Summary

When prices rise too far, even gold forgets how to whisper. The metal that once spoke of safety now stands in silence; neither cheap nor in a bubble, simply aware of its worth. This month, Netra listens to that silence.

Welcome to the October 2025 edition of Netra, where we present data-driven market insights that can inform your investing decisions.

This month, we’ll focus exclusively on gold: how investors can assign it a fair price, how they should approach their existing gold investments, and why deep drawdowns might not be causes for concern.

How to think about gold’s price

Gold has been shining bright lately… and not just in jewelry stores. Prices have surged to new highs in 2025, leaving investors wondering:

“Is there still room left to climb, or has gold reached its fair value?”

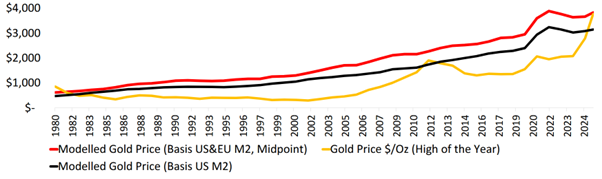

Let’s try to answer this question using a plausible assumption: gold is money, so its value should roughly track the combined money supply of reserve-currency blocs.

Given this premise, here’s the math in brief:

-

Add up the US M2 money supply and half of the EU’s M2. (Why half of the EU’s M2? So as to reduce double counting, since the euro area also holds gold and US dollars as reserves.)

-

Divide the above result by the total gold mined.

What you get at the end of this calculation is a theoretical fair price for gold.

According to this model, gold should be trading somewhere between $3,166 and $4,484 per troy ounce, with a midpoint of $3,825.

And what’s the gold price right now? As of 14 October 2025, it is greater than $4,000.

That’s right: for the first time since 1980, gold prices are above their modeled fair value.

Source: World Gold Council, Fred, DSP. Data as of September 2025

In short, gold is no longer the undervalued underdog it used to be. It’s now fairly priced.

A golden approach

However, just because gold is now fairly priced doesn’t mean this gold bull run is over. But it does mean we’re entering a phase where prudence pays.

Here’s how investors can think about their existing gold allocation right now:

-

Hold your position: this could lead to further gains, but leave you with little margin of safety.

-

Trim gradually: maybe 5% per week, so as to reduce at least half of any overweight exposure if you’ve gone heavy on gold.

At this point, phasing out gold mining stocks from your portfolio, or at least normalising their weightage, might be a good idea.

Even bull markets take breathers

Gold’s biggest rallies have rarely been smooth. During the great 2000–2011 bull run, the metal fell nearly 26% during the Global Financial Crisis (GC), even as the overall uptrend remained intact.

We don’t know whether gold has peaked. Both the theoretical price framework and price momentum (3-year price CAGR) suggest that a margin of safety is no longer present.

This is not a call on the end of the bull market: it may well continue, but steep drawdowns are possible.

In the current cycle (since late 2022), gold’s largest correction so far has been less than 8%, which could be a sign that volatility is overdue.

As long as investors stick to prudent asset allocation, they can still benefit from drawdowns.

Gold vs. equities

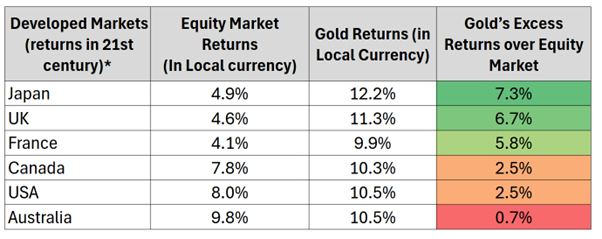

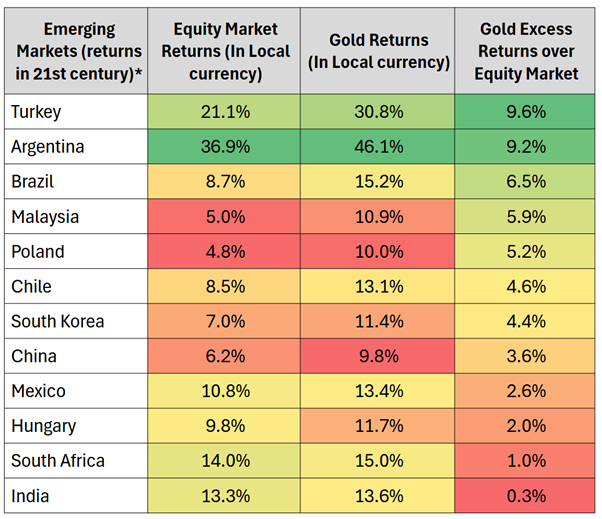

Before we conclude, let’s place gold in perspective against global equities.

In the 21st century, gold has outperformed equities in developed markets like the US, UK, and France, as well as in emerging markets like India, Malaysia, and China.

Source: Bloomberg, DSP. Data as on Sep 2025. All Market returns are TRI using TRA Function on BBG. Data since 31-12-1999*

This is undoubtedly a remarkable feat for a non-yielding asset.

The bottom line

Gold isn’t in a bubble, but it’s no longer in bargain territory either.

If you already hold gold, you’ve likely benefited from this extraordinary run. Now’s the time to treat it like a mature investment: respect it, rebalance it, and be patient.

The real opportunity may soon shift to spotting the next undervalued asset in the cycle (with silver looking like a strong contender).

For more actionable insights backed by data and analyses, we invite you to read the latest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment