Summary

Subtle shifts across trade, valuations, and gold’s drivers suggest a closer look may be warranted.

This month, we examine three areas where surface relief meets underlying transition: moderating but unresolved trade frictions, returns that look strong yet stretched in context, and a gold rally shaped more by momentum than structure. Together, these snapshots frame how narratives evolve beyond headline calm.

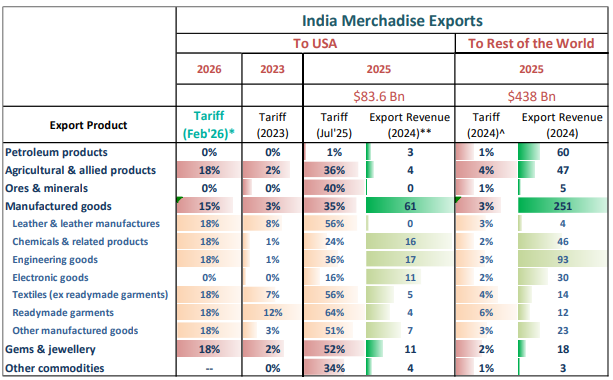

Trade relief, with limits

Tariff pressures between the US and its trading partners have eased from their peak, particularly relative to the sharp escalation seen through 2025. Yet current levels remain meaningfully higher than those seen before trade tensions became a defining feature of the global landscape.

For Indian exporters, this distinction matters. Manufactured goods, gems and jewellery, and several labour-intensive categories continue to face elevated tariff levels compared to both earlier years and key competitors. While some segments retain competitiveness through scale or diversification, the broader picture suggests that margins remain under pressure. Companies are adjusting through pricing, supply-chain reconfiguration, and market diversification, but these are incremental responses rather than structural resets.

The key takeaway is that while the most acute phase of tariff escalation may be behind us, trade has not reverted to a neutral backdrop. For businesses and investors alike, this implies a longer adjustment period where outcomes are shaped less by sudden shocks and more by persistent frictions.

Source: Nuvama, WTO, Global Trade Alert, WITs, CMIE, DSP. Data as of 3rd Feb 2026. *Preliminary estimates, as the full deal text is not yet available. **Breakdown of Export Revenue adds to $83.6Bn. The remaining $3.3Bn is unclassified and can be counted under others. ^Based on top 10 export partners

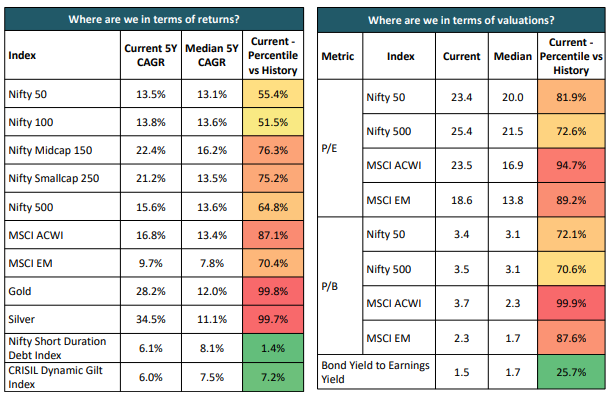

Strong returns, tighter margins for error

That sense of adjustment extends to asset markets. Over the past five years, most major asset classes have delivered robust returns, with equities in particular compounding strongly. Even after recent corrections, many indices sit in the upper half of their historical return ranges.

Valuations, however, tell a more nuanced story. Several equity markets are priced well above their long-term medians, narrowing the cushion available if growth disappoints or conditions tighten. In contrast, parts of the fixed income universe and select defensive assets appear more moderately positioned, offering relative comfort rather than outright opportunity.

This divergence creates a familiar but challenging setup. Returns have been generous, but future outcomes are likely to depend more on discipline than on momentum. When valuations are elevated, the range of possible outcomes widens, and the cost of misplaced conviction rises. In such phases, flexibility across asset classes becomes less a tactical choice and more a strategic necessity.

Source: Bloomberg, DSP. Data as on 30 Jan 2026. Period considered for evaluation: Apr 2005 to Jan 2026. All returns in INR terms.

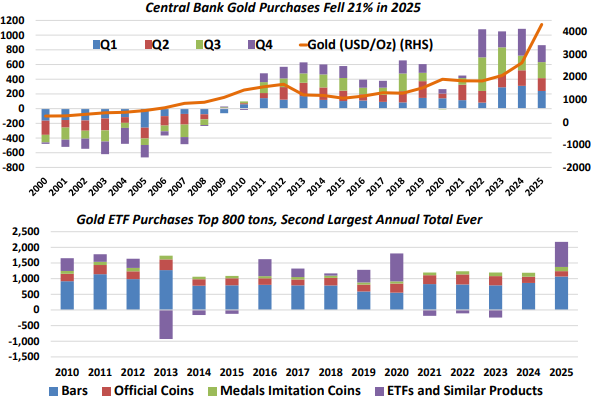

Gold’s rise, and what’s driving it

Gold’s recent performance sits at the intersection of these themes. Prices have surged, placing long-term returns near the top of historical ranges. This rally initially drew meaningful support from central bank buying, which was a notable driver in the early phase.

What stands out in the current cycle is a shift in leadership. Central bank purchases have slowed, while investor demand through ETFs has accelerated sharply. This pattern suggests that recent strength is being driven more by return-chasing behaviour than by long-horizon accumulation.

That distinction matters. Momentum-led demand can amplify trends, but it can also reverse quickly when sentiment shifts. Gold continues to play a role as a diversifier, but its recent trajectory underscores a broader point: asset behaviour often reflects who is buying, not just why the asset exists in a portfolio.

Source: Bloomberg, DSP. Data as of Jan 2026.

Reading the environment as it is

Across trade, markets, and commodities, the common thread is moderation without normalisation. Extremes have softened, but underlying conditions remain unresolved. Expectations are adjusting, leadership is shifting, and assumptions formed in earlier phases are being tested.

In such an environment, clarity rarely comes from bold forecasts. It comes from recognising where stability has returned, where it has not, and how investor behaviour adapts in between. As markets move through this phase of recalibration, staying attentive to these quieter shifts may matter more than reacting to the loudest signals.

Industry insights you wouldn't want to miss out on.

Disclaimer

All content on this blog is the intellectual property of DSPAMC. The user of this site may download materials, data etc. displayed on the site for non-commercial or personal use only. Usage of or reference to the content of this page requires proper credit and citation, including linking back to the original post. Unauthorized copying or reproducing content without attribution may result in legal action. The user undertakes to comply and be bound by all applicable laws and statutory requirements in India. Large caps are defined as top 100 stocks on market capitalization, mid caps as 101-250 small caps as 251 and above

Past performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Account Statement

Account Statement  Capital Gain Statement

Capital Gain Statement  Key Information Memorandum

Key Information Memorandum  PAN Updation

PAN Updation  Register / Modify KYC Online

Register / Modify KYC Online  Nominee Registration

Nominee Registration  Email / Phone Updation

Email / Phone Updation  OTM / eNACH Registration

OTM / eNACH Registration  Guidelines for Incapacitated Investors

Guidelines for Incapacitated Investors  FAQs

FAQs Reach us

Reach us

.

.

Write a comment