Summary

REITs promise real estate stability, steady income, and diversification. But the data tells a very different story. What if the “real asset” you trust behaves almost exactly like equities when you need protection the most? This blog uncovers the uncomfortable truth behind REITs.

When people hear the word real estate, they imagine stability. Something solid. Something that doesn’t swing wildly like the stock market.

REITs (Real Estate Investment Trusts) borrow that aura. They own and operate real estate; office parks, malls, warehouses, apartments, even data centers. They collect rent, pay out most of their earnings as dividends, and promise something every investor craves: steady income, inflation protection, and diversification.

But here’s the big question we rarely ask:

Do REITs really behave differently from stocks, or are they just stocks wearing a “real estate” costume?

Let’s find out.

What Exactly Are REITs?

REITs pool money from investors → buy and manage income-generating properties → distribute at least 90% of taxable income back to investors.

They are known for:

- High dividends

- Real-asset backing

- Supposed inflation protection

- Perceived diversification from equity markets

So the story sounds perfect.

But when you look at the data, the story changes.

Are REITs Really an Inflation Hedge?

Yes… but only sometimes.

Real estate values and rents often rise with inflation, so REITs usually benefit.

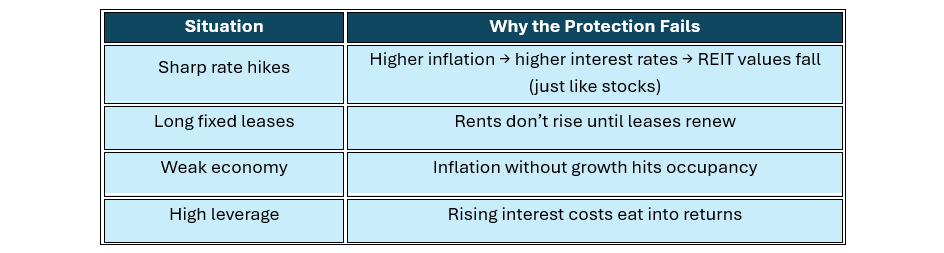

But the hedge breaks down in 4 scenarios:

So yes, REITs help, but only in a normal inflation cycle.

In stressful cycles, they behave just like equities.

The Most Important Question:

Do REITs Diversify a Portfolio?

Globally? No.

And this is where things get interesting.

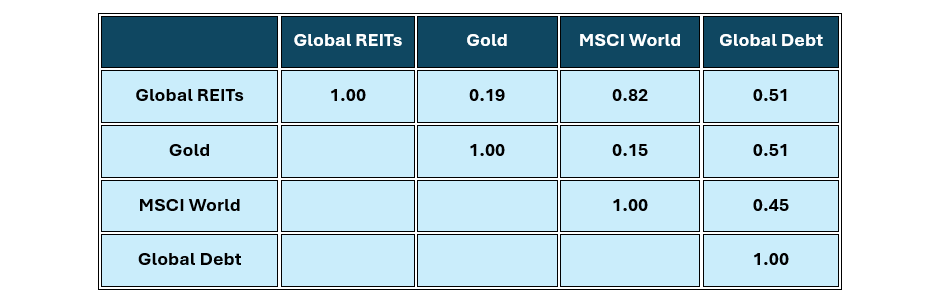

Correlation With Equities (Since 2005)

Data as of Oct 2025.

Gold diversifies.

Bonds diversify.

When REITs market gets evolved, the correlation of REITs vs the Equities rises leading them to move in line with the equity markets and taking away the diversification benefit which investors expect.

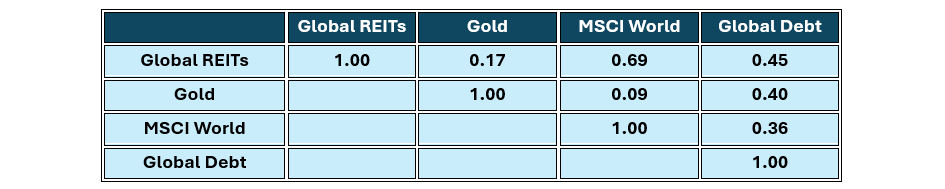

Long-Term View (Since 1989)

Takeaway:

The belief that “real estate = diversification” does not hold when that real estate is packaged into a tradable market instrument.

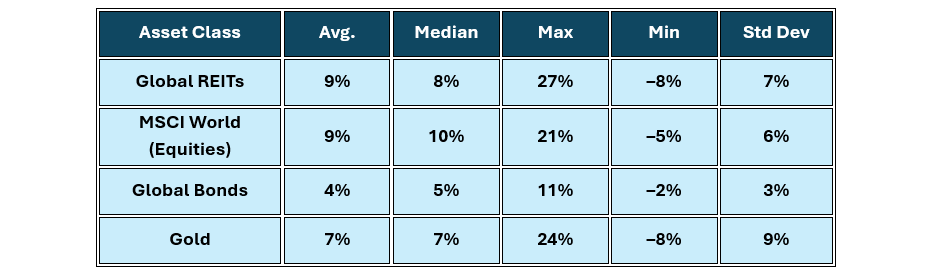

REITs Look Like Stocks Even in Returns & Volatility

5-Year Rolling Returns (1989–2025)

REITs are equity cousins, not bond cousins.

Why Do REITs Behave Like Equities?

4 Simple Reasons

- Discount Rate Effect – Higher bond yields reduce present value of REIT cash flows, just like stocks.

- Investor Base – REITs are traded on stock exchanges → influenced by equity sentiment.

- Leverage – Borrowing makes them sensitive to interest-rate cycles and credit markets.

- Passive Flows – Being part of equity indices pushes REITs to move with equity flows.

Result?

In volatile or flat equity markets, REITs don't give the protection investors expect.

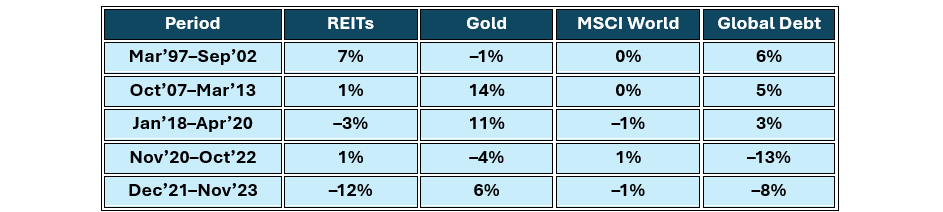

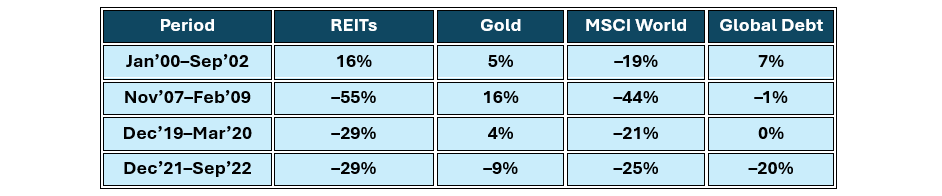

When Markets Go Flat: Do REITs Offset Anything?

Gold shines. Bonds steady.

REITs… move with equities.

Data as of Oct 2025. For less than 1 year period Absolute returns are calculated. All returns are in USD. Indices

used are: for World REITs – S&P Global REITs USD TRI, MSCI World: MSCI World Gross Total Return Index, Global

Debt - Bloomberg Global Aggregate Bond Index TR (USD)

Sometimes resilient, sometimes deeply negative.

REITs do not reliably cushion falls.

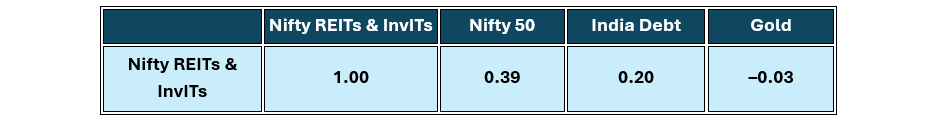

What About Indian REITs?

A Young Market With Different Behaviour

India’s first REIT listed in 2019, so the market is still developing.

Here’s what the data shows so far:

Correlation in India (Since 2019)

This is much lower than global levels.

But globally, low correlations in early years rise later.

So India’s current low correlation may not last.

Returns Since Inception (Jul 2019)

Indian REITs = lower volatility + equity-like behavior (so far).

So What’s the Final Verdict?

Key Takeaways

- REITs are real assets, but market behaviour = equities

- Global evidence shows high correlation between REITs and stocks

- Gold remains the most reliable diversification and inflation hedge

- Indian REITs are currently less correlated to equities, but this may change

- REITs provide income and partial inflation protection, not true diversification

In Simple Words

REITs maybe are great for income.

Good for partial inflation protection.

But not reliable as crash protection or a diversification shield.

If an investor wants:

- Stability → Bonds

- Hedge → Gold

- Income + mild volatility → REITs

REITs are a useful ingredient in a portfolio, but not the hero the brochures promise.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly

available, including information developed in-house. Information gathered and used in this material

is believed to be from reliable sources. The AMC however does not warrant the accuracy,

reasonableness and / or completeness of any information. The above data/ statistics are given

only for illustration purpose. The recipient(s) before acting on any information herein should make

his/ their own investigation and seek appropriate professional advice. This is a generic update; it

shall not constitute any offer to sell or solicitation of an offer to buy units of any of the Schemes

of the DSP Mutual Fund. The data/ statistics are given to explain general market trends in the

securities market and should not be construed as any research report/ recommendation. We have

included statements/ opinions/ recommendations in this document which contain words or

phrases such as “will”, “expect”, “should”, “believe” and similar expressions or variations of such

expressions that are “forward looking statements”. Actual results may differ materially from those

suggested by the forward looking statements due to risks or uncertainties associated with our

expectations with respect to, but not limited to, exposure to market risks, general economic and

political conditions in India and other countries globally, which have an impact on our services

and/ or investments, the monetary and interest policies of India, inflation, deflation, unanticipated

turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Other Blogs

Sort by

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment