Summary

When hype fades, fundamentals start whispering. This blog explores why Indian IT once the market’s favourite, fell out of fashion, what the numbers really say, and why silence in this sector could signal opportunity. If you’ve written off IT as yesterday’s story, this piece will make you rethink where the next steady compounding might come from.

Few sectors fall from grace as quietly as Indian IT. Two years ago, it was everywhere, in portfolios, headlines, and quarterly calls. Today, it’s missing from most conversations.

While defence, manufacturing, and PSU stocks now dominate attention, the one sector that built India’s corporate backbone trades in silence.

The same firms that powered digital transformation through the pandemic are now treated like relics of a different market cycle.

This silence, though, is not without meaning. It often precedes change.

The Current Landscape

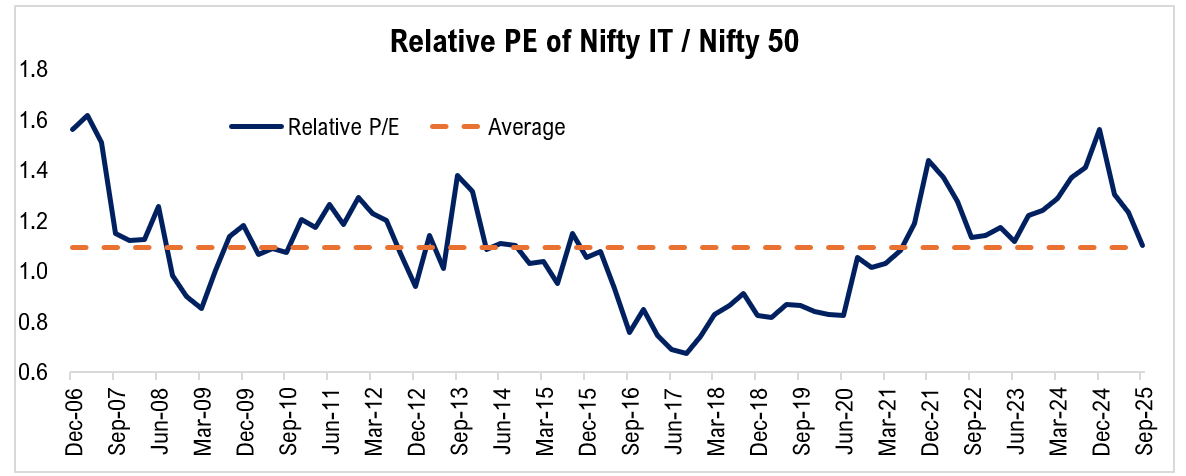

Valuations today appear reasonable as compared to broader markets. Earnings growth has remained steady across most companies yet share prices have not reflected that. This has created a valuation gap that could narrow if sentiment improves.

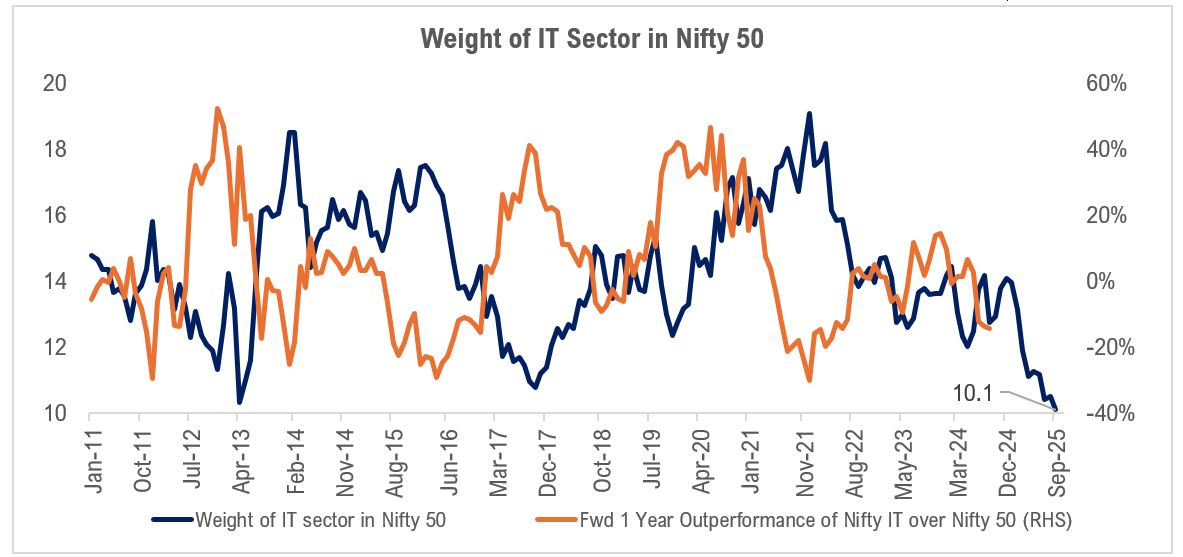

Source: NSE, DSP. Data as of Sep 2025.

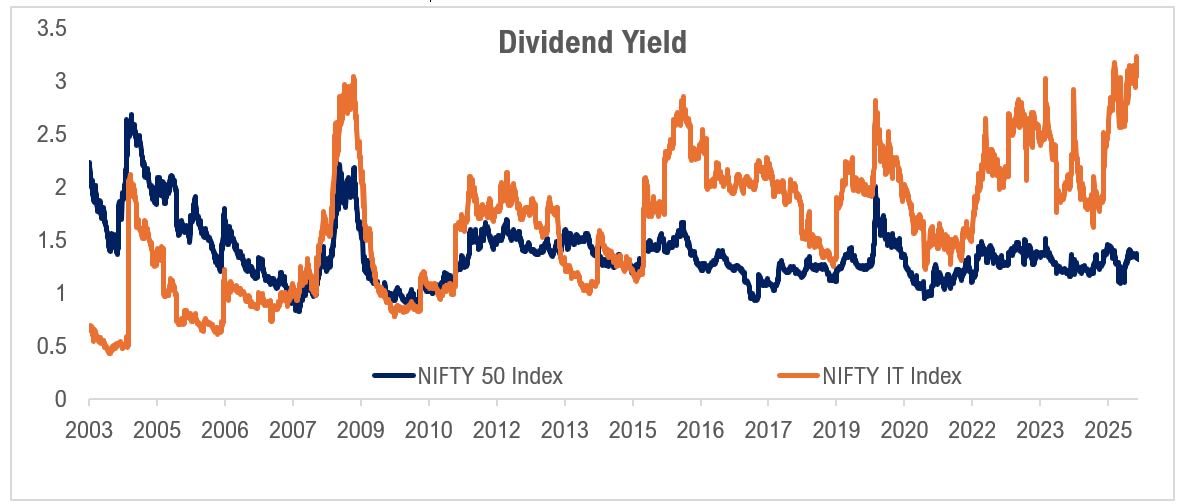

The sector’s dividend yield, at around 3.2 percent, offers some downside protection. Balance sheets remain strong, with high cash levels and minimal debt. These characteristics provide stability in uncertain markets.

Source: NSE, DSP. Data as of Sep 2025.

Reasons Behind the Underperformance

The sector’s recent underperformance is largely explained by a confluence of cyclical and structural factors:

-

Post-Covid Demand Normalisation

The surge in digital projects during 2020–21 was temporary. As global offices reopened, spending on transformation slowed, returning growth to mid-single digits. -

Margin Compression

Operating margins fell from roughly 20% to around 15%. Rising employee costs and limited pricing power meant higher expenses could not be fully passed on to clients. -

Client Consolidation

Large clients in banking, financial services, and retail reduced the number of vendors they worked with. This consolidation led to lower order volumes and tougher competition for renewals. -

Cost Inflation

Higher wages, travel expenses, and attrition-related costs added pressure. The sector’s earlier cost advantage narrowed, especially in offshore delivery. -

Shift in Investor Focus

Market attention moved toward AI, manufacturing, and PSU themes. Indian IT lost visibility in both domestic and global portfolios as capital flowed to higher-growth stories. -

Valuation Correction

At its 2022 peak, the Nifty IT index traded at about 38× forward earnings. Slower growth brought that multiple closer to 21× in April 2023 triggering a broad de-rating even though earnings held steady.

The Global Perspective

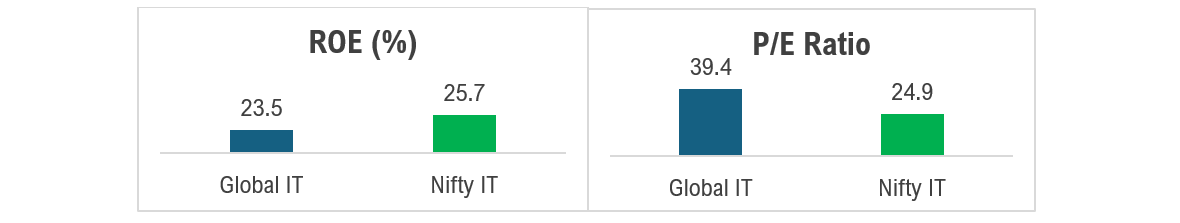

Globally, technology still commands premium valuations. Yet Indian IT firms deliver similar or better return on equity than peers, while trading at lower valuations.

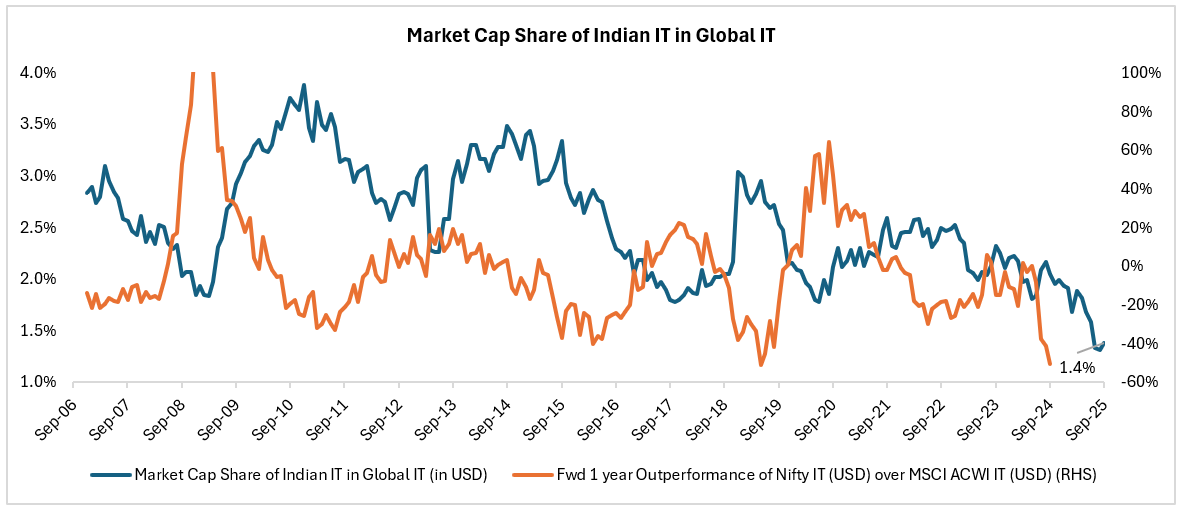

Despite strong profitability and discipline in capital allocation, the sector’s weight in global indices has fallen to multi-year lows This under-representation rarely lasts. Periods of neglect have often preceded phases of relative outperformance.

The gap between perception and performance is clear fundamentals remain intact, but prices reflect fatigue, not failure.

Source: NSE, DSP. Data as of Sep 2025.

Beyond market weights, fundamentals tell an interesting story. Indian IT companies continue to deliver stronger returns on equity than global peers, while trading at lower valuations.

This contrast shows the gap between perception and performance. Indian IT remains efficient and profitable but is priced as if its best years are behind it. That disconnect often forms the base for future value creation.

Looking Ahead

IT’s share in the Nifty 50 has dropped to about 10 percent, its lowest ever. Historically, such underweight phases have marked turning points as positioning and sentiment rebalance.

-

Relative opportunity: Indian IT may not be an absolute deep-value play, but it looks attractive versus the broader market. Earnings stability and lower valuations leave room for gradual re-rating.

-

Potential for re-rating: Fundamentals remain intact, and most firms continue to generate strong free cash flow. Any improvement in discretionary spending could lift valuations.

-

Dividend cushion: At roughly 3.2 percent, the Nifty IT Index offers one of the highest yields among major sectors. In volatile conditions, that payout gives investors practical comfort.

The Broader View

Markets tend to overreact in both directions. The same optimism that pushed IT stocks to record highs in 2024 has now turned into fatigue. Neither extreme defines their true value.

The long-term fundamentals of cost efficiency, recurring revenue, and client stickiness remain.

Indian IT may not lead the next rally, but it continues to offer consistent earnings and strong governance. For investors seeking diversification within equities, the sector remains a credible option.

Periods of neglect often reset the starting point for future gains. Indian IT today reflects that pattern. The excitement is elsewhere, but the foundations are visible.

Sometimes, opportunity does not arrive with noise. It waits in silence, for patience to notice it.

Author,

Parth Shah

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment