Summary

Markets look settled. But are they really? But some of the more meaningful shifts tend to happen quietly. Through changes in growth expectations, market composition, and investor positioning.

This month, we look at three themes that are quietly shaping investor thinking: how bond markets are reacting to slower growth and subdued inflation; shifts in the share of large companies within India’s equity market; and evolving sector weights that reflect recent performance patterns.

Together, these snapshots offer a view of positioning and valuations beyond short term price moves.

When growth slows, bonds tend to respond first

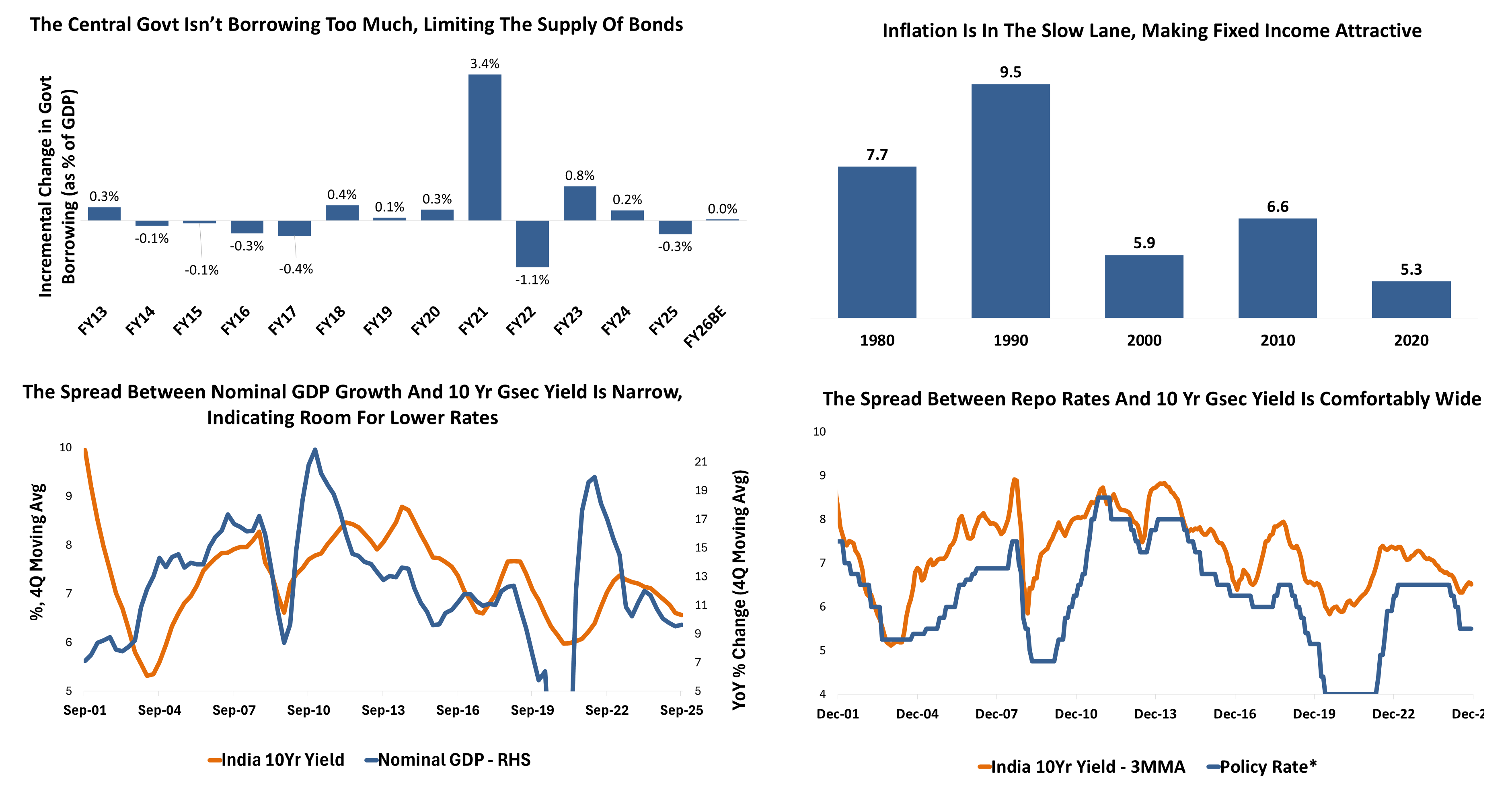

Over the past year, growth has moderated and inflation has eased from earlier highs. As a result, the gap between nominal GDP growth and long-term bond yields has narrowed. Historically, this gap has mattered because it reflects how much compensation investors demand for growth and inflation risks.

At the same time, central government borrowing as a share of GDP has remained broadly stable. This suggests that the supply of bonds has not increased sharply relative to the size of the economy.

What this tells us is not that yields will move in any one direction, but that bond markets are adjusting to a macro environment where growth is relatively steady and inflation pressures are lower than before.

Source: CMIE, DSP; Data as of Nov 2025.

- Policy rate pre-GFC is taken as average of repo and reverse-repo; post-GFC is repo rate.

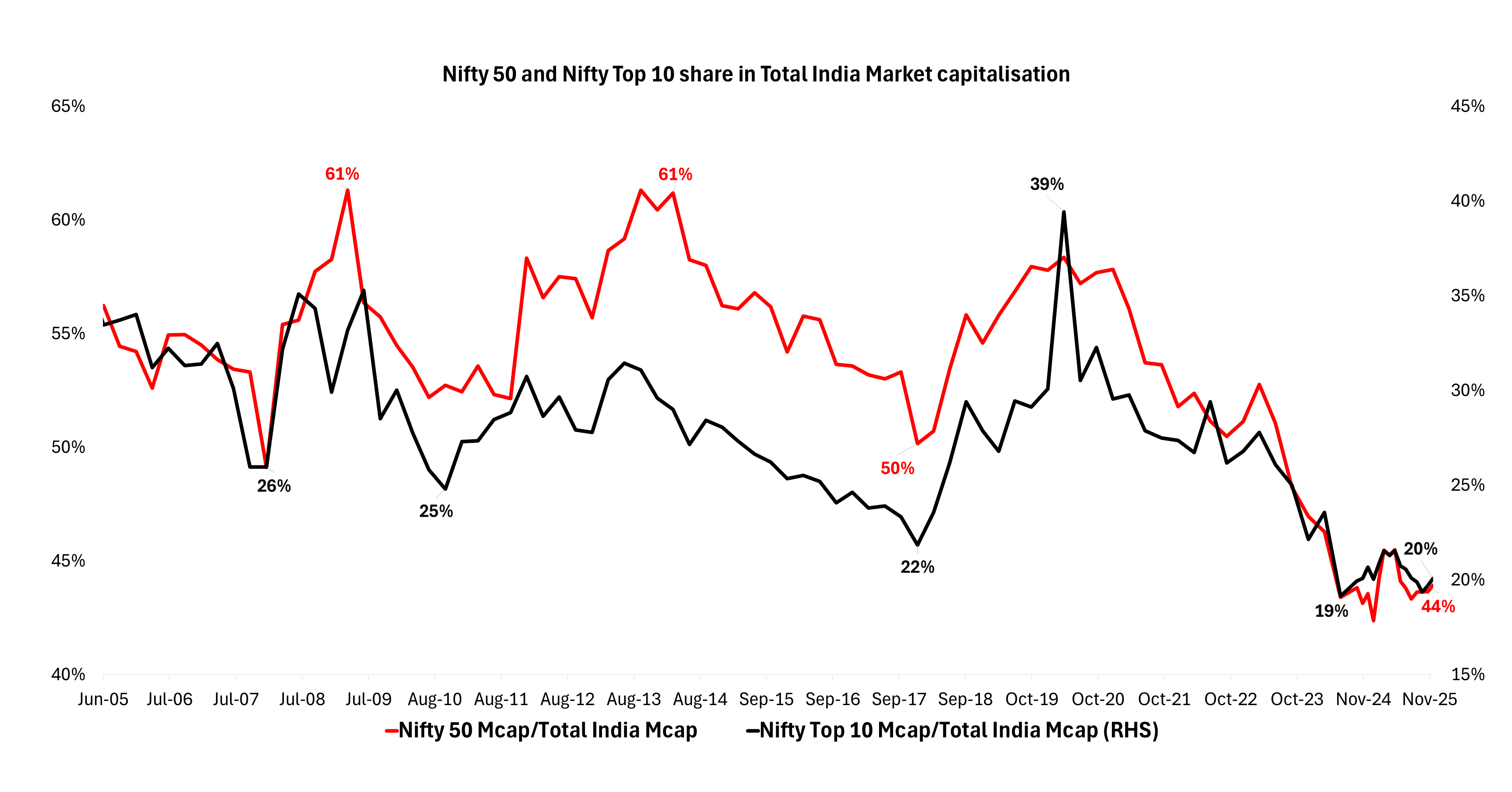

Large companies, a smaller presence

As newer listings and mid and small cap stocks gained traction, market participation broadened. Over time, this reduced the relative weight of the largest companies, even as the market itself expanded.

In simple terms, large cap stocks are today less dominant in the market than they were during earlier phases.

What this highlights is a change in relative positioning rather than an immediate signal on performance. When large cap stocks account for a smaller share of the market, their role within portfolios often comes back into focus, particularly during periods of uncertainty.

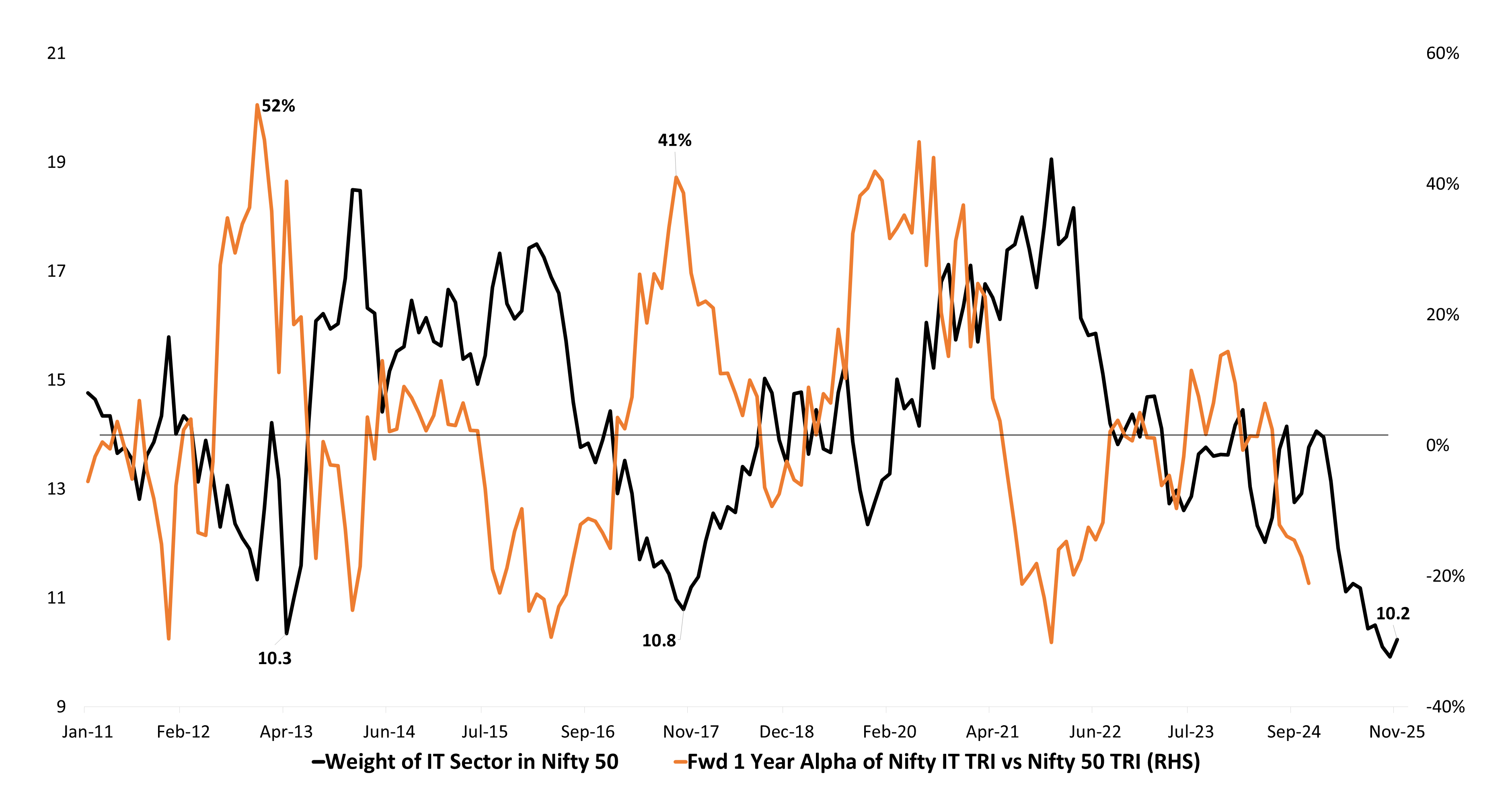

IT: a sector at lower weights

Finally, consider how the IT sector is currently positioned within the market.

The weight of IT stocks in the Nifty 50, which has declined steadily and is now close to its lowest levels in the past decade. This follows a period of weaker performance, influenced by slower global growth and cautious enterprise technology spending.

As these trends played out, investor allocation to the sector reduced over time. The outcome is an index where IT occupies a meaningfully smaller space than it did in previous cycles.

This does not suggest that the sector’s challenges have fully played out. Rather, it reflects a period where expectations are more restrained, as seen in its current weight within the index.

Finally, consider how the IT sector is currently positioned within the market.

The weight of IT stocks in the Nifty 50, which has declined steadily and is now close to its lowest levels in the past decade. This follows a period of weaker performance, influenced by slower global growth and cautious enterprise technology spending.

As these trends played out, investor allocation to the sector reduced over time. The outcome is an index where IT occupies a meaningfully smaller space than it did in previous cycles.

This does not suggest that the sector’s challenges have fully played out. Rather, it reflects a period where expectations are more restrained, as seen in its current weight within the index.

A closing perspective

Across both market structure and sector allocation, the common theme is adjustment rather than acceleration. Large companies and IT stocks now occupy a smaller share of the market, not because they have vanished, but because participation and preferences have shifted over time. Viewed together, this positioning is particularly relevant in large-cap equities and the IT sector, where lower representation and more measured expectations point to relative opportunity driven by positioning rather than sentiment.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment