Summary

You’ve built wealth. Now comes the real question, is it building the world you want to live in? To explore this idea, we’re launching a new series of thoughtfully curated articles designed exclusively for our most discerning readers. Crafted through in-depth conversations and meticulous research, this series reflects what truly matters to you, especially our High Net-Worth Individual (HNI) audience.

From wealth creation and preservation to fine art, luxury travel, and lifestyle choices that reflect

sophistication, our content will align with your evolving interests.

But this isn’t a one-way dialogue. We see this as a shared journey and welcome your voice. Share

your thoughts, suggest topics, or tell us what’s missing in today’s content landscape on

[email protected].

This is content with purpose, for readers who expect more.

Emotional roots, financial relevance

The timeless pull of real estate

For many Indian families, real estate has been a practical and trusted way to build and store wealth.

It is a physical asset something you can live in, rent out, or pass on to the next generation. This

familiarity, along with the potential for long-term value appreciation, has made it a popular choice

across income levels.

Among High Net-Worth Individuals (HNIs), real estate continues to be a common avenue for

deploying excess capital. While emotional factors do play a role, decisions today are also shaped by

factors such as potential rental income, long-term asset stability, and inflation protection.

Real estate stands out for its low correlation with listed markets and its ability to offer diversification

in a portfolio. It is less affected by daily market volatility and is often seen as a long-horizon, stable

asset. While its illiquidity can be a constraint, real estate continues to support long-term wealth

planning and preservation especially in the context of legacy planning and intergenerational

transfer of assets.

Real estate at its peak in India

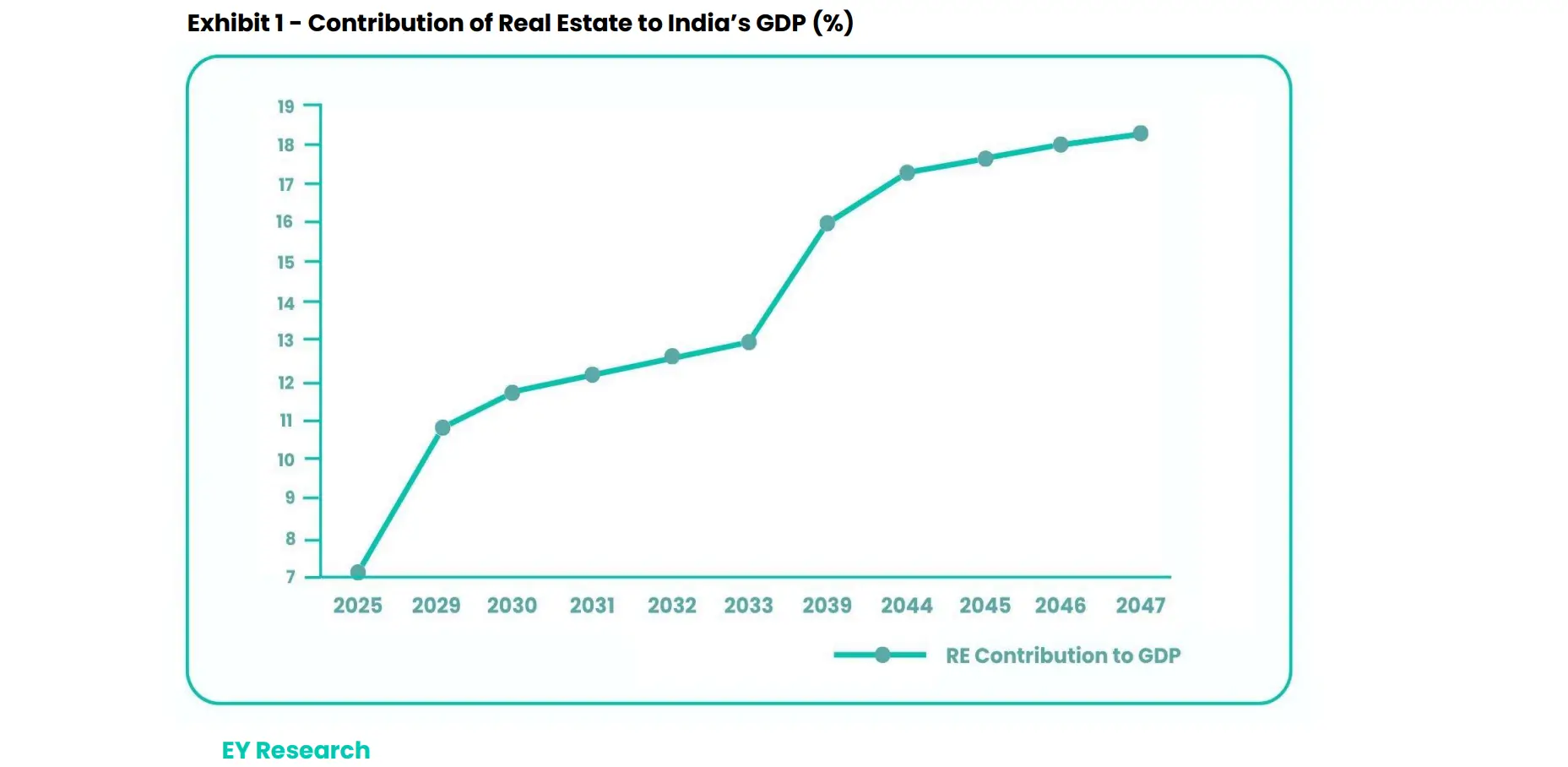

The domestic real estate sector is poised for exponential growth, projected to contribute 18% to the

GDP1 . At present, the sector accounts for 7% of the nation’s GDP.

Within this broader growth narrative, the luxury segment is emerging as a key pillar driven by rising

affluence, lifestyle upgrades, and a shift in buyer expectations post-pandemic. HNIs, in particular, are

reshaping the demand landscape for premium housing, with a growing preference for larger

layouts, integrated amenities, privacy, and long-term asset value.

Luxury housing, defined as homes priced above INR 4 crore (US$ 464,000) x2 now represents a

significant and growing share of both sales and new supply in India’s top urban markets.

Key trends shaping the luxury segment:

-

In Q1 2025, sales of luxury homes rose by 28% year-on-year, with 1,930 units sold across the top seven cities (vs. 1,510 units in Q1 2024).

-

Delhi-NCR led the segment with a 49% market share, followed by Mumbai at 23%.

-

Bengaluru saw the sharpest growth, with luxury sales rising from 20 to nearly 190 units over the year.

-

Luxury homes now account for 27% of total residential sales, while 30% of new launches are

positioned in the high-end category. -

Rental yields are up, driven by hybrid work models, migration, and demand for flexible,

high-end living spaces.

For HNIs, luxury real estate now offers not just a lifestyle upgrade but a tangible, long-horizon

investment..

However, there are hidden costs to going solo

On the surface, property ownership seems like the quintessential investment, tangible, familiar, and

often sentimental. But beneath the comfort of bricks and mortar lies a host of complexities that most

portfolios quietly absorb without ever truly pricing in.

For one, the capital outlay is significant. High-value real estate, especially in prime urban or

vacation markets, demands a substantial upfront investment often concentrated in a single asset.

Liquidity, or the lack of it, is the next hurdle. Unlike financial securities that can be rebalanced with a

few clicks, exiting a property takes time, negotiation, and often a compromise on price.

Then comes the ongoing drag: maintenance, regulatory compliance, tenant management, and the

inevitable surprises leaks, litigation, and local zoning shifts. Add to this the geographic concentration risk: even a trophy property in a marquee location is still subject to regional economic swings, political shifts, and currency exposure for international holdings.

In essence, direct real estate ownership may feel reassuring but it can anchor a portfolio with

hidden costs, operational burdens, and liquidity traps.

These concerns are assuaged to a great extent by investing in Real Estate as a financial asset.

REITs & AIFs - smarter, scalable access to real estate

Where emotion meets efficiency.

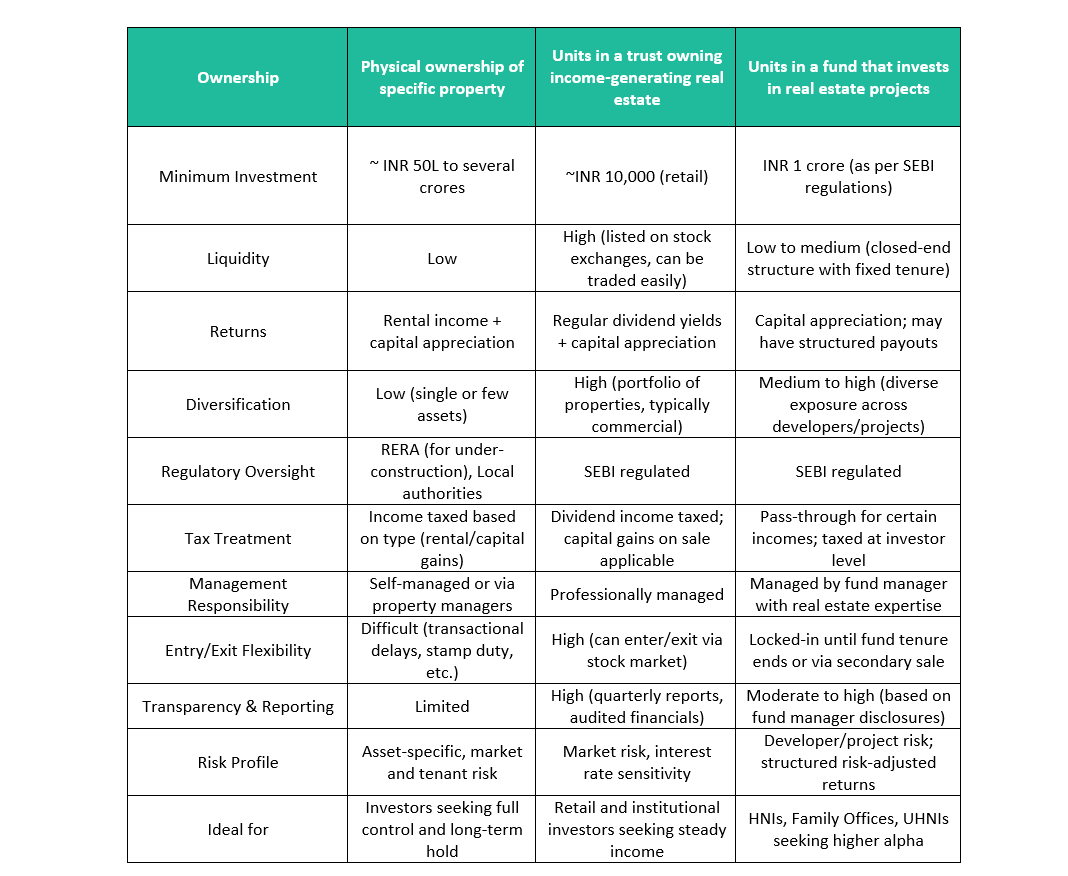

Real Estate Investment Trusts (REITs) are investment vehicles that allow individuals to invest in

large-scale, income-generating real estate without having to directly own or manage physical

property. Registered as trusts with SEBI, REITs typically own or finance commercial assets such as

office parks, malls, warehouses, or hotels. Investors can purchase units of REITs on stock exchanges,

much like buying shares of a company, and benefit from regular rental income and potential capital

appreciation.

In effect, REITs offer a structured way for private capital to participate in public infrastructure and

real estate development, while giving investors exposure to high-quality properties across sectors.

Although India’s REIT journey began only in 2019, it has picked up significant momentum. Today, four

publicly listed REITs operate in the country - Brookfield India Real Estate Trust, Embassy Office

Parks REIT, Mindspace Business Parks REIT, and Nexus Select Trust - covering primarily the office

and retail sectors. These include large commercial portfolios in cities such as Bengaluru, Mumbai,

Hyderabad, and Delhi-NCR.

Large headroom for growth

-

Only about 12% of eligible commercial real estate is currently structured under REITs, compared to around 60% in mature markets3.

-

Estimates suggest 400 million sq. ft. of office stock and 70 million sq. ft. of retail space remain outside the REIT framework4.

-

Cities like Mumbai, Delhi-NCR, Bengaluru, and Hyderabad account for nearly half of all small and medium REIT (SM REIT)-eligible assets among India’s top seven urban centres.

Amid sustained demand for premium assets, REITs are emerging as a compelling option for diversified, professionally managed real estate exposure.

In Q4 FY25, India’s four publicly listed REITs distributed over INR 1,553 crore (US$ 181.6 million) to more

than 2.64 lakh unitholders, representing a 13% year-on-year increase from INR 1,377 crore (US$ 161

million) distributed in Q4 FY245.

Separately, Alternative Investment Funds (AIFs), are now targeting premium real estate themes

such as fractional ownership, curated villa communities, co-living spaces, managed leasing

portfolios, warehousing, and even data centers. These aren’t merely “second homes” they are

first-rate, institutional-grade vehicles offering yield generation, capital appreciation, and lower

operational hassles.

As a result, they transform a brick-and-mortar asset into a dynamic, diversified portfolio play.

SEBI-regulated Category II AIFs, in particular, address structural inefficiencies in direct ownership.

Investors gain access to portfolios spread across verticals such as office parks, industrial logistics,

retail, and student housing far beyond the traditional focus on residential apartments.

AIFs are especially effective in mitigating concentration risk. Individual investors often hold just one

or two properties, tying up substantial capital and exposing themselves to local market fluctuations.

AIFs solve for this by investing where macro tailwinds exist not just where one resides.

Recent regulatory shifts, including SEBI’s move to allow Small & Medium REITs, have further widened

access, lowering entry barriers and offering greater portfolio flexibility.

A new era for real estate investing

Evolving with the times, investing with intent

Real estate in India is no longer just a lifestyle indulgence or an emotional comfort zone. It is emerging as a strategic alternative resilient, inflation-resistant, and capable of delivering both income and growth.

With the rise of professionally managed REITs and AIFs, investors now have access to all the benefits of real estate, without the baggage of direct ownership. From income-producing properties to warehousing, data centers, and luxury vacation homes, the spectrum of opportunity is expanding.

In a market marked by heightened volatility and growing appetite for alternatives, real estate alternatives offer not just access, but confidence.

In a world where change is constant, investing in something solid, yet sophisticated, may just be the smartest move.

Talk to the DSP team to know more about making the right investment choices.

Industry insights you wouldn't want to miss out on.

Disclaimer

This article is for information purposes only. It should not be construed as investment advice to any party. In this material DSP Asset Managers Pvt Ltd (the AMC) has used information that is publicly available and is believed to be from reliable sources. While utmost care has been exercised, the author or the AMC does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Readers, before acting on any information herein should make their own investigation & seek appropriate professional advice. Any sector(s)/asset class(es) mentioned do not constitute any recommendation and the AMC may or may not have any future position in these. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. There is no assurance of any returns/capital protection/capital guarantee to the investors in any of the schemes of DSP Mutual Fund. All opinions/ figures/ charts/ graphs are as on date of publishing (or as at mentioned date) and are subject to change without notice. Any logos used may be trademarks™ or registered® trademarks of their respective holders, our usage does not imply any affiliation with or endorsement by them.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment