Summary

A chameleon survives by adapting. Shouldn’t your investment strategy do the same? Rigid models often fail when markets shift. Enter India’s first Flexicap Index, designed to sense changing market moods, capture SMID upcycles, cushion downturns, and move tax-free across caps. One smart, adaptive strategy you can invest in forever.

What if I told you that some of the smartest investment algorithms backed by decades of data, advanced statistics, and AI-powered models still fail miserably in the real world?

Now imagine this: If you have over three decades of data and a stock market that has delivered 13% annualized returns over the past 25 years. Surely, with all this information, building a winning algorithm should be easy, right At first glance, it seems simple: study the past, build a formula that selects the best-performing companies, and construct a portfolio around them.

Today, with AI and machine learning, even a novice can design a strategy that appears to beat the market. But markets, like nature, are never static. They shift constantly, and rigid models that predict instead of adapting often fail, like a creature unable to blend into its surroundings.

This is why numbers-driven, rule-based strategies often showcase stunning backtest results. Investors drool over charts showing double or triple the returns of fixed deposits, often claiming to beat benchmarks like the Nifty 50 on paper.

Most models fail in real markets

The real world is however different. Many of these strategies stumble once deployed. The rules or quantitative models that worked in the past often stop working or underperform for long stretches. This frustrates investors and erodes confidence quickly.

The biggest culprit? Survivorship bias i.e., basing strategies only on past winners. Many backtests “look good” simply because they ignore the losers that didn’t survive.

We need to understand that markets aren’t predictable straight lines; they’re shifting ecosystems. Like a chameleon that constantly adjusts to light and temperature changes, a strategy must adapt to survive and thrive.

Can We Build an Adaptive Strategy?

Rather than focusing exclusively on survivors and historical data, what if we ground our strategy in first principles?

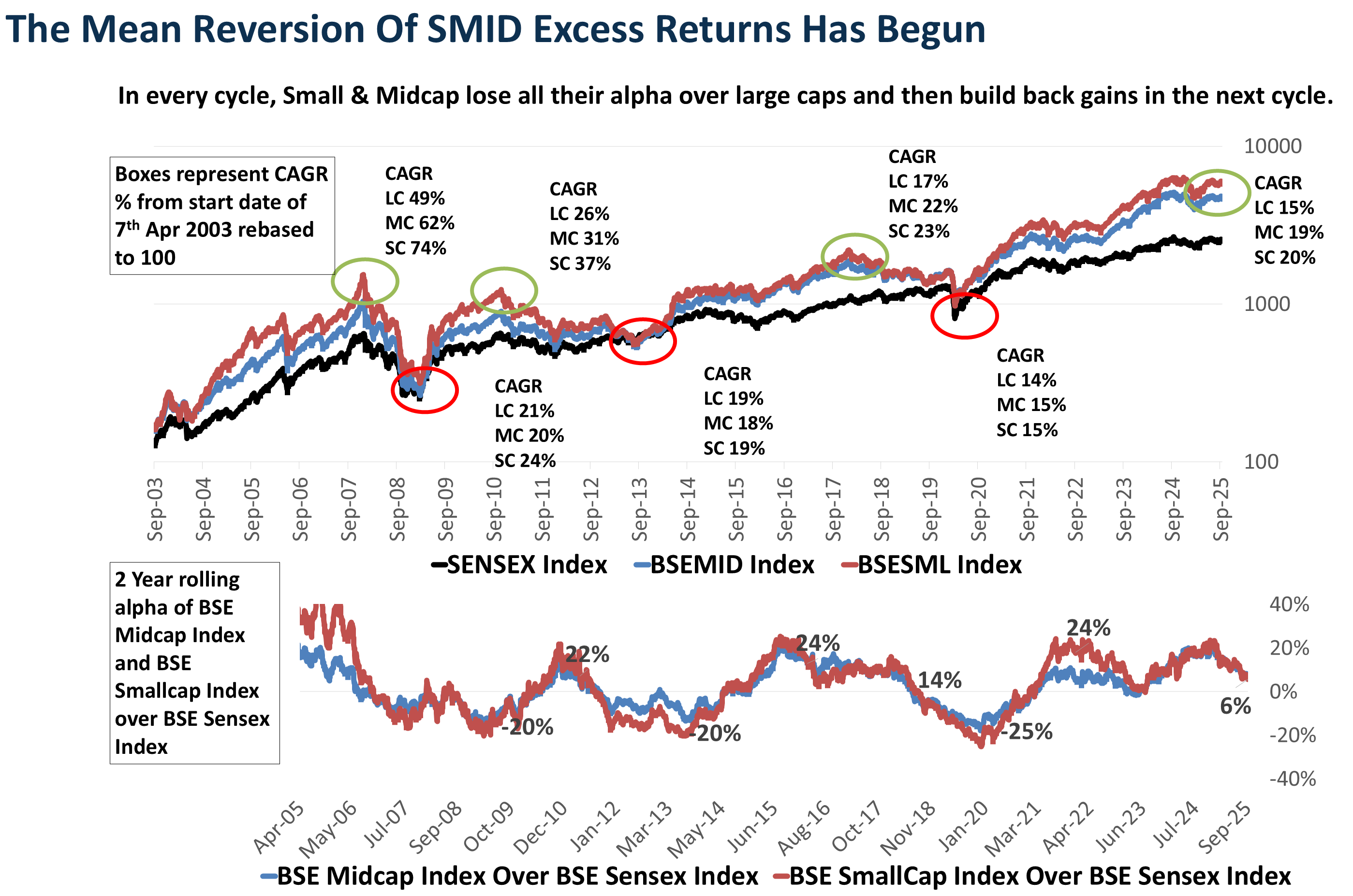

Take Small & Midcap (SMID) stocks for example. Historically, SMIDs have outperformed large-cap stocks during bull markets. But they’ve also been the hardest hit during crises. At DSP, we highlighted this dynamic visually in DSP Netra, showing how SMID cycles play out over decades.

Source: Bloomberg, BSE, DSP Data as of Sep 2025.

This raises key questions:

- Can we capture SMID outperformance while avoiding their deep drawdowns?

- Why do these phases keep repeating?

- What if they don’t?

- And most importantly, can this be done in a low-cost, tax-efficient way?

The Power of SMID Re-Rating Cycles

More than two-thirds of all alpha in the Indian market can be explained by capturing SMID re-rating cycles.

- In crises (2008 GFC, 2013 twin balance sheet problem, IL&FS crisis, COVID-19 crash), SMIDs often trade at huge discounts as survival fears dominate.

- In euphoric times, they often trade at premiums to large caps.

This deep-discount-to-premium cycle is a powerful source of returns. But capturing it is extremely hard.

At the lows, fear keeps investors away. At the highs, seductive “golden future” narratives keep them invested far too long. A strategy that rigidly sticks to past rules will often get it wrong, while an adaptive one like a chameleon can sense when the environment is turning and adjust accordingly.

The Birth of India’s First Flexicap Index Strategy

In 2024, we began building a strategy with NSE to address this. We evaluated various iterations combining relative momentum, quality, and concentration in a single, elegant framework. After 6 months of deliberation & rigorous review, Nifty 500 Flexicap Quality 30 Index was born which was designed to dynamically allocates across large, mid, and small caps.

The The strategy works in following ways:

- At any time, 66.66% of the portfolio tilts toward the segment (SMIDs or large caps) most likely to outperform.

- A strict Quality filter ensures we only pick companies with low debt, stable earnings, and strong shareholder returns.

- Only the top 10 high-quality companies from each market-cap segment are selected.

A Truly Forever Strategy

This index is a one-of-a-kind solution for investors who want to “set and forget”. Implemented via a long-term Systematic Investment Plan (SIP), it allows you to invest in a single index or ETF and stay invested forever.

We even delayed the launch by nearly a year to ensure we introduced it during a phase of underperformance. Why? Because most rule-based strategies will eventually go through lean periods. Launching during a soft patch increases the probability of strong post-launch returns.

The Hidden Tax Efficiency

Imagine starting a ₹1 lakh SIP today. Traditionally, you’d split it across Large Cap, Mid Cap, Small Cap, or Flexicap funds. Over 10 years, if your portfolio grows multifold, rebalancing between caps can trigger significant taxes.

But with an index fund tracking the Nifty 500 Flexicap Quality 30 ETF, 66.66% of the portfolio can shift dynamically without any tax incidence during rebalancing. You don’t need to make hard calls about when or how much to shift.

Adapt Like a Chameleon, Invest Like a Pro

This isn’t just another index. It’s India’s first Flexicap ETF strategy, designed to adapt to market cycles like a chameleon, instead of rigidly sticking to predictions.

Just as the chameleon senses its surroundings and blends in seamlessly, this strategy adapts to market realities capturing SMID upcycles, cushioning large-cap phases, and maintaining quality at its core.

It’s built for permanence, not trend-chasing. A strategy you can truly invest in forever.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

This blog for information purposes only. It should not be construed as investment advice to any party. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Large caps are defined as top 100 stocks on market capitalization, mid caps as 101-250 small caps as 251 and above. Data provided is as on 30th July 2025 (unless otherwise specified). The figures pertain to performance of the index and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index. All opinions, figures, charts/graphs and data included in this blog are as on date and are subject to change without notice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Other Blogs

Sort by

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Comments

Total 3

Hanif

31-07-2025

Wonderful read it's a brilliant write up by Sahil as usual

Ravish

31-07-2025

This is a brilliant read. Does does DSP have a fund for this?

Sanju

01-08-2025

Very well written and presented...

Write a comment