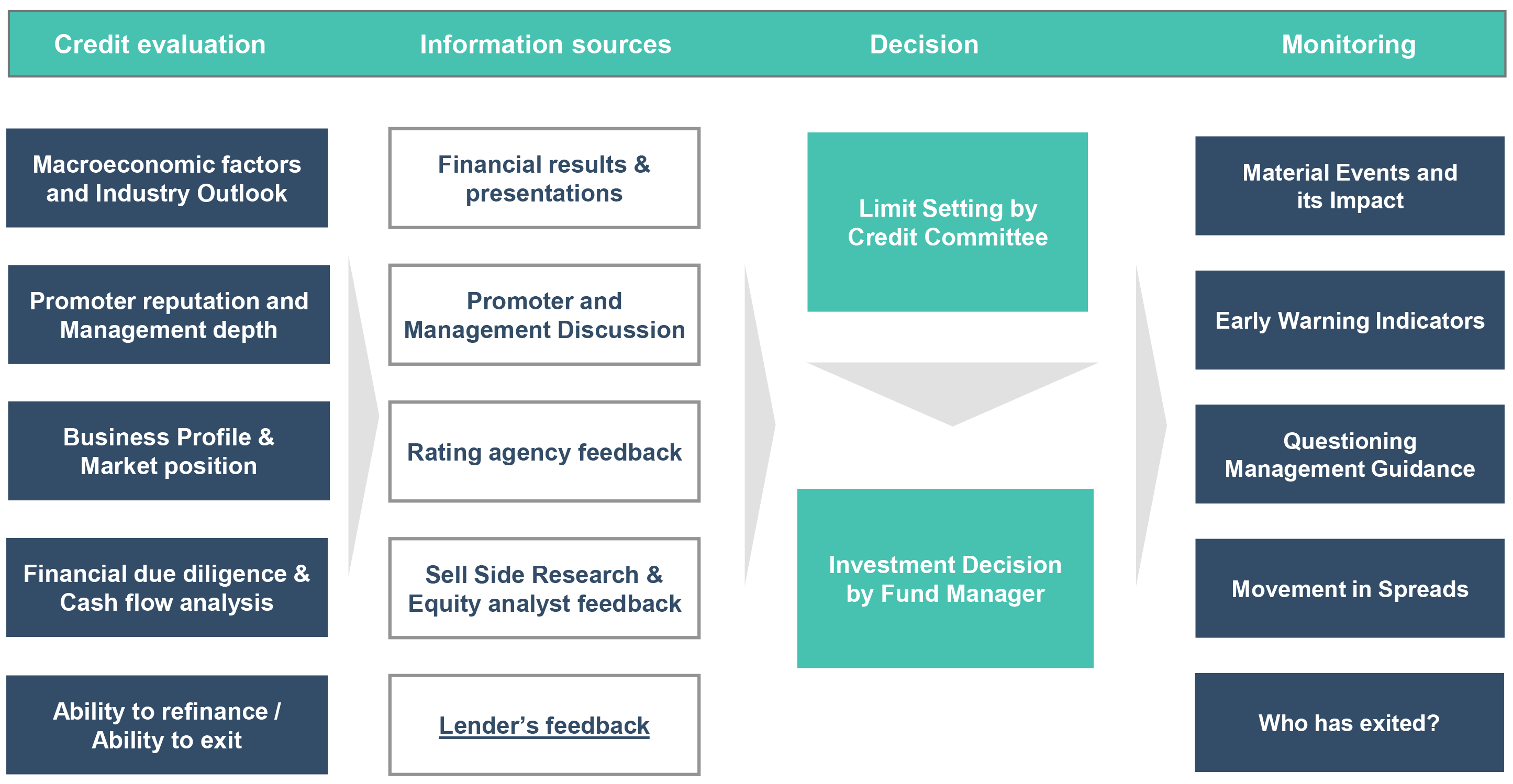

DSP Credit Investment Process – Better Safe, than Sorry!

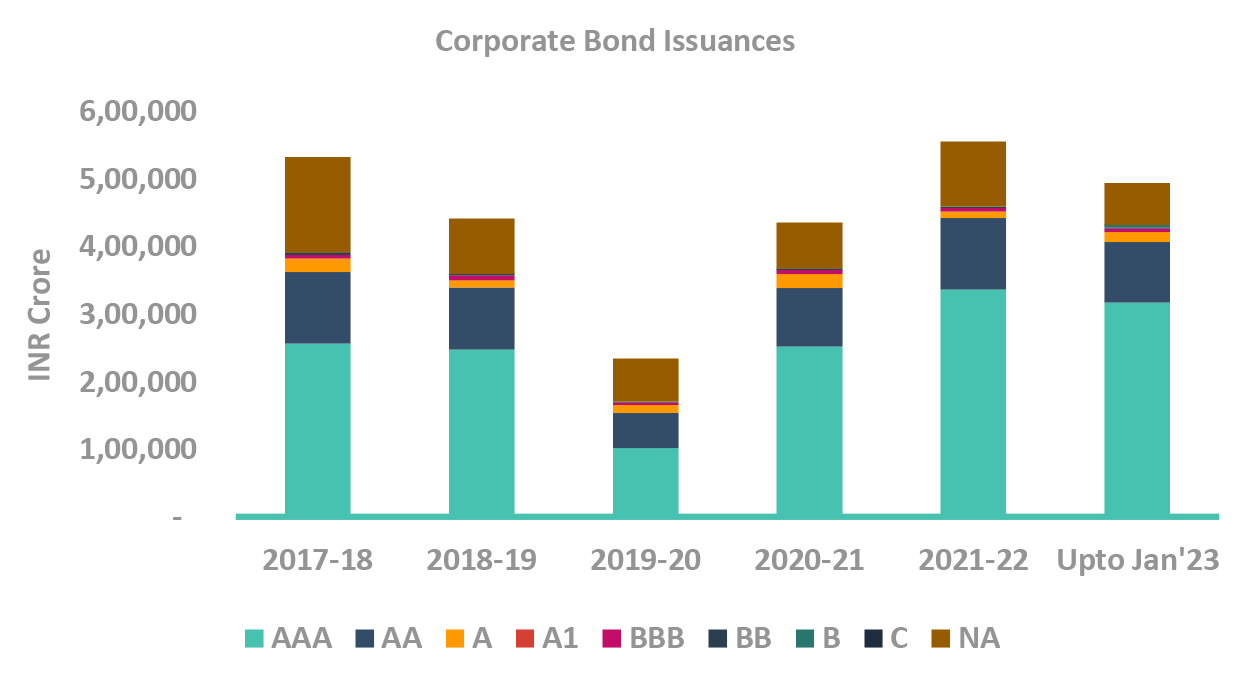

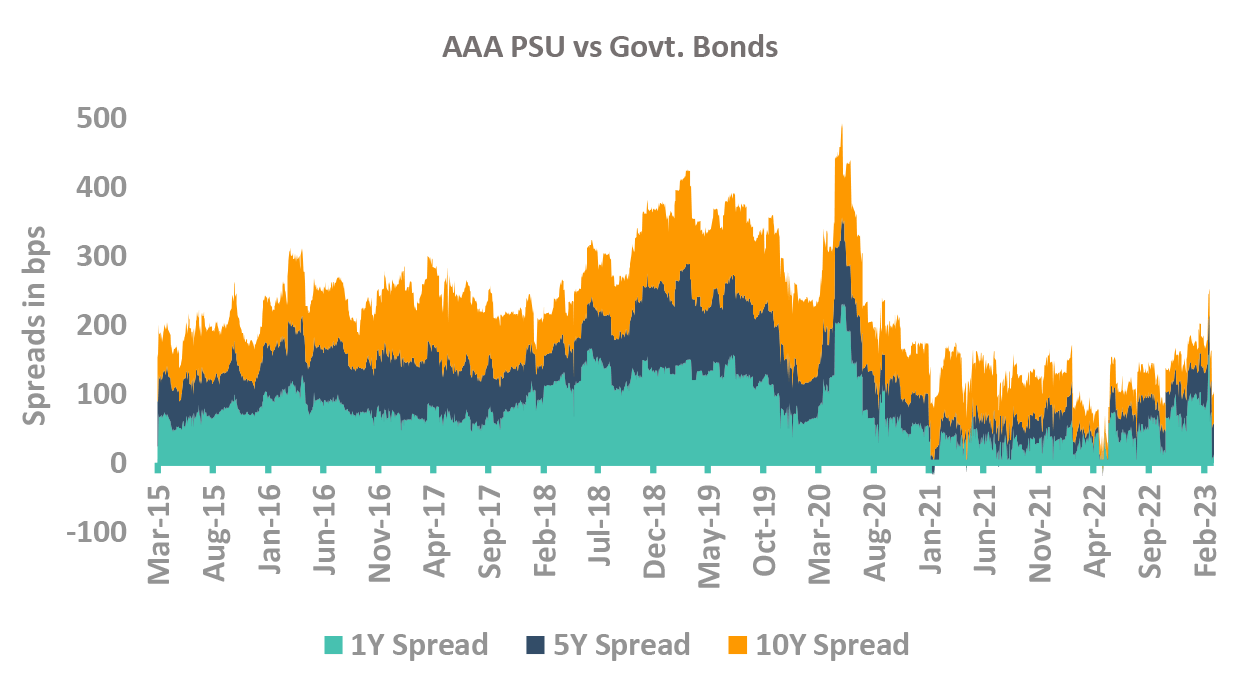

DSP Asset Allocation: Corporate bonds vs. Sovereign Bonds

-

Demand for corporate bond in the long end has been exceeding the supply keeping the spreads low

- Corporate bond issuances have picked up

- The issuances till Jan in FY23 have increased to ₹ 4.94 tn vs ₹ 3.85 tn till Jan 22

- But with govt. on path to reduce off-balance sheet borrowing, issuances may not increase meaningfully

- The non-discretionary / stable demand from the long-end investors viz. EPFOs, Insurance, NPS have matched the supply of bonds in the longer end keeping the spreads narrow.

- Corporate bond issuances have picked up

-

The corporate bond spreads have increased, demand from long end investors has flattened the yield curve

- The short end spreads (1-3Y) are at their median levels, the long end spreads remain narrow as the demand is strong from long end investors

- Steadily increasing allocation to short tenure corporate bonds as spreads have widened.

- Tighter liquidity, and high credit offtake could mean that CD supply from banks will remain elevated.

Takeaway:

Corporate bond spreads have slightly widened, we are steadily adding corporate bond allocation in our funds

Source – Bloomberg, CCIL

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.