Summary

Investing success doesn’t come from chasing trends, but from staying within your circle of competence areas you truly understand. Like athletes built for their sport, investors thrive when they play to their strengths. Learn patiently, stay humble, avoid overconfidence, and grow your circle gradually. Simplicity, discipline, and self-awareness win long term.

Dear Young Investor,

I hope this letter finds you well.

Let me start with a story. It’s about two remarkable athletes. You’ve probably heard of one. The other, maybe not.

Michael Phelps is regarded as one of the greatest Olympians of all time. With 23 Olympic gold medals, he redefined the world of swimming. With long arms, enormous wingspan, and an efficient dolphin kick, his body seemed designed for the water. For over a decade, Phelps was virtually untouchable in the pool.

Now, meet Hicham El Guerrouj. He may not be a household name, but he’s a legend in the world of athletics. A Moroccan middle-distance runner, El Guerrouj held the world record in the mile, the 1,500 metres, and the 2,000 metres for years. At the 2004 Athens Olympics, he won gold in both the 1,500 and 5,000 metres, which is a feat last accomplished over 80 years before him.

So, here are two world-class athletes: one is a master of water, and the other, of land.

Now, this is where it gets interesting.

Phelps is 6 feet 4 inches in height. El Guerrouj is 5 feet 9 inches. Despite the seven-inch difference, both athletes wear the same length inseam on their pants. You may wonder how is that so? Well, this is because Phelps has a long torso and relatively short legs, which are perfect for swimming. El Guerrouj, on the other hand, has long legs and a shorter torso, which are ideal for running.

Their physiques tell you that they were made for different races. But imagine if they had switched. Suppose Phelps had decided to try his hand at distance running. With his tall, heavier frame, he’d be at a natural disadvantage. Every stride would burn more energy, and every lap would be a strain. He might be fit, disciplined, and driven, but he wouldn’t win.

The same goes for El Guerrouj. Put him in a pool next to elite swimmers, and he’d struggle from the start. His legs, so useful on a track, would offer little advantage in water. His shorter torso would reduce his buoyancy and stroke efficiency. No matter how hard he trained, he simply wasn’t built for that environment.

Both men are extraordinary. But their success came from competing in the domain that matched their strengths.

And that brings me to the lesson I want to share with you today, which is about the powerful idea of “circle of competence,” and which works wonderfully well in investing.

You see, we often think that success in investing is about intelligence and owning the next hot idea. But more often, it comes down to something much simpler and far less glamorous. And that is the idea of staying inside your circle of competence.

