Summary

In investing, false precision is dangerous. Our minds crave exact numbers, but markets are messy, complex systems never physics. Valuations, models, and target prices offer comforting illusions of control. True wisdom lies in embracing uncertainty, working with ranges, and staying humble before what can’t be known precisely.

A group of tourists was visiting a dinosaur museum. A guide was entertaining them with interesting trivia about various dinosaur species. Just when they were passing by a huge skeleton of an ancient carnivore, an inquisitive member of the tourist group asked the guide, “How old is this skeleton?”

“Oh, that big T-rex skeleton? It’s about 100 million and 5 years old.” quipped the guide.

“That’s quite an odd figure. I understand the 100 million part but how are you so sure about the last 5 years?”

With all earnestness, the guide replied, “Well, that’s the most accurate part of the figure because exactly 5 years ago a world-famous expert on dinosaurs told me that the skeleton is 100 million years old.”

The guide was honest in his attempt to provide accurate information but he confused accuracy with precision. His answer was precise but was it really accurate? In fact, a better question to ask would be: did the guide make the expert’s answer any more useful by making it more precise? I think no.

Sir John Maynard Keynes said:

Better roughly right than precisely wrong.

When it comes to investing, precision has much less practical application than a new investor would think. This tendency to look for precision where none exists is a human bias. Charlie Munger called it Physics Envy.

In his 2003 lecture on Academic Economics, Munger said:

It’s my view that economics could avoid a lot of this trouble that comes from physics envy. I want economics to pick up the basic ethos of hard science, the full attribution habit, but not the craving for an unattainable precision that comes from physics envy. The sort of precise, reliable formula that includes Boltzmann’s constant is not going to happen, by and large, in economics. Economics involves too complex a system. And the craving for that physics-style precision does little but get you in terrible trouble…economics should emulate physics’ basic ethos, but its search for precision in physics-like formulas is almost always wrong in economics.

Our mind is wired in such a way that it hates ambiguity, and anything that can’t be measured by assigning a precise number to it feels ambiguous to the human brain. Psychologists call this “ambiguity aversion”; we prefer the comfort of a wrong but precise number over the discomfort of an honest “I don’t know.” That’s why many investors would rather cling to a target price down to the decimal than admit the wide range of possible outcomes.

In Poor Charlie’s Almanack, Peter Kaufman writes –

Charlie strives to reduce complex situations to their most basic, unemotional fundamentals. Yet, within this pursuit of rationality and simplicity, he is careful to avoid what he calls “physics envy,” the common human craving to reduce enormously complex systems (such as those in economics) to one-size-fits-all Newtonian formulas. Instead, he faithfully honors Albert Einstein’s admonition, “A scientific theory should be as simple as possible, but no simpler.” Or in his own words, “What I’m against is being very confident and feeling that you know, for sure, that your particular action will do more good than harm. You’re dealing with highly complex systems wherein everything is interacting with everything else.

This caution echoes a larger truth in decision-making. Most real-world systems are “complex adaptive systems.” Markets, like ecosystems, constantly change as participants react to each other’s moves. The moment you find a neat equation to describe it, participants change their behaviour, invalidating the formula. That’s why investing resists tidy quantification in a way physics does not.

Paul Graham, a very successful venture capitalist and founder of Y-Combinator, in his wonderful book Hackers & Painters, writes:

Everyone in the sciences secretly believes that mathematicians are smarter than they are. I think mathematicians also believe this. At any rate, the result is that scientists tend to make their work look as mathematical as possible. In a field like physics this probably doesn’t do much harm, but the further you get from the natural sciences, the more of a problem it becomes. A page of formulas just looks so impressive. (Tip: for extra impressiveness, use Greek variables.) And so there is a great temptation to work on problems you can treat formally, rather than problems that are, say, important.

Excessive quantification is the norm in physics and mathematics, but dangerous in investing. When looking at numbers in investing, always ask what do they mean and in what context were they arrived at.

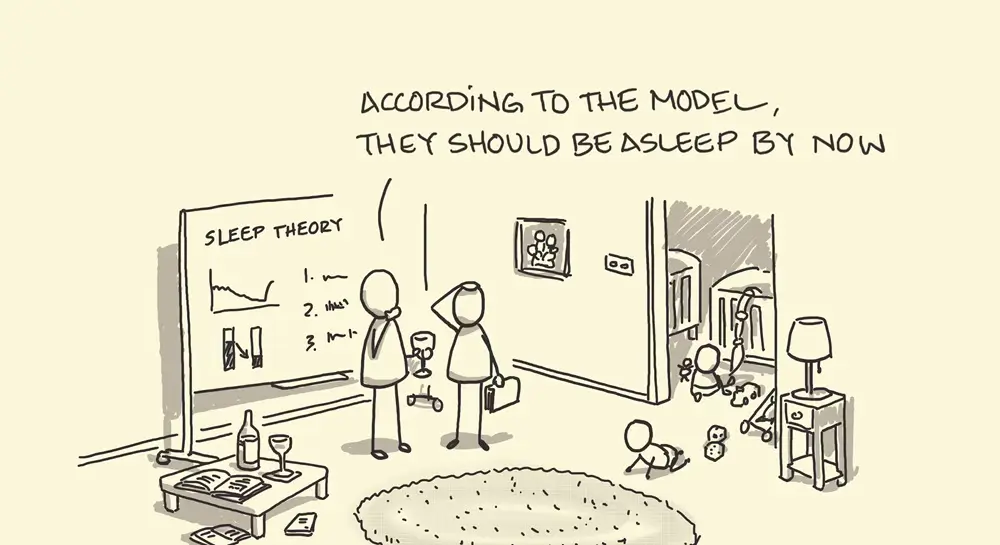

A discounted cash flow (DCF) model may give you a valuation down to two decimal places, but if your growth assumption is off by 2%, the whole model collapses. It’s like using a ruler with millimetre markings to measure a moving object. The precision is an illusion!

Making investing decisions involves dealing with a lot of moving parts, including but not restricted to human behaviour, market conditions, competition, future prospects, and industry dynamics. Which means it’s nearly impossible to predict the final outcome accurately. Trying to put a lot of false precision into a complex system like the stock market is the source of severe errors.

There’s a famous saying in the value investing community: More fiction has been created using Excel than Word.

Excel, or any spreadsheet software for that matter, is a dangerous tool. Relying too much on Excel-driven models can divert your attention away from things that really matter.

Benjamin Graham instructed:

Price is what you pay and value is what you get.

As a value investor, the first thing I learned is to ensure that I don’t pay more than the intrinsic value of a company. Now, this poses a challenge. We are being asked to compare the price, which can be measured precisely, with the value which is largely an estimate i.e., inherently imprecise. But most new investors attempt to do that i.e., try to arrive at a precise number for intrinsic value. It’s a classic case of Physics Envy in action.

Even some of the best investors I’ve known accept fuzziness. They don’t hide behind a “magic number” but work with ranges, probabilities, and margins of safety. This is a psychological discipline: learning to stay humble in front of uncertainty rather than forcing false clarity.

If you are a long-term investor, then price target is a misleading number to follow because the preciseness of target price builds a false sense of confidence. And this false confidence makes you vulnerable to serious mistakes.

Think of analysts’ reports with target prices like “₹734,” as if the market will reward such exactness. In reality, these targets play more to human psychology (our craving for precise anchors) than to the messy truth of business value. Kahneman and Tversky showed how powerful anchoring bias can be: once a number is given, however arbitrary, people treat it as meaningful. Target prices exploit this very weakness.

We are not mentally wired to handle this counterintuitive aspect of investing. That’s why most of us never earn decent returns in the stock market. And that’s why the best strategy for most of us is to invest through mutual funds.

But even mutual fund investors are not immune to Physics Envy. Many chase funds with the “best” 3-year or 5-year return down to the decimal point, assuming that past performance figures contain hidden precision about the future. They compare expense ratios as if a difference of 0.1% will make or break their financial future, while ignoring far bigger factors like discipline, asset allocation, or behaviour during market downturns.

The truth is: whether you invest directly in stocks or through funds, you are still human. And being human means being prone to biases. Which is why the most important investment you can make is in building awareness of these psychological traps, and seeking help in navigating them. Just as a fund manager can help you diversify your portfolio, a teacher, mentor, or advisor can help you diversify your thinking away from dangerous biases.

So, if you’re going to wander into the stock market, despite every warning you’ve ever heard, know that Physics Envy will be waiting for you, like some invisible pothole you only notice after you’ve already stumbled. And if you comfort yourself by saying, “No, no, I’ll just stay with mutual funds, that’s the safer road,” well…sorry. Biases don’t really care what vehicle you’re driving. They ride along anyway.

The real advantage in investing doesn’t come from chasing some perfect number you’ve squeezed out of Excel, but comes from shrugging and admitting, “I don’t know.”

It’s not easy work. You have to learn to sit with the fuzziness instead of the comforting precision of absolutes. You have to leave yourself room, a margin, because you’ll be wrong more often than you care to admit. And the liberating truth is that investing will never hand you neat answers. At best, it hands you uncertainty wrapped in stories and numbers. If you’re patient, though, and just a little humble, you start to see that uncertainty isn’t a curse; it’s the whole game.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

This is an investor education and awareness initiative by DSP Mutual Fund. All Mutual fund investors have to go through a one time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (‘RMF’). For more info on KYC, RMF and procedure to lodge/ redress any complaints visit dspim.com/IEID. For SMART Online Dispute Resolution portal, visit link https://smartodr.in/login

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment