DSP Converse December 2023

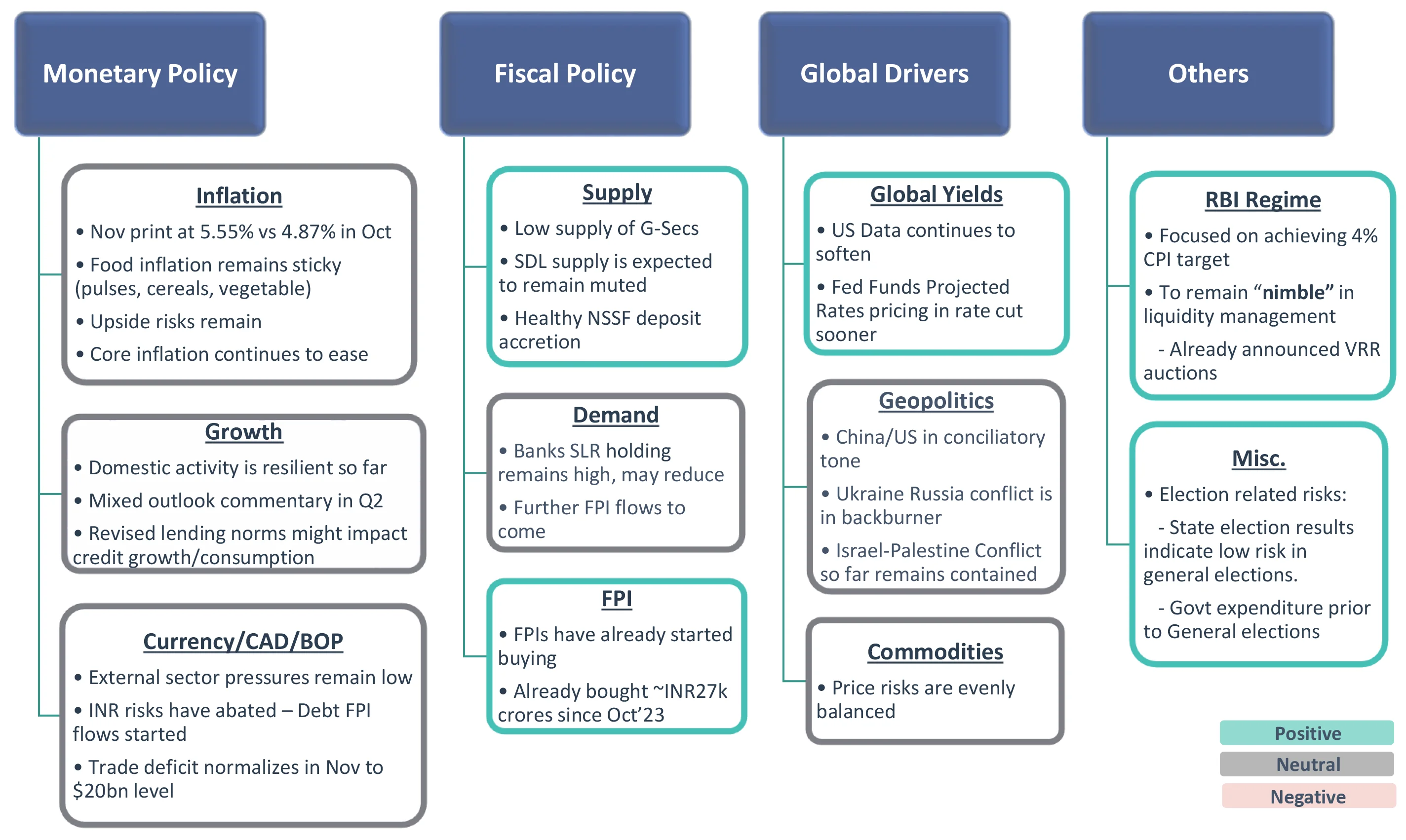

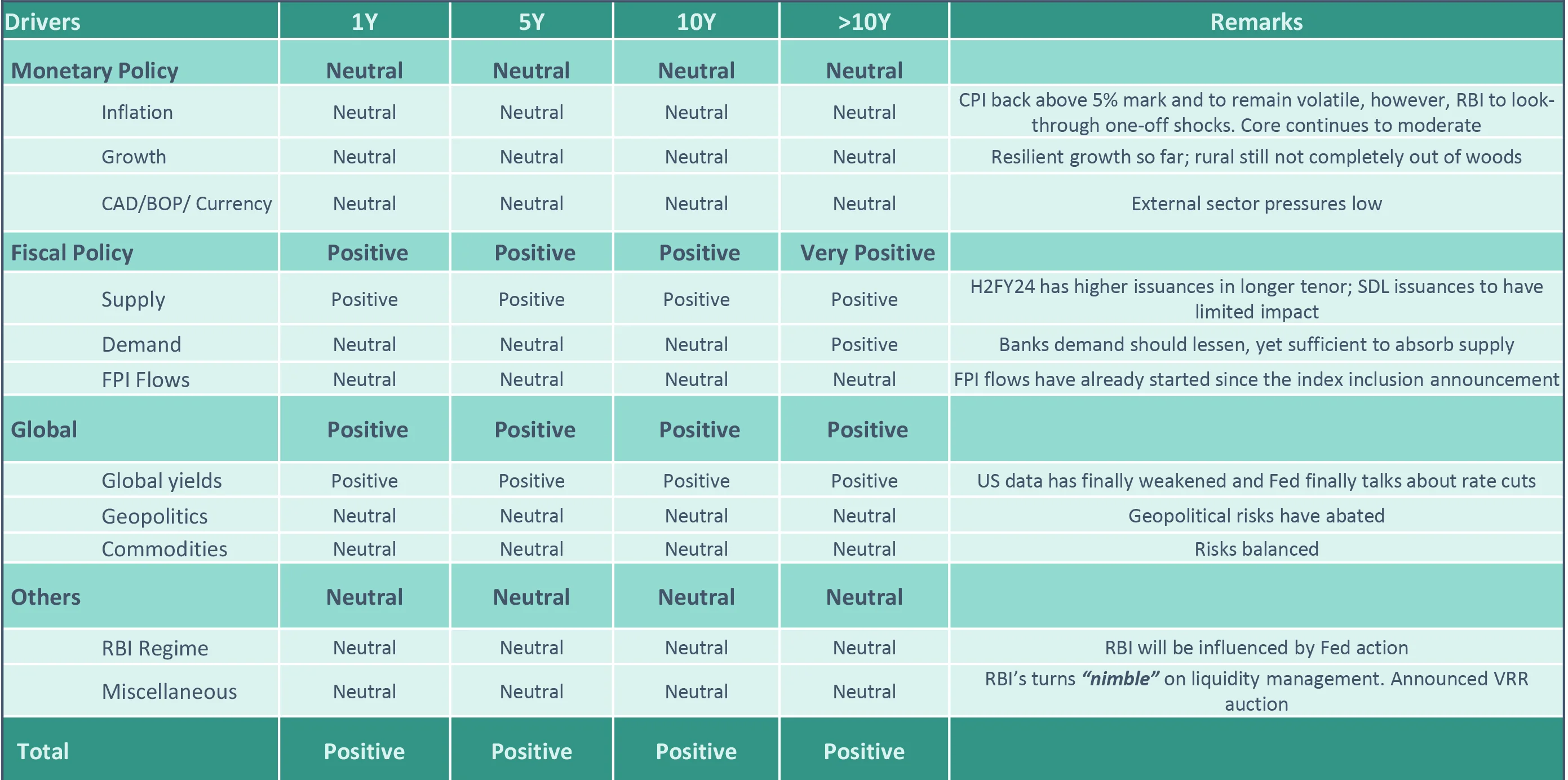

Our Framework

Takeaway:

Domestic environment steady, US pricing of rate cut expectations to drive bond yields

CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; FPI: Foreign Portfolio Investment; NSSF: National Small Savings Fund; VRR: Variable Repo Rate

Still Long! Why?

Rate cycle has probably turned around

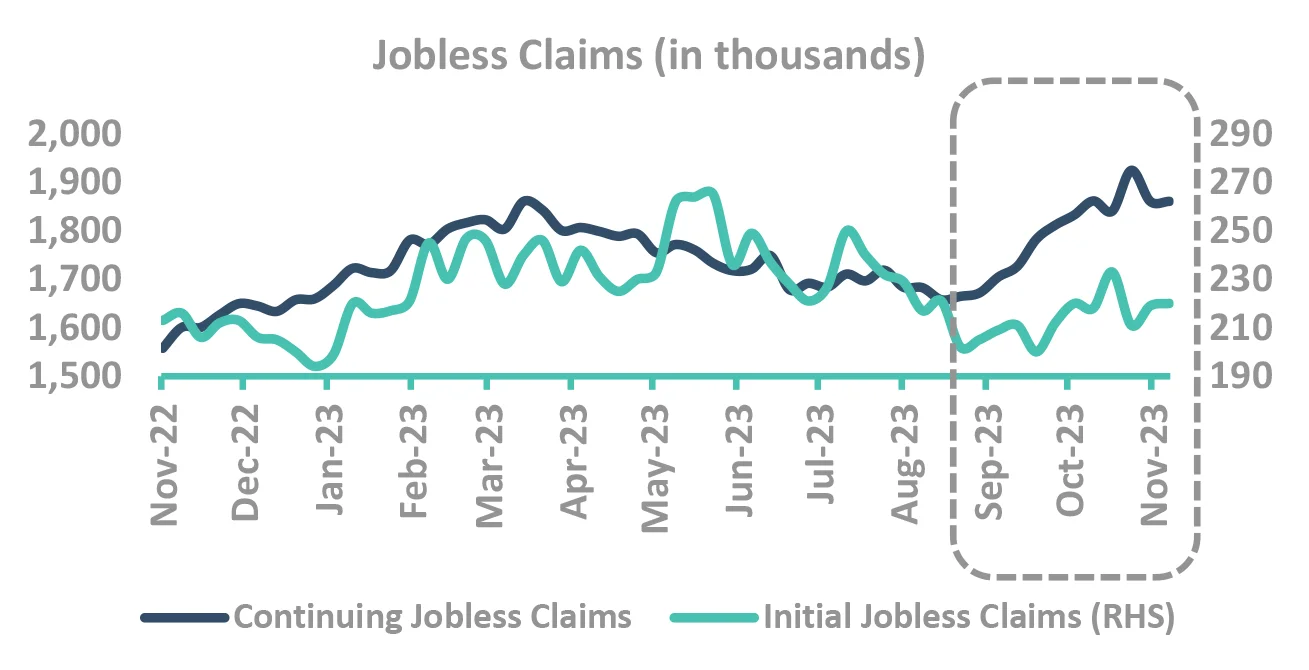

Globally the data has softened

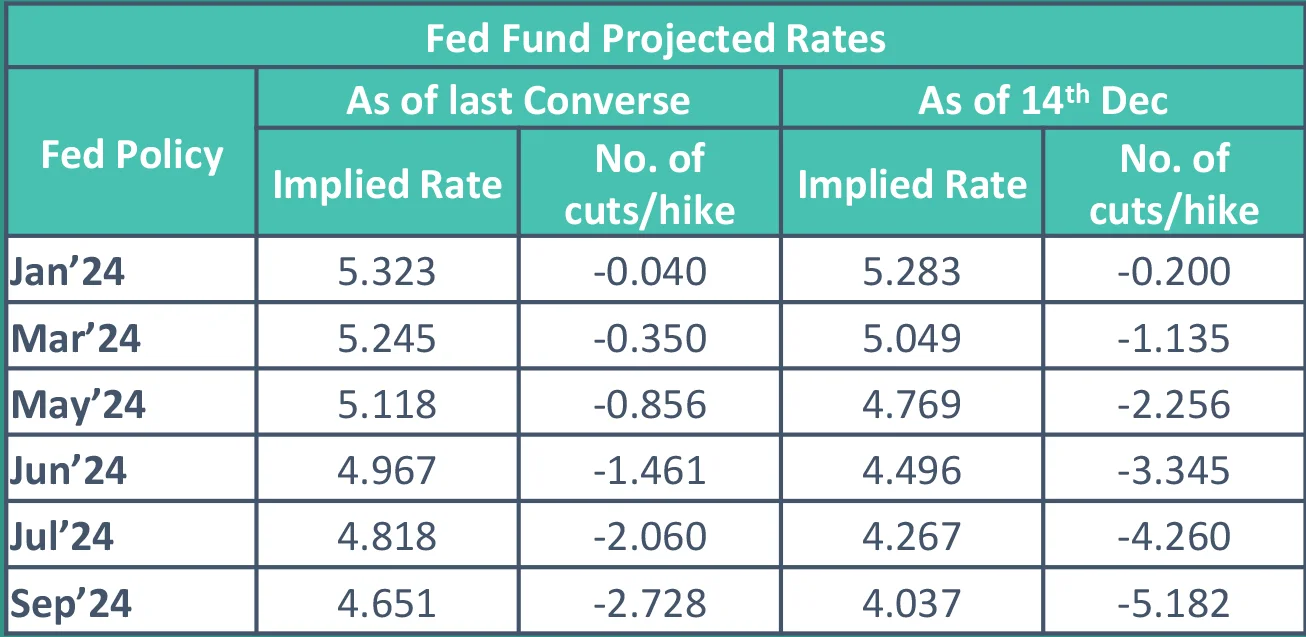

Let’s revisit our rates call trajectory

Source – Bloomberg, Internal

To start with,

Recap of events since last release.

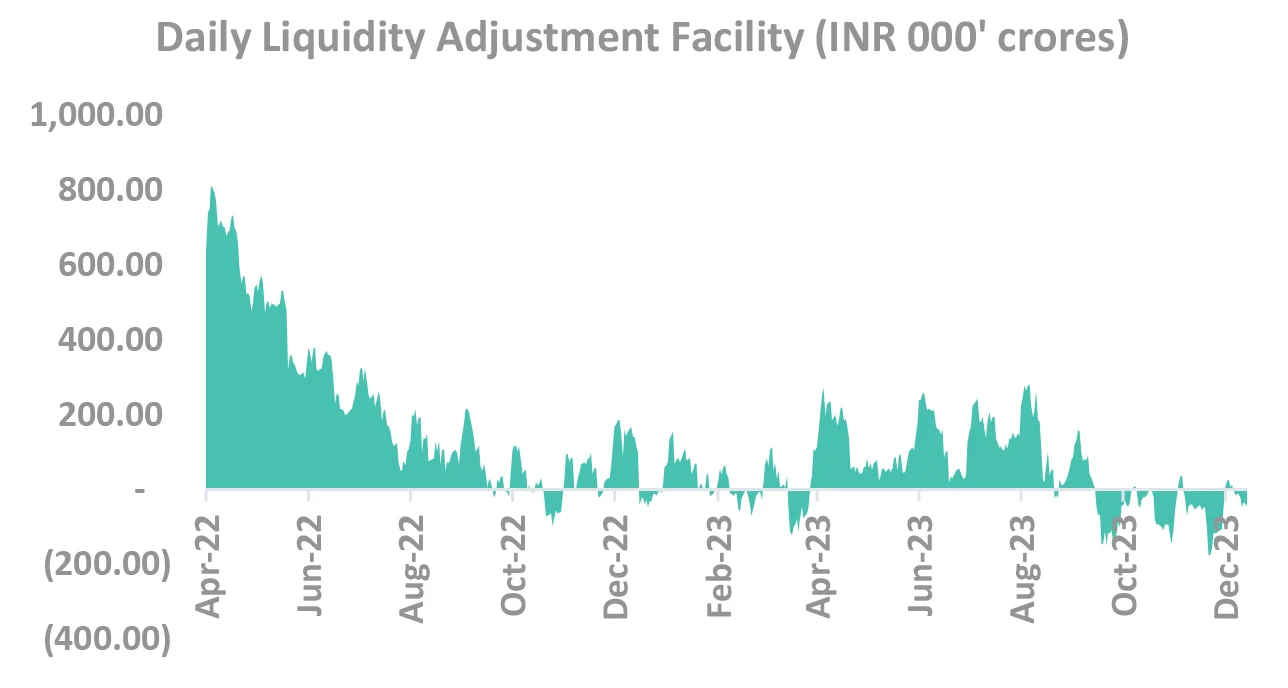

RBI's “nimble” stance on liquidity (change from hawkish liquidity stance in Oct policy)

US Data continues to soften

Fed finally talks about rate cuts

RBI’s not-so-status quo policy

Key highlight

- ✓ To remain “nimble” in liquidity management vs considering OMO-sales to manage liquidity in the previous policy

-

REPO rate unchanged at 6.5%

Stance retained at “focused on withdrawal of accommodation”

- ✓ By a majority of 5 out of 6 members

Inflation Projections unchanged

- ✓ Adequate bufferstocks, moderation in international food prices and GoI’s supply side interventions to keep a check

- ✖ El-Nino weather conditions need to be monitored

- ✖ Re-iterated working towards a 4.0% inflation target

FY24 Growth Projections revised up

- ✓ To 7.0% vs 6.5% in the previous policy

- ✓ Buoyancy in services, gradual revival in rural demand, Govt’s thrust on capex and healthy corporate & bank B/S

- ✖ Headwinds from geopolitical tensions and volatile financial markets

RBI: Reserve Bank of India; GDP: Gross Domestic Product; B/S: Balance Sheet; OMO: Open Market Operations

US data has finally weakened/Dovish fed policy

Takeaway:

Fed finally talks about rate cuts “coming into view”

Source – Bloomberg, Federal Reserve CPI: Consumer Price Index; FOMC: Federal Open Market Committee

Now our framework

And

What we track

Our Framework

Takeaway:

Domestic environment steady, US pricing of rate cut expectations to drive bond yields

CAD – Current Account Deficit; BoP – Balance of Payment; SLR – Statutory Liquidity Ratio; SDL – State Development Loans; RBI: Reserve Bank of India; G-Sec: Government Securities; FPI: Foreign Portfolio Investment; NSSF: National Small Savings Fund; VRR: Variable Repo Rate

Resilient domestic economic activity so far

Expansion in urban demand while rural still not completely out of woods

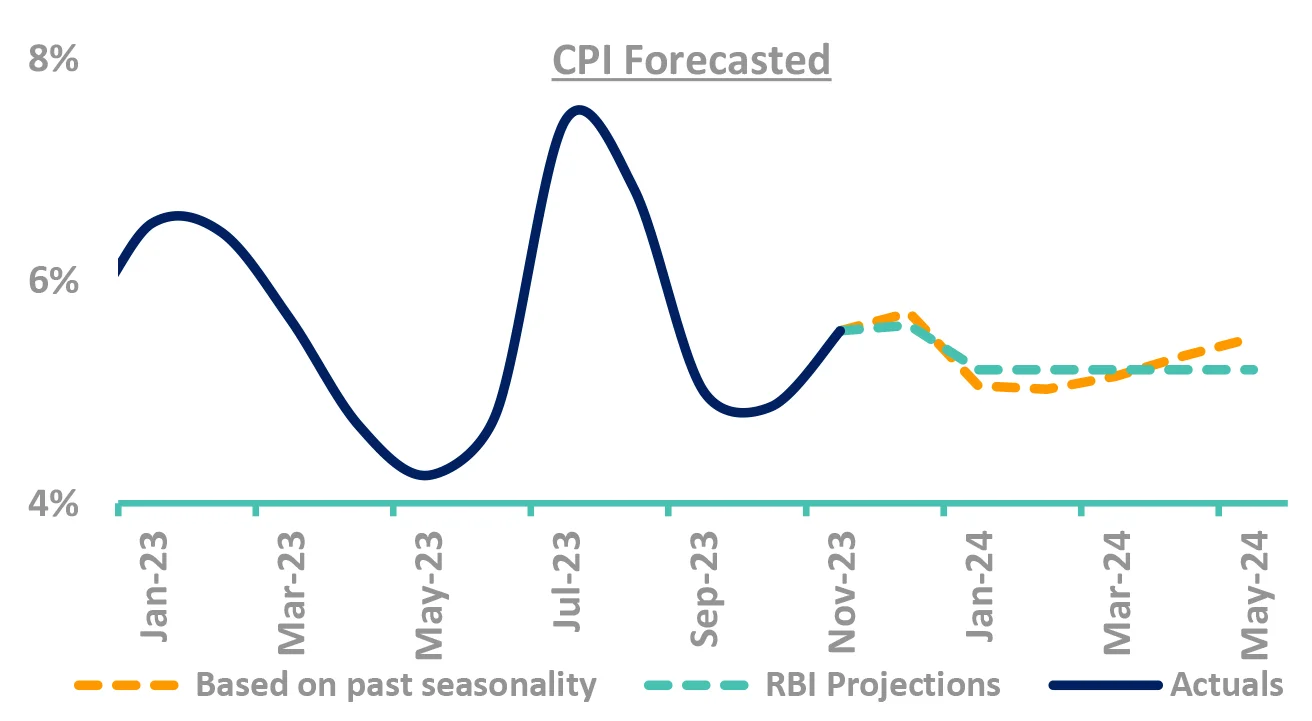

CPI to remain volatile, however, RBI to look through

RBI to be nimble in liquidity management

Inflation above 5% mark. Risks remain, but RBI to look through

-

CPI rose sharply but lower than expectations

- Nov print came in at 5.55% vs 4.87% in Oct

- Led by sequential uptick in food prices

- ✓ Vegetables, pulses and cereals

-

Risks remain due to

- ✓ High vegetable prices and low reservoir levels

- However, RBI to look-through such intermittent shocks unless price pressures become generalised

Core CPI eased further

- From 4.3% in Oct to 4.1% in Nov

-

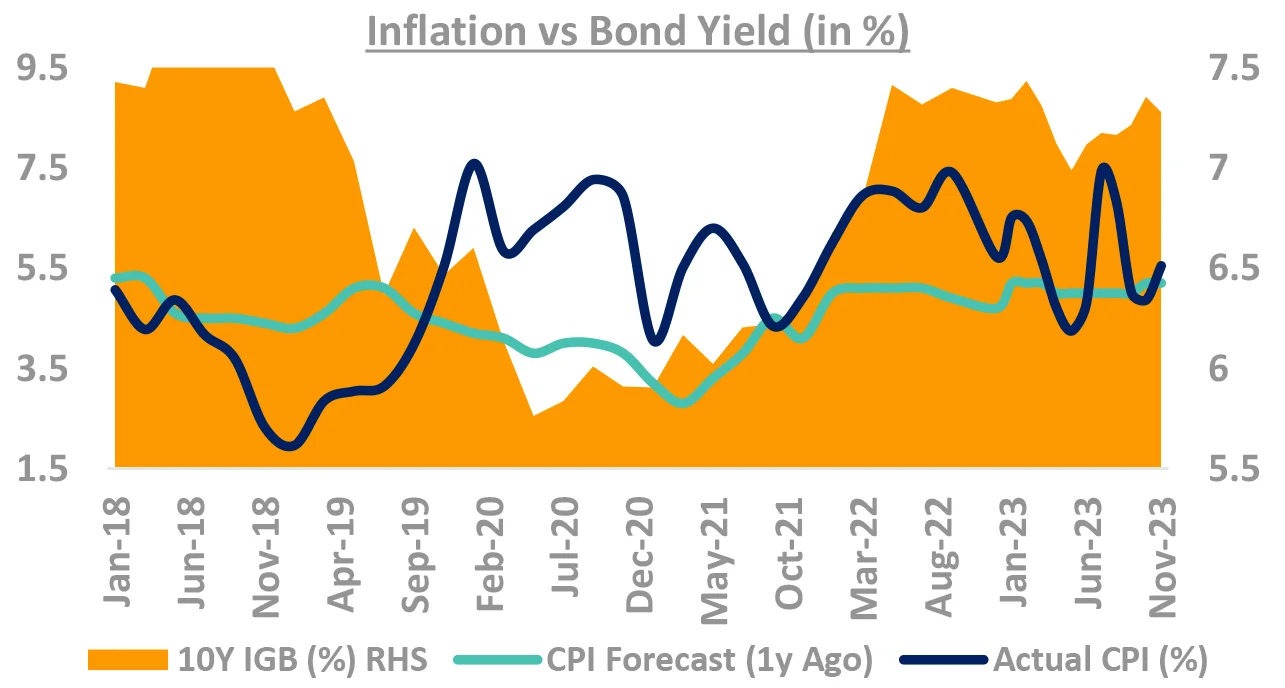

Do yields track inflation projection? No.

- Orange area (chart) is 10Y yields, Blue line is CPI

Can forecasters predict Indian CPI? No.

- Green line is forecasters CPI 1-Yr ahead prediction

- Blue line is where inflation actually came

- Guess the error of margin!

CPI forecast corelated (not causality) to yields

- Low predictive power, high current corelation

Takeaway:

Watch out for uncertainties even though core provides comfort. However, volatility in CPI has not impacted yields (especially in 2023)

Source – Bloomberg, RBI, Internal CPI: Consumer Price Inflation; RBI: Reserve Bank of India; IGB: India Government Bond

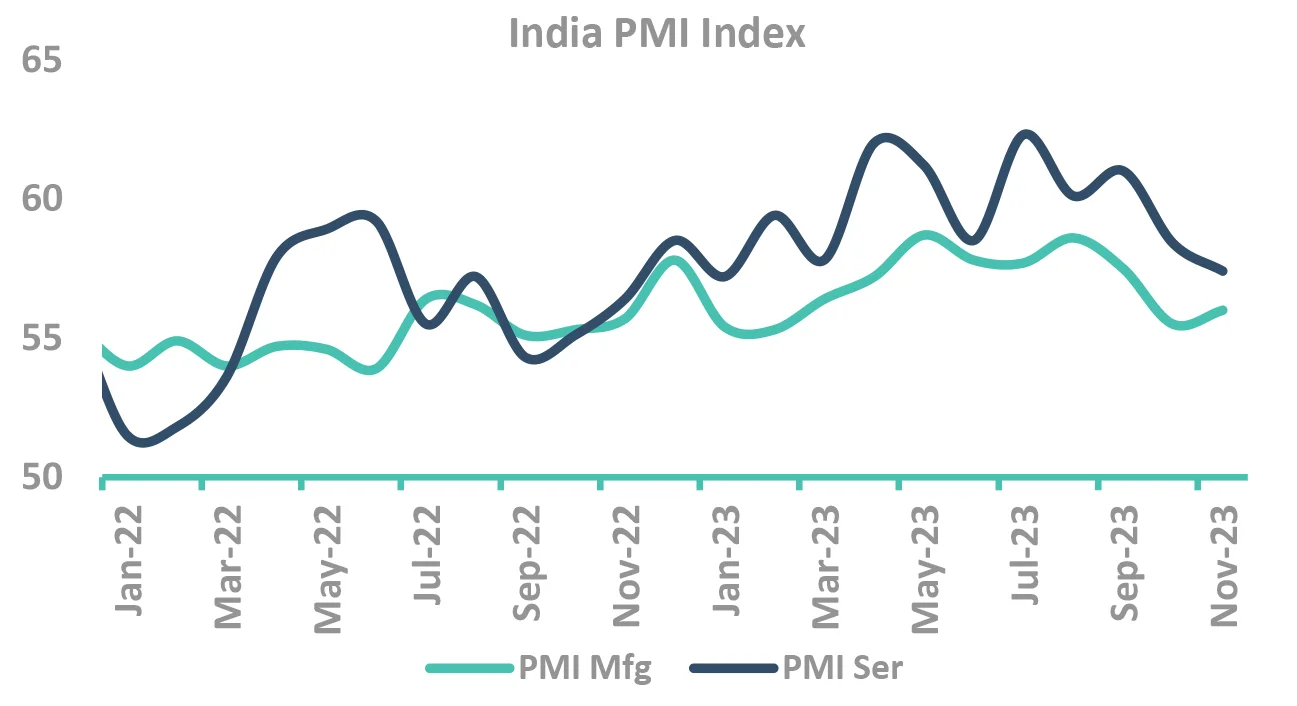

Domestic growth resilient so far: But watch out for trends

-

Watch out for domestic growth

- PMI is in expansionary mode, however….

- ✓ 2nd consecutive month of slowdown in services PMI

- GST collections at ₹ 1.68tn; up 15% YoY

- Outlook commentary in Q2 was mixed

- PMI is in expansionary mode, however….

Impact of revised lending norms still to play out

- Early signs of slowdown already visible (e.g. Paytm putting low ticket postpaid accounts on hold)

- Large corporate credit growth further moderated (5% in Oct from 6% in Sep)

-

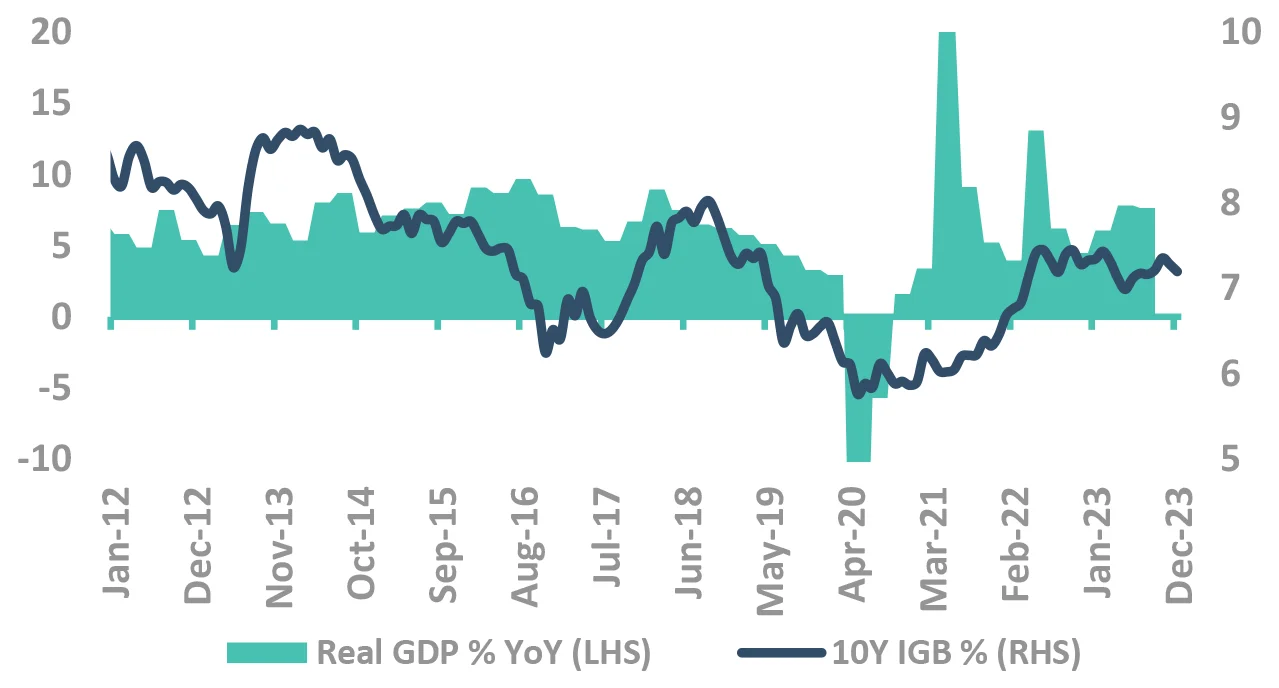

How closely do yields track growth?

- Yields have usually tracked GDP growth, with correlation stronger when growth slows, barring

- ✓ 2013, rupee depreciation and debt outflows

- ✓ 2017, during demonetization

- Yields have usually tracked GDP growth, with correlation stronger when growth slows, barring

FY24, growth may not be big driver for yields

- FY23 GDP growth at 7.2% -in line with RBI projections.

- Q2FY24 GDP Growth came in at 7.6%.

Takeaway:

Domestic growth seems to be resilient so far but watch out for emerging trends

Source – Bloomberg, PIB, Internal GDP: Gross Domestic Product; PMI: Purchasing Managers’ Index; GST: Goods and Service Tax; IGB: India Government Bond

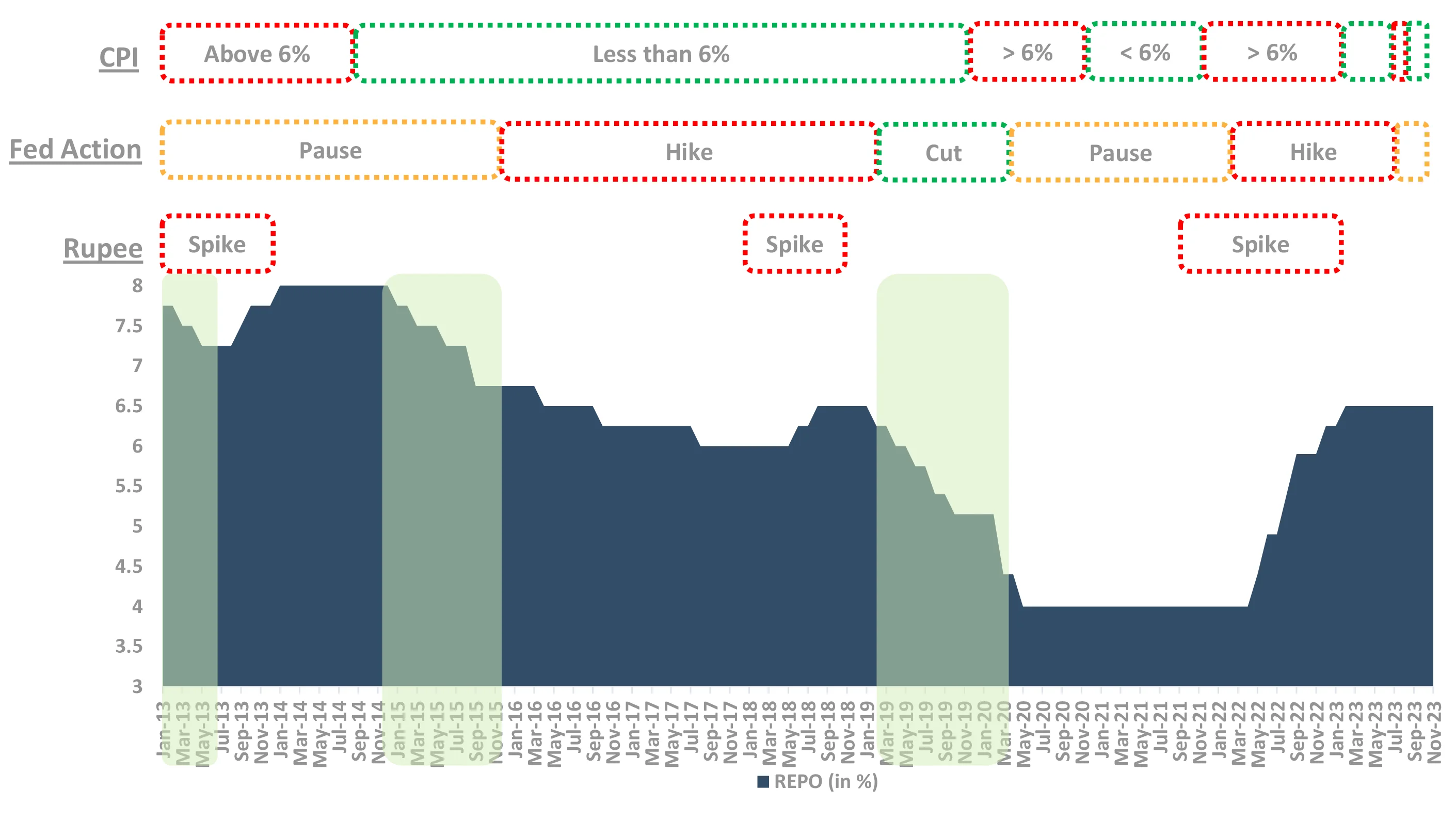

What makes RBI Cut Rates?

Waiting for more conclusive evidence from Fed

-

Checklist for cut:

- Fed Pause/Cut

- Stable Rupee

- CPI less than 6% (except in 2013 when RBI didn’t have 6% target)

-

How is the Checklist now:

- Fed has turned dovish

- Given the FPI flows, forex reserves at $600bn+ and normalization of trade deficit, rupee to remain stable

- Inflation (although expected to remain volatile), RBI to look-through one-off shocks

CPI back above 5% mark, but core moderates

Growth remains resilient

FPI flows to support INR

State election results indicate low risk in general elections

Let’s turn to Fiscal policy

Generally, it drives the long bond yields

It is reflected in demand/supply mismatch.

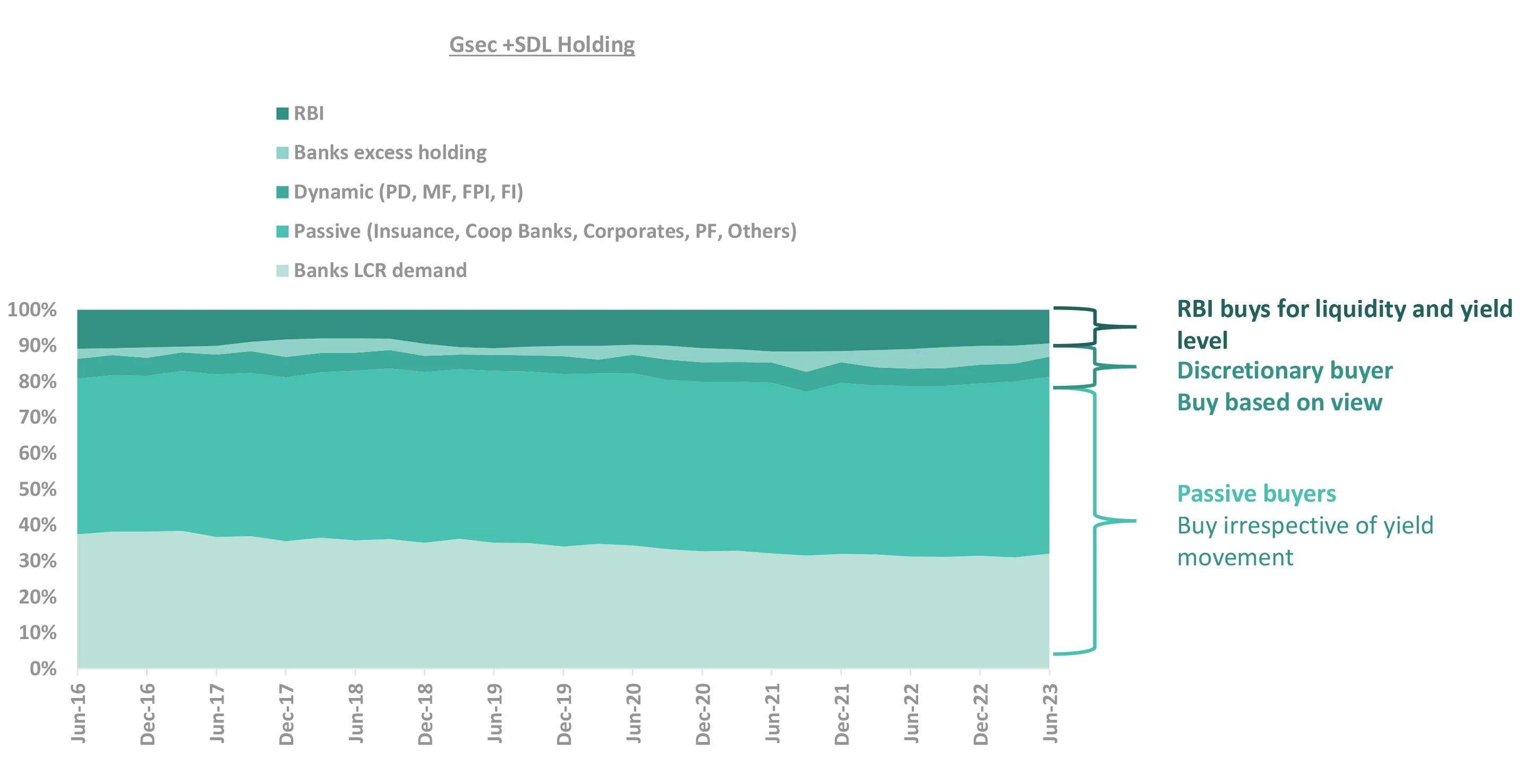

Fiscal policy is favouring bonds right now

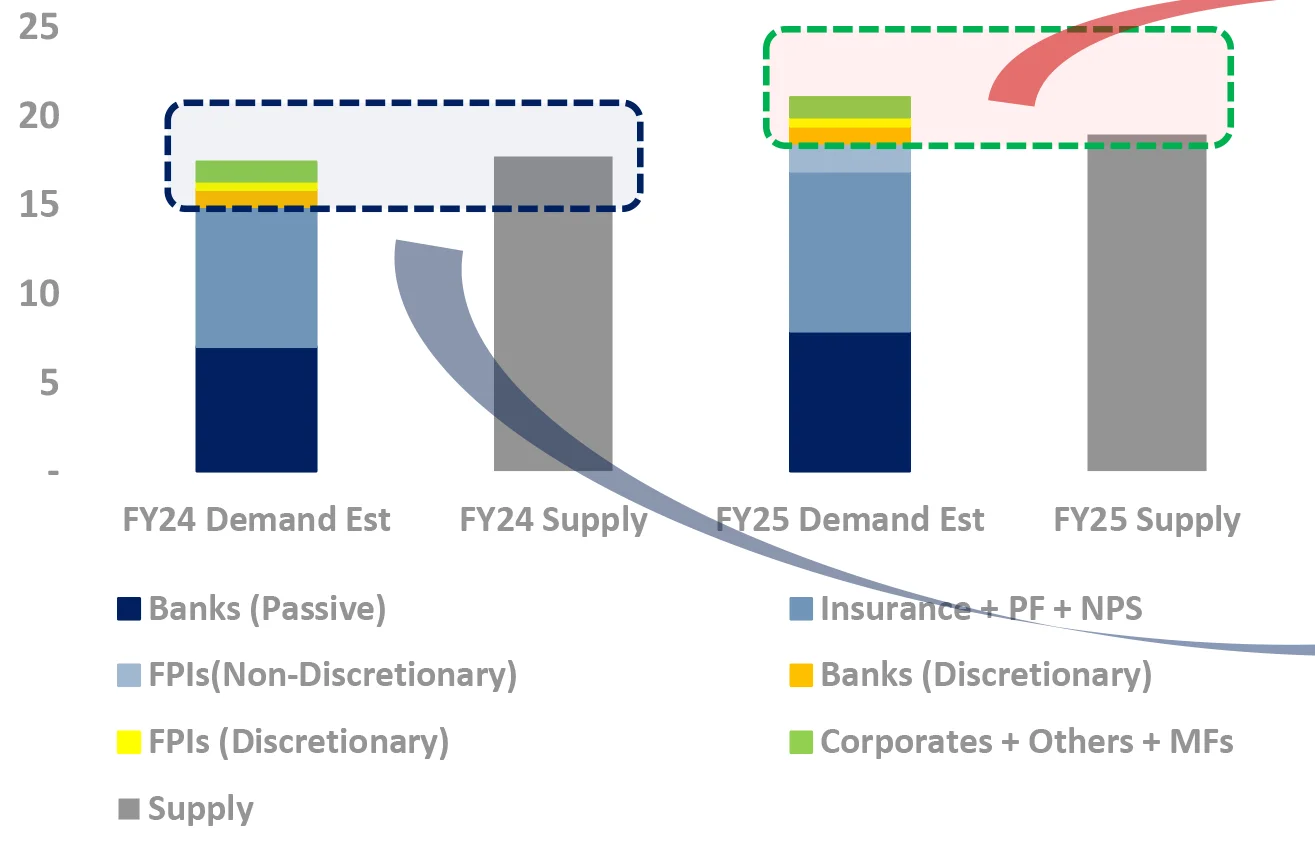

Only a small part of bond buyers are discretionary buyers

They drive yields

Supply fluctuation is borne by these buyers

Gsec market is still driven by lumpy institution purchases

Takeaway:

Increase in supply impacts the discretionary buying. Banks excess holding, passive buyers have been absorbing the supply

Source – DBIE LCR – Liquidity Coverage Ratio; SDL – State Development Loans; PF – Provident Funds; PD – Primary Dealerships; MF – Mutual Funds; FPI – Foreign Portfolio Investors; FI – Financial Institutions; RBI: Reserve Bank of India; GSec: Government Securities

Why FPI inflow is the big thing: Look at the right metrics

-

FPI demand seem insignificant to total supply

- Assuming higher supply by just 6-7%

- ✓ Assuming Centre plus State fiscal deficit of 8.3%

- Non-discretionary buying growth at 14-15%

- ✓ Non-discretionary => need to buy for regulation and ALM (Insurance/PF/NPS/Bank-LCR) no matter the yield

- $25billion FPI flow ($20bn non-discretionary and ~5 billion discretionary) may seem pittance in front of INR19 lac crores of supply

- Assuming higher supply by just 6-7%

-

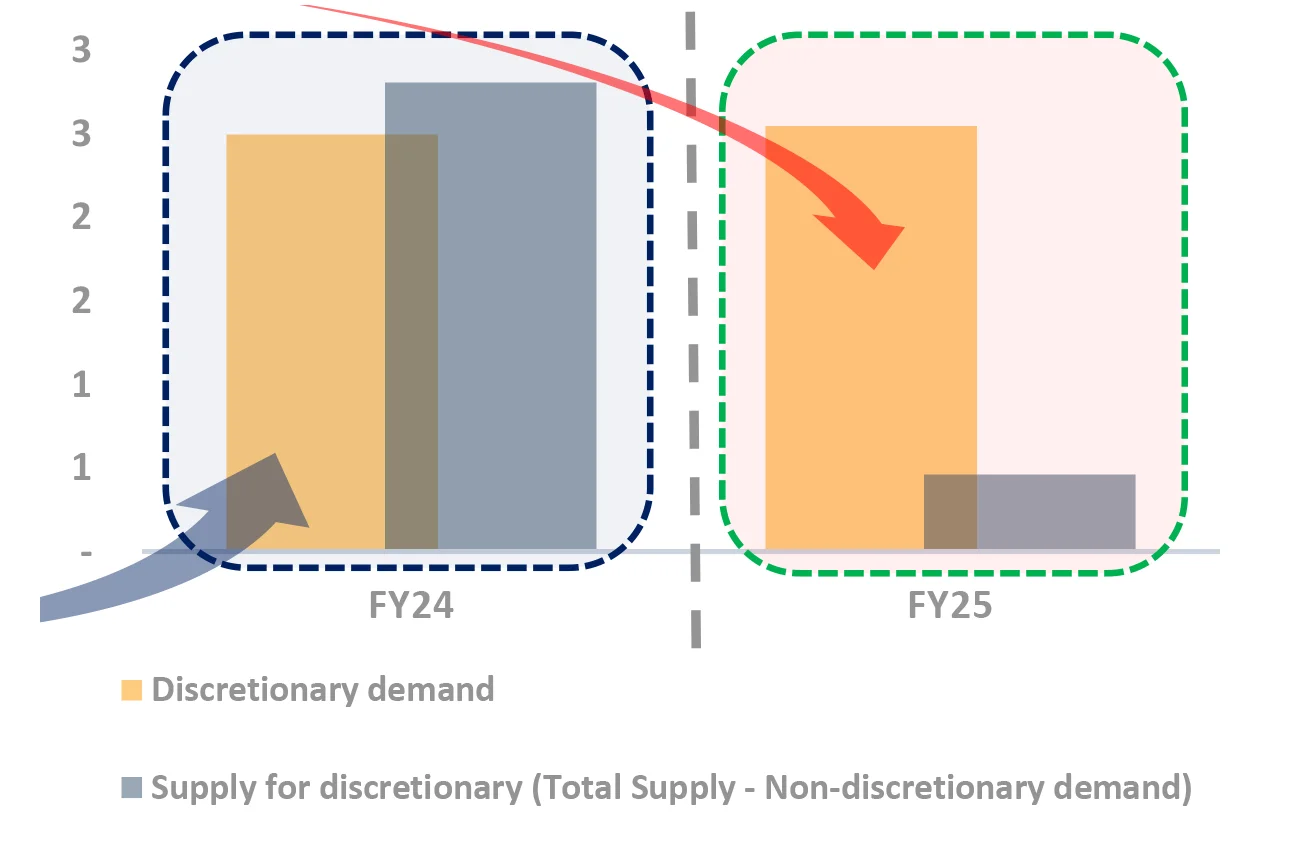

… yet FPI inflow is mammoth

- Supply available for discretionaries is less in FY25

- ✓ Bank non-discretionary demand growing faster

- But the demand from discretionary will increase

- ✓ Discretionary = Look at yields to buy

- Supply available for discretionaries is less in FY25

It’s not share of supply that matters

- It’s the share of residual supply

- That’s why, OMO fear of < 1 lac cr rose yield by 20bp

Takeaway:

Additional FPI demand to compete with discretionary buyers

Source – Internal SDL – State Development Loans; PF – Provident Funds; PD – Primary Dealerships; MF – Mutual Funds; FPI – Foreign Portfolio Investors; G-Sec: Government Securities; OMO: Open Market Operations

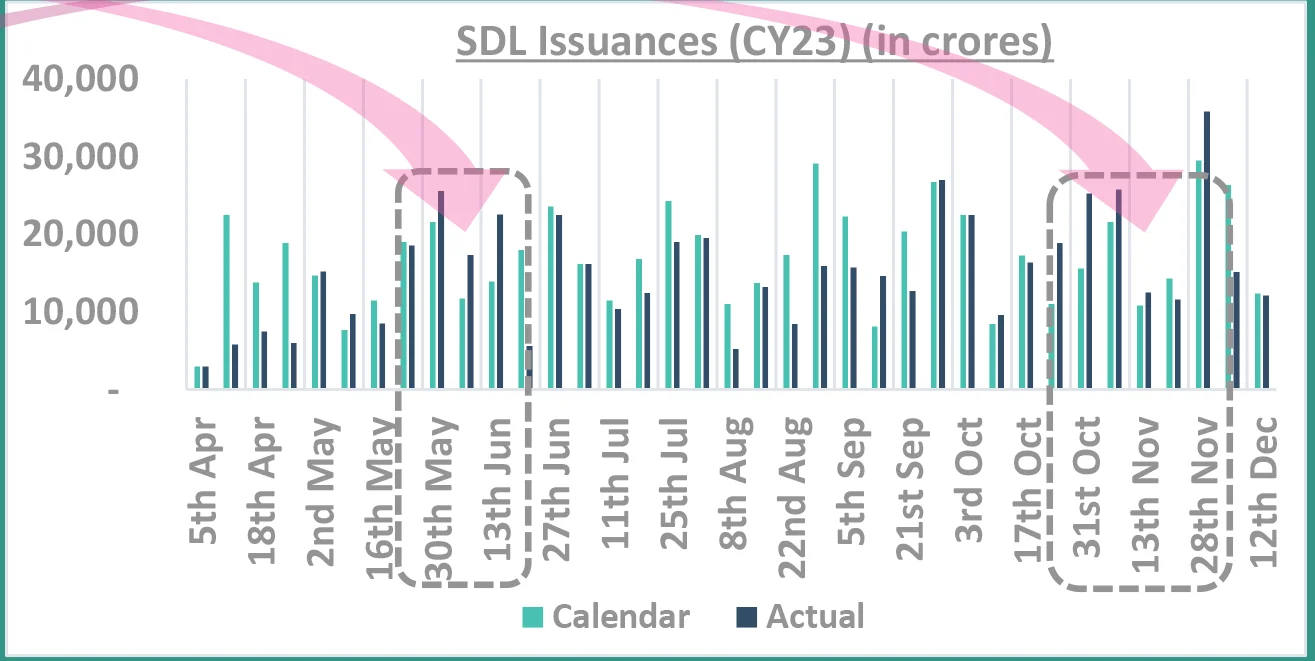

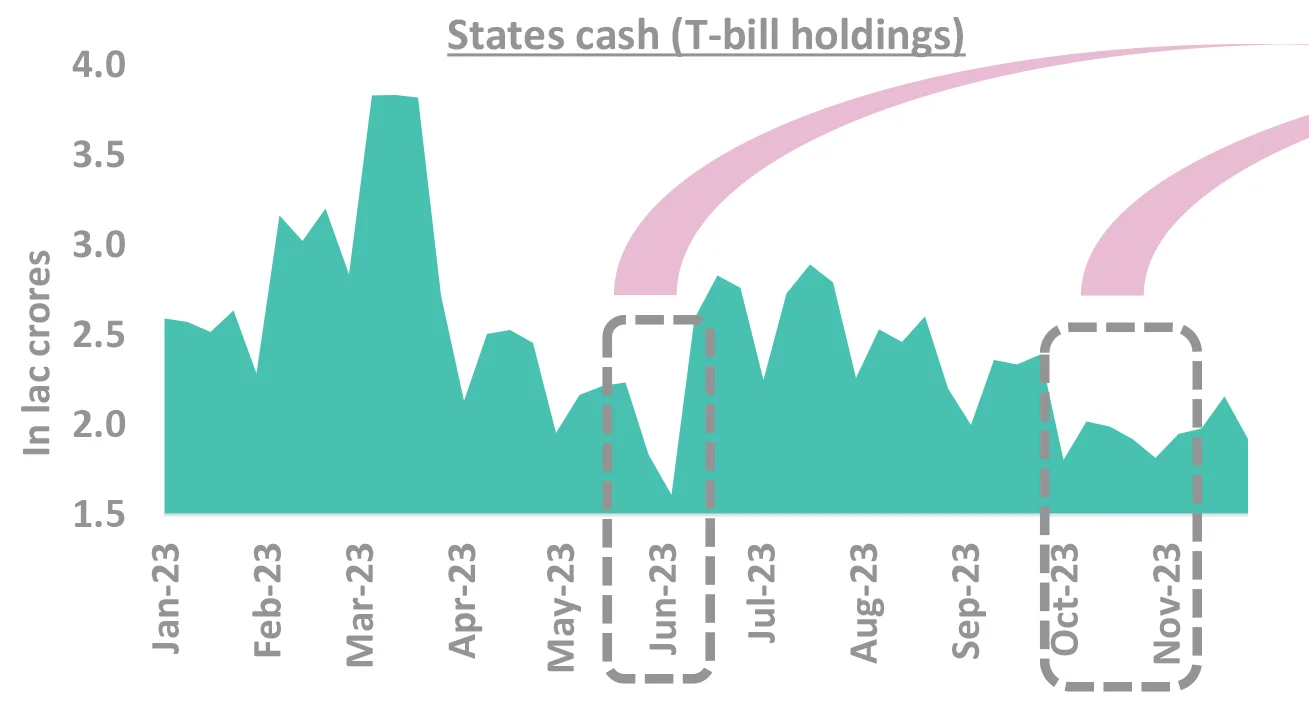

Comfortable supply/demand dynamics for FY24

But it will be bumpy ride

Last 8 months demand/supply has been rosy (latent purchases, low SDL issuances)

SDL supply only increases when states cash dip

-

Actual SDL borrowing in line with expectations

- Higher than the calendar only when state cash balances dipped below 2 trillion

- 8mFY24 issuance now just 9% lower vs the calendar amount (vs 12% lower in our last converse)

- ✓ 2nd consecutive month of higher issuance vs the calendar

-

SDL issuance impact is expected to be limited

Takeaway:

SDL supply may remain muted in FY24

Source – DBIE, RBI T-bill: Treasury Bill; SDL: State Development Loans

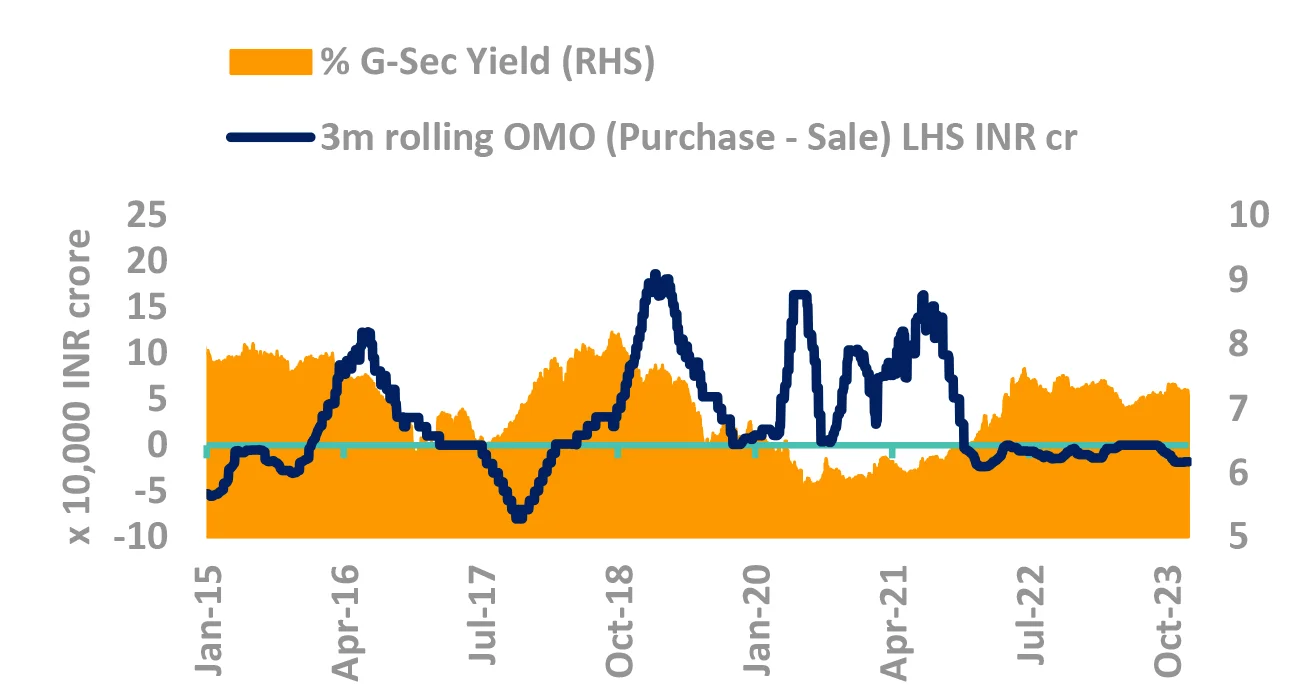

Banks will continue to buy.

-

Yields usually track RBI OMO purchases

- Yields have strong correlation with RBI OMO

- Demand/Supply mismatch is filled in by RBI

-

RBI softened its liquidity management stance. However,

- Liquidity will remain tight till Dec mid

- Yet, by Jan, liquidity will be in surplus as Govt will have less need to keep cash post maturities

Takeaway:

Banks’ demand for SLR investments to continue

Source – Bloomberg, DBIE, Internal OMO – Open Market Operations, SLR – Statutory Liquidity Ratio; G-Sec – Government Securities; RBI: Reserve Bank of India; SCB: Scheduled Commercial Bank; CIC: Currency in Circulation

How much is the excess supply

Takeaway:

Estimated excess supply of ₹ 0.68 tn is not very significant. Banks may sustain a higher SLR ratio (we have taken 29.5%)

Source – Internal, CGA G-Sec: Government Securities; OMO: Open Market Operation; RBI: Reserve Bank of India; FPI: Foreign Portfolio Investment; NPS: National Pension System; MF: Mutual Fund; SDL: State Development Loans; SLR: Statutory Liquidity Ratio; PF: Provident Fund; EPFO: Employees’ Provident Fund Organisation; NSSF: National Small Savings Fund

Indian yields tracking Global yields

Except for two instances

RBI’s stance on liquidity change led to correlation again

Indian yields – Dancing to the tune of US Yields

-

FOMC rate at 5.50% - more hikes unlikely

- Fed Fund projected rates indicate sooner rate cuts

- Data has continued to soften

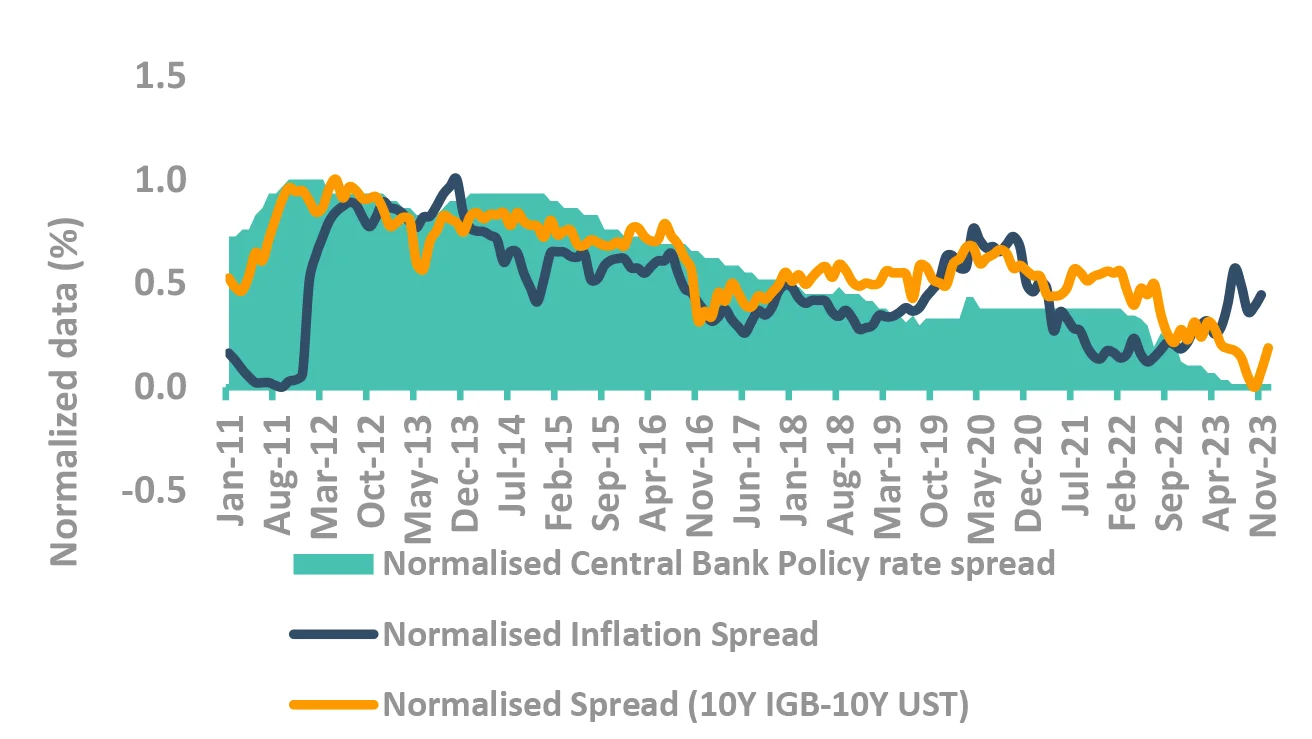

Are spreads of US Treasury and Indian Govt. Bonds low?

- Yields spread mimics inflation and policy rate spread.

- ✓ Currently divergence with inflation spread.

- ✓ US CPI is falling so correction may come from fall in US yields rather than rise in India yields.

- Yields spread mimics inflation and policy rate spread.

Takeaway:

With domestic data being stable, India yields incrementally tracking US yields

Source – Bloomberg, Internal Fed: Federal Reserve; CPI: Consumer Price Inflation; RBI: Reserve Bank of India; IGB: India Government Bond; FOMC: Federal Open Market Committee; UST: US Treasury

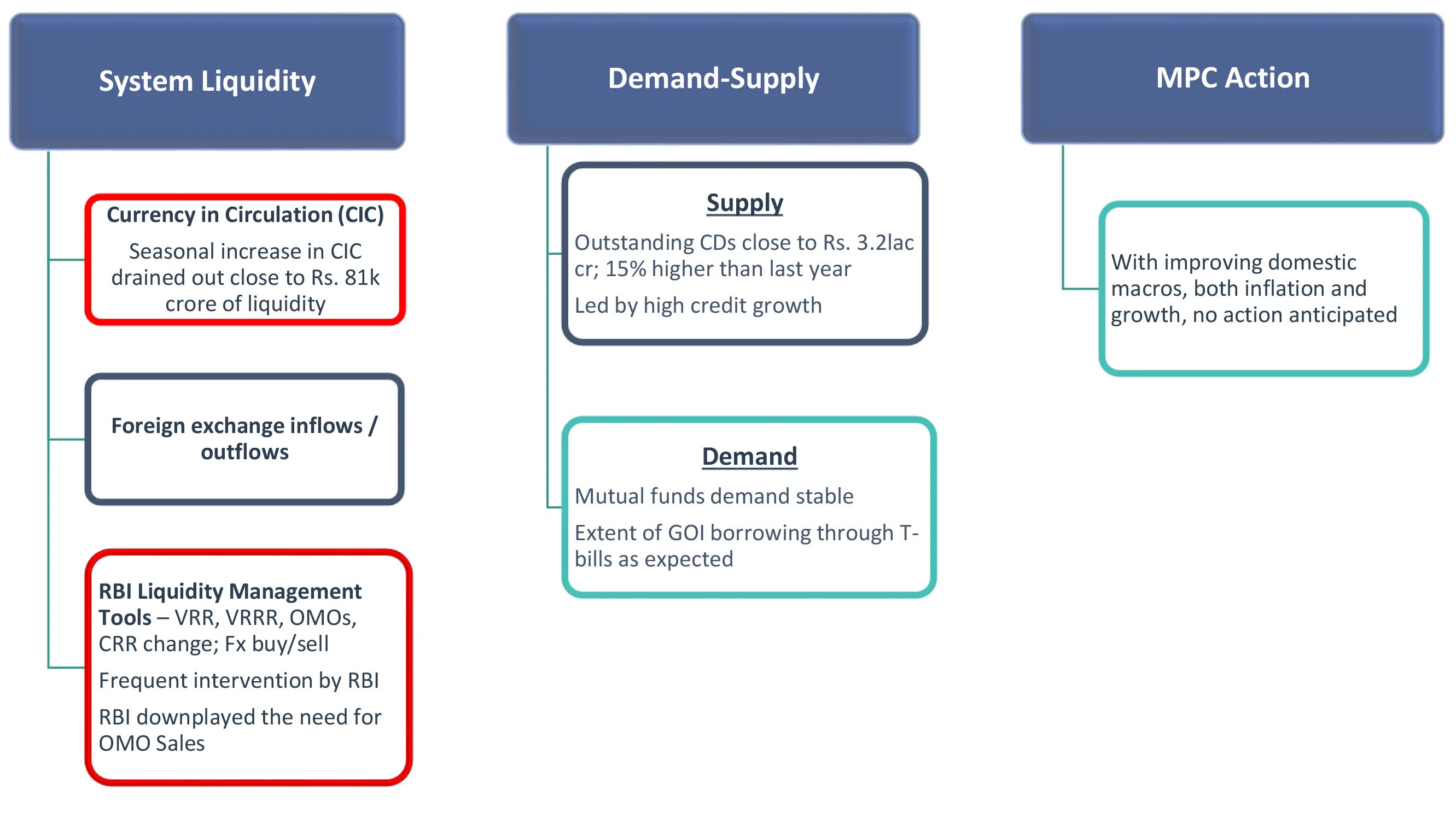

Money Market Assessment Framework

Takeaway:

With surplus durable liquidity, stable domestic macros and well-matched demand-supply dynamics expect money market rates to remain range bound. We will remain long in our funds to gain accrual at existing spreads.

CIC: Currency in Circulation; CD: Certificate of Deposits; OMO: Open Market Operations; VRR: Variable Rate Repo; VRRR: Variable Rate Reverse Repo; RBI: Reserve Bank of India: GOI: Govt of India

Liquidity to have opposite drivers: Festive season and G-sec redemption

Takeaway:

Banking liquidity expected to remain tight fuelled despite G-sec redemption

Source – Bloomberg, RBI, *Internal Estimates G-Sec – Government Securities; CIC: Currency in Circulation

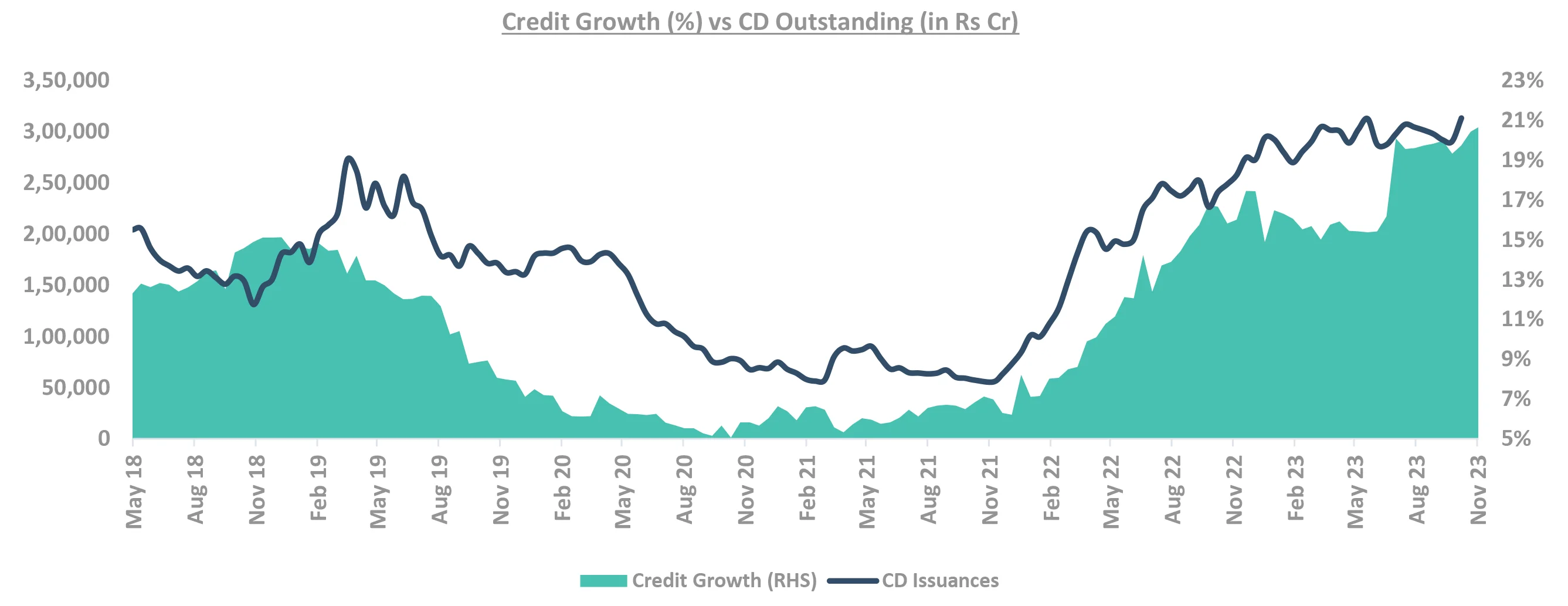

Well matched demand supply has money market rates range bound so far

-

High credit growth has contributed to increase in Certificate of Deposits issuances over the last year

-

Nearly ₹ 3.2tn CDs are outstanding; up 15% YoY. 1-year CD rates have moved up to ~7.85% – 7.90%

Quarter-end redemptions will likely put pressure on money market rate, though RBI’s VRR auction will provide some respite

Takeaway:

With supply expected to be at current levels, demand from mutual fund participants to be the key determinant of money market yields

CD: Certificate of Deposits

With money market rates anchored, play for accrual

Takeaway:

Our current strategy is to gain accrual at elevated levels as we expect money market rates to remain range bound

*Internal Estimates CD: Certificate of Deposits

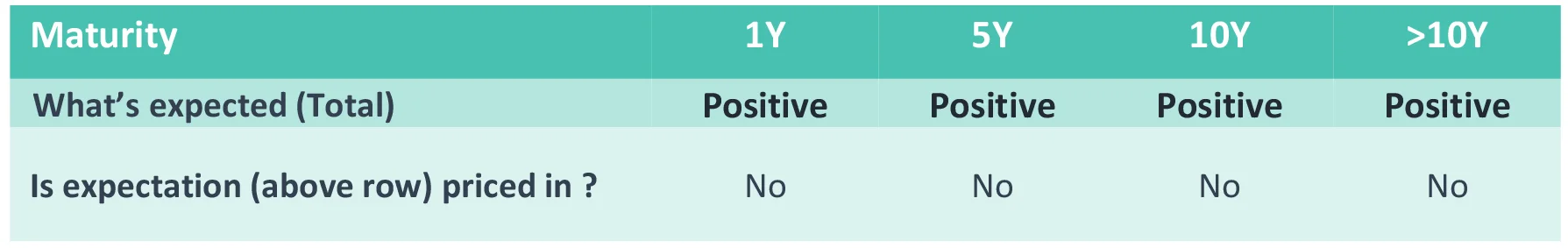

DSP FI Framework checklist

DSP Duration decision:

The chart shows how much expected yield fall/rise is already

priced in the current curve.

Large gap between the current yield and forward yield shows

that yield change is priced in – and thus yield change will not

give capital gain/loss.

Similarly small gap means that the market is not pricing change

in yields.

We have discussed duration and yield movement.

How do we choose corporates and credit?

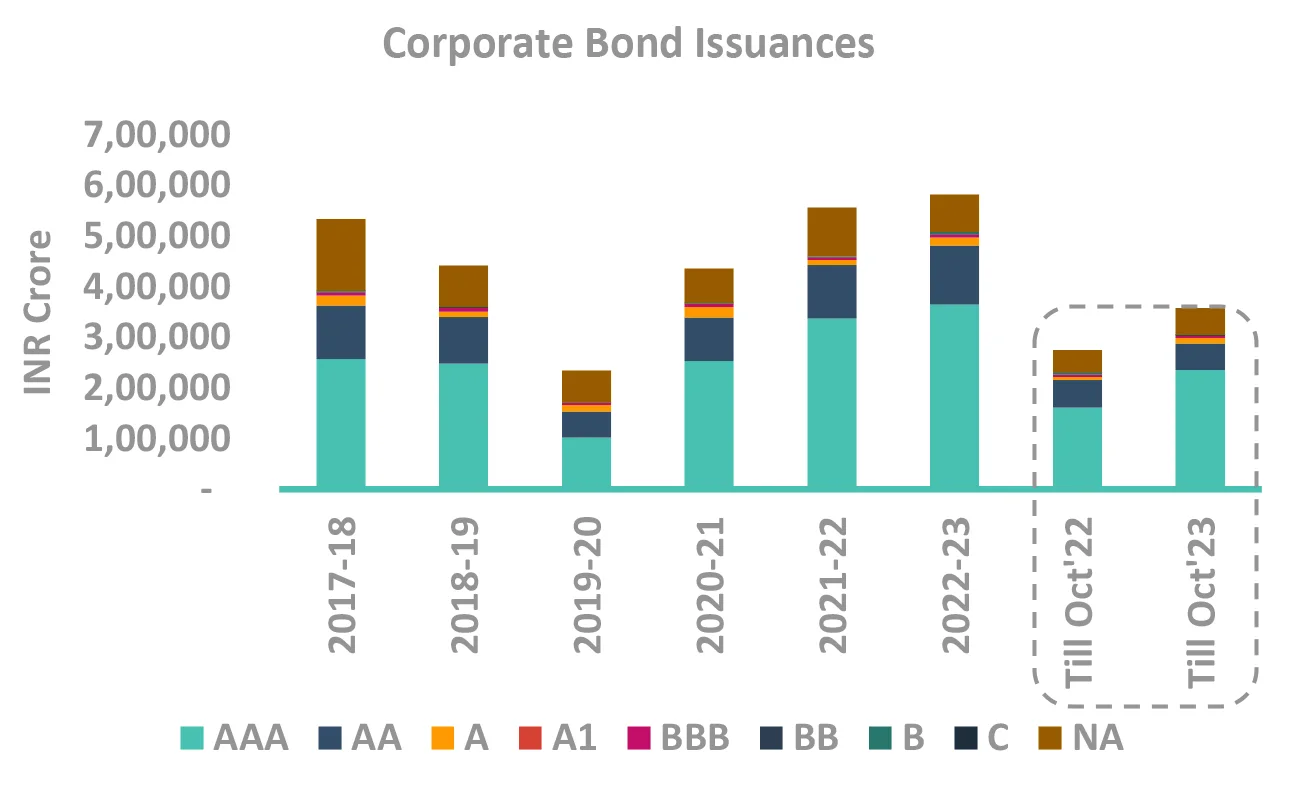

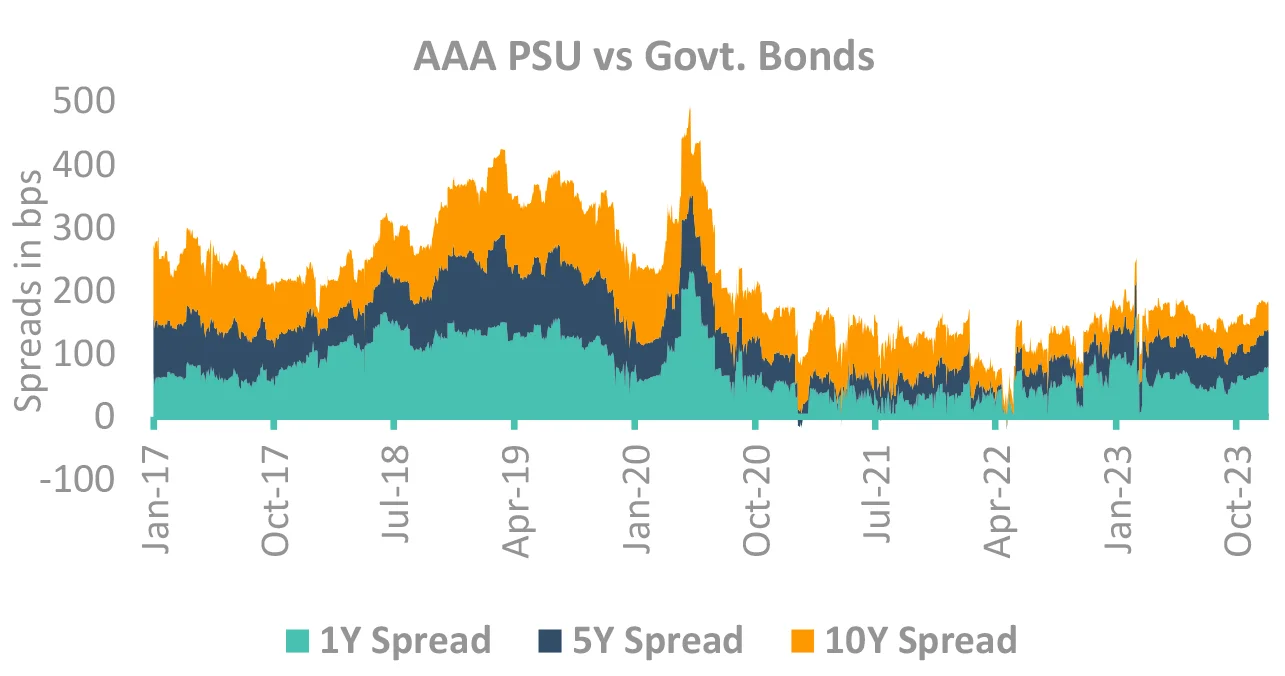

DSP Asset Allocation: Corporate bonds spreads wide

-

Supply has remained manageable so far

- 7mFY24 issuance at ~1.3x of 7mFY23 led by AAA segment

- Supply in Nov at ~88k crores

- ✓ Led by banks (expected to continue in Dec as well)

- ✓ 20k crores issuance by a large pvt. sector corporate

-

New NBFC regulations to lead to more issuances

- NBFC to shift part borrowing to bonds form bank loans

- To result in further rise in NBFC spreads

- ✓ Depending upon liquidity and supply

Takeaway:

Corporate bond spreads near their long term average, spread curve flat.

Source – Bloomberg, CCIL, Internal PSU: Public Sector Undertaking, NBFC: Non-Bank Financial Companies

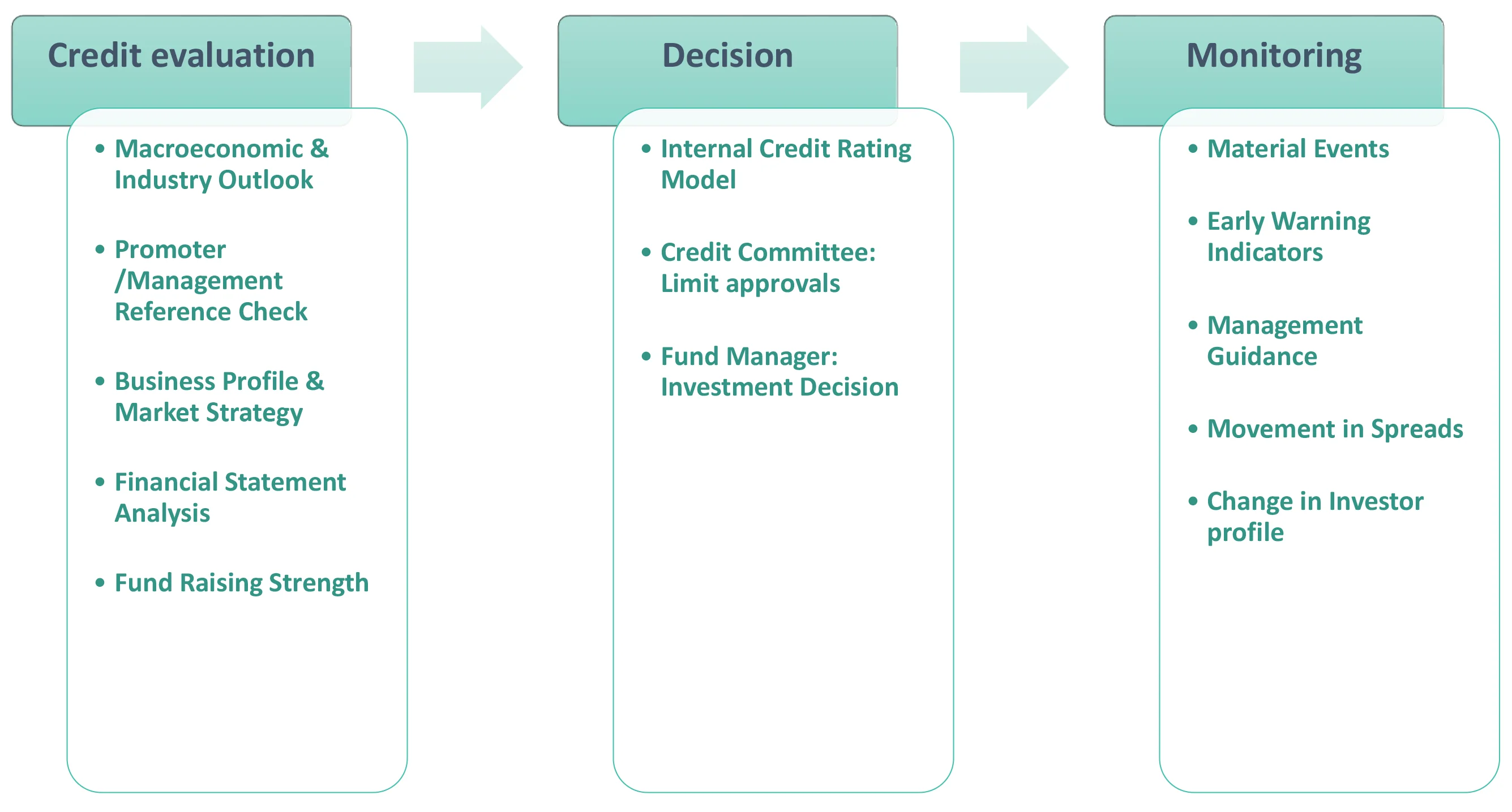

DSP Credit Investment Process – Focus on Governance

DSP Credit view on sectors

Done with our market view framework?

Now

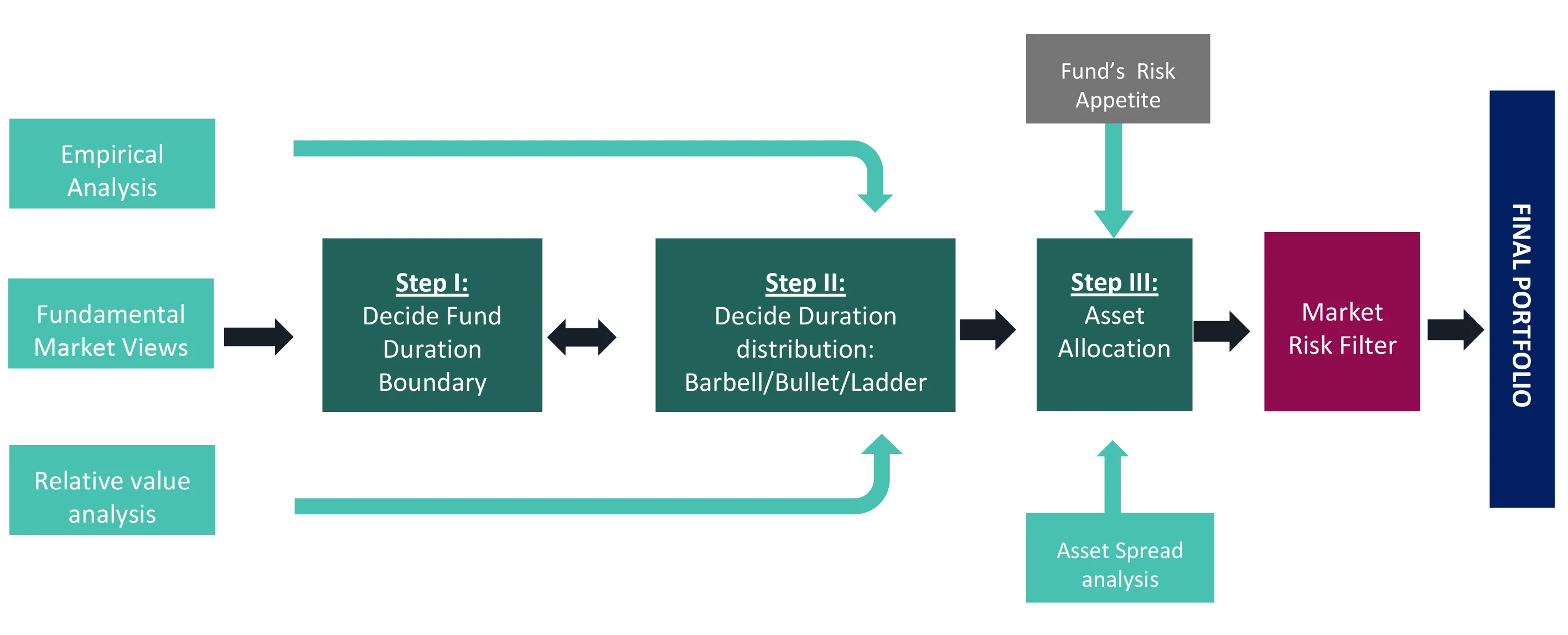

Our Portfolio creation framework

DSP Portfolio Creation: Multi-step process

DSP Fixed Income Funds follow a defined methodology for fund portfolio construction

- We apply market risk filter which can help the Fund Managers not to take extreme risks. Thus, Value at Risk is limited by ensuring the positions are balanced.

Investment approach / framework/ strategy mentioned herein is currently followed & same may change in future depending on market conditions & other factors.

Key Risks associated with investing in Fixed Income Schemes

Interest Rate Risk - When interest rates rise, bond prices fall, meaning the bonds you hold lose value. Interest rate movements are the major cause of price volatility in bond markets.

Credit risk - If you invest in corporate bonds, you take on credit risk in addition to interest rate risk. Credit risk is the possibility that an issuer could default on its debt obligation. If this happens, the investor may not receive the full value of their principal investment.

Market Liquidity risk - - Liquidity risk is the chance that an investor might want to sell a fixed income asset, but they’re unable to find a buyer.

Re-investment Risk - If the bonds are callable, the bond issuer reserves the right to “call” the bond before maturity and pay off the debt. That can lead to reinvestment risk especially in a falling interest rate scenario.

Rating Migration Risk - - If the credit rating agencies lower their ratings on a bond, the price of those bonds will fall.

Other Risks

Risk associated with

- floating rate securities

- derivatives

- transaction in units through stock exchange Mechanism

- investments in Securitized Assets

- Overseas Investments

- Real Estate Investment Trust (REIT) and Infrastructure Investment Trust (InvIT)

- investments in repo of corporate debt securities

- Imperfect Hedging using Interest Rate Futures

- investments in Perpetual Debt Instrument (PDI)

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.