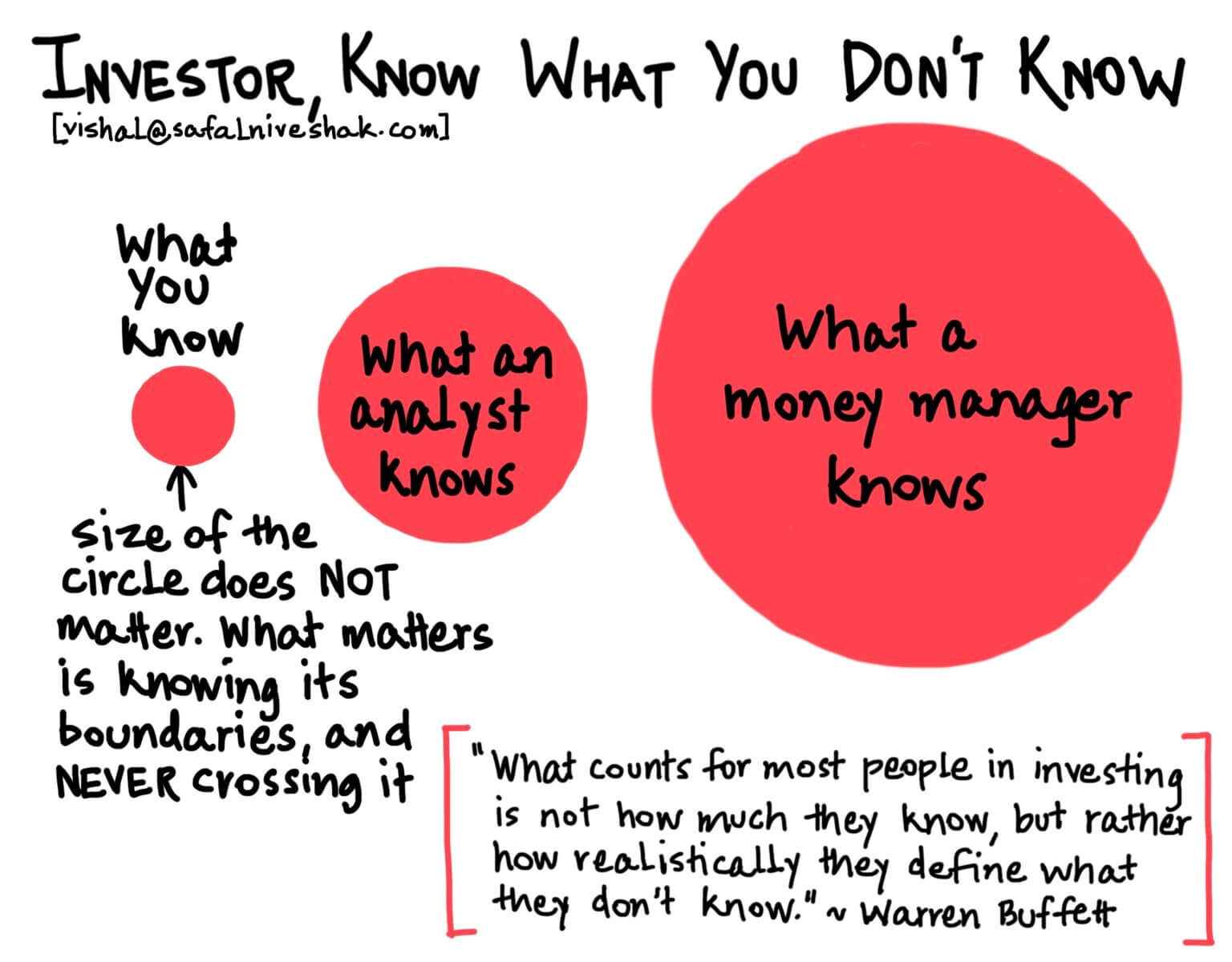

It’s a phrase made famous by the legendary investors Warren Buffett and Charlie Munger. Your circle of competence is the area where you truly understand what you’re doing. It’s the industry you’ve studied, the kind of business you can explain clearly, or the investment product you know inside out. It’s not built on opinions or tips, but on real knowledge, often earned through years of reading, thinking, and observing.

And here’s the thing that even a lot of experienced investors don’t understand: your circle of competence doesn’t need to be big.

As Charlie once said:

I think about things where I have an advantage over other people. I don’t play in a game where the other people are wise and I’m stupid. I look for a place where I’m wise and they’re stupid. You have to know the edge of your own competency. I’m very good at knowing when I can’t handle something.

Then, as Warren said:

Risk comes from not knowing what you’re doing.

In other words, venturing beyond your understanding is akin to gambling, not intelligent investing. Staying within your circle of competence doesn’t mean you must know everything about every industry, stock, or investment product.

You might be an expert in only a few areas, and that’s perfectly fine. What matters is that you are clear on what falls outside your competence. A software engineer, for example, may have keen insight into IT companies but might find a biotech startup baffling. An experienced farmer may intuitively grasp which agri-tech venture can solve real farming problems, yet that same person could be utterly perplexed by a fintech company. Recognising these boundaries keeps you from costly missteps.

Think of your circle of competence as a safe harbour in the vast ocean of markets. Inside it, the waters are familiar and navigable. But outside lies turbulence you may not see coming.

History is full of cautionary tales about investors who strayed outside their circle of competence and suffered ruinous consequences. For example, during the tech-stock euphoria of late 1990s, many investors again ventured beyond their competence. Little-known tech companies with barely any revenues and profits saw their share prices multiply absurdly. It didn’t matter that few understood these companies’ business models. People bought because prices kept going up. Inevitably, reality struck. When the frenzy collapsed, those stocks fell back to earth, destroying the reckless investors who believed the party would never end.

Fast forward to the mid-2000s, a time where was working as a stock market analyst. The Indian economy was doing well and optimism was sky-high. In January 2008, Reliance Power’s IPO became the hottest story in town. It was a power company with ambitious plans but no operating history to speak of. Yet, seduced by the famous brand and the frenzy, scores of retail investors, including many first-timers, borrowed money or emptied savings to grab those shares. I still remember the listing day, when reality bit hard, and the stock plunged. Till this day, 17 years later, the stock is down around 80% from its 2008 levels.

Now, I don’t recount these stories to scare you, but to show a common thread. In each of these cases, and many more like these, people (and institutions) ventured beyond their competence, whether seduced by greed, glamour, or overconfidence. And in each case, the outcome was painful.

Yet, there’s a flip side to this: when you do stay within your circle of competence, you tilt the odds of success in your favour. Investors who stuck to businesses they understood deeply often fared much better. For example, someone who had a background in agriculture in the 2010s might have recognised the long-term potential of a farm automation company solving real productivity problems, precisely because they understood the farming pain-points that tech could address. Investing in that familiar domain, they’d be much more confident and patient, even if others ignored it.

Indeed, many of the great investment success stories come from sticking to one’s knitting. Peter Lynch famously said he made his best stock picks when he “invested in what he knew.” By staying in familiar territory, you not only spot opportunities that others miss, but you also avoid panicking at the first sign of trouble because you have conviction in what you own.

Now, you might wonder, does staying within your circle mean you can never try new things or grow as an investor? Not at all! Your circle of competence is not fixed. It can expand over time with effort, experience, and education. The key is to approach expansion gradually, patiently, and with great humility.

Rome wasn’t built in a day, and neither is competence. Warren Buffett became a legendary investor not by leaping into every hot sector, but by reading voraciously and continuously learning for decades.

Every time, as you read and observe, you will find that some things which once confused you start making sense. Little by little, your circle widens.

In this journey of learning, humility is your best friend. Always remember that no matter how smart you are, the market can humble you if you overestimate your own knowledge. The downfall of some investors often begins with the phrase “This is easy, I can’t go wrong here,” especially in a field they haven’t studied. Avoid that trap. Pride and overconfidence, what the ancients called hubris, can blind even brilliant people.

So, never delude yourself that you’re an expert in something when you’re not. It’s far wiser (and ultimately more profitable) to say “I don’t know enough about this, so I’ll pass,” than to charge into an investment blindly. Maintaining that honest self-awareness will save you from many disasters.

Patience is also crucial here. In a world obsessed with quick results, having the patience to wait for the right opportunity within your circle of competence is a superpower.

Remember, you don’t have to swing at every ball that’s thrown at you. You can watch dozens go by until you get the one that’s squarely in your zone. Over time, as you keep learning, you’ll find that your circle naturally broadens.

This is a lifelong process. Even in my own experience, I started with a very narrow circle (just a few industries and companies I understood well). Gradually, through reading annual reports, talking to industry experts, and sometimes making a few small experimental investments, I learned more and expanded my circle of competence. Some areas never quite clicked for me (and I happily avoid those to this day), while others that I once ignored eventually became part of my competence.

You can do the same, step by step. The important thing is to never stop learning and to stay humble about how much there is still to learn.

In closing, I want to reassure you that staying within your circle of competence is liberating. It frees you from the pressure to follow every fad. It allows you to invest with confidence, because you know the why behind your choices. It protects you from the avoidable errors that derail so many investors. And as your knowledge grows, so too will your circle and the opportunities within it.

Investing is often portrayed as complex, but it doesn’t have to be. As a mentor, my sincere advice to you is to keep it simple and clear. Be content to say “no” to opportunities that you can’t quite grasp. Over the long run, this approach will serve you well, both in wealth and in peace of mind.

I’m excited for your journey ahead and will be cheering for you every step of the way. Investing, done wisely, rewards not just with profits but with lifelong learning and personal growth.

Embrace that process.

Sincerely,

Vishal

This article is authored by Vishal Khandelwal of safalniveshak.com, an initiative to teach investors how to make simple and wise investment decisions.

Industry insights you wouldn't want to miss out on.

Written by

Disclaimer

This is an investor education and awareness initiative by DSP Mutual Fund. All Mutual fund investors have to go through a one time KYC (Know Your Customer) process. Investors should deal only with Registered Mutual Funds (‘RMF’). For more info on KYC, RMF and procedure to lodge/ redress any complaints visit dspim.com/IEID. For SMART Online Dispute Resolution portal, visit link https://smartodr.in/login

The sector(s)/stock(s)/issuer(s) mentioned in this document do not constitute any recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment