Summary

Recent market trends might give a false sense of expertise due to high returns across many stocks. However, consistent double-digit returns are rare and difficult to sustain. Successful investing relies on choosing fundamentally strong, undervalued stocks rather than relying on market trends or investment strategies alone.

If you’ve only begun investing in equities over the last 18-odd months, then you probably have a rather warped view of the markets right now.

Allow us to explain. An analysis of around 1900 listed stocks for the period from March to December 2023 found that nearly 90% of those stocks ended up in the green. What was equally impressive was that most of them also managed to post double-digit or even triple-digit returns over that period*.

Thus, even if you’d picked random stocks from this huge basket during the period in question, there’s a good chance you’d have made a tidy profit, or even beaten the Nifty 500.

And so far, 2024 looks like a continuation of the bullish run that began in 2023, with the year-to-date returns of the Nifty 500 index being around 21% as of 21 August 2024**. Such runs can easily make you think that you’re a rather skilled stock-picker, or that such market returns are here to stay.

But this is a warped perspective. What’s happening here is simply a live demonstration of the adage ‘A rising tide lifts all boats’.

The harsh truth

As the more level-headed and grizzled investors among you might recognise, the truth is that getting consistent double-digit returns is very difficult. And consistent double-digit real returns (i.e. the effective returns once inflation has been factored in) are incredibly rare indeed.

This is true even if we look at the world’s most prosperous countries, over investment horizons as long as 140+ years!

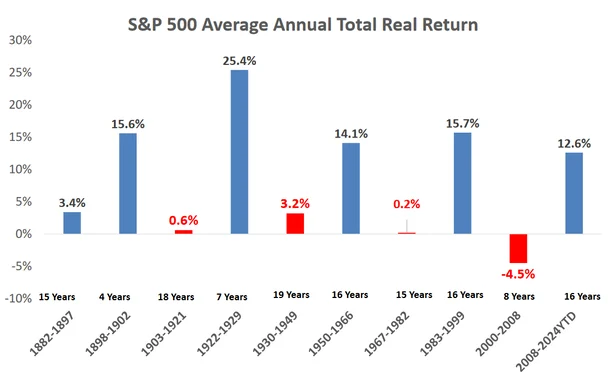

Source: Gail Dudack, Sungard Institutional Brokerage, Global Financial Data; DSP. Data as of July 2024. The returns are on a calendar-year basis. Red means weak cycle, blue means strong cycle.

Consider the S&P 500. As the chart above indicates, periods of double-digit real returns were punctuated by long periods of poor or even negative growth.

Now, it’s true that investors have developed a whole suite of approaches to tackle this challenge, such as Buy and Hold, SIPs, and strategic asset allocation. But it’s important to recognise that such approaches are simply attempts to navigate the underlying unpredictability of the market, and don’t actually eliminate that unpredictability.

So if the stocks you’re investing in are of poor quality to begin with, the only thing such approaches will give you is the illusion of control.

Something finance writer James Grant once said is quite relevant in this regard:

"I am more afraid of remedies than diseases."

So what can you do?

Make sure your portfolio is built on a solid foundation, rather than quicksand.

We can’t control the period over which our investing lives unfold, but we do have the power to choose where we invest. And that’s what’s critical to maximising the odds of success of any investing strategy.

If you decide to invest in a fundamentally poor stock, then it doesn’t matter whether you buy and hold it or create an SIP around it: your long-term returns will suffer.

But pick a sound business whose stock isn’t overvalued, and you’re much likelier to do well regardless of how you invest in it.

This is a simple conclusion, but it’s important to remind yourself of this fact whenever market noise threatens to drown out the basics.

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

*Source: https://stackwealth.in/blogs/featured/2024-smallcap-largecap-midcap-equity-mutual-funds

** Source: DSP internal

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of July 2024 (unless otherwise specified) and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index/Model and do not in any manner indicate the returns/performance of this scheme.

The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

For Index disclaimers click here. Large-caps are defined as top 100 stocks on market capitalization, mid-caps as 101-250, small-caps as 251 and above.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment