Summary

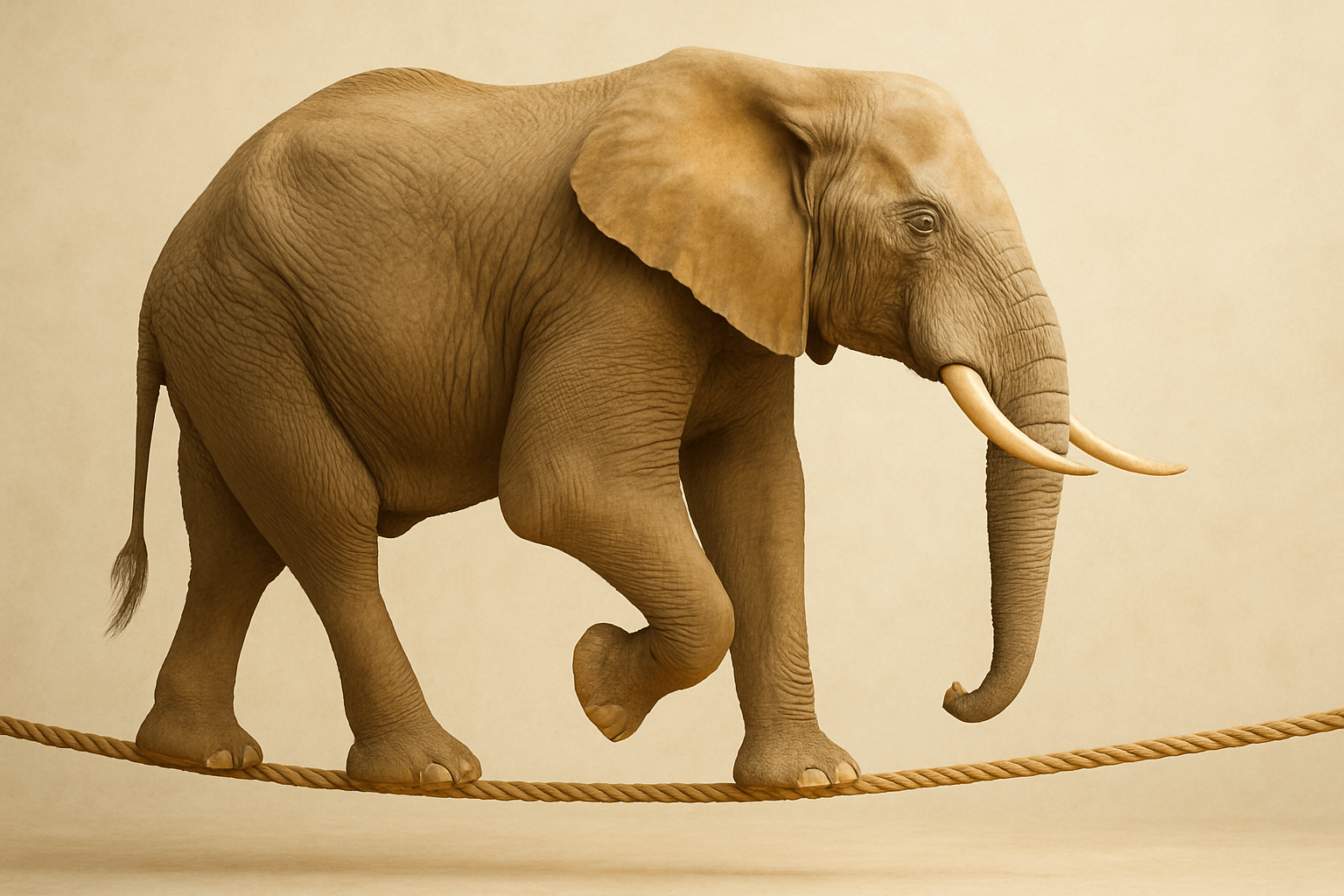

Volatility isn’t your enemy. Panic is. As more investors take control of their money, emotional decisions are derailing smart strategies. This blog explores why staying calm, avoiding trend-chasing, and seeking guidance matter more than ever in a choppy market. Let’s grow wealth with intention, not impulse.

Hey there, Investor Fam

I used to curse the tide for holding me back; until I stopped to wonder: Am I the one holding the oars wrong?

The market’s been throwing a few curveballs our way lately. Small and mid-cap funds have had a bit of a rollercoaster ride. They soared till about September 2024 and then dipped before recovering by April 2025. Naturally, this kind of turbulence got a lot of investors nervous - Some bailed out. Some remained silent. Some doubled down. But most? Well, most just panicked.

As someone who works in digital strategy and handles the DIY investor segment at a mutual fund house, this trend is more worrisome for me. SIP closures have outpaced new SIP registrations this year. And guess what? Almost half of these SIPs are closing within just three months of starting.

So, what’s the story here?

To put it simply: a lot of us are reacting emotionally or irrationally not strategically. Volatility is normal. The market goes up, comes down, takes a chai break, and goes back up again. But it's our reactions, like fear, confusion, or chasing last month’s top performer, that cause us to stumble.

We also observed that the funds getting the most inflows now are the ones that recently did the best. Small-caps, mid-caps, and hot sector funds are topping the sales charts. But look, history has taught us something important: buying what’s hot right now isn’t a recipe for long-term wealth. Often, the best time to invest in something is when nobody’s talking about it.

The thing is, without a guide, an advisor, a mentor, or even a well-designed tool many DIY investors end up relying only on past returns and performance charts. Long-term investing is not just about numbers. It’s about purpose. It’s about being calm when things look shaky. Look at your asset allocation than following a one rule policy forever. It’s about choosing what’s right for you, not what’s trending.

Even the investment platforms out there are slick, fast, user-friendly as they are, could be do a better job. They rank funds by returns, but rarely explain the why, the when, or the what if. I wish more of them nudged users towards diversification, goal setting, and understanding risk, not just speed and returns.

Let me be clear, this isn’t a rant against DIY investing. Quite the opposite. I admire your independence, your drive to learn, and the way you’re stepping up. But hey, even when the world best batsman listens to his coach. The best politicians have the best advisors.

So, here’s what I’d ask of you: don’t walk this path alone. Find someone you trust. It could be a financial advisor, a well-informed friend, or even an app that’s built to educate not just transact.

Markets will always go up and down. That’s a given. But your response to them? That’s in your hands. And that response needs to be steady, informed, confident, that’s what truly builds wealth.

Take care of your money like you would a growing tree. Give it time. Don’t remove it out of the soil every time the weather changes.

Onward,

A fellow traveller in this wealth journey

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house. Information gathered and used in this material is believed to be from reliable sources. While utmost care has been exercised while preparing this document, the AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information.

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Comments

Total 1

Gajendra Kothari

14-05-2025

Very well written Manish. Spot on. Most investors confuse temporary volatility with permanent losses. Unless you press the STOP / SELL button, it is just a paper loss. I believe volatility is the friend of great investors. FDs have no volatility and hence you never create wealth through FDs. The greatest role of a financial advisor is not to manage the clients investments but to manage the investor's behaviour. If behaviour is managed, the money gets managed automatically. The behavioural investment counsellor (as Nick Murray would like to call) acts as a wall between the investor and she committing an investing blunder. I have made all my wealth in life by simply leveraging volatility and remaining patient through all the fads and fears of the market.

Write a comment