Summary

What happens when central banks start turning away from the US dollar? A quiet revolution may be underway with gold at the center. As global reserves shift and supply remains tight, gold could rise in prominence. Find out why this matters, and how it could impact your portfolio.

A seismic shift might be underway in global monetary dynamics, and gold might emerge as its primary beneficiary.

For decades, the US has run massive trade and fiscal deficits while maintaining the world's reserve currency. Foreign central banks that wished to invest their surplus in the US dollar would buy dollar-denominated assets, which in practice would usually be US Treasuries.

However, this arrangement now appears to be breaking down.

China and other major creditors are increasingly avoiding US Treasuries, fundamentally weakening the traditional link between the dollar's reserve currency status and its role in funding US deficits.

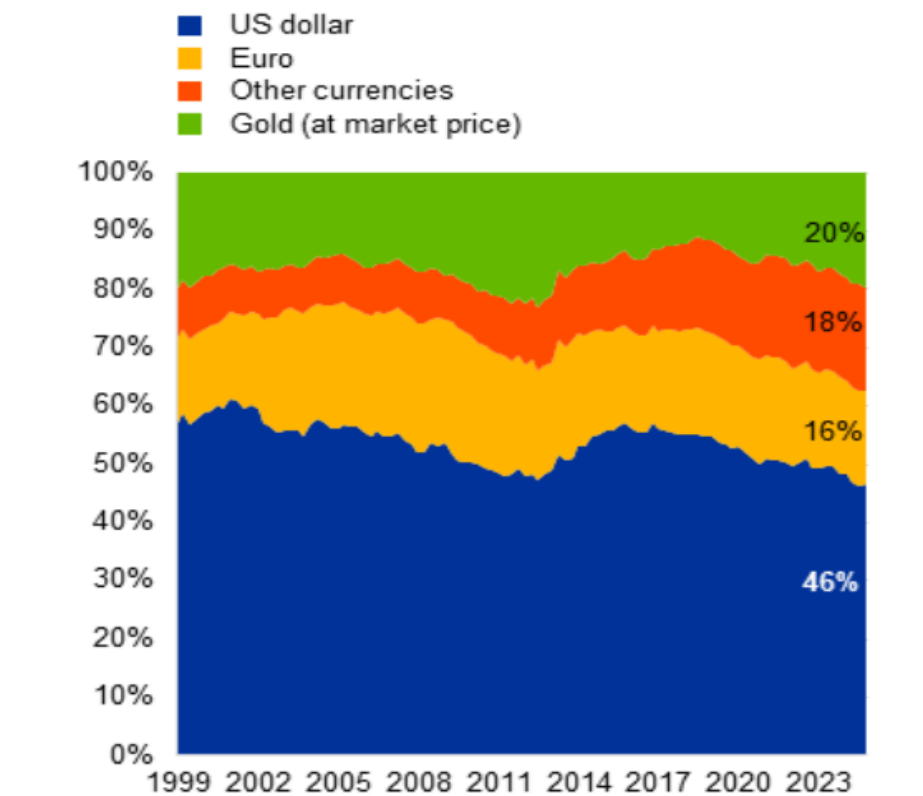

But if not dollar-denominated assets like US Treasuries, what should central banks invest in? Well, perhaps unsurprisingly, gold has emerged as the sole credible alternative for reserve flows. The chart below shows how it’s been edging out currencies in global reserves.

Source: ECB, DSP, Data As of June 2025

Right now, global foreign exchange reserves total approximately $12.5 trillion, while the global gold market is valued at around $23 trillion (15% of which is held in India).

Now, here's where the story becomes fascinating: of all the gold ever mined throughout human history, 65% exists in the form of jewelry (which means it’s not readily available for central bank purchases). This creates a critical supply constraint.

The implications are staggering. A mere 5% shift of global reserves into gold could trigger a sustained rally in its price, since its supply is probably too limited to absorb such massive flows.

For more actionable insights backed by data and analyses, we invite you to read thelatest edition of Netra in its entirety.

Industry insights you wouldn't want to miss out on.

Disclaimer

This blog is for information purposes only. The recipient of this material should consult an investment /tax advisor before making an investment decision. In this material DSP Asset Managers Pvt. Ltd. (the AMC) has used information that is publicly available, including information developed in-house and is believed to be from reliable sources. The AMC nor any person connected does not warrant the completeness or accuracy of the information and disclaims all liabilities, losses and damages arising out of the use of this information. Data provided is as of June 2025 and are subject to change without notice. Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. These figures pertain to performance of the index and do not in any manner indicate the returns/performance of this scheme. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on prevailing market conditions / various other factors and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements.

All content on this blog is the intellectual property of DSPAMC. The User of this Site may download materials, data etc. displayed on the Site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action.. The User undertakes to comply and be bound by all applicable laws and statutory requirements in India.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

Write a comment