Summary

Cricket fans obsess over toss results, pitch reports, and player form. But when it comes to investing, most go in blind. Strange how the stakes are higher, but the thinking is lazier. In this blog we expose the paradox and make you rethink your real strategy.

This IPL season, you couldn’t miss the flood of fantasy league ads. Cricket fans from every corner of India were shown winning crores just by using their cricket knowledge and a small investment.

As a cricket fan, the idea of monetizing your knowledge felt exciting. But as someone in finance, I couldn’t help but think: What’s the math behind these jackpots?

Turns out, it’s a lot like investing except most people apply more rigor to fantasy cricket than to their portfolios.

The Fantasy League Phenomenon

Fantasy leagues have exploded in India. Over 300 million people participate, more than 6x the number of mutual fund investors. You pick 11 players, balance batsmen and bowlers, select your captain and vice-captain, and pay a small entry fee. The best-performing teams win prizes.

Fans don’t take it lightly. They study player stats, pitch conditions, weather forecasts, even home vs away records. Some have become “experts” with large followings and paid advisory services.

But here’s the harsh truth: the odds of winning a jackpot are 0.0000013%. Even if you’re 100x better than the average player, your chances barely improve.

And yet, millions play. They love the thrill, the community, the hope of winning big.

Why Don’t Investors Play with the Same Rigor?

What struck me is this: fantasy players work harder on team selection than investors do with their money.

When it comes to equities or mutual funds, many investors still rely on tips from friends, TV, or social media. Few evaluate market conditions (Are large caps leading? Or small caps?), study company quality in terms of fundamentals, governance, or track records.

In fantasy cricket, you’d never pick a spinner on a flat track. But in investing, people routinely make “flat-track spinner” choices.

A Better Way: True-to-Label Index Investing

What if there was a way to bring that same condition-aware selection to your investments without spending hours researching?

That’s exactly how the Nifty500 Flexicap Quality 30 Index is built. It’s designed to dynamically shift between large, mid, and small caps based on market conditions. It only selects quality companies with strong financials, high corporate governance, robust returns matrix and allocates capital in a way that’s neither too concentrated nor too scattered.

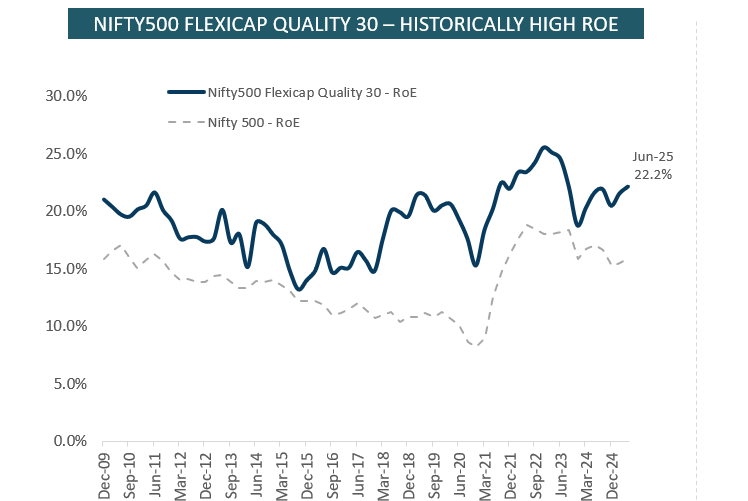

Source – NSE, Internal. Data as on 30 Jun 2025. RoE (Return on Equity) values are quarterly averages

And it does this without fund manager bias and at a low cost.

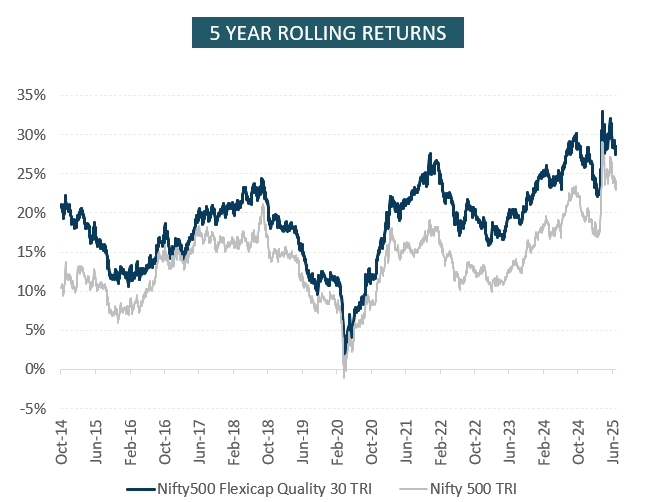

The results speak for themselves: over five-year rolling periods, this index has consistently outperformed the broader Nifty 500 by ~5% annually.

*Source – NSE, MFIE, Internal. Data for the period 01 Oct 2009 to 30 Jun 2025.

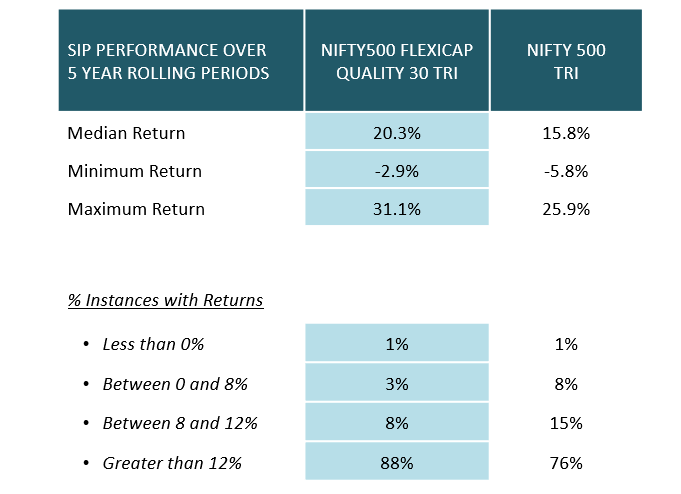

Further, with focus on high-quality stocks combining with dynamic allocation to SMIDs, makes it a compelling case for long term systematic investments via SIP.

Source – NSE, Internal. Data for the period 01 Oct 2009 to 30 Jun 2025. The above returns are in annualized terms.

This isn’t just about outperformance. It’s about a structure designed for staying power an index that’s built for you to last.

The Real Jackpot

In fantasy cricket, jackpots are a long shot.

But in investing, the odds can be in your favor. Systematically investing (via SIP) in an index like the Nifty500 Flexicap Quality 30 can help you steadily build wealth, without needing to predict every twist and turn of the market.

The secret to success in both fantasy and finance is the same:

- Strong selection

- Adapting to conditions

- Discipline

The difference? In investing, you don’t need to beat millions of competitors. You just need a solution designed to endure.

And that’s what the Nifty500 Flexicap Quality 30 Index is: a product engineered for the long game, built for you to last.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

This blog for information purposes only. It should not be construed as investment advice to any party. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this blog, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as on 30th July 2025 (unless otherwise specified). The figures pertain to performance of the index and do not in any manner indicate the returns/performance of the Scheme. It is not possible to invest directly in an index. All opinions, figures, charts/graphs and data included in this blog are as on date and are subject to change without notice. Past performance may or may not be sustained in future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. There is no assurance of any returns/capital protection/capital guarantee to the investors in this scheme of DSP Mutual Fund. The recipient(s) before acting on any information herein should make his/their own investigation and seek appropriate professional advice.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Other Blogs

Sort by

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